Sales volume in Q3 plunges 67% from a year ago.

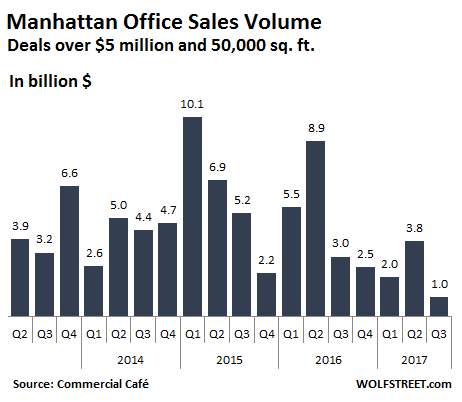

Manhattan, the biggest most expensive trophy market in the US for commercial real estate, used to be particularly appealing to exuberant foreign investors, such as Chinese conglomerates. But in the third quarter, sales volume of large office properties (minimum $5 million and 50,000 sq. ft.) plunged 67% year-over-year to $991 million, the lowest in five years. It was down 90% from the peak in Q1 2015.

“Q3 2017 might signal a return to normalcy for the highly sought-after Manhattan market,” the report by Yardi Systems’ Commercial Café commented.

This chart shows the dollar sales volume of large office properties. The $991 million in Q3 is rounded up to $1 billion:

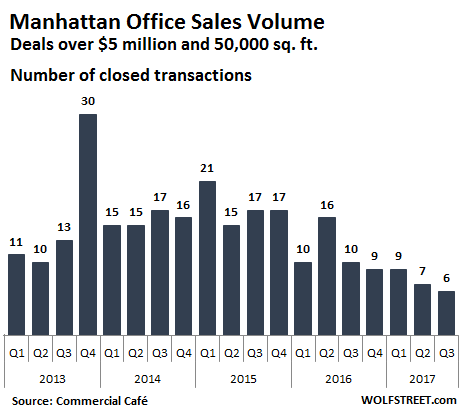

The number of closed deals plunged 40% to just six transactions, according to Commercial Café. That’d down 71% from the peak in Q1 2015:

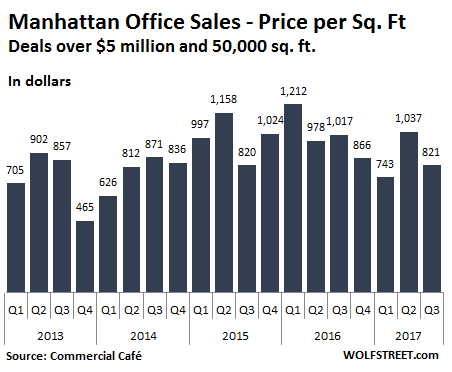

The average price per square foot fell 19% year-over-year and is down 32% from the peak in Q1 2016, but is up from Q1 2017 and about flat with Q3 2015.

As this chart shows, the average price per square foot varies based on a number of factors, including seasonality, but with a trend since the peak in Q1 2016 that doesn’t look promising:

The largest deal was the $465-million sale of 375 Hudson, a 19-story, 1 million-square-foot Class A property, acquired by Trinity Real Estate, the real estate arm of Trinity Church (51% stake), Norges Bank (48% stake), and Hines Interests (1% stake).

What’s sorely missing? The big transactions at inflated prices by Chinese buyers, such as the $2.2 billion purchase in May of 245 Park Avenue by the Chinese conglomerate HNA Group that had boosted Q2 sales. The deal was more than twice the size of the six transactions in Q3 combined. At $1,282 per square foot, it was also “among the highest price-per-pound for this type of asset” ever recorded in Manhattan, as it has been described. Those trophy purchases by Chinese conglomerates really moved the needle.

But now the large Chinese conglomerates that had considered the Manhattan office market their trophy hunting grounds were absent.

This absence follows the crackdown by China’s State Council on cross-border transactions. Its guidelines spell out what Chinese companies can and cannot acquire overseas to “promote healthy growth of overseas investment and prevent risks,” as the guidelines said.

Some transactions are still desirable according to the guidelines, with a big emphasis on China’s “Belt and Road Initiative” in Central Asia and on companies that “take the lead to export China’s superior technology and equipment, upgrade the nation’s research and manufacturing ability, and make up the shortage of energy and resources through prudent cooperation in oil, gas and other resources.”

Other overseas investments will be “restricted,” including “real estate,” “hotels,” and “entertainment.”

So here we go. Over the past few years, and building up into a powerful crescendo that culminated just a few months ago, Chinese conglomerates have been buying up whatever they could get their hands on with precariously borrowed money. But now they’re being reined in by Chinese authorities who are worried about the soaring debt levels of those conglomerates and about their acquisitions at inflated prices and about a financial crisis that these debt levels could trigger when they go bad. And trophy markets, such as Manhattan, are among the first to feel the effects.

US Treasury securities with maturities of two years or less have taken a beating, and their yields have been soaring, but the yield spread has collapsed to the lowest level since early in the Financial Crisis, and even the Fed is worried. Read… US Treasury Rates Hit Nine-Year Highs

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

– This info confirms signals that Chinese investors/buyers also seem to have lost their appetite for real estate in both Australia and New Zealand.

Australia put a *foreign tax* on overseas buyers of I think 30 percent. Naturally, this is a disincentive for Chinese buyers of AU real estate. How about NZ? Did they put a foreign tax on overseas buyers?

– Not that I am aware of. Authorities in NZ tightened lending standards some 2 years ago and now the once red hot sizzling real estate market in NZ is already “cooling down”.

– China simply “cracked down” on the outflow of money. Chinese investors were able to “export money” when they used it for buying real estate. I assume that now even that has become much tougher or impossible.

NZ is placing restrictions on immigration that make it a less desirable destination for foreign investors in real estate.

If you can’t reside in NZ, then it makes little sense to buy residential property in NZ.

They also just had an election, so the future policies of the government are unclear.

http://www.scmp.com/week-asia/politics/article/2112237/meet-jacinda-ardern-kiwi-trump-hoping-cut-chinese-immigration

http://www.straitstimes.com/asia/australianz/nzs-labour-sticking-to-its-immigration-plans

This next PM, Jacinda Ardern, reminds me of when Helen Clark was elected PM in 1999. The Kiwi tanked (as low as 0.39/USD). Ardern is a socialist and bad news for NZ prosperity.

– Both Australia and NZ have seen “break neck” immigration levels in the past say 17 years. The immigration was almost the only reason why these 2 countries showed growth in those same 17 years.

– The author of the article below disects what’s wrong with NZ. It’s a similar story for Australia.

Just read the headline: “NZ economy: more Ponzi than real growth”.

https://www.macrobusiness.com.au/2017/08/nz-economy-ponzi-real-growth/

https://www.interest.co.nz/opinion/89257/jbweres-bernard-doyle-nzs-productivity-recession-population-growth-driving-economic

– And one is surprised that our “beloved” Mr. English is replaced by Labour’s Ardern ? And what about of the rise of the “NZFirst” party ? Seems people are “not too happy” here in Kiwiland.

“And one is surprised that our “beloved” Mr. English is replaced by Labour’s Ardern ? And what about of the rise of the “NZFirst” party ? Seems people are “not too happy” here in Kiwiland.”

Team Winston is on at least rise three. He dates back to 93 as an independent and 81 as a sitting polly.

English has always been No 2. He lacks something even shipply had (Backstabbing killer instinct?)or perhaps he has some Morals.

Strange as it may seem “kiwiland ” is the last thing we would call it.

Kiwi comes from the shoe polish, the national bird, and “K1W1” which was a WW II radio/morse ID in the Desert/italy.

A baby one on CG more is in teh pip[eline.

The “New female child in town” wants to shut foreign non occupier ownership down COMPLETELY.

And her aged coalition partner is right behind her (possibly leading her along) in that.

As an Objective it is defiantly a future voter winner. In a country that last had worse housing affordability and availability in 1951.

The real estate investment arm of ………. Trinity Church ?

Gee … no blatant abject hypocrisy within their ranks … ( re: Matt 6:24 ” Ye cannot serve God and mannon ” ) now .. is there !

And we’re still handing out tax exemptions wholesale to the likes of them ?

My tax plan for the US gov. End tax exemption status for all religions, end ALL tax giveaways/exemptions for the NFL and ELIMINATE the social security tax income ceiling completely.

Now that the big Chinese Communist Party confab has concluded, China’s central planners perhaps won’t be under as much pressure to keep their Ponzi markets levitated to ensure an uneventful session.

Some Chinese guy said: Other overseas investments will be “restricted,” including “real estate,” “hotels,” and “entertainment.”

WHAT!

WHO THE HECK IS GOJNG TO BUY THE STEAMING FRESH TURD THAT IS WEINSTEIN & DUDES FILM COMPANY?

Hollywood is the finest coke-snorting sweaty-pig political propaganda sex machine of all time, that’s a brief list and not to be confused with easily duped irredeamables.

The labor arbitrage scam run by globalists necessitated offshoring of irredeamables financial future and running up national debt in lieu of taxing the proceeds.

Thus the tale of two swamps, political and financial.

To point out the elephant in the room, why is China of all countries worried about cross border transactions? Why is capital outflow a problem for a country that still has three trillion in foreign reserves? Debt would seem like a logical explanation, except that China has no problem whatsoever with internal debt, which just keeps growing. Not only New York, but Australian and Canadian housing bubbles are all financed with Chinese money. Is this simply a case of the Chinese government stopping communist party rats from fleeing a sinking ship?

Question; Pondering what would stop China investors that are connected to their central bank to get money freshly printed out of thin air to buy the real estate all over the world, of course off the books and not have to pay it back.

Are there audits to monetary reserves? How much money has been produced and where did it go?

It really boggles my mind how this country can buy a large swath of the iron range in mn, a great amount of farm land throughout the breadbasket, both coasts, and all these other countries honestly.

Makes me ponder

It’s the Chinese Government, which includes the PBOC, that is cracking down on helter-skelter capital outflows and borrowing. They’re worried about a financial crisis they cannot handle. So if they want to re-open the spigot for office transactions in Manhattan, they could just relax the crackdown.

But they’re just being choosy. Some acquisitions, as the guidelines point out, are encouraged, such as tech. But acquisitions of hotels, real estate, and entertainment are blocked.

Another reason to clamp down hard on OFI by mainlanders is that much of then cash used in these “Investments ” it the product of fraud, corruption or other criminal activity on the mainland.

A large volume of the cash provided by what become NPL’S on the mainland, ends up in foreign “property investments”

me too, but egos don’t buy quality, they buy flash.

there is a difference between price and value shopping.

Simple: China wants domestic investment and consumption.

They tried that and it ended up with ghost cities. Smart people got wise and took their money overseas. The next act of this play should be something for the history books.

I am more interested in the plunging price…

Usually, low transaction is precursor to low prices

Someone call Jeff Bezos for Amazon’s HQ2 :) so he can own both left and right coasts (err. ..west and east)

Wolf, The real question though is – So WHAT?

People who bought /leased need to follow through.

For the ones needing to sell / lend they need to reduce prices. Worst case they bought at the top and are left holding the bag.

Again so what or Cui plagalis – who loses what? And how>

We all now RE is priced up the wazoo and if some folks can’t sell/lease why does it affect the man on the street? Isn’t all these $5 M and above owned by millionaires and billionaires – so we feel sad for them :)

Just wonder what it will look like when the tide goes out as it always does eventually,remember when the Japanese had to liquidate their worldwide holdings at a loss in the 80s? Rockefeller Center anyone? Wolf probably has a better understanding of that little episode,i’m just recalling from memory. i imagine the Chinese foreign holdings are vastly bigger than that today with more serious implications for RE markets world wide? as for now the central committee is holding things together with ever more grandiose projects and visions. unfortunately,there is always Murphy’s Law…..

What happened to the Japanese, that caused their liquidation, differs from then mainlanders .

Mainland chinese put money outside china, with the intention of never returning it, or the profit from it, to china. Not returning both at some time like the japanese.

Many Mainlanders are trying to put something they have obtained, beyond the reach of the CCP. Even apartments in manila qualify. If that’s all you can afford.

The economy is doing fine and commercial real estate has never been better.

Manhattan is a crap hole and anyone doing serious business stays away from it. It’s the bitcoin of real estate.

http://www.dcvelocity.com/articles/20171018–us-industrial-property-rents-hit-record-high-in-third-quarter-jll-says/

The article you linked is about “industrial” — which means warehouses and fulfillment centers for eCommerce. That sector is hot. Just look at Amazon, setting up warehouses everywhere across the country. But that’s very different from office space in Manhattan.

Garret – My boss and I found a place, 1600 square feet, nice building, for a dollar a square foot. Right smack in the middle of silicon valley here. There were a few to choose from, actually, and we just chose the nicest.

There are a lot of empty buildings here. In fact I think there are more now than there were 5 years ago. Lots of empty space too, although a lot of it is being built on now. Condos and residential buildings with businesses on the bottom floor are going in, but there’s sooooo much stuff going empty.

I can rent a small office, 200-300 square feet at a dollar a square foot. Right here in San Jose.

So, yeah, prices from 2003, commercial RE is hot…

Well, I am surprised prices didn’t sink faster since Chinese investors left months ago

There are still plenty of buyers out there to help delude sellers the boom is ongoing.

US commercial real estate can be said be roughly split in half by value: half domestic buyers and half foreign ones, with the latter category usually concentrating in ultra-prime markets such as New York and SoCal.

While Chinese companies have been a major player among foreign buyers, they are far from the only ones. Korean companies started a buying spree in 2016 led by Korea Post, a 100% State-owned company. Then we have Gulf funds: like it’s always the case it’s extremely hard to say how much these funds are private and how much they are public entities.

Finally we have European companies, spearheaded by Norges Bank… yet another State-owned company.

As Mr Richter highlighted in the past, these foreign, mostly State-owned buyers have entered the market with impeccable timing: at the very top of it. The beneficiaries have been with a very few exceptions, mostly Canadian, US-registered entities, ranging from the RE arm of JP Morgan to Jehovah’s Witnesses.

These properties were mostly bought with hope rents would continue to grow as they have over the past five years, with little regard to the fact there’s a lot of commercial real estate in the pipeline and that cheaper cities such as Atlanta, Houston and Newark are pitching themselves aggressively as an alternative to New York, Los Angeles and Seattle.

Like it always happen, landlords will continue living in their fantasy world, where rents can be increased at will with no consequences even in face of aggressive competitors.

They should probably ask Borders and Barnes & Nobles how well their startegy og ignoring Amazon worked out in the end…

WeWork and Rhone Capital just bought Lord and Taylor flagship store on Fifth Ave for 850 mil. So there is still domestic money sloshing around.

And they are going to turn it into a coworking space, right?

Well, if the building has revolving doors, they’re all set. Because coworking spaces have extremely high turnover.

Store is slated for WeWork HQ on the top 8 floors with a scaled down L&T on bottom 3. From what I have briefly read about WeWork, they try to buy with a large long term built-in lessee and then do the “shared space” with the rest of the building. Rhone looks like a very strong partner.

Seller is 350 year old Hudson Bay whose RE is worth way more than the core retail. IMO, Next up on the chopping block will be Saks on 5th, whose value pegs in at 4 billion. NRDC Equity Partners owns 48% of Hudson Bay so stay tuned for more RE sell off. Sound familiar anyone…?

Lord & Taylor always had the best Christmas windows on Fifth Ave. I hope they don’t kill off one of the good reasons left to visit NYC.

it’s called flash and splash.

Every significant Chinese businessman has relatives in Canada or the United States who manage and oversee the real estate investments deriving from money stolen from their own firms. Several years ago I dined with the chairman of a large conglomerate who was year one into a 4 yr. stint as chairman. He was paid the equivalent of $100,000 per year and had no pension. Halfway through dinner he mentioned that his predecessor used company funds to make a $6,000,000 investment in NYC real estate but there were no records or follow-up to confirm. I offered to look into the situation, but there was no response. Although the Chairman spoke poor English (I think) his wife was a graduate of CCNY. Family is everything in China

China’s central planners “requested” that firms delay reporting bad results during the recently-concluded Communist Party Congress that started on October 18th. Looking at the daily charts of the Shanghai exchange, it also seemed clear there was blatant central bank intervention to keep stocks in the green, though gravity was clearly dragging them downward. Now that the Congress is over, how long will China be able to sustain the Potemkin “Everything is Awesome!” show?

https://www.bloomberg.com/news/articles/2017-10-24/china-is-said-to-ask-firms-to-delay-bad-results-during-congress-j953swi6

Have you ever considered that people are sick of NYC?

It’s basically a big prison staffed by stop and frisk guards .

First they did away with cash tolls and put facial recognition cameras on all the bridges.

https://www.wired.com/2016/10/nys-pumped-cash-free-tolls-kinda-ok-dont-pay/

Now they are doing away with cash mass transit transactions and you will only be able to pay with your phone or credit card (presumably the police will be able to find you quicker!)

https://www.nytimes.com/2017/10/23/nyregion/metrocard-subway-new-york.html

No, we’ve reached peak NYC, and nobody wants in anymore!

Maybe sales are dropping because all the good and “great” stuff has been sold?

Retail and restaurants are closing at a ferocious pace as their leases expire in these trophy buildings. Having the first floor empty sure doesn’t help the perceived value of the building nor does having prime space empty help pay for debt. It is possible that some businesses who have leased forever in these buildings start to buy their own buildings in affordable Queens and Brooklyn, which are becoming vibrant young hipster areas. Let’s face it….the young have to take over eventually.