It was one gigantic party. But wait…

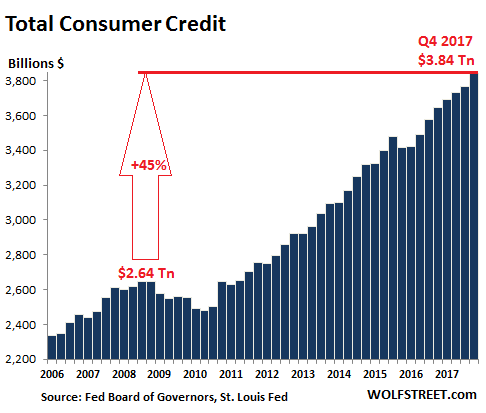

Total consumer credit rose 5.4% in the fourth quarter, year over year, to a record $3.84 trillion not seasonally adjusted, according to the Federal Reserve. This includes credit-card debt, auto loans, and student loans, but not mortgage-related debt. December had been somewhat of a disappointment for those that want consumers to drown in debt, but the prior months, starting in Q4 2016, had seen blistering surges of consumer debt. Think what you will of the election – consumers celebrated it or bemoaned it the American way: by piling on debt.

The chart below shows the progression of consumer debt since 2006 (not seasonally adjusted). Note the slight dip after the Financial Crisis, as consumers deleveraged – with much of the deleveraging being accomplished by defaulting on those debts. But it didn’t last long. And consumer debt has surged since. It’s now 45% higher than it had been in Q4 2008. Food for thought: Over the period, the consumer price index increased 17.5%:

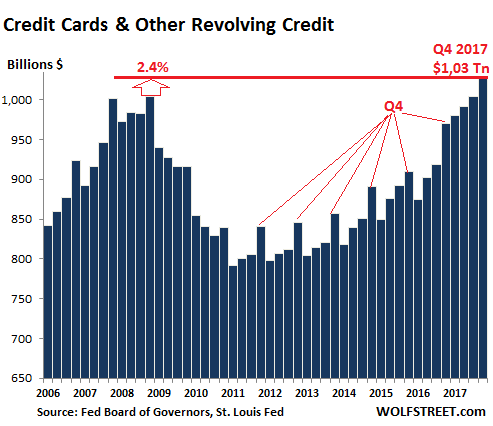

Credit card debt and other revolving credit in Q4 rose 6% year-over-year to $1.027 trillion, a blistering pace, but it was down from the 9.2% surge in Q3, the nearly 10% surge in Q2, and the dizzying 12% surge in Q1. So the growth of credit card debt in Q4 was somewhat of a disappointment for those wanting to see consumers drown in expensive debt.

The chart below shows the leap of the past four quarters over prior years. This pushed credit card debt in Q3 and Q4 finally over the prior record set in Q4 2008 ($1.004 trillion), before it came tumbling down via said “deleveraging.”

These are not seasonally adjusted numbers, and you can see the seasonal surges in credit card debt every Q4 during shopping season (as marked), and the drop afterwards in Q1. Revolving credit includes credit card debt and personal loans [visit the Credit Ninja website]. But then came 2017. In Q1 2017, credit card debt skyrocketed to an even higher level than Q4, when it should have normally plunged – a phenomenon I have not seen before.

This shows what kind of credit-card party 2017 and Q4 2016 was. Over the four quarter period, Americans added $58 billion to their credit card debt. Over the five-quarter period, they added $109 billion, or 12%! Celebration or retail therapy.

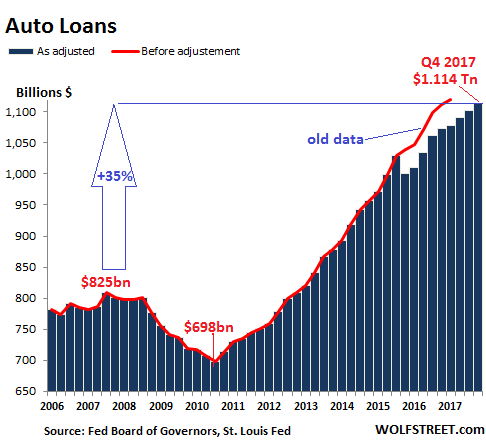

Auto loans rose 3.8% in Q4 year-over-year to $1.114 trillion. It was one of the puniest increases since the auto crisis had ended in 2011. Since then, the year-over-year increases were mostly in the 6% to 9% range. These are loans and leases for new and used vehicles. So the weakness in new-vehicle sales volume in 2017 was covered up by price increases in both new and used vehicles in the second half and strong used-vehicle sales:

The red line in the chart above indicates the old unadjusted data. In September 2017, the Federal Reserve announced a big adjustment of consumer credit data going back through Q4 2015, impacting auto loans, credit card debt, and total consumer credit. This adjustment was based on survey data collected every five years. So routine. But for Q4 2015, the adjustment knocked auto loan balances down by $38 billion.

Hence that misleading dip in auto loans in Q4 2015 in the chart above. This was at the peak of the auto-buying frenzy, and actual auto-loan balances certainly rose.

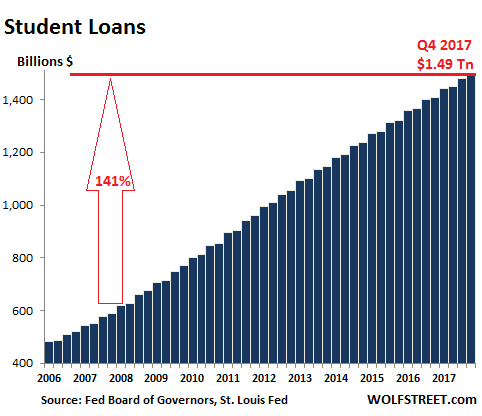

Student loans surged 5.6% in Q4 year-over-year. This seems like a shocking increase, but the year-over-year increases in Q3 and Q4 were the only such increases below 6% in this data series. Between 2007 – as far back as year-over-year comparisons are possible in this data series – and Q3 2012, the year-over-year increases ranged from 11% to 15%:

And there was no dip in student-loan balances during the Financial Crisis; in fact, those were the years with the steepest growth rates. From Q1 2008 to Q4 2017, student loan balances soared 141%, from $619.3 billion to $1.49 trillion, multiplying by 2.4 times over those ten years. More food for thought: Over the same period, the consumer price index rose 17.5%.

The problem with debt is that it doesn’t just go away on its own. If one side cannot pay, the other side takes a loss on their asset. Some auto loans and credit card debts remain on the balance sheet of lenders, while others have been securitized and are spread around among investors. But most student loans are guaranteed by the taxpayer or directly funded by the government.

Over the years, student loans have fattened entire industries: Investors in private colleges, the student housing industry (an asset class within commercial real estate), Apple and other companies supplying students with whatever it takes, the textbook industry…. They’re all feeding at the big trough held up by young people and guaranteed by the taxpayer. Food for thought, so to speak.

In terms of corporate debt, it’s only a question of how disruptive the adjustment will be, whether it will be just a sell-off or junk-bond mayhem. Read… Corporate Bond Market in Worst Denial since 2007

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I can’t believe how fast student loans are growing. It seems not long ago the number bandied about was $1 trillion. Now it is $1.5 trillion, a staggering number. I heard that some students who study 12 years or more to become a doctor have ran up student loans as high as $400,000. It would be interesting to know what the record highest loan amount to a student has ever been in recorded student loan history.

Sadly that’s not a piece of data that is published, or likely to be published any time soon, but you can easily find out which colleges and unis have the classes with the highest average debt load and which percentage defaults within three years.

I won’t spoil the surprise of an Internet search, but #2 is Grambling University which, while I am sure provides high quality education, is not exactly Yale, the Caltech, Cornell or the MIT when it comes to academic fame and prospects for high earnings during one’s early career.

Grambling U graduates carry over $51,000 in student debt upon graduation and have a massive 17.7% chance to default on said debt within three years of graduation.

This may have something to do with the fact that all that wage inflation bonanza apparently fails to touch Grambling U graduates, who during their early careers average far from “inflationary” $40,700 earnings per year.

Blacks make up 40% of the student debt. This will be a big social issue in future where they will demand debt forgiveness.

No one dares to talk about this.

Hmm. The “white” ones won’t also be asking for debt forgiveness as well? I have not noticed any racial distinction in that regard.

Arnold, that is a darn shame. Watched the show Finding Your Roots and the celebrity learned that his ancestors were among a 100 or so sold to the slave traders by “the king”. Too bad they didn’t elaborate more on who “the king” was (hint – he was not European). The king had about 4,000 for the traders to choose from. When slave trading was ultimately abolished by the Europeans, the Nigerians actually protested, something taught in Nigerian schools today.

Lots of stains on all involved, but many prefer not to waste a great and divisive weapon.

Arnold Ziffel, Can you cite a source for this? Thanks. This is not the number I remember, but I couldn’t quickly find the data.

I am surprised that this comment received a civil reply from Wolf and didn’t get you insta-perma-banned.

Personally I find rather more intriguing the fact students get into debt to acquire skills that no employer in his right mind would consider remotely useful for any business.

Learning how to perform humorous impersonations of Anna of Cleves may be personally satisfying, not to mention hilarious, but I honestly doubt it’s a talent much in demand these days.

The hell of it is, most of these kids have no idea what they are getting into. I am glad there was no such thing when I went. I had to actually get a job and work.

During the financial crisis many replaced a lost job by going back to school. It was they only way to replace the lost income from the job. Student grants and debt pay for both school and living expenses and if you have any income, refundable tax credits come into play too.

Believe it. College grads aren’t getting jobs, or only getting part-time jobs because of the Obama-care rules. They are going back to school to defer the debt.

Way too many young people are going to college nowadays bottom line. This student loan bubble is scarier than anything else. No way in hell there are enough jobs out there and with people staying longer in the workforce, illegals, visa workers etc. It’s a huge issue government and US society is turning a blind eye to. Just think about how many students colleges and universities are graduating EVERY DAMN SEMESTER??????? It’s literally absurd! No way in hell our economy can absorb all these people and provide jobs for them. And with our industry and manufacturing and unions being gutted over the last 50 years young people have been brainwashed into believing college is the only answer. 75% of the kids in school nowadays don’t belong their and will never contribute anything substantial to society compared to the costs of “educating” them.

And yes I’m typing on my phone and I realize the irony of my grammatical and spelling mistakes!

College is mostly hidden unemployment and a place for young people to stay busy and conformistic before becoming slaves.

I am saying that after 23 years of academic teaching in Europe and in the US.

Even worse over 80 % of the Degrees those Students are obtaining. Will not help them get a job, with a true tertiary education level salary.

@d, you and I rarely have the same opinion but in this case you’re absolutely correct. When I look at student numbers, an awful lot want to study Marketing or Psychology. WTF? Here in s-e Asia, too many also want to study Medicine in a region already saturated with doctors. (Blame parental delusions.)

Both our kids are moving into non-M.D. STEM fields. We’re doing the Asian thing. Are prepared to be angel investors for them somewhere down the line. Can’t see a future any other way.

I know a woman who was one of Hong Kong’s top Psychologists before she left.

HK and Asia is actually under supplied. So the Population to Practitioner ratios are very high.

However.

Asians do not use visit Psychologist any where near as much as their western counterparts. So the ratios do not necessarily indicate a Practitioner supply problem.

Dmon,

Are student loans negative amortizing? If so, what % of the growth of student loan debt over the past decade can be attributed to this?

I know a couple who racked up $420k in debt combined just for grad school (parents supported them as undergrads). Fortunately they both established good-paying careers, but are still repaying debts 12 years later.

It would be a real mark- to- market exercise to put that book on the block. Goldie might bid if was allowed to put defaulters into debtors’ prison.

BTW: the 400K the doc rang up has a better chance of being repaid than the loans made to private college Kaplan, which are 40 % sour.

Many doctors now leaving residency have $500,000+ of student loan debt. When I started medical school in 2007, many people in my class had gone to Ivy League or other private schools for their undergrad degrees and already had $250,000 of debt (provided they didn’t have wealthy parents). That would be tacked onto ~$250,000-300,000 total cost of four years of medical school. Re-payments are deferred during the 3-7 years of residency, and interest compounds on the debt throughout that time. It’s relatively easy to end up with $500,000 in debt at the end of more than a decade of education and training.

Medical students are very cognizant of this debt and how challenging paying it back will be if they choose a lower paying specialty. It’s a terrible shame as the country desperately needs more primary care physicians, gerontologists, palliative care specialists, etc. I think many would like to do it, but it’s a tough sell you’re looking at that kind of debt load.

Their corporate employers should be footing at least part of the bill of the cost of training their employee doctors. Back when doctors were their own boss, the debt was part of the start up cost to own their business. Now it is just the price of getting a job. Becoming a doctor – especially a primary care doctor- is a financially stupid decision for anyone with the intelligence to become a doctor. Goldman pays way better.

And rates are rising at the worst time. Might get ugly.

And the bubbles are all blown with care, waiting for Mr. Crash to get here.

Apologies to “The Night Before Christmas”.

On the time honored principle that things never go to the Underworld in a straight line, car loan rates have been inching upwards since early last year, albeit this isn’t happening in a straight line: usually interest rates are adjusted upwards across the range but when the manufacturer needs to goose up sales of a certain model or model range to improve sales figures and provide stocks a temporary boost or just get rid of some stock, rates on “selected models” may go down drastically, albeit the insane 0% EAPR no money down deals we had in 2003-2008 seem a thing of the past; however I’ve seen similar ones pop up in Europe on some high margin FCA and JLR models. But financial conditions there are still loosening, most likely to help put a EU-friendly government in charge in Italy no matter the cost.

Very telling these days is how cash has made a dramatic comeback as a preferred way of paying. Dealerships will offer extra large discounts to customers paying cash without even the pretense of haggling: back in 2003-2008 salesmen were generally instructed to sell the loan first and the car later, so cash was somehow looked upon (read: low discounts). But these days? You get a big red carpet rolled in front of you the minute you mention it.

I can’t wrap my head around the cash thing, just that it must have to do with NIRP. Mind, you have to pay the bank to keep your money.

I loan you 10K at 5%.

Later I will sell the paper to investors. If market rate stay at 5%, I make nothing. If market rate goes up, I lose. If market rate goes down, I gain. Like all loans/bonds. When rate rise, I do NOT want to loan you money for the car, I want cash.

Makes sense if you package the loans into bonds. But then, there must be some nervousness about rising rates.

“But financial conditions there are still loosening, most likely to help put a EU-friendly government in charge in Italy no matter the cost.”

Should that not Occur. T things could get ugly in both project Euro and eve closer union Eu as the norther league and five star are both very out of both, party’s.

Five start may not enter a coalition, but it could enter a confidence and supply agreement, in support of a minority coalition, if OUT of both, was the price.

Brussels under junker and his Socialist, ever closer union Dictators, has over played its hand.

How is this the “worst” time? It has been the “worst” time for almost a decade now, I don’t think we’re gonna have a better one.

Tuition alone is $50K for a normal, 2 semester academic year now where I went to school for 7 years (M.I.T.)

That does not include books, food, or a place to live.

I pretty much put myself through, small amount of debt paid off my first year working…lousy food, no personal life, working, buying and selling old cars to and from mostly foreign graduate students, …

I remember students protesting the latest tuition increase with signs and chants that “$3750 was too damned much.”

Obviously couldn’t do that today.

Daughter will probably go to college in Thailand.

No problem.

$5K a year is enough.

Will you sleep well if your American (I assume she is) daughter goes to Thailand for university ?

I AM NOT being sarcastic or provocative. As an American in today´s world, I am not sure I would feel safe living in Thailand.

There are no Thai cities on Wikipedia’s latest list of murder capitals of the world. There are four American cities on the list. https://en.wikipedia.org/wiki/List_of_cities_by_murder_rate

How did Chicago not make that list?

Good response, that was obvious — and I should have easily made that connection. But I did not.

Real terrorist actions against Americans occur daily in AMERICAN cities. I guess you could call a high murder rate by easily available handguns ¨domestic terrorism¨ .

Robert,

As a fellow American who not only completed university abroad in Asia, but also continues to live and work outside of the US, I have some news that may come as a shock to you.

First the good: Many top tier schools outside of the US have and continue to provide 100% undergraduate tuition + living stipends to international students as a way to bolster their global image. I was *paid* to go to an elite university in Asia which helped me land a job at a global EPC contractor *before* I even graduated.

Also, Robert, I hate to burst your bubble, but there are far more dangerous places *within* the US than in many other countries, particularly in Asia. Paul and his daughter have it right. You too should begin to look East, and West, and North young man.

I apologize for the snark, but certain American attitudes such as the kind you expressed in your comment are insulting to many and have shackled many youths to accept a future within a system that simply does not have their best interest in mind anymore.

I was not trying to be insulting, my question was gently asked — and was also asked in the sense of wanting to become informed.

Can´t a person ask a question without being harshly judged for the asking thereof ?

My response to Anon2017 also stands as a response to your post.

I try not to be angry or judgmental in my posts, and I do hope that others can learn a gentler approach. And I do not mean to be judgmental or insulting by saying that, too.

One of my very good friends told me this many years ago, ¨you can never know another person´s motivations¨, and that thought has guided my responses (to others) over the years, as I came to fully understand the solid wisdom in what she said.

Sir;

I would like to know what/where these universities are and how to find them?

You should spend time in Thailand before you start spouting nonsense about it. Any American city is much more dangerous.

I was not spouting nonsense — I merely asked a question.

So many angry people out there (and here, too). Why is that ?

Strangely I felt safer on the streets of Bangkok at night, than I did in LAX Immigration in Broad daylight.

I have had guns pointed at me in earnest 2 countries. America nad Lebanon. Ther was ahot war in Lebanon at teh time.

In the Us all I did was get out of a car

Result Two police officers screaming at me to turn around an put my hands on the roof of the car whilst pointing loaded guns at me with the safety’s OFF.

America is not a nice, or safe, place.

Why, I would and go every year.

@Robert —

In Thailand you also don’t see homeless people on the streets as you do everywhere in Berkeley and Oakland, where one (1!) semester at the Haas School of Business has been costing $50 thousand for at least the last couple of years and a studio apartment rental quite commonly starts at $3,200 a month.

No offense, Robert, but you seem to be an American who doesn’t travel much. I’ve lived in the San Francisco Bay Area for forty years but have a UK passport. I like it, but it was always obvious to me that much of the U.S., since it was large and recently settled, remained a third world country outside the obvious centers.

And nowadays, if one does travel, it’s increasingly obvious that by comparison with the rest of the OECD countries (bar a few outliers like Turkey) the U.S. is largely a backwards, third world country — highest prison populations, worst healthcare and outcomes, worst public educations, worst infrastructure, declining average lifespans, etcetera. And those are facts.

The thing that holds the US where it is. Is that of the big 4 evils. That wish to replace the US and dominate the planet for their own gain, iran, india, china, Russia,(In descending order of evil) and the US which is the current major reserve currency.

The US is still the lesser evil, and currently there still is nothing better to replace it.

There was hope for the Eu/Euro, but it is in vain. Europe is still to tribal. The Economic constraints from 2008 and their reaction to it, Show us that.

The US is a net buyer, china is a net seller, every quarter for the last 43 years. The world is not going to tolerate being milked by china, for much longer. As china is not a global growth Engine

It is a Predatory global Wealth Extraction Engine.

You’ve spent 40 years in SF, and pronounce the entire US as third world, oh great world traveler?

I live in the Southeastern US, and have travelled around the world many (as in more than several) times. If you can proclaim the US as third world, I can comfortably state that you haven’t been anywhere at all.

“I can comfortably state that you haven’t been anywhere at all.”

In terms of average , National infrastructure and condition (Including the lack of functioning cost effective national power grid.), Healthcare systems, Public Transport systems, Homeless peopel %, Commercial law(America is the land of legalised corporate fraud) Murder rates.

He is not far from the truth.

America like the world, has little Islands of wealth, sounds like you spend all your time in them.

Tution at the University of Chicago Booth School of Business is $69,200 for the current 2017-18 school year (9 months). The total suggested budget comes to almost $104,000, including a $4,000 suggested health insurance charge. Details at: https://www.chicagobooth.edu/programs/full-time/admissions/tuition-financial-aid For the 1970-71 school year, the tuition was $2,475.

Of course tuition is high – it’s being subsidized by the Federal government.

And society allowing (encouraging) 18-21 year-olds to make financial decisions about borrowing 1.5T without adult supervision is irresponsible. Kids that young have no realistic concept of the consequences of that much debt.

No, the real problem is the kids are going into it WITH adult supervision. The adults are telling them all about what worked 40 years earlier. Going into electronics in 1945 was a great idea. In 1985 it was a huge loser. My lifetime earnings could not be worse if I’d decided to be a professional heroin addict. From the very start, the guys working in the warehouse made more than I do. I know dishwashers and felons making more than an electronics tech does.

At the time I was entering college, in my early 20s because I had to actually work and support myself from age 18 on, if I weren’t worried about making a living I’d have gone for a degree in music. That’s what I was interested in. And it would have been a far better choice. First, no matter what your instrument is, you learn plenty of piano. That means you can always play piano in lounges and whorehouses etc. And whatever instrument you choose, once you’ve got your 4-year degree it’s a hop skip and a jump to get a teaching certificate. You can play music in lounges, clubs, the aforementioned whorehouses, illegal gambling dens, on the street and at parties held by the rich (extra points if you can steal anything cool from them).

Nope I say let those kids study any cockamamie thing they want because it’s likely to end up a better choice than the adults can make for them.

Javert,

Remember though that a student will be hard pressed to actually find a loan provider that will distribute a student loan *without* an “adult” co-signer on said loan.

I am sure there are more parents, uncles, aunts, and grandparents than one would expect that have been caught off guard when they find that their credit score has been lowered and loan collectors are pounding on their door because little Johnny or Sally has defaulted on their six-fugure student loan.

Germany offers free university tuition, even for foreigners, and offers some courses in English. And you get the life-experience of living in Europe. I know a few American students going that route.

If one of your parents or grandparents etc. was a victim of Nazi persecution and fled Germany during the Third Reich, you are entitled to reclaim German citizenship for yourself and the rest of your immediate family after completing a lot of paperwork. In these uncertain times, there may well be an advantage to having a backup citizenship in another country.

I wish I’d had the sense to get the hell out of the US when I was in my 20s. In my 50s now, and I’d almost take my chances now, going to the EU and trying to become an EU citizen. I’d have to live on the street and ply the old “I’m stranded here and need money to go home/replace my passport/for a hotel room/etc.” scam on unsuspecting American tourists, but I’ve heard it can pay well.

But you won’t find a lot of B-school on offer. To oversimplify, they think it’s a crock.

And that has worked out far better for them than for us Yanks.

MIT is much better endowed now. Parents are not asked to pay more than 10% of gross. It’s not publicized. If you get in, they will make sure you can go. Room and board was 15K for my daughter, our only expense, and a friend’s son did not have to pay a thing at all, based on a lower middle class income. NYU, on the other hand, costs 68K a semester now, and is much less generous.

If your daughter is thinking about MIT – apply. Their admissions are need-blind.

For us in the 99%, well … today I did quite a bit of looking around at jr. colleges etc in my area, places like ROP (Regional Occupational Center) and CET, and the long and short of it is, say I want to learn to be an HVAC tech. It’ll only cost me $18,000 dollars for the 7-month program, and that’s if I get financial aid.

What the hell happened to working-class occupational programs the working-class could afford?

alex: there are paying internships and apprenticeships in HVAC available. Here are the requirements:

Responsibilities for the Intern:

Demonstrate the core values every single day: Service, Teamwork, and Development

Arrive on time and well-groomed

Work alongside technicians from all levels – just starting to senior tech of 25 years+

Learn the in’s and out’s of the warehouse including parts and equipment

Participate actively in all trainings and morning meetings

Qualifications for this position:

Must be mechanically inclined

Must have passion for exceptional service

Must enjoy serving and helping others

Must have pride in workmanship

Must pass drug test, background check, and have a clean driving record

Must have excellent communication skills

Must be team oriented as well as work independently

I dare say that the folks who can’t muster the requirements to get trained for free will go get a student loan. Then they will not be hirable because the same requirements will be asked of them.

“Food for thought, so to speak.” That is so bad, it’s good.

I just saw a tv ad for a national furniture outfit for no interest for 72 months. Now, if you add a 96 month car note for a $60 000 vehicle and throw in a couple of student loans………that isn’t even the end of it and I can’t imagine how people deal with living that way.

I get a lot of good information here, but I still have trouble wrapping my head around what folks will take on these days.

Once you have had a bailiff knocking on the door, you take on no debt at all.

Until then, it seems like living the dream…….

This info may not surprise WS readers, but the 72 month 0% interest got me curious and figured I’d share what I came up with. I’m not finance guy so welcome corrections.

So a $5000 purchase would have about a $70/mo payment for 72 months. I’m assuming these deals are actually 25% loans that, upon a late/missed payment, go into effect retroactively to day 1. Therefore if the 36th payment was late, $2500 would have been repaid thus far, but the $70/mo applied retroactively to a 25% loan would not cover the monthly interest, therefore the principal would not be reduced at all. And the interest shortfall is added to the principal bringing the new balance going forward to over $6800. At 25% that’s over $140/mo in interest only.

And the longer timely payments are made, the worse it gets. If the 72nd payment is late, $5000 had been repaid and new balance is $10,690. That’s $223/mo interest only.

How many people can make 72 payments on time? Now consider the incentive for the finance company to misplace a payment. Truly frightening.

MB732

Pithy analysis. Good job.

@MB732 – Thanks from me too! I was wondering how this 0% advertising worked behind the curtain. Quite the lovely scam. One wonders about the magnitude of sales incentives from the Finance Scammers – err companies. Could it be that sales people make more money “financing” these purchases than they do on commission selling the product purchased. (?)

Night-Train: These days nobody actually sits down with a calculator and pen and paper. No one seems to understand the difference between amortized, simple or compound interest and how it affects their future. No one reads the fine print on those “special no interest” 72 month furniture specials (Late on a payment and you then owe all back interest of X percent). I rarely run into anyone who is financially educated, has a real budget or even knows how much they are spending.

There was a TV show a couple of years ago called Life or Debt. Families who were drowning in debt got a financial expert out to come out for several days and give them a wake up call on how to track, budget, downsize and get out of debt. He would then come back 90 days later to see how they were doing. The follow up visit was so cringe worthy as some of the families could not follow through even a little bit and had racked up even more debt. Some had totally turned it around and were on track to get out of debt prison. I wish that show was still on….but I’m sure it got cancelled because it didn’t fit the consumer economy narrative.

Can I get an AMEN?

Here’s your AMEN…

https://www.youtube.com/results?search_query=life+or+debt+season+1

Looks like you might have to pay to see it, or depending on what services you’re subscribed to, it might be free.

Actually, there are quite a few consumers that do the analysis before committing to the purchase/financing – probably about 20%.

The rest are exposed to the “fool and his money are soon parted” rule.

BTW, I have yet to bump into a Millenial who (admits to having ) lost money on cryptos. When I was a brokerage firm CFO, I hardly ever met a day-trader that admitted losing money (brokerage records showed about 80% did).

That is amen worthy.

I remember that show. I guess it was only watched by people who understood debt slavery.

Wolf

What is the status of Federal Action/Pursuit if a US citicen. Completes a degree, leave’s the US. With a huge unpaid Student loan and other unpaid debt.

Takes foreign Nationality, Frequently in Marriage, where they can also take another name (both genders can do this) then Forswears US citizenship.

Student loans cannot be discharged in bankruptcy. Only the government can forgive them. So for most people, there is no escape. But if you receive no income in the US and have no assets in the US and don’t live in the US, there is nothing the US government or anyone else can do to collect. So if you live overseas (you don’t even have to renounce your citizenship), have no income and no assets in the US, and don’t expect to ever have any in the US, and if you expect to die overseas, I suspect you would be able to escape those student loans.

This is my understanding. If there is a reader who has contrary info, please inform us.

This is correct Wolf…you can technically escape the loans if you leave and never plan to come back to the US…and many people are beginning to do this since they realize the only other way out is death (and in some cases permanent disability)

There are countries that want people. If you’re Jewish, Israel wants you. Ireland wants people. Lithuania, Serbia, all sorts of places would welcome a US’ian with a US degree who’s willing to learn the local language and culture and become a citizen.

So far, there’s no US secret police coming after you. I believe if you make over $50k overseas and are still a US citizen, you’ll have to pay US income tax as well as whatever taxes you pay in your new country. Which is why settling down and renouncing your US citizenship is the way to go.

According to this 2012 journal article, 40% who tried received partial or total forgiveness.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1894445

I also read (don’t recall the source) that in one’s second bankruptcy they can be discharged readily.

So indirectly control, a trust in another country, that controls a corporate in a third country, and put all your activities through that.

Similar to many of the ultra rich (with the brains to stay out of the public limelight) who personally earn very little in the US or anywhere else.

As I still oversee a lot of Pleasure craft maintenance contract work. I see lot of those type of people. Most of them look like they dont have a 1$ to their name.

If the US was Pursuing or even considering Pursuing. Student Debt, on Non Doms, the way it does taxes. I think we (at least you) might have heard.

Social security checks can be garnished up to 15%. The number of garnished SS checks due to student loan default has shot up 540% in recent years.

I certainly hope you aren’t a product of the US higher education system with that appalling level of English. If you are – what an indictment.

Reads like it’s written by an eight year old.

MD, don’t assume the worse. Could have been typed on a smart phone.

Lets not turn WS into Reddit. Have a little respect for the outlet.

I’ll place my Amen here

Amen

:)

https://www.zerohedge.com/news/2018-02-03/student-loan-crisis-worsens-looming-defaults-strain-govt-bailout-program

I’m an avid reader of your blog Wolf. Thanks for your insightful analyses. It seems to be the only place we can get a realistic view of the economic landscape these days, frightening as it may be!

Free Beer. You end up on your knees hugging porcelain and vomiting up your ring. Not much to add really….except , …..no one believed it when the USSR collapsed over night !

Well the Beatles did sing Back in the US, back in the US, back in the USSR.

Debt has been growing faster than nominal GDP for a long time. It will change direction sooner or later (tip: sooner). Since it is the fast money growth (liquidity) that has mainly driven asset prices (and benefited economic growth as well) it is pretty obvious what will happen once this happens …

Maybe it’s time to discuss some sort of debt jubilee or forgiveness. Personally I’d start with the estimated $3-4 trillion given to banks and other financial institutions in 2008-9. Half of that amount would go to student loan holders the rest to homeowners with mortgages. Personally I believe that would really jumpstart the economy.

Sooner or later that is what will happen…

Yeah great Give the people who borrowed money they could never pay back afreebie Meanwhile I broke my you know what to put my son through 4 years at Georgetown like a fool Talk about moral hazard

Not a fan of how it was handled, but TARP was actually repaid. Student loans forgiveness, i.e. i paid for my kids to go to college as well as paying for the kids of others to go, is too big of a political weapon to get settled any time soon. Sortof like a DACA for those in student debt.

TARP was repaid ? Ahhh … not really . Some of it was .. but much of it was swept under the table or buried in accounting magic leaving the tax payers once again holding the bag .

I think banks that should have been allowed to fail and was no fan of TARP. In fact, many banks were actually forced to take TARP. They repaid as quickly as they were allowed to. Of course, a few bank’s still went under, but TARP was repaid at a very high %, so curious what is your basis for claiming TARP was not repaid?

I don’t believe the car company TARP loans were fully repaid (could be wrong).

BTilles,

Yeah, but who’s going to pay for the debt forgiveness? Remember these student loans are assets for the other side. $1 trillion in loan forgiveness = $1 trillion in losses for the other side. Taxpayers expect them to be collected.

I think it’s better to add claw-back provisions: if a student defaults, the government can go after the university where the student paid tuition and after the landlords where the student paid for housing and after Apple whose products the student bought with student loan money. These are the beneficiaries of this. They should carry the risk. Otherwise it would be a straight wealth transfer from taxpayer to corporation. I don’t like those.

Claw-back provisions; This would bankrupt all the institutions of higher learning as well as the business communities that have grown around them. Seems like a fix that is worse than the problem.

And BTW The taxpayers have not been footing the bill and would all go bankrupt the minute they would be called on to do so. So we just go back to authorizing the fed to give us a higher credit limit.

Hi Wolf,

Of course you’re right but two thoughts.

1. Who pays? The same folks who “paid” to bail out the banking system in 2008-9. Massive mortgage frauds were perpetrated. We can think of this as mere retoactive reparations.

2. I’m getting on my very small soap box here, but I think at its core, the jubilee year was about hope and freedom. Slaves were freed, hereditary property rights were restored (Leviticus 25:10). Today, it is not too much to say many are debt slaves. About a decade ago the financial system got bailed out and another blatant corporate giveaway occured with the tax bill. My suggestion is that there is another group (debtors) also in heed of similar largesse.

3. As to practicality, again you’re right. The same objection comes up. Back in the day, conservative rabbis sensitive to concerns of business came to an interesting but not surprising conclusion. Reading Leviticus more closely it seems that the Jubilee Year could only be celebrated once the tribes of Reuven, Gad and Menassheh lived in the land of Israel according to their tribes. Since they had decamped (allegedly for beachfront property along the newly developed Euphrates) around the yr 600bc, regrettably the Jubilee Year could not be “celebrated”.

Jubilist or conservative Talmudist?

“… Otherwise it would be a straight wealth transfer from taxpayer to corporation.”

Um, hasn’t that been the way our whole ‘system’ has worked for quite some time (witness WalMart, for-profit ‘colleges,’ public/private projects, etc.)?

Um, well, um…

And the book publishers who rape students with exaggerated costs……..on and on and on. The higher education system just like medical industry, just like insurance, just like finance, is a complete and utter racket nowadays. Criminals are put in jail for the same rackets that colleges and universities run.

That one is easy: the Fed! Just like they did for the ultra rich Wall Street un-prosecuted criminals. Do you think WE deserve less then those corrupt pampered and protected fraudsters?

But on a more seriously note…this is how it could be done:

The Fed should consider buying student loans, then announce a permanent suspension of payments until further notice, thereby effectively dissolving the debt and injecting some REAL QE into the economy. This way, it will go to people who can use the help and will spend the money they get – not invest it Bitcoin or stocks or a 3rd or 4th or 5th house/mansion – instead of the ultra rich, banks, rich gigantic corporations who benefit for conventional QE.

Thats a nice idea .. and on the surface one that appears to have a fair amount of credibility .

Unfortunately though … as history has show time and time again Debt Forgiveness 99% of the time leads to more incurred debt by the one receiving the debt forgiveness once they’ve realized they gotten away with something and maybe they can do it again with little or no consequences

Thus has it always been whether forgiving the debts of countries , states , entities , corporations , manufactures , banks , individuals etc – et al – ad nauseam

And what do you give those who managed their finances responsibly, free ticket to paradise? Personally, I think even the bankruptcy process is lenient. I don’t have to look for examples: the current economic malaise is enough, which is nothing but spreading the consequences of irresponsible behavior to the whole society. No, the bankers didn’t do it alone.

Those who managed their finances responsibly get to pay higher Medicare premiums in their old age. Premium surcharges were first implemented in 2007 and the income levels where they kick in at higher and higher levels have not been adjusted for inflation. In 2015, the Doc fix resulted in higher premium surcharges taking effect starting in 2018 for many higher income Medicare beneficiaries. If I live long enough, my guess is that Medicare (Parts B and D) and my HMO supplement will entirely wipe out my Social Security benefits.

I am glad I was able to take early retirement, Social Security at age 62 and start to draw down my 401k plan at age 60.

BTilles

How did you get to $3-4T given to banks in 2008-9? TARP was only about $800B (not T)

Hi Javert Chip,

The Fed’s LSAP (large scale asset purchases) which we colloquially refer to as QE (and there were three) in addition to the Treasury-funded TARP expanded the Fed’s balance sheet by approx. $3 trillion.

PS Wolf has been on this like white on rice.

BTilles

Your quote was: “…I’d start with the estimated $3-4 trillion given to banks and other financial institutions in 2008-9…”.

Agreed Fed balance sheet went up $3.somethngT; don’t agree it went to banks directly, other than eventually (excluding mattresses) flowing (sometimes unprofitably) thru banks.

The only Debt Jubilee you will, see is through the bankruptcy courts, Fines and student loans are not discharged through bankruptcy.

Why should the responsible be punished, so the irresponsible can gain for nothing, and continue to gain.

Let’s bring back the debtor’s prison or a penal colony for debtors, or bring back indenture servitude.

Set up a system where the debtor’s can remain free if they have a job and have the debt directly deduct from their paychecks or if they can make regular payments.

If they do not have jobs or not willing to find jobs, or if they missed a payment or two, then open a debtors’ labor camp/factory and have them work there until the debt is paid off. And the lenders should pay for the building and maintenance of these camps, room and board for each of the debtor.

That way lenders would consider their lending practice more carefully.

And people would think twice about borrowing if that is the case.

Did you forget to add the /sarc tag?

Actually, in ancient Greece if you couldn’t pay your debts, you could be sold to slavery. I guess, there were far fewer debt slaves. Did the term originate there?

So the vast majority of the debt increase is simply student loans. That is a big trough. Delinquency and write-off #s are also staggering and much worse since the Govt took over student lending. It is a big ball and chain that has been attached to a large number of people, but it will be the taxpayers who get burned.

Correct. What can’t be repaid won’t be repaid. It’s always been important to me to stay out of debt but maybe a lot of young people today with nothing to lose are loading up on debt knowing they’re not going to be able to repay it. Ethics aside it might wind up being a good financial strategy for them.

Actually is very hsrd to get rid of students loans without paying. The debt is still there until it gets paid. Is way easier to defult on a car, stop paying the car gets repo.

My neighbor had his outstanding student loan balance forgiven after 25 years, but his partial disability may have had something to do with it.

Yeah, there are established programs for student loan forgiveness. For example, there’s the Public Service Loan Forgiveness (PSLF) program, which essentially wipes away 100% of (federal) student loan debt after 120 qualified payments.

There’s a bunch of qualifiers, though (hence qualified payments)– must work for the government or a non-profit, must work full-time, payments must be made in full within payment date, etc.

The only difference between $1 and a trillion is a string of black swan eggs and everyone is waiting for the first to hatch.

And we could have ovens and fake showers….

Sorry my comment was supposed to go under the debt slave camp post

Consider this. CPI increased 17.5% since 2008. We all know (don’t we) that CPI is underreported. I would submit that at least a sizable portion of the difference between the 45% increase in consumer debt and the 17.5 CPI increase IS ALSO INFLATION related. Of course some component would be population related since these numbers are not on a per capita basis. Same theory for auto loans. We know cars are much more expensive than 2008.

The massive increases in college loans indicates the huge inflation still occuring in that arena but probably also tied to increased student numbers over that period.

All this said, it paints an unsustainable picture unless you understand that this is the ONLY way the US economy can stay out of depression. And, once debt repayment becomes a major problem, I predict the Fed will intervene again with another round of QE to essentially wipe the slate clean with printed money.

In terms of enrollment: undergraduate enrollment decreased by 6% between 2010 and 2015 (report released in May 2017).

https://nces.ed.gov/programs/coe/indicator_cha.asp

Thanks for that clarification Wolf. So the debt increase is ALL inflation for a college education and then some.

here’s the chart:

Interesting, student enrollment down but loans are up. Must reflect tuition price increases . good call

Major and substantial increases in tuition across the board is closer to the mark . With tuition about to go up even further due to many of the provisions within the ‘ so called ‘ tax reform directly impacting institutes of higher learning from Junior Colleges to Ivy League graduate programs and all places in between .

So plan on student debt to increase substantially over the next five years

Has anyone tracked the reason student loan debt is up? Is it just higher tuitions going to cover salaries and pension liabilities? Or fewer grants and scholarships available?

Surging tuition, surging housing costs, surging smartphone costs, surging textbook costs…. it adds up :-]

Yes, tuition is moving up much faster than CPI. And the product appears to be getting worse. If you run a college and you don’t raise tuition, etc. and get your school’s share of the easy $, you will soon lose your job.

The whole system is a very civilized and intellectual version of looting. And yes, wiping the slate clean with printed money, as you mention, would be much more politically palatable that having taxpayers (or non-taxpayers) face reality.

Not just tuition which has quintupled from 1990 to 2016. Living and other expenses have tripled since then. Wages and scholarships, in real terms, meanwhile, have fallen.

http://time.com/money/4543839/college-costs-record-2016/

That’s why I choose to adopt pets instead of having kids.

Good points, Wolf, about the whole student loan scam.

Well, on the one hand, academics have always been rentiers: in medieval Europe they lived off the income from land granted to them by noble and royal patrons.

However, those were real assets producing an annual rent which could be depended on.

But , on the other, building on the extension of credit to those who are by definition not credit worthy – students? A whole different game.

It works though: I know of a partner in a London/US hedge fund who, when things collapsed in 2008, took his winnings and speculated in the student real estate market in Ireland. In a short time he made £10m.

Currently he is drinking himself to death (too much leisure, too much gin and tonic, in his rural mansion: the widow may do well!

Prediction: Within the next 5 years, the U.S. Federal Reserve will begin buying student loans in large quantities (greater than $100 billion).

Also the Federal Reserve will be buying all the car and fracking loans.

If I was praying person I would pray that you be wrong forever.

I am going to stridently disagree with the above posters regarding a Debt Jubilee. A large part of becoming an adult is learning from mistakes and accepting that along with rights there are responsibilities. If “you can’t do the time, then don’t do the crime”. So, if you are going to forgive student debt, then let’s take away the certification/degree that was paid for by the folks who will be left holding the bag and paying for other’s debts. Why should people have it both ways?

My kids are in their thirties. My daughter went to university and now has a good solid job working as a school district music teacher. She worked all through University, Dad (me) paid for 1/3 of her costs, and she took out some additional loans. I warned her about the loans, but she replied, “everybody takes out student loans, Dad”. (Old stupid Dad, gee….. :-) Now, she is still paying them off at age 39. She curses them, but she is paying them along with her mortgage, etc.

My son took a different path. He lived at home while doing an electrical pre-apprenticeship course at a nearby community college. I paid for the pre-app course as it was a fraction of his sister’s financial needs for university. He worked as a cook, nights….,to pay for his car (cheapo Tercel). He is now 34, and earns $120,000+ year working away in shifts. He has no student loans, or debt beyond a mortgage.

Debt is obviously a nightmare. So is having a poor lifestyle, alcoholism, drug abuse, risk taking injuries, other diseases. And many things in life, like my wife contracting type 1 diabetes at age 13 and my getting cancer at 55 are unavoidable bad luck. Not much we could do about it except try to work at getting better. But being in debt is different in many many cases. People need to take responsibility for their decisions and life choices. If the debts are un-payable, then bankruptcy is an option for some of the debts. I understand folks cannot declare bankruptcy for student loans and there is a reason for that because everyone might do it. But a debt jubilee for student loans is like letting someone keep the truck they cannot afford but promised to pay for, or the house, boat, rv, whatever. People, like me and others on this forum, should not have to cover other people’s debts that arose from making poor decisons. Forgive student loans? Fine, but repossess the degree.

When this implodes, and I believe it will, then maybe some object lessons will be learned. Living within your means is a basic life skill that should be taught at home, along with good eating habits and personal hygeine. I’ve been to university and have a couple of degrees that I saved and paid for along the way. It was my experience that about 1/3 of my fellow students had no business being there. University is not the place to find oneself or figure out what you want to do in life. The best place to do that is on the business end of a shovel figuring out what you don’t want to do.

I feel like we’ve been living on one of those Virginia Slims cigarrette commercials from the ’70s. “You can have it all, Baby”.

regards

Paulo, you’re right on target with everything, especially with the advice about community college for the first two years.

“… right on target with everything, especially with the advice about community college for the first two years”

One of the great unsung heroes of American prosperity and, sadly, like other great institutions we’re letting them die.

Disclosure: I started a 35-year career in technology at a local CC, where my father was a teacher, career counselor and administrator.

But it wasn’t community college for the “first two years” it was some pre-courses (probably stuff like basic math) to enter an apprenticeship to become an electrician. Community colleges typically offer vo-tech stuff as well as the first two semesters of college.

And notice, Paulo’s son is doing well, while his daughter is still struggling at age 39. College is a curse!

Paulo.

I understand your position (what you are is what you were when). But today, really the whole system is involved with sucking people into debt they can’t afford. Take college. It’s a known fact that college has been “dumbed down” to accept just about anyone. And once accepted get through to a degree (usually worthless). Why would an higher education institution do such a thing? In our day, there were some pretty reasonable requirements to get into college and stay. Of course too, there were more opportunities for non-college grads.

Take housing. The whole system has been changed and financialized to promote housing and housing gains. Young people feel like they’re being left behind if they don’t buy a house (expensive as it is). Who’s to blame for this?

So while I support and understand your attitude (values), I also see a completely different side to this for many of our citizens that essentially encourages, goads, promotes them into more debt than they should take on.

And one more thing. It’s not exactly like we (the adults) are setting any kind of sterling example with regards to frugality and living within our means (aka the US debt debacle). Something to think about.

Mike Ra. .. at the risk of incurring Wolf’s wrath for one too many comments on a single article … the simple reality is … those ‘ sucked ‘ as you say into debt are not victims of someone else’s actions . What they are in reality are victims of their own .. dare I say it ignorance and/or stupidity , arrogance and sense of entitlement .

Suffice it to say no one is forcing them into the decisions they are making and there are plenty of damn good options available to avoid those bad decisions ..

( such as attending a local state college/university or community college and living at home .. going into the trades where there is a desperate shortage of workers rather than the current ‘ flavor of the month ‘ career … holding off buying a home till one’s finances justify such a massive purchase … buying a basic good solid reliable used car rather than the new or hippest thing available .. curbing ones spending buying just enough instead of more than you’ll ever need etc )

.. so in the end the majority of them ( unless some catastrophic even precipitated incurring the debt ) have only themselves to blame .

But I do absolutely agree with your last statement . Many of us ( the adults in the room ) are partially to blame by our bad example

But then again as witnessed by a couple of previous comments by others … setting a good example is no guarantee that anyone will follow it .. so once again the ultimate blame falls on the one making the bad decisions … not everyone else

Thanks for your response. All that I am suggesting is that it is not as black and white as we’d like it to be. Healthy societies have elders that encourage/expect healthy values. We use to have that. Bankers wouldn’t have done this sort of nonsense in the 50’s. Same with Universities. We have none of that now. It’s if the whole country is sick.

Amen. The US of A is spending money willy nilly and going into debt. ” Why shouldn’t I do the same? ” is not unexpected attitude from that.

I too agree with the values point, but something is very wrong and needs to righted somehow.

My husband briefly worked as a university professor. He was instructed to give everyone passing grades. He was asked to give a couple of rich brats from overseas who didn’t know basic English and paid others to write their assignments good grades. This was a reputable institution.

He quit and joined the corporate world.

The standard of education in America is circling the drain. Many college students are semi-literate. They have degrees that don’t mean much and a lot of debt.

Compare that to graduates from Germany, Japan, or China. It foretells the future.

My child (3rd grade) almost won a spelling bee contest (3 -5th grade) in one of the best public schools in California. He prepared may be for one and a half day. I thought it was not enough to do well.

I was surprised he almost won. But then I started thinking how good the competition was, and the more I see education system in the US, the more I want to get the f… out of the “best” public schools districts. I want my kids to be globally competitive, not “bubble” protected with inflated egos. Such a shame ….

Using debt for consumption is like addiction for drug use, gambling, sex. All the vice …

Yeah, you do get hurt eventually but you have the fun too. Do the crime, and think about the time later.

Crime is fun, I may or may NOT do the time and maybe somebody else will do the time for me as long as I can drag everybody down with me.

Like day and night, human nature has both bright and dark side. Vice makes a lot of money for the mafias, debts make a lot of money for the politicians and corporations.

Get out of debt is like get out of vice, needs to go to rehab and may not work.

The best way is to NOT get into it at the first place.

Principle, you only consume what you have saved.

When I tell my son to be prudent in financial matters, he says “Where did that get you.” And he has a point I cannot refute. After seeing that doing the right things got us nowhere, he just doesn’t feel invested in the system. He has a lot of company out here.

“Where did it get you?” is the current headache for all of us. Holding on to our hard earned money, watching expenses climb while the government lies to our face saying inflation is only 2.*% every year. Meanwhile speculators and wall street gamblers keep making record profits.

We are all tired of playing fair only to get crushed.

Doing everything right doesn’t always work out, unfortunately. It’s the simple truth that luck plays a huge role in life. Where you were born, when you were born, who you were born to… these three things alone probably determine a huge percentage of your lot in life. Oh, you’re a moron but were born to a NYC real estate magnate? You can become President some day. You’re brilliant but were born in crack-infested and gang-riddled projects? You’ll probably end up dead or in jail by age 20. And that’s a depressing realization: the world isn’t even close to fair.

That being said, being prudent skews the odds in your favor. It doesn’t guarantee things will work out, and being irresponsible doesn’t guarantee things won’t work out, but that’s the way the world works. You do what you can.

If being prudent doesn’t work for your son… why not just establish some level of decent credit, and then absolutely max out every credit card and personal loan he can, bury it in cash, and declare bankruptcy? It’s like being Robin Hood, except to yourself.

“When I tell my son to be prudent in financial matters, he says “Where did that get you.”

–woman, that is FUNNY. where did that get his mother? a fearless outspoken woman who is about as free as one can BE in this society, she loves her family madly, cares about The Poor, and wears rhinestone flip flops and doesn’t need crap.

they don’t even make women like you anymore. what else IS THERE?

wait til he steps out a little more, Miss Petunia.

The game rules change all the time, so “doing the right thing” may NOT get anybody anywhere. Who says “it is the right thing?” Parents? Society? School? Your competitor? People tries to manipulate and exploit you?

We all have to figure out how the game rule has changed and figure out correct responses.

Currently, the game rule is

Reward debt consumption now and punish them later.

Punish saving always.

Reward capital and punish labor.

Reward wealth transfer and punish wealth creation.

With these rules, it basically forces everybody to play “getting out of saving and become debt slaves”, “getting out of labor and play in capital markets”.

Here is the thing that Buffet says it well. NOT all people are good at playing markets (pokers, casinos), but the game is forcing everybody to play.

so what is the “right thing to do?” given these rules?

1. become good at playing capital markets and spent less time doing labor. But all gambling says all wealth goes into top 10% and leave the mass penniless.

2. Save as much as you can and wait for a decade or two until the market reset/clean itself with most player dead and then you switch from labor into capital holder.

Still, debt consumption is simply cocain. “Doing right things does NOT get you anywhere” is NOT a reason to taken on debt and spend.

I tried doing everything right in the markets: learned the rules, read the books, followed the gurus, exercised prudent money management, don’t drink, don’t smoke, don’t take drugs, eat healthily, get enough sleep, married to a wonderful woman, no kids to worry about… yet I lost everything and now we live in brutally straitened circumstances.

“followed the gurus”

That was probably your undoing.

Petunia

You’ve been pretty open about your financial past, and appear to be recovering (here’s hoping that continues).

What you have that your son may not, is control of your own destiny. School and life are very different; in life, first you get the test, then you get the lesson.

YESSSSSS!!!!!!! It is crazy to me that this is not the conversation everyone should be having…all this crazy debt and bubbles. One word. ACCOUNTABILITY. As a gen X er I have had an interesting view of this complete unravel. Growing up, I was raised with the classic … “American Dream”… go to college, get a great job,marry, buy a house…you know the drill. When time for college came I was super engrossed in my job as a florist I loved what I was doing and while taking classes at the community college, dreamed of owning my own shop. But engrained in their keep up with the Jones mentality, my parents would have none of it. I was sent off to University with their blessing to take out loans to get it paid….” that is how it is done,” I was told….fast forward to today. In my mid 40’s I was lucky enough to have enough of a rebellious streak not to get caught in the trap. Sometime around 2008… when my perfect little American Dream experienced a slight upset… my husband and I were forced to change everything. So in our mid 30’s with a one year old a three year old in tow, we chose not to look for new corporate sales jobs but to bet on ourselves. We started our own business. We used our 401k,s, what was left of them. Credit Cards ($82,765 total outstanding at one point and I know this number because we paid back every penny). Unemployment benefits, severance. We went ALL IN … and went in with the attitude we are not doing this to get rich, but to create a lifestyle. To be a part of our children’s lives, to work hard, but rest nicely, take care of our team. At one point we got some money from my husband’s parents, which helped us as our business grew. But that wasn’t our only blessing. We also had several challenges, Duh. Right? Because raising two babies and starting your business is hard. F**ing HARD. While we were in the early stages we got to watch our friends claim bankruptcy in 2008/09… only in 2015 ish start buying big ol trucks and houses again on credit. Aside from creating an emergency fund for our growing family and paying our mortgage, whatever profit we made went into paying back our debt….our business had grown to a multi million dollar revenue by now and aside from the benefits we got from it being our own…we were still not out of the woods. We reinvested in our company, we paid our debt. In 2010, we got health benefits for our small team. We pay 100 percent of the deductible. To this day that is our teams most treasured benefit. But I digress. My long story short point is this. We need to do hard things. We have to miss the party sometimes. We have to honor our obligations. We have to raise our children. I guess one would say…there is no get rich quick….but the question and the message needs to be…Why should it? All the goodness comes from the struggle. All the riches come from NOT chasing riches. Our business is going to break 10 million this year. We have 25 amazing team members. Our team, every. Single. One. Has health insurance, 401k option. Time with their families. Our kids are 13 and 10 now…and I feel so grateful I am home more to hang out with them after school. We aren’t rich by Wall Street standards, but we feel amazing. We can look at ourselves in the mirror and know. We are doing this right. It is hard sometimes to grow slow and steady as we get excited about the future. It is hard still that we have to worry about the sh*tshow around us…. But we would still choose ACCOUNTABLE AND HARD ANY DAY !!!!!!!!!

Kimm-

it’s folks like you who will seed the future. that’s a really cool story. i smiled and read it twice.

Good points, Paulo. As a dad of three grownup kids, with an Atlantic ocean between you and me, I feel we think surprisingly alike. Great minds, perhaps? :-). Personal actions have indeed personal consequences. Taking responsibility is key.

But from where I stand, there are some aspects about the American way that never cease to amaze me. I know most Americans will balk at me for what I’m going to say now, but in my view there are three societal services that government should always subsidize: Healthcare (because nobody should die prematurely for lack of income), the legal system (because justice should be delivered impartially to all) and yes, education, be it professional or academic (because poor brilliant students should not go undetected, whereas rich clueless kids should not be admitted).

And here in Belgium – a somewhat failed state in so many other ways – we have an excellent health care system for which I gladly pay taxes. The same goes for education: expensive perhaps for the Belgian state, ergo for me as a taxpayer, but we always perform very well on literacy, mathematical skills and other aptitudes on all school levels in comparison to most other countries. Also, I never fail to repeat to my kids that the community is financing the better part of their education and that they should be extremely thankful for that. But IMO this is a matter of sound investment in our national future.

Admittedly, our legal system is the only thing that’s still kind of a work in progress.

I know all this makes me somewhat of a communist in the eyes of most of you guys, but I’m here to testify that this system works and well at that, with good results here in Flanders.

I like to make some remark regarding government ran healthcare. My home country Taiwan has run a nationalized health care for many years now. Taiwan is a very productive country economically and the government used to have large surplus year after year.

After the national health care kicks it, it became bankrupt within a few years. The system cannot beat human nature, human nature that likes to take advantage of anything that is “free”. So the health care system is still running and people in Taiwan loves it. The government still have surplus to pay for it for now. But guess who doesn’t like it? Doctors and hospitals and medical professionals do not like it at all. They over work and get under paid. Physician has become a very unpopular career choice in Taiwan now. So maybe it worked well for you in Belgium, but it won’t work so well for Taiwan in another 20 to 30 years, if the current trend does not change.

Yes, I agree with you that no one should died just because they are poor. However, I disagree with you that it is the government’s duty to take care the poor and the sick. I believe it is the community’s duty to do so. Churches, local organizations, families, friends, relatives, etc. These local non government organizations can be more efficient in helping the needy and also they can hold the needy accountable for receiving the help. I have seen and experienced how this kind of charity can work locally and I do believe it has to be done if the US is to get out of the debt from all the welfare obligations.

In thirty years, we’ll have high tech medical robots. Big changes coming.

amerikkka is a very mean country. always has been.

“…there should be some kind of debtor’s camp/factory setup that they would be able to work and live there, with room and board paid for by the lender, until they pay off their debt.”

In the days when the U.S. was an agricultural economy, we had such institutions. They were called “poor farms”, where debtors could live, help raise crops and pay off their debt.

The “social justice” warriors of that time killed them off.

Kitten, there are kindly folks among us – you and me, for example.

(Welcome back Kitten – haven’t seen you for awhile …)

thanks for the hello, RD.

that felt like being handed a daisy. no lie.

thank you.

x

I work for a large steel mill. The only one in my state and we start out at $18/hr with full health benefits and a nice 401k match. We can’t find enough good people. After a few weeks new hires can big into positions and get a huge bump upwards of $25/hr. We are a union mill. I don’t care what people say about unions anymore in America…….they protect jobs PERIOD! Politics aside unions have their problems but they are the backbone of the middle class and a godsend for young people who aren’t cut out for college and “institutional” learning. We have a lot of young guys that can move into electrical, HVAC, machining apprenticeships.

Steel making is a dirty, hazardous, extremely energy intense process. We fight tooth and nail my states’ draconian environmental laws, OSHA laws and regulations, and worst of all an energy company that keeps raising prices to some of the highest in the nation. America is circling the drain for a plethora of reasons………illegals, gutted manufacturing, government largess and bureaucracy etc. But it’s our social fabric and cohesiveness that is being dismantled and destroyed. We are a divided country and we can’t even take care of our posterity and progeny because we are out trying to save the world and enriching companies and government troughs…..I consider myself a conservative but even the amount of money we spend on defense is mind boggling considering our domestic problems we have here at home.

” I don’t care what people say about unions anymore in America…….they protect jobs PERIOD!”

Nick,

Back when I was 20, and knew everything, I thought Unions were destroying the country…Now, at 71 years of age, and knowing much less, I have changed my perspective….

Paulo, your shovel recommendation reminds me of a college friend: he joined the Parachute Regt. in England, at 18 (‘pure violence’); moved to the Royal Marines (‘intelligent violence’ ) ; and then decided to become a physician.

It took him those moves to realise that he wanted to use his head not just his muscle -he was a superb athlete back then.

I recall his Scots father always used to say to him:’ Tell me what you can do’. We lost touch, but his career has been remarkable, and he can certainly do a lot.

The irony and arrogance of your asinine post is astounding!

“My getting cancer at 55 is unavoidable bad luck … People need to take responsibility for their decisions and life choices … People like me should not have to cover other people’s debts that arose from making poor decisions”

Cancer IS avoidable; it isn’t dished out on a “luck” basis; cancer ISN’T all genetics, in fact it’s heavily dependent on lifestyle! You accept no responsibility in it though?? Who paid for your treatment? The rest of the insured pool I imagine!

You have no humility. You learned nothing.

Birdbrain, you have no idea what caused his sickness, how he dealt with it financially, etc …and yet you disparage his comments as if you know. Not a great display of humility on your part there dude, but we all have our bad days.

“you have no idea what caused his sickness, how he dealt with it financially, etc …and yet you disparage his comments as if you know.”

Touche’! — he has no idea of others’ woes. Thus my comment. D’oh!

You proved my point, thank you.

Small children get cancer too. Just sayin’.

patient was 55 years of age at diagnosis.

The statistics of cancers (cancer is many different diseases, actually) are well known. It is a disease of old age- goes like the fourth power of age. However, it is statistical, meaning sometimes children also get it.

Many causes are known and are lifestyle related. However, some, such as some brain cancers and even colon cancers are not understood well enough to know the cause of a large fraction of them. In the case of brain cancers, so much statistical work has been done that it’s hard to believe- they still do not know what causes glioblastoma. I have had two friends die of it, and spent many hours looking into this subject.

Even if your assessment of Paulo´s post has merit — that ¨The irony and arrogance of your asinine post is astounding!¨ — your post is worse than that on many measuring sticks.

I re-read his post twice after reading yours, and of the two your criticism of him applies more to your post than his.

Lifestyle choices can lead to debt and other failures. And to cancer too. But you have no facts to support the conclusion that the cancer was a result of lifestyle choices (s).

I live in a house whose foundation was build in a hole blasted out of granite ledge. If the radon seepage from the granite gives me cancer, is that a lifestyle choice ?

This conclusion you made in your post is not necessarily always correct, or even usually correct:

¨cancer ISN’T all genetics, in fact it’s heavily dependent on lifestyle!¨

Angry and judgmental is my assessment of that statement. Unfairly to Paulo too.

Some of the time cancer is 100% a genetic result, and some of the time it 100% results from a life choice. Most of the time it is an indefinable mix.

To BirdBrain

¨Hereditary breast–ovarian cancer syndromes (HBOC) are cancer syndromes that produce higher than normal levels of breast cancer and ovarian cancer in genetically related families . . . . ¨ from:

https://en.wikipedia.org/wiki/Hereditary_breast%E2%80%93ovarian_cancer_syndrome

So when you have an instance of that cancer in a given family, in some cases, it is 100% genetic and also 100% heredity.

There are many cases of cancer that are 100% lifestyle choice(s) (when they occur) — I suspect we will find much agreement tween us on that.

Giving me responsibility for radon-caused cancer may be fair, but I bet that a lot of today´s cancer is a decade´s late derivative of nuclear atmospheric testing in the 40-s to 50-s and a bit beyond. Who gets blamed for that ? Who among us gets to breath and drink purified air and water too ?

Paulo´s post may have been a bit stern (may have) but I found your response to be just a bit strident. Just a bit.

Still — I can tell you are a good guy, just like I assume of Paulo, too!

Birdy,

My cancer was an outlier and quite mystifying for the oncologists. They have/had no idea what caused it? (You might be one of the few experts on cancer so they might be wrong). I was healthy, in great condition, and lived a responsible lifestyle. (No smoking, not over weight, occasional beer or wine…good food, etc) The cancer treatments were paid by our universal single-payer healthcare system we have here in BC, Canada. I am now 63, and I finished cancer surveillance and follow-up treatments just over 2 years ago. At that time I was declared cancer free. I take no medications and see the doctor just once per year for a yearly physical. In fact, it was during a routine physical that my cancer was detected. (I highly recommend them).

We are also a healthy family who grows much of our food, eats wild salmon for protein, our own eggs, etc. Growing our food and maintaining our gardens and orchards is one passion my wife and I share. Others, I won’t mention:-) (Just kidding).

At my last appointment (2 years ago) I told the doc that contracting cancer was one of the best things that ever happened to me. It created for me a sense of real gratitude and realization that life is fleeting, and that good health is tenuous for any of us. There were many many scary and sleepless nights as those will attest who have found themselves in the same situation. Cancer is a very scary word. I hope it never happens to you or anyone else in your family. If it does, it most likely won’t be your fault and you might remember this post. :-)