Why is Fannie Mae Offering Goldman Sachs et al. Such Fat Margins on Defaulted Mortgages?

By Wildfry, currently in Hong Kong.

Much of the attention on Fannie Mae has been focused on the potential merger with Freddie Mac; the repayments on the Treasury’s $187 billion of senior preferred stock; and the new equity cushion concession to ensure that the accounting loss in 2017, triggered by the new tax law, does not force Fannie Mae to draw on its funding lines with the Treasury Department.

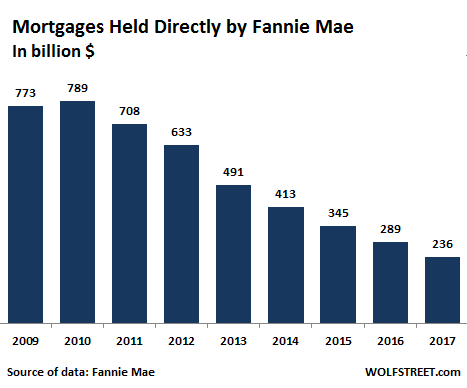

But even as Fannie Mae’s exposure to mortgage backed securities (MBS) has grown to over $3 trillion, it has quietly taken its portfolio of directly held mortgages from $789 billion at the end of 2010 to $236 billion by November 2017 under a mandate from the FHA:

Banks have been focused on offloading their non-performing mortgages (home owner is three months or more past due). Their main driver has been the capital coverage ratios stipulated by Basel III on any portfolio with non-performing assets.

Fannie Mae’s mortgage sales, by contrast, have been a mixed bag of performing and non-performing pools. But a large proportion of the sales have been from its non-performing book. Present at the trough are the usual suspects: Goldman Sachs, Lone Star Funds, and Bayview Asset Management.

Why are these large fund managers lining up to buy non-performing mortgages?

The answer lies in the steep discount to BPO (Broker Price Opinion of the value of a property) that Fannie Mae is getting. This combined with 90% gearing available to the funds, without offering collateral, in securitized bond coupons at 2.5% to 3.5%. These combine to provide handsome returns, with average internal rates of return (IRR) of 20%-25% with very low risk.

The Funds bid for pools of between 1,000 and 3,000 non-performing home mortgages across the US, sold by Fannie Mae at regular auctions. Winning bidders in 2016 and 2017 have been securing the blocks of mortgages at a low 60% of BPO. This is particularly surprising as the auctions are occurring in a housing market that has seen growth in every quarter of this period.

Funds then have to go through the usual process of refinancing or repossessing the houses. The former taking an average of 9 months and the later 30 months. All of this is outsourced to state-accredited agents, for a standard fee which equates to between 10% and 20% of BPO. The funds are then able to either sell the refinanced mortgage as a performing loan, or sell the house itself.

Again, the risks are low. In a flat housing market the funds will make 20%-25% IRRs. In a rising market the return will be greater. A major collapse in the housing market would be required to see these funds hurting.

So the real question should be: Why is Fannie Mae, a quasi-governmental entity, offering the likes of Goldman such fat margins to perform, on its behalf, what is essentially outsourced work?

The state-accredited agents for the repossession process are available to Fannie Mae, as are those that negotiate refinanced mortgages at reduced rates. They are the same people Goldman would use. Securitized bonds would also be available for the duration of either process. Is it that Fannie Mae doesn’t want to dirty their hands with the ugly process of reprocessing houses? It would be uncomfortable when it was set up as a government entity to encourage affordable homeownership, and so, seems likely.

Looking at this question from the other side, why are some of the buyers not bidding 70% of BPO and scooping up all the auctions? This would still provide mid-teen returns which, in today’s low interest/high risk environment, are still attractive, as they include real bricks-and-mortar collateral. Could there be some collusion on these auctions by the bidders? This also seems likely.

The auctions are in a one-bid system, which does not allow bidders to keep bidding until the highest bid wins. Each bidder has one shot. The selection of this process suggests even the possibility of collusion between Fannie Mae and the bidders themselves as it does not ensure the highest price for the seller.

The murky waters of quasi-governmental organizations still provide excellent hunting grounds for bottom feeders with the right contacts to make billions from millions of homeowners who expected to flip homes before their 2-year introductory interest period expired in those heady years before 2008. By Wildfry.

The US government bond market has soured, even the 10-year yield is surging, and mortgage rates have jumped. Read… What Will Rising Mortgage Rates Do to Housing Bubble 2?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

” …still provide excellent hunting grounds for bottom feeders with the right contacts to make billions from millions…” – article

Bottom feeders are found in all niches. I even bought one for my aquarium.

Dah, it’s obvious. It’s because the CEO of Fannie is expecting to go to Goldman afterwards.

Such an obvious ploy.

>>The auctions are in a one-bid system, which does not allow bidders to keep bidding until the highest bid wins.

This is the key observation. Wow, what a scam that is. Much easier to collude and rig the price if everyone just submits a one-and-done bid. A live auction is the only way to ensure that the mortgage owners (citizen taxpayer) get a fair price. Excellent article.

The still more interesting part is that the supposedly private shareholders of Fannie (and board members) agree to this process which minimizes their profits. Something strange is going on.

Private shareholders in Fannie lost all rights while under conservatorship, thus they have no say about this or anything else Fannie related. It makes it conveniently easy for FHFA and Treasury to take every penny of profit as well as put Fannie into receivership. Shareholders need a champion.

A good piece throwing light on a shadowy area. Especially interesting is the one- bid so called ‘auction.’

Check to see if winners alternate: ‘Why fight each other, you pick off one on the cheap, then I get one’.

Information about some of the sales of mortgage bundles can be found at this webpage and the links below it.

http://www.fanniemae.com/portal/funding-the-market/npl/index.html

The taxpayers must be thankful these gifted price-gouging criminal enterprise house flipping rent seekers are showing up to the feeding trough.

So who wants this stuff? Goldman at least has the deep pockets, if the mortgage market blows up. And where does Goldman gets those deep pockets? They rehypothecate their investors assets, and that’s really nothing new. They have always used investors holdings to provide margin to sell puts, which if you ever tried that you would appreciate the difference between the rules for the retail investor and the institution.

Wolf, I enjoyed your article.

I do have to admit that my grasp of your entire argument was murky the first time I read through it. Your readers may not be as savy with the economic jargon as you are. I had to go offsite and do some digging into IRR and gearing. I could imagine newer readers would also struggle with other concepts as well.

This is just a suggestion, bit maybe it might be worthwhile to link these terms with a small window that gives a small description of the concept. Most people who will stumble upon WolfStreet probably won’t know what a senior preferred stock or capital coverage ratios are

I am still beleaguered what the concessions were to the equity concessions and how these reinforce your point. And the line “does not force Fannie Mae to draw on its funding lines” left me asking isn’t that how things are suppose to work.

I think sometimes you look back and think the readership is right behind you, when you have lapped them a few times. Most times you explain things pretty well, but these occasional articles only get five comments as most people are probably scratching their heads.

Raymond,

You’ve made a good point.

The article was written by a new WS contributor, as you can see in the byline. He is a fund manager and investor and deals with all kinds of complex things. So he is ahead of us on some of the topics. This might require a little more explanation in the article, without bogging down the article with explanations, which is a fine line to tread. I’m glad to have him on board because he brings unique insights.

I will take your point to heart. We can probably add some explanations that make these complex, little known topics easier to digest.

BTW, he is also a WS reader, and that’s how we got into contact.

Apologies for the mix-up.

Another option is to break these articles up into parts if the explanation are extensive. You already do the “see this article” practice. But I would label them as part I or part II because some of the current links are sometimes subjects that are loosely connected.

Hi Raymond,

Really appreciate your advice. Will do my best to explain each area without the article getting too lengthy or tedious. It’s hard to know what people know and don’t know.

i) IRR is internal rate of return per year on capital invested.

ii) Gearing of a fund is the ratio of equity from the fund and borrowed funds from the bank.

iii) Senior preferred stock is one of the two tools heavily used by Warren Buffet and others. It is an investment which, over a period, can switch between equity and debt, it sits ahead of all other equity holders in a liquidity situation. I will explain Warren Buffet’s use of this in my next article, as someone should explain how he made his fortune, and it wasn’t ‘value investing’!

iv) The new Basel III has higher capital coverage requirements than Basel II on non-performing loans. This means that a the bank needs more combined equity and deposits for these pools to meet stress tests than before. One irony is that the capital coverage in Japanese Treasuries for example is 0%! Lending to an organisation with the highest national debt ratios and who is printing money to buy its own debt carries zero risk!

v) Under Fannie Mae’s original conservatorship, if she made a loss then the Fed, or taxpayer, would be obliged to transfer funds. This change will ensure that doesn’t need to happen this year.

Let me know if you have any further queries. It’s hard to match Wolf’s editorial standards.

1) Great idea about adding the background info. There’s so much jargon in economics and finance that it’s difficult to separate the justifiably technical from hoodoo distraction and / or fake facts that everyone ‘knows’ to be true.

2) Also, sometimes there’s a simple explanation that does not involve government incompetence or conspiracy. In this case, perhaps – and I’m only playing devils advocate, I have no specific knowledge – they did a cost analysis and decided that even with sales that look like gifts, they’re actually coming out ahead because of the cost of the infrastructure needed to support disposals. Believe it or not, there’s an actual cost to service real estate disposals and foreclosures and somebody has to pay for it.

Yes. There is a substantial cost to support disposal. As mentioned in the article it averages 15% of BPO. This has to be outsourced because it requires state by state permits. So there would not be a new department built at Fannie Mae. This 15% is calculated into the IRRs.

I certainly would appreciate some small, explanatory windows!

Wolf,

An example of the validity of this article.

in 2015 my brother and I tried to buy a 1bed 1bath in Culver City, LA from a short saler. Price in the $300k. Seller was eager, agent very accommodating, bank refused to let go for selling price. They expected a bidding war to increase it, but that didn’t materialise and pressured us to increase our bid anyway. When we didn’t bite, bank just refused, no reason given. Four months later house was sold for $225k in an auction to a Blackstone subsidiary.

Why would the bank take such a loss?

So started looking at the auction process. Talk about sleazy sales. Not only is it a one-bid-system. Most auctions are held at a small room within/or predominantly on the steps of a court house. The seller, mentions the property name and price from a list. People submit bids, winner hands the full amount “undisclosed” in the form of a check, there live, on practically what is a “street corner” to a stranger. What normal person would feel comfortable handing a $200-600k check to what is essentially, a stranger? in this day and age, to keep a closed circuit system like that is purely for insiders.

I know its just one example, so maybe i’m stretching its validity, but it was this particular experience that awoke us to finance and eventually lead us to wolfstreet. Always a silver lining =)

How is this website not referenced on the front page of WSJ daily, boggles my mind. We’ve been tracking Bloomberg/wjs news, and wolf, they are lagging you by at least 6 months in most of the topics you pick.

Lenz, your last sentence just made my day!

Agree Lenz. The SEC just made a public warning about block chain/crypto name chages and general shinanigans yesterday, when Wolfstreet was talking about this long ago. Fyi Long Island ice tea has a potential buyer from the UK (SEC filling).

Also agree this article is very interesting as a macro concept for me and for people with a deeper understanding im sure it’s even more insightful. Part of the reason i love reading Wolf Street is it’s always a learning experience; its like CSI for the world of finance. So, I would have been more than happy to have read a deeper explaination of some of the concepts.

Long Island Iced Tea company… hmmm, rings a bell.

Not that I think anyone reading WS would be sucked into this latest crypto scam but run a mile from this one!

NZ ‘Businessman’ Eric Watson has his fingers well into this pie…

Headline… Kiwi businessman Eric Watson’s company changes name to Long Blockchain, shares skyrocket 22/12/2017

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11964634

That would be the same Eric Watson who many NZ investors hold responsible for the collapse of his part owned company Hannover Finance…

Headline… Hanover Finance freezes $554 million 23/7/2008

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10523117

Yhe 554m is NZD, so approximately 380m USD, sorry I don’t know how to link the URLs.

Hannover went down, investors lost everything and the Watson party rolled on. The Serious Fraud Office pursued him for years but in the end the usual complex web of companies and ownership of responsibility meant the case was eventually dropped due to insufficient evidence being available to obtain a conviction.

A leopard never changes his spots, and Long Island Blockchain is just another chapter in the now global game of finance scam that continues in it’s various forms to this day.

I love this website, sometimes posting but always lurking! In the last couple of years I have learned so much about economics and finance, and it’s various legal and illegal scams. Most of this seems to go over the heads of ordinary people but we all have a duty to help get them informed, Wolf is leading this charge!

Again, to play devils advocate …

Your description may be spot on. Or, they may have been a problem negotiating with the bank. A good negotiation requires preparation and knowledge on your part along with a strategy to implement it. It’s NOT just walking in and being charming or slick. Not even close.

Sometimes you need to educate who you are trying to buy from, sometimes you need to outsmart them. Sometimes you need to do their thinking for them. Depending on what you want, you may need to be persistent or may have to let a couple of perceived insults roll off your back in favor of the big picture.

It’s always a mistake to assume ‘no’ means ‘no’ in an example like yours until you’ve tried everything you can think of and/or are willing to do. Most sleazy sales people assume ‘no’ is the word they hear right before they hear ‘yes’ if they keep at it long enough. That’s why they keep you talking.

cdr,

we didn’t have a direct line to the bank.

The realtor of the seller was the middle man. The seller was in rush to rid of the place because it was/would impact his credit. He was currently not paying his dues, house was short-sale, heading to foreclosure.

The original listing was $290k. We contacted the realtor we made an initial offer of $270. After a few weeks of them presenting the offer to the bank, they came back to us with what they thought the bank would accept. 300k. We told them, that didn’t make sense, its higher then the listing price, and inquired if they had other offers. They said we were the only offer. So we matched the listing price of $290k on our second try. They came back to us saying bank finally returned them with a concrete number. Bank wanted 340k for the property. 16k shy of what the orignial owner had paid.

We said no. Bank was fine with us pulling out.

The house was removed from the market listing online during this process. 3 months later it was put up for $356k. 1 month after that, the realtors emailed us asking if we were still interested, and if we were willing to make a 300k+ offer. We ignored the email. 1 month after that the listing was removed again. Ending in an auciton for $225k.

You’re better off NOT being on the front page of WSJ. You become a target for groups wanted to direct articles on trending social media websites, (then planting agitprop alongside newsworthy stuff) and the discussion board is taken over by trolls. Offshore content which appears to be highly insightful can be a trojan horse.

That sounds like a normal property auction. House flippers are familiar with the process.

Yeah, it is “normal.” Bid rigging at foreclosure auctions was/is very common, but that doesn’t make it legal, and some people are getting caught and are going to jail for it…

https://wolfstreet.com/2017/04/19/bid-rigging-at-foreclosure-crisis-auctions/

The sheeple who mindlessly vote for Goldman Sachs’ political prostitutes in Wall Street’s Republicrat puppet show are sanctioning crony capitalism and plutocrat swindles against the 99%.

Wolf ,

In a similar vein in 2008 and 2009 my wife and I purchased several condos

to rehab and rent out.

One of them was an FHA foreclosure priced at $33,000. We put in an offer of $29,000. The offer was rejected. We were told by the listing broker that this was rejected by a computer program used by FHA that would not accept for consideration any offer more than 10% below asking.

The upshot was that about 1 month later the property was relisted at $26,000. We immediately submitted an offer at $26,500 and secured the property.

Another example of our tax dollars at work.

Keep up the good work, great article.

This is such as great article. Please continue exposing this massive fraud as well as the fraud perpetuated on the shareholder for Fannie and Freddie

Who does GS farm out the foreclosure and sale of the houses on these non-performing loans?

1st time on your site, please post more on the fraud called #fanniegate and all other info pertaining to Fannie Mae and Freddie Mac

thanks

in regards to this article, its obvious collusion . No one is playing fair.