As banks pull back from mortgage lending amid inflated prices and rising rates, “shadow banks” become very aggressive.

In the first quarter 2018, banks and non-bank mortgage lenders – the “shadow banks” – originated 1.81 million loans for residential properties (1 to 4 units). In the diversified US mortgage industry, the top 10 banks and “shadow banks” alone originated 260,570 mortgages, or 14.4% of the total, amounting to $75 billion. We’ll get to those top 10 in a moment.

Banks are institutions that take deposits and use those deposits to fund part of their lending activities. They’re watched over by federal and state bank regulators, from the Fed on down. Since the Financial Crisis and the bailouts, they were forced to increase their capital cushions, which are now large.

Non-bank lenders do not take deposits, and thus have to fund their lending in other ways, including by borrowing from big banks and issuing bonds. They’re not regulated by bank regulators, and their capital cushions are minimal. During the last mortgage crisis, the non-bank mortgage lenders were the first to collapse – and none were bailed out.

So let’s see.

Of those 1.81 million mortgages originated in Q1 by all banks and non-banks, according to property data provider, ATTOM Data Solutions:

- 666,000 were purchase mortgages, up 2% from a year ago

- 800,000 were refinance mortgages (refis), down 11% from a year ago due to rising interest rates.

- 348,000 were Home Equity Lines of Credit (HELOCs), up 14% from a year ago

HELOCs, which allow homeowners to use their perceived home equity as an ATM, are once again booming: $67 billion were taken out in Q1, though that’s still less than half of peak-HELOC in Q2 2006, when over $140 billion were taken out.

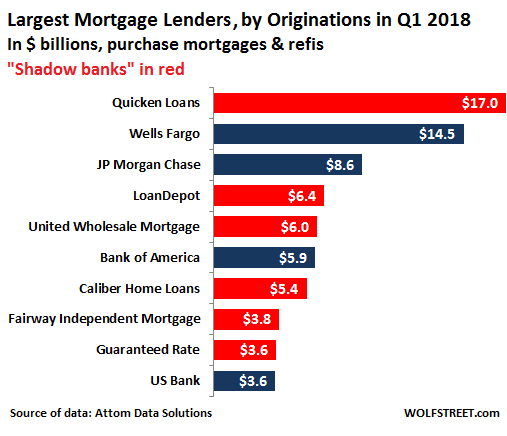

The Top 10 Mortgage Lenders in Q1 2018

Wells Fargo used to be the largest mortgage lender in the US until fairly recently. But it fell to second place, trounced by a “shadow bank.” In Q1, the number of purchase mortgages and refis it originated, 44,320 in total, plunged 37% from a year ago. And dollar volume of mortgages originated plunged 30% to $14.5 billion.

The largest mortgage lender in Q1 was a shadow bank: QuickenLoans. Its total mortgage originations edged down 3% to 73,896 mortgages, though dollar volume rose 4% to $17.0 billion.

Third largest mortgage lender was JP Morgan Chase. Its mortgage originations plunged 21% to 27,329 mortgages. And dollar volume plunged by 21% to $8.6 billion.

Fourth largest was a shadow bank, LoanDepot. Its mortgage originations soared 27% to $24,691 mortgages. And Dollar volume soared 29% to $6.4 billion.

Fifth largest was also a shadow bank, United Wholesale Mortgage. Its mortgage originations skyrocketed 55% to 20,387 mortgages. Dollar volume skyrocketed 67% (!) to $6.0 billion.

Sixth largest was Bank of America. Its mortgage originations plunged 43% to 14,325 mortgages. Dollar volume plunged 37% to $5.9 billion.

Seventh largest was a shadow bank, Caliber Home Loans. Its mortgage originations rose 4% to 18,629 mortgages. Dollar volume jumped 14% to $5.4 billion.

Eighth largest was also a shadow bank, Fairway Independent Mortgage. Its mortgage originations soared 28% to 14,655 mortgages. Dollar volume soared 37% to $3.8 billion.

Ninth largest was – you guessed it – a shadow bank, Guaranteed Rate. Its mortgage originations rose 4% to 11,525 mortgages. Dollar volume rose 7% to $3.6 billion.

Tenth largest was – surprise, surprise – a bank. US Bank’s mortgage originations plunged 24% to 10,817 mortgages. Dollar volume plunged 19% to $3.6 billion.

This is the trend: Banks are pulling back from mortgage lending in a big way, likely cherry-picking their customers to curtail the risks amid inflated prices and irrational exuberance in an environment of rising mortgage rates; and non-bank lenders aggressively chase everyone else. And since these “shadow banks” not regulated by bank regulators, they’re free to do as they please.

This chart shows the top 10 mortgage lenders in the US in Q1, by dollar volume, shadow banks in red:

ATTOM obtained this data from publicly recorded mortgages and deeds of trust in more than 1,700 counties accounting for more than 87% of the US population.

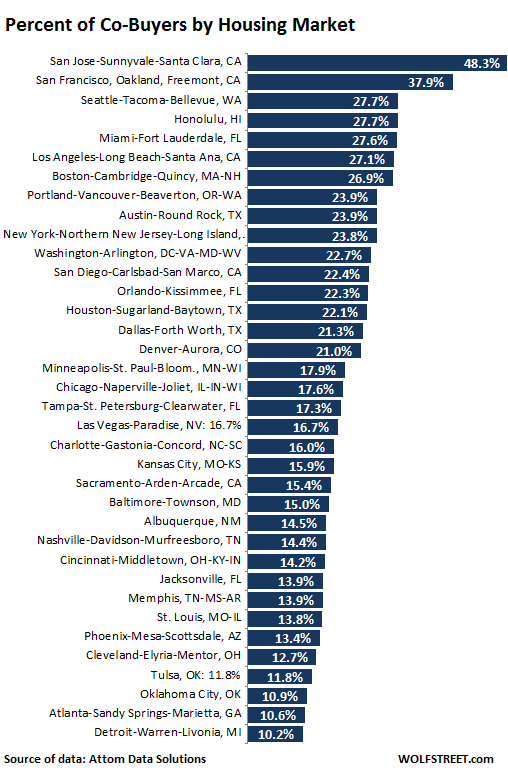

It also pointed at the curious dynamics of co-buyers – defined as multiple, non-married buyers listed on the sales deed – in the most expensive markets. Nationwide in Q1, 17.4% of all single family homes were purchased by co-buyers, up from 16.3% a year ago, and up from 14.9% two years ago. But the national averages paper over the vast differences in individual markets.

The chart below shows a sample of the 184 metropolitan statistical areas (MSAs) analyzed in the study by percentage of co-buyers. Not surprisingly, the most expensive housing markets rank at the top, where people have to gang together – such as resorting to the “bank of mom and dad” – to be able to afford a home. Nevertheless surprisingly, nearly half of all homes in Silicon Valley were purchased by co-buyers and nearly 38% in the San Francisco MSA:

In terms of down-payments, forget 20%. The average co-buyer down-payment amounted to 15.3% of the average sales price. For all other homeowners, it amounted to 11.4%. This does not include the possibility that the down payment has been at least partially borrowed. And down-payment lending is becoming a hot business in this market.

The “waterbed effect” of money flows. Read… How Chinese Investors Inflate Housing Markets in the US, Canada, and Australia, as Governments Try to Stem the Tide

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

OK so … “shadow banks” aren’t the Mob, they’re simply companies who stay back in the shadows, as it were, with generic names like Sunshine Finance Co. or something.

Is the point that, say, I think I’m financing a loan from say, Wells Fargo, but then Wells sells the loan to Sunshine Finance Co. so now I’m stuck with them (or they’re stuck with me)?

No, Wells Fargo doesn’t sell the non-bank or “shadow bank” your mortgage. You go to the shadow bank and ask for a loan. QuickenLoan, the largest shadow bank, and largest mortgage lender in the US in Q1, advertises all over the place, including on this site :-]

But if it’s true that the shadow banks borrow money from real banks, besides issuing bonds, wouldn’t that put the real banks at some risk? As well as banks have hidden risk in the past my guess is they have done so this time too.

Beware of second hand paper! You broke it , you buy it!

The largest banks in the US have more or less learned their lessons: when they lend money to these “shadow lenders”, usually through lines of credit (a mortgage-oriented company as huge as Quicken Loans needs a lot of capital to function) they do so as senior creditors.

Senior, or secured, creditors have well defined and legally binding claims to some of the debtor’s assets and/or revenue streams in case of a bankruptcy. I am ready to bet a shiny ChF1/2 coin those lines of credit and loans are backed by mortgage revenues, likely the most financially sound the shadow bank has on books.

In short it means large banks have little to fear: even if the shadow bank gets liquidated in a bankruptcy, they get the revenue stream from the soundest mortgages, the ones with little or no risk of going under. They lose some money but not much: as usual senior creditors are sacrosanct.

The other creditors may not fare so well. All the bonds issued by Quicken Loans I could find are in the “unsecured” category, meaning those holding them have no specific claim to an asset or revenue stream.

This means that in a bankruptcy those holding these unsecured bonds must join the line with all other creditors and have to split with them whatever is left after the senior creditors have laid claim to their legally sanctioned assets and/or revenue streams. Worse yet, in case of a debt restructuring deal they have little of the warranties and leveraging power senior creditors have: they must accept large losses or face the uncertainties of a liquidation.

As far as shadow banks go Quicken Loans is solid: Moody’s rate their bonds as Ba1, meaning the best financial junk your money can buy. The others are not so solid, especially those such as Caliber Home Loans which specifically targets not-so prime mortgages.

As with all junk-rated lenders these shadow banks are blowing off the Fed: there’s still a lot of appetite for long term junk carrying little yield. But it won’t last forever.

MC01: with respect to who eats the losses – aren’t the vast majority of these loans guaranteed by Freddie Mac, Fannie Mae or govt agencies?

Yep. And no, I don’t believe the part about the biggest banks ending up with the safest slice only. Remember the last time around even some A rated bonds turned out to be junk. These shadow banks by definition have lax underwriting standards. I don’t think their mix would be 80% safe and 20% toxic. Most likely it’s going to be the other way around. In order for the lender to get truly the safest slice, they’ll have to control the underwriting, but they can only do so if they own the shadow bank.

Also don’t forget the derivatives side of it. Shadow banks can generate all the mortgages they like, but it still takes the big investment banks to generate the derivatives. And given that profits in IBs are at a record high, they must be taking some risk somewhere. Maybe it’s not mortgage, maybe it’s shale oil, etc, but the point is there are many ways US banks can get bit.

David Calder,

Yes, it puts banks at risk of a loss, but only for the amounts of the loans, and they’re not huge compared to the loan portfolio of a big bank.

It’s difficult for me to believe that anybody would sign with Wells. Perhaps the 14 billion was one deal. Three techies co-wrote a Painted Lady…

Hence the “or they’re stuck with me” quip, since if I’m dumb enough to deal with Wells I’m probably not good with finances … may take off one night after being 90 days’ delinquent taking the copper pipes with me.

The last crisis became a crisis after the treasury sec. Stole 750 billion from the taxpayer to pad banks balance sheet which has been greatly expanded hence chicken little-ism? (the real crisis piggybacked off of subprime!)Dont fight the Fed or negative interest rates (needed or not)will punish your Will to earn and/,or save?

Wolf, who is purchasing the Quicken Loan to market as a security?

I read somewhere awhile back (maybe here) that most of these financial institutions, whether banks or shadow banks, make their money through mortgage origination and then quickly sell the actual loans to Fannie, Freddie or other GSE. I think I read that 97% percent of new loans land on the books of a GSE, do you know if this is true?

If these banks and shadow banks are merely earning fat fees for mortgage origination and then unloading the risk onto government backed GSE’s, then there is no risk of a 2008 style collapse. The government can easily absorb the losses from their GSE’s because, as every economist is keen to point out, it’s impossible for the U.S. government to default on its obligations (at least in nominal terms and those are the only terms that count here).

Am I wrong in my assumptions? Won’t the potential losses land on the government that backs these institutions? And won’t these government losses eventually be backed by the Fed? It is said that a government that owes money in its own currency can never go bankrupt – I believe that applies in this case – although technically control of the U.S. dollar belongs to the Fed not the government.

If I’m wrong, and this is an instance when I would like to be proven wrong, please anyone explain where my assumptions are false.

Of course if I’m correct it means cash is trash.

There are many types of mortgages that the GSEs do NOT buy. There are size limits, minimum credit score requirements (no subprime), down-payment requirements, etc.

Here are some rules by Fannie Mae on requirements concerning down-payments, LTV ratios, etc.

https://www.fanniemae.com/content/guide/selling/b5/1/01.html

Fannie Mae does not buy mortgages whose borrowers have credit score below 620 (generally considered “subprime”) for fixed-rate, and below 640 for AMRs

https://www.fanniemae.com/content/guide/selling/b3/5.1/01.html

There are other limitations on what the GSEs are buying. So the percentage of mortgages that they do buy is not nearly 97%. It is much lower.

The GSEs also have strict underwriting standards, including income verification, etc. If a lender fails to follow them, sells that mortgages to one of the GSEs, and then the mortgage goes bad, the lender can be forced to buy back the mortgages and take the loss. This happened a lot after the financial crisis, and some of those cases are still tied up in court.

These are among the reasons why there are specialized mortgage lenders that write mortgages that cannot be sold to the GSEs.

A quick google search turns up the following from valuewalk website:

“Through the Government Sponsored Enterprises the government either owns or insures 3 of every 5 mortgage loans currently outstanding in the country” That was as of 12/31/17.

So according to valuewalk.com government GSEs currently own or guarantee 60% of the entire mortgage market, and VA and a few other GSE guaranteed loans don’t seem to require strict underwriting. The article did not say what percentage of new originations are either directly sold to GSEs or otherwise insured by GSEs, it is my understanding that the percentage is quite high – but I will admit I honestly don’t know.

If 40% of all outstanding loans are not insured by the government that does provide an opening for things to turn south but I bet the government and/or the Fed would come to the rescue – they did last time why would this time be different.

van_down_by_river,

Thanks for digging up the data. The percentages have likely not changed all the much since we had the last mortgage crisis, which was caused by only about 10% of the mortgages defaulting, if I remember correctly.

Wolf, I’ve also seen a number in the 90%+ of all mortgages since the Great Recession quoted in various places, although this number is a total of all mortgages guaranteed not just by the GSEs but also includes the FHA and VA (in either case the effect is the same as far as the government guarantee). You might want to check the actual figures but I think van down by river migh not be all that off.

Max Power,

Whatever the percentage is, it’s about the same as it was in 2007 when defaulting mortgages started taking down the banks. This is the thing to keep in mind.

I once got an Amerisave mortgage and they then quickly sold it to PennyMac.

I think of these are both non-banks. So the shadow banks deal with each other but not with real banks ?

Sure, anyone can sell a mortgage to anyone. Every time a bank gets acquired, or its assets get acquired, those mortgages on its books go to the acquiring bank.

But your example is special: PennyMac was set up by some investors in 2008 to acquire troubled and defaulted mortgages and squeeze a buck out of them. It has since become more of an actual mortgage lender. But initially all it did was acquire mortgage portfolios from banks that wanted to shed those mortgages during the mortgage crisis. This is a very special case.

If Wells Fargo wants to sell a performing mortgage to QuickenLoans (this was the scenario my comment replied to), QuickenLoans would require a HUGE discount, and Wells Fargo simply wouldn’t do that. QuickenLoans can make a lot more money originating its own mortgages than it would make acquiring a performing mortgage from Wells Fargo without a huge discount.

Acquiring non-performing mortgages is a different deal. They’re sold at large discounts to firms like PennyMac that then hound homeowners with all legally available force.

Wolf,

In case of one of these non-banks defaulting, could the new owner/purchaser of the mortgage renegotiate the terms of the loan with the home owner? Could they renegotiate the interest rate on a fixed mortgage loan?

Lenz,

Only if both parties (lender and borrower) agree to renegotiate the interest rate. There is nothing in a mortgage that allows one party (no matter who) to change the terms of the mortgage unilaterally.

There was a time in the 80’s when banks held 6% mortgages from homeowners while homeowners were making 12% in short term CDs. No incentive to pay off the loans. Poor banks.

Will we get there again with banks and shadow banks holding 3.5% mortgages and CD rates up at 6%?

If so, in this fast pace computer age, will banks and shadow banks be offering buyouts to these low interest loan owners?

But what about the “Shadow” mortgage collectors? My mortgage has been owned by Mr Cooper and Cenlar. I don’t think they make loans but with 3 calls and 10 E-mails per week, Mr Cooper is trying to make a deal with a 4.8% 30 year loan with cash out. So far I have resisted.

Our Mr Cooper loan was formerly CitiBank. The Cenlar loan was sold by Loan Depot.

What if Mr Cooper and Cenlar go under with all of these money-losing 3.5% 30 year loans out there? Who gets these loser loans?

If you go to a real bank to take out a loan using a deposit that you borrowed from Usury Loans Inc (but you don’t tell ’em), is that fraud? Seems like booming down payment lending is the canary in the coal mine.

Leverage!

Volume isn’t necessary indicative of quality. I’ve had several experiences with Chase in the past 6 months that indicates that there are certain departments that are funding things that most shadow banks wouldn’t touch with a 10 foot pole (putting more far focus (potentially all?) on LTV over DTI, but in super high value markets where it can be difficult to find buyers now). Not to say that shadow banks suffer worse in the next downturn, but one major bank at least is definitely using questionable underwriting standards.

And all these mortgages are bundled up and sold around the world as securities to poor little investors. So, the big boys are safe; the little investors will pay through the nose just like last time.

Wolf,

Can you speak more about how shadow banks finance their lending? If at some point there are large numbers of mortgage defaults because the mortgages are essentially subprime, does that contribute to the risk of bank failure if the banks had financed these shadow bank companies?

Traditional bank: Deposit(short term, think about 1 year CD) funding and Capital (long term, such as 30 year mortgages) market lending.

Shadow banks: Money Market (think about over night fed funds, 7 day treasury repos, 3 month commercial papers,

all of those stuff in money market funds) funding and capital market lending.

The difference is regulation regarding stuff like reserve ratio, capital ratio, how you can securitize then loan etc.

I do NOT know the details but what I am 100% sure is that when economy is good, they make money on fees and rate spreads between short term and long term. When economy is bad and loans are NOT being laid, they will sink and walk away and in the end the bill lands on TAX payer through GSE or bailouts.

The undamental issue in the market is these “risk transfer” mechanisms (securitization, GSE guarantee, Bail out and CB printing) to “encourage/enable” all kinds of “irresponsible” behavior with little or NO skin in the game to let the mass carry more debt and transfer wealth into the hands of the few that are in this entire “financial” system doing these “lending” plumbing work.

It is my understanding that you are correct, most of these loans land on GSE’s that are backed by the government. And GSE’s are only allowed to buy loans that meet conservative underwriting standards, so we have nothing to worry about. Americans appear to be piling up giant mortgage debts but the GSE’s say they are good for it.

I make a tad under 100k/year and my modest income is not enough to qualify for a non-conforming mortgage to buy the typical home in Seattle (now over $1,000,000) and a conforming loan amount (about $460,000) is entirely inadequate for the purchase of a home (unless you make a down payment of over $500,000). This tells me there are a lot of people who have a lot of money laying around and these people are using their money to buy homes – they live and work in a different economy then me. My economy keeps me living in a van down by the river (Skagit)

If you make 100K and you live in a van down the river, you will save 40K a year.

Do you want to carry 800K debt and accumulated nothing every year with a risk to lose the house when recession hits or market resets OR do you want to live in a van down the river accumulating 40K a year and not worrying about sucking up to your boss

or fright about market, and go out and vote for who ever that will keep house price up at what ever cost?

Keep doing what you are doing and you will get rewarded. Those turkeys will get slaughtered on thanks giving.

“Shadow Banks” which are regulated by the various state Division of Banks who also regulate state chartered banks secure their funding from other financial institutions such as US Bank, Bank of America, Santander, etc. by pledging the loans as collateral on what is called a repo line. And these “Shadow Banks” can often sell the loans to such places as Wells Fargo, Chase, TD Bank and numerous others or in some cases with Fannie/Freddie directly and into mortgage backed securities.

Precisely, thus, the major banks will be seeking another bail out. Unfortunately, like Paulson, Trump will not impose conditions. It will just be more free money to the banksters.

Couldn’t resist a 3% 15 yr fixed a few years ago. The papers to sign were literally stacked a few inches high and took over an hour; quite a change in only a few years. Many of the forms bordered on ridiculousness, including a form designed to inform me and make me acknowledge that mortgage education assistance was available at the number provided. Loan closing seems like a less than ideal time for that, but later that day I called the number just for kicks. No answer, no recording, …After a couple tries, I finally got through to someone, but I had to explain twice that the form said that I could call for mortgage education assistance. Then I asked a few very very basic mortgage 101 questions and the person was totally incompetent.

Somebody obviously set up a nice racket that adds even more time and cost to originating a mortgage. Cui bono? Some friend of a politician probably.

The spud is getting warmer!

Shadow bank is a post modern name for savings and loans

No, because “savings and loans” take deposits. That’s why the S&L crisis was so vicious – because deposits were at stake, and hence the bailouts. These non-bank lenders don’t take deposits.

So do these shadow banks package and resell these loans, thus reducing their exposure?

Yes, the GSEs may buy the qualifying (conforming) mortgages. Non-qualifying mortgages can be packaged into MBS that are not guaranteed. But some risks are retained. And they retain other mortgages that cannot be packed into MBS and sold off. So they issue bonds to fund those mortgages. Given the huge volume in mortgages they write, and given the small amount of capital these non-bank lenders have, it doesn’t take much for them to topple. This is exactly the same process that happened with the non-bank mortgage lenders that collapsed during the last mortgage crisis.

If they do securitize the loans and these get sold to pension funds like last time, I can just smell another lawsuit settlement in the corner. But just like last time, it will be just another cost in doing business.

Banks will be fine this time because they know they are systemic.

The next crisis, Jamie Dimon is going to be president and Mark Z will be his President in waiting. And the next amendment to the constitution is EVERYONE must have a Facebook account.

At this point, might as well just say Heil Hydra!!! Where’s Captain America when you need him?

REPLY

Steve

23 HOURS AGO

When in the car, I tend to listen to 2 radio stations. CBC (about 5% of the time) to see what the latest politically-correct, neoliberal narrative they’re selling is and the FAN590 (about 95% of the time) for sports summaries or the latest Toronto sports game. What I’ve noticed is that even just a few minutes of listening to the FAN, I am exposed to several advertisements for shadow banking businesses. Private lenders that offer subprime mortgages or offer loans against home equity. I cannot remember a time that such offers are not made in the limited time I am driving and listening to the radio.

And, anecdotally, I can tell you that the homes for sale in our area of the GTA are NOT selling. Most of them have been up for months and there’s little to no movement on them at all even with the prices being reduced again and again…

I assume the shadow lenders are borrowing the money short term and the stowing the mortgage in a private mortgage backed security where it is sold to my pension fund. Well the riskiest tranche is sold to my pension fund.

Shadow banks perform the loan origination and grab their fees. I don’t think they hold the loan until maturity. I believe they carve the mortgages up and sell them as CDOs. If I am correct the CDO holder would be at risk from potential mortgage defaults not the shadow bank. CDO holders probably include pension funds, mutual funds, insurance companies etc..

How are these non-bank actors funding these mortgages, using CLOs?

In any case, regardless of the originators, I guess one way or another the taxpayer will end up on the hook during the next downturn, be it through the FHA, VA, GSEs, FDIC or NCUA.

As for HELoCs, adjusting for actual income growth between ‘06 and now, lending volumes are only about 37% of what they were then. Wouldn’t really call that a bubble. BTW, the recent tax code changes have made HELoC interest non-deductible if the cash isn’t used to improve the collateral property.

MCO1

Good insights. If the large banks lend in exchange for the cash flow of the bond/loans, and if the home is over priced (they probably are) and the down payment is low and/or borrowed and the recession comes (which it will, just don’t know how deep/hard it will hit), then the borrowers will lose jobs, take pay cuts, stop paying mortgages and probably walk away from the loans leaving the banks with NO income stream. I have no hard data, however I remember hearing that one of the best ways to determine the performance of a real estate loan was the percentage of the down payment. True, these are not no down loans, but they are obviously lower downs and it appears from what we are seeing here that alot of the down payments are borrowed.

What is the rational that the banks are safe in doing all of this lending? Maybe they are a ‘little’ bit safer since the loans are ‘lower’ (yet still borrowed) down and not ‘no’ down.

But it is important to remember only roughly 2 types of buyers immediately forclose when shit hits the fan.

Over extended flippers, as wolf pointed out in his articale on Canada and variable interest peeps with no down payment cushion. Every one else tends to whether the storm as long as they have work.

Housing prices in cities always come back up unless something drastic about home buying changes.

I would be interested to see how many ridiculous speculators there are still buying homes in socal in search of short term profit. I really have no idea.

In my hood there are lots of Indians and other people who probably hold dual citizenship. If things go downhill they can most likely jingle mail then roll back to the country they came from. Take out a HELOC first, of course. I doubt there is much recourse the banks here can do.

In my hood (Washington state), if things go downhill anyone can jingle mail (dump the house on the lender) and then roll anywhere or way they please. Simply skate away.

Washington is a non-recourse state and the bank is entitled to nothing other then foreclosure of the home – the borrower is not responsible to pay back the loan – the borrower is not legally obligated to pay back the loan. Of course the IRS may still count the difference, between what was loaned and what was recovered, as taxable income.

To my knowledge, Washington state is NOT a non-recourse state; the lender has the OPTION of either a trust deed sale (usually cheaper for them), OR a judicial foreclosure (if they think they can collect a deficiency from you). You’ll find out which you get when you can’t make the payment anymore.

They hide it anyway they can. Last time it was CDO and CDS and now they re-jigged it. Its not clear what to short but its out there somewhere unless it all goes back to the Big 5 who will get bailed out again.

The TBTF banks and Wall Street financial firms can speculate with reckless abandon, knowing the Fed and middle class taxpayers have their backs.

Is UWM even on the hook for anything. I have a new mortgage with them 20% down 30 year fixed. Within 2 weeks of closing the loan was transferred to Fannie Mae. I hear this is pretty common, even normal. I still go through the UWM portal to pay.

It would not surprise me to hear they take on riskier mortgages than a big bank. I got connected to them through a broker/ realtor.

You didn’t mention Portfolio Line of Credit, which is popular. My broker ( on your list) assured me that THEY would not revalue the balance on that loan even if the market were to lose value. He also instructed me that the proceeds could not be used to buy more stock with THEM, but that I could use the money any way I saw fit. While home equity values are inflated and the market is less liquid, it will take months even years before that revaluation gets to market. Of course if you don’t have the cash to pay the interest it all comes to a conclusion much sooner but at least in the matter of stock portfolios they can unwind your holdings I suppose, just like margin. To me RE represents a much smaller problem, and one which the lack of supply will continue to support. Stock margined through equity loans is the real trapdoor in the economy.

Really interesting article Wolf. Two questions why are the banks reducing their mortgage business? Is there better returns elsewhere? Also I had a look at one of the shadow banks and saw they had a debt note repayable 2025, interest on the note was 5.25%. What sort of interest rate would you have to charge to make this business model work?

That’s where subprime comes in. Rates on subprime loans can be fairly high.

Wolf called it risk aversion, but in a rising rate environment if you write fixed rate loans you could get hurt.

Co-owners might explain the multigenerational family of five adults who bought the house across the street.

Curious, what happens if one of these Shadow banks collapse? What would happen to the loans?

Both good and bad? I assume they would be sold off in bankruptcy to someone else in different tranches, but are these also guaranteed in some way by Freddie and Fannie?

I wonder if this opens the doors to more foreclosures.

How much of a role do cash-out refis and helocs play in inflating the residential real estate market?

It would seem to follow that an owner of a house owned free and clear (or with substantial equity) would be more flexible on price than an owner of a house with 100% LTV. No offers would be accepted unless the sale price would bailout the owner from the debt on the property, ratcheting prices upward.

A clear title should be worth something. If your mortgage is packaged into MBS and sold, who holds it if the servicing company gets into trouble? The question was never answered in the first housing bubble. If you pay up front how do you know the mortgage has been cleared, again the servicing company is in trouble and they pool their debts? Pays to be very careful in this market.

From Newrepublic.com

The year just wouldn’t be complete without one final dubious financial fraud settlement. A consent order between the Consumer Financial Protection Bureau, every state but Oklahoma, and the mortgage servicing company Ocwen again shows the continued, systemic mistreatment of American homeowners. Ocwen stands accused of “violating consumer financial laws at every stage of the mortgage servicing process,” according to CFPB Director Richard Cordray. But under this settlement, their executives will face no criminal charges, the firm will not actually pay the large majority of the penalties themselves, and they did not even have to admit wrongdoing in the case.

Ocwen built their servicing empire in part by purchasing the rights to handle mortgage accounts from big banks like JPMorgan Chase, Bank of America and Ally Bank, the same ones that settled their own cases of mortgage servicing abuse in the $25 billion National Mortgage Settlement in February 2012. So to recap, big bank servicers abused homeowners, paid a nominal fine, and sold their servicing operations to non-bank servicers like Ocwen, who routinely engaged in identical practices. This game of Whack-a-Mole, with customer accounts passed around from one rogue business to another like a hot potato, shows that the problem lies with the design of the mortgage servicing industry itself, not the individual companies.

“Too often trouble began as soon as a loan transferred to Ocwen,” said CFPB Director Cordray on a conference call announcing the enforcement action. The complaint, filed in federal district court in D.C., alleges that Ocwen charged borrowers more than stipulated in the mortgage contract; forced homeowners to buy unnecessary insurance policies; charged borrowers unauthorized fees; lied in response to borrower complaints about excessive and unauthorized fees; lied about loan modification services when borrowers requested them; misplaced documents and ignored loan modification applications, causing homeowners to slip into foreclosure; illegally denied eligible borrowers a loan modification, then lied about the reasons why—the list goes on.

You can bet your sweet bippy, this will become the norm with Shadow banks……