The death spiral of the department store.

Retail sales overall were not a disaster in May. But there were some disaster areas. Total retail sales in May dropped 0.3% from April, to $473.8 billion and were about flat with January, adjusted for seasonal variation and holiday and trading-day differences, but not for inflation, according to the Commerce Department this morning. But year-over-year, retail sales were up 3.8%.

This year-over-year increase was in the middle of the five-year range of 1.6% to 5.2%.

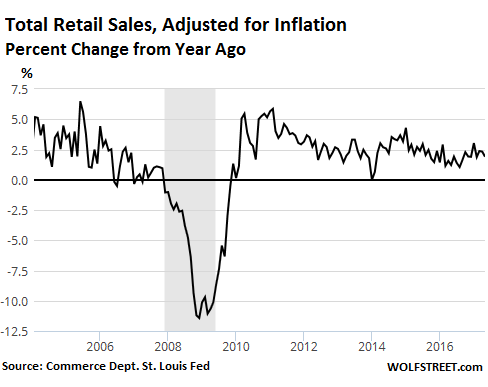

The Consumer Price Index rose 1.9% in May, year-over-year, according to the Bureau of Labor Statistics this morning. So the increase in “real” retail sales, adjusted for inflation, was 1.9% year-over-year. This is also in the middle of the five-year range of 0% to 4.3%. In other words, in May, “real” retail sales grew at the same lackadaisical rate we’ve seen for years:

Sales at motor vehicle and parts dealers, which account for 21% of total retail sales, rose 3.7% year-over-year, not adjusted for inflation. This includes sales at used vehicle dealers. While new vehicle sales have been struggling, the used market is booming. It’s powered by a flood of auction cars from rental car companies, lease turn-ins, and increasingly repossessions, and powered also by lower prices.

Used vehicle prices at the retail level – so these are not the wholesale prices I normally report on – fell 4.3% year-over-year, according to the CPI report today. This demand for used vehicles, at lower prices, is one of the key factors hurting new vehicle sales. New and recent-model used vehicles compete, often on the same dealer lot, and used vehicles have a bigger edge. There’s nothing like lower prices and loads of supply to stimulate demand.

Despite the demand for used vehicles, total vehicle and parts sales remain 3.3% lower on a seasonally adjusted basis from the peak in December.

On a year-over-year basis, most categories of retail sales were up, some in the double digits, like sales at building materials and garden supplies stores (+10.8%) and sales at “non-store retailers” which includes parts of ecommerce (+10.2%).

But sales at electronics and appliance stores fell 1.8% year-over-year, and sales at sporting goods, hobby, book, and music stores fell 4.7%.

Clothing sales in May were flat with May two years ago, which is part of the department store fiasco. As clothing sales have moved online in a stagnant apparel market, online grabs a larger share, and brick-and-mortar retailers are losing it.

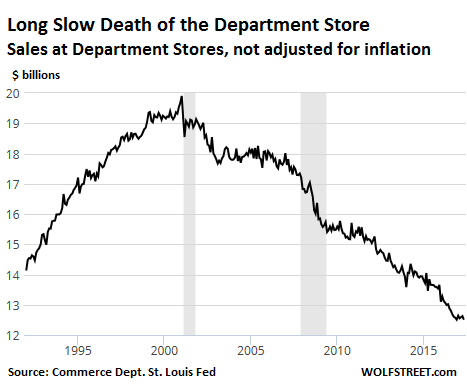

So sales at department stores fell 3.7% year-over-year. Department stores are in a structural death spiral that will never reverse. They’re at the core of the brick-and-mortar retail meltdown.

This chart of department store sales shows that long-term plunge. With sales in May down to just $12.5 billion, they’re 11% below where they’d been in January 1992 (back then, $14.1 billion)! This chart is not adjusted for inflation. So figure 25 years of inflation into it, and the real fiasco that department stores are in becomes apparent:

The Fed isn’t fretting about the fate of department stores. That’s a structural change – one type of shopping being replaced by another. The Fed is glancing at overall demand from consumers, and this overall demand is experiencing about the same unexciting slow growth that it has been when the Fed embarked on its rate-hike cycle.

So what would Yellen do? Indications are that the Fed has its eyes firmly fixed on soaring asset prices in the various markets and on financial conditions, which are now looser than they were before the rate-hike cycle started. And there is nothing in this retail report to throw the Fed off course.

Aldi’s $5 billion bet in the US comes at a brutal time. Read… Albertson’s Reveals Supermarket Meltdown as Global Deep-Discounters Promise Price War in Stagnating US Market

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Last time I went into a Macy’s (and a Sears at the same time); I was appalled by the low quality of the merchandise. Everything said ‘Made in China’ and looked it: cheap copies of the ‘real things’ sold on some faraway planet.

Cheap junk can be had on Amazon, w/ free shipping: use once then throw away … this is the tail end of ‘merchandise as a way of life’. Not surprising garden supply is increasing: gardening more rewarding than sitting in traffic for hours lugging yesterday’s purchases to the dump.

The cars are going, too. Too expensive and wasteful. Crawling to work uses less time than that spent on the job to pay for the car.

The so-called ‘American Way … ‘ it was fun while it lasted.

http://cassandralegacy.blogspot.it/2017/05/why-american-way-of-life-is-negotiable.html

Sears sold craftsman for 900 million to black and decker!

That Eddie Lambert character needs a pastime like softball to get him more exposure?

“In a nation that was proud of hard work, strong families, close-knit communities, and our faith in God, too many of us now tend to worship self-indulgence and consumption. Human identity is no longer defined by what one does, but by what one owns. But we’ve discovered that owning things and consuming things does not satisfy our longing for meaning.”

Jimmy Carter was right 40 years ago. But speaking to a nation of petulant children, he was instead spurned. Now the chickens are coming home to roost, I guess.

Always found it ironic that young people are criticized for believing they are special (snowflakes)… when by and large, it is the older generations who believe Americans as a whole are special… exceptional… etc.

Yes, at one time AMERICA was special.

The ‘old people’ remember when it was so.

It isn’t anymore.

The American experiment is mostly dead destroyed from within.

Lot’s of dumb, lazy, uneducated people living there that haven’t a clue.

“But in some populations, confusion about basic food facts can skew pretty high. When one team of researchers interviewed fourth, fifth and sixth-graders at an urban California high school, they found that more than half of them didn’t know pickles were cucumbers, or that onions and lettuce were plants. Four in 10 didn’t know that hamburgers came from cows. And three in 10 didn’t know that cheese is made from milk.”

“Seven percent of all American adults believe that chocolate milk comes from brown cows, according to a nationally representative online survey. ”

SEE:

http://www.theage.com.au/world/the-surprising-number-of-american-adults-who-think-chocolate-milk-comes-from-brown-cows-20170615-gws81e.html

Yeah, DUMB.

Off topic, but some of those chickens were hatched by Carter’s downright evil foreign policy. I don’t believe in his vicious semitic God, but if I did I know where his closest advisor, Brezhnski, would be roasting about now.

Funny that Macy’s has their purchase agent in the fashion district of downtown L.A. All clothing they sell can be found there at lower cost from the same Chinese manufacturers. The same fashion district where the IRS raided many businesses that laundered money for Mexican drug cartels.

” The so-called ‘American Way … ‘ it was fun while it lasted ”

Amen to that . The only question as we proceed even further into this Transitional Age we’re in ( ” At the End of an Age ” John Lukacs ) .. is .. do we shed the past quietly , slowly yet surely and with dignity moving forward rather than looking back … dealing with the short term pain in order to survive , thrive and move on ..

.. or do we go down kicking and screaming like a bunch of volitionally ignorant head in the sand xenophobes unwilling to deal with reality to all our eminent destruction ?

One look around and even reading some of the comments that show up on this site occasionally … I’m betting the later … unfortunately

If that is the case, many will be wise to stock up on canned goods. Others will be wiser to stock up on can openers.

Nah. You can find cheap food or even free food if you know were to look. The thing is finding jobs that lasts. Considering more and more jobs are being replaced by robots and AIs I will say we will have to learn how to be Jack Of All Trades.

homo sapiens neanderthalensis

“.. or do we go down kicking and screaming like a bunch of volitionally ignorant head in the sand xenophobes unwilling to deal with reality to all our eminent destruction ?”

You’ve met my mother?

I tell all of my friends to prepare their offspring carefully. Grab all the capital you can and leave them a fighting chance.

Its a major challenge to try to explain a simple point. Yellen will raise short term interest rates to fill the trough for the pig bankers and not to slow ,tailor or care anything about what the economy did . is doing or will do? The banks have a continued balance sheet problem and need you to pay them more money. You can’t have money in their banks if you keep buying cheap Chinese stuff ……cheap Chinese stuff or your mortgage you can’t have your cake and take huge bites out of it, at the same time!

And now you will no longer be able to know which of the swamp creatures is involved in fraud.

“On Monday … the U.S. Department of the Treasury formally recommended that Congress and the White House stop public access to a database that collects consumer complaints about financial companies, tracks responses, and records whether consumers end up satisfied. The Treasury Department said the information should be available only to government authorities.

The proposal, if passed by Congress, “could create a bigger incentive for companies to take advantage of people,” said Pamela Foohey, an associate professor at Indiana University Maurer School of Law.”

https://www.bloomberg.com/news/articles/2017-06-14/trump-wants-to-hide-your-complaints-about-wall-street

Yellen only has until the end of the year to damage the current administration in any way she can. She knows she is on her way out and will do everything she can until then to obstruct. It will all be political posturing until she goes.

Maybe she will sell out her country’s interests to a hostile foreign power.

And then move there?

Well, she has plenty of help to do that, and ‘they’ don’t even work at the FED.

How can anyone feel like spending when unelected beaurocrats are undermining an elected government? Whether you like or do not like this government, you are not comfortable, right?

And the disappointed are running after the meat scraps as fast as they can, for fear of getting labeled as …one of them Trumpers. And, this party lines up against the other party for the biased press sound bites and photos with all the very expensive teeth they bought with your money. I am not a Republican but my disgust is not getting thru, so my wallet is CLOSED.

Nothing happens by accident, and the retailers and restaurants and the groceries are getting eaten by your investments.

When the tally comes in on ebay, apple, and Amazon this quarter you will see how tight the wallet is shut, shut as tight as a King Tuts toom.

So ask yourself…feel like spending money in this dark and hostile atmosphere?

Lastly, you can not under estimate that someone, is making lots of money on this disruption. And he lots of experience doing just that.

Always a voice of reason Petunia. But there are those that believe that we have just experienced 8 years of wonderful growth and inclusiveness and everything bad that happens from here on is just someone else’s fault, not the product of past bad decisions/policies that are just now coming into full effect.

– Yellen doesn’t look at the Retail sales. She looks at the 3 month T-bill rate. And then I would put my money today on “no rate hike”. But the story could be different tomorrow.

– Another reason why Yellen won’t hike is the yield curve that seems to be in the stages of steepening.

Yellen hiked. As expected.

Yeah, but did she really? :-p

just 25 basis point

Yes… 3-month yield responded, now above 1% (Fed raised target range of federal funds rate to 1% – 1.25%).

I’m working on a piece on how, as is usually the case for about 6-12 months after the Fed begins to tighten, the longer-term bond market, including junk bonds, are blowing off the Fed. The past two cycles, there has been a financial “event” when the markets SUDDENLY got the drift. But until then, longer-term markets and the stock market ignored the Fed, even as short-term yields were responding nicely.

Interesting piece in the Globe the other day, saying that a .25 % increase seems small but not in the context of the enormous debt affected.

If you owe 100, 000 and rates go up .25 no biggie but if you owe just 10 times that much or a million, that is a biggie.

If it seems odd to say ‘JUST 10 times that much’ look at the National Debt compared to when the Fed would raise a whole percent at a time. It is more than 10 times as much.

The other day ANZ increased interest only mortgage rates by 30 basis points.

It also decreased P & I variable rate mortgages by 5 basis points.

Now the banks only have another 195 basis points to reduce rates to get to the same margin as at the time of the GFC.

That 5 basis point cut on a A$100,000 mortgage works out to a whopping A$4 a month cut. On the average A$300,000 mortgage about A$12 a month.

The cost of mailing out notices and programming will probably cost the bank more in the first month, but wait……………

Overall, the action is going to INCREASE the bank’s profits by 1.5%.

They could have cut variable P & I rates by much more to make the move neutral and actually reverse some of the huge margin they have built up over the past 9 years or so, but no they have to pad the bottom line even more.

So yes, when rates increase there is a huge impact. Too bad that the banks have taken so much more margin over the years.

And economists and politicians still wonder why people are spending in stores. That 200 basis point increase in margin is taking A$500 a month out of the pockets of every person that has an average mortgage and right into the pockets of the banks.

Every year.

as telegraphed?

If ‘she’ can’t hold the …bond market together, the stock market tanks. I don’t think she has control of it, the bond market, and the appearance is only because of the other ‘central bankers (former Goldman) buying or biding our Treasuries has it held up. lets not forget they are more ‘liquidly deficient’ than we are, so what then? More music? Until?

This is a razor blade stroll down the path into the future, and not even the FED and Ol’ Yeller’ can’t see what they hath rot upon us, and themselves. You do.

Along with that are “PlaYbill” stage shows…..the retirement funds, and pensions. After that…what?

– I noticed. But it also gives me a good clue on how the FED looks at the chart of the 3-month t-bill rate when they’re considering whether or not to hike rates.

– It will be interesting to see whether or not and by how much that rate goes above the 1.00% level in the next day & days.

– There’re a number of things that don’t bode well for the stockmarkets and the economy. E.g. Dow Theory keeps flashing “WARNING” and so does the (falling) 10 & 30 year yield(s).

Anyone who believes that Fed isn’t going to hike now that the new administration is in must also believe what the mainstream media is selling. The Fed has raised more since the election than they did the previous 8 years. They will raise again at least once before then of the year.

FWIW: It does not appear to me that “retail,” particularly the department and “big box” stores, were not “killed” but rather committed “suicide,” by a combination of egregiously bad personnel management practices and “financial engineering,” aided and abetted by the PE firms. Nothing could sustain the company debt levels.

This segues into another suggestion that a new felony be created, analogous to “careless and reckless operation of a motor vehicle resulting in death or serious injury*,” namely “careless and reckless operation of a corporation resulting in bankruptcy or serious job loss.”

* https://en.wikipedia.org/wiki/Reckless_driving

http://legal-dictionary.thefreedictionary.com/reckless+driving

I just returned from my local O’Reilly auto parts store, and I was surprised at the lack of care and professionalism of the staff working there. The workers were moving slowly and ignoring the phone. One caller was put on hold for at least five minutes, and I left (thankfully) before the clerk answered back.

Sorry for the rant, and it’s a small sample, but the workers obviously did’t give a damn, and nobody, including the few customers seemed to be happy.

O’Reilly stock has been been at $290.48 last August, but it’s at $234.33 now. I have owned some in the past, and did nicely, but there’s no way I’ll buy any soon.

Dan,

Your post reminded me what fellow employees used to say at a small airline I worked at in my early twenties, “You pretend to pay me, and I’ll pretend to work.”

Actually that was a joke supposedly told by USSR workers in one of the era’s grand communist nations (remember the USSR?).

Why would any American work in a place if they were that unhappy? Sometimes you have to accept the consequences of your own lack of decision.

“We appreciate your patronage; f$#% you very much.”

Do yourself a favor and shop online – these dedicated auto parts stores are thieves. The markup is incredible and the peons you and me always lose.

I do shop online with TireRack.com for all my brakes, suspension, wheels and tires, and I will look into it for other parts too, but I needed a 10 amp fuse and tail lights (brake & running) for my motorbike.

Having no taillight or brake light is an invitation to be pulled over by the police, or worse, to getting run into. I needed the parts ASAP, but I will try to avoid doing any more shopping at O’Reilly’s

Yellen thinks a low unemployment rate will eventually cause inflation (she’s wrong) so she’ll hike. But only another 0.25%.

There is the un-employment rate and then there is the under-employment rate. A “job” is not simply a job. The median or typical American worker has had an [understated] inflation adjusted *STATIC* income since the 80s, not factoring in loss of benefits such as employment stability, defined benefit pensions, employer paid health insurance, and higher taxes, e. g. sales and fees. What inflation we see is asset bubbles mainly resulting from QE and “financial engineering.”

Lose of pensions is a huge difference. Baby boomers may be the last group retiring where a good portion have some form of pension combined with a 401k and social security.

Gen X and even more so Millennials will be purely relying on 401k’s and possibly a shrinking social security. We could be in for a very poor next couple generations of retires. Or possibly worse, old people who remain in the labor market too long.

Probably will be a shit show. I would like to just ignore it all and say you deserve to work forever or retire poor if you never had the good sense to save and invest, but if there are too many people in that category they will harm the whole system.

RE: I would like to just ignore it all and say you deserve to work forever or retire poor if you never had the good sense to save and invest, but if there are too many people in that category they will harm the whole system.

=====

Before you can save and invest you must have some discretionary income. When you must spend all that you make, and more, on current living expenses, there is nothing left over to “save and invest,” and there is the current minuscule interest rates leaving only the RE and markets casino.

My bank offers 0.22% savings rate (*note* that is less than 1%!). How the he// can I retire on that? I remember my parents’ rate in the mid-90s at 7%. Again, how the he// can I retire on 0.22% savings rate?!

As B.H.O. would say, “We inherited this mess”.

I honestly don’t even know what a high yield savings rate would feel like. Since I have made money bank savings yields have been basically below 1%.

Low cost index stock and bond investments still seems prudent in either environment. Though short term, sub 30 year savings goals are killed by today’s non-existent returns.

Now maybe back in the 1980’s when you could get 12%+ on 5 year CDs we were in another world entirely. But I think those numbers are not directly comparable due to drastic difference in inflation…

I would not underestimate the amount of people who have the means to save but don’t have the energy or desire to learn how, or are getting duped in to poor investments, like sinking everything into a house they can’t afford. Of course all of this is a mute point if you are chronically underemployed, these people will suffer either way.

Baby boomers, even those who scrimped and saved, are in for a triple whammy.

Bonds and CDs get them nothing.

Stocks are way overpriced.

Pension funds are struggling.

The next decade will be brutal. The average Boomer has $1.1 mn in retirement assets. The median Boomer has just $200,000, and things don’t look good at all.

Cause & Effect

Demographics – Specifically the aging of the ‘Boomer Generation’.

Until fairly recently the baby boomers had all other generational cohorts outnumbered by size and percentage of population. During 2016 the first wave boomer generation turned 70 years old. There are two more waves to arrive, within the next eight years.

This generation has been described as the “bump in the snake” of the population. Older people no longer save for a rainy day, since their rainy days have arrived. They divest themselves of large houses, two or three cars with RV or boat, cash in bonds, in general just liquify their assets.

Their shopping habits drastically change from one of mindless consumerism, to one of careful consideration of resources, (especially to threatened pensions) with an eye to healthcare and extended care, in an old age dotage.

The ‘slack’ in the system is systemic. The up-coming generations will not, and have not, been able to fill the void being left by the passing of the boomers. All part of this “Fourth Turning”. A new century cycle.

I’m reading “The Fourth Turning” right now. Uh oh. There may be rocky times ahead.

Thank you for reminding me to read that. Was meaning to, and kept forgetting.

Main street is in a death spiral as the fed and main street are being held hostage by the banks?

The recent hike in short rates by the Fed takes money out of the economy to prop up banks balance sheets death spiral! Appalling?

Yes?

Yes?

Yes, this is exactly what’s happening. What plea bankers is now more important than the well-being of the entire rest of our country.

They’re too big to fail, right?

The rest of us are individually too small to succeed.

Trump is on record as long refrains, ‘they’re a great time to buy’. Nevermind the suffering.

Does anyone else see depression coming?

To be fair, the Fed gets flack if they keep rates low, they get flack if they try to “normalize” them. Which one do you prefer? I prefer normalizing rates so that asset bubbles can be deflated.

Crash it baby.

In the meantime, think how to blame Trump.

Seems clear to me that Yellen will continue to raise rates (slowly) until stocks correct. This tells me the correction is coming soon. The quarter point increases add up. The Fed is now putting a lid on stock price appreciation.

Retail sales are going to continue to be flat to down if consumers are all like me. I am only replacing items I need, nothing extra.

I noticed during the Xmas season that inventories were really down in most stores. I still see that continuing or getting tighter. Last year I was looking to replace some furniture damaged during our move and the wait time for delivery was days, I’m still looking and now the delivery wait time is months.

Petunia –

Thrift shops are the way to go.

Was looking for 2 love seat sofas (7 months) and found a matching pair of pre-seventies Sklar sofas for cheap. They sold for top dollar back in the day. Best quality construction with an excellent frame, although the upholstery was in decrepit condition.

Was worth it to have them reupholstered and the wood refurbished, at a custom shop. Can’t beat the older furnishings for quality construction. Now have what I want, for the price of what would be considered “top-of-the-line, “new” cheaply made crap.

Did this death spiral result in negative job numbers? I don’t think so. And until that happens, yellen is fine.

a paltry rate increase and QE sterilization schedule. but no worries BOJ and ECB liquidity will prop up any fall. The real

litmus test is the proposed GOP budget for 2018 . 404 billion

deficit . who will buy the deficit? ? oh take a look at the national accumulated debt for the proposed budget and future years. from what i see national debt increases every year. The beat goes on .

https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/budget/fy2018/budget.pdf

The chart labeled “Long Slow Death of the Department Stores” does seem to resemble the Fed’s “Velocity of M2 Money Stock” chart, since the year 2000.

Yellen and the Fed are wholly focused on further enriching their oligarch cohorts at the expense of everyone else. The fate of retail or the 99% means nothing whatsoever to her and her ilk.

Gershon Your comment is the best on this story No doubt

The Fed cannot help department stores.

The business model structure of many department store is the problem. It’s not competitive.

To avoid CAPEX, unsold merchandise, and risk of low turnover, department stores use designers and vendors to provide goods on consignment, as much as they can.

They shift the risk to the vendors, away from them. A vendor in troubles can always be replaced by another. There is a waiting line.

The vendors are also forced to spend money on advertisement and in

some cases on personnel.

The vendors must use a high markup above the cost of goods.

The department stores have their own markup, making product price expensive, exposing themselves to sophisticated competitors.

When department stores cannot compete, the consignment vendors

get hit. Both get hit.

An example :

– if the vendor cost of goods is $100, he will charge 60% markup.

– a consignment good that was sold by the department store will generate $60 for the vendor, before expenses, commission, etc. The vendor will issue an invoice to the department store for $160.

– the department store will rarely be sold out. Even tomatoes have

rejects and leftovers.

– suppose the department store sold 50% of the goods.

– the vendor profit is not $60, but : 50% x $60 = $30.

– that said :

1) the vendor probable markup is not 60%, but 30%.

2) the vendor have to deal with $50 rejected goods, bad items that came back and liquidate them at well below wholesale prices, cutting his real profit by half. Perhaps, to a loss.

If the vendor increase his markup, to better compensate himself, the

retail price will be pushed higher. make it less affordable for the

consumer to buy.

The solution is a quick replacement of winner. Quick turnover by 20% to 30% of the goods are hopefully winners. But in a bad market nothing move fast, even the stars can lose their sparkle.

So, the internet is to blame or is because they borrowed money? Probably both.