4.73% now. 5% in a few weeks. Then 6%.

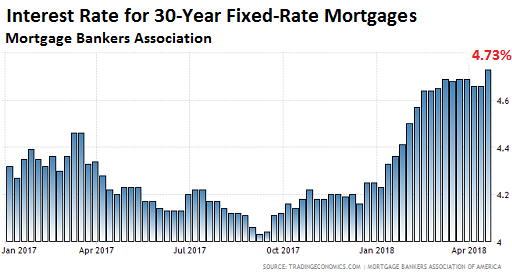

The average interest rate for 30-year fixed-rate mortgages with conforming loan balances – $453,000 or less – and a 20% down-payment jumped to 4.73% for the week ending April 20, from 4.66% in the prior week, according to the Mortgage Bankers Association. This was the highest rate since September 2013. So far in 2018, this measure of the average mortgage rate has risen half a percentage point (chart via Trading Economics):

And since mid-2016, mortgage rates have now risen a full percentage point.

Points – these pesky upfront fees, such as origination fees, that are usually plowed into the mortgage balance – rose 3 basis points during the week to 0.49% of the mortgage amount.

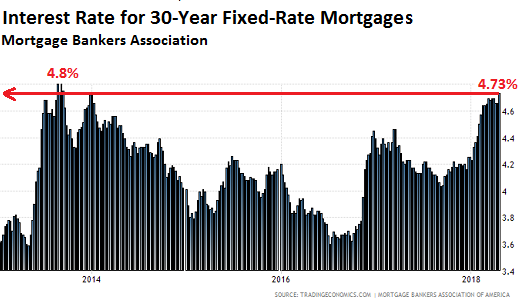

If the average mortgage rate rises to 4.81% — at the pace the average rate has been increasing, this might happen in a few weeks or less – it will be the highest since 2011 (chart via Trading Economics):

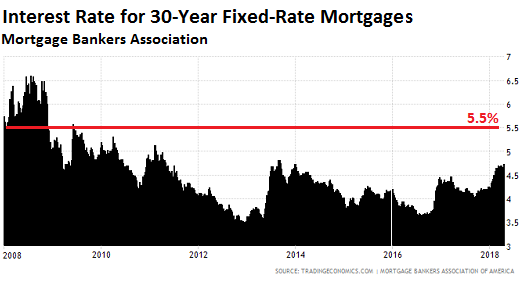

If the average mortgage rate rises to 5.2% — perhaps in the second half of this year — it will be the highest since 2010. And 5.5% would take mortgage rates back to levels not seen since 2008 (chart via Trading Economics):

But there is a difference between those higher mortgage rates now and the same rates back then: Home prices! Depending on the metro area, home prices have surged over those years, while incomes have not, and now the free lunch – the combination of rising home prices and falling mortgage rates – is over.

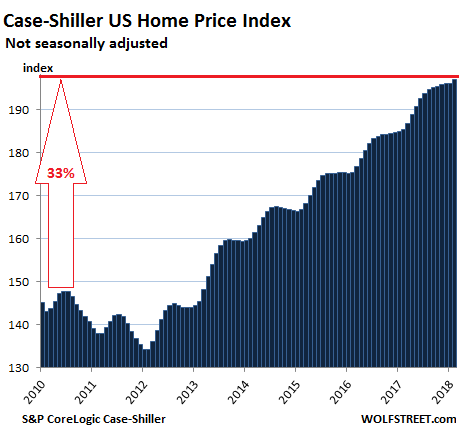

Since 2010, the last year when mortgage rates where at 5% for a significant amount of time, home prices as measured by the nationwide Case-Shiller home price index have surged 33%:

Fearing even higher mortgage rates in the future, home buyers are rushing to take out mortgages while they still can: the Mortgage Bankers Association’s Purchase Index, which tracks the number of purchase mortgages (as opposed to refis) that were originated during the week increased 11% compared to the same week a year ago.

The pain threshold for the US housing market is at 6% (average 30-year fixed-rate mortgage, as measured by the MBA, conforming, with 20% down). That’s my story, and I’m sticking to it. There may well be a cold-shower effect at around 5% that will sober up some home buyers. But pain will set in at around 6%. People have forgotten what a 6% mortgage feels like though that’s still a historically low rate. And they’ve never had to finance homes at these sky-high prices at 6%. That’ll be the new thing. And something will have to give.

And so everything spikes. Read… Update on the Most Splendid Housing Bubbles in the US

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’m sure the Fed will fix everything they’ve caused ….

They surely have all of our best interests at heart……

Hmmmm well don’t forget – many seem to have due to unprecedented propaganda and misinformation – that it was the reckless gambling of ‘free marketeers’ financiers 10+ years ago that triggered the need to drop IRs to the floor in order – literally and without exaggeration – to cause the global economy to implode and take everyone’s savings, pensions and investments with it.

And it’s those same ‘free marketeers’ (large funds – activist shareholders) who have been very keen for the last 40 years on moving wealth-producing manufacturing jobs abroad, in order to bolster short-term stock prices by taking advantage of cheap labor – thereby gutting the country of its means of producing real, sustainable wealth.

Nope – it ain’t just the fault of the Fed. Not by a very long chalk. This has been baked in since neoliberalism came a-knockin’ over 40 years ago – total financialization and debt saturation is the end game. And here we are.

I should have said ‘drop IRs in order to save the global economy from imploding’ not ‘in order to cause the global economy to implode’.

…however give it a few more years and quite possibly my mistake may prove to be correct.

If not for the Fed we would have crashed all the way into another great depression by 2009 if it took that long. Lots of people, especially on the right, love to bash the Fed but it was really Congress that refused to fund a needed and long overdue massive infrastructure revival which would have revived domestic steel and hired tens of thousands of workers and instead cut taxes on the wealthy in some sort magical thinking that these were the job creators when it was the same class of people who moved US manufacturing overseas, gutted pension plans, and bribed their way into getting tax cuts for their class and the rest take the hindmost. Their class was made whole in the bank bailouts while ordinary Americans who lost their jobs were reminded about their obligation to a mythical moral hazard while the rich use bankruptcy as an escape plan. Lenders were made whole and borrowers were not. The Fed had nothing to do with any of that..

The FED is nothing more than a group of parasitic bankers who only care about themselves That Much should be very obvious to everyone by now David Shame on you for defending them sir

The zombie banks should have been shuttered, 12 regional fed banks to replace all credit swaps, interest, savings and money market mechanisms and the speculators should have been wiped out. For some reason you think the fed was right in rewarding idiot speculators emboldened by easy money shenanigans created by the fed, treasury and govt. while savers were gutted?

Rediculous, the fed blew it by saving stupidity and crushing the prudent smart folks….

The FED banking cartel did not have to give free money to bankers after they were defrauding pension funds and other investors by selling securitized mortgages. The bankers knew those would fail and actually bet that would happen. Banksters were not essential as they claimed.

They saved the crooked bankstershareholders and their minions. The institutions are essential but they could have continued with the US government as owner… broken up …Then later the smaller banks could have been sold to new owners for billions. The economy and the poorer 90% of Americans have and will continue to suffer due to the QE and the US becoming responsible for the crooked banksters’ bad loans.

The Fed is the deceptively named banking cartel through which they saved themselves. It has funneled millions in way below market rate loans and QE commissions to their member banksters. Remember before 2008 the banksters made billions selling bad mortgages to investors. They then we’re bailed out by the FED and TARP.

Wrong! The Fed is absolutely to blame for flooding asset markets with cheap money and enabling massive asset inflation and government deficit spending.

Greenspan lowered interest rates to 1% and held them there and caused a huge housing bubble. What Bernanke did subsequently is an absolute disaster. The Fed enabled the government to double the debt from 10 trillion to 20 trillion in short order.

So tired of apologists for the Fed. The Fed have been reckless and focused only on very short term results, completely ignoring the long term effects of their policies. Fed policy has been a disaster for our economic sustainability. The snow has piled high on the mountain slopes and avalanche season has arrived.

But wait! Wasn’t it important for “Greenspan to get his ‘record’ long expansion!” Wasn’t it more important to stroke his ego than to give a fair shake to the american factory worker! I think you go too far! Have some sympathy for Poor Alan Greenspan!

Nope – it ain’t just the fault of the Fed. Not by a very long chalk. This has been baked in since neoliberalism came a-knockin’ over 40 years ago – total financialization and debt saturation is the end game.

Wow, the delusion is strong in that one. The Fed is part and parcel of the oligarchy’s game plan, i.e. neoliberalism, to turn America and the entire planet into their exclusive looting colony. The Fed was set up for this express purpose (read “The Creature from Jekyll Island), and your “end game” has already arrived.

There’s no ‘delusion’ here I can assure you – that’s why I said isn’t JUST the fault of the Fed…

And I know we’ve reached end game – that’s why I said “here we are”.

Maybe less knee-jerk, bit more time reading and considering is the answer Gershon. And decaff..?

I was thinking of “The Creature from Jekyll Island” as I read this thread. You are dead on the money. Maybe MD should take his/her own advice and read it.

We should stop labeling things in political sides. Both parties have MASSIVE corruption or the banksters would be in jail. All Americans that are not in the top 10% suffer or will suffer due to the bankster and other politicians’ corruption.

Our country will soon have more surveillance of that 90% of victim Americans than George Orwell could even imagine. We should target the congress persons supervising banks and the intelligence and law enforcement community for prosecution and defeat in elections. The insider trading and trading on information acquired during such surveillance opportunities are amazing. The crooks will just get richer.

The majority of Americans of all ethnic or religious groups will realize that we all have seen our country’s wealth comp!etely stolen by crooks only when the economy collapses.

I always said that 43 was an FDR neoliberal in a Republican suit, he championed the Home Ownership Society.

Funny! I hope that was a joke.

I’m curious, if the 10 yr treasury is at 3.0% today, won’t that mean that when the Fed hikes two more times, it’s likely to be at 3.5%? Won’t the 30yr be well over 4%?

Won’t the bond markets shoot right to these elevated numbers today based on the expected future valuations?

Long-term rates don’t move in lockstep with short-term rates. Hence all the hand-wringing about the flattening yield curve.

And also, the 30-year yield trades on a 30-year horizon, meaning it tries to anticipate and factor in what else might happen over the next 30 years, so it won’t just look at short-term rates. Right now, there is expectation that the Fed will raise rates in 2018 and 2019 and probably into 2020, and then, the bond market hopes, the Fed will cut rates again. So for 4-year and over yields, this future rate-cut probability figures into the scenario, along with many other things.

Like navel gazing you mean ? Has anyone got it right or even close after 30 yrs ?

Only by chance.

>Like navel gazing you mean ?

a la Timothy Leary?

I would say that the longer the timeframe, the murkier the outlook. That’s why longer term bonds should normally have higher yields, to account for unknown unknowns. The fact that the spread is narrowing is an indication that there is expectation of a recession, and falling interest rates, or just flying blind.

I’m not sure the Fed would care that much if home prices fell a good 20%. Most of the bank loans that are currently outstanding were originated at a time when home prices were 20-40% lower, and those loans would not be underwater if the market dropped 20%. However, more recent home buyers would be hung out to dry, as a fitting end to their stupidity.

Problem is, prices are determined at the margin and nobody knows if/when a selloff turns into a bust dragging other bubbles along with it. The Bernanke though the market adjustment down would contain itself the last time around and may have acted way too late to save the bubble.

The conundrum now is that if the Fed packsaddles/panics again in the face of a small selloff then they would destroy the remaining credibility of actual normalization forever. If that happens, we may witness even more extreme bubbles of “rational” exuberance akin to a rockstar who just injected himself with heroin and driving 150mph thinking he’s truly immortal.

Yup. The true meaning of moral hazard. When the speculators are the only ones who get backstopped, everyone will become a speculator.

That’s the whole point of the Wall Street-Federal Reserve Looting Syndicate’s rigged game. Create moral hazard on a vast scale, blow up unsustainable asset bubbles, and launch a scorched-earth financial warfare against savers and the responsible. Net result: the muppets flock into Wall Street’s rigged casino in search of yield, where they can be fleeced at will by the Fed’s bankster accomplices. Wash, rinse, repeat.

This will not stop until we have a grotesquely wealthy .1% and everyone else is a debt serf whose only intrinsic value lies in their ability to generate more wealth for the Oligopoly to steal.

Ok, so a 5-6% may dry up demand but how much of an impact would it have on people who need to refinance? Would they just stay put and not sell, resulting in a lethargic RE market for as long as no other variables change?

It’s pretty clear somebody with a 30-year 3% mortgage isn’t going to move from the house, but they’ll have to stay in that house for 30 years to fully capture the benefits of the low rate loan. Of course, even if they stay in the house, the house will decline in value if the market drops. All it takes is a few sellers at the margin, and there will be plenty of those including:

-people who bought recently and go underwater (foreclosures)

-people who get laid off

-people who get divorced

-people who view RE as an investment, not a home

Bobber,

Let me just add here that most people don’t even realize they’re underwater until they’re trying to sell.

Even if they know they’re underwater — say, they think 20% — they’re still not going to default if they have a fixed-rate mortgage unless they lose their jobs and cannot make the payment.

Being underwater doesn’t really matter all that much to the homeowner with a fixed-rate mortgage unless something big changes.

So long as their income and expenses are unchanged. However, the economic shocks that may burst the real estate bubble can cause thousands to lose their jobs and thereby homes… As happened to many in 2008. Companies like one that I worked for in 2008 go under when their customers then stop or delay payments.

I think at some point that will happen again if something bursts the bubble violently: Fed incompetence or other economic shocks.

I’ve made a hobby lately of going to open houses of FSBO sellers. In about 7/8s of the cases, it’s clear it’s FSBO because the greed head seller’s wish price was wildly out of whack with a price point that would allow a realtor a quick sale and an easy commission. When they ask me at the end of the walk-through, “Well, what do you think?” I tell them exactly what I think: that their shack is priced way above what I’m prepared to pay. You would not believe the number who respond, “Well, I have to get out of it what I put into it.” Sure, pal…but I don’t have to PAY your delusional greedhead wish price, when I can wait for the coming fire sale on foreclosed houses.

It is all about payments. The price of the house has to fit someone’s ability to make the payments and pay the taxes and insurance. If the taxes go up or the payments go way up, or if you lose a deduction that made your lifestyle affordable on your wages/incomes. It is just a mathematical equation. People can only stretch their money so far. After that it is misery and eventually collapse. Always was, no way to change the math…

Unless we go back to variable rate mortgages or 5 year interest only balloons or negative interest mortgages. Maybe allow people to lie about their incomes again? There is a limit to the amount of living a person/family can do with a finite income..

Tops are the worst because people are hard sells on their property losing value. So the prices stay high and the inventory builds.. Sales drop off. Eventually the price starts to break down but people hate to lose and are very reluctant to acknowledge losses. So the back side of a real estate boom is extremely slow and painful.

The last drop took 3-4 years from top to bottom. If we are at the top now, most buyers will wait it out to avoid losing money. It’s the sellers that get nervous. In 2007, I looked at a house being offered for $800,000. When he found out I was leaning toward a house down the block. He dropped the price $100,000 in a day because he knew the market was dropping hard. I bought it, and sure enough the value did drop to that within a year. He was a builder who knew the market.

Going from 4.5% to 5% is not a market mover, but, I think if we start to see 5.5%-6% that will certainly be a factor.

700k 20% down at 4.5% is roughly equal to 650k at 5.5%

So if rates continue their upward trend then the people that bought at lower price points over the past 5 yrs with lower rates (in the 3’s) would have no incentive to “move up”; and therefore their property will not be listed further limiting inventory and combating a drop in prices?

I don’t know; chicken/egg paradox.

phathalo

Yes. People not being able to afford to move is already a problem. That’s in part the reason for the relatively low inventories on the market.

I was NOT burned by the last one. The price movement of past 10 years wil program the thinkings if the 30 year old and younger.

Short term, people will be buying to lock in low rates.30 year money below 5% is a no brainer at this point in time.Make that mortgage open and transferable.The Fed is going to raise rates inexorably Other side of the equation real estate is an actual tangible asset that will probably inflate in value with the move to hard assets as t bills implode.

Hopefully this will send this bubble to hell where it belongs.

Actually you don’t. The FED bailed out the 2008/9/10 mess because even their models could see disaster. With fiat currency, every debt is someone else’s asset.. Over and Over. Having this bubble to go all the way to hell would mean the debt ridden economy really rolled over. And all that unrecognized risky debt would be defaulted/re-written or written off.. And all those holding that debt would have that much less and would make many in default as the equity behind their debt falls and the balance.. is called. As that happens, all newly created debt would be at a good premium, as in much higher interest rates.

No! It isn’t rational to want that to happen other than metaphorically. I wish the nuts in charge would just quit putting their fingers on the sales in their favor. They are insane IMO.

No, it’s rational for people like me with ZERO debt. You didn’t read wrong. I live debt free. What you are really saying is that there’s supposed to be a way to save the irresponsible who makes up probably close to 90% of the population.

So yes, it will go to hell in the end anyways.

And no, I don’t loan money to other people nor do I own equities.

So yeah, no problem for me.

My theory is that rising oil, rising transportation costs, rising commodities will be what causes the bond bubble to burst. If there is a wiff of inflation bonds should sell off..( in turn have higher yields)

Yes, I think that will play a role. For a while, Wall Street will point to the ex-food-and-energy inflation numbers, but pretty soon, commodity prices filter into core product prices and into services like transportation, and core inflation rises too. Already happening.

[rising oil]

Electrified transportation is going to wipe out bonds backed by oil reserves. Energy return on investment for oil and gas is decreasing while the energy return on investment for wind and solar are increasing.

The fix is offering a 50 year mortgage in place of a 30 year mortgage.

Anything to keep prices high, yet monthly payments acceptable. And most homebuyers are too dumb to understand an amoritization schedule. They’re getting SO equity buying a house, even if 75%+ of the payment is interest…

Here is the thing Mark. If you tell people “hey, buy this house and you can work 30 years paying for it”, people think, okay, I can work for 30 years. If you tell them to work 50 years to pay for a house, they will say “F this, i will not be able to work for 50 years”. Then you tell them “U don’t get it, house prices always go up, and you can borrow now and sell later at higher prices and have the nice TAX deduction”. You think they will buy it? U think they will never question whether somebody else would like to work 50 years to pay for something they do NOT want for themselves? You think they would NOT think this is “Ponzi”? There is a line where the lie would be obvious, 30 year is the line.

“hey, buy this house and you can work 30 years paying for it”,

I don’t think anyone expects any job or career to last thirty years anymore. We’re in a neo-feudal, neo-liberal ‘gig’ economy.

Everyone is waiting for a robot or Amazon to take their job. Take a look on Zillow.com at how many homes are in pre-foreclosure in any major metro area. It’s horrifying.

That’s the thing. Everybody knows they have No idea ehether they will be able to maintain income for the next 30 years and yet they make 30 year commitment with 30 year obligation to buy an consumption item under the name of “investing”. I get when rent seekers come in and jack up the price because they can pool the money that fed showers. What I do NOT understand is for people spending 40% of income paying mortgage assuming they can keep doing that for 30 years and any two year job loss will make them lose their home. So these voters go out and vote for bailout, vote for globalization, get the immigrant come in, get foreign money come in, support government spending and endless debt creation, for what? yes, maintain the price of the home so that they can off load it to the next guy committing 30 years obligation. This is ponzi and this is wealth transfer, pure and simple. I own a home and saw the price doublez. I am happy that my home keeps me away from the rent seekers but I am still disgusted about the price move that enslaves people, create stress, isolation corruption and mass shootings. :)

The 30 year mortgage is an arbitrary duration. In the early 20th century when property ownership was really restricted to the upper crust of society, mortgages were much shorter duration 5-10 years, and banks wanted much larger downpayments. You had to be quite well off to actually own property. As time went by, prices went higher while homeownership transitioned from being something only the wealthy could afford to something for the masses, and the financial services industry was there to make ‘ownership’ possible.

And most people aren’t going to keep a home anywhere close to 30 years. More like 7-10 before moving up. I suspect that if most homebuyers were told they could afford significantly more house with a 50 vs 30 year mortgage, they’d take the 50 year. They’re not thinking about living in the house until they’re 70, all they care about is the monthly payment and that the paper value of the house is going to be a whole lot higher in the future.

Mark, maybe I am NOT most people. If I care “ONLY” about monthly payment, and I only plan to live in a place for 5 or 7 years, why would I put down payment and commit 30 year obligation? Why don’t I sign a long term lease and just pay rent? The “ownership” of the house is important to me, and I do NOT speculate on the rise of the rise of the price and offload to next sucker. Spend 50 year of my life to “own” a house cross the line. 30 years is already too long. To me, if Inhave NOT paid off the mortgage, I do NOT own the home no matter what everybody else is telling me. I just feel said when people say “I am a home owner” while they are actually “debt owner” and their “ownership” can be taken away at any moment there is financial difficulty. Maybe I am NOT thinking like most people. I do want that ownership, I want to pay down debt and own zero to nobody. So that i have this “ fuck you position” to say anything I want to my boss or Donald Trump, and I only work and hang out with people that I like. If you give me a 50 year debt obgligation and ask me for a down payment to enslave myself, I would rather give up the ownership and pay rent instead. I am “more” free that way.

I think Mark is correct. We will see 50 year mortgages again.

When I bought my first house in the 1980’s I had an option for a 50 year loan at 13%. 30 year loans were at 12.5%. I did not take it.

I considered taking it because:

1) The monthly payments were much lower so I could buy a larger house. and actually keep my PITI to below 30% of my income.

2) Since I wasn’t planning on staying for 30 or 5 years. My plans were 10-15 years so either loan would work.

I decided not to take it because at the end of 15 years, the 50 year loan was mostly interest paid. 30 year had much more principal paid.

Here is an example of a buyer wanting to take out a loan with an 800K mortgage.

PI for a 50 year loan at 5% – 3633/month

PI for a 30 year loan at 5% – 4295/month

Fairly significant difference at $662/month

The Seller is happy becasue more people qualify, RE Agent is happy they can close, the mortgage lender is happy they can close, the buyer is ecstatic (for now) with saving $662 per month.

Win-Win – Right? :-)

Since I wasn’t planning on staying for 30 or 50 years.

What I actually did was take out a 10 year ARM based on a 30 year term at 11%.

Meaning my payments were fixed at 11% for 10 years and then would adjust to the going rate for the next 20 years.

We might see more of those.

Since I was planning on staying for 10-15 years, 11% was guaranteed for most of that.

If the rates went nuts and leaped up to 30%, I was more protected than a 1 year ARM.

Ha! I thought 11% was only slightly crazy back then. Rates had already been near 20% for 30 year fixed. 30% was a likely possibility back then.

Fortunately, rates went down and I refi’d at 8%, 7%, 5% and now 3.75%. A bit of loss with each refi but these have been good times.

I laugh now at the panic that people are having with rates approaching 5%.

But Bob, you did NOT take the 50 year because paying interest is same as paying rent. Why take the 50 year and give your down payment? That’s why 50 year does NOT work from cost point of view. The only reason to take the 50 year is to “speculate” on house prices. Go speculate on stocks and leave the house out of it.

I viewed the 50 year loan as equivalent to a 50 year lease on the house. If rents went up, I was protected. I never planned on staying for 50 years but at year 15, I knew what my monthly “rent” would be.

At the time, real rents were going up dramatically with high inflation.

The 10 year ARM was riskier because I did not know what my monthly “rent” would be after 10 years.

Your comment about speculation is correct.

However, the speculation does not have to be short term with a 50 year loan. What are the odds with all of the up and down cycles and inflation over 50 years, that at some point your house will achieve an acceptable ROI. Timing is everything.

As I pointed out above, the monthly PI would be $3633/month for 50 years. That might be close to rental parity today. Will rents go up in the next 50 years? I expect they will.

The 200K down payment invested in stocks would likely have compensated the rent savings.

It is hard to predict the future.

Taking out a 50 year loan when you are 60 would shorten your odds. The bank would have better odds and return.

Bob, I agree with everything on your comment. That’s how one person would think about 50 year mortgage.

My view is simple, if the loan is 5 years, I can look at my savings, and make very good predictions about my income earning capability within 5 years and I can make decision buying/owning a house wisely.

Once that term becomes 50 years, as you said, it is difficult to “predict” the future, I will have zero clue about future and I have to risk a big down payment on something expensive.

The pros hedge long term loans with credit default swaps, interest rate swaps, what does the consumers do? They put down payment and hope for inflation. If inflation does NOT happen, they go and vote for TARP, ZIRP, QE, deficit spending and support wall street buying and foreign capitals buying houses.

The combination of higher interest rates and lower allowable interest rate deductions is going to impact prices and demand, especially in the expensive cities. On the low end the new standard deduction may exceed past benefits, but that will be eaten away by higher rates.

People who say, “What’s the big deal? Rates were over 10% not long ago!” don’t get it.

It’s the rate IN RELATION to the previous rate paid. People max out their borrowing power regardless of the rate, so if they max out at 2.5% and a humongo mortgage, if rates go to 4%, that’s a massive increase in their payment.

What rates were in 1985 is meaningless, because back then people didn’t owe 500K on their mortgage, so they could borrow at 20%, because they only owed 100K tops.

Wages would be relevant…..

$22 an hr welder in the 80s is making $40 an hour now…..

Jason that’s NOT true in my area I was making as much in 1985 as I was making when I gave it up in 2012 The illegal workers didn’t exist to compete for work back in the 80s to the degree they do today My exboss was paying guys 12 dollars an hour for masonry and carpentry work in the Hamptons That’s far less than I made in the 80s

When you say welders I assume you are referring to union workers which are a minority

Frederick, I agree with you on the illegal labor force issue…there is no doubt it has kept wages down in certain trades and or industries… It is imho, a huge problem here in good ole California that needs to be addressed…. and yes I was referring to union wages, but I know a few non-union contractors, and they try to keep there wages within 10-15%…otherwise they will loose the ones that are worth a darn.

Agreed – it’s the monthly payment the median buyer can afford which drives things. When rates went down, people could buy more house for the same money. Increased demand means price increases due to limited supply ( takes time to build houses). We’re now seeing the downslope – rates rise, fewer buyers can afford the asking price, demand falls, prices drop…

Not only that The US was in a far better position economically in the world in 1985 compared to today Look at the debt to GDP I’m certain it’s a lot higher today

Wolf is there a way to make a chart of mortgage rates vs home prices going back as far as possible… would love to see the pattern….

That long-term chart would have to be adjusted for wage inflation to make sense. Also, since there is no national housing market, but only local housing markets, you’d have to do this chart for all major markets.

Some “affordability” charts attempt to do something close to this. They consider median household incomes, mortgage rates, home prices, and other housing-related costs.

Just do it for New York since that city has crazy prices for crazy people.

If you are one of the 10K per day of the baby boom generation that is retiring per day, and you live in a high tax state like NJ or NY, and you want to move to a low tax state, a lot of time you need to sell your current home to afford the next purchase. It would seem to me people will want to move, but can’t due to increasing rates, so real eastate sales will slow until the pain point is reached, then prices will drop. The real question is whether prices will drop as much in low tax states where retireees are looking to buy next.

Anybody have any thoughts about demographic effects on real estate?

I saw a story somewhere where the retirees in huge volumes are buying RVs and Winnebaegos to live in because they can’t afford their medicines and rent or mortgage at the same time.

Not every Boomer was a whiz investor. There are just as many money-foolish Boomers as X’ers and Millennials etc.

At the top level you have the whiz money wizards, then you have a large segment for which the money-thinking was done for them like cops, Unionized workers in general, it’s done for them in the form of pensions. Then you have the average Joes, who might have a house they can sell, and SS. Then you get the people like me, who will have SS and unless things change for me somehow (this is about 2% personal volition and 98% luck) will be trying to get by on whatever SS pays per month. I suspect I’ll have to try to have one or more cash/blackmarket “fiddles” by which I make money, by playing music, doing crafts, maybe there’s some sort of grey-market swindling I can get into, like selling faux insurance to those with money to burn on it, heh heh.

So yeah, put some money into a Chevy Sprinter and fix it up, and it can be a nice life. A good example of this is a guy named “Nomadic Fanatic” on YouTube. He’s younger than me, and while I can say I’ve worked as a vet tech, as an electronics tech, as a seller on Ebay, and in a phone bank, ol’ Nomadic has, except for the typical teen jobs, just “worked” being himself. He has stickers made up, and gives those in exchange for donations, and he just entertains people and is a sort of cyber-RV-panhandler/entertainer.

For all the hard work I’ve put in over the years (was especially hard-working as an electronics tech, I was stupid) I really admire him. Earning a living by being something between an honest entertainer and a fast-talking con man, and getting to travel around the country. Had a girlfriend for a while, who knows, may have another by now.

And when you’re not longer physically fit, I guess the 9mm retirement plan.

With Medicare part D this is unlikely. Part D mail order discount drug plans such as Humana reduce drug costs to only a few dollars per month at most, although these plans ship mainly generics and not not exorbitantly over priced priced US name brands. I speak from experience being 79 and on Medicare w/part D.

You’re right and thank you for your reply. I’m on SSDI and have Medicare part D and it saves my ass for now but the other expenses are going up and eventually I’ll have to do the motor home nomad deal. There are retirees that also do it for the fact that there’s no other way to have their savings last until death.

I sold my house and did that for a couple of years back in 2002-2004, but in a nice road car and a tent. Some people call that being a nomad. It was great! No house payment, no utilities, no phone bill, no snoopy neighbors, no visiting relatives, plenty of interesting places to see and plenty of things to do, etc., etc., etc. And no one calling me up on the phone and causing me irritation. That’s because I didn’t have a phone. In other words, no frigging technology leash around my neck. Imagine, if you will, being an IT manager for a multi-billion dollar corporation and being on a pager seven days a week, 24 hours a day. ULCERVILLE!!!

Ahhh, the old ‘pager’, those were the days…

Now I’m seriously considering doing it in a van in a year or two or three like Bob Wells does. Life could be a lot worse, you know. I could be a poor civilian living in Syria always worrying about the U.S., the U.K. and France nuking me with Tomahawk. ;-)

You sound pretty sure that fate will never befall Americans I wouldn’t be quite so cocky unless policies in DC change and that doesn’t appear likely with lunatics like John Bolton residing there

I know it could have been worse with the beast

“I sold my house and did that for a couple of years back in 2002-2004, but in a nice road car and a tent. Some people call that being a nomad. It was great! ”

You wouldn’t last more than a few weeks. You’d be given citation after citation if you camped out in most urban areas today. They hope you’ll be rendered desitute then thrown in jail so your body can turn a 30K/year profit in some private prison somewhere.

Now the militarized police are looking for people just like you (plate scanners make it easy). A combination of 9-11 and the homeless problem have given them a mandate from property owners all across the country.

The new ethos is that if you’re wandering you must be bad and likey a terrorist or drug dealer.

This is in response to Bob’s reply (“You wouldn’t last more than a few weeks.”) to my comment.

How sad. People get locked into a very narrow mindset or in a “box” as some might call it. Who said I was camping in urban areas. If you’re going to camp in urban areas, what’s the frigging point!!! You just as well live in a house or an apartment if you’re going to do that. When I was being a nomad, urban areas were the last place I wanted to be.

We were just at Capitol Reef NP in Utah and the Camp Host said the parks’ visitors were up 44% just in the last year.. He said, “Mostly Baby Boomers!”

Yeah it’s mostly boomers I just mentioned the boomers but it’s not just them. Alot of Xers and millennials are doing it because they see trying to live the traditional “American dream” is like a one legged man in an ass kicking contest and they’re not going to swallow that blue pill and be a slave in the matrix.

How much are the nightly camping rates now?

Locally, they are $20/night in the National Forest (Covers water and an outhouse but no showers). That is $600 per month. Camping at the local WalMart is free and you can buy water in Walmart and use their bathrooms but you need a camper or RV. The ambience of a local Walmart parking lot is not the best.

$600/per month for a primitive nomadic life is not cheap.

I know a couple of people who picked up seasonal jobs as a campground host for free camping and minimal pay (if any). You lose the nomadic feel since you have to be there for 5 months straight.

Two articles on retirees living and working out of motorhomes out of necessity and an amazon link to a new book about them called “nomadland”. The make-up of them is diverse and eye opening.

https://harpers.org/archive/2014/08/the-end-of-retirement/?single=1

https://www.cheatsheet.com/money-career/real-reason-retirees-are-choosing-live-rvs.html/?a=viewall

https://www.amazon.com/Nomadland-Surviving-America-Twenty-First-Century/dp/039324931X

Thank you for the links. One of these days I might just have to do it. you never know.

“Nomadland” — check it out, worth reading. It’s a tough life.

Yup the Northeast is toast except for some prime areas High taxes and other costs will be the death knell for many areas IMO ie Hartford Ct

Baby boomers retiring at a rate of 10,000 per day will, in ten years or so, morph into 10,000 baby boomers dying every day and dead people don’t buy houses (not even in low tax states). Younger people need only wait a decade or two and many houses will be ready for new occupants.

Millennials are a larger generation than baby boomers. They’ve started to move into the laborforce years ago and they’re moving into the household-creation phase in large numbers. Zuckerberg is a millennial. They’ll more than replace the retiring and eventually dying baby boomers.

Without seeing bankruptcies, a few unicorns hung out to dry and job loss.

House prices will just continue to rise.

I thought from a previous article here that Trump tax plan would cool the market, but all it has done is effect the top end ONLY. It has pushed buyers into secondary market were previously they wouldn’t have wanted to move into. In effect, spreading price hikes in RE to the low and mid tier market.

As a techie, I have never, ever, in my decade long career, been paid so much money yearly for a fraction of the work i used to do not four years ago. Companies are flush with cash, and keep people employed. Productivity is still an illusive creature.

So, Wolf, if i’m being payed 150k/year to just show up to work,

like a poor student payed by gov to attend a community college.

Whats 100 basis point increase in mortgage to me?

If i wanted to buy RE and thought my job was “safe”.

We need to see unproductive companies going bust. I’ve seen companies take quarter million dollar loss on a single projects and brush it off. How can anyone start a small business and compete with this monstrous big players willing to take losses.

Nothing is gonna effect RE till we sill unproductive people and companies out of the market. When good hard working people don’t mean a damn, and morons are being paid to show up, there’ll be plenty of suckers jumping in real estate.

But the housing market is sooner or later going to run out of people like you ;-]

Wolf,

Ho, ho, ho… Read my mind.

Nick sounds like a millenial buyer i just closed a loan for.

750k house w/ 15% down; he makes 170k/hr in IT.

Payment was around 4k/mo; but, it’s a 5 bedroom house and his brother and 2 other friends will each be renting rooms from him.

So; as these millenials stick together; this millenial buyer will have an effective payment of less than 2k.

Thank you Broker Dan,

Was possessing my co-workers views for a moment.

I’d like to thank the academy.

Wolf, it might run out of people like me (and hope so), but looks like foreign “asian migration” might not be over and the desperation is #realz.

https://www.bloomberg.com/news/articles/2018-04-26/ghost-home-tax-fills-vancouver-coffers-but-rentals-remain-scarce

Which would explain why the markets i follow are not only up, the low end has been removed mostly and just see the very top end lux homes up for sale. We might be looking at another wave of hot money. Also Dan, being a Millennial is harder then you think, we are quite fickle because we match our freelance transient jobs.

Hey, so remember the Berlin’s coming together? It was followed by the USSR capitulation. Hopefully we see Chinese Rmb devaluation soon or we might be stuck in this artificial system for a few more years and all the logic and fundamental you speak of wont mean a damn thing in the world.

…and like my brother told me earlier.. “Today I’m all out of love, so drained, after North Korea went down on South Korea. Too much lovin’ for one day”.

just thinking to myself. now, let me see…….

6% will make difference, yes.

and bonds draining funds from equities will make a bigger difference.

but then rates would drop.

depends.

discuss.

Well you Yanks have now caught up to what is being charges on most Australian owner occupied ARMs.

And over in Sydney, the price of houses has sorta of fallen bu a little:

“Sydney house prices have taken their biggest hit since 2015, recording a 2.6 per cent drop in prices over the March quarter.

The median house price in Sydney is now $1,150,357, which is $30,000 cheaper than in December, according to Domain Group’s March Quarter 2018 House Price Report. House prices peaked in June 2017 with the median at $1,198,550. ”

SEE:

https://www.domain.com.au/news/house-prices-in-sydney-drop-26-per-cent-over-march-quarter-domain-group-data-20180426-h0z5p4/

Still way overpriced for not much house. They should move to Melbourne, the world’s most liveable city where last week the trains were down during the day for hours during morning rush hour, closed for construction work for a large part of the system AND the main freeway moving at a snails pace as a result of ongoing construction work there at night.

Yep, Melbourne.

A person I know is trying to sell their very nice home in Florida for a year now. Over that time frame, they’ve dropped their asking price by 8 percent. Still no takers. Nice area, nice home, and most of the time very nice weather. Took a look at Zillow and a couple of homes on their street have now gone into foreclosure. It will be interesting to see what happens.

What’s that old saying? “Don’t count your chickens before they hatch.”

Absolutely…

They priced it too high.

Properties priced accordingly in good areas FLY off the shelves.

Powell, stop rigging the markets. Keep raising them interest rates and unwind the Fed ‘s balance sheet.

I dont understand.

All I’ve heard the past 3-4 yrs is that the Fed cannot raise rates as they are now painted into a corner. if they raise rates, US will default.

Here we are now and the Fed is raising rates. Where are the defaulters/doomsdayers?

Different people have said different things in different camps. We never said in a WS article that the Fed cannot raise rates. We’ve always belonged to one of the other camps ;-]

Wolf – when the rest of the world starts pouring money into the US 30-year T-bonds as a safe haven, that should suppress the yield.

It seems like people here are assuming the mortgage rates will automatically go up because the 30-year T-bond yields rise in lockstep with shorter duration Treasuries.

But if hot money arrives from overseas and keeps the 30-year yield suppressed, this correlation lockstep thesis doesn’t work.

I’m expecting a flattened, or possibly an inverted, yield curve due to this phenomenon.

Thoughts?

I think the likelihood of an inverted yield curve is not huge. But it’s possible. I think the 10-year and the 30-year yields will stay ahead of the 2-year yield. They’ll get close, and then the 10-year and 30-year yields lurch forward as they did over the past few days, and the spread widens again. Sort of a cat-and-mouse game.

is it possible for the yield curve to invert while rates are rising, I mean sure it’s possible, but likely?

The last time the yield curve inverted was the last time the Fed was doing a long string of yield hikes exactly like this (the string of hikes starting back in 2005 and running to 2008.)

It doesn’t mean that the yield curve will invert this time, but I would say generally Fed serial rate hikes pushes the curve flatter and towards inversion, so that yield curve inversions are more likely during periods of extended serial rate-hikes instead of less likely. Why this is the case is that each Fed rate hike tends to put more pressure upwards on the short end of the curve then it does on the long end. What will help offset this effect is that QT puts more upward pressure on the long end then the short end. Without QT, or any other such Fed intervention, I bet the curve would be much flatter now and a few Fed rate-hikes more would invert the curve. QT and massive new bond issuance may put enough pressure on the long end to prevent the inversion this time though.

This rate hike cycle is very different from the prior ones (in addition to the QE unwind, as you pointed out):

The last rate-hike cycle started in June 2004 and ended in June 2006. In 2 years, from 1% to 5.25%.

This time, the Fed is moving at a glacial pace. It started in December 2015 with a 25-basis-point hike, did another one in December 2016, did three in 2017, might do four in 2018, might proceed at a similar pace in 2019 and possibly into 2020. At this pace, the rate-hike cycle might last up to 5 years – instead of 2 years.

https://wolfstreet.com/2018/04/22/whats-the-deal-with-the-treasury-market/

that scenario most likely will not play out as treasuries are not quite the safety many countries want now, they see the debt monster we are and their is no backstop this time. We are out of time outs…..

Time for some bread without the butter…pain would be good. BTW-I was in Vegas and all I heard was how much money new homeowners made in last 6 months, reminds me of a top about 11 years ago.

This is a gentle reminder that the 5 year bulk housing sales to hedgies, pe, banks etc. is now approaching the time constraints on sales…I looked at Sacramento and inventory exploded for some reason in last 45 days….the top is this summer if not this spring….8 is lucky, 9 and 10 not so much, end of decades are not great for all assets..

The rest of the world wants nothing to do with USDollar denominated assets I have a lot of dollars from the sale of my house and alive been diversifying for the last few years

I work as a Realtor in Sonoma County

Prices have flattened over the last 6 weeks or so, days on market are increasing, there’s a slight increase in price reductions and inventory has begun to increase significantly.

Annnnnnnd It’s gone

Thanks. That’s really interesting.

Your very welcome Wolf

Frederick,

My comment was a response to Tom’s comment. But I liked your comment too :-]

Tom Stone, I hope all is well CCLT

Same happening in my market while inventory is NOT increasing and is still very low. Longer DOM and more price reductions in just the last 4-6 weeks or so.

As time goes by I more and more believe that inventory is low (at least in my market) because sellers cannot sell. Three real examples:

1. A doctor in his 70s. Owes 100k to IRS. 70k to credit card companies. 3 new cars financed. No equity in his home. No savings. Even if he could sell his home, he has no likelihood of qualifying to buy another. So he’ll continue working and making that mortgage payment underwater or not.

2. Another doctor in his 60s. Also owes 100k to IRS. He’s considering a home equity line on his 250k house to cover it. No savings to speak of. He won’t sell unless his wife divorces him which is now a good possibility.

3. Couple in their 50s, home maxed out on heloc to put their kids through college. Four nice, financed cars in the driveway. So they cannot sell for at least 4 more years since they’re using the housing ATM for tuition.

If you met any of these folks at the country clubs they belong to in their sweet rides, you’d never suspect it. None of them CAN sell, where else would they live?

Good lord… They should have read this blog (and then lived it):

https://www.mrmoneymustache.com

Maybe not to the extreme that the blog writer goes to, but they should have developed some common sense along the way…

It is astounding how many folks with all the breaks in life wind up with their backs to the wall and nothing in the piggy bank.

Three sad stories based in bad decisions. Imagine if they came into a 200K windfall from maybe a lottery ticket or passed parent’s will. They could pay down debt and maybe retire earlier or could splash it around, maybe leverage some into more debt.

Answer: Obvious

Nothing to fear here folks, investors like myself are sitting on the sideline wringing our hands in anticipation of the next bubble to burst.

I’m with you Gian and it’s coming

Wonder how much big money is sitting on the sideline waiting to dive in.

– I think brokers will try to continue to keep the flow of lending going. And then I think they will try to squeeze their margins for a while.

@JZ

“I am happy that JZmy home keeps me away from the rent seekers but I am still disgusted about the price move that enslaves people, create stress, isolation corruption and mass shootings. :)”

Yup! Add in the fact that our children will not be able to buy a house. What are you doing to the next generation. When you screw the next generation, you are going to screw generations that come later. The cumulative effect of all these on society is so mind-bobbling that I am surprised that people who are in power are doing such things with some misconceived ideas. Highly detrimental would be an understatement!

I don’t live in a “bubble” state. According to Zillow, the value of my house has dropped $75,000 in 6 months so I can’t imagine whats happening in places like San Fran

Well, Fannie May has reintroduced 3% down loans and lenders are increasingly doing “non-prime”, which is another name for subprime.

https://www.msn.com/en-us/money/markets/emboldened-homebuyers-stretch-budgets-to-win-bidding-wars/ar-AAwhMkC

I got four offers on my house last month within 24 hours of listing. Things vary region by region, I guess.

I thought you just bought a house in Boise? Did you already sell it?

The RE market is a bit uneven, but I tend to agree with the notion that most of the rise in RE asset value is based on cheap lending, only because vacant property has not risen nearly as much as homes. The high cost of building has also had a spillover effect on local building codes and permits and planning commissions, the reason why new housing has not kept up and there is a shortage in some places. Rule of thumb if home values fell back to a par with vacant land the market could pull back 25 to 50%. That would of course release new building and put further pressure on existing home prices.

It’s all of the above.

Cheap credit

Foreign hot money

Millenial demand (coming of age for household formation)

Lack of SFH building

Economic strength

Baby boomers not downsizing

I recently retired last year with a pension at the age of 52 from a well known insurance company. When this came to folks living in RV’s / vans, I felt I needed to make a few comments. I NEVER EVER financed a home in Florida – rising property taxes, and, if your a coastal county or perhaps not, Windstorm coverage – only available by The State- Flood Insurance, and Homeowners – from an unknown insurance company. These premiums have risen quickly since last year hurricane. I did recently purchase a USED RV in Florida. Many are using a relatives address and purchasing a form of a POB. They are frequenting the Florida State Parks. If your over 65 or disabled, the weekly rate for a site around $90 a week. Varies by campground. I can not imagine any other way for those only living SS. I can say I am happy now – lost weight & quit smoking. Worked near to death for 30 years, only to discover a better way to live on less income.

Just because you’re posting anonymously i fell i may ask you.

How much do you live on and can you break the budget? (taxes, rent etc….).

Make it as detailed as possible. I’m your age but no pension.

Thanks

Hi Wolf,

From an investment point of view, do you see US Treasury/ Government Agency Bond yields rising higher by this time next year? My buddy was telling me that the current 10 year is 3.84% and the 20 year 4.17%. Wolf, is it possible these 10 yr and 20 yr yields will be in the range of 5%-6% by the summer/fall of 2019?

thank you

GC

What “current 10 year yield is 3.84%”? The US Treasury 10-year yield is 2.95% today. If it gets to 5%, that’s pushing it. 6% is not in my scenario of probable outcomes though it could be a “long tail” event. But I don’t see it.