A blistering boom, backed by $4.3 trillion in bank loans, ends.

In the era of the never-ending “Everything Bubble,” where asset prices can do only one thing, namely surge, it might come as an unwelcome surprise: Commercial real estate prices had their first down-year since the Financial Crisis, according to the Green Street Property Price index, which ended December 2017 at 125.96, a notch below its level a year ago (126.66).

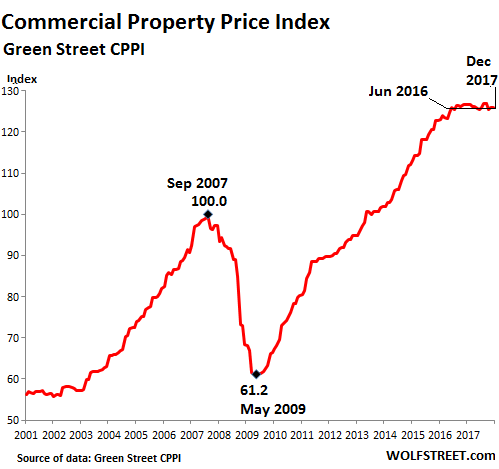

The index is flat with its level 18 months ago, in June 2016. This is when the index began to plateau, after a huge surge that pushed the index up 106% from May 2009 and leaves it 26% above the peak of the prior crazy bubble that imploded with spectacular results.

Even after inflation — according to the Fed’s favorite measure, core PCE, consumer prices have risen 18% since May 2007 — the index is significantly higher than at the peak of the prior crazy bubble.

This chart of the Green Street Commercial Property Price Index shows the phenomenal eight-year boom that has now been teetering at an uneasy plateau for a year-and-a-half.

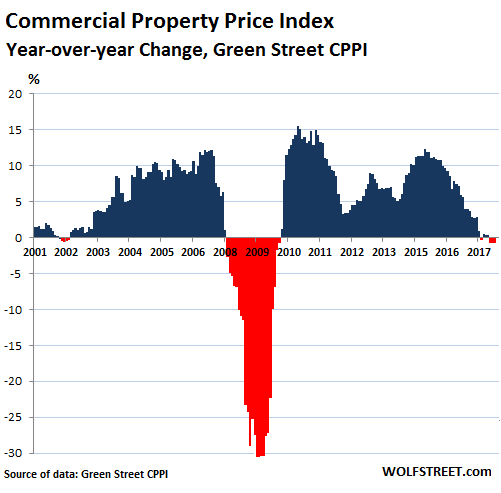

The chart below shows year-over-year percentage changes of the CPPI. Note how enormously volatile CRE prices can be when the math doesn’t work out anymore (red columns), or when enthusiasm reigns (blue columns), with double-digit year-over-year price plunges and surges being part of the deal:

Commercial real estate is highly leveraged, backed by $4.3 trillion in bank loans, as of November 2017. Much of this debt is held by smaller banks with less than $50 billion in assets, concentrated in CRE in their local markets. And these banks are less able to withstand shocks to collateral values. Boston Fed President Eric Rosengren has been fretting about them for a while. The “significant decline in collateral values” of CRE was one of the root causes of the Financial Crisis, as he said in a presentation on the topic.

The CPPI is based on estimates of private-market value for REIT portfolios across the five major property sectors of institutional-quality commercial real estate, according to Green Street Advisors.

It was a mixed bag among the sectors.

Brick-and-mortar retail space is hurting. The index for strip retail fell 3% in 2017, and the index for mall prices dropped 11%.

Self-storage, formerly a white-hot sector, having surged 180% since the trough of the Financial Crisis, has turned cold after an onslaught of new supply, and prices are down 2% for the year.

Lodging took a 12% plunge that started in 2015 and never recovered. In 2017, the index rose 2% from the beaten-down levels in 2016. Lodging has been under attack from an invasion on its turf by home-sharing rentals, such as Airbnb. Even at its peak in 2015, the index barely hit its peak before the Financial Crisis, before dropping again. It is now down about 10% from its 2007 peak.

Industrial is hot. The index rose 9% for the year. Industrial includes warehouse space for “fulfillment centers,” as Amazon calls them. They are in demand, not only from Amazon, which has been leasing them around the country, but also from other logistics and retail companies involved in the online retail boom. This is the irony of online retail: it involves a lot of “brick-and-mortar” facilities, but they’re warehouses and distribution centers instead of malls.

The apartment sector is still hanging on by its fingernails, with prices up 1% for the year, but down a smidgen from their peak in early 2016, at which point the index had surged 40% above the bubble peak in 2007.

The office sector index rose 3% in 2017, a far cry from the price surges in past years.

Healthcare is up 4% for the year as the supply of healthcare facilities is sprouting everywhere, and as the industry takes up an ever larger slice of the economy.

CRE is now facing rising interest rates, in addition to unique challenges for each segment, including a flood of new supply of high-end apartments in some markets, such as in Seattle, oversupply in the self-storage segment, a surge of home-sharing in the lodging segment, or the inexorable structural shift of retail from malls to online – and often enough by the same retailers.

Retail sales are doing well, powered by online sales. But brick-and-mortar retail is struggling. On a daily basis, the details drive it home. On Thursday, Walmart suddenly closed 63 of its Sam’s Clubs. Some of them will be converted to fulfillment centers for its online operations (see “Industrial” above). A few days earlier, Sears had announced more store closings, as had Macy’s. But Walmart and Macy’s, along with many other retailers that want to stay relevant, even as they’re shrinking their brick-and-mortar footprint, are investing heavily in their thriving online platforms. Which is of no help to mall owners.

So what the heck had gotten into Walmart? “This is how fly-by-night companies operate.” Read… Walmart Suddenly Shutters Numerous Sam’s Clubs without Notice, 11,000 Jobs Impacted, Chaos Breaks out on Twitter

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It will take global QT to bring junk assets down to earth and even below ground. Some of these malls that have been vacant for years are floating on a sea of QE. QE needs to stop, junk needs to sink.

Sell your overpriced bubble real estate and get yourselves some physical gold and/ or silver Yourll thank me later

Problem is nobody out there is stupid enough to pay the asking prices. They’re all standing around watching real estate prices fall. Just like we are.

Online sales make up around 8-10% of total retail, and Amazon makes up around 4% of total retail. So it doesn’t matter how “hot” those are, they cannot make up for the 90% dropping by double digits.

No way in Hades is retail doing well, not a chance. With thousands of stores closing, not for one second do I buy the narrative that sales are good. The govt lies, as does the media.

Wow, shocker huh?

Just the fact that the percentage of working age people is at a near record low and the velocity of money is in the crapper tells me the true story Things aren’t good for the majority Perhaps the upper West side and left coast nuts are doing well but not so much for everyone else (except you of course Wolf)

People who think the government lies usually think the Super Bowl is fixed. Please don’t be one of those kinds of people because I have bet on Minnesota to win it all. Also, Sears and JC Penny are not doing very well in the West.

Who’s to say the NFL doesn’t want the Patriots to lose for a change? Unless you’re saying they really want Philly to make the Super Bowl, but I think Minny finally winning one is a better story.

People keep saying it because they WANT to believe it. Here is reality:

1. Remove e-commerce from total retail sales: leaves 90% non-e-commerce retail.

2. Remove retail sales that are “online proof”: gasoline sales, auto sales (23% of non-ecommerce retail), grocery sales, restaurant and bar sales

What’s left = 45% of total retail.

That 45% of total retail is under brutal attack from online sales. And online has already gotten over 20% of that, and in some sectors a lot more, and in other sectors just about all of it. Department stores are dying (sales peaked in 2001 and have declined ever since), music stores have already died, bookstores are in deep trouble, toy stores are dying (the switch to apps and video games are killing it in addition to online plastic-toy sales). And so on.

These dying sectors dominate malls. And that’s what mall-focused CRE is dealing with.

The only reason I want Tesla to succeed is so they would kill the auto dealership model and bring car sales online and direct from the manufacturer. Dealerships should be replaced by authorized service centers. I don’t know why this has never materialized. It would make the experience so much better to not have to do with middlemen for sales or service.

Your scenario will happen when self-driving cars become a force. Manufacturers (including GM just a couple of days ago) are now saying that they will own the cars, dealers will service them, and consumers will pay for their use when they need them.

Since there is no vehicle sale involved, this model gets around state franchise laws that have protected dealers. And it cuts out all the middlemen for the manufacturers.

These servicing dealers don’t have to have huge lots for inventory. And the used-vehicle trade may deteriorate as well.

This is still a few years away. But as far as brick-and-mortar meltdown is concerned, it looms ahead.

Wolf – I’d like to say I’m doing my part to kill brick-and-mortar retail but really, it’s a case of suicide rather than murder. I buy things on Amazon because they can’t be found locally. I’m in a pretty major city, San Jose, and in the midst of smaller cities, making up a large metropolitan area, and when I go to the local music store and can’t find Max Schlossberg’s book of daily trumpet exercises, a book that’s considered essential, well, OK I order it on Amazon. Oh, and the local music store sells Getzen trumpets but they don’t sell Getzen valve oil, which I happen to consider to be the best. Mayyyyyyybe if I rode the train (and then took a cab or something) I could buy Getzen valve oil from the other Getzen dealer, and maybe not. So I’m really glad to have Amazon.

You’re not the only one. I’ve gotten really frustrated wasting a lot of time trying to buy things at local stores. The internet is just so easy, and it has everything, any model, any size, any color… If someone makes it, you can find it on the internet. That’s not the case at the local store.

You’re feeding the giant squid.

Try EBAY….it’s full of entrepreneurs.

You’re absolutely right.. I’ve been buying DVD’s from The Teaching Company because you are never too old to learn but I wait until a 90% off sale because they are so expensive. I tried Amazon and did find a few savings on used DVD’s but some prices were actually higher than The teaching Co.. E-Bay has a huge long list of former students selling what they no longer need. Exmp. Teaching Company 70% off sale on a chemistry course is $80 bucks, a little higher yet on Amazon but I just bought it from E for $24.50 including shipping and the seller claims is new in the box..

Most likely “lie” is too strong a word, as it is not a lie if you really believe it.

The problem is the “separate reality” and unique perspective many of these people who are making the fantastical statement have. In other cases it is simply one careerist telling another careerist a little higher up the food chain what they want to hear, under the policy that we’ve always done it this way.

Of course any organization that starts believing their own press releases is doomed.

What is the overall market value of CRE in the US?

It doesn’t matter what the overall value of CRE is. The only important thing is that:

QE needs to stop and asset junk needs to drop.

– QE has already ended (in 2014, remember ??).

Only in the US. The other 5 major central banks are still printing an estimated $3.6 trillion per year and much of that is supporting the US bond and stock markets. The Swiss central bank has been reportedly buying FANG stocks by the millions of shares. The ECB is supposed to begin a mild tapering this year.

The blight of new commercial real estate and apartments cannot end soon enough. It’s too late as there appears to be years of supply in process.

New commercial real estate ? What a ridiculous notion that is Maybe some of it can be converted into precious metals vaults

A philosophical musing. (I’ll understand if you decide not to print it.)

I’m an old guy so economically speaking I no longer count. At my stage of life I’m getting rid of stuff rather than acquiring more. One of my regular weekly activities is the trip to the transfer station (I still call it a dump) with a trunk full of junk. For Christmas I bought no gifts, gave the kids and the postman cash, took the family out to dinner and donated the rest of the money that I would have spent in days past to charity. Other than food, gasoline and medical services, nearly everything I buy, and it doesn’t amount to much, comes from Amazon. I don’t particularly care for Amazon, but I realize that’s where the world is today.

The experts make the point that our economy is driven by consumption fueled largely by debt. I think that’s unfortunate. I was born during the depression and grew up during the 40s and 50s when production, initially for war and then for peace, was expanding enormously. We had saved the world and now we were rebuilding it. I was proud to be an American. So were most people. Life was not easy but it was good.

Its hard to see how we will get back to those days from where we are now.. Not in my lifetime, I guess. But hopefully eventually…….

I’m in downsizing mode as well, first out of necessity because we needed the cash, and now because housing is too expensive. I don’t buy anything I don’t absolutely need and then I buy the best I can afford. I have taught my son that expensive is a function of utility. If you pay $20 and never use it, it is too expensive. If you pay $100 and use it often, it is cheaper.

This Xmas every gift in the family was something we needed and knew would get used. Yes, I needed a bottle of perfume. We also budget for a nice Xmas family dinner out.

What Amazon has really done is it made online shopping a reliable experience. They made consumers comfortable with the online shopping experience. They set the standard and it is a good standard. I now buy more online from other vendors because of Amazon.

Brick and mortar retail isn’t dying because of Amazon. It committed suicide with bad service and bad security. I keep coming back to this point and it keeps getting dismissed. I don’t want to go to the mall because it is no longer an inviting experience. This is true from the luxury to discount stores. It is unusual to find a truly helpful, knowledgeable person working there, when you can find a salesperson at all.

It’s only been 24 hours since I wrote this last post and my local mall is closing a few more stores. They include the Gap, Banana Republic, Gymboree, Johston & Murphy, Godiva, and at least one local business.

This is all in the good mall.

Yes sir, I believe we will get back to those days. I’m sincerely hoping we don’t have to repeat the 1940’s but the 1930’s are going to make some sort of encore. I just don’t see how they can’t!

Cheap money has cheapened everything else in life. It has enabled a disconnection from reality never seen before. When it runs out – or at least tapers off substantially – it won’t be all bad things that come back.

The 1940’s came as a consequence of the 1930’s. You can’t get one without the other. The only difference is that Murica might be on the wrong side of history now.

+10

I am at the same stage.

That whole self-storage space boom always puzzled me – seemed like it may have had to do with all those companies being REITS and gaming the tax effects somehow for their own benefit rather more than anything to do with the actual laws of supply and demand.

The stocks of those storage REIT companies (EXR, CUBE, etc) always tended to do quite well recently when similar yield vehicles were hot. Made me always chalk that up to the rampant financialisation of everything.

Or is it rather that Americans just buy so much utter crap and actually need all that storage space? Not an anti-US intended comment. Legitimately wondering.

I knew a ver eccentric guy in Southampton NY He just kept buying stuff on eBay and filled two storage units with the crap He was losing his house to foreclosure last time I heard back in 2009 He had a true psychological problem no doubt I think his monthly bill was over three hundred dollars

The storage places don’t just make money from renting out space. They also make money from auctioning off the contents of storage units, if they stop paying rent. There’s even a tv show about people who buy and resell this stuff. We have become a nation of hoarders and scavengers.

In some areas there are restrictions as to what type of business licenses can be registered to a private residence. Storage units are a way around that, people use them to register businesses to.

Also Public Storage bought out a lot of companies. The properties and customer service declines heavily once they do, rents get raised over and over.

We know that America is suffering from an obesity epidemic. ( Eat, drink and be merry for tomorrow….. ) At the same time hoarding has become a recognized psychological condition. Results: signs on seats in public places that say “not over 300 lbs” and a countryside littered with storage units….. Sad.

I think a number of storage units are being rented by people who have lost their homes and refuse to give up everything, as well as people who are now living in their vehicles and RVs.

Colorado kid You May be right about people who are living rough It’s a sad commentary on the so-called recovery isn’t it Supposedly even people with two jobs can’t afford Shelter Very sad and pathetic actually

Enrique – the guy I work with was spending $1000 a month on storage before I found him this place (our “old” shop). We’re now moving into a space 2X as big, our “new” shop. The guy just accumulates electronics junk like you’d not believe. At least we’ve made his junk-collecting propensities into a business.

But what’s funny is, he’s recently been getting a bunch of stuff (like 150 lb+ Eimac tetrode tubes like maybe Voice Of America would use for their transmitters) from a guy who seems to have the same junk-collecting superpowers, but doesn’t have the ability to sell stuff. So he just gives it to my business partner with some hope of getting a share of whatever it sells for. But the guy is renting a bunch of storage units, and is easily spending what our “new” shop rents for, about 2 grand a month. My friend and I agree the guy’d be better off just renting a commercial space like we are, that he could get into 24/7, he’d have a big roll-up door, etc.

But people are just in love with storage units in the US. Over the past year I’ve rented small storage spaces for a month or two at a time, and everyone I know seems to have a storage unit somewhere – generally full of stuff like furniture and knick-knacks that they’re convinced are worth all kinds of money (and are not).

Keep in mind the American saying: He who dies with the most toys wins.

The melt up in CRE prices in the US is different in every submarket. The big banks have favored loans on properties in the gateway cities because the Credit Officers believe there is more liquidity in these markets. As a result, developers took the credit and built the products like class A apartments and high end condos. While the gateway cities are currently having a bit of correction in pricing, many smaller growing markets are still playing catch up with demand.

The good news is the developers have more skin in the game in this cycle compared to 2005 to 2007. While market forces will bring prices down in some submarkets, bank balance sheets are so much stronger than in 2007 and I do not expect a meltdown in the US CRE space.

Been watching my old (CITI) bank branch, closed two years ago sitting empty all that time. Finally someone came in and they are putting a new front on the building. As I understand some CRE mall covenants are written in such a way that a certain property can only be a bank. They closed Famous Daves, and that has been empty over a year. There is an old car dealership, more than ten years vacant, near me. If I didn’t know better I would say we are in recession.

Ambrose Bierce –

BINGO! Go to the head of the class!

Another who has come to the same conclusion.

The subject of this article is another basic fundamental.

To add to all the others that are screaming the same thing.

RECESSION.

Literally all the fundamentals, financially and politically/militarily, point in the same direction. Except those that report sunshine, lolly pops and cotton candy for all. Put out by the “Department of Information” to keep the sheep in line, so as to be shorn of their last remaining wealth.

as a rejoinder I might also suppose that markets feel we are in a recession and that the recession is ending. Fed raises rates, GDP and inflation turn a bit higher, the storyline for investors: it was a mild recession and now its over. all it would take is for the Fed and some economists to make their case but why, the markets are making it for them. (and mild recessions become mild depressions)

Yes, an old adage also says that markets ride the escalator up, but take the elevator down.

Markets are always most optimistic, at the blow off tops.

Self storage is a product of save it for use later on thinking. And later on never arrives. It is also a product of throwing it all in boxes and dealing with later, which never arrives, or only after getting tired of a monthly payment. A lot of storage is also small businesses using it to surge inventory.

I find that out of sight and out of mind is financially deadly, but a lot of America lives in this fashion.

This I type as I look at the heaps of stuff awaiting sale on my dining table. That is after the giant cull that took place during the holidays of donations and real trash- with more to go.

Someday this war’s gonna end…

A guy down the road from me had a storage pod out front on his property for over a year. I used to call it an addition.

Moving is a great opportunity to downsize. Problem is, Americans are moving at the lowest rate since it has been tracked. That also limit social mobility and depresses wage as people are afraid to move to seek out better work. So they just keep hoarding crap and stay put.

It’s been my observation that people “aren’t moving for a better job” because 9 times out of ten the hiring corporations automatically reject out of state applicants, which is very easy to do with an ATS (some companies even program their ATS to reject local applicants with addresses beyond a certain mile radius). I applied to loads of out-of-state jobs but couldn’t get even a phone screening despite my stating in my cover letter that I don’t require relocation assistance. Once I applied for a job at Nvidia in CA; after two months they re-advertised the job, so sent them an email asking what kind of game are they playing, I got a reply from some girl in HR saying I was disqualified because I was out of state and they don’t offer relocation assistance (so she admitted they never even read my cover letter).

Not only finding a job but getting an apartment, buying a car, anything at all that you have to do in a new location is very difficult without a local address and a local phone number.

When I came to the Bay Area I rented an apartment that was owned by the same company I’d rented from for a few years in Newport Beach. It would have been much more difficult otherwise. I rented a car for a couple of weeks, then bought a cheap Saturn Ion once I had the local address.

I had a great deal of trouble dealing with anyone until I got a local phone number with the proper local prefix.

The moral of the story is, unless you’re doing it by transferring within a large company that has a branch where you want to move, you’re better off just moving to the area you want to move to and then find a job (if you can).

Just a thought

When you move you lose your informal support network and extended family. This mat not be a problem for a single person, but may be a serious social/financial obstacle to relocation for a family, for example child care.

This shows yet again the risk of making lifestyle choices based on financial criteria without including *ALL* the costs, and the social, cultural, recreational, etc. costs. may be even higher.

As Alex already said, people should move and then find a job. Trying to find a job and then move is not going to happen unless a company is desperate. But if you move – I’ve done it several times – it shows initiative and they’ll more likely hire you. You get to know a new place to boot. Companies and especially HR people are lazy. They don’t want to deal with out of state people.

Due to a 2 month delay with our condo closing we had to rent a storage unit at $350 per month (10’ x 20’) for all our stuff. We moved into the condo 2 days before Irma hit and downsized the storage unit to 5’ x 5’ at $63. Plan to be completely out by March 1 (6 months).

To rent at most places in South Florida requires auto deduction from your credit card. I assume the self storage business here must be pretty profitable…as rent money is guaranteed except for possibly fraud.

Renting a unit due to a move-in crises, is a lot cheaper than paying moving company storage rates. It’s great if used for a temporary purpose.

On the other hand, we do know a guy here who has rented a large storage unit for over 10 years…his wife estimates over $25,000 spent so far to store collectibles!!

Wolf Street Readers are the best!

Where will I go when it all goes down?

There are only a few of us left now….

Never underestimate the power of the media. if it’s on a screen somewhere they will believe it

That’s all you need to know

– I see here a relationship with the low interest rates since say 2007. People are engaged in a game called “Chasing yield” and thought that Commercial Real Estate would provide that yield. Same story for residential real estate. Hence the building frenzy in e.g. Seattle. And now it’s all about to go south.

So Wolf, I recall that ENRON in it’s time could report future prospective profits as current profits and gain value by mere speculation. Is this practice still legal? We are looking at the data, but I fear it’s tailored. How accurate are the reports and the data we get? Let me rephrase this one…how to you know what we see is what actually is?

If you look at Carillion’s financial reports (which I did this morning), they’re pretty rosy, even the last one which came last fall. But also, they’re trying to bury the essential data underneath all the nonsense they want you to read. I’m not familiar with UK accounting rules, but that rosy report three months ahead of the liquidation tells me that UK’s financial fraud investigators ought to look at it.

On your chart : after a zigzag up, from 2011 to 2015, leg 3

down started.

Leg 3 is usually the longest & most powerful.

Since 2007(H), it’s a-b-c down. leg a down = 2009(L), leg b up = 2010(H), leg c, the final leg down = incomplete.

Since 2010 peak > 2007 peak, it might end up under 2009(L).

At a future bottom, expect a long trading range. Doubt the index will move up in a V shape.

We marched today in Seattle for MLK Day past shuttered grocery stores waiting for Paul Allen’s wrecking ball at 23rd and Jackson and then northward on 23rd past all new and expensive apt. and condo complexes and then westward on Olive to Westlake Park in downtown Seattle past either new construction or 4×8 signs telling of some new high-rise just waiting for an excavation crew and a crane if one can be found.. This year beside the traditional NAACP folks came BLM and every socialist banner known.. I have given up trying to gauge crowd size but it stretched for many many blocks and all of it was tightknit to keep it from spreading beyond the powers of the police to keep traffic from jamming up.. When the crowd got to the police station on Pike St. a solid 10,000 took the knee right in the street. At some point this real estate bubble along with all of the other bubbles will pop and if the bubble makers think that this time the bailouts will save their butts just like 2008-09 then they should have seen what I saw today in the streets of Seattle. Any President, Senator, or Congressperson who hints at a bailout when this mess implodes will be run out of town..

Hopefully that’s the case, but I have little confidence in Average Joe’s ability to understand financial matters and bailouts. His desire to understand it is even less.

They were smart enough to know that bankers got bailed out and homeowners were not.. Smart enough to know that QE was used to ramp up Wall Street but actual shovel ready jobs were just a step too far.. They are all cognizant that cheap money has allowed connected developers to completely change an entire city and all of it directed toward those with money but it looks like they may have overshot and possibly by a very wide margin. With all of the QE and artificially cheap money we have had nowhere near the inflation all of that money should have fueled because little of it went to those who would have spent every dime just trying to live.. There has been little velocity. Wages have been depressed by a number of factors which does benefit whatever business that can get away with paying as little as possible but that is fatal to the whole, as in no customers, but no business ever sees itself as part of a whole.. Once the bubbles start to pop they will. From what I’ve seen and heard there is a seething anger across all lines and classes and this in a city that is supposed to be rich. It is for some..

Seattle needs those apartments and condos though. Houses are so expensive around the city because there’s not enough cheap places to live in it.

About Seattle….. We rent a house (family of 4) and our lease came up last June and it’s $600 lower than last years lease. We’re in Wallingford.

But according to your IP address, you’re in Sweden?