Tripped up by “eroding affordability and persistently low inventory.”

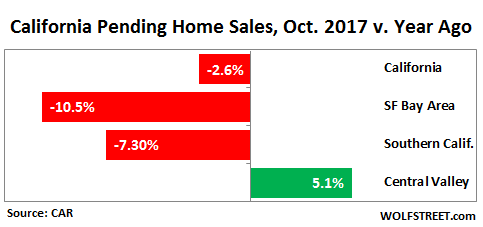

Pending home sales in California, based on signed contracts, fell 2.6% in October compared to a year ago, the fourth month in a row of year-over-year declines, after having dropped 6% in September, 3.5% in August, and 2.6% in July.

“A continued scarcity of housing inventory, which drove up home prices, may squeeze the market heading into the closing months of the year,” explained the California Association of Realtors (C.A.R.) in the report.

Of the three major regions, only the Central Valley booked gains.

San Francisco Bay Area: Pending home sales dropped 10.5% year-over-year in October, after having dropped 10.8% in September, 11.6% in August, 11.5% in July… the 13th month in a row of year-over-year declines. In the two counties that make up the core of Silicon Valley – the counties of San Mateo and Santa Clara – pending sales plunged 10.9% and 21.4%! San Francisco County was “the anomaly,” as the report put it, with pending sales jumping 15.1%.

Southern California: Pending home sales fell 7.3% after having fallen 7.1% in September, and 3.8% in August. In July, they’d still inched up 1.4%. The counties with the sharpest declines were San Diego (-11.4%), Riverside (-14.0%), and San Bernardino (-10.4%). But year-over-year declines also hit Los Angeles (-4.7%) and Orange (-4.9%).

Central Valley region: Pending home sales rose 5.1% year-over-year, driven by the 6.6% increase in Sacramento County, where pending sales had plunged 16.8% the prior month.

As the sharp reversal of the Sacramento data from September to October shows, pending home sales can be volatile. But if they start pulling long enough and hard enough in the same direction, they’re an indication of what actual sales might look like over the next few months. In the Bay Area, pending homes sales have been plunging in the double digits for months. And even Southern California is no longer immune.

What’s the biggest concern among brokers?

- 44% cited “declining housing affordability/inflated home prices/rising interest rates.” The interest rate concern is fascinating because 30-year fixed-rate conforming mortgages are still quoted below 4%, which is historically low.

- Another 30% of brokers cited a lack of available homes for sale as their biggest concern.

- Others cited “a slowdown in economic growth, lending and financing, and policy and regulations.”

In a separate report on sales and median prices of single-family detached houses – not including condos and townhouses – C.A.R. blamed the decline in actual sales of houses (-3.4% in October compared to a year ago) on these factors:

As we enter the fall home-buying season, we’re seeing signs of the market slowing as eroding affordability and persistently low housing inventory cut into home sales.

Moreover, the looming tax reform bill that eliminates important incentives that help first-time homebuyers and existing homeowners will only further adversely impact the housing market.

The statewide median price – half sell for more, half sell for less – of single-family detached houses declined for the second straight month in October to $546,430, after a record August, and remains up 6.1% from a year ago. Active listings dropped 11.5% from a year ago:

Since the beginning of the year, active listings have declined by more than 10% every month, and the number of available listings for sale has trended downward for more than two years.

At the current sales rate, unsold inventory dropped to 3.0 months’ supply in October, down from 3.4 months’ a year ago.

And the median price of single-family detached houses (not including condos and townhouses) has reached these levels, according to C.A.R. – the craziest ones in red:

But these are the median prices for single-family detached houses only. Condo and townhouses are not included. And that makes a difference. For example, in San Francisco condos outsell single-family houses by 60%. The median house price soared 13% in October year-over-year, to $1.59 million, after a record number of luxury home sales. But the median condo price fell a smidgen year-over-year to $1.13 million as a flood of new supply has been coming on the market [read… San Francisco House Prices Go Nuts, Condo Prices Stall].

Across California, listing prices of the homes under contract got cut more often: In October, 32% had their listing price reduced, up from 26% in September.

Sales above asking price have declined, and sales below asking price have increased:

- 23% of pending sales were above asking price in October, down from 29% in September – at an average premium of 9%.

- 46% of pending sales were below asking price, up from 28% a month earlier – at an average discount of 12%.

- 30% sold at asking price, down from 43% a month ago.

What gives? After years of surging prices, buying a home has moved out of reach for many households. And existing homeowners who have trouble moving up to a nicer place don’t put their current homes on the market. Hence the tight supplies of houses – but not of condos. This is causing some shifts in the dynamics of the market, with the condo market already showing signs of weakness in the pricing arena.

How much have home prices in Silicon Valley surged beyond the prior bubble peak? And by how much have household incomes inched up? Read… The Cities in Silicon Valley with the Biggest Housing Bubbles

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The recipe is in. Without the FED the housing market is living on borrowed time. Low down payments and credit scores with the government purchasing up to 70% of all originated residential loans? We are seeing a bubble of epic proportions. As the air leaks out of the balloon it will be a market of overpriced residential real estate with stagnant income growth and over leveraged consumers. There is inflation everywhere despite what the carefully massaged government numbers show. Rates will rise, economy will slow and the process will start all over.

Inflation is rampant and every where. BUT not just the the shrinkflation is off the charts. When my children were small I used to buy those uncrustable PB&J’s, they were handy travel snacks. Well i had one recently and there’s virtually nothing there, it’s about 2/3 the size of the original and the “puddle” of the PB&J is about the size of a silver dollar.

the product is like night and day difference. Now it’s mostly just air…..in the dough.

I don’t eat there all that often but a #6 at Carls Jr. medium size……the $6 hamburger ……..combo is $10.56…….WTF….

Housing Bubble 2.0 is starting to run up against fiscal reality in all the markets superheated by the central bankers’ tsunami of “stimulus” and resultant hot money flows. While the “former” Goldmanites at the central banks will pull out all the stops to keep their Ponzi markets and asset bubbles levitated, the underlying erosion in the real, productive economy – as opposed to “the markets” – means the global financial crisis ahead will vastly surpass 2008 in its scale and in the wipeout of trillions in fictitious valuations and portfolios.

http://www.zerohedge.com/news/2017-11-24/partys-over-australias-56-trillion-housing-frenzy

“will vastly surpass 2008 in its scale”

So what you’re really saying is the coming bailout is going to be a real doozy!! And everyone will want it this time.

All it takes is a shift in momentum, and house prices will start their spiral downward. What goes up must come down. As soon as buyers sense that prices aren’t going up anymore, demand will plummet because rent vs buy makes no sense unless you’re banking on appreciation.

Staircase up, broken elevator down.

Got popcorn?

Here we go again … “jingle mail”, burying a statue of some saint, I forget which one, on a corner of the property to hope it would sell, putting lots of 8’s in the price, talking about FB’s (f*cked borrowers) etc.

In finding the new commercial space we’re moving into, I’ve realized there’s a shitton of vacant commercial space here, just a couple miles east of the SJ airport. I’d say this is a pretty good area, business-wise. Ebay and PayPal are just up the street, some other well-known companies right in this area, but there’s just a lot of empty square footage. And places are leaving – MSC (kind of like McMaster-Carr, place you order tools and things like sheet metal stock from) has left and that’s empty now. That’s right on Brokaw. Sharp and some semiconductor company have left also, and both were right on Brokaw Road.

What’s kind of cool though is Telemundo/Univision have moved into the area, complete with huge satellite dishes and studio lit up and people working there 24/7. You can even watch the big TV screens through the windows.

The question is … why the low inventory .

If its anything like whats happening here in the Denver metro area .. its not due to a lack of homes .. but rather a lack of homeowners looking to up or downsize because of the outrageous prices and an insane market .. keeping what they have .. rather than selling .

Leaving the only ones selling their homes those that are leaving the area

And who’s primarily to blame for this ? The Colorado Real Estate Industry.. what with their constant rantings and propaganda since 2014 about the perceived lack of inventory etc … making real that which they were propagandizing and marketing about ( in order to artificially boost sales ) creating an infinite loop destined to collapse upon itself

So….. does that sound similar to the CA problem Wolf ?

Low inventory has many explanations, chief among which is population growth coupled with inability to rapidly increase available stock. As people in Vancouver and Sydney learned, population growth can be replaced with “a large number of absentee landlords”.

Generally speaking at one point one of two things happens: either high prices become their own cure or supply starts to catch up, driven both by frenzied construction and often decreased immigration/increased emigration due to unaffordable house prices/rents.

The first thing is what regularly happens in Monte Carlo. Even there, where prospective buyers belong to the filthy rich category, prices regularly plateau because they become so insanely high buyers feel the costs outpace the benefits: there are other way to pay as little taxes as possible. Right now it seems prices will be rocked as Prince Albert is set to outdo his father, Rainier, in the land reclamation department: more (rabidly expensive) land to build upon means fireworks in the pricing department.

The second thing is what is happening right now in Miami East of the I-95. Supply is coming on line fast and will continue to do so at least until 2019 as more and more projects are completed. Perhaps prices won’t “tank” but they are bound to adjust, and meaningfully so, unless inflation truly heats up (right now we are being slowly boiled like frogs in a fairy tale) while lending conditions remain as relaxed as present.

Of course this doesn’t take into account a real estate “hard landing”, but I honestly doubt we’ll see a highly spectacular one in our lifetimes ever again unless something truly unpredictable happens: I think however many markets all over the West (plus Japan and most likely China) will see a years- if not decades-long Japanese-style price adjustment, especially once inflation is factored in.

Finally one thing about the Colorado Real Estate Industry… my small town is slowly depopulating. A quick search reveales there’s one house or apartment for sale every 3.5 persons, which given the slightly declining population trend would be considered an oversupply.

Yet last year the council went to the funny farm and started handing out building permits like candies, obviously without warning us taxpayers.

I don’t know who these speculators are, nor do I care, but after the initial frenzy they quickly ran out of steam and building sites are starting to be abandoned, turning the place in an eyesore. The roads have been thrashed by heavy lorries and the sewers clogged by streams of mud and cement… in short us residents are left to pay the bill while the bandits made it off in the dead of the night.

No end in sight for Denver.

My neighbor sold her home, (in the city) as is, substandard roof, offered at a 1/3 more than it was worth a year ago,and sold it ABOVE the asking price. Here are the bullet points. Existing is scarce, if you sell now you could be handing over some rapacious gains, better to rent your old home and buy another. Rents are even more obscene.

Muni planners have ramped up the revenue permit requirements : vacant land is actually losing value, much of it goes with an HOA! Remote land with no utilities is parceled up and sits waiting, miles from nowhere.

Building costs are lower for large tracts but there are few being built, as Muni planners now place public infrastructure covenants on the land. SD county raised the minimum number of acres required to build. That set a lot of projects back.

Pot growers in places like Palm Desert have created a land rush of sorts, even though the county (Riverside) has an outright ban on cultivation. One good crop and you can pay that mortgage off. My friends son is working in a business that sets up commercial green houses for that purpose. California has perfect POT growing weather.

The Reverse mortgage requires you to live in your house, but most Helocs or other asset lines of credit do not. You cannot margin your portfolio and buy stocks with the broker who holds your assets, but you can go online and buybuybuy, and the same applies to multiple ownership of homes. With hedge funds buying up rental property you are a bit more comfortable with the idea that the government will not allow the rental market to collapse, (unless you are Max) private home owners can go at it hammer and tong. The next ten years should be better for RE millionaires than stock millionaires because whichever way interest rates go, its all good. They rise and you are fixed, good, they stay low good.

the city where my neighbor lives in NOT SF, its a semi rural part of SOCA

I think you are living in another reality. Rents are obscene? Rents are obscene, but compared to a year ago, at least in Santa Clara county, they are dropping like hell. Begging for new renters have already started :).

maybe that’s what caught Yellens attention in the weak CPI number, equivalent rents. Is is likely that rents will lead the housing market lower?

The current pricing is not supported by the wages which are quite slow to grow

There would be a tipping point….

It has happened before many times and it may happen in the future as well

Wait till interest rate is in negative territory. You can probably add one zero to the back of each of those figures.

Wait till inflation forces bankers to raise the rates whether they like it or not. Then you can take 1 zeros from each of those figures. Specially now that gamblers have found out crypto currencies are easier to gamble with.

I agree with you. Your scenario will take place first and then mine. On the way, bacon too will probably gain 2 zeroes.

Pork belly futures, here I come!!!

Did you guys remember Ben Bernanke saying he can kill inflation above target (2%) within 20 minutes?

I have underestimated state power for this cycle.

What’s strange to me is that guys here still talks about supply/demand/lending/ like there is a “market”. Same way the stock guys talks about how price is out of line comparing to “valuation”.

There is NO market.

There is NO valuation.

There is just CB doing ctrl-p and price will be what ever they say so until society decays to a point of revolution or war.

So the question to ask is what do the “Fed want?”. The answe is, only the Fed and their friends know. Too bad you are NOT in the club.

Market analysis? Useless. Geopolitical analysis regarding social disasters, maybe useful.

SF is still on FIRE.

https://www.paragon-re.com/trend/san-francisco-home-prices-market-trends-news

No. What’s on fire is the median price of single-family HOUSES. They jumped 13% year-over-year. The median price for condos and TICs DECLINED year-over-year; In SF, condos outsell houses by 60%. See my article linked below.

Paragon and I use the same data. I quoted Patrick Carlisle, Chief Market Analyst at Paragon, and I linked Paragon’s article. He explains why the median HOUSE price jumped: a record 38 houses over $3 million were sold (there tends to be rush of luxury sales in many Octobers). These 38 sales moved the median price of HOUSES.

This distinction between the jump in the median HOUSE price, and the decline in the median condo/TIC price, along with charts, is all explained here:

https://wolfstreet.com/2017/11/06/san-francisco-house-price-bubble-condos-price-bubble/

Rents are falling here in Santa Clara. For sale prices are 3x the cost of rent financed on a 30 year note with 20% DP. Worse yet, nothing is selling.

The capital gains exemption on home sales has not been adjusted upwards since the current rules were put in place 20 years ago. An older person who might want to move into more suitable housing but in the same area would face a huge capital gains tax in California’s high cost housing areas. Add in the broker fees and other expenses related to home sales and there is a strong incentive to stay put.

I am currently in the process of moving from an insanely overvalued home in Sunnyvale CA (Santa Clara County) to a cheaper, but still grossly overvalued home in Union City CA (Alameda County). I will benefit from a CA program where seniors moving to a cheaper home can take their old property tax basis with them if they go to a county that participates. My capitol gains are small enough to avoid federal tax on the move, but the state will lift a few thousand dollars from me. No way to avoid taxes completely, but two out of three ain’t bad.

Same goes for a rental investment home. I am leaving mine empty (do to Cali tenant laws) rather than selling. Its value is compounding tax free, I will just leave it in my estate for my children. Way more tax efficient.

There is no “downsizing” due to rampant home inflation. Further is you are getting 10 to 15% home value growth what’s the point of cashing out. In California add to the mix proposition 13 tax rates and now you know why there is so little inventory

to address two aspects of “inventory”, the first is new housing, which is needed to offset population growth. new housing should be near job centers, which is the second factor, the American economy was built on the mobility of the US worker, (the automobile) wherever the jobs went the workers followed. as corporate America franchised out its jobs (GM is everywhere) that became less of an issue and in a service economy almost no issue at all, since all cities have about the same number of hotels and restaurants and theme parks. if i have a nice house here i am less inclined to uproot my family to find a better job, so i take a job in service. and if you live in CA its going to take a lot to convince you to take a job in some state where worker safety laws and the same quality of the social experience is not as good.

I trust C.A.R.’s figures as much as I trust used car salesman’s promises about the car that he is selling. These bastards lie like hell.

I always connect real estate market to rents. I keep an eye on the rentals listings by the building that I live in. They have reduced the price of rentals by about $500-$700 per apartment in comparison to a year ago, and they also have one month free incentive.

Yet, they are basically begging in their Craigslist listings; they include any positive details that they can to lure potential tenants in. A year ago, their Craigslist listing was like declarations of a dictator that if you do this, or that we will kick you out. Now, they are begging.

Can you list some of these listings? I am looking for a new place to live in the city.

As I mentioned, I keep an eye on the listing by the building that I live in, and not other postings. It is a typical building, and the manager is no fool; she prices in accordance to what is happening in apartment market in Santa Clara. So, I take that as an indicator.

I’m definitely not going to post her listing here since that would interfere with my privacy.

This ain’t your fathers real estate market. The old models/cycles are no longer applicable. For example is used to be a couple would buy a starter home then roll that equity into a larger home to accommodate expanding family. Once the offspring were sent on their way , the couple would downsize and move to a retirement community. A lot of product churn would result. Additionally ,today , much housing inventory is sequestered as non primary residences exasperating supply. The weak link today, unlike the subprime debacle, is when these non primary residences are no longer profitable to hold

And don’t forget the millennials than cannot get onto property ladder in the first place. Where I live, your generic starter home runs $500-600k and is a beaten up mid-century ranch home where maintenance has been neglected for decades. The downpayment runs you $100-120k and you’re competing with a half dozen investors and foreign buyers who make all cash offers.

The system is unsustainable and eventually will break. How and when are the unknowns.

Living in the Bay Area, lack of inventory is because of: demographics, leverage, and behavior.

Demographics: the average age in my block is north of sixty because of taxes they simply can’t move.

Leverage: HELOC and refinancing has made it impossible for a family with 150k income to move and get a mortgage for a similar size house.

Behavior: Why sell now when your house is worth 13% more on paper next year.

Next downturn will be most unfortunate for many Bay Area residents.

Sorry not unfortunate but it is poetic justice. The next down turn will be a sequel to 2007. Those who do not learn history are doomed to repeat it.

$1,500,000 house in CA is going to run you about $1,500/month in property taxes. Sounds like fun.

The taxes alone are more than my rent. And more than it will be next year and the year after that as well

The taxes alone are more than my gross income.

How does this go again? Oh, ya, I remember.

1. housing prices stall and then fall.

2. the housing market economic impact hits the larger economy.

3. the economy stalls and then falls.

4. recession.

5. stock market crash. ( 5 could happen before 4 )

6. talking heads assure everyone that this could never ever been seen, and no one ever predicted this.

Yet prices in Alameda county keep rising

Housing prices are high, that being said, anyone who has lived in California for more than 10 years knows that the population increase has been ridiculous and that a lot of this is supply and demand. Traffic used to only be bad during rush hour but now 2am on a weeknight is the same as 5pm.

I live in a neighborhood where rents are going up quickly and houses are being flipped, yet everyone on public assistance here is overweight, they throw their food everywhere, they have 4 flat screen tvs in their 1 bedroom apts, 5 cars, their kids have 3 bikes/skateboards and 2 tablets each. I get why the Fed doesn’t see a problem. These are people who don’t qualify for most debt and they are a far cry from my grandparents who hoarded ketchup and sugar packets after surviving the Depression. While our situation is not ideal, I am not sold on the fact that it is dire until people “without means” no longer have so much disposable income.

I’m in socal and I agree with you.

Their income is all disposable. Why we don’t give them more to excite economic growth has always been a mystery to me. They spend everything they have. I asked a friend about her favorite charity, she said “I’m tired of giving money to kids who have everything,” so she donates to the local church fund. Not sure that completely sidesteps the issue. I have been looking at heifer.org, which gives direct help rather than cash.

Yeah, I used to know this nice homeless guy. He would come to Safeway cafeteria, and would buy so much food on government assistance card, and would sit on one table and start eating them. This was his daily routine. On that one table, there was more food than I can eat in one week. This is not the definition of poor that you see in old movies where they could barely afford bread.

I understand helping people in need, but what the hell; this is just wasteful use of borrowed and taxpayers money. It is encouraging many just not to work. Why the hell should I work hard if I can sit home, watch tv all day with my rent, cable, and food all paid for?

It sounds like the person has an eating disorder. This often occurs when one has experienced hunger.

The housing market is completely wacked out. The FED is 100% responsible. To much liquidity pumped into the system for to long. New blood needed for the wind down.

Housing prices in California are not doomed until they double from today’s prices. Probably won’t see that unless the Fed keeps rates low for another decade – which by all indications they won’t.

If the rate hikes proceed at roughly 0.75% : year there will be a natural damping of home prices that will allow for wages to catch up with affordability.

The only way we see a “flash crash” in California real estate is if a global conflict of some sort sparks a stock market panic. The sudden drop in equities will pull the punch bowl of cash from the party and then we have bubble 2.0. Maybe North Korea or POTUS Impeachment are the catalysts

Austin Texas real estate is softening. SFH rents are coming down. Market cycles are not dead.