“Pricing power has erupted…”

The transportation industry, particularly trucking, has benefited from the rise in retail spending in the fourth quarter and in much of 2017. The surge in e-commerce with all the transportation challenges it brings along has been a boon for the industry. Shipments have soared, rates have soared, dollars spent by shippers have soared: companies have been complaining about rising shipping costs and are trying to pass on those costs via higher prices on their goods. But here’s what that looks like from the transportation and trucking industry’s point of view: a view from Cloud Nine.

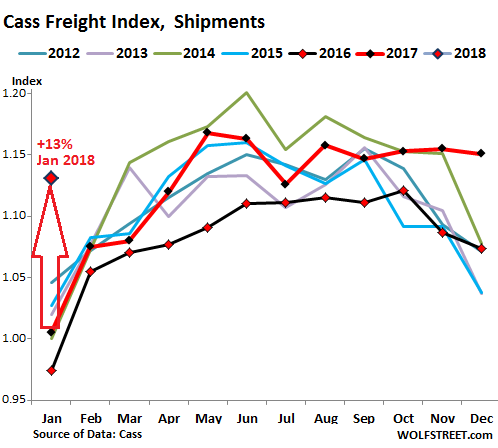

US shipment volumes by all modes of transportation jumped 12.5% year-over-year in January, according to the Cass Freight Index. The index, which is not seasonally adjusted, hit its highest level for any January since 2007:

Note how the red line (2017) at first timidly and then more aggressively outpaced the black line (2016). In December 2017, shipments had been up 7.2% compared to December 2016. The index normally drops sharply in December with the end of shipping season, but this time the index edged down only a tiny bit.

The index, which is based on $25 billion in annual freight transactions, according to Cass Information Systems, covers all modes of transportation and is focused on consumer packaged goods, food, automotive, chemical, OEM, and heavy equipment — shipped via truck, rail, barge, and air. But it does not cover bulk commodities, such as oil and coal.

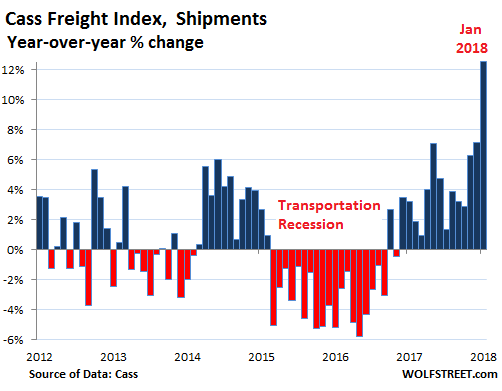

The chart below shows the year-over-year percentage changes in the Cass Freight Index for shipments. Note the transportation recession in 2015 and 2016 – and that phenomenal spike in January:

The report warns:

Volume has continued to grow at such a pace that capacity in most modes has become extraordinary tight. Pricing power has erupted in those modes to levels that spark overall inflationary concerns in the broader economy.

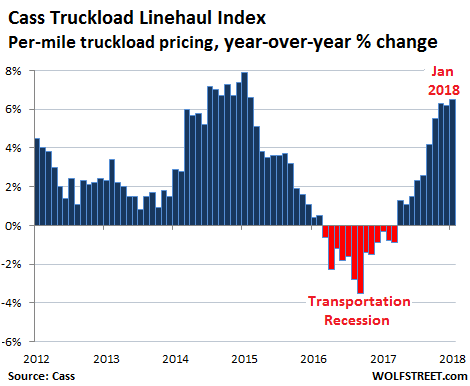

This surge in volume inevitably leads to increases in prices. The Cass Truckload Linehaul Index, which measures linehaul rates and does not include fuel surcharges, rose 6.5% year-over-year in January, to 133.5, just below December’s all-time record.

This chart shows the year-over-year percentage change of the linehaul index. Note the transportation recession from March 2016 through March 2017, when rates declined on a year-over-year basis for 13 months in a row. January was the 10th month in a row of year-over-year increases:

“In just the last seven months, our pricing forecast has increased from -1% to 2%, to 6% to 8%, and now giving us reason to believe the risk to our estimate continues to be to the upside,” said Donald Broughton, analyst and commentator for the Cass Indexes.

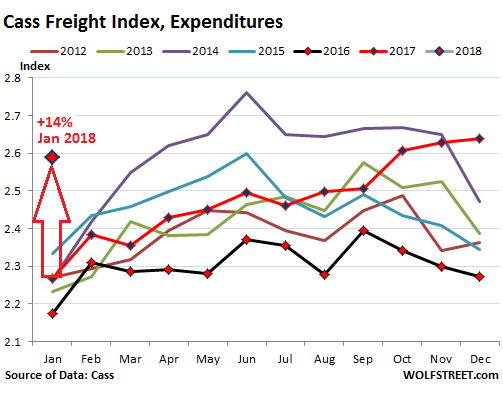

With shipping volumes rising, and shipping rates rising, and with fuel surcharges still up year-over-year, the amount spent on shipping has soared. In January, the Cass Expenditure Index – which tracks the amounts spent on freight for all modes of transportation and includes fuel surcharges – soared 14.2% year-over-year, to 2.29, the highest level for any January in the data series. If expenditures follow seasonal patterns this year, they’re going to be off the chart:

Note how the red line (freight spending on all modes of transportation in 2017) rose throughout the year, even blowing by what should have been a normal seasonal decline in December. The black line (2016) was lumbering along the bottom, mired in the transportation recession. The report:

January’s 14.2% increase clearly signals that capacity is tight, demand is strong, and shippers are willing to pay up for services to get goods picked up and delivered in modes throughout the transportation industry.

Where do these costs go from here?

When demand is strong, companies will be able to pass these surging shipping costs on by raising the prices of their goods. This cascades through the entire supply chain. And in the end, the consumer pays for it – even if shipping is “free” – via higher prices of goods. It may only be a relatively small amount per item, but it spreads across the entire goods-based part of the economy.

This transmission of higher freight rates to the consumer doesn’t happen overnight. But just like falling freight rates during the Transportation Recession were a factor in the so-called “low inflation” of 2015 and 2016, the surging freight rates now will be a factor pushing up consumer price inflation. These transportation costs – like so many other costs that have reversed direction and are now rising or surging – will be working their way bit by bit into consumer prices this year. It may not be a huge amount, but changes in the Consumer Price Index of some tenths of a percent are enough to rattle some nerves.

E-commerce is surging, but this comes at the expense of retailers in malls, and entire sectors have already been wiped out. Read… Brick & Mortar Meltdown Hits These Stores the Most

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

– A counterweight to those inflation pressure is “modest wage growth”. US consumers will be forced to cut back on spending. Any one ever heard of the word “Recession” ??

There will certainly be a recession in the future. There always is. It’s part of the business cycle. Even the Fed won’t be able to get rid of it.

Just like even we cannot get rid of the Fed! How sad!

Fed induced ELD mandate made trucking more expensive, about 30-60 c per mile depends on the type of trucking.

https://keeptruckin.com/blog/spot-market-rates-january/

Drivers can’t keep multiple logbooks as they did for decades.

I agree that with the consumer at peak debt and slow wage growth there will be a self generated economic feedback mechanism that will dampen any inflation by causing consumers to “cut back on spending”. And this will be a decade or multi-decade effect on the economy. Get ready for a slow roll economy for the foreseeable future.

Would be nice to hear from some of your readers who are truckers…

Has the demand picked up that much or is there a slight shortage of trucks due to not updating/enlarging the fleets, or shortage of qualified drivers?

So maybe the costs will go back down as it balances out?

We finance transportation equipment and business is very strong. Fleets are adding equipment at feverish pace.

Family business is in trucking. We are seeing record demand – the limiting factor will continue to be access to qualified drivers. This is keeping capacity limited and in turn freight prices high.

https://keeptruckin.com/blog/spot-market-rates-january/

Thanks Quack. So it looks like the ELD mandate in December is to blame.

Hi, I just read that link and its hard to say what is going on as they are offering a 20$ service for ELD. BUT they said this…Perry believes that the mechanism “is more emotionally based” than diligent enforcement or compliance with hours of service rules.

Loading and unloading is now considered part of maximum mandated/monitored hours available to work….so less milage, which is how they are paid. If you are several hours waiting behind other trucks to load/unload it is going to sting.

This has been like the Perfect Storm, with the shortage of drivers and the new law that as of Dec 2017 we are required to use ELD aka electronic logging devices which has really hurt productivity. My feelings are companies like Qualcomm have really pushed this via lobbyist in Washington. New truck equipment cost, ELD subscription fees,fuel prices and drivers wages which have been low and now slowly increasing have all attributed to this and most shippers knew this was coming.

It is not easy to attract drivers with today’s traffic and the poor image of today’s trucking companies and drivers.

Agree – “like the Perfect Storm”.

This upswing in numbers has all the ear marks of a ‘catch up’ bounce.

Inventories were allowed to shrink to low levels, so therefore restocking or going out of business was the decision facing many companies.

The end user (broke consumer’s) does not have any wriggle room left on the debt side of the balance sheet. The so-called “tax break” crumbs are being used to pay down, debt obligations, of course the lion’s share of the tax relief is going to the corporations.

As to “passing on” higher shipping costs to the end user? Good luck with that as the consumer has pulled in their financial horns and is now hunkering down for the really tough times coming. Most ten per center’s don’t see this.

Rob, your point on ELogs is dead on. Ask anyone who owns or dispatches for a trucking company. Fuel prices and the inability to cheat on hours has put many independents out of business. The older drivers are retiring.

Will be interesting to see what happens to rail.

Last stop on the inflation train.

Panic buying of UST, the safest vault on earth. Down day in the long duration, especially the UST10Y rate, while the DOW is up 350 pt on low vol.

The DOW & the SPY already retraced 62% and the moon is not shining.

I think this is mostly a good news story. It is a welcome change to hear a segment of industry is improving.

I do feel a bit sorry for the drivers these days. With the electronic logs and GPS snooping I often see them pulled over for some zzzzzzzs, and only a few hours away from destination. If its gotten that regimented then maybe drivers should be straight salary with a firm shift of work hours like other industries. And owner operators just get the shaft from what I can see. Any delays are on their dime. It’s a rough business. And to top it off everyone wants to drone your job with electronics. I would really like to see a self-driving truck evaluate whether or not to attempt a mountain pass in winter. In BC they’ll be over every icy cliff.

“If its gotten that regimented then maybe drivers should be straight salary with a firm shift of work hours like other industries.”

America is still one of the few countries that pays by the Rippoff the worker mileage rate so all loading and delays are on the drivers cost.

Most others are either contract for the task or hourly, With guaranteed weekly minimum and over time allowances Etc but flexible start/finish times. Some of our operators pay only when the unit is working. But when they use that system. The Hourly wage is VERY High (like double normal wage +).

As an online buyer I am not experiencing the higher transportation cost because the sellers are all providing free transportation, and I am not vulnerable to any one seller raising prices because I am always free to purchase the best bargain.

The on line sellers will have to continue to absorb higher shipping costs and provide free shipping if they want to be competitive against the brick and mortar sellers.

I hear what you are saying, however, I think most sellers sink the shipping into their sell price. So if shipping cost go up, it affects online and brick and mortar. If the seller absorbs this cost, then their margin shrinks, which is possible to do, but I think most sellers in the long run, will pass some or all increases on.

They may raise their prices simultaneously, which is usually what happens, since they use algos that watch market prices and price changes. One raises the price, others follow. You’ll just pick the best deal that is available, but its price is higher than the price of the best deal a little while ago. You’re happy because you got the best deal. And the vendors are happy because the price increase stuck. And shipping is “free.”

I have been in the market for furniture for about a year. The sales tax and the delivery charge would add almost $200 to the cost. I have been patiently waiting for a sale that reduces the price by this much. In the mean time, two independent furniture stores in town are closing down. Had they offered free delivery, I think they would have had a competitive edge.

“Had they offered free delivery, I think they would have had a competitive edge.”

Depends on the Margin.

Cheap/Low end, mass produced, Furniture.

Has bad margins, just like Cheap/Low end Clothing. Needs big volume to be after overheads competitive, and profitable.

“Free delivery” isn’t free just as the interest free Credit Terms, are not truly “Interest Free”.

Those that complain about the lack of Quality goods, also complied about the price of quality goods, when they had the opportunity’s to buy them. But didnt as they were to expensive.

One of our suppliers, in an industry where many still demand quality tools and consumables. Has a sign at the trade desk. Other top quality brands Available on Order number/cash with order, basis.

d,

I wasn’t complaining about the price of the furniture. I was complaining that a high sales tax and the addition of a delivery charge kept me from purchasing the furniture. I think that charging for delivery on an item which is meant to be delivered is gouging. Most of the time when I wait for a sale, I am waiting for a discount that covers the sales tax and/or delivery.

“I think that charging for delivery on an item which is meant to be delivered is gouging.”

Sometimes you are particularly unbalanced in what you expect for your dollar.

As previously stated, free delivery, is not “FREE”.

With Fridges, Stoves, and Washers these days. Installation and inspection is part of warranty (Where we live) so those items have delivery (Variable) and installation in the price, Everything else is sold at the door, or the price is jacked on all items in store, to cover delivery Which is Gouging the cash and carry/collect customers. .

At sometime every store has to hit a certain margin so if costs go up for everyone prices will go up.

But yes online retail makes that a tad mor e complicated because you always have access to the cheapest price. Though store fronts like Amazon are likely smoothing out much of the potential price variance by funneling most goods through one shipping process.

Eitherway changes in just one year would likely be impercetable to an individual.

A totally cheap credit-driven “recovery”…I still don’t believe it.

Show me a recovery that wasn’t credit driven and I will show you one that never happened!

See “The Forgotten Depression of 1920” by Tom Woods.

Does anyone still look at carloadings/

With inflation solidifying, the Fed has no choice but to raise rates. Speculators are long commodities, and higher yields are the only way to curb this ramp in longs. With that being said, I think the fed funds rate will have to be much higher in order to make the dollar attractive again.

And gold sinks!

Hi Kiers:

Yes gold is sinking because the Fed doesn’t want any signs of inflation!

Gold is manipulated using VIX and Yen. Also by controlling small silver paper market (JPM).

Gold acts as a reference point, like the horizon. The Fed does not want anyone to have any reference points.

“When demand is strong, companies will be able to pass these surging shipping costs on by raising the prices of their goods. ”

Pretty much validates that the economy is booming and that the recent stock market hic-up (poorly designed VIX ETNs) will be shown to be nothing more than a blip on the way to dow 30,000.

Good article.

lol! to the economy booming. The Dow may continue to rise, but not because of any underlying, organic strength to the economy.

Great articles, but I keep reading news stories where Republican allies of Donald Trump say he is serious about attacking North Korea.

The Winter Olympics are almost over. US-South Korean military exercises are scheduled to start again after the athletes all leave.

I think the U.S., and the world, are about to have much bigger problems soon.

Not to worry, Ivanka is over there to straighten things out. When Jared gets through with working out the ME two- state solution next week maybe he’ll give her a hand.

My truck has been parked for months in response to the EOBR mandate. I’m pretty sure I’m not the only one, and I’m equally sure that the guys running them have had their productivity hammered as a result.

This entire situation is the direct result of stupid government regulation.

Wolf, can you tell how much of this is oil and blending components? It doesn’t seem like other data agrees with this big of a spike other than in oil.

The answer should be “none.” Shipping volume and costs of commodities, such as oil, coal, and grains, are not included in the Cass data that I used in the article.

I think Amazon announced their intention to enter the delivery business. UPS and Fedex both took a hit from this. Competition coming on strong.

UPS is a good example of why prices could skyrocket. They are a balance sheet disaster. They owe their pension plan $9 billion and have 5 billion in short term debt. This year they announced a huge capital project, which they can’t afford and their stock tanked.

Many of these companies have borrowed so much money to finance stock buybacks that they can only survive if prices go way up.

The charts all look the same to me. There was a transportation recession? We’ve all been looking at flatline growth numbers for so long that every blip on the radar seems huge. And chartists have a tendency to live trading at the short interval, (and they repent when the long term trend reasserts itself) The fact that trade deficits are at all time highs might suggest that those trucks are picking up containers at port of entry and heading for Walmart. A good sign, right?

The wild card coming will be the introduction of fully autonomous shipping trucks. I suspect this will be the first group of autos to successfully be automated ahead of public transit and consumer vehicales

Autonomous trucks are BS. There is no way a self driving truck will, in my lifetime anyway, be able to navigate itself up a frozen logging road in the PNW, back itself under the shovel, undeck the dolly, properly secure the load, then check and adjust that securement while it navigates its way back down the mountain to the mill.

Self driving trucks will never (I pray) haul fuel or any hazmat material, they will never haul any kind of open deck trailers where the load must be secured to the trailer and then constantly monitored and regularly checked while in transit, just to name a couple of examples.

It’s a all BS

No sir. Autonomous trucks are a functioning reality right now. I think, for what ever reason, like a lot of drivers you can’t / won’t accept that we drivers perform a semi-skilled task that is so easily automated. You use extreme examples of certain situations in trucking which will likely always require a human.

So let’s look at this issue realistically with some real examples of how automation can / will replace drivers in the VERY near future. I have a run (pinto beans, 46,000#) once a week from Denver to Nashville. The vast majority of loads throughout the industry are similar to this both in distance and weight. Runs like this are right on the verge of no longer requiring a driver. Don’t believe me? Read up a little about the recent load of Budweiser (sans driver in the seat) which successfully ran from Fort Collins, Co. to Colorado Springs.

Sure, there will always be conditions which require a human

( mountain passes, ice, etc.) but lets face facts- most of a driver’s time is spent simply holding a steering wheel for hundreds of boring miles at a time. Why in the world do we need steering wheel holders? Lidar, radar, and GPS are already proven to be safer and more productive than a human for operating equipment engaged in normal, long distance freight hauling.

As for “backing under a shovel” I’d urge you to read about the mine in Australia which has begun using high speed haul trucks which don’t even have any provision for a driver!

Regarding things like dropping and hooking trailers, securing loads, etc., remember, this type of work, being nearly completely unskilled can/ will be done by unskilled laborers.

Your concerns about regularly checking the securement of loads is unfounded since electronic sensors and camera equipment are far more effective for keepin’ an eye on things than a driver’s eyes even on his (her) best day.

I’m sorry to report that most long distance truck drivers are about to be made redundant, much the same as a railroad locomotive fireman became superfluous with the advent of the diesel.

Two final things:

I respectfully doubt that you’ve “parked your truck”. If you had, how would you be making a living and/ or making your truck payments?

Also, if anyone reading this is interested in more on the topic of “why has truck driving become such a low life vocation and why some drivers feel it necessary to operate in violation of the HOS law thereby making on board recording a reality” and “why has truck driving become such a poorly paid vocation?” Let me know and I will compose a short dissertation on this topic.

rx

“As for “backing under a shovel” I’d urge you to read about the mine in Australia which has begun using high speed haul trucks which don’t even have any provision for a driver!”

But the shovels and othe rloaders are operated by remote off site and most of the offsite operators are”Women” not AI.

Please do. FWIW I bought my first truck in 1974. My opinions may be subjective at times, but they are based on a lifetime in the industry.

And in response to the other poster, there is a word of difference between a mining operation and logging. The people who think self driving trucks are imminent are people with limited knowledge of what’s involved in a lot of trucking.

“And in response to the other poster, there is a word of difference between a mining operation and logging. ”

I have been in forestry as well .

All the problems with log loads, can be resolved by placing the logs in a bin. Which has a Hydraulically closable top, with a robot.

When there is no expensive Log Truck Driver in the mix, It becomes cost efficient to bin the logs instead of load on bolster.

It also becomes efficient to bring the logs to better condition Skid/load sites, with Feller Buncher’s/Skidders when you Robotise and remove all the expensive requirements of the human Tuck Driver

The only drivers that will remain, long term, are the specialist 1 off load operators.

My paid for 2011 Freightliner is sitting at my shop. I’m supporting myself through income from my rental property and by driving California intrastate for a friend. I really want you to explain how truck drivers are under paid, given what I’m currently earning from this job.

I can answer this in more detail when I’m not in the truck, typing on my phone.

You’ll see autonomous trucks introduced first in controlled environments like container ports or mining operations where routes are predictable. The many issues with running trucks on public roads are going to take a long time to resolve, and not just in technical terms.

Seems like conflicting information to me.. On one side we see B/M retail closing stores in a general slow motion collapse.. On line is increasing but it was maybe 12% of retail and it increased by 18% so it is now maybe 14-15% of total retail… but that doesn’t seem to be enough to justify an increase in shipping. Restaurant chains in trouble..

Then the charts on worker incomes that show that most of the increases have gone to the upper 20%.. Which means that 80% is doing either worse or actually flat. Hours worked/ week slightly down, productivity going now where… And credit card debt is at record highs along with auto debt and student debt continue to be at record levels ..mortgage debt up.

And now this about the increases in moving something around. Up rather dramatically..

While the cost of borrowing is increasing….

Wolf, anyone? Can someone make sense of all this? What’s going on? Is this all in anticipation of that the consumer/employee will have a few extra dollars from the lower taxes?

Retail is up year-over-year by a good clip (5.2% in Q4, including restaurants and bars). But it’s a lot more than just retail. All supply chains, including those for manufacturing, oil & gas drilling, construction, etc., rely on transportation to get their goods to where they’re needed.

For example, manufacturing output hit a new all-time high in Dec and Jan.

https://fred.stlouisfed.org/series/INDPRO

thanks Wolf

Still wages don’t seem to be heading in the same direction

https://fred.stlouisfed.org/series/LES1252881600Q

So with debt up, interest rates up and wages on the downside according to the FED, How long can this last?

Definitely interesting times!

Consumer price inflation is like a freight train…it has Inertia and Momentum. Businesses have to absorb input cost increases without being able to raise consumer prices due to intense competitive market forces. Online shopping has only served to increase that intensity. So the “consumer inflation freight train” is very difficult to get rolling down the track. However, once a critical mass of businesses are subject to a substantial enough rise in input costs, the train starts picking up speed because businesses at large feel they can raise consumer prices in unison with impunity. Once that initial inertia of the train is overcome and it’s rolling down the tracks, it now has momentum. As difficult as it was to get that inflation moving, it will be equally as difficult to slow it down…just ask Paul Volcker in the late 70s/early 80s. Anyone who believes consumer inflation can be turned on or off like a light switch without serious unintended consequences is sadly mistaken.

Might not be explained by something like more drivers – less retail workers, more trucks – less shops plus a higher oil price?

“A 3.0 percent jump in energy prices in January caused the overall Consumer Price Index (CPI) to rise by 0.5 percent in the month. This brought its year–over–year increase to 2.1 percent. However, core inflation remained modest, rising 0.3 percent in the month, with the year–over–year rate at just 1.8 percent.

Even this 1.8 percent rise is overwhelmingly due to the role of shelter. The core index, excluding shelter, has risen by 0.8 percent over the last year. There is no evidence whatsoever of accelerating inflation in the core index outside of shelter. Since the rise in the price of shelter is primarily the result of the limited supply of land in desirable areas, the inflation in this sector is not the result of conventional inflationary dynamics.”

http://cepr.net/data-bytes/prices-bytes/prices-2018-02

This is hilarious. When energy prices were collapsing YOY in 2015 and 2016, they all fretted about deflation and wanted the Fed to cut rates, rather than IGNORING it, which is what they should have done.

The energy CPI (now at 220) is STILL 10% below where it had been in 2014 and prior (240+). In my entire life there were only three quarters of deflation but decades of often hefty inflation. And yet these folks are frazzled when they imagine consumer price deflation beyond the horizon — though it would be a godsend for workers, whose wages are rarely adjusted for inflation — and they can never get enough inflation. And by saying that since x,y, and z caused this inflation, it doesn’t count and it isn’t enough? Just too funny.

d-

Forestry is not logging. If you knew anything about logging you would know that:

1. Skidders and feller-bunchers can’t work on steep slopes.

2. They damage the ground wherever they do

work.

This is we have yarders. A yarder side will prove very difficult to automate. The idea of a robot trying to pull haywire in the brush is kind of funny.

The idea of putting the logs in a bin is pretty funny too. The weight of the bin will come right off the legal payload of the truck and the logs will still have to be secured in the bin. If a log shifted in the bin while the truck was rounding a turn it could cause the truck to overturn.