In search of the elusive soft landing.

“So, what am I worried about?” New York Fed President William Dudley, who is considered a dove, asked rhetorically during a speech on Thursday at the Securities Industry and Financial Markets Association in New York City. “Two macroeconomic concerns warrant mention,” he continued. And they are:

One: “The risk of economic overheating.” He went through some of the mixed data points, including “low” inflation, “an economy that is growing at an above-trend pace,” a labor market that is “already quite tight,” and the “extra boost in 2018 and 2019 from the recently enacted tax legislation.”

Two: The markets are blowing off the Fed. He didn’t use those words. He used Fed-speak: “Even though the FOMC has raised its target range for the federal funds rate by 125 basis points over the past two years, financial conditions today are easier than when we started to remove monetary policy accommodation.”

When the Fed raises rates, its explicit intention is to tighten “financial conditions,” meaning that borrowing gets a little harder and more costly at all levels, that investors and banks become more risk-averse and circumspect, and that borrowers become more prudent or at least less reckless – in other words, that the credit bonanza cools off and gets back to some sort of normal.

To get there, the Fed wants to see declining bond prices and therefor rising yields, cooling equities, rising risk premiums, widening yield spreads, and the like. These together make up the “financial conditions.”

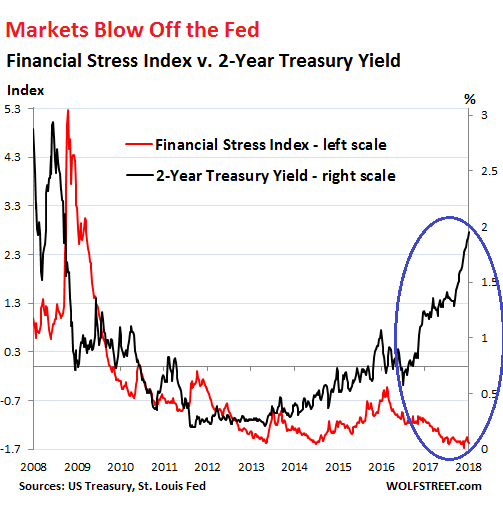

There are various methods to measure whether “financial conditions” are getting “easier” or tighter. Among them is the weekly St. Louis Fed Financial Stress Index, whose latest results were published on Thursday.

The Financial Stress Index had dropped to a historic low of -1.6 on November 3, meaning that financial stress in the markets had never been this low in the data series going back to 1994. Things were really loosey-goosey. On Thursday, the index came in at -1.57, barely above the record low, despite another rate hike and the Fed’s “balance-sheet normalization.

And this rock-bottom financial stress in the markets is occurring even as short-term interest rates have rocketed higher in response to the Fed’s rate hikes, with the two-year Treasury yield on Thursday closing at 1.96% for the third day in a row, the highest since September 2008.

The two-year yield and the Financial Stress Index normally move more or less in parallel. But in July 2016, when it became clearer that the Fed would finally stop flip-flopping and start raising rates, the two-year yield began to rise sharply and recently began to spike. But the Financial Street Index fell.

This chart of the St. Louis Fed’s Financial Stress Index (red, left scale) and the two-year Treasury yield (black, right scale) shows this gaping crocodile-jaw disconnect:

The Financial Stress Index is made up of 18 components. A value of zero represents “normal” financial market conditions. Values below zero indicate below-average financial market stress. Values above zero indicate higher than average stress.

So with the economy facing the risk of “overheating,” and with markets doing the opposite of what the Fed wants them to do – namely cooling off – Dudley warned:

This suggests that the Federal Reserve may have to press harder on the brakes at some point over the next few years. If that happens, the risk of a hard landing will increase. Historically, the Federal Reserve has found it difficult to achieve a soft landing – especially when the unemployment rate has fallen below the rate consistent with stable inflation.

In those circumstances, the Federal Reserve has been unable to both push up the unemployment rate slightly to a level that is consistent with stable inflation and avoid recession.

It was a shot before the bow – one of many – for the markets to start paying attention to the Fed. Monetary policies have no impact unless markets believe in them, react to them, and thus effectively implement them. But this might be a lot to ask, after the Fed has spent years methodically and thoroughly destroying its own credibility by flip-flopping wildly at every market squiggle, first on tapering QE while it was still going on and then on raising rates.

Eventually markets fall in line. And if I read Dudley’s words correctly, he is worried that markets will fall in line too late, and only after the Fed has fired some big guns to get their attention, and then it might happen all at once, and the sudden adjustment in prices, yields, spreads, risk premiums, etc. might be too brutal for the economy to digest.

At taxpayer expense, the easiest, risk-free, sit-on-your-ass profit ever. Read… Fed Pays Banks $30 Billion on “Excess Reserves” for 2017

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I see the Fed is still constructing their scary straw-man villain, “Low Inflation”. Oh dear how will they combat sinking prices without the ability to print endless money? Oh wait! That’s exactly the kind of scenario every central bank dreams of. One where they get to print, print and print some moar to save us all from low prices and affordable assets. Oh thank you Fed, you’re our hero!

The Fed’s role in the overall Ponzi is simply too small to matter anymore.

We have a rogue Ponzi, which will destroy itself when it destroys itself, thank you very much.

The Fed is a puny player, with no effect. Same is true for the entire on the books financial system. The real story is not on the books. It’s elsewhere. Wolf, write about the elsewhere.

To put it another way, the Fed no longer has the punchbowl, the Ponzi has the punchbowl.

Put that in your headline.

Ppp, you seem to have a very flawed understanding of cause and effect. Do you think the trees waving make the wind blow?

The “former” Goldmanites at the Fed and other central bankers are wholly responsible for creating these runaway Ponzi markets with their trillions in funny money and mad monetary experiments that benefited only their plutocrat cronies.

I don’t understand this — a Ponzi scheme is where money isn’t invested, it’s returned to earlier contributors from later contributors. How does this relate to the American, or world, economy?

B borrow from FED to pay higher prices to buy assets from A, C borrow from the FED to buy assets from B at higher prices. FED is unlimited since they print. None of the money is earned or saved. As long as FED prints, everybody makes money. GOT it?

Now the FED says I am no longer printing, guess what? D comes a long and buy at higher prices from C because D thinks E in the ponzi future will be able to somehow borrow money and buy from D himself at higher prices.

No inflation?

Perhaps it has slowed recently somewhat but, 20 years ago groceries were sooo much cheaper…

The same dollar that bought a 16 oz bag of chips is buying these 4.75-5 oz bags today. Hamburger was .69-79 cents per pound, today hamburger is 3-4 bucks per lb…

Let’s do the math…

Chips-up 320%

Hamburger is up 400%

Divide 20 into 320 = 16% ave yearly inflation less compounding which lowers the inflation % to around 12% annually… divided 20 into 400 = 20% on meat annually perhaps 15% inflation over 20 years…

Lying metrics and falsified data persists to benefit themselves by printing so their 1.37% borrowing rate boosts credit and lending worldwide…It is the credit engine that must be fed in order for this “Alice in Wonderland” to continue…

However, I would listen to the bond markets, they are signalling their lack of confidence in any words spoken by the fed….ie long end of treasuries not buying their BS!!!

When they did their fiscal voodoo after the financial crisis to stop the followup crash that should have happened after the Great Financial Crisis (to clean the mess up), they completely uncoupled “the system” from any form of logic (or sense). None of those “economic geniuses” with their pieces of useless paper qualifications saw the mass carnage that CDOs would ultimately do. So how can *any* action they take now be seen as anything but the blind fumblings of a confused and constipated child. They have no idea what they are doing and it is patently obvious that it is now “every man for himself”. We are back in the “wild west” of the 1920s as there is no prudential oversight at all and all the banksters are still playing their games when they should be in jail. No system acts logically when certain key components are chronically faulty. Only until the faulty components are replaced will there be any sense of a logically functioning system. Until then we will just see random and spurious actions/incidents apparently with no rational explanation.

This is how it works:

1. Banks provide funding for Economics Departments at major universities.

2. PHd economists come up with economic theories that can’t take account of credit use in an economy.

3. The Federal Reserve hires these economists.

4. The banks blow up the economy.

5. The economists blame government regulation of the banks.

6. ???

7. Profit!

I believe the only rational explanation might be that the long bond realizes that the fed is in a pickle.They can raise rates only so far before everything falls apart:So why take the losses while waiting for the fed to reverse course.

The FED with a $4T balance sheet can manipulate the long rate too. QT is just one example. How about if they inform the buffoon Mnuchin instead of floating short term debt you reintroduce the 20-year and float the 30-year bond more frequently because by end of year the FED will focus on not rolling the 10-year Note and 30-year Bond vis-a-vis shorter duration notes. If that doesn’t get his attention then the FED could change its QT policy to outright selling the 10-year Note, 30-year Bond and MBS instead of not rolling them over when they mature.

In short, let’s bend that yield curve so it expands instead of contracting. And oh BTW the dollar is losing value everyday.

Why do this besides making banks more profitable and therefore want to loan money? The issue has never been liquidity since QE. No, it has always been collateral. With that said only those companies that can borrow with a good balance sheet will and the Netflix’s of the world won’t. It gets rid of zombies and those sucking all the air out of the room.

The Fed says a lot of nonsense – blah blah blah – market participants have figured out Fed officials are compulsive liars and nothing they say means anything.

Besides, listen to what they say:

“This suggests that the Federal Reserve may have to press harder on the brakes at some point over the next few years” – guy says conditions are too loose but still not going to do much for a couple years – not exactly urgency. Sounds like a green light to borrow as much as possible on margin and buy stocks – will have plenty of time to get out.

Fed has talked about tightening for years yet somehow Fed rate is still just 1.37% and the bloated balance sheet still sits at 4.41 trillion. Sounds like a lot of talk and not a lot of tightening to me. Their excuse: other cb’s are even more loose – weak.

Jan. 2016, after a tiny rate increase, the market had a tantrum and guess what – the four anticipated rate hikes never arrived. Big Surprise! Participants in the market know the Fed has their back – they won’t let the market decline.

Besides, the U.S. is doubling down on huge deficits – cutting taxes and increasing spending – if the Fed doesn’t fire up the printing press who the hell is going to pay the government’s growing bills.

To quote Dick Cheney: “Reagan proved deficits don’t matter” inflation can (and will pay for everything). Why work to pay the bills when money can be gotten by a simple keystroke?

Dudley Do-Right always showed up just in time to rescue Nell from the evil Snidely Whiplash just as William Dudley today is just now showing up to save us from the evils of too much QE stimulation. Will he be able to rescue us off of the conveyor belt headed for the buzz saw or remove us from the rail road tracks before the train runs us over? To be or not to be? That’s yet another question.

Here is another thought. If he gets the job done we can nickname him Dudley Do-Right II. If he doesn’t get the job done we can nickname him Dudley Do-Little.

He’ll be retiring from the NY Fed in mid-2018. So I doubt “he gets the job done” in time. The thing is, he was a real dove for years, and now he sees just how far this situation has gone, and he’s getting a little spooked, and he is trying to lay the groundwork for the new Fed. That’s my impression.

“he’s getting a little spooked, and he is trying to lay the groundwork for the new Fed. That’s my impression.”

My impression is that he quit before his term expired to get out of Dodge before the new crew coming in made him go along with everything he has been fighting against for years, namely a return to free markets. No more free milk from the cow.

But wait, Bullard will always be there to come out of the woodwork on cue (3% fall in Dow) to hint at everlasting QE with more on top if asked for. Perhaps ZH or someone can create a Bullard Barometer that changes to deeper shades of green as the S&P falls with a dark green Bullard Imminent at the top of the scale.

Hi Wolf,

I agree with your notion re Dudley being a bit “spooked”. But I think he’s also seeing a parallel track of utter disregard for any of the “normal” regulatory protections. What I believe the econ people call macroprudential regulation. This lax regulatory posture of “letting the inmates run the asylum” ofter generates crises of their own. I’m thinking about Enron, Worldcom and the like.

astute it does seem that outgoing central bankers always like to put a brick in the wall of worry, and they usually redact all of their policy decisions and statements made over the years, like that wasn’t the real me.

“he’s getting a little spooked, and he is trying to lay the groundwork for the new Fed.”

It does not match reality. The legacy media’s memory span is a few microseconds, and that’s how the blame, or credit are assigned. It might be a different world if a legacy was rigorously counted.

It just might that the fed has been using the wrong matric to guage the rate of inflation.That is where the worry should lie.

Why should markets “cool it” when they know the Fed will handle any loses for them…so they’ll let profits run until direction goes negative. What have they got to lose? Maximize profits. Loses monetized by taxpayers.

Elizabeth Warren ( with AMA hubby over $10,000,000 net worth, 4 homes and counting) says

“Auditing the Fed would exhibit a lack of confidence”.

War Party Of The Rich got to stick together. And they do.

You mean the Native American Elizabeth Warren?

My mom’s family is from Oklahoma and I also was told I they were told I have Native American in me. Half of the people living in Oklahoma were told this by their parents. If you don’t know this, you don’t know Oklahoma.

Now, if Elizabeth Warren used that to get preferential treatment from her college or from the government, that’s a different story I’d be interested to hear.

No that’s not the case at all She’s just a lying politician and I’m surprised that you would try to cover for her to be honest but hey whatever floats your boat ED

“Everybody lies” – Dr. House

FRED, do you have any evidence at all that she gained from it?

If you don’t have evidence, I’d say this is a lot more about what floats your boat.

People don’t like her because she’s strident and comes off as self-righteous. That makes the whole Pocahontas thing lots of fun. But fair? My best guess is that she was being self-indulgent but that she really had been told that. Her parents corroborated it and it really is COMMON in Oklahoma, which I begin to think you know nothing about.

If one is infected with the PC virus and cannot say “Indian”, I suggest “primordial American”. Why? Because logically (I know – there’s not much of that around in sociopolitics, these days) I am a native American. I was born here.

Does anyone happen to know the context in which E Warren uttered that? The commenters seem to want to vilify her, irrespective of the fact that she’s one of the best Congresscritters.

Great post.

How about the next rate hike be .50% instead of .25%, Mr Dudley?

Wolf’s quote of Dudley may be showing us why Mr. Market does listen to the Fed:

Dudley warned:

“This suggests that the Federal Reserve may have to press harder on the brakes at some point over the next few years.”

Over the next “few years”? Few years? Seriously? Why so aggressive? Maybe Mr. Dudley should have changed that to “the next few decades or centuries.”

Stock market bubble? Fear not – for the Fed will answer that by thinking about what to do the “few years” about maybe doing with more of those terrifying .25% rates…in the “next few years.”

Or something something something.

Here’s another reason why Mr. Market does not listen to the FED :

The article above states this, “In those circumstances, the Federal Reserve has been unable to both push up the unemployment rate slightly to a level that is consistent with stable inflation and avoid recession.”

“UNABLE TO PUSH UP THE UNEMPLOYMENT RATE SLIGHTLY” ?

Lessee, I have read innumerable times that “95 million people have left the workforce” (I do not remember the date range for that) . Well then, are they not unemployed, strictly speaking ? Not unemployable, merely “not in the workforce”.

So how can anyone believe a FED, so lost in its dogma, that defines words and phrases to mean other than their common-sense meaning.

MESSAGE TO THE FED : Try speaking some hard truths and see what Mr. Market does. Like this one, “Americans should save more and spend less”, or “We have not been saying so, but our REAL goal is to lower the value of the dollar” .

I do not know if the FED is comprised of Liars or Fools or Both. It does not really matter in any case. None of them are truthful people of honor by my reckoning.

He needs to talk to Paul Volcker, who raised in increments of one percent.

To the extent that the Fed is beholden to the stock market, it is not acting in the interests of the economy.

Ironically, as an enabler,it is not even acting in the best interests of the market. Market pundits are fond of talking about ‘healthy corrections’ of up to ten percent.

But if those are healthy, their absence must be unhealthy. The higher the market goes,the harder it is to have a soft landing.

Re: the old saying from a former Fed governor: ‘The Fed’s job is to take away the punch bowl just as the party really gets rolling’

This Fed has acted like the teen- age host of a party thrown at the mansion while the parents are out of town.

Not only is the punch heavily spiked, there are some strange faces in the crowd.

Saving more money than we spend is amusing. I believe in that, theoretically. But seriously….my retirement was pilfered during Enron. After that, and all the other scandals perpetrated by the vile, greedy banksters, et al, who in their right mind even believes money can be saved? Every day these people implement policies which enable police to steal from us under the guise of stopping drug trafficking, or making it illegal to have any substantial access to what we consider “our” money. Where would YOU consider a “safe” place to SAVE money? Stock marker? Bank? Investments? Gold? Crypto? Under your mattress? There is NO SAFE PLACE to “save” money. Period. Not that the people have anything to save, mind you. We dont have a dime. The majority of us working Americans have to choose between buying food to eat, or gas to go to work tomorrow. The next emergency will destroy all of us. THAT is what tptb WANT. They have removed every method for us to SAVE, and they have stagnated the economy, wages, etc. to further disenfranchise us. Americans older than I, live in the fairy tale of yesteryear. That reality is gone. Time to apply reality to today.

The fed is irrelevant to Americans younger than baby boomers. The fed was a mechanism baby boomers utilized to ensure that THEY had what THEY needed, everyone else be damned. My entire genX life, I have known (and been told) that SS would NOT be there for me, even though I would pay into it my entire life. So I could support baby boomers. I started saving for MY retirement at age 18. The longer I live, the more pissed off I get when I listen to baby boomer brats, who have had lifelong access to government welfare, complaining about anything! Baby boomers have been the ONLY generation with lifelong access to the government benefits MY GENERATION IS CONSTANTLY DENIED! Baby boomers are the only idiots who buy into this Fed doublespeak, because it benefits their larceny of the future their children and grandchildren WOULD HAVE HAD, if they werent so damn selfish!

None of the Fed members is suggesting a retreat from their rate hike policy (none we know of) I characterize this policy as the greatest misdirection in Fed history, and apparently the market agrees with me. Should rates collapse I assume that the market would also align with my view that it is time to sell equities. I cannot explain why the market believes rates should be lower, and why when rates actually drop, the market will react negatively (if that turns out to be the case). I suppose it has to do with the correlation to what a drop in rates means to an improved economic outlook but markets follow their own rationale.

Just like Draghi said a few years ago that he would do whatever is necessary,the Fed is telling the markets that they will do whatever is necessary to raise longer term rates and break the back of the stock market rally.A crash is coming in equities and the Fed is not being subtle about it.

If the Fed raised rates to15% NOTHING would happen to the market. Cope with that reality.

The Fed would never get to 15%. The entire global financial system, its huge pile of debt, would not be refanciable. It would default. This means that companies would go bankrupt and their shares would be worthless.

All of this debt is someone else’s assets and wealth, and it would just evaporate. You cannot even imagine the kind of mayhem at federal funds rate of 15% would cause these days.

You guys are being way too dramatic about it. The Fed will move slowly with hikes in the FFR until inflation (and thus long term rates) increases in a substantial way. Core PCE remains below 2%…their hand is not being forced yet as inflation still hasn’t picked up. The last thing they will want to do is to invert the yield curve, so they will move at a glacial place, picking up the occasional 25 bps as long as the 10 year permits it..

It may even be sensible to target a 50 bps spread between the 3 month and 10 year, and adjust the FFR to maintain that.

Do you ever get the feeling that the Fed has become the victim of its own cow manure?

The US Federal Reserve is victim of two things of their own creation.

First is the idea a soft landing can be not just managed but engineered from the ground up. The idea originated in China, chiefly to try and cool off the amazing real estate bubble that country has been going through, and in the end was scrapped in favor of “more business as usual”, China style.

The Politburo most likely saw the futility, not to mention potential dangers, of popping a monstrous bubble, no matter how slowly and careful, so they decided to just forget about it outside the usual press releases aimed at gullible Westerners.

But the idea of a “soft landing” in which nobody ends up eating the losses has spread abroad and taken hold in the financial mentality, helped no doubt by the appeal of being the first in history to harmlessly deflate a financial bubble.

Second is the US Federal Reserve has no credibility left. For years every tantrum originating in Wall Street, no matter how childish, has been met with “dovish” leaks, declarations and press releases if not monetary accomodation.

This is not how the supposedly most powerful central bank in history should behave: the Fed should be above mere financial markets, let alone brokers and speculators.

Please avoid blaming the usual sinister conspiracies with their corollaries of human sacrifices, thank you.

This akin to a couple of parents having spoiled a baby rotten and then wondering why he keeps behaving like a hooligan in public despite continuous threats of punishment. The child may be a juvenile delinquent in the making but he’s not stupid: he knows that threat will never materialize.

Just like in 2000 and 2008-9, the excesses of the markets this time will also be unwound. The Fed may delay the business cycle via their machinations, but it can’t be prevented. The question is not whether or not the Fed steps in yet again with their very “visible hand” to muck things up again, but when.

History tells us that they will, to the detriment of the our nation, and my portfolio.

This time around, however, “financial markets” means pretty much every asset class (The Everything Bubble), and “the third time’s the charm” is not going to work since the Fed balance sheet wasn’t unwound in time, and interest rates are already way below the natural rate; only just above the zero bound. The lunatics are still running they asylum!

When the SHTF later this year, IMHO, once again, the financial landscape will be laid waste for the third time this century owing to a cabal of nefarious bankers running (ruining) our finances. End the Fed. Free markets and sound money.

“All the money and all the banks in Christendom cannot control credit…Gold is money and nothing else.” – JP Morgan’s 1912 Congressional testimony on “the justification of Wall Street”

“I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank. … You are a den of vipers and thieves.” – Andrew Jackson, 1834, on closing the Second Bank of the United States; (unabridged form, extended citation)

“Those who cannot remember the past are condemned to repeat it,” – George Santayana

Three:Those who drive these unhooked market believe more in Santa Claus than us.

Four:Now that I am retiring, I should have more time to read those famed alternative media rather than waste my time with legacy media.

been there for a few years, let me tell you all you learn is that there is nothing you can do. there are no alternatives which do not have a counterbalancing risk.

Everybody is blowing off the fed because their rates affect a tiny portion of the market. Their 2yr rate is 2% and mine is 60%. In the real world if I charge $100 to a store credit card and pay it off in 2yrs, it will cost me ~$60 in interest.

Hi Petunia,

I think you just solved your own problem. You need to become a bank or perhaps just a credit union. As a depository institution you could the borrow at the 2% rate you cited (overnight and uncollateralized).

1928?

And now you know why every mom-and-pop shop is offering their own credit card, their customer base is just a captive, advertising group to milk.

Opinion question:

Is there any real economy left beyond a paper speculative one?

And, for those who are still in a ‘real economy’, (producing goods and services people actually need) does it really matter long-term if this FIRE rocket ship explodes?

I get that fear/concern will stop a borderline purchase of a new F-150, and someone who lost a bunch of paper wealth wil forego the new Beemer or vacation, but isn’t that really a good thing for our values and even the environmental health of the Planet?

People will still need that new roof. Cars will still need to be replaced. Food will still need to be grown and sold through stores. People will still need clothing and entertainment.

The word ‘Reset’ is often used on Wolfstreet. Isn’t this a good thing once in awhile? I remember in a past work life I lost my aviation medical and had my pilots license suspended. It was due to numerous back injuries and the examiner deemed I was no longer fit to fly until it was dealt with. (I had kept it hidden on my yearly physical until it was no longer possible to do so). Anyway, I had a two year extended health plan that would pay a portion of my salary (55%) provided I made an effort to retrain. I did retrain and competed a 5 year degree in 2.5 years and moved on. It was the best thing that could have ever happened to me, in hindsight. It was hard on me, especially on the family, but we did not lose our house or basic lifestyle.

Isn’t it time for a forced stop in this insane rush for AI, self-driving cars, robot factories building whatever, more dodgy offshore drilling, and on and on and on?

My concern is that the longer this goes on, the fewer options we have as a Society to ‘retrain’ and/or regroup. It just seems like this thoughtless rush for growth growth growth and ever bigger stock profits is a headlong rush to nowhere; possibly even a cliff.

In our house we ‘collapsed ahead of the rush’, downsized, relocated, and have experienced nothing but benefit by doing so. I no longer understand the mass hysteria of The Market, investing, and what the Media says about it. Thanks Wolf Richter for providing this forum of insight.

Key phrase (for me) in the following quote snippet: “unjustified terror which paralyzes needed efforts to convert retreat into advance.”

From FDR’s Inaguration speech: “So, first of all, let me assert my firm belief that the only thing we have to fear is fear itself—nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance.”

I feel exactly the same way. It appears the economy is based on taking on debt to buy some asset (house, stocks) that appears to be undervalued, then selling it to someone else who buys it with debt because they believe it is undervalued, at a yet higher price of course. Then call yourself an entrepreneur and vote for Mitt Romney.

If any of these people had to do anything that actually added value to their community, they’d starve to death.

Suffice it to say there is a more concise , non-political , utterly devoid of partisan conspiracy theories as well as much simpler answer as to what the current economy and markets are based on ;

The ‘ Potemkin Village ‘ principal

Look it up if you’re not familiar with the term . But to summarize .. its all a facade up front with zero substance or reality behind it created to fool all those who see it .

So as I’ve stated many times previously .. the only real question(s) is ;

When will that impending dreaded Black Swan finally make its appearance … and what form will it take when it does ?

I am familiar with the expression and think about it often. I also like, “The emperor has no clothes” when I watch the daily news…err tweet storms.

What a shame, though. So much angst and hurt is baked in, and so many that will be affected will be the collateral damage of other’s actions.

I would be interested in reading a list of reader’s “fundamentals of a healthy economy”. We all see the looming iceberg coming with current unfettered greed and a lack of oversight and penalties.

I wonder how China would have handled the bankers behind the financial crisis? 35 cent bullet? Iceland jailed a few, but in the US and most of the world they were given the keys and Govt support for future malfeasance. And now, here we are. waiting.

Long ago, our family retreated from what used to be called “the rat race”.

Wolf allows me to publish our odyssey once every six months.

Time’s not up yet – hasn’t been six months since the last posting.

Paulo,

I think your ‘how much of the economy is actually real’ question is THE question of the era.

I also think that the only groups who have looked at the question seriously have all of the reasons in the world to keep any answers they’ve found to themselves. So I don’t think that you’ll find any good and concise answer to this question – I do however think that your question is its own answer – ie: you’re asking because the answer is substantially enough less than 100% that you actually notice it enough to ask.

That all being said, I think that the most instructive parallel that you could look at as a reference is the economy of the USSR prior to its collapse. The west, by and large, mis-estimated its size at something like 4x its actual ‘true’ or ‘residual’ size. Gaidar is a pretty interesting read and paints eerie parallels to the US. Individual results may vary tho obviously, as Dmitri Orlov likes to point out the Soviets were much more interested in measuring the production of real things in the Soviet economy (millions of tons of concrete, gigawatt hours of electricity, tons of cold rolled steel, etc) whereas in the west we’ve become obsessed with measuring everything in Dollars, or Euros or whatever, and conveniently forget that these are meant to be a claim on an underlying economic capacity of the issuing jurisdiction rather than an actual output in and of themselves.

The other elephant in the room with respect to attempting to answer your line of inquiry is energy. And, in particular, how much of ‘the economy’ is simply pulling carbon (oil) out of the ground, burning it then printing some dollars. And secondly what is the realistic longevity of this basis of economic activity during and after some sort of ‘reset’ type of event?

So I think that the answer really involves not just how many paper games are creating fictitious economic landscapes, but how much energy extraction do we assume to be embedded in the system but is, in fact, a claim that is overextended and vulnerable.

Great question and I’d love to know the answer too. My guess is that it’s well south of 25%.

Now you got uncertainty!

When the fed raises rates it feeds 50 billion dollars to the banks balance sheet? The economy is supposed to fail ? Where is my menu and can someone get this wine off my white wingtips?

Can someone enlighten me, if the FED got away with increasing its balance sheet by 4 trillions, why can’t they increase it to 10 next time the stock market goes down?

Why can’t they own everything thing in the end and micromanage the economy in a centralized way? Is there any legal constraints to prevent them from owning everything?

If they found a way to unleash QE without any legal consequences, it looks to me that the road is clear for the future, endless QE at FEDs whims, markets have seen the light and are reading the situation correctly imho.

Wolf noted in another article that Japan has a balance sheet of about 100% of it’s economy while the U.S. has a mere 23%. So why not QE $20 trillion? And we don’t know that 100% of the economy is anywhere near a “limit” or if a limit even exists.

As Mr. Smith said in The Matrix: “More!”

“The Fed has spent years methodically and thoroughly destroying its own credibility by flip-flopping wildly at every market squiggle, first on tapering QE while it was still going on and then on raising rates.”

That pretty much says it all. Saying the Fed has lost credibility is just another way of saying it has become a walking joke.

Dudley fires a warning shot? Please….

That man is a 70 pound weakling when its comes to any hard decision.

You shouldn’t expect a worm to jump 10 feet.

The market will do what it wants to do, regardless of the fool Dudley.

http://www.alt-market.com/articles/3346-party-while-you-can-central-bank-ready-to-pop-the-everything-bubble

I don’t see that the Fed ever “wanted” to tighten financial conditions, they want to normalize rates. Ex A their use of RRPO. The Fed gave trillions to corporate bonds and how exactly do you mop that up? They got out of their comfort zone and now (like 2007) debt creation (and money by extension) is out of their control. Can the Feds crash the market with interest rates alone? Market says no.

Thanks for the link.

Very good analysis and good read. There is a dose of sanity, a small dose, but it is also rather plainly stated in Powell’s phrases and word choices .

I am not entirely anti-Trump, but his claiming ownership of this stock-market insanity will surely bite him with a vengeance — and I am glad for that. In truth, Presidents are not much responsible for the economy’s booms and busts. That much is true.

AND EVEN IF THEY WERE RESPONSIBLE, it would be with a four or eight-year lag. The economy is most certainly not immediately responsive to any kind of a policy shift.

Obama did not own his vaunted “recovery” and Trump will not really own the coming crash. Not really.

“Even though the FOMC has raised its target range for the federal funds rate by 125 basis points over the past two years, financial conditions today are easier than when we started to remove monetary policy accommodation.” — William Dudley

One should not expect macroscopic effects from microscopic causes.

To start the FRB should gradually raise the margin requirements for securities and commodities trades [including FX] from 50% to 100% over the next 180 days, and require reporting of, (and possible restrictions on) securities backed loans [SBLs] on the books of their (and FDIC/COC) tp regulated banks to limit speculation/gambling.

Then the FRB can start gradually (over 90-270 days?) increasing the discount rate to a more normal level as well as forcing the interest paid on bank deposits to a more normal/reasonable [3 to 5% inflation adjusted?] rates. NO MORE FREE MONEY!!!!!

Here are my two pennies:

– Among PD professionals, it is accepted that banks (at least in Europe) are dying and that corporate credit will be taken over by PD funds.

– PD funds tend to be very influenced by Anglo-American laws/rules/mindset (as finance in general), whose mindset is very aggressive in comparison to the European one.

– The managers at the helm of PD funds do not tend to worry so much about interest rates in the banking sector. I think there is already quite an established market for PD funds, a market which is more advanced in the US than in Europe. Furthermore, the compensation structure of a PD fund incentives a PD fund manager to invest even if the credit worthiness of a company is not what one should/would expect.

– I was reading a study some weeks ago about how the dry powder of PD funds worldwide is estimated at USD 7.7trillion.

What I am trying to say is that, from personal experience, I am not sure how important interest rates for credit generation are these days. Since banks have restricted lending for years now and PD funds do not seem to be affected much by interest rates (rather by dry powder), I am not sure how central banks can restrict markets these days and tighten credit conditions. It is true that were interest rates to rise, LPs would not put money anymore into very risky PD funds. However, given the leverage ratios right now, central banks cannot act too swiftly so even if they did start raising rates, it would take a long time until LPs choose a “risk-free” bond over a PD fund which promises 8-10% return p.a.

I agree that the overall picture is bleak and personally am not very optimistic about credit or the economy in general. I believe that the negative consequences of past actions are so advanced, that by now there is nothing really left to be done, but be prepared for the next crisis. What the FED and all other central bankers are doing is but window-dressing, so that when the crisis come they can say “We did all we could”.

“We did all we could”

When have they ever gotten it right? Hopefully this time is different and these psychopaths aren’t allowed their overused plea of insanity.

My opinion is that the statement is more of an excuse if/when they get sued by anyone.

Sorry I have no idea what a Professional Development Fund is

Apologies for the confusion. “PD fund” stands for “Private Debt fund”.

“When the Fed raises rates, its explicit intention is to tighten “financial conditions,” ”

Does this account for $30B reward to banks for not lending?

That’s in a category called “extra profit for the banks,” a very different category than “tighten financial conditions” :-]

Here’s a history of mortgage rates since 1971. Since 2013 the average mortgage rates for each full year has gone from 3.98% in 2013 to 3.99% in 2017.

When the Fed starts doing interest rate increases that DO affect mortgages rates by increasing them, then maybe Mr. Market will pay attention. Until that point, maybe the Fed is shuffling very slow down at very speed an indeterminate gray area or Twilight Zone it must pass thru, before it enters the zone that impacts mortgages and long term borrowing.

http://www.freddiemac.com/pmms/pmms30.html

Thanks for the link

I can’t wait, though I know it will never be allowed to happen.

We desperately need overvalued homes to take a 50% haircut, otherwise renters will never be able to afford to buy a home. I make a very good income but the median home price in my neighborhood also just hit $1M, and I don’t know anyone with $200k – cash – to plunk down on a house.

Higher rates —> sellers have to accept lower prices if similar affordability is to be sustained. Unfortunately, even more than lower stock prices, lower home prices will NOT be allowed to occur. Too many NIMBY boomers are caught up in the paper wealth of their wooden boxes…

Let me recite a story from this afternoon, I decided to walk to the corner store for pop and crap I shouldn’t have bought. Many SUVs and big trucks going by, debt laden and too high priced, no credit, bad credit, no problem, while my free and clear vehicles sit in my garage. Get to the store, lots of people, nice jobs you got there, what telemarketers and restaurant workers, etc. everyone in front of me bought cigarettes or alcohol or lottery tickets or two or all. Our great economy, yeah right. The Feds should just get out the big gun and end this charade, it’s already over. Yes, I’m retired and this is 2 in the afternoon.

Hilarious

Corner stores are not a great place to get a look at the whole economy. They *are* a great place to get a look at how the bottom 30% spend their money and yeah, cigarettes, swishers, those little roses in the little glass tubes, “The Bomb” burritos, enough soda pop to float the Queen Mary, yeah, you’ll see people spending money on the most ridiculous sh!t.

That’s how these people spend. It’s almost like, they see money as something that will evaporate unless they turn it into things, even stupid things, right away.

We’re looking to downsize and have made a couple of offers on homes last week.

We’ve been outbid 5% over asking price. This is not San Francisco. This is Boise freaking Idaho. I’m waiting for this madness to stop and things to calm down before home-shopping again. I like my current home.

Who are all these people tripping over each other to pay tens of thousands over asking? And why? What about comps? Appraisals? No one seems to care.

Maybe Boise Idaho is the site of the next Amazon HQ.

“When the Fed raises rates, its explicit intention is to tighten “financial conditions,”” This time around, I would argue that while this may be their intention, this is NOT the message the Fed is sending, particularly given the prodigious excesses of money creation of the last 10 years. Instead, the message the market is receiving is the following: We’re simply moving financial conditions from HISTORICALLY AND RIDICULOUSLY easy, back towards normalcy. Furthermore, given these excesses, we’ve barely begun the (rightful) move to the range of 3% or so on short rates, and 6% or so on long rates that many market participants expect. IOW, the meteor is still far out beyond the sun.

Treasuries, like gold, are calling BS on the Fed’s incessant jawboning about supposedly pending rate hikes and tightening.

https://www.marketwatch.com/story/2-year-treasury-yield-pushes-above-2-for-first-time-since-sep-2008-2018-01-12

Read the article that you linked before you post this nonsense. It says that the 2-year yield hit 2%, the highest since 2008. Shorter-term interest rates, like the 2-year yield, have jumped in recent months. The 2-year yield was barely above 0% not too long ago. That end of the market hears the Fed loud and clear about rate hikes and is reacting to it in lockstep.

If you want to use an example where markets are blowing off the Fed, you should cite something like junk bond yields, which are extraordinarily low.

“If you want to use an example where markets are blowing off the Fed, you should cite something like junk bond yields, which are extraordinarily low.”

Agree. My hunch is that high yield will blow like oil did a couple of years ago. Nothing … nothing … nothing …. kabloooowheeeee. Oil looked solid and certifiable dummies actually believed growing oil prices equated to a growing economy. Then came supply and demand. High yield will eventually react the same way to high rates. Equities will probably follow at he same time.

Hopefully, the Fed will treat it as a liquidity event (no ioer for example will keep credit flowing) as opposed to a need for a new TARP or QE.

Then, afterward, junk euro rates will look a little suspicious. All they’ll need is a little excess vibration. Then comes some EU intrigue. Kind of like dominoes.

With the dollar falling while short term rated are at multi-year highs, I think the dollar has lost its #1 reserve currency power. This means higher rates are needed to stabilize this decline. Positive, real rates could be the only way to get global investors to stay in dollars.

This refrain is so familiar. Remember the dollar prior to the big crisis. Long term and short term rates were super high back then comparatively, and yet NO ONE wanted the dollar including Super Models who demanded to be paid in pounds or euros. Once the crisis began, all everyone wanted was ….. dollars.

Best pay attention to who buys US Treasuries. China said they were not going to buy more (rumor?…I don’t think so). So what happens to bond interest when nobody wants to buy US bonds…the FED buys them…interest rates shoot up…FED has to pay lots of interest…US economy goes boom.