Oops, they’re already rising.

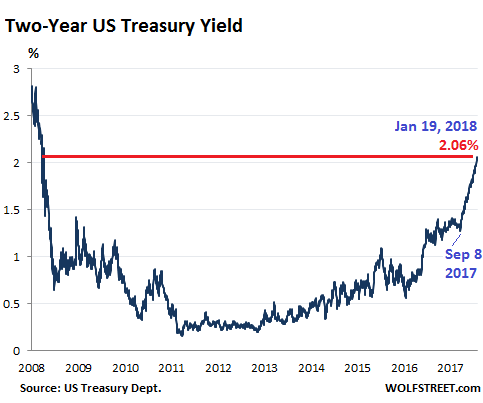

The US government bond market has further soured this week, with Treasuries selling off across the spectrum. When bond prices fall, yields rise. For example, the two-year Treasury yield rose to 2.06% on Friday, the highest since September 2008.

In the chart, note the determined spike of 79 basis points since September 8, 2017. That was the month when the Fed announced the highly telegraphed details of its QE Unwind.

September as month of the QE-Unwind announcement keeps cropping up. All kinds of things began to happen, at first quietly, without drawing much attention. But then the trajectory just kept going.

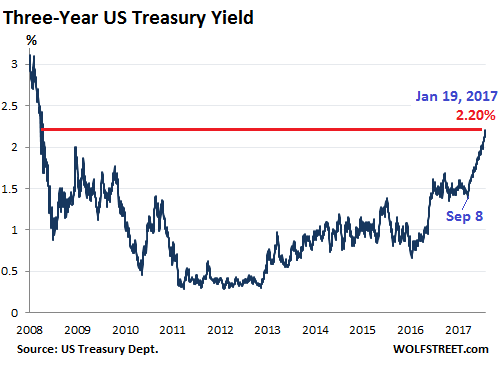

The three-year yield, which had gone nowhere for the first eight months of 2017, rose to 2.20% on Friday, the highest since October 1, 2008. It has spiked 82 basis points since September 8:

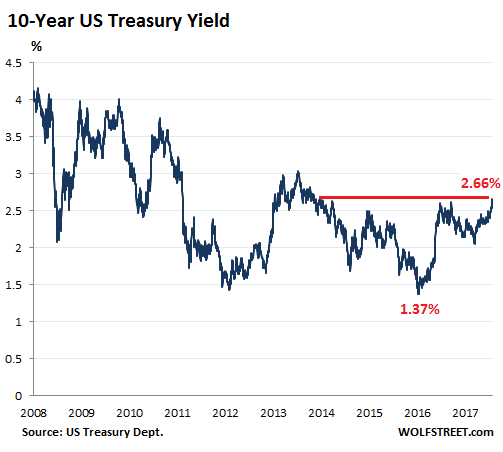

The ten-year yield – the benchmark for financial markets that most influences US mortgage rates – jumped to 2.66% late Friday.

This is particularly interesting because the 10-year yield had declined from March 2017 into August despite the Fed’s three rate hikes last year, and rising short-term yields.

At 2.66%, the 10-year yield has reached its highest level since April 2014, when the “Taper Tantrum” was winding down. That Taper Tantrum was the bond market’s way of saying “we’re shocked and appalled,” when Chairman Bernanke dropped hints the Fed might eventually begin tapering what the market had called “QE Infinity.”

The 10-year yield has now doubled since the historic intraday low on July 7, 2016 of 1.32% (it closed that day at 1.37%, a historic closing low):

Friday capped four weeks of pain in the Treasury market. But it has not impacted yet the corporate bond market, and the spread in yields between Treasuries and corporate bonds, and particularly junk bonds, has further narrowed. And it has not yet impacted the stock market, and there has been no adjustment in the market’s risk pricing yet.

But it has impacted the mortgage market. On Friday, the average 30-year fixed-rate mortgage with conforming loan balances ($417,000 or less) for top-tier borrowers, according to Mortgage News Daily, ended at 4.23%, the highest in nine months.

But historically, 4.25% is still very low. And likely just the beginning of a long, uneven climb higher.

And the impact on mortgage payments can be sizable. When rates rise for example from 3.5% to 4.5%, the payment for a $250,000 mortgage jumps by $144 to $1,267 a month. This can move the payment out of reach for households that have trouble making ends meet.

A one-percentage-point increase takes on larger proportions in a place like San Francisco, where it might take a mortgage of $1.25 million to buy a median home. At 3.5%, the monthly payment is $5,613. At 4.5%, it jumps to 6,334, an increase of $721 a month and an increase of $8,652 a year.

A mortgage rate of 4.5% is still very low! And it is likely headed higher.

Since the Financial Crisis, the ultra-low mortgage rates were among the factors that have caused home prices to soar. But as rates are heading higher, the housing market is in for a big rethink. These higher rates are going to be applied to the now prevailing sky-high home prices.

This will come in addition to the rethink triggered by what the new tax law will do to the housing market.

There’s another aspect to this equation: Homebuyers who are willing and able to stretch to cough up those higher mortgage payments can’t spend this money on other things. Falling mortgage rates gave a huge boost to home prices and to the entire economy in numerous ways. But that process will go into reverse.

So where will it go from here? The 10-year yield is still historically low and has a lot of catching up to do with regards to the trajectory of shorter-term yields. In addition, the Fed will continue to push its buttons – gradually hiking its target range for the federal funds rate and proceeding with its “balance sheet normalization.” And as the 10-year yield rises, mortgage rates will respond, and Housing Bubble 2 will get a lot more costly to deal with.

Even the bond market’s inflation expectations now exceed the Fed’s target. Read… Bond Market Smells Inflation, Begins to React

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Fed and the other central banks set mortgage rates. For 10 years the Fed has allowed mortgage rates to fluctuate between 3.5% and 4.5%, they will maintain that range until an even lower range (2% to 3%) is required.

Ben Bernanke’s explicit policy of house inflation will require ever decreasing mortgage rates over time. The Fed can never allow their house price bubble to deflate. Inflating house prices is a prime mandate of the Fed, second only to monetizing government debt. The house price inflation scheme requires the bubble to go forever (or at least till the dollar goes to zero) and the Fed will eventually push mortgage rates negative to keep the scheme going.

I’m waiting for the 30 year fixed to drop below 2%, then I plan to borrow as much as I can (zero down) to purchase a house or condo. If house prices were to fall I would merely walk away and leave the Fed with the non performing loan. There are no consequences to walking away from a zero down mortgage, Washington is a non recourse state, if I walk away from the loan the Fed gets ownership of the house but I owe them nothing more. They can put the moldy shack, overgrown with blackberry brambles, on their moldy balance sheet – after all it’s just an electronic entry on a spreadsheet.

Everything is free, especially speculation, there are no consequences – no price to pay for making bad bets, just walk away unharmed and stick the Fed with the cost (they have all the money in the world).

“I’m waiting for the 30 year fixed to drop below 2%….” You will need a lot of patience :-]

Only a LOT????????????

Patience may give the opportunity for a deflated housing price in the future. But it won’t ever see the existence of a 2% mortgage, banks and their government friends get the free money.

I was recently listening to an interview with Dr Lacy Hunt and he seems to think that interest rates will have to be low, like Japan’s. And that the CBs will have to do whatever to keep them low.. until of course people finally realize that they are never going to be paid and the entire thing collapses.

With all the additional demand for money, created only by creating new debt, that is baked into the system, I just can’t imagine how interest rates can remain low.

Guess I’ll watch and learn.

For now, mortgage rates are ticking up. Today, the average 30-year fixed reached 4.27%.

WR: check out today’s (26) bit in Guardian re: stacks of unsold lux condos.

I can’t seem to find that article. Can you post the link?

I may have got date wrong re: time change: so it’s 27 Jan in UK

Title is: Ghost Towers

I’m pretty sure that WA is non recourse ONLY if the lender takes the property back through a statutorily allow trustee sale.

The lender usually is allowed the right to go a different direction by opting a judicial foreclosure in which they could seek damages.

This is much more expensive and less efficient though…

Make sure you know the ins and outs before going down that road…..

Non recourse means non recourse. If you stop paying, the bank only gets the property – nothing else. No judgments, no financial consequence other than bad credit. Speculate with 20X, 30X or even 100X leverage (if you can finance the 3% down) and walk away if prices go down.

The Fed has made this cheap, easy money available to you and they want you to take it. If you stop paying it doesn’t come out of their pockets, it’s just electronic bits in an account, and it can all be papered over with ever more printed money.

HomelessEncampmentCleanUpCrew is correct. The lenders usually do not take the judicial foreclosure route in WA but they certainly can. If they do, all your assets, not just the house, are fair game. You can take that risk if you want but be it on your own head!

California, Oregon and Washington are difficult places to live each with their own burdens they place on their citizens. If you live outside of Seattle then the leftist bureaucracy is less burdensome. There are factors at play:

1) Like California, Chinese are parking their money on the West Coast of the US & Canada’s major cities real estate fearing a crash. They are also parking their money in Australia and New Zealand real estate. IF AND WHEN THE CHINESE BUBBLE POPS WEST COAST PROPERTY VALUES WILL TAKE A HIT.

2) Seattle has fewer but larger earthquakes due to the Cascadia Subduction Zone and it has very little land being restricted from sprawl by mountains and water. Earthquakes make it expensive to build up. If that isn’t enough…like California and Oregon zoning restricts development. My personal opinion. Seattle is an ugly city and an uncomfortable place to live. I couldn’t wait to leave.

Boeing has already seen the writing on the wall and opened an alternative site in South Carolina which is doing quite well. As it becomes more expensive for businesses and employees, both will flee the state.

No one gives zero down mortgages any more.

USDA gives residential loans with 0% down, in qualified rural areas. In September 2017 we sold our home to a buyer with this type of loan, despite our suburban locale in Greenville, SC, about 20 minutes drive to downtown.

Other offers we received: VA 0% down and seller to pay all closing costs (laughed at that one), FHA 3% down….none of these folks have much in cash savings.

Ability to pay is totally dependent on 1 full-time job in many cases. If a layoff comes along it seems foreclosure is likely, unless housing prices continue to rise at rates higher than historical norms.

In 1978, in California, my husband and I had to come up with 20% down plus closing, a total of $26,000, plus interest rate was about 9%. This was huge money in 1978, equivalent to around $100,000 in today’s money. We could not get a loan at less than 20% down back then…times have certainly changed.

the 3% down payment can easily be financed – the buyer needs nothing more than a good credit rating – no money required to buy a house.

Get out there and speculate – sure beats working for a living. Assets only go up – they are guaranteed by central banks – you can’t lose. And if you do lose just stick the central bank with the loses. What a world.

Here’s a wrinkle in the recursive/non-recursive loan phenom: in some states, the non-recursive 1st trust deed ONLY applies to the original home loan. It does not apply to subsequent refi’s of that first TD! You may want to check this out if you’re thinking about refinancing down the road.

and you will get to live there for a few years rent free.

thats what happened last time. milk it for what it’s worth.

it’s just business after all.

hmmmmm

or just short the market and pay cash for the condo.

good luck all.

The reason “no one takes the Fed seriously” is because:

a. Velocity of money, and all it implies (middle class can’t afford to buy) is still falling.

b. Asset price manipulation is the only thing keeping the illusion of prosperity going. Step outside the megalopolises, and the illusion crashes

c. The value of labor continues to be constrained by automation and globalization, and that continues unabated and inexorable

d. Rates go up, then less money available to buy. Velocity decreases further.

The Fed (and our economy at large) is trapped under massive structural forces, and the reckoning with those forces will require fundamental change, and some crunching pain.

Neither the Fed nor any other top-down entity is going to precipitate that painful reckoning. The Fed will back off the rate-change a few months after the first big correction (stock market, real-estate market, etc.). There is no plan B, everyone knows it, and that’s why the binge-excesses (ridiculous asset valuations, negative-interest BBB-rated bonds) and Bitcoins (money not manipulable by gov’ts) are occurring.

Wolfstreet seems to believe that the Fed or the “Market” has identified a path out from under the inexorables identified above. Please elaborate what that path out is.

If you can’t spell it out (my hat’s off if you can), then the Fed backs off.

The Fed will not back off substantially or reverse unless a market correction of sufficient magnitude occurs (or another unforseen event) that threatens the solvency of one or more of the largest financial institutions (those created by the Fed in last crisis when they “circled the wagons”).

The solvency of the US pension system is in crisis right now due to the lack of available high quality paper with adequate yield. The Fed knows this as does anyone paying attention. The immediate survival of these funds is crucial, so the hikes will continue regardless of the Dow and S&P. Otherwise, if the pension systems begin to collapse there will be nothing to stop the pitchforks and torches.

As an aside, if the Fed wants some real credibility they should start acknowledging the true inflation number that includes all the hidden inflation and some items considered “transitory” rather than the fairy tale they print or the goal-seeked PCE referenced nonsense.

“The solvency of the US pension system is in crisis right now due to the lack of available high quality paper with adequate yield.”

The political right would love for the pension funding problem to develop into a crisis as it would prove them correct about their terrible opponents on the left who over-promise what they can deliver to those terrible, corrupt union people. So, best to pretend to fight inflation but in actuality, keep interest rates below inflation level ’til pensions fail and the little people drown.

That’s silly. The looming pension failures/crises are across the board from public to private.

Interest rates were dropped because of that little dustup around 2008/09 and have been kept low throughout 8 years of leftist presidency. How does your nonsense identity-politics theory explain that?

Pension programs are also invested in mortgage backed securities. Double edge sword.

Neither the FED nor the government can acknowledge actual inflation because under the law they would then have to add that to wages, pensions, SS etc..COLAS!. and that would blow up the deficits. They have other ideas about blowing up the deficits with walls and tax cuts and military spending and infrastructure… The insanity is totally beyond imagination. And the worse part is that many of them haven’t a clue as to the consequences of what they are doing… Going along to get along…

Fed is already backing off, as evidenced from their SOMA holdings which actually increased $4.6 billion in the latest report. That “unwind” isn’t going according to schedule. No surprise, because in their rush to levitate markets and their systemically important constituents, Fed officials failed to comprehend the long-term consequences of their actions. There was/is no plan B, because there was/is no accountability for their actions. Doesn’t exactly inspire confidence when the folks leading the institution profess to believe in unicorns (Phillips curve).

As someone who works in the real estate industry, It has been fascinating to watch the Fed’s army of economists working so tireless to rewrite history while failing to even grasp the concept of moral hazard. The housing market is not going to react favorably to higher rates because consumers are already stretched beyond their means with rising debt levels. New rules relating to SALT deduction limitations will only add to the conundrum.

“Fed is already backing off…” No. On the contrary.

The QE unwind relates to Treasuries and MBS. Concerning its Treasury holdings:

So far in January, the Fed has shed $7.2 billion in Treasuries, which is the fastest monthly rate yet, and the month isn’t up yet. It will likely shed around $12 billion in Treasuries in January, as planned, which would be twice the pace of prior months. The Fed’s QE unwind is accelerating as planned.

I think the Fed is terrified what’s going to happen to them when the next crisis hits and they can’t even pretend to fix things. During the last crisis they saved their patrons at the banks and the assets of the 10,000 high wealth families. And the saved all the debtors with strong hands. Everyone else got left out. And they couldn’t increase demand quickly, or wages, and structural unemployment has been stuck.

If the crisis hit now employment will collapse and a most of the mid to lower middle class debtors real assets will end up in the hands of the 10,000. Fall out from that is going to be really ugly politically.

Sorry Wolf but you might want to check with Anthony Sanders on that. The math so far doesn’t support the unwind they were advertising. Those agency MBS are barely dropping. I’ll believe the unwind when they have shed the advertised amount of mortgage backed securities along with Treasuries. So far that MBS unwind isn’t happening per schedule. On October 4 2017 the MBS balance showed $1.768 trillion (all maturities). On January 17 2018 the balance was…$1.770 trillion. They obviously have some catching up to do!

https://fred.stlouisfed.org/series/MBST

Aaron,

You need to read my articles on this topic before you make these nonsensical statements on this site.

In the article linked below, I explain what is happening with MBS — that they take 2-3 months to settle and that therefore the first declines wouldn’t even show up until sometime December, that they have very large weekly variations for reasons that I explain… and that what we need to look for are lower lows and lower highs of MBS. And that’s exactly what we’re getting.

https://wolfstreet.com/2017/12/07/the-feds-qe-unwind-is-really-happening/

About a month after I published my article, the NY Fed came out and confirmed my info about MBS, including the fact that they take 2-3 months to settle, and the other timing issues:

http://libertystreeteconomics.newyorkfed.org/2018/01/balance-sheet-normalization-when-will-agency-mbs-holdings-decline.html

I fail to see how the unwind is “accelerating as planned” when the balance sheet INCREASES $4.6 billion in a single week. Must be new math. :)

OK, Aaron, Fed course 101. The Fed has many roles. Among them:

1. It is the official banker of the US government — it is the “fiscal agent of the US Treasury.” That’s the official term.

The US Treasury does not keep its operating cash on deposit at JP Morgan. It keeps it at the Fed. This is so by design. When the cash balance in the Treasury deposit account at the Fed fluctuates (just like my checking account at my bank, only a little bigger), the Fed’s balance sheet changes in equal amounts on both the liability and asset sides. Given the gargantuan size of Treasury’s money flows, this deposit balance varies by large amounts from day to day. These numbers are disclosed on the H.4.1. They’re right in front of you.

2. The Fed holds “Foreign Official Deposits” – deposits by other central banks and governments. When they fluctuate, they impact both assets and liabilities of the balance sheet, just like a deposit by a US bank at the Fed.

3. The Fed has other functions like these that impact the overall balance sheet — but that have nothing to do with QE.

https://www.federalreserve.gov/monetarypolicy/bst_frliabilities.htm

You’re looking at that overall number on the balance sheet to determine on a weekly basis if QE is unwinding or not. But what you’re actually seeing is the net result of all of the Fed’s activities, including the changes of Treasury deposit and official foreign deposits. QE was the purchase of Treasuries and MBS (and some small amounts of agency mortgage debt), and those two accounts is what you have to look at to determine whether QE is being unwound or not.

I assume the kick up in yields is due to the albeit minor fed selloff. Perhaps more due to market perception of the fed starting to do instead of just talk rather than the actual volumes of the fed. Surely though if the yield is reacting this dramatically to the modest start by the fed, this will not be allowed to continue and we will end up back at QE infinity as we all expect given the corner they have painted us into.

Aaron Layman Properties said: The housing market is not going to react favorably to higher rates because consumers are already stretched beyond their means with rising debt levels. New rules relating to SALT deduction limitations will only add to the conundrum.

Good!!! The artificially low interest rates combined with the flood of people fleeing failing blue states have flooded the North Texas suburbs of Denton, Frisco, Mckinney, et al. with new McMansion-villes that are driving up home prices beyond 2006/07 bubble peaks. Flippers are coming in droves to every neighborhood too, further driving up inflated property values, and ultimately property tax bills. Who benefits from this? Surely not Texas homeowners who pay the 6th highest property tax rates in the nation (slowly rising tax rate * fast rising home value = high property tax in dollar terms). The ones who benefit the most are local municipalites that use their new windfall tax revenues to bloat their budgets in bubble times then raise tax rates in hard times “to close their budget shortfalls.” The other people that benefit are realtors skimming commissions on ever inflating property sales prices. Best to pop this housing bubble 2.0 now and deal with the consequences before it gets worse.

https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585/

Hi Tom,

The Fed might back off, but that list of yours is beyond sobering, nontheless.

My first house was at 7%, and that was considered a very good rate at the time. I won’t even mention, (ooops did) when 5 years later at renewal time the rate ballooned to 18% (and I had never missed a payment on any product, ever). It was life-changing scary.

In Wolf’s article the sobering fact(s) for me are realizing just how big mortgages are in some areas, and how unaffordable any rate increase will be. Then Tom pointed out there is no Plan B after a collapse.

I have a slightly different take. I think plan A is also the only Plan and that it is unfolding too late in the game; that this rise in rates is simply a gambit to ‘quickly’ get the rates high enough in order to re QE as soon as everything seizes up. They should have started this years ago, but were lulled into the extremely low rates for too long by mistaking RE jumps and Dow record rates as the sign of a growing economy, and also as a way to reward insiders with massive leveraged profits in both RE and Stocks. Regular folks buying houses and investing for best returns got roped into the meme and hype. Savers (like me) are on the sidelines after having their return pockets picked by speculators.

This ‘Crash’ could happen pretty fast. Pick your trigger. And when it does happen QE will be seen for what it is. The DOW will be seen for what it is. I don’t think these slow but inexorable rate increases will be the trigger, and the first slow rise might actually increase sales as people rush in to lock in. But after that?

I have a question? What I am curious about is who will be blamed when it crashes? What will be blamed? I keep hearing the mantra from boosters that right now the economy is absolutely wonderful. Pick your superlative. I’m a pretty positive and optimistic guy with two kids in their thirties who are working, paying for homes, etc. I look at their lives and it looks pretty precarious; pretty shaky.

I have to laugh when I see people in fear of mortgage rates rising to…wait for it FIVE PERCENT!!!!. Oh, the humanity!!!!

When I bought my first house in 1982, I got a private mortgage held by the seller at 12 3/4%. I was happy, because most people were paying 18%. When I became a Realtor in 1986, mortgages were 12% and the country was in the middle of the biggest housing boom ever. Rates eventually settled down to just under 9% a few years later. Everybody these days is too young or too feeble minded to remember what happened then.

When people have real jobs and real savings and the future looks bright, double digit mortgage rates are not a deterrent. America does not have any of that now.

Totally agree, Tom:

It’s a Wall Street government with it’s revolving door, especially Goldman, running the Fed. The Fed catches the flack from most of the commentators but the real powers behind the Federal Reserve are the Wall Street banks.

I see no way out of this mess, and it’s global, without a genuine collapse but with the bankers running the show including owning Congress then this will stumble along until it won’t.. I do think once one bubble pops then they all will and in close order and then we’ll see what real poverty looks like. 2008 was just a warmup..

The Feds rate hike program which I consider entirely irrational, does make sense if you consider the weak dollar policy, and the problems that will create. The Feds charter is not specifically tied to dollar policy (Bernanke once said “the dollar is not my problem” and Bush called him into a cabinet meeting and he sang another tune thereafter.) It’s been a long while since bond vigilantes had any effect, the US being an issuer which dwarfs all others, at auction when Treasury sets rates the market seldom questions their acumen. So far the prospect of a bond panic, where buyers sense rates are going higher and either boycott the auction, or lowball the bid, hasn’t happened. So bond yields rising is a bit of a soft landing for the dollar. with clear limits with the caveat implicit that when the Fed backs off the rate hike program equity markets will not panic either.

“The Feds rate hike program which I consider entirely irrational”

I would say the plan to lower rates and eviscerate savers was irrational. It created a debt bubble and an asset bubble, neither of which is sustainable. Ever since money was invented, except for the recent invention of financial engineering, reasonable interest rates were charged for loaned money. The concept of the need for inflation to raise rates is goofy at the least and criminal at the worst.

Remember, your interest expense is my interest income. You seem to forget it or hope to live off artificially low interest rates for borrowed money, for a longer time.

Good analysis Tom everybody.

I would like to point out though that the FED is in this position because the US Congress was and has been unable to do its job. Government set up and supposedly manages the rules by which the economy runs. It is responsible for the deficit spending and all the other debts and the off shoring of jobs. It is under these rules that we operate.

The FED as the unofficial/unregulated 4th branch of government was forced to manage an untenable situation with the only tools they have.. Otherwise the US economy would have already melted down.

IMO the velocity of money is the really big issue. The way this chart has been headed means that in the end, the Monopoly game will have been won and all the money will be in the hands of a few. When that happens, the USA will no longer be.

In the mean time, we have a partial government shut down which to me seems like a crisis with no clear end. Whoever flinches loses big time.. And the country has been divided into so many Tribal Camps which don’t seem to even speak the same language.

“The FED as the unofficial/unregulated 4th branch of government was forced to manage an untenable situation with the only tools they have.. Otherwise the US economy would have already melted down”

You believe too much of what you read. Yes, it’s an unregulated 4th branch of government. “Unregulated” … That’s what makes it a target for those who know how to manipulate and control the uninformed and trusting. The Fed and all central banks are target #1 for all who want something for nothing and have the ability to influence.

Economics is very very simple but still requires logical thought and an appreciation for cause and effect. Charlatans added math to make it look complicated and add the illusion of precision. The math is used to create fake relationships. Designated experts confirm the phony relationships as good.

People who can be influenced make monetary policy.

The recent bunch, and hopefully the last bunch the Fed employs, decided to support the free money crowd. They used printed money to create the free lunch, which, unfortunately, also created asset bubbles and demanded savers subsidize their ideas. The ultra wealthy, the socialist utopians, and the fast buck crowd, noticed that controlling monetary policy was simple … just control the people who make policy and those who appoint these people. Hence, our current situation.

If the Fed and Bernanke did not create QE, the economy would not have melted down. The utopians and the fast buck crowd would have tried to make it look that way and sound that way, but reality would be different.

If savers had been able to earn normalized rates over this time, and not forced to accept low rates that subsidize asset flippers, the world would be lots better off today and not facing a debt bubble of more than massive proportions. The fast buck crowd and the free money social utopians would not have won.

People do the work. Not ‘government,’ not ‘rules,’ not some invisible force. People follow crowds and if you make it to the top you have learned to follow lots of important crowds, all of which have their own self interest at heart … not yours and mine. The self interest of the upper 1% controls each and every central bank everywhere … not some economic abstract ideal.

FED was forced to manage? LOL haha what a crock!!! The FED was created to do exactly what it does!!! Extract wealth and assets from this once great prosperous nation in order to enrich the private banks and select few oligarch families that control them. This has been going on for 100+ years! The FED will never go away and Americans further become indebted financial slaves unless a revolution happens but it never will. We are all too fat and happy.

“the velocity of money is the really big issue”

Money velocity has accelerated since the 2nd qtr. of 2017. But it is still THE issue. Money velocity plateaued in 1981 (because of the saturation in deposit innovation). The reason why it has decelerated has to do with the way people have been deceived, by oligarchs and academia. See the Un-Icon: “The time has clearly come to harness money market funds in a manner that recognizes both their structural importance in diverting funds from regulated banks and their destabilizing potential…” Paul Volcker

Never are the commercial banks intermediaries (conduits between savers and borrowers), in the savings-investment process. All bank-held savings, by definition, are un-used and un-spent (contrary to every economist on the planet).

The absolute stupidity of mankind is astonishing. All savings originate within the framework of the payment’s system. But commercial banks, DFIs, do not loan out existing deposits saved or otherwise. Saver-holders never transfer their savings outside of the payment’s unless they hoard currency or convert to other national currencies. So the only way to activate savings is for the saver-holder to spend/invest outside the payment’s system, directly or indirectly, e.g., via a non-bank conduit. This is the sole source of both stagflation (up until the saturation of deposit classification innovation in 1981), and secular strangulation since then. Philip George got it almost right.

Thumbs-up. You said it well.

The Fed does have a plan to get out of this – they will simply debase the currency so debts can be paid with worthless confetti. We are approaching a day of reckoning for the dollar. You can bet the Fed has a plan in place to introduce a new currency so they continue to screw savers to pay government deficits.

I’m not sure what will crack this market, but this I am sure of. I’m a lifelong Los Angeleno who moved to Atlanta five years ago. I just took a cursory glimpse on Zillow yesterday to browse prices there. I knew they had reached Bubble 1.0 levels and a bit beyond…no. That market has gone INSANE with 1000 sq ft ONE BATH fixers in marginal areas approaching a million bucks, add a bath and you’re over. Junky 4-plex rental? 3 mil! Who is paying these prices, why, and how? I know that town like the back of my hand and yes it’s ‘boomed’ over the last half decade but this isn’t even remotely sustainable. It is awash with very poor immigrants and no-hope actors and writers etc waiting tables. Just nuts.

Who is paying those prices? Good question. When fed prints trillions, it can’t control where it goes. Looks like it went to real estate. All great inflation periods start like this, first real estate prices go up, then rents, then services around and before you know it, your money doesn’t buy match. You have been dispossessed of your hard earned savings by the most insidious and tricky government shenanigan: inflation.

You can’t have inflation without wage increases – and that’s not happening. Nor is there much pressure there. Deflation remains the most significant risk, and it could be triggered by a big enough stock market correction – just as it was in 2008. The real question is when/what the trigger will be. In 2008 it was obvious, but today, who knows. I wouldn’t rule out war as the trigger, since war tends to follow periods of great wealth disparity.

On deflation: In my entire life, there have been only a few quarters of relatively minor year-over-year consumer price deflation. But there have been DECADES of often big-fat consumer price inflation. You don’t ever need to worry about consumer price deflation in the US. You do need to worry about consumer price inflation.

You can have inflation without wage growth. The wage earners need to speculate to increase their income – wages don’t matter anymore. Wage earners, who don’t supplement their income with speculation, will be left behind to starve. Ben Bernanke showed disgust and contempt for loser wage earners – called them hoarders.

There is a central bank party going on – get up and dance. Never mind wages. Wages are tiny compared to speculative opportunities given to us by our banker overlords – they are kind masters.

I don’t a know single person who can pay the asking prices in Seattle and many are giving up their rents for the same reason. I canvased for a voter drive and saw for myself one room apts. with a tiny stand up kitchenette for $1,800 which included nothing, not even parking. Friends who are in business have taken to living in their office, again.. Sleep on the office couch, bathroom down the hall, and a hotplate, a tiny refer or an old one.

But I don’t see inflation coming (once this pops) because, as Tom Pfotzer says, there has been no velocity.. The money never made it to those who would have spent every dime just to live but went into a rat hole of pumped up real estate and pumped up stocks and will disappear from the books when this implodes..

I do think the Fed had a good idea where the money was going to go because it went where Wall St. wanted it to go.. The Fed didn’t just create money willy-nilly because if it had I and you might have gotten a little bit of it. It bailed the banks, it bailed the stock market, (for it’s wealth effect) and it sloshed from the banks to well-healed developers..

This building boom still continues in Seattle but Wolf reports that cracks are forming but I think too late to save what was once a wonderful place to live.

I remember that back in the Nineties, the “Pacific Northwest” was considered a low cost-of-living area. I guess that’s changed LOL.

I was interested in your comment on registering voters. No doubt those people getting displaced in droves are still signing on to support democrats. I’ll say no more…

There are some buyers here who can afford these prices. It is almost always a two income engineering family, or a tech person with lots of cash on hand from a sale. That can bring a 1mil+ down to 800k pretty easily. Also, with such a supply crunch here in Seattle it does not take a large pool of buyers to keep the median price going up. If supply ever increases or we ever get a recession again…. watch out!

Seattle desperately needs slums or man-camps – someplace where workers can sleep, shower and defecate in between slaving away at work.

First houses became unaffordable for workers, then they could no longer afford condos and now even studio apartments can no longer be afforded.

There are tens of thousands of us living in our vehicles. We make too much to qualify for subsidized housing and we don’t even come close to earning enough to afford an apartment.

I suppose it never occurred to Bernanke that making one group wealthy would come at the cost of impoverishing another group – more likely he just doesn’t give a damn.

Ben never looked at the group on group effect.

He looked at the economy as said.

If I do A. X, Y and Z should happen, the Administration should do G, E, and F, at the same time and the result will be a general lift in the US Economy which is currently in the S*(T.

“Monetary policy alone can not resolve all of the economic Ill’s that confront us” (Word’s to that effect ).

Was as close as Ben got to openly criticising the P 44 Administration. For FAILING TO PLAY ITS PART AND DO G, E and F.

The Failure of the P44 Administration to Do G, E, and F. left large quantities of cash with no work, so it went to the only place it could, paper and Property Asset Bubbles.

And as usual everybody blames the FED, as it so easy to hit the soft target, that can not fight back.

The landing must be soft. The engineers will take measures to ensure it. Dudley’s home equity fantasies could die aborning. I believe the Fed will buy all the debt required for a soft landing. We are in a new moral era where we are only limited by our earthbound imagination.

It’s been ‘soft’ since 2008, and will continue to be soft for another decade or two.

Even in the UK most news channels hammer on about Trump or Royal weddings, or other inane distracting junk.

While a slow reallocation of wealth occurs via inflating away the debt.

The thing is that this time inflation has been hidden away, but signs are showing now.

Anyone comparing a decade old product with a recent one for a similar price (corrected for supposed inflation) can’t miss it.

At some point everyone is gonna see the water has gone way way out, their salaries buy them junk on monthlies, and all their stuff of value is gone, having bought ‘new’ cool junk.

All while being distracted by nonsense on the news/tv/stupid box.

Case in point, I rented a ubox container in 2012 and paid $1200.

I had to do exactly the same thing last month, same ubox, same location and delivery port, it cost me $3800. It just blew my mind.

didn’t you guys get the memo – inflation is a good thing in our modern times!

Fighting inflation is sooo 1980. Inflation is now something to be embraced – everyone agrees.

Inflation means we don’t have to pay back the wealth we borrowed – we are all in debt so we can all agree defaulting through dollar debasement is fantastic!

Cut taxes and increase government spending! Double down – Reagan proved that deficits don’t matter, after all it need never be paid back.

Wolf

You should have also mentioned that the 2017 tax law revision will also negatively impact home sales and prices. Many potential buyers are waking up to the fact that part or all of the real estate tax deduction will not be deductible because the state and local tax deduction is capped at $10,000.

For many buyers, the impetus to buy was dependent on the tax savings. The new SALT limit will change that calculus and ultimately lead to fewer sales, slower appreciation or worse–actual declines in the value of homes.

We are already seeing the first signs of these negative impacts. Sales in “second home communities” ie. beach communities and sky resorts areas had massive increases in contracts that didn’t settle in Dec. due to the tax law changes.

The carnage has just begun and only the people in the business like myself understand its full extent.

I read awhile ago the the large motorhomes seen on our Canadian roads, driven by US Octogenarians (or sun-wrinkled look alikes), were so numerous because these codgers were able to deduct the interest on their rv loans as they were classified as 2nd homes.

The bright side of this is that at least they might have something to move into when the foreclosure man arrives. Plus, they will be mobile and able to stay ahead of the collection agencies.

Nothing more sobering than seeing a little old man driving a bus-sized behemoth with a little gnome perched on the seat across from him, barely in shouting distance. Sometimes, even towing a boat or an additional trailer for God’s sakes.

Maybe this excess will soon end.

Yes, those of us who frequent the American SW see the same thing in the winter, but it’s Canadian geezers.

I did mention the potential impact of the new tax law and linked my article that discussed it in detail.

Yes you did. I guess I should have said they might lose one or the other, but the excess is getting some brakes. :-)

The 2017 tax law will be negative for the HCOL areas, such as the coasts, but a net positive for flyover in the short term. The downstream consequences will be interesting.

Right on. I would guess that there are few, very few, people in flyover land that pay even half of the $10,000 dollar SALT limit. I live in the coastal northeast, and even in this high-priced territory, people that are (i) on the water or (ii) who are in tony suburbs pay over $10,000. The rest of us in the middle-middle class, in less prestigious suburbs, pay less than half that, typically.

No effect there, except we will no longer be subsidizing

San Franciscan million dollar homes, and Hampton Hedge-Fund homes.

Perhaps the Hampton Homes, you know the $10M and $25M and even $50M homes were paid for using the results of what I think of as the LBO fraud-racket. So what if the LBO fraud artists lose their deduction ?

Why Do People Who “Analyze” Interest Rates Only Look At The Cost Of Borrowing And NEVER At The Income Derived From Higher Interest Rates?

Look, your interest expense is MY INTEREST INCOME. I’m bone tired of subsidizing the fast buck crowd and will never glorify their phony economists who make it look like the world will end if rates ever return to where they have been historically since money was invented.

Too bad if the Eurozone ends due to rate normalization. I’m not the one who told endless lies to justify their low rates and printed money. The people of the EU voted for the clowns who appointed the free money socialist utopia crowd in Brussels. If there’s a rebound that causes them to actually pay for their excesses, I can’t wait to see it. Maybe they will be the ones who serve as the bad example so that it never happens again. Same with Japan and Switzerland. China, being not free, will survive and will hopefully not disintegrate when their debt issues fully flower.

Those people did it to themselves. Don’t ask me to pay for it for a little while longer and allow them to consume my savings just to they can live on artificially low rates and printed money for a while longer. Artificially low rates are a form of theft.

The goofballs who run the central banks decided that income from savings could be replaced by the wealth effect and low rates supporting massive new debt balances would create the necessary asset inflation. Those morons decided wealth could be printed as long as everyone did the same thing at the same time while rates remained low to negative, preferably negative. The long run effect represents criminal stupidity. Massive wealth for a few. Savings confiscation from most. A massive debt bubble that won’t respond well when rates normalize in the US soon. Remember, this scheme doesn’t work unless everyone does it enthusiastically.

I would think that contrary to what most expect, the increase in interest rates will boost real estate prices. As rates increase and the economy starts showing signs of stress the FED will reverse its QE and start all over again, after all it did work under Bernanke. QE will become established standard with no limit to Fed balance sheet. Why stop at 4 trillions? Why not 10 or 20trillion, whatever it takes?

People will eventually smell the trick and start buying real estate again no matter what as the only thing available left to them to salvage some purchasing power of their savings.

Look how real estate went up during high inflation periods 1970 – 1980, with interest rates in double digits. Why should it be different this time?

The high inflation 1970 -1980 was driven by the oil embargoes of 73 and 79, which about tripled gas prices, which caused the inflation during that period. In 1970 gas a gallon was 29 cents. A Olds Cutlass I bought in 1978 was priced at $7,350 and in 1983 that same car doubled to $14,300. The double digit interest was instituted to counteract the inflation, it was not a driver for inflation and the home prices were a reaction to the inflation just like the car prices. Wages during that period were also not stagnant like they are today.

If you are a home buyer, you will essentially be looking for property that stays under the new $750K mortgage interest deduction, and under the combined state/local/property tax limit of $10K. There are very few places in the country where this is possible. Florida is one place where it is possible because there is no state income tax. In NY and CA it is virtually impossible for working people to stay under those limits.

The rising interest rates will kill real estate markets in the high cost high tax areas and force businesses and workers to relocate. I have already read articles of plunging prices in the Hamptons, NY and Greenwich, CT.

Since income is king. Rising interest rates will matter less than where Amazon locates their new headquarters, with 50K jobs.

Come on Petunia, I like your comments AND I ALWAYS READ THEM. I like you a lot !

You said, ¨If you are a home buyer, you will essentially be looking for property that stays under the new $750K mortgage interest deduction, and under the combined state/local/property tax limit of $10K. There are very few places in the country where this is possible. ¨

Really ? ! ? ! That statement is really claiming that the average home price is in the vicinity of $750K, since ¨ . . . There are very few places in the country where this is possible.¨

How about this, not counting the places where the Coastal Elites live (NY, SF, LA/Beverly Hills, DC, etc.)

or should I say, ´flyover America´ MOST HOMES ARE WELL UNDER THE $750K TOTAL price, let alone necessitating a $750K mortgage, of all things.

In most places in America it is possible to buy a home without even getting near the magical $750K mortgage number.

So figure $5K for Local property tax deductions, and $5K for State income tax deductions, and YOU HAVE MOST OF AMERICA. Well under the $10K magic number .

I don’t disagree that you can still buy a nice house for $250K, pay all your taxes and still use the tax breaks, in most of flyover country. You can do it where I live.

The problem is that most people in flyover country don’t make the amount required to finance these purchases. Down the road from me is a collection of mobile homes with one or more brand new trucks parked in front. We joke that one of those trucks is worth more than any of the trailers. The reality is that for those people the truck gets them to work and therefore has more value than a nicer house would.

We pay more in rent than it would cost to pay for the house we rent, but we don’t have the credit or the down payment to buy it. The new tax bill makes it almost irrelevant for us to buy and the job market makes it imprudent.

If you weren’t impacted by the financial crisis you are doing great regardless of where you are, and if you were impacted, the climb back may not include owning another house.

Why buy a brand new truck? Why not buy a reliable used car that cost 1/4 as much and gets 2x to 3x the gas mileage? Save money on gas, too. A reliable used car gets a person to work just fine.

Correction; not 750k price, but LOAN amount. In that price range you need to come in with around 10% down, so, you are talking more about 825k price.

DK,

They buy new trucks because it is cheaper than buying used and more reliable too. A used car may have a lower price but they charge more interest so there may be no real savings, especially after you add in repair work on older cars.

If you have a job and decent credit you always buy new, in the lower income brackets. It protects you from unexpected repairs you may never be able to afford. It’s the economics of poverty.

“If you have a job and decent credit you always buy new, in the lower income brackets. It protects you from unexpected repairs you may never be able to afford. It’s the economics of poverty.”

Yes buy new on minimum payments (almost lease term’s) Extend teh warranty and take the service inclusive price sell before warranty and service period expires. repeat.

Uneducated to man driving a low range Mercedes “you must be rich you drive a Mercedes”.

Driver “No I am poor, so I Must buy Mercedes, as they do not break”.

A bicycle works just fine getting to and from work. Anything more is a luxury – not a necessity. You want to be lazy while trying to impress the neighbors that’s fine but that money gets diverted from things that are more interesting than a fat, ugly, bland truck.

Movement across state lines isn’t a zero sum game.. The consequences of the new tax policies have not really been thought out.. The high tax areas will have many losses as lower sales and then lower prices then defaults radiating out thru their economies with not only the loss of write offs but these losses will contribute to even higher interest rates. Some one is going to take these losses. Giving away money isn’t free of costs. (some will say that tax reduction isn’t a give away but it is when the entity has to borrow it.)

Higher interest rates seem inevitable with both the increasing needs to be financed by the government, the FED’s downsizing of its portfolio and inevitable defaults. Also I have read that much of the corporate money sitting off shore has never really been just sitting in accounts. It was lent out.. With a lot of it in US Treasuries.. So bringing it *home* will also cause them to sell other bonds and Treasuries… Or it is just an accounting gimmick and there will be NO real benefit.. Other than higher government borrowing.

So as the demand for more US debt rises, those with the ability and need to purchase it will be declining..

Seems like a Perfect Storm to me.

There are some perverse consequences to the new tax bill. If you live in a state that allowed you to deduct all your federal taxes from your state return, the lower federal tax rates will reduce that deduction and increase your state taxes. This will increase tax collections in those states and decrease the value of the federal deductions. It will also impact the federal deduction caps for taxes by using them up with higher state taxes.

>>If you live in a state that allowed you to deduct all your federal taxes from your state return,

Never heard of such a state, Petunia, did you state it backwards?

Pay state and local taxes first, then pay federal taxes only on the remainder, yes, that has been common. But the other way around?

Alabama, Iowa, Louisiana, and a few more but they have caps.

Interesting, I did not know. I don’t quite understand how it works, because presumably the federal tax that you deduct from your state income will in turn depend on how much state tax you paid. So there seems to be a bit of a circular problem there.

https://www.thebalance.com/deducting-federal-income-taxes-on-your-state-return-3193248

I have friends who trade the markets as an individual with many other independent traders.

They have taught me a thing or two , lessons they tell me wallstreet is forgetting now. It’s never different this time. independent traders hate the fed with a passion as they are or have destroyed a free market. Neither are they big fans of the biggies who run wallstreet with their larcenous con games. . Algos run it all. Just look at CAT. BA acting like a crazy tech stock back in 2000. Moral hazard never ends well….. ever. The markets are so false it’s beyond belief. Anyone one with experience beyond ten years is very nervous and are going into or is in cash. Some expect a pullback in the coming months but not the real correction that is sorely needed. It will come eventually as stocks desperately will seek a return to the mean and most likely way overshoot. But the markets can still see higher. I used to laugh at the prediction of DOW 36000. Not any more. But it’s downright scary to think of the price to come after that high is hit. To give some idea of how parabolic the markets have become, the DOW can see 5000 and still be in a technical long term uptrend.

So many smart authors above. Now is the time for them to seek employment in a field other than finance.

Judging from the influx of foreign money into So. Cal I’d say the USA is using the Canadian model of ‘suck the wealth out of your citizens’ then replace them with wealthy foreigners when rates rise. You can see your fellow ex-citizens wandering the streets of So. Cal homeless.

The influx of Chinese into San Diego is crazy, but all the politicians see is a pay raise when taxes go up. About a 1/3 of the patrons in many of my resteraunts are speaking Chinese.

http://business.financialpost.com/personal-finance/debt/one-in-three-canadians-say-they-are-unable-to-cover-their-monthly-bills-as-rate-hike-looms

This is the Fed’s true “price stability” mandate. The bottom 80% have between roughly 50-75% of their net worth in home equity. You cannot have rising mortgage rates tamper down the “wealth effect” this creates for the US consumer. This entire century, home prices have seen parabolic gains in relation to income, the only exceptions were during times of inflation and war. That’s why the Fed really fights inflation. The victim of this policy is real wage growth.

The Economist has an interesting chart on US home prices to income from 1980 to Q2 2016:

https://www.economist.com/blogs/graphicdetail/2016/08/daily-chart-20

On the Price to Income chart, there was a decline from 132.0 in Q1 2006 to 99.0 in Q4 2011, so that’s not a parabolic gain, but a reduction in home prices in relation to income for five years.

There was a parabolic gain in home prices, on aggregate in the US, though from January 1st 2001 to January 1st 2006 that was reported in the Economist in August 2006: Collective value went from $14 trillion up to $23 trillion in those five years!. You do not add $9T to $14T in half a decade based on realistic appreciation and new construction.

For a good perspective nowhere we are now, Zillow reported on 28 December 2017 that the total value on US homes is now $31.8 Trillion.

https://www.zillow.com/research/total-value-homes-31-8-trillion-17763/

Wolf, I just went through the link to Zillow, and they use a different measuring criteria than the Economist. Zillow reports that the Jan 1, 2001 number was $17.6T, and the Jan 1, 2006 was $28.4T. That seems high from what I’ve seen reported, but it makes the Zillow report of $31.8T currently more reasonable..

What should scare you is going to the Federal Reserve’s website, and check out charts for homeownership rates, both nationally, and within your own state. Then take a look at a chart for take home income. You will find that real estate prices have been on a tear for ten years, but not underpinned by any fundamentals.

Wolf is right. What we have been seeing is debasement of the dollar, combined with the buying of real estate for investment/ rental income purposes. To top it off, most of the buyers are not individuals. Say your prayers when rates start to normalize, and the real estate investment math doesn’t work anymore.

2006-2011 is just a small blip. This is the chart that I was referencing in my comment: https://voxeu.org/sites/default/files/schularick_fig2.png

The chart is very interesting but there is 1 component missing (my opinion), even at these high prices and rising interest rates people are still buying/selling/renting. For this to correct, interest rates or prices would have to seize the real estate market. Unlike similar situations in Canada, Aus/NZ, China where prices and demand were rising on speculation. Homes sat empty as a place to park investment cash so when the correction came all those empty investment housing went on the market creating a surplus. We (US) lack the typical build on speculation, surplus and overbuilt status. This says to me that we have yet to enter the over investment bubble stage even with rising prices and interest rates.

That’s why the Fed really fights inflation. The victim of this policy is real wage growth.

Since the Fed’s misbegotten 1913 establishment by the robber barons of the era (read “The Creature from Jekyll Island”), the value of the dollar, which had been remarkably stable in previous decades, has dropped in value by 98% thanks to the Fed’s debasement of the currency. The Fed does not “fight” inflation, it creates it (not to mention asset bubbles) through its deranged money-printing and mad Keynesian monetary malpractice.

The central banks’ involvement in setting interest rates has been a complete disaster. It was a foolish endeavor from the start.

Who’s doing more harm to this economy? The people who over-consume, or the people who save way more than they can possibly spend in two lifetimes? The two problems go hand in hand.

The Fed has been trying to rectify the problem via interest rate increases, which attacks the savers and subsidizes the spenders/borrowers. This is pointless because it attempts to solve one problem (the excess savings problem) but exacerbates the other (the over-spending problem). The only real solution is to address the extremes on both sides.

I guess this is too obvious for any economist to figure out. I think my dentist could have done a better job running the Fed.

Put a decent annual tax on net worth above $30M, while raising interest rates. This discourages the extreme saving and extreme spending. The extreme savers will be forced to spend their excess savings on active investments (or else have it partially taxed away), and the extreme spenders would be unable to take on too much debt. Wealth distribution would return to healthy and sustainable levels over time.

Most importantly, people who have a rational need for saving would be able to get a fair rate of return on their investments.

Don’t interest rate increases cause more savings not less and less consumption? Your comment isn’t making sense to me.

With a wealth tax on savings over $30M, there is no incentive for the extreme wealthy to save as it offsets the impact of higher interest rates. Mainstream savers like you and me that have less than $30M in passive assets would get the benefit of the high rate with no offset.

The problem today is we have a small subset of the population that is extremely rich, much more than in the past. They have the bulk of their wealth in passive assets, which creates deflation in the economy.

>>The Fed has been trying to rectify the problem via interest rate increases, which attacks the savers and subsidizes the spenders/borrowers.

Scratching my head here. You must mean DECREASES not INCREASES.

>>(the excess savings problem)

There is no excess savings problem, only an excess debt problem. Fractional reserve banking with a very low reserve ratio is what causes the ability to create debts that is 12x or 16x as large as the actual savings (capital).

Yes, I meant DECREASES. Sorry.

Also, if there is excess debt there has to be excess savings. The two go hand in hand. For every debt, there is a “saver” on the other side of it, even if it’s a bank. A bank is just a middle man or conduit. Loans that the bank holds are offset by equity or debt on the bank’s balance sheet. Thus, all assets of a bank lead to liabilities of the bank, which represent the excess savings of equity investors and creditors such as CD holders.

” For every debt, there is a “saver” on the other side of it, even if it’s a bank. ”

Not with the leverage ratios they run today.

If they wereb running 1 – 1 or 1.5 -1 yes today they are over 10 -1.

The Fed has been trying to rectify the problem via interest rate increases, which attacks the savers and subsidizes the spenders/borrowers.

The Fed’s War on Savers is intended to force them to seek yield in Wall Street’s rigged casino, where the Fed’s bankster pals can fleece them at will. The Fed’s sole purpose since it’s clandestine 1913 inception has been to facilitate the transfer of wealth and assets from the 99% to the Fed’s oligarch wire-pullers. These gold-collar criminals have been a brilliant success at arranging the financial strip-mining of the middle and working classes, while building a financial house of cards that is doomed to implode under the weight of its own fraud, insane debt levels, and artifice.

“The US government bond market has further soured this week, with Treasuries selling off across the spectrum. When bond prices fall, yields rise. For example, the two-year Treasury yield rose to 2.06% on Friday, the highest since September 2008.”

I wish I had a better understanding of the bond market but I have yet to find a good basic explanation on a YouTube video for someone who is not in the bond market.

I have heard so many commentators say that what happens to the bond market is the crucial game changing factor in the economy.

Still I want to say this article was very best and clear explanation I have heard so far.

I just listened to Wolf Richter on the x22report and he gives his information in such a simple, clear, easy to understand way for ordinary people who just want to understand the financial markets and how they work a little better.

Will start following Wolf Richter, via his website writings and his interviews, much more closely. Mr. Richter does not seem to be selling anything, or not overtly anyway.

There is no bond market – only central bankers and speculators hoping to front run central bankers who will buy their bonds at a future date for a higher price.

Super Mario buys more Euro bonds then even those profligate countries issue. The bond market now exists only in history books.

Negative interest rates cannot exist in a “bond market”. Why would an investor pay a government to borrow money from the investor. We live in a world where currency debasement is stated monetary policy – a bond market can’t survive in that world.

Some years ago you could move to a cheaper place. Nowadays companies don’t want you working from home so unless you have one of those kind of professions that allow you to work in most places you are screwed.

But don’t worry! Bubbles crash so in a yesr or two you might actually be able to buy a home. Unless you don’t have enough money and or credit then you are still screwed. And the place were you can buy a home might be one were the company you work for isn’t there.

I wonder how many minimun wage office workers might start to live in their cars?

I think the focus on rates may be the wrong source of collapse in buyers. I guess it could be impacting all the speculators, but what I think what we’re really seeing is the true beginning of the demographic collapse. Via Saeculum Research a while back

“Preliminary data indicate that the U.S. general fertility rate declined to 61.0 births per 1,000 women ages 15 to 44 in Q2 2017, an all-time low. This figure is yet more evidence that 2014’s fertility increase was a mere head fake. (National Center for Health Statistics)”

Young adults completely and continue missed out on the “home price recovery” (we did not own homes, or have the capacity to purchase our first home when prices were allowed to have market forces and actually go down, and anyone whose family could have helped them already did years ago), we generally did not have enough disposable income to invest due to student loans and nondiscretionary requirements (missed the stock bubble) and have had our rights violated for a decade with non-dischargeable debt despite de facto generational bankruptcy.

At this point, the entire world is heading towards a 5th Village problem – yet everyone in power is acting like we’ve got another 2 billion babies born and growing up. (that era has passed) The world currently has near 0 youth, and young adult’s people remain utterly abused and neglected by the system.

Add to it a totally inverted tax code (compare after-tax take-home pay by profession, and you suddenly see the true horror of the lack of wage inflation) – you have a generation that cannot pay its debts, cannot discharge them to get a do-over, has the highest rents/property prices ever (and thus taxes), CPI through the roof when you remove basket manipulation and include rent and healthcare. Oh yeah, and we can’t start families and have kids because we secretly want to be responsible so everyone is deferring childbirth, and have been for a decade or more! (thus no babies)

Interest rates can keep on rising, the idea that buying a home is a “good idea” is so far, far beyond the reach of 80%+ of young adults, that I have no idea where the bottom is in price. There are no other new buyers in the market, and it will take a generation to make more. Marketing echo chamber fails to realize no one is listening anymore. Add to it a global property bubble, and well The game is rigged. Why not Play something else?

Dreamer:

A fine piece that was, indeed.

I’m a gray-hair, and I heed it well. These excesses in economic gyrations – e.g. the sky-high home prices, education prices with no actual jobs…relentless automation vying with you for jobs…it’s a very tough position your generation is in, no question. The velocity of change is really intimidating.

And yet, you said the right thing: “Why not play something else?”

I reply: “Now you’re thinking, Man. Keep as cool as you can.”

Some of my generation will remember that line.

Sun Tzu advises “never pit your weakness against your adversaries’ strength. Instead, change the game”.

So, Dreamer: what new game is afoot? Have you twigged it out yet?

Moody Blues, ‘On the Threshold of a Dream’ track one, ‘In the Beginning’ by Graeme Edge

There you go, man

Keep as cool as you can

Face piles of trials with smiles

It riles them to believe

That you perceive

The web they weave…

And keep on thinking free

These wise words combined with Sun Tzu’s are good advice.

Cryptocurrencies are doing a decent job transferring wealth to the younger generation that bought in early.

Even though I’m a mortgage payer, it’s a good thing that interest rates are normalizing. The difference nowadays is at least you are prewarned. If you cant afford a 1% interest increase then youre in the wrong house. As in the US the house prices in the UK are crazy, needs a correction.

This may sound mundane, but maybe there are folks out there who occupy positions to make policy who are interested in learning from the past, which might be:

The recent past few years of Fed tightening out of it’s way of QE seems to show they moved too slowly. Interest rate increases of .50% should have been used, and the pause after the first .25% was a tactical error. Also QE unwind should have happened years earlier as should have rate normalization.

Looking even further forward, the Fed should stop using words and language that implies it’s got investors back, like easing, QE, or any term associated with low interest policy, etc. The FED IMO should always project neutrality – even it it has a “secret” QE plan for emergency, stop talking bout it.

So far 1/4 percentage rate increase is not substantial enough to make an impact, however if we see a 3/4% move and rates start to touch 5% then that will have an impact in my opinion both on the bottom line payment and psychologically for buyers.

“So far 1/4 percentage rate increase is not substantial enough to make an impact,”

Only a fool wants to SEE impact. Impact = More Hovervilles.

What ism need is slow steady change so that when you look back 5 years later the evidence of change becomes apparent.

The US doesn’t have a big gentrification problem because of all the legal and illegal young migrants entering the US to work there. Obama had the right idea, make easy for foreign young people with universe degrees to live and work in the US because immigration is the only way to deal with gentrification that has been historicaly proven to work.

Countries in the past century used to be way more open to immigration, that includes the US. And it have an impulse to the economy by providing a much needed working class.

Then times changed and so did factories, not only much less people was needed, factory workers needed to be more qualified, and then cheap imports killed most local factories.

That’s a very stupid and gross simplification but I don’t have like a hundred pages of space here.

People should start to live together in big homes again. Better to be stuck with the family you hate that having to sleep in your car.

And that’s a good idea for a sitcom, big family that hates each other is forced to live together due to rising inflation and rent costs.

Heck they could be cheeky about it and call it “The Bubble Family” or something like that.