But this time, there’s no Financial Crisis, and no QE in sight.

The asset class of beautiful machines is suffering. These assets range from a rare 1962 Ferrari 250 GTO Berlinetta, which sold for $38.1 million with impeccable timing in August 2014 before the peak, to American muscle cars that can be acquired for a few thousand bucks.

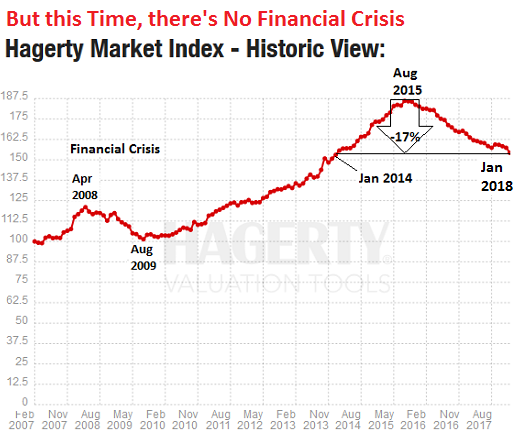

According to the Hagerty Market Index, prices of vintage automobiles that sold at private sales and at auctions fell 3% from a month ago, are down 7% for the year, and are down 17% from the all-time high in August 2015. This 17% drop from the peak is worse than the 16% drop from peak-to-bottom during the Financial Crisis.

The index in the January report, at 154.33, has now two declining years in a row under its belt.

The index provider, Hagerty, specializes in insuring vintage automobiles. Its Hagerty Market Index, unlike stock market indices, is adjusted for inflation via the Consumer Price Index. So these are “real” changes in price levels.

The chart below from Hagerty’s January report shows how the index surged 84% on an inflation-adjusted basis from August 2009 to its peak in August 2015, how it surged 54% on an inflation-adjusted basis above its prior peak, and how it has since given up one-third of those gains. The 16% drop during the Financial Crisis was triggered by financial panic. But there is no Financial Crisis today, and no financial panic. Instead, financial conditions in the markets are ultra-easy, and something else entirely is causing these price drops (dates added):

During the Financial-Crisis, the index peaked in April 2008 at 121.0 then plunged 16% in a little over a year to bottom out in August 2009 at 101.39. By then, the liquidity from the Fed’s zero-interest-rate policy and QE was washing across the world, and all asset prices began to soar, and the owners of those beautiful machines received a powerful boost from the Fed’s intention to create the “wealth effect,” as Bernanke himself called it.

But this time it’s different. This time, there is no Financial Crisis and therefore no QE in sight. The drop has now been going on for over two years, in an all-too-orderly manner. The peak occurred just before the Fed embarked on its rate-hike cycle in December 2015. And now the Fed is getting more serious about tightening, and the QE Unwind is already underway.

More data points from Hagerty:

- Both the auction and private markets were down month-over-month.

- The private market experienced a slight increase in December with a slight decrease for January.

- “Auction activity saw the largest drop of any section this month.”

- In the survey, owners became more negative. The number of those who believe the values of their own vehicles are rising dropped further, “continuing the trend seen throughout almost all of 2017.”

- “Expert sentiment” was more upbeat. “Market observers cited optimism surrounding the auctions in Scottsdale as well as tax cuts for their positive outlook going into the beginning of the year.”

The tax cuts are going to solve everything. That’s the meme right now. That’s what everyone is hoping for. Overpriced assets, no problem.

And there is always hope for the upcoming auctions. The Scottsdale auctions start this week and go into the weekend. But it was precisely prior auctions that have turned from hope to disappointment and have brought prices down over the past two years.

Maybe it’ll be different this time. Maybe the tax cuts will boost prices. We can always hope. But it might not be a great idea to count on cryptocurrency billionaires and millionaires to swoop into Scottsdale with their “hot wallets” and bid ferociously and push up prices; at the moment, they’re watching half or much more of their assumed wealth tied up in cryptos evaporate before their very eyes, and that is too painful an experience to have emotional room left to appreciate a multi-million-dollar beautiful machine.

Across the US, the blistering seven-year commercial real estate boom, backed by $4.3 trillion in bank loans, is ending. Read… Commercial Real Estate Suffers First Down-Year since 2009

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I can assure you that my four speed dual quad posi-traction 409 didn’t drop. She’s still real fine!

Can you also assure us that she ain’t sittin’ on a trailer, as a Trailer Queen, that never gets fired up, or taken out for a run? Can you imagine the fuel bill for a day’s worth of four speed 409 time?

I hope you hold stock in one of the oil companies when you tank up for gas.

MOU

Beach boys, nice

Oh yes it did

And it was a bad day for Bitcoin; down 25 percent.

Ripple is down 40% plus. Yesterday a millionaire, today a pauper.

Ripple is down 69% from Jan 5th. $3.84 to $1.19 That probably means Bitcoin will go to $8k in the near term

Ripple is not a true Crypto currency. It has nothing to do with Bitcoin

Well that is just terrible, because you walk into a grocery store with a $5 gold piece and walk out with only enough food for a light lunch. But buy food with your 5 bitcoins and walk out with a 1000gb hard drive full of virtual food.

Huh ?

FIVE DOLLAR GOLD EAGLE, ( NOT the antique, but the modern 1/10th oz. coin MARKED 5$) is above $150 on Apmex today. For an average or random date ANTIQUE 5$ half-eagle from the 1800s, it would be $300.00 OR MORE.

https://en.wikipedia.org/wiki/Half_eagle

Light lunch, really ? Or did I miss the ¨/sarc¨

designation on your post ?

I am wondering the average age of the owners of these vintage cars and wonder if the younger generation lets say those born after 1989 have any emotional ties to these cars ???? Could demographics be affecting the Vintage car market also ????

It’s about demographics.

Rich people in their 60’s buying 50 year old cars they lusted after in their youth.

I am 67 and was fortunate to have driven a red Porsche in Europe for 22 years in my youth.

Now, I content to have an old red VW Polo Gti

You´re right, THAT´s ME, and I still want a 56 T-Bird — WITH THE PORTHOLES — as much as I did when I was a teenager.

It won´t ever happen, it was only ever a dream.

So few cars today have any design distinction.

And yes, I am embarrassed to say I have a 1928 Studebaker Coupe in my shop-running boards, rumble seat, etc. I could pour $50,000 into it and still not have it road worthy.

No. I wasn’t driving in 1928.

Could be … interesting thought.

I’m a Millennial and have zero emotional attachment to any car made before the mid-90s.

I’d love to get my hands on a 98 yellow Mustang Cobra convertible with the bikini bar and put it in storage for a while; or a 2006 red BMW M3 convertible with the SMG II transmission and put it in storage for a while.

The thing is … most “younger” people have no attachment to these things and look at them as “poor peoples” cars. The only people I know who like these things were born in the mid to late 80s — like myself.

Interesting thought demographics tied to the collectible car market.

Put to storage? Drive your classic. That’s what it was built for. Enjoy it, for a car in storage is like keeping a painting in a dark vault. Life is short, and it should look worn out, the day it must be returned.

Right on plus alternative stores of value that are sucking funds to Asia. Which vintage cars will the Asian market buy? Where will they park them. Space is at a premium!

I agree. But wouldn’t young people’s affection for newer cars of their generation offset the waning interest in the Duesenbergs if it was primarily demographic?

I would count as a millenial interested in such cars. But I am also not an idiot, those auctions are full of rubbish cars that look good with fresh wax. Once you see what they are offering you realize the cheap clunkers on craigslist and kijiji will offer you the same experience for much less money.

yes, demographics is destiny.

you can look it up.

do i want to ride in what my daddy thought cool?

eh.

do i want to ride in what i thought cool?

eh, i’m not a car guy. but i did see a 61 safari wagon i liked, but, i got a 2003 volvo wagon. it’ll do.

I’m a Vintage car buff, and I watch the American Muscle Car Markets.

Buyers are investors that know the true cost of such a hobby. Each year the costs are skyrocketing for professional body shop service, parts, and insurance. Shop space is going up exponentially due to Environmental Protection taxation in the form of increased costs to run a body shop on rent, or mortgages. Additionally, as more and more people are staring at closed up main street USA, and FOR LEASE signage dotting the landscapes, we witness downsizing across the car markets. The downsizing typically happens even if the markets for investments are good elsewhere because Vintage car ownership is subject to a change of owners every 25 years or so. Many of the boomers are getting to the point of full retirement, and when they approach retirement they like to downsize. With the 2018 cohort of boomer downsizers there is more than ample supply for anyone that is considering an investment. In contemporary car culture the boomers are running up against the speculative class of short term flippers that have turned selling into a game of greater fools. And the markets are running out of greater fools because people are much more concerned about long term costs associated with this class of investing that requires overhead costs to maintain the investment without undo risk attached.

MOU

Interesting insight. Makes sense really. The “Boomer Downsizers” intuitively must make up a big slice of this potential market.

And then the people entering the pre-downsizer zone as far as age goes – their youth would presumably be memories of the Era of Malaise cars in the US.

Less demand for a vintage K car or those dreadful late-70’s “Mustangs” than one would imagine for a 1970 Camaro.

K-cars, 70’s Mustangs, Cuda’s n’ Camaros, are all on barnfinds.com, and they all fetch very high dollars compared to what one could get them for in the 80s & 90s. And I can’t believe my eyes when I see K-cars on Barnfinds.com that actually sell. Suffice to say that even the millennial generation likes what they saw as kids when they were growing up. Boomers like the 50’s & 60’s stuff, and Gen X likes the Iroc Z.

I’m a 49 Merc fan myself. And I would need a barn or warehouse if I actually owned one due to their size, eh. The average home today does not have an attached garage that would fit a 49 Merc. In brief, downsizing and Vintage car ownership are slightly not in sync these days, methinks.

MOU

49 Merc is a Ford flat head engine. You either just want to look at it, or if you want to drive it, you better be a good mechanic.

This is helpful to me, an aging boomer client will be putting his 1960 Impala (4 door) on the market and it helps to price things realistically,.

Tell your client to photograph the car inside and out and then list it on https://www.barnfinds.com/ A four door 60’s Impala will fetch okay money right now if it’s in reasonable shape with a numbers matching engine that turns over still.

MOU

Thanks for the URL. I have a 78 Mercury Monarch that has been in the family since new. Needs a new home and TLC, as I wore out before I could complete restoration.

This is all nonsense and blasphemy! Ben Bernanke was a savior of the American and world economy. There’s even a Time Magazine or Newsweek cover to prove it. Thank God for our central banking masters!

Greenspan, Rubin, and Summers, were on the cover of Time Magazine as The Committee to Save The World. Bernanke was the Central Banker that followed up after The Committee to Save the World actually ruined it like

Buffet said they would. Brooksley Born warned us they were going to ruin it too, but Congress decided to believe The Committee to Save the World instead.

Did Bernanke make the cover of Time Magazine?

I know he told us that we did not need to worry about housing prices falling on a national basis pre-Bear Stearns & Lehman Bros.

MOU

He not only made the cover, he was their person of the year for 2009…

How many millennials really care about owning a muscle car from the late 1960s? These vehicles are to the millennials what depression-era antiques were to the boomers – the polar opposite of cool. Pile on the idea that car ownership is an afterthought for many young people and the writing is on the wall. The era of “cool” cars as status symbols is permanently over.

Even if the millennials wanted the cars, they can’t afford them. Low entry level wage jobs, sky high rents, and student loans.

This is why the kids are so into bikes these days. Stripped-down “messenger” single speeds or fixed-gears, cruisers equipped with great sound systems, all sorts of custom creations out there. Knowing how to work on bikes is the new transportation-related status symbol and I was mentioning to my friend while fixing a flat on my bike, when the economy crashed I seriously considered taking the last bit of money I could get my hands on and going through the full course at the Barnett bike repair school in Colorado Springs. Then at least I’d have a viable skill.

You know, I think it’s not just affordability, although I do think that affordability reinforces what you’ve observed (similarly, kids will have pimp phones and pimp gaming laptops, but never dream of owning a car)..

I suspect that a much of what drives this trend is that for a whole lot of people (young people in particular) their first experience with autonomy and freedom was actually afforded by bicycles, not cars.

These weren’t the stories told by the baby boomers (or at least the auto industry marketers) who largely attribute their first experiences of independence to autos. But for younger generations, I don’t think that the car ushered new and special experiences, rather it ushered in a /continuation/ of experiences that were largely started via bicycle. (similarly mobile phones for the people younger than us).

So, in this respect, I think that a lot of the romanticism of the auto has been co-opted by bicycles, at least the in imagination of the younger generations. And, similarly today, cars have baggage that bikes do not: finding parking spots, DWI’s, etc. Not even to mention their costs.

Honestly, bicycles were always a much better conceived innovation than cars, so this sea-change really is for the better imho..

Biking is becoming Yuge in Warsaw Poland The City is setting up bike lanes everywhere and they have those bikeshare systems throughout the city I know because ai almost got run over by one for making the mistake of stepping into “their” zone Not sure how popular it is during the winter though

Will – in the heyday of the Boomers, it was entirely possible to have a car when you were 14 or 15 years old. There were a ton of cheap used cars on the market and while they typically needed work, that just made it more fun.

But I love riding my bike. I’m getting the exercise my doctor is happy to hear I’m getting, I never even think about parking, and a bike is so much better for exploring.

Interestingly, I’m just old enough (55) to have gotten a glimpse of mid-late 1960s life in Southern California and it was every stereotype writ large. The “ranch” style house on – you guessed it – White Oak street. Front and back lawns we kids spent a lot of time playing on (TV for for the evenings and Saturday morning). And we all had bikes or trikes. Even Dad had a Raleigh “English racer”. We’d ride our trikes around the block, and it was great fun when Dad put me in the kid’s seat mounted on his bike’s handlebars (thus ensuring my probable death in any accident, but hey, The Pill was just barely a thing then, so stay-at-home Mom could just pop out another kid) and zoom up and down in front of our house. My older sis, the oldest, had an official “Barbie” bike. One of my favorite memories was Dad showing me how to repair a flat, complete with driving (of course) up to the local gas station to find the leak using the big sink they had on the side of their building, full of water, for just that use. Leak found, we patched it with his “Monkey Grip” patch kit.

This was the last of the “Go outside and play and come back when the street lights are on” era, and lots of that playing around was simply riding our bikes around. Basketballs, swim fins, roller skates, jump ropes, bikes … if it was something that required vigorous exercise, we were all over it.

Bikes are a totally urban thing now. If you are close to a high population center you will see them used for hobby or transportation, otherwise you don’t. I’m in the south and rarely see them although the local authorities are always pushing for bike lanes everywhere.

Everybody here has or wants a truck, except me.

Alex I like your posts, but had to disagree with the one below.

“This was the last of the “Go outside and play and come back when the street lights are on” era, and lots of that playing around was simply riding our bikes around. Basketballs, swim fins, roller skates, jump ropes, bikes … if it was something that required vigorous exercise, we were all over it.”

I don’t think this era ended until much more recently than you think, at least in my experience. I’d put it right around the early 2000s, which was when helicopter parenting became a big thing.

When I grew up, the neighborhood was full of kids. Video games were becoming bigger, but they weren’t a main attraction, yet– if the weather was nice, you’d almost always rather be playing some whiffle ball, street hockey, or just hanging out. Also, no kids or teens had cell phones, and the internet was still relatively unknown.

Not coincidentally, little league participation peaked in 1997, and began a precipitous decline in the early 2000s. My last year of little league was 1998, and it was still huge. Every kid played.

Now, I think families are smaller, so there’s naturally just less kids around. So even if you wanted to go out and play, the odds that there are just some kids hanging out– which was almost a guarantee when I was young– are much smaller. And between the internet and technology in general (smartphones, video games, streaming media), kids can keep themselves well occupied all day without ever leaving the couch.

Helicopter parenting dramatically changed the typical American childhood, and combined with demographic and technological changes, I don’t ever see a revival of the community of local neighborhood kids hanging out sun-up to sun-down.

Diff generation diff idea of cool. The mid 20 plus are more likely to chase Toy Celica or 240 Z etc. (or if enough $, Porsche) than 60-70 Detroit iron.

‘As for cool cars as status symbols over’….depends on which kid you talk to.

They are humans not a separate species. Lots of different types.

That said, I’m kind of amazed it took my millionaire nephew until age 35 to get his first car. Jetta TDI. And it is an affair.

Yeah, they’re definitely still status symbols. Diminished, perhaps, but status symbols nonetheless.

Tesla seems to be a big one for the young and affluent.

“depression-era antiques”

Many of these are fascinating if you think about it, consider for example not many people had the means to buy a new Cadillac at the time. A definite collectors item reserved exclusively for the serious enthusiast, IMO

I’m not so old as to recall but think about how it would be to not have electricity 24×7, for something as simple as trying to keep your food from spoiling. One answer was cutting and storing blocks of ice during winter, say what?

Other products considered essential were gasoline powered lanterns, stoves and even sad irons.

Every couple of decades there is a generational shift in the classic car market as one generation ages out and sells off, and a new one (hopefully) starts collecting. Except GenX are fewer and less affluent than the boomers, and more financially stressed with higher housing, insurance and education costs, less job security and pensions.

Even if they weren’t, the generational handover is accompanied by a shift in which cars are popular, to what the rising generation sought after in their childhood years, so boomer favorites from the 60s would likely decline in price.

My sibling´s children — and mine — DO NOT WANT my parent´s (still alive) ¨antique¨ furniture, much of which once belonged to their parents.

ALL NICE STUFF, well-cared for, not heavily worn now, and JUNK to every millennial in our family.

And as a recent retiree boomer, I am downsizing and have no room for this furniture, to which I have a real emotional attachment.

It’s all related to baby boomers. When they were in their 20’s there were cars that they dreamed of owning, but couldn’t afford, then when they had the money in their 50’s they bid them to the sky. Now that they are pushing 70, they are downsizing their collections, and the indebted next generation of college kids don’t know what the hell an AC Cobra, or gull wing Mercedes is to save their life. Besides, those are cars only Grandpa is interested in. Now prices are plunging, and we are supposed to be surprised?

Well said, MOU (I saw a beautiful ’50 Merc at the cinema Sunday night-marveled that the proud owner would risk parking it in the tightly-spaced lot). I wonder if Hagerty’s figures go back to the late ’80’s-early 90’s era. I worked as parts mgr. at a Lotus-Ducati (really!) dealership in Walnut Creek. In the late ’80’s truly silly money was being asked and given for many a sow’s ear of Ferrari and Corvette. Blood in the streets later. Like so many ‘passion’ markets (as termed by ‘The Economist’), the tide comes in, and goes out. Autos now seem particularly vulnerable to the changing age/disposable income demographic-hard to jones for an exotic when you don’t have, or care to have, a fun lower-priced car to aspire from in the first place. TJM, what say you? Wolf, thank you, as always.

Parts Manager at a Lotus-Ducati dealership would be a fairly interesting task day-to-day, methinks. :-) I fully get what you are saying parts wise!!!

Sow’s ear Vettes is an understatement given the frames that GM had for that line, I hear ya’ on that one too. The whole paradigm of car collecting was invented by the boomer generation of which we are both a part.

Just found this synopsis by another gearhead/motormouth that agrees with us.

http://driving.ca/auto-news/news/motor-mouth-6

I collected British motorcycles for a while and they were practical investments compared to the classic 60s high performance muscle cars I’ve owned. Today, if I had the funds I would get a Vincent, Ducati, or 850 Norton Commando. These classic bikes don’t depreciate ever.

MOU

Anybody in the market for a customized Humber Snipe with gull wings?

I just Google-d the Humber Snipe with gull wings, and I found the Humber Snipe Saloon 6 1934. If you have the 1934 Humber Snipe Saloon 6 I’ll gladly take it off your hands. Also, I get the sneaking suspicion that the Humber you are selling is in the United Kingdom given that North American markets doubtfully had many Humber Snipes. I could be wrong though.

Very cool car IMHO.

MOU

Those that rotated out of vintage cars to crypto currencies probably wish they still had that car in the garage to admire .

In those days many people were in the habit of offing these cars once past ~50k miles so yes, being teenagers we would eagerly buy them from total strangers listing for sale in the newspaper. Of course we were obligated to race them around.

As I recall, one was a ’72 Barracuda or Plymouth Satellite, another was a ’69 Chevelle, an Olds Delta 88 barge and a huge Buick with 455 that would absolutely smoke the rear tires on a whim.

I still have a few collecting dust and cluttering the barn.

Had a friend in the early 80s that had an Oldsmobile with a 455, or something similar, that would smoke the tires on a whim too. After a while he started to realize that he was removing perfectly good rubber off of his rear tires every time he lit them up. Now, whenever I see clear indication of rubber marks on pavement I calculate out what it likely cost in terms of market prices for rubber. And if you still have the Cuda collecting pigeon droppings & feathers n’ dust in the barn, it could haul in some bucks at auction. I do envy the cluttered barn idea you have going there, mean chicken.

MOU

A 70’s Chevy pickup truck/ Fall guy re-creation just sold for 55k usd at barret today. LOTS of DUMB money out there.

#auctionfever

I don’t understand the suggestion that the Fed is out of ammunition. They can print all of the ammunition they want just like last time. So their balance sheet balloons temporarily from 4 trillion to 18 trillion. At this point how would that matter?

The Fed is not out of ammo. No one said that. The Fed is purposefully unwinding QE and raising rates to curtail the risks that have been building up in these asset bubbles. The Fed giveth, the Fed taketh away.

Any real signs of trouble and more QE 4, lowered rates, negative rates.. whatever it takes. They won’t stand idly by and watch prices collapse… will they?

In the last financial crisis many millennial friends in Calgary snagged vastly discounted repo luxury cars/boats from California. Even with import duty, due to strong CAD currency, the savings were amazing. So bring on the next crisis. Cash will be king once again.

Argentina has a few places that either repair vintage cars to.mint comdition or do fully functional replicas of vintage cars. You guys could visit here if you want vintage cars that bad. The exchange rate would also make it cheap.

The financial crisis is all around if you look hard enough. All you need to do is drive down el Camino real and look at all the people living in RVs in front of the Stanford fields.

Millennials lust after old VW buses. If they can’t have that, any old van will do. They trick them out and live in them. The prices of old VW buses is going up everyday, especially the Westfalia.

Is it a valid comparison across time?

Hagerty’s ‘Market Rating’ index dipped below 50 during the credit crunch signalling a contracting market, whereas today it is at 64 signalling an ongoing expansion albeit it at a slower rate of expansion ?

The “Market Rating Index” you cite is based on a survey of investors and experts and their sentiment about the market. It’s a sentiment indicator, similar to consumer sentiment indicators such as the U of Michigan Consumer Confidence Indicator.

The index I cited — the “Market Index” — tracks actual sales prices obtained at auctions and private sales. It tracks the reality of dollars, not sentiment. The index is similar to the S&P 500 index (but it’s inflation adjusted).

Sentiment has been decent for two years while prices have dropped and continue to drop.

Thanks very much for clarifying.

Vintage cars? And people say investing in bitcoin is silly.

It’s all the same except the opinions..

Vintage cars treated as assets are not really vehicles any more, they have been converted into pieces of art or something. The problem is that even low end fun cars (for example, Bugeye Sprite) have been turned into assets and typical boomer enthusiasts like myself have long since been driven from the market. It’s a shame.

Is there any change in the average price? Sometimes these things move around as the financial demographic shifts. Maybe those who were buying vintage cars are now buying Picassos.

Old car collectors are ditching their collections en masse because they are all most interested in new electric stair climbers with padded seats, and new Jarvic(tm) hearts. Hip replacements & knee operations are good investments too.

MOU

I have owned a classic car business for over 27 years. The average age of my customer is 63 years old. The ones in the 70-85 year range are selling due to age and the younger buyers just do not have the funds or the emotional connection. The younger generations tend to be embracing the more minimalist lifestyle and are not interested in a house with a 3 car garage with costly toys that need constant upkeep.

Where do you see prices going? Nice to hear from an insider.

and really kids, those cars were poorly engineered and of often poor quality relative to what you can buy now. you could barely get 100K miles out of them, while many cars today give you three times that.

IMHO the only main difference between a collector and a hoarder is …. organisation

International Harvester Scout Traveler 1980 street modified

perfect!

Driven in good weather sd33t, w inter-cooler, 727 auto, 2 A/C units

22mpg. will pass MARTA bs

The market for 50s and 60s cars may be dropping as Baby Boomers age. However, the market for 1980s Era cars like Lamborghini Countachs has been going up. Because people who grew up then are starting to make enough money to be able to afford them.

However, Generation X isn’t as big as the Baby Boomers or the Millenials, so the effect of their spending may not be as great, in various markets. Also, I don’t believe they’re doing quite as well financially as the Boomers did. A lot more of them are part of that struggling middle class.