See Manhattan.

In the second quarter in Manhattan, Chinese entities accounted for half of the commercial real estate purchases with prices over $10 million. By comparison, in 2011 through 2014, total cross-border purchases from all over the world (not just from China) were in the mid-20% range.

“At a time when domestic investors have pulled back, foreign parties have ramped up their holdings in Manhattan,” according to Avison Young’s Second Quarter Manhattan Market Report.

This includes the $2.2 billion purchase in May of 245 Park Avenue by the Chinese conglomerate HNA Group, the sixth largest transaction ever in Manhattan. And at $1,282 per square foot, it was “among the highest price per pound for this type of asset.”

The purchase of the 45-story trophy tower is being funded in part by money borrowed in the US via a $508 million loan from JPMorgan Chase, Natixis, Deutsche Bank, Barclays, and Societe Generale, according to CommercialCafé. The rest is funded by HNA’s other sources, presumably in China.

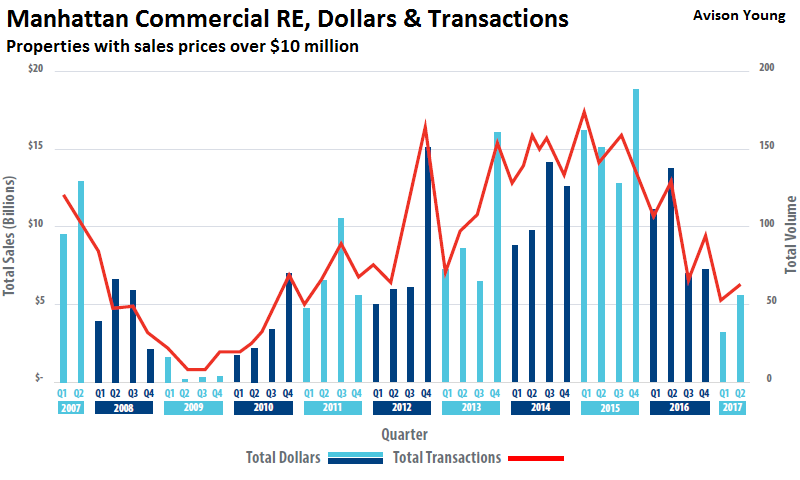

The influx of Chinese money and the propensity by Chinese companies to hunt down trophy assets have propped up prices in Manhattan. And yet, despite the Chinese hunger, total sales volume has plunged, according to Avison Young:

At the end of the first half of 2017, the annualized forecast of total transaction volume was on pace to be 40% lower than 2016, and a 60% drop-off from 2015. At the current pace, 2017 is shaping up to have the lowest sales count since the period from 2008 to 2010, the last market trough.

Dollar volumes tell a similar story at the year’s halfway mark. The first quarter’s $3.2 billion in dollar transactions was improved to $5.6 billion in the second quarter, but this increase was largely attributable to a single $2.2 billion purchase while the first quarter lacked any billion dollar transactions.

From the third quarter of 2013 through the second quarter of 2016, the Manhattan market averaged 141 transactions per quarter and never recorded less than 112 in that 12-quarter span. In the trailing four quarters ending 2Q 2017, the average transaction count dropped to 71, with the most recent tally [in Q2] at 66 for this second quarter.

This chart by Avison Young shows the peak in 2015 and the plunge since (click to enlarge):

That’s the gloomy data on investment activity. Office leasing activity, the underpinning of the office market, isn’t exactly booming either. According to Avison Young’s report, office leasing volume in the second quarter plunged 32% year-over-year to 5.0 million square feet.

Both in Midtown and Downtown, leasing volume in Q2 plunged 35%. In Midtown, the vacancy rate rose to 11.0%, up from 10.1% a year ago; Downtown, it rose to 12.1%, up from 10.4% a year ago.

So the Chinese money is sorely needed to prop up the market. “Since the beginning of 2013, Chinese companies alone have poured nearly $18 billion into Manhattan real estate,” the report says, but cautions: “This flow of funds, however, may soon be threatened.”

Last year, the Chinese government got serious about imposing capital control. This year, it’s trying to crack down on lenders to get a grip on the ballooning risks threatening its financial system.Just over the weekend, top Chinese authorities struggled at the National Financial Work Conference with the rampant risk-taking and leverage. The Wall Street Journal:

Fear permeated markets, which tumbled Monday after President Xi Jinping gave a speech that supported efforts to tamp down complicated lending along with other financial-system risks. Frightened investors – seeing room for yet more policy tightening after cheery GDP growth data – are now searching for signs of the regulators’ next hit.

At hand is an ever-growing asset-management industry – now around 60 trillion yuan ($8.8 trillion) – and the deepening nexus of banks, brokers, trusts and insurance companies. The central bank elaborated on the linkages it uncovered in the asset-management industry in its recently published financial-stability report. That is likely telling of where regulators will go digging.

If regulators do take on the asset-management business, it could spell trouble for corporate borrowers. Corporate bonds account for more than 40% of underlying assets in wealth-management products sold by banks. Asset managers have been the only active buyers of these bonds so far this year.

On Monday, following the conference, the Shanghai Composite Index dropped 1.4%, and the small-cap index, ChiNext, which includes a lot of tech companies, plunged 5.1%, to the lowest level since January 2015.

China’s crackdown on leverage and fund-flows already had some consequences in the US and elsewhere: quashing a slew of Chinese cross-border deals, including Anbang Insurance Group’s $14 billion bid to acquire Starwood Hotels & Resorts.

These efforts by Chinese authorities to get financial risks and capital flows under control could have the effect, according Avison Young’s report, that “the major Chinese players may be regulated out of the market.” And with Manhattan being “a primary target for funds, it is likely to experience the greatest impact.”

This will happen just when domestic buyers have lost their appetite for overpriced commercial real estate after a breath-taking seven-year boom. The report identified “near-term impediments” to the commercial property market, among them:

- “Chinese governmental regulations on capital allocations outside the country.”

- “General investor sentiment.”

- “Rising interest rates.”

- Pre-recession 10-year commercial mortgages that have been packaged into Commercial Mortgage Backed Securities that are now struggling to refinance. Ratings agencies have also been warning about CMBS.

- “Slumping residential market, slow condo sales, and heavy concessions in rental market” as asking rents have been declining.

- “Dearth of construction financing and stalled construction sites needing funding.”

- “E-retail depressing brick-and-mortar retail values.” This meltdown has reached the Crown Jewel in American retailing as seen in haunting photos of Shuttered Stores on Madison Avenue

But unlike last time, there’s no Financial Crisis tripping up the property market. Stocks and bonds are booming. Wall Street is exuberant. There’s “no catastrophic event causing the current correction,” as the report explains. In other words, these are still the best of times.

And it’s not just in Manhattan. Chilling photos of for-lease signs are lining the Great America Parkway in Santa Clara, Silicon Valley. Read… Silicon Valley Begins to Crack Visibly

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I am wondering why the FTSE China 50 is still not going down. That index is mostly banks, insurance companies and other sorts of entities that seem to be exposed to the supposedly slowing Chinese economy.

I was visiting a long time friend in Sausalito,CA today (nearest town to san francisco over the golden gate bridge) and she was telling me how the demographics of her little sleepy town are changing. She said that 4 of her long time neighbors put their homes up for sale and 3 of the 4 houses sold over asking to Chinese investors. she informed me that there has been a huge influx over the last 2-3 years. Particularly this year.

Wolf do happen to know if the Justice Department is still reviewing purchases of homes worth more than 1.5 million dollars in the Bay area? Does the Bay Area include SF North Bay or just SF and silicon valley?

The US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) is looking at home purchases over $2 million in these Bay Area counties: San Francisco, San Mateo, and Santa Clara; and in Southern California: San Diego County and Los Angeles County.

So Sausalito (Marin County) is not included. Maybe that’s why your friend is seeing that kind of activity.

Ah yes … the Marin Republic !! … ‘Our aura of mindfulness suggests that you do as we project, while we make bank …. but just don’t move-in too close!”

Ohmmmmm

The Chinese authorities need to bring back Trudeau’s War Measures Act circa 1970 for these Chinese crooks and criminals. Guilty until proven innocent should be the new slogan for these money launderers.

>Guilty until proven innocent

How un-American

You mean un-Canadian?

I do not believe that most Chinese will pull out their money in the U.S. They park their money here for safety until the Communist Party of China collapses and the rule of law in China will change that ensures individual property rights. Even though the commercial properties decline, political risk is always at top of their concern.

Jim,

It’s not that they’re pulling out their money. What they already invested here may well stay here. It’s that the new money coming from China into the US is drying up and that deals get scuttled because they can’t get funded from China and that Chinese companies are curtailing their overseas shopping spree.

The worry any rational person would have is that of the Chinese buying enough in the US that they can, essentially, make their move … I’d not expect them to treat anyone who’s not Han Chinese any better than European invaders treated aboriginal Americans.

One can consider what happened with the 80’s Japanese buying spree in the US. A lot of real estate investments were sold at a loss. I think the Japanese still own a fair amount of commercial stuff. But face it, they’re landlords. Would not surprise if most of the rent stays in the US one way or another.

alex in san jose, duuuude, you are ON lately. i’m hardly online anymore now that i’m gonna be 50 on aug 10th and i’m kicking up my reclusiveness to get more done in this desperate REAL LIFE, but YOUR rage and HUMOR is PERFECT and NECESSARY reflections FOR where we are NOW.

i laughed at “no one normal can afford a car” as well as:

“It was good to leave the 70s, man. I remember sitting in my rooming-house room with a clean floor and clean sheets and a window with a curtain, and a desk, and thinking, “I can eat a whole package of hot dogs myself and no one can keep me from doing so!”.

keep going. please.

my god, alex in san jose, this is just GENIUS (your quote below)… i’ve read it half a dozen times and i’m like “YEAH… that’s IT.” / i laugh because how much LOWER on the totem pole can some of us still GET??? /

“The worry any rational person would have is that of the Chinese buying enough in the US that they can, essentially, make their move … I’d not expect them to treat anyone who’s not Han Chinese any better than European invaders treated aboriginal Americans.”

i thought of the twilight zone episode where “To Serve Man” turned out to be a COOKBOOK. gotta love that one. i used to watch twilight zone marathons like they were the actual for real news. now i don’t have cable. i just REMEMBER episodes. it’s okay. i know them by heart like 70s songs i can’t shake.

oh mandy…

Kitten – Glad you like my ranting.

It’s been pretty conclusively proven that I’m at least 10 years younger than the average here, and probably make on the order of 10% of the median income here.

As I’ve said, I’m as exotic as a fluorine-based life form on here.

I think it’s important that I post on here. I represent at least 30% of the population where I am. Yeah we have high tech, but it’s only about 5% of jobs, and only about 5% of tech workers are making any more than they’d make driving a forklift.

Reality is not pretty and neither am I.

to me you’re fxckin’ BEAUTIFUL. crazy mad pretty.

listen to the rant at the end of iggy pop’s new song, “paraguay.” i’ve totally forgotten how relevant music was SUPPOSED to be. his rant and that song felt like a defibrillator. stick around, brother. we’re the troglodites and yeah i love your rants because you speak for me when i’m so TIRED.

i’m coming up on fifty aug 10th and it’s my New Year and i prepare all spring/summer for my birthday. leo thing and let me tell you after trying to play that sxht down i’m relieved i’m STILL mad romantic this way.

i’m dancing outside in public to metal to kick it up for the new year. i lost my belief in solidarity and need something harder to dance to so i’m returning to motorhead and megadeth and i hope i don’t start a rant. but i’ve been too “accepted” lately and it’s making me NERVOUS.

just a dispatch from this side of our troglodite reality.

That’s a good thing not a bad thing. The Chinese authorities need permanent changes in their judicial system to bring in guilty until proven innocent for all these Chinese crooks and criminals. Money laundering is a serious crime. Pierre Trudeau did it during the FLQ crises… it worked.

Correct. Money which came over last year isn’t going anywhere. This affects the money which would have been buying property right now.

There is nothing invested. It’s all mortgaged.

Now the real mysterious part in all that confusion about CRE or simply RE Chinese investment is the amount of re hypotecation / layers of fictional collaterals underlying the whole shebang . The level of zero cost of goods in present situation might send things spinning that much faster if credit conditions tighten. WMP s anyone ??

If any of those factors prevail and lead to an unwinding of present leverage, we might be looking at something that would make 2008 look like a blip on the radar! Central banks have very little choice , but to keep the credit flowing , even if the debt cannot be sustained.

Jim, Here is a good article on the declining Chinese money coming into the US:

http://www.latimes.com/business/la-fi-wanda-hotels-20170710-story.html

There have been many cases of “disappearing” Chinese Billionaires who have been kidnapped by the Chinese government; some have committed suicide, some have reappeared only to deny it was by the government, some have reappeared and have stepped down as CEO, some have begun selling their assets.

Most likely those who put their money offshore early in the game will continue to quietly buy here. With the heavy scrutiny it will have to be under the radar from here on out.

Not only is it laundered money it’s blended in with money taken out of China illegally as in tax fraud with no taxes paid in China.

So who cares if they are breaking ‘Chinese Law’ – it isn’t the job of the USA to enforce Chinese law.

China is nothing more than a plain old dictatorship run by a bunch of old and getting older men that believe in maintaining control of the country by any means possible including arbitrary arrest, torture, and murder.

Wake up people – the place is run by one of the few remaining COMMUNIST governments in the world.

As if arbitrary arrest, torture, and murder aren’t the norm in the US.

No, as a white male you’re not likely to experience this first-hand, but just the other day a nice blonde gal who could be on the label on a bottle of Breck shampoo was arbitrarily offed.

If you’re black or Hispanic, this becomes much more of a reality. A lady was arbitrarily offed by a cop who shot PAST his partner in his eagerness to kill her, a week or so ago.

Empires just do this shit.

Alex,

Yes, shot by a poster boy for multi-culturalism with some complaints against him.

IMO the situation with police in the USA has a lot to to do with declining standards of recruitment. You hire idiots and your going to get idiots pulling the trigger when they shouldn’t.

Years ago after tying the knot I brought my Japanese wife to visit the folks. After the usual idiotic questions from some dumb relatives: “Do you have washing machines in Japan?” I took her out shooting.

She had never shot or held a gun before. So out to the sewage settling pond area to do some target practice. (The place had these huge earth berms where people went to shoot.)

While shooting the Sheriff drove up and asked what we were doing and I told him just target shooting.

All he said was, “Ok, just don’t shoot across the road and pick up your brass.”.

I doubt that would happen these days in most places in the USA.

Oh, and by the way, I used to have a concealed carry permit before I left the USA for Japan

Alex,

I think it was Bill Buckley, the conservative commentator, who said that all cops are criminals because they are recruited from the criminal classes.

I read a story where a Chinese man borrowed $10 million in China and used that money to for $7.1 million in cash purchases of several properties in Canada. So that got him into Canada and he now owns million of dollars worth of assets paid with cash. The problem is he defaulted on the $10 million dollar loan in China.

Nice more. He is a millionaire now assets wise. Of course he owes $10 million in debt but will he ever have to pay it back. I wonder how many times this same scenario is being played out. People are not really millionaires but borrow the money in China, pay cash in North America, and default on the Chinese loan.

ru82 – They will be making an example out of that guy.

https://www.usnews.com/news/world/articles/2017-06-01/china-hails-first-fugitive-extradition-from-us-under-trump

Beware the Red Notice: http://www.chinadaily.com.cn/china/2017-04/25/content_29072176.htm

They can run but they can’t hide.

I’ll cap him myself, for a *relatively* small fee …

Exactly correct and these are facts and the Canadian government sits idly by and does absolutely nothing.

When the commercial property market really tanks, I expect of version of what happened in Japan back in the 90’s, except with the Chinese playing the role of outside investors instead of Americans. I had a friend of mine who worked as a lawyer for a big wall street investment bank in Japan during the 90’s. His job was to try and obscure the ownership trail when U.S. companies purchased newly cheap Tokyo properties after the Japanese Real Estate collapse. If it was discovered that a building was owned by the Americans, the Yakuza would show up at the hired in-country building managers office and announce that the tenants would now be receiving a 50% discount on their rent. This was of course a dispute that out-of-country owners could not win so they would give in and sell at the earliest possible time, learning the pitfalls of owning real estate in a foreign country where you had no political leverage.

Some money is going to have to come from somewhere for 666 Park Avenue.

The really good story is 666 Fifth Ave.

http://www.slate.com/blogs/moneybox/2017/04/07/kushner_s_666_5th_avenue_is_a_perfect_metaphor_of_the_trump_administration.html

Sorry that’s the one I meant.

With that address, I guess there won’t any evangelical money flowing in, unless there is a very attractive interest rate.

Did you know that 666 Park Ave. was the name of some satanic tv show?

666 and 888are extremely good numbers for Chinese folks

Great article. Thanks for the reference.

Okay, friends, I have a bit of a rant here about real estate investment. I’m going to talk about farm land because that’s what I know, but the same arguments apply to other real estate, including Manhattan offices.

In my area (lower west side of the Sacramento Valley) farmland prices run about $25,000 to $40,000 per acre. This is far above the agricultural value of the land. Three things are driving the inflated prices. One is that rich people buy up farmland so they can build a mansion on it; once that land is encumbered with a million dollar house, no farmer can afford to buy it. The second thing is that investors (speculators) buy up farmland to hold with expectation of increasing price over time. This includes, in my area, investors from China. Typically, they lease the land out to the worst kind of industrial corporate farm that has no stake in the long term health of the land and just farms it exploitatively for short term profit. The third element is that since California legalized marijuana production, there is a lot of out-of-state drug/tobacco money buying land. In Yolo County, one of the few counties that permits open field cultivation of marijuana, land prices have increased dramatically. A well grown crop of marijuana can gross $400,000 per acre. In those circumstances, price of land doesn’t matter.

I serve as mentor to several young farmers, and I tell them not to even think about buying a farm. We try to secure long-term leases instead, which for many reasons are not as satisfactory as ownership. These young farmers are good people who don’t want to grow marijuana; they just want to grow food for their communities, and they’re being deprived of their opportunities.

And this brings me to my point. When market are distorted by speculation, genuine harm can be done to innocent people, whether it’s farmland, houses, or commercial buildings. If people want to speculate in bitcoin or CDO’s or similar abstractions it doesn’t really matter; there will be winners and losers, and presumably they went into this voluntarily and with their eyes open. But when they speculate in tangible assets, an ethical variable enters the equation. You might earn 7% on a REIT and think you’re pretty smart, but you also should be thinking about who got hurt.

The logical conclusion to your argument, Old Farmer, at least as I see it, is the eventual demise of agricultural holdings up and down the entire Great Valley …. sooo, how in Hadies half- acre is the state of California going to feed itself, let alone the world, without arable cropland ?! …. foreign (Chinese & others) ag compounds only ??

‘shakes head in disgust’

Speculation in farm land or shelter is harmful. There is no way to escape the inflation. I am sure they (the government) like it that way.

A good deep recession will fix that.

Yes, inflation and a hike in interest rates will fix all these bubbles.

Sky high interest rates and deep deflation is always a more desirable outcome and much more beneficial.

Hear! Here!

We here in mountainous West Virginia enjoy a real delusion, fellow Old Farmer.

No farmer in his right mind would move to the stereotype of WV, so we enjoy its reality without the distortions you face.

Second thought; “No farmer in his right mind (etc.)” should be “No money-mad-maven”.

The place is full of legitimate family farms (mostly cattle), of long standing.

You mention the material harm which is considerable. Farm land is precious. But there is other kind of harm: the corruption of mind from the lesson that speculation pays better than farming.

I feel you, old farmer.

Let’s NOT rant, let’s understand this so we can survive it.

When Bernanke started to print back in 2010, I start to question the soundness of the stocks/debt. If they are good, why would they need to print? They I started to question what is “money”. If they can print, how can I compete by spend my life working?

I was NOT sure about the consequence of money printings. People were saying inflation when confidence is lost. People were also saying deflation because you can NOT artificially lift price for ever.

7 years past, you, the old farmer, has illustrated the true consequence of money printing.

It is NOT out right inflation or deflation. The printed money went to “supply”, which produces goods that suppresses price so consumers will NOT feel the inflation while there is enough money going into “supply” what trickles down creates productive business, hiring people, create some demand, so there is NO out right deflation either.

Supply means producing corporations, RE, farm lands etc.

If printed money directly went into “demand”, like shower consumer 40K each per year, the it would have been inflation.

But the true consequence is NOT about consumer price. It is about “ownership” of productive assets like land, houses, corporations.

Those who work can NOT compete to get ownership of productive assets against institutions that has access to freely printed money through various financial sourcing methods.

Those who work will NEVER own while enjoying roughly stable consumer price.

They have made those who work into SERFs who can consume happily.

Economics – the study of the production, exchange, distribution, and accumulation of scarce resources.

Land (shelter), oil (energy, heat, transportation), water & food. About as basic as it gets. Don’t let all the other noise distract you from what is important. It’s been this way forever.

245 Park Ave is the old Bear Stearns building. When I worked there it was owned by the Canadian company Olympia & York. O & Y lost the building in bankruptcy sometime during the 90’s.

Olympia and York had property in bankruptcy I’m sure they screwed somebody I worked in heavy construction in NY back in the 80s( Slattery Const) Maspeth Queens and those guys didn’t have a very good reputation They were considered a notch below used car salesmen Thanks for the memory

Sleazy financial firm and their sleazy landlord are now both gone. God’s work?

God looked the other way. Hubris and greed called Canary Wharf in London what sank it.

Chinese money will never dry up, they will just keep printing and printing and printing and keep buying the world for $1,000,000 over asking.

why would they stop, everyone keeps accepting the tribute? Everyone seems to think that the future IS CHINA so……..who’s going to turn down an all cash offer at millions or possibly tens of millions over asking……the sale will be over in 7200 seconds……look that one up.

the new bullets are not made of lead, they are paper with pictures on them.

That Chinese is money is debt. Everything is leveraged in China – and I mean leveraged to the hilt, in multiple often opaque layers. Debt, once it gets big enough, blows up. That’s what Chinese authorities are grappling with right now. They have domestic reasons to try to get a grip on this.

Thats right. It’s all mortgaged.

Wolf,

Remind you of the situation in Japan where the big banks, quasi-public corporations, and local governments were able to keep the debt hidden from everybody (Westerners) until it all blew up?

I used to get a kick out of reading some of the income and expenditure statements of some of the cities and other entities in Japan.

If you think that Japanese company accounting can be strange, funky, and convoluted, take a look at the way cities and those quasi’s report…………….

I doubt that anything has changed in that regard in the past 25 years either.

They can’t print dollars. They have made a lot of $, based largely on the exploitation of the former peasant class, who have been working in factories and living in factory dorms.

Not nice but better than under Mao.

Now with a emerging ‘middle’ class they are no longer the cheapest labor and face competition from Pakistan etc. for budget apparel (second largest category of China exports to US at 19%)

One of their problems is that that they are price takers

not price givers. It is more or less taken for granted that stuff from China will be lowest cost and low quality. If they want to transition to the status of a Japan or Germany, this will have to change. (The CCP leaders have criticized Chinese industry about this)

The much touted transition to a consumer driven service economy, lead by the ‘middle’ class, is problematic, given that by developed world standards, they are still not that well off.

To the extent that they can’t afford to work for each other, they will have to work via exports for the developed world.

This paper bullet was invented in the US, and then secretly smuggled to China. It is called debt-by-choking (pun intended). Let’s see who will choke first. My bet is on China, since the fiat reserve currency can be printed at will.

– One reason chinese “investors” have been “investing” in US (and australian) real estate is that this way the chinese were allowed to get money out of China.

– Topic: Golden Visas

http://www.cbsnews.com/news/golden-visas-chinese-investors-24-billion-in-u-s-and-elsewhere/

(one familiar name pops up: Jared Kushner.)

Lots of land to grow food on NOT in CA….plenty of rich soils/more rainfall in other parts of USofA.

Old Farmer doesn’t like what he sees, but that ‘speculation’ in land has been going on since humans and land….

Free market and all that…

It is far from a free market and that is his point.

There is no true price discovery in the current land and home market.

Prices are elevated because inventory is constrained as because banks no longer have to declare losses on their loans due to the the suspension of FASB 157.

I hate to make such a brash over reacting statement but … in light of the mass delusion , over optimism and suspended reality of Wall Street etc … does this or much of anything else that may happen in the near future really matter one iota ? Slowly but surely I’m coming to the opinion that it does not .

Slowly but surely I’m becoming of the opinion that the Black Swan is hovering overhead like some financial Damocles Sword … and that nothing we can do or know will be able to anticipate its landing .. all we can know is that it is a When … not an If .. and that when it does .. financial heads will roll from the over exposed billionaire right on down to the average guy .

Which is to say … thanks for everything Wolf .. its been fun and ( very ) informative … but in light of how little all these specific events matter in the short term .. I bid you and all adieu . Cause as the great Zen teachers as well as the Good Book tells us .. no sense worrying or concerning yourself with that which you have no control over … as long as your head is not in the sand .

So see y’all after the great bird has landed … and lets hope most of us can walk away if not unscathed .. at least in survivable condition .. including those I’ve been in conflict with in the past

Ciao

TJ Martin, i don’t think it’s brash or over-reacting. i smile inside because so many everywhere are getting fatigued. it’s like a form of abuse to watch the suicidal insanity go on unchecked. i come in and out of here and am happy to lurk once in awhile now that i’ve gotten in trouble for ranting here or going off point. i wrote because i didn’t wanna only TAKE from y’all, as i’ve learned SO much about business money and PEOPLE from this site. but i was ETERNALLY grateful to be checked by our host, Mr Wolf, because it stopped my sick habit of leaning over and checking the state of roadkill every day you pass by it.

that’s what this site is good and bad for. reality. but it gets to you watching so many maggots eating flesh as it decays. that’s what it’s like being aware of the downfall of …ALL “this.” it’s not just amerikkka. it’s global. it’s tragic. it’s maddening. really… there are NO WORDS i have for how i feel about all the suffering for…what??? to what end ALL or ANY of this???

it’s unholy.

i know (or THINK) i’m not supposed to be talking about such existential topics on this site, but i think they go hand in hand. you cannot be HUMAN, be AWARE of this stuff, and NOT have a constant existential crisis about this and where we’re going and WHY.

that’s why i used to say Wolf should open a bar. you need straight shots to take a lot of this. or at least a group bear hug if you’re clutching your seltzer water and a 5-year-clean coin.

good luck, TJ Martin. you’ll be back here sooner than the other side of all this. there’s nowhere else to go and read this stuff or read such comments. you might take a break but you’ll be back. didn’t Walter Map tap out then come back in?

i don’t know how Wolf can inspect all this road kill day in and day out. that’s why he swims in the bay, i guess. it’s so cold it’ll focus and clear your mind and connect you to god in a hurry. any god with a free line. even the ancient ones watching mid-day technical institute and trucking commercials on cable.

but i’ll miss you, TJ Martin. for real. take a breather. this is evil stuff. go air your spirit out. i will, too.

(smile)

p.s. to TJ Martin, if you’re checking back for replies:

my metaphors have gotten flabby as a former writer. i should’ve equated your reasonable agony over the death of EVERYTHING and the insanity, as if you were daily checking over the decay of your favorite furry animal.

if death, marriage, moving, loss of a job wreck lives, we’re watching the destruction of all of ’em at once everywhere. this affects EVERYTHING in our lives so how are you expected to have cold, detached cynicism? that’d be a lie, anyhow. disassociation i think they call it. another form of insanity and the reason for all these delusions.

no. “waking up” to reality isn’t like you sit back and watch and eat popcorn. not unless you’re a cold sociapathic mxthrfucka’. occasionally you end up in the fetal position crying out for some kind of jesus.

and then this is what those wacky artists are for. hand holding through these dark nights of the soul that are no longer personal and micro, but now macro.

over reacting? how could that even BE? for, what else is there? there’s no mars to escape to. this is it.

Yo, kitten! Welcome back!

thank you, baby love!

and speaking of west virginia, i was a kid in the 70s there in charleston and my mom was being a lesbian with a woman who lived in the mountains and we were quakers then and knew menonites and blah blah blah.. point is i loved that place. tiny biscuits and sausage for breakfast after meeting at a place that looked like someone’s first floor basement and i got my love for how to prepare for boyfriends from the seven pretty white girls we lived with. i couldn’t feather my HAIR! but i know how to paint my nails and vacuum at the same time let me tell you.

anyhow, saw the PBS doc on america reframed on “oxyana” and i had NO idea it had gotten so bad over there and i’m ashamed at my silly city assumptions and i am horrified at how we all don’t see this as the CLASS ISSUE that it all truly IS.

i was in West Virginia when there were coal miners everywhere and pride … and i NEVER saw the connection like with the indians where they steal their mountains, rape ’em, poison the water and now they’re selling pharmaceuticals to poor folks and stripping them THAT way now.

seeing how this is the paradigm of this country and its history at every turn, i feel speechless and have the wind knocked out of me because… there are literally NO WORDS. it’s Too Big.

well according to this release (data up to march 2017) foreign residential real estate is not faltering. The Canadians may be selling their over valued homes and buying here.

http://www.cnbc.com/2017/07/18/foreigners-snap-up-record-number-of-us-homes.html

Source of data?

It’s a totally different ballgame:

Residential real estate = individual houses and condos.

Commercial real estate = entire buildings, such as high-rise towers with offices and rental apartments (among other types of buildings and uses).

The Chinese market has been equated to the US market in the fifties.

That is partially right, we were also still digging out from World War ll.

China to US. makes me think of California to Massachusetts…

CA swings further in any direction…more volatile, same issues but the reaction tends to be more extreme. What you see in MA as a single issue is multiplied in CA. China has central government, when they move it magnifies whatever they are addresses or omitting. Remember, they built from nothing the colossus that is Hong Kong in a very short period of time,

by taking risks…

YOU were digging out? In the US?

That is funny.

The fifties were the golden age for the US, because everyone else was literally digging out.

But by the late forties, Sochiro Honda was moving on from his motorized bicycles. In Wolfsburg, the VW factory floor was no longer flooded and pay was in other than groceries.

That 50’s age is gone and no matter who you elect, its not coming back.

I worked for with a commercial developer 30+ years ago. We did a deal with SA investors. The deal was a dud, but the currency arb bailed them out big time. So even if CRE values here decline, the Chinese investors may book gains in Yuan terms.

The japanese lost dough investing in Pebble Beach, which would seem almost impossible; right?

That just means the money laundering from China will stop but not Russia

I suspect that President Xi Jinping will do what he has to do to keep China sucking up foreign currency. That money will build a middle class that will rival our middle class in it’s heyday.. All at the rest of the worlds expense… Almost like OPEC and the price of oil….

As far as the Chinese purchases of world wide properties goes – they will either become the new homes of soon to be?? expat Chinese – or the cash cow to support their expat life – even if the properties sell for much less than they were bought for – seeing as how the China based loans that actually paid for them will not be collectable.

OR – the US banks / lenders will end up owning a great amount of near worthless real estate.

It was the 80’s when Japanese money was buying up LA CE? (subtext to the movie Die Hard) and the skyline of that city is not getting any smaller.