Didn’t miss a beat.

The sixth month of the QE-Unwind ended on March 31, which is reflected in the Fed’s balance sheet, released this afternoon, for the week ending April 4. The QE-Unwind appears to be on automatic pilot, clicking along at the pace that accelerated in January, despite the sporadic stock market sell-offs since early February.

During the years of QE, the Fed acquired a total of $3.4 trillion in Treasury securities and mortgage-backed securities. The MBS are backed by mortgages that are guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Now the Fed is shedding those securities at a rate that accelerates every quarter until it reaches its maximum pace of up to $50 billion a month in Q4 2018.

By the end of the year, this plan would shrink the balances of Treasuries and MBS by up to $420 billion. In 2019, and going forward, up to $600 billion would come off the balance sheet per year, until the Fed deems the balance sheet to be sufficiently “normalized” — or until something big falls apart, whichever comes first.

For Q1, the scheduled pace was up to $20 billion a month. So for March, we’re looking for a reduction of $12 billion in Treasuries and $8 billion in MBS.

“Rolling off” Treasury securities

On today’s balance sheet, there are $2,413 billion in Treasuries, down $11 billion from February 28 ($2,424 billion). In total, since the beginning of the QE-Unwind, the balance of Treasuries has dropped by $53 billion, to hit the lowest level since July 16, 2014:

The stair-step movement in the chart above is a result of how the Fed sheds securities. It does not sell them but allows them to “roll off” when they mature, which is mid-month and at the end of the month. In March, no Treasuries on the Fed’s balance sheet matured mid-month. But at the end of March, $31 billion matured.

So the Fed replaced $19 billion of the maturing Treasuries with new ones directly via its special arrangement with the Treasury Department that cuts out Wall Street. Those $19 billion were “rolled over.” But it did not replace $11 billion of maturing Treasuries. Hence, they “rolled off.” The blue arrow in the chart above shows the March 31 roll-off.

Allowing MBS to “roll off”

For March, the plan calls for $8 billion in MBS to roll off.

But residential MBS are different. Holders receive principal payments continuously as the underlying mortgages are paid down or are paid off. Thus, the principal shrinks. At maturity, what’s left over is paid off. To keep the MBS balance steady, the New York Fed’s Open Market Operations (OMO) continually buys MBS.

Settlement of those trades occurs two to three months later, which is when the Fed books the trades. This time lag causes weekly fluctuations on the Fed’s balance sheet in the range of $10 billion to $20 billion. It also delays when MBS that have been allowed to “roll off” disappear from the balance sheet [my detailed explanation is here].

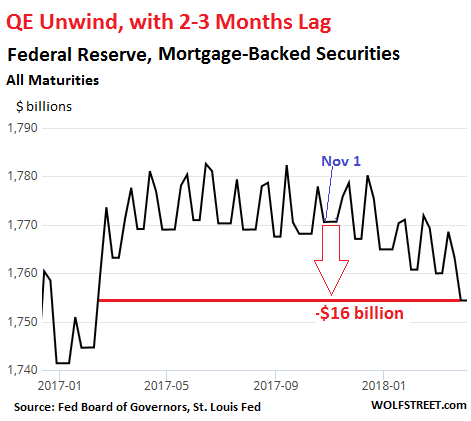

Given the jagged line on the chart, we’re looking for lower highs and lower lows. Today’s balance sheet reflects MBS that matured somewhere around December and January. In December, $4 billion in MBS were supposed to roll off per month; in January, the rate was scheduled to accelerate to $8 billion.

The chart below shows the lower highs and lower lows over the past few months. At the low in late October and early November, the Fed held $1,770.5 billion in MBS. This marked the starting point. The low in early March was $1,760. Today’s balance sheet shows $1,754.4 billion. From low to low over the past month, the balance dropped by $5.6 billion, reflecting trades somewhere around December and January. In total, the balance of MBS shrank by about $16 billion:

The overall balance sheet too

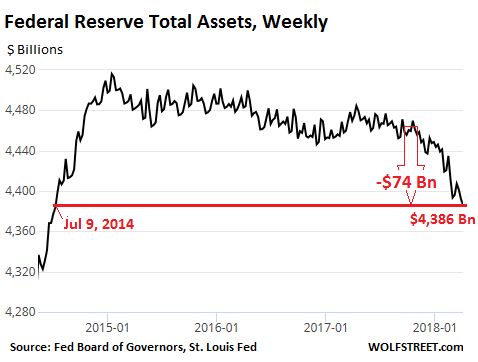

The QE-Unwind only relates to Treasuries and MBS, which dropped $53 billion and $16 billion respectively since the beginning of the QE-Unwind, for a combined decline of $69 billion.

Total assets on the Fed’s balance sheet dropped by $74 billion from $4,460 billion at the outset of the QE-Unwind to $4,386 billion on today’s balance sheet. This is the lowest since July 9, 2014:

The balance sheet also reflects the Fed’s other roles that may impact its assets and liabilities. It acts as the bank of the US government, and the Treasury Department keeps its cash balances on deposit at the Fed. It also holds “Foreign Official Deposits” by other central banks and government entities. But these and other activities have nothing to do with QE or the QE-Unwind.

It will let them rip.

Despite the sporadic sell-offs in the stock market, the QE-Unwind proceeded on plan, and I expect this to continue. It looks very unlikely that the Fed will try to stop a sell-off by altering its QE-Unwind routine. The Fed is targeting “elevated” asset prices. Sell-offs are part of the process, and the Fed will let them rip.

However, if credit freezes up as it did during the Financial Crisis – when fears arose that even big companies might have a hard time making payroll – all bets will be off, and the Fed will step in as lender of last resort. But that scenario is not yet on the horizon. So the QE-Unwind will be allowed to do its magic, which is to undo part of what years of QE have wrought.

Interest rates “may go higher and faster than people expect,” explained Jamie Dimon. The Fed may have to “sell more securities,” and “as all asset prices adjust to a new and maybe not-so-positive environment,” there’s “a risk that volatile and declining markets can lead to market panic.” Read… “When the Next Crisis Begins…” JPMorgan CEO Jamie Dimon

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Deflationary for assets. Will the trade war with China be inflationary

for consumer goods ? Going to be an interesting year.

Yes –

I don’t understand the trade war discussion.

In my opinion, the effect of the various measures and counter-measures will take quite a long while to show up (soy beans, for example, needs to be grown and harvested before they can be tariffed) and yet both China and Donald Trump are slapping tariffs onto each other sort-of daily while claiming immediate effects. (This notion is backed up by the talking heads on the stock market chat-channels).

The risk is that by only discussing / following the “Markets” short-time response, one is substituting real-world effects with pure speculation based on fumes, vapours and magic numbers – to make decisions :).

I think someone will suddenly have a very nasty surprise in, say six to nine months time, when the tariffs percolate through on “the physical side” of the Soy trade, f.ex.

Not really, faj.

Take soybeans. If the tariff talk continues the farmer might plant something else later this spring or plant a smaller crop. The farmer might delay buying that new tractor. New pickup? Well, the old one runs okay. Maybe we’ll forgo the vacation over the winter…for the tractor and car dealership sales force, etc who experience declining sales.

Meanwhile, Brazil plants a bigger crop and Canada looks to plant soy in Manitoba and Sask instead of the usual rape seed. It might not unfold this fast, this year, but that is how it starts. Meanwhile, China remains pissed and resolute and looks to new markets and vows not to return, + buys more farm and land holdings throughout the world.

I am sure Bombardier has already contacted Chinese aircraft buyers about their rival to 737 product, which is partially owned by Airbus, (due to previous punishing tariffs, which I might add, were ruled illegal). I look for several more trade delegations from around the world to visit China.

Plus, hard feelings. It’s easy for Canadians to export to US, still…and right now, but when new markets are forced into development people are reluctant to touch the hot stove, ever again. Multiply this to other countries and the effect increases. China might do the same.

I am reminded of a simple analogy. I am a builder, and 15 years ago relocated to a rural home. I needed to replace a SS chimney for my woodshop and visited the main supplier in the nearby city/town. The owner gave me shit because I asked a few questions. He said, “You Sayward guys are all the same, you waste my time getting information then you’ll go home and do the work yourself”. (think…Intellectual Property). I told him I am a builder and this is a chimney, not rocket science….of course I plan to install it myself. (easy peasy). I promptly went to his competitor and bought $1,000+ of new chimney parts. Meanwhile, I have since spent over $10,000 from other wodstove suppliers over the last few years and ensured many others I know used my new supplier. In fact, I now drive an extra hour to buy from another sheet metal company just so I won’t have to deal with doofus. That is what I did Wednesday, as a matter of fact. Trade is trade.

So you’re saying you don’t have a problem with the first chimney vendor protecting his own interest, just with the way he did it? Not sure I get your point.

Just a tid bit from a farmer. Soybeans may take time to grow, but last years stock is sitting in the bin waiting on the market to buy what hasn’t been sold yet. At the end of the growing season not all crop is bought instantly like Amazon.

Soybeans aren’t being grown from thin air, the tariffs will be felt in days or weeks but not months.

“Soybeans aren’t being grown from thin air, the tariffs will be felt in days or weeks but not months.”

I don’t think the latest tariffs would even go into effect for a few months. There’s a 60 day discussion period first– re: a period for lobbyists to get their exemptions carved out.

Facebook market cap alone drops more $billions in one week than the Fed unwinds in 6 months.

Shows you the outsized effect Fed balance sheet reductions can have. No, I’m not saying FB dropped because of Fed balance sheet normalization. But that normalization will likely have an outsized effect on asset prices.

You have hit it on the head. If people got in the habit of thinking “banks that own the Fed” every time they read “Fed” they would understand that to the extent that the national debt can be expanded, they get funds as close to interest-free as possible, and any “tightening” is anathema (it also means they might have to pay a few cents more to savers- HAH!). Rates will only go up appreciably after their trading desk, which is the biggest in the country- has finished lining up their bearish positions to profit from a crash (which will be conveniently blamed on Trump, as the ballooning deficit from LBJ’s Great Society plus Vietnam fell on Jerry Ford as he haplessly walked arounf with his W.I.N. button (Whip Inflation Now)

The Fed and the Treasury have sailed so far into uncharted waters, I think it would have been unimaginable just 20 years ago. Everything is just “beyond”. Which makes me wonder…

Should we just stop worrying about a stock market that has gained 400% in 9 years? Will the equity markets be “orchestrated” in the same way as interest rates? Will the Fed, with just 5% down, buy options on E-mini S&P 500 futures, and back-stop a market crash? Why wouldn’t the Fed do just that? It’s a cakewalk compared to the economic and political nightmare of 2008. I am by no means a stock market bull. I’m a bear. But seriously, how much would it cost to just kick the can, and engineer a 10-12 year correction in the equity markets?

“…and engineer a 10-12 year correction in the equity markets?” They engineered a 9-year bull market. Why can’t they do the opposite?

This is what truly matters and yet everybody is looking at Trump trade wars and Stormy Daniels, and how much the neighbors are selling their houses.

No one of any consequence is worried about Trump’s marital afairs aside from their entertainment value… People knew what kind of guy he was decades ago….

The trade wars brewing is worth looking at at least on par with QE because we know from history the consequence are potentially great. It is also easy to talk about because China vs Trump is easy to grasp and there is an element of surprise as new tariffs are announced or kick around.

QE isn’t sexy enough for week to week news. It’s slow and plodding so it only crops up in forcasting segments.

So the Fed replaced $19 billion of the maturing Treasuries with new ones directly via its special arrangement with the Treasury Department that cuts out Wall Street.

Is the above legal ? The Federal Reserve act appears to prohibit the Fed from buying directly from the Treasury.

Section 14 paragraph 2 (b) 1 of the Federal Reserve act

Section 14. Open-Market Operations

Purchase and sale of obligations of United States, States, counties, etc.

(b)

To buy and sell, at home or abroad, bonds and notes of the United States, …..

Notwithstanding any other provision of this chapter, any bonds, notes, or other obligations which are direct obligations of the United States or which are fully guaranteed by the United States as to the principal and interest may be bought and sold without regard to maturities but only in the open market.

That special arrangement is perfectly legal. But it only works to roll over existing debt. It goes like this: I give you these old maturing notes with a face value of $1 billion, but instead of paying me cash for them, you pay me new notes with a face value of $1 billion.

Let’s not get ahead of ourselves boys. In percentage terms, the Dow is only down 10% give or take. That’s nothing. That’s more like healthy correction.

I think the Fed can tolerate another 10% down. It probably wants that to happen.

Correct me if I’m wring here or that I cannot see reality…..The headline above mentions a Stock Market sell off??????? The DJIA just shot the lights out by a rise of over a thousand points within 24 hours, so how does the owner of Wolf Street, a published financial expert and frequent Max Keiser guest , see that as a sell off?

Please explain.

Since early February there have been several significant sell-offs, that left the S&P 500 down 10% by April 2 from its January 26 peak. Sure stocks have risen since then, but nothing goes to heck in a straight line. Some of the sell-offs were steep enough to where Wall Street already began clamoring for the Fed to step in, and Dudley said the Fed wouldn’t step in. These were the worst sell-offs since early 2016.

A “sell off” is not a crash. A 10% sell off over the span of a week is a “sell off.” 15% down in one day might be considered a “crash”… Just because there is a bounce after a sell-off doesn’t mean that there wasn’t a sell off.

Got it?

Looking at the 5 yr charts on the DOW and S&P the sell off is clear to see. The one day, one week charts reported never show the big picture.

Let’s take a holistic look at Trump economic policy actions:

1. Passed huge tax bill allowing U.S. companies to shift funds from the “overseas” column to the “domestic” column. This makes them available for investment in the U.S. with no tax penalty.

2. Made it a point to replace Yellen (against the advice of nearly everyone), who he said is a “low interest rate person”. Installed a non-PhD in her place known for his criticism of “excessive regulation” and his somewhat-hawkish temperament.

3. Levies hefty tariffs on China, which responds in kind, only to get more tariffs ladled on. Note that current Fed policy also affects China negatively; they will face hard choices if the dollar strengthens. Note also that raising tariffs also raises tax receipts in the short term, possibly negating the effects of #1.

4. Reverse QE continues as planned, with Jamie Dimon (part of Trump’s initial econ advisory team) publicly stating that it may not be fast enough. Mr. Powell, for his part, uses more obscure but similar language during testimony to Congress a month ago. Clearly, the value of the dollar is being robustly defended.

5. Threatened Mexico and Canada during NAFTA renegotiation with the same new tariffs China gets. Canada and Mexico appear likely to blink first.

6. Stated flatly that California cannot supersede federal law where it concerns land sales and environmental regulation. This will have the ultimate effect of opening up more land to industrial development.

7. Relaxed mpg requirements on cars & trucks, thus securing production of profitable trucks, CUVs and SUVs domestically.

We should believe the Fed when they say reverse QE will continue unabated. Actually, we should be on the look-out for it to be sped up. Everything listed above favors a strong dollar.

But why would we want a strong dollar if we hope to increase exports? I suspect one major goal is to break the Renminbi peg. China may not hold enough dollars to defend it anymore, so the time may be ripe. If the last 20 years have proven anything, it’s that the U.S. always loses the devaluation wars. So we’re not playing that game anymore. Instead we’re choking China’s exports and RQE’ing like crazy to force it into a currency crisis.

Without the peg, China’s international shopping spree might come to a screeching halt; specifically, its ability to control resources and raw materials in Africa and South America.

That’s what I think RQE is about. I think we’ve been told very clearly that the asset markets are on their own. Small banks and companies won’t get bailed out. We’re pivoting back to domestic industry. RQE is part of the toolkit necessary to break the backs of China Inc. and convince U.S. companies to repatriate their operations.

You got it. Everyone who schemed a piece of the pie at the expense of the 99% is slowly taking it up the place where the sun doesn’t shine.

Economics and successful trade is a game of seeing need, opportunity or weakness somewhere and exploiting it. Every country that thought they had a free lunch of some kind needed the US to participate in their plan to keep their plan working. We just collectively told the world we have no more interest in supporting their free lunch plans.

The result will be complaints and bluster, followed by media campaigns about how horrible we are and how we will suffer if we don’t go back to supporting the status quo, to growing gains for all in the US simply by looking out for our needs first.

I suspect the Swiss National Bank is supporting the stock markets now using printed money to protect their nearly $100 billion portfolio. The ECB is said to be buying even more debt lately to keep rates from rising in euro-land. Neither can do this forever. Both will pay a high price when their free lunch plans falter, sooner than later. China can use a little humility and the tariff plans are a good start. Japan is off in their own cosmos.

Overall, the new game will be to live off actual income. Printed money will never be a substitute for income and asset bubbles will never be a substitute for capital formation. Not to mention all the debt that needs to be repaid. Sorry Mr Bernanke. All the other central bankers should have never listened to your ideas.

Just two “quickies”.

While the Banque Nationale Suisse (BNS) is often claimed to be many thing, it’s not omnipotent.

And while it’s often fashionable to say the BNS owns these or those stocks, the reality is the BNS itself does not divulge much about their investments, as you can read here: https://www.snb.ch/fr/mmr/reference/annrep_2017_rechenschaft/source/annrep_2017_rechenschaft.fr.pdf

What is known, is known through SEC filings: as a foreign investor, the BNS must disclose to the US Stock exchange commission their dealings. Shares bought in Switzerland, the EU, Japan, China, Brazil, South Korea, Russia etc get reported to local authorities… and data are much much harder to find and access. For example there are no data (at least easily accessible by the public) about their holdings of shares traded in Zurich such as Hoffmann-La Roche and Bucher-Motorex.

However, and here’s the kicker, the BNS statute says that their stock purchases must be “as neutral as possible”: in short they cannot manipulate share price at will by “printing money”. They buy Apple because AAPL is in upward trend or believe will bounce soon and, given the sheer size of their purchases, that is bound to somehow affect prices.

In short while the BNS has an effect on stock markets worldwide by “sheer weight” it does not actively manipulate them as the People’s Bank of China (PBOC) does.

Regarding the European Central Bank (ECB)… what they did lately, increasing securities purchases in what can only be called a veritable panic, destroyed whatever credibility they had left. If any.

Say what you want about the US Federal Reserve or Fed (and we do), but they are proceeding towards normalization at their own pace, albeit there are tectonic plates that move faster than them. They merely shrug off the recent panic on financial markets and soldiered towards their goal. Those same markets will continue to blow them off but now they know a 10% selloff is not enough to get the “New” Fed’s attention, especially if liquidity is enough to guarantee a bounce. A while back somebody here in the comments said the Fed would be comfortable with a 40-50% drop on stock market indexes if spread over a long horizon (4-5 years) and it looks like they do.

By contrast the ECB’s hair caught fire the second securities and equities sneezed. Rest assured financial markets took notice and now know where the easy fix is.

The Swiss National Bank would never active manipulate equity prices with freshly printed money. They would use Euros purchased with freshly printed money to stabilize an unnatural shock to equity prices. They would use their dictionary to define terms such as ‘unnatural shock’ as needed.

Any central bank that prints money to buy assets in massive quantities can be counted on to panic as normal people would panic. Especially when the Swiss bank uses ‘profits’ to subsidize the Swiss people. Losing money on this trade would be bad for everyone.

Of course, anything purchased with printed money, even if it was laundered into another currency, has a cost basis of $0.00 so any amount received is a profit and the other side of the ledger is a problem for creative accounting and the above mentioned dictionary. I’m sure the Swiss people would happily look the other way ‘just this once’ if needed.

US international economic and military strategy is implemented across many terms of presidents. It looks like US has been aiming to break China’s back the same way it broke Japan’s in 1990. Script is simple. Keep buying China goods/services and let China INC compete with each other by scaling up using debt. The debt is the best if it is debt in dollar. Once they have reached over capacity and malinvestment, US will raise the rate, cut the trade deficit and see how those Chinese malinvestment pay down debt.

China is no fool and they have accumulated large amount of reserves and they are channeling over capacity to the “new silk road”. Still, the recent AnBang, HNA issues in China is a sign that the multitude decade process has entered the phase of Japan in 1989.

Domestically, Trump cares only about one thing, the vote. Presenting himself as a strong man facing off with China, Mexico, setting up steel mills are just all aiming at winning vote. It is consistent with multi decade international strategy though so they are letting Trump do what he is doing.

Meanwhile, Yellen is collecting her payola for services rendered to her Wall Street cohorts while a “public servant.”

https://www.reuters.com/article/us-usa-fed-yellen/exclusive-yellen-gets-post-fed-payday-in-private-meetings-with-wall-st-elite-idUSKCN1HC0SI

I think a 1,000 points up swing is quite a bit more than a “bounce”…..

Just how fraudulent can everything get before something “happens”?

Pretty fraudulent to extremely fraudulent is a good range to assume. Fraud is the new normal. The absence of fraud looks odd and dangerous. If the fix isn’t in then nobody knows what to do or how to plan. Maybe someday.

It’s not, really.

Maybe in the past few years it would’ve been, but in the last few weeks alone we’ve had days where 1000+ point ranges are much more common, both on the down and upside.

There are competing forces in the market, the psychology of speculation really has little to do with the flow of funds. It could become speculative on the way down. For years the bulls have done it on low volume, now the bears have the power, and why hurry? Let them take the prices on the counter rally with nothing behind it, and then sell into the rally. It’s all very orderly at the moment.

The swings up are a function IMO of the nature of the beast. Take Tesla. The stock has lost $80 from best levels currently & had lost over $130 at recent worst levels. Yet as of yesterday a friend told me he couldn’t short TSLA as there was no stock to be borrowed.

So you can get in these big selloffs yet if you were lucky to have sold short at $360-$380/range. There maybe too many shorts trying to short TSLA so the recoveries while violent aren’t truly bullish in nature just shorts trying to cover their original positions perhaps?

Trade War?? I see a President executing a new strategy to inflate our economy because despite QE ad infinitum, inflating our economy has proven very difficult.

Now that QE unwind is rolling along any additional export of deflation from China can be detrimental. Preventing that by forcing prices higher via tariff seems pretty sound policy and I think China sees the merit in it despite the bluster of promised retaliation.

Being one of the little people, I have seen plenty of asset price inflation. I have seen health care costs up, food up, fuel up, insurance up, rents up. What I haven’t seen is wage inflation.

There has been both tremendous benefits and losses from our China policies. Many products are cheaper. Many US corporations made a lot of money. Our farmers and oil producers did very well.

Who didn’t do well were American wage earners. Were the benefits worth it. We will never know because it is impossible to go back and re run history.

Many people believe things should have been different though.

I look at the current direction and published polices and they make me very uneasy. I can not see how the new direction benefits those who were harmed by the previous ones. And I do not believe that those in charge care about the little guys.

Labor force participation rates are mugh higher after years of decline, which is a positive and wage growth is strong enough to actually fuel inflation fears. Wow. The masses are working, which also reinforces positive self- esteem which is a by-product of actually doing something productive with your time. Funny, 3-4 years ago, i talked with a Moodys economist about what was being called the “new normal”, i.e. stagnant job market, no wage growth and low GDP. I asked him if we could get impact these metrics and have policies to get us back near 3% GDP … he laughed and and said No in a hell no and condescending sort of way. He then pontificated about common misconceptions (Even with a MBA i was unwashed in his eyes apparently)

I have a side business tha is tied directly to the health of the US middle class consumer – their ability and willingness to spend was like a light switch being turned on a year ago. Hope to ask the same economist about this. Some phds with 150 IQs are really lacking in fundamental ways, including their arrogance which is a blindng force . The content on sites like this plus some independent thinking is much more valuable.

“Labor force participation rates are mugh higher after years of decline”

This is completely untrue.

The LFP today is 62.9%.

It’s lower today than it was in 2011, 2012, 2013, 2014, and is about the same as it has been for 2015, 2016, and 2017. It has yet to meaningfully appreciate from the low hit in 2015 of approximately 62.5%.

“I have a side business tha is tied directly to the health of the US middle class consumer – their ability and willingness to spend was like a light switch being turned on a year ago.”

The vast majority of which has been funded by debt.

I just posted an article with charts on this topic, including the LFP rate going back to 2000. Check it out:

https://wolfstreet.com/2018/04/06/the-jobs-report-sliced-and-diced/

In the comment section, upon request, I posted a chart of the LFP rate going back to the 1960s.

Fuel is a very bad example of inflation as crude is still 70 percent lower than where it was at its peak in 2008 Why would wages be higher when people in many countries are willing to work for far, far less ?

Is the Spread between 2 Yea and 10 Year bonds a matter of worry now? It almost fell below 50!

When interest rates are gamed, universally, then they are not, and never could be, accurate indicators of anything. Wait until they normalize in a few years and then apply analysis to them.

If the Fed gets worried about it — and they’re not at this point — they can just speed up the QE Unwind and start selling securities outright. That’ll do some magic on the long end of the yield curve.

“If the Fed gets worried about it — and they’re not at this point — they can just speed up the QE Unwind and start selling securities outright. That’ll do some magic on the long end of the yield curve.”

Not so fast. Speeding up the QE unwind is likely to materially affect markets and the economy negatively, potentially leading to lower yields.

I don’t think there’s any real precedence for the Fed controlling the long end of the curve. Why would they ever allow it to invert if they could prevent it?

The BOJ started specifically targeting the yield curve in 2016 (the 10-year yield “near but above 0%”) to prevent the 10-year yield from going negative — and they did so successfully. They’re always way ahead. They started QE long before anyone called it QE.

Remember the Fed wants to bring down asset prices (rising yields = lower bond prices). They also mentioned “elevated” stock prices and CRE prices, among other targets. The economy is doing OK. It can handle higher long-term rates.

In the past, before QE, the Fed didn’t have enough securities on the balance sheet to sell them in large enough a quantity to make a difference. This has now changed. Those $3+ trillion it acquired during QE are a new tool in their toolbox.

“Those $3+ trillion it acquired during QE are a new tool in their toolbox”

You say tool. I suspect they are thinking “Crap, how do we get rid of this thing?”. It was only a tool when they were building it. Now it’s a problem.

How about using tariffs to expand Medicare

for all ? Sure prices will rise but the cost to

Business for employing workers falls.

It would help level the playing field even more

with overseas labor.

US government-granted patent monopolies on pharmaceuticals cost US consumers over $350B more each year than if drugs sold in a free market. Generic drugs from China would save consumers a lot of money but drug company shareholders (i.e. CEOs and their board-member cronies) would have to downsize their yachts and dachas.

Generics and other pharma products come mostly from India these days – but the gist of what you said is correct.

Yes and see if you can determine how often the FDA inspects those generic manufacturing facilities.

Less inspections than US facilities last I read.

The cost is in clinical trials and drug development, not in production of the drug. Your supposed solution is inane.

There is no free lunch; take away that incentive structure and you’ll get far less research. The cost to develop a new drug is now over 2 billion dollars with all the hoops set up by the FDA. You will gut innovation if you take away that 350 billion without fixing the rest of the system, because money spent on research by pharma far outweighs that invested in biotech by the NIH, NSF, etc.

CAR T-cell therapy and AAV-based gene therapy are all happening because someone is willing to pay for it. If it was such a scam, anyone could start a biotech company and get rich. Biotech investments are incredibly risky and only make sense when there is a big payoff to balance out the 95% failure rate in taking a drug to market. The rest of the world gets a free ride off of US R&D.

“The cost is in clinical trials and drug development,…” Actually, that’s only part. The biggest part of the cost for the consumer or insurer is largely the insane profit pharmaceutical companies make and the insane compensation packages their top levels get, and the costs of M&A, and the like. That drug development costs drive up drug prices in the US to such extremes is industry propaganda.

1 – Start a pharma company! If pharma is grossly inefficient, displace them! The only money they make is through the value they provide. They aren’t being subsidized. Many people don’t like the reality that the value they provide is small compared to those who have a positive impact on human health, reality that hits in the form of a large bill.

2- Your view that the R&D should be given away at prices you dictate will help only those patients whose therapies already exist, by robbing patients whose treatments are yet to be developed. New development is funded by those prices that you consider obscene and it will stop if the money stops. Maybe you want public funding of the entire drug development process?

3 – You are advocating for the right to steal someone’s IP/work – it is no business of yours whether they get rich, or how rich. If someone else develops a drug *with their own money*, who are you to determine what they get to sell it for? The pharma company is creating a new treatment option for patients – if they don’t think it’s worth it, don’t buy it.

4 – The approval process is so slow that by the time a drug gets approved, much of the patent protection has run out. That means the window of time to recoup costs and profit is short. Those profits also need to also account for the drugs that eventually fail.

ZeroBrain,

Don’t be silly. You need to understand “competition” or rather the lack thereof in the pharma industry. That’s the biggest issue.

M&A has seen to it that there is very little competition. Instead we have oligopolies and monopolies. Then check out the scandals of how pharmaceutical companies are extending patent protection way past the original limits, or check out the scandals of how they’re keeping generic competition off the market, or the scandals of how hedge funds and pharma companies alike buy the rights to old generics where there is only one maker and jack up the price by many multiples.

The entire industry is a racket. And we’re paying for this racket.

Hence the huge profits, compensation packages, M&A premiums, share buybacks, and the like. That’s where a big part of the costs that we pay go.

The issues you bring up are real, but hardly tell the whole story.

Generics only account for ~20% of drug sales so even if in some cases there have been abuses, it’s hardly the market overall.

Secondly, biologics are the top sellers now, which unlike small molecules, face greatly decreased competition from generic manufacturers for reasons you apparently don’t appreciate. In a nutshell, for biologics it’s almost as difficult for a generics manufacturer to prove they have the same process/product as it was for the original producer to gain FDA approval.

My question is….

Am I correct in thinking that not only is this a headwind for the markets, but shouldn’t it also be a boost to the dollar?

Thank you Wolf for these regular updates!!

For the past year, the dollar has done the opposite of what “logically” it should have done, like so many things. When the Fed raised rates and started its QE unwind, the dollar actually fell. But I think it has carved out a bottom recently. And it’s likely to move higher. My bet is that it’ll be higher by the end of this year than it is now.

But a low dollar plays into the Fed’s hand and gives it additional leeway to tighten.

“shouldn’t it also be a boost to the dollar”

A strong dollar means imports cost less but exports cost more to the countries we export to. This is bad for manufacturing and other export related jobs. This is good for things made in other countries and imported here. Other countries will import more here. Exports down, Jobs down, imports up, prices mixed.

A weak dollar means exports cost less to those we export to. Domestic employment increases. Imported items increase in price. We will export more but import less. Cheap Chinese items cost more domestically. Jobs up, exports up, imports down, prices mixed.

Explain: why do you prefer either? For each plus, an equal but offsetting minus appears. Hint: you’re not supposed to know that.

I’m comfortably aware of each of those points.

I didn’t indicate a preference.

My only preference, is to know which way the market winds are blowing. Market winds fills my sail!

Hint: Don’t fight the FED.

So have US banks, contrary to European banks, have taken measures to avoid crashing? Because there won’t be another bail out, Trump voting base would most likely be quite displeased and scream murder if that happened.

The issue of how fast or how much paper the Fed is retiring, should be held up against the issuance of new mortgage paper, is the system expanding or contracting? That is the essence of liquidity, or collateral in the system, take too much collateral out and you get a credit squeeze.

@Wolf,

Since we are approaching the 6 month mark of QE unwind and because a lot of the QE money ended up in places like Bay Area, do you see any kind of correlation between employment in start ups, funding of startups with the QE unwind? The correlation may be spurious at this stage, of course, but then with the prop gone, one would expect the Bay Area bubble to burst.

Sez my tea leaves:

The Bay Area is uniquely dependent on the stock market. So a long decline in stocks — along with a souring of the startup scene — is going to have a big impact here. It always does. I think the QE Unwind and higher interests rates are going to put pressure on stocks for a long time, and its via this indirect route that monetary policy will likely leave skid marks on the Bay Area.

Thanks for the response.

Assuming Trump gets no concessions from the Chinese, the tariffs start kicking in. This should generate more tariff revenue for the US than China as there are more Chinese exports then Chinese imports from the US. If sustained long enough the supply chains will shift to other countries such as Mexico and SEA. These countries are less likely to maintain predatory merchantilist practices and use the proceeds to fund military expansion and aggressive posturing. This will save in the long run on US and allied defence costs. By moving the supply chains to less hostile countries it improves the geo politics.

In addition the US does not have VAT. Every other developed country has it and it is a very significant source of tax revenue. One could look on these tariffs as collecting sales tax on selective consumer items, a very long list of which originate in China. This revenue would accrue over the very long time it would take to shift the supply chains to other countries. This tax revenue would be a useful offset in the current fiscial circumstances.

Another very good article however, it does not (in my view) express how small this reduction really is compared to the MASSIVE amount to be dealt with. Baby steps will NEVER get this done. There will be too many political excuses to interrupt the process. Feels a bit mis-leading………..

It took the Fed six YEARS to pile on these assets. Do you want the Fed to unload all this in one day? :-]

And the Fed “tapered” QE out of existence gradually, spread over one year. It is now ramping up the QE unwind gradually, spread over one year. It is ramping up the QE Unwind only slightly more slowly than the pace at which it tapered QE in the second half of the taper. It’s nearly symmetrical (look at the first chart). Yes, this is a matter of years, just like QE was.

By Q4, the monthly QE unwind will be $50 billion, or a rate of $600 billion a year.