Up 10,000% in 16 months? These charts truly depict our crazy times

“One word, a question: Ethereum,” said the guy at my swim club on Sunday. “What do you think? It’s a ten-bagger since January.” Meaning that the value of the cryptocurrency has multiplied by ten in the four months since January 16.

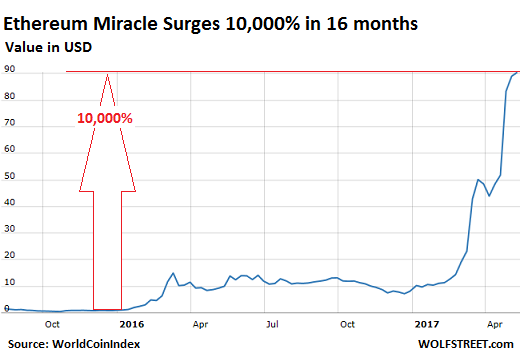

It’s actually more than a “ten-bagger.” At the end of 2015, it was worth $0.90. As I’m writing this, it’s worth $91.30. Those who bought it at the end of 2015 had a ten-bagger on their hands by January 16, 2017. Those who bought at that time also have ten bagger on their hands. Those that rode it all the way up over the 16 months have a 100-bagger. For percentage fans, that’s a gain of 10,000%.

Here is the chart of this financial miracle (via WorldCoinIndex):

d of insane instability. But it really doesn’t matter what it is as long as it is going up.

d of insane instability. But it really doesn’t matter what it is as long as it is going up.

By “market capitalization,” ethereum is now the second largest cryptocurrency at $8.4 billion.

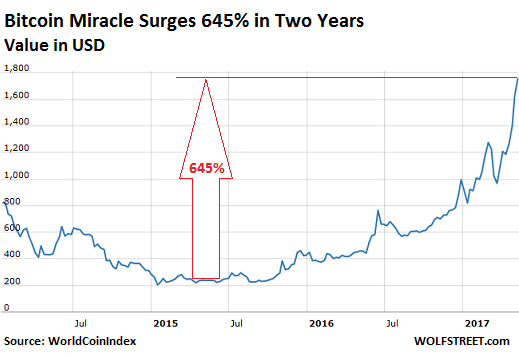

The largest one is bitcoin with a “market cap” of nearly $30 billion. It’s the granddaddy of the cryptocurrencies. The value of a single bitcoin, at $1,789 on Sunday, is 46% higher than the value of one troy ounce of gold. In mid-May 2015, bitcoin was at $240. Over the two years since, it has soared 645% (via WorldCoinIndex):

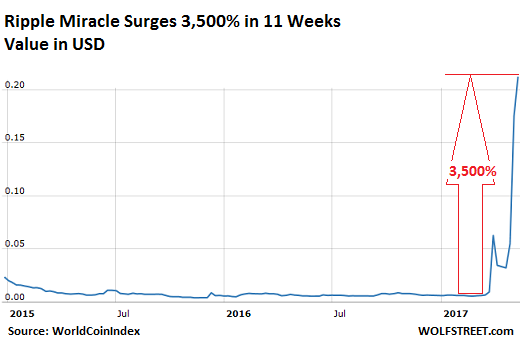

Number three in line, in terms of “market cap,” is Ripple, which now trades for $0.215. There are a lot of them, and all of them combined are valued at $7.3 billion. It’s up from $0.006 at the end of February 2017. So in the 11 weeks since, it has soared by 3,542%. Or to use my friend’s term, it’s a 35-bagger in 11 weeks. This is its ludicrous chart (via WorldCoinIndex):

It’s not some kind of bad joke. This is being played with real money. That it will inflict maximum pain on the latecomers – whenever this happens – is now perfectly clear.

There are over 830 “alt-coins,” as the alternatives to bitcoin are called, out there, with new ones being added constantly. The “market cap” of all these cryptocurrencies combined, according to the Financial Times, has pierced the $50 billion mark. So this starting to involve serious money.

But there are a couple of issues with this miraculous scenario, according to the FT:

An increase in initial coin offerings (ICOs) – unregulated issuances of crypto coins where investors can raise money in bitcoin or other crypto currencies – is fuelling the market and drawing attention from lawyers and financial professionals.

Many fear ICOs, which are trying to market themselves as an alternative to venture capitalists as a way of raising cash for businesses, breach existing securities law.

“An ICO issues crypto tokens rather than stocks and bonds, but that’s irrelevant to the substance of the activity, which is raising capital from the general public,” said Ajit Tripathi, a director in fintech at PwC. “Capital raising activities need to be regulated to protect investors . . . The question is how sophisticated are these investors?”

Many of these investors may not be “sophisticated.” But others appear to be highly sophisticated, now that the sums involved have gotten big enough for them. The FT:

Observers say many individuals are trading alt-coins from corporate IT departments, concentrated in the financial sector and falling under the radar of senior executives. Many are sitting on virtual fortunes, but are unable to liquidate their cash as banks clamp down on measures to avoid money laundering.

“Systems are being used here by employees to increase their own individual wealth. In the process, corporate systems are coming into contact with the fringes of the criminal world,” Brian Lord, former deputy director for intelligence and cyber operations at the UK’s electronic espionage agency GCHQ and now head of cyber practice at security group PGI, told the FT.

Big sophisticated traders – including hedge funds and others – are in this trade, not because it might make some real economic sense, but because, as the charts above show, these things can be pushed up quickly with enough money involved. And if enough new people can be drawn in due to the ballooning hype, then the big boys can get out, once they figure out how to deal with the banks’ concerns about money laundering.

For now, the SEC and other regulatory agencies have turned mostly a blind eye, as they usually do. Later, when it’s too late, after considerable wealth has been transferred from those getting in late to those getting out in time, the SEC might get interested in it. And that act alone could reverse some of those charts above.

For now, cryptocurrencies remain relatively small compared to derivatives. Oh, and the unintended consequences of trying to regulate that monster. Read… $500 Trillion in Derivatives “Remain an Important Asset Class”: Hilariously, the New York Fed

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The governments will eventually outlaw the use of cryptocurrencies- it is only a matter of time. The question is, will the governments succeed in the enterprise? I am unsure.

With ‘bit coin’ being the preferred payment system for ransomware extortion schemes, governments have every reason to want to find a way to end this.

It might be done like ‘tax cheats’. Catch a few and send them to prison ( China will probably execute any bit coin criminals they catch) or it might be done by reverse malware. Log into trade your bitcoin and your screen freezes up with instructions to call the IRS or some prosecutors office to turn yourself in.

Would not be the least surprised if the Ransom ware criminals drove up the prices in advance of their release. You know, sort of like some Saudi mind readers bought airline short positions prior to 911.

Make those insiders Americans (wish it was different!!) . Source: The Corbett Report et al (on Youtube)

“Global ‘Wana’ Ransomware Outbreak Earned Perpetrators $26,000 So Far”

$26,000 is peanuts compared with what investors are trying to do.

“Global ‘Wana’ Ransomware Outbreak Earned Perpetrators $26,000 So Far” (https://krebsonsecurity.com/2017/05/global-wana-ransomware-outbreak-earned-perpetrators-26000-so-far/)

$26,000 is peanuts compared with what investors are trying to do.

(Sorry, messed up the URL again.)

Fiat currency, US$ UK £ are the preferred payment system for criminals. Bitcoin is the preferred currency of the internet

Most durg dealers require hard fiat currency

That’s foolish. Are we going to ban the dollar because banks get robbed??

Hopefully or at least ban Mr Yellen

The corrupt govts are the ones who put the ransomware into play – because if they are not the criminals in charge of it ; it might compete with their rape of the middle class – cant have that now…. It will go away soon if they have their way… they always do get their way.

No need to outlaw crypto currencies. The NSA (or any other agency) could merely put their vast computer resources to work. If you own 51% of the Bitcoin minining, you can reject all of the Bitcoin transactions. Rendering Bitcoins immediately useless.

Are we talking the same NSA which not only allowed their taxpayer-funded tools to be stolen but did absolutely nothing about it once they found about the theft because, hey!, they do not answer to mere peasants funding their spending binges?

Because if it’s that NSA we are talking about I wouldn’t hold my breath.

The NSA has built a huge facility 25 miles south of Salt Lake City.

They no doubt have the ability to shut down any crypto currency.

Saudi Arabia spends billions each year buying highly sophisticated weapons and hiring “contractors” from the US, France, UK and other countries and it’s being “stalemated” in Yemen by insurgents wielding rusty Soviet vintage weaponry.

Throwing money out of the window, especially when you face no consequences for incompetence/corruption/monumental waste, is not the equivalent of being even remotely competent at the job.

Wolf, you can only understand the value of ETH once you understand the technology and the 1000’s of potential use cases for Ethereum. Blockchain technology as a whole has evolved from the simpler currency based models of Bitcoin and Litecoin, companies and groups are building complex systems on blockchain today that have utility far beyond the simple transfer of value. ETH is the primary example. At the same time there are 100’s of Bitcoin clones that are worthless. If you think the timeline the internet evolved over we’re in 1996, things are evolving fast and Bitcoin is like the first bulletin boards, email or IRC servers, it shows whats possible, but the killer apps (like ETH) are just starting to be developed.

So what are these 1000s of utilities?

I assume they’re essentially putting transaction data into the blockchain as proof of some or other task?

Being distributed and having £££ behind it means it’s a secure database of what’s happened?

Is that really a ‘thing’ in business world?

Doesn’t tax law etc say you need your own records? Not ones that can disappear or change (let’s not pretend they’re immutable forever)?

So you backup, what if things do change? Who has the ‘real’ data?

Or if these services are all just financial, who manages the keys to everything in a big business?

They’ll need insurance in case of mistakes/hacks. That adds costs back. Perhaps internal ‘clearing’ systems?

Or big business running their own blockchains? So basically a database again?

I’m still waiting for one person to outline a working example for how you’d use eth or btc or blockchain for any regulated business activity and it work better than other means.

Please give just one and I’ll be happy!

Wolf,

Love reading your blog! this is my way to give back!

Wolf and Yancey,

you cant be any more far off in your statement or assessments of block chains future. Of course, dont believe me. Do you own DD.

Hints: EU, Japan, Australia already legalizing and adopting crypotos. And why would world’s major banks (JPM is among them) already test these technologies (+ BHP, BP, MSFT, United Nations!!! etc).

Oh wait, what about the Fed which owns by the same banks? will it allow it? :)

https://www.federalreserve. gov/econresdata/feds/2016/files/2016095pap.

pdf

It is a question of when not if, imho.

That’s precisely my question – Why are Governments allowing this? If this is sound money, they would have already banned or at least controlled it. See what they do to Gold and Silver. This question always worry?

It’s not whether it is widely accepted now or in future is not worrying me. What is it backing? At least for Dollars, it has Trillions of Dollars of Bonds(debt) backing!

Can someone tell me why this is different from Dollars when it is backed by nothing!

“Can someone tell me why this is different from Dollars when it is backed by nothing!”

It is backed by nothing.

The other fiats at least have a shaky state Administration behind them.

Governments have no intention of outlawing the block chain technology. (Central) BANKS (not governments) will resist for as long as they can to let their masters to get in, but eventually will give up, first by letting USD and BTC coexist. As for individual cryptos banning – case by case basis. MANY are scam ( in fact over 600 are dead already and probably as many will be dead after another “pop” $xx,000/BTC?).

I suspect, USA (along with UK ) will be one of the last to utilize BTC as currency, if ever. It is now obvious, QEs did not and will not have a long last effect. Each “fiat” infusion requires more infusions – another software update to add Trillions. Blockchain concept was introduced 8 or so years ago, and is possibly an answer to central banks’ problems. Fun fact: they both use software; one is transparent, another is not~!

Fortunately, or unfortunately, USA did not have to go thru what EU and Japan in Central Bank Experiments like negative interest rates. Thus,

EU, Japan, China, Russia, India, even Africa will lead the way, not USA.

BTC is first out of many, and as of today, it is a “reserve” blockchain ~ a king of crypto, even if technologically it is far inferior to “2nd generation cryptos”.

Accept it or not, it is a new asset class like CDS, VIX etc. and price (cycles) = human behavior. It is unregulated at the moment, and not highly used (like USD) thus the volatility.

It is still early. 2013 for bitcoin was just like 2000-01 or 2007-2009 bubble/crush. Compare that to a long term chart of AAPL and AMZN…

I’d rather have physical silver, gold, or platinum I can hold in my hand than a scam cryptocurrency or printing press FedBux backed by nothing but “faith and credit.”

Government have already tried outlawing or banning bitcoin and it hasn’t worked. China tried outlawing BTC yet the chinese continued buying them off various exchanges using VPN software. Japan has recently accepted BTC as an exchange medium and used at 260,000 locations. It’s far more widely accepted internationally and suspect BTC is unstoppable. What might happen is government/banks/alleged regulators will adopt their own cryptocurrencies (which is happening) yet it still wont’ take away confidence from BTC as it is unregulated. Onlookers will see the banks control end-to-end functionality of “their’ crypto-currency so when there’s a bank run there’s nothing you can do, hence why there will still be confidence in unregulated cryptos that’ve fostered a great deal of adoption outside of gov.t. regulation.

“hence why there will still be confidence in unregulated cryptos that’ve fostered a great deal of adoption outside of gov.t. regulation”

Should read

hence why there will still be Speculation and manipulation in unregulated cryptos that’ve fostered a great deal of adoption outside of gov.t. regulation

– Quite simple. Three words: Bubble, bubble & bubble.

Pump and dump like the folks on The Street of Walls??

In late 2013 after having been mostly a joke for years, Bitcoin sudden shot into the stratosphere to over US $1200.

In little over a month it had collapsed to US$630, but the “Buy the dip!” brigade charged in and managed to send it soaring back over US$1000 for a fleeting moment before it crashed first and then declined all throughout 2014 and languished forgotten throughout 2015.

In 2016 something different happened. It wasn’t the wild gyrations which had taken it for a wild ride previously. It was a steady and concertated effort to send Bitcoin higher and higher, not merely an attempt to get bitcoin to shoot into the stratosphere so as to fleece the gullible greedy in a very short time.

There have been two explanations for this: either individual traders from IT firms using bitcoin to “hide” their illicit operations from their bosses and/or regulators or Chinese capital flight.

Personally I incline towards the former.

But in the last month it seems something else happened: we are back at the old wild gyrations. And bitcoin is pretty tame compared to other cryptocurrencies, which exhibit a behavior very similar to that of the Shenzhen Small Caps (SSC) in early 2015: they only go up and very fast.

Personally I believe cryptocurrencies are going through exactly the same phase as the SSC: after an initial period which saw professional speculators send an “underpriced” asset soaring, the dumb money came pouring in, driven both by greed and years of the most savage financial repression in living memory.

I call this the Apple Effect: when it’s revealed Warren Buffett or the Banque Nationale Suisse (BNS) have increased their AAPL holdings, value shoot up some more, not so much on fundamentals but on the premise both Buffett and the BNS have access to some secret, privileged information and hence it’s better to follow their lead.

We all remember the most emblematic picture of the Chinese stock market bubble: a greengrocer checking stock graphs in a small market stall among mountains of fresh fruit.

Investors like him are usually very late comers to the party . By this time the original speculators have already abandoned the field for greener pastures or have their mouse pointer hovering over the “Sell” button.

The main different between professional speculators and “Johnny Come-Late” is the former have benchmarks at which they’ll sell. They do not care that the market may go even higher next week: they’ve made their profit and are checking out.

By contrast the late-comer tends to stick to his “investment” far too long. “I’ve already gained 15% but this asset is still going up. I am holding on to it some more” ruined millions and keeps on ruining millions.

Cryptocurrencies have also an extra benefit for old fashioned speculators over traditional asset classes: they are completely unregulated.

This means there is no central bank trying to save greedy retail investors or geriatric megabanks from themselves. If bitcoin crashes, it crashes: there’s no plunge protection team bruning through billions to make sure people don’t eat their well deserved losses.

You can make some serious money and nobody can do anything about it.

Interesting article on Chinese and BTC… http://www.coindesk.com/real-volumes-revealed-bitcoin-reacting-new-age-trading-fees/

One of the main arguments against crypto is ‘volatility’.

But first, yes, alt coins especially are the wild west. full of scams and pump and dumps.

Yet Bitcoin has survived and if you only ever yell negatives about it you have no done more than a modicum of research. Case in point – volatility.

It is all good and well to shout about the plunges in a small market cap. But try looking at it on a risk adjusted basis and you will see the downside swings pale in comparison to the upwards price returns.

It has been the best performing asset class in the world for 4 of the last 5 years, usually up hundreds of percent per year.

It is not a scam or a ponzi but a token of access to the most secure, decentralised asset ledger in the world, giving you the ability to transfer data securely without needing a middleman. Access to this ledger is limited and the more people find use for it (be that due to fiat devaluations, economic downturns, sanctions, currency controls, or businesses looking to make their supply chains more efficient etc etc) the more the price rises due to limited supply.

It may go to zero. But if it doesn’t it may go to $10000. Economists, unable to fathom the decentralised security of Bitcoin and marry it to the rise of global internet commerce, just don’t grok it, or don’t want to.

Good. I’m up 28x on my btc, while my gold has done nothing for 6 years.

Yeah, it’s not a joke anymore is it? Now it’s evil, right? Is it crazy? A mania? Forget all that stuff… Just get some of it as part of a diversified portfolio. A little gold, a little silver, some SP500, some crypto, some safe bonds (treasuries), a little real estate. But if you look at the potentials of all these asset classes you’ll probably get most excited about the crypto.

Also forget about what the gov and the speculators and the big bad money “MIGHT” do – invest how YOU want, not how they want.

Hey those charts are even better than Melbourne real estate!

My guess is that this is result of the Chinese govt cracking down on illegal money transfers out of China by Chinese citizens, e.g. to buy overseas real estate. I expect the Chinese govt to step in shortly and snuff this out somehow.

If there was genuine ‘fear’ of fiat currency losing value or, perhaps, the Euro disappearing then one might expect the other shadow currency, gold, to be soaring along with the crypto currencies. No sign of that.

Then there is the spectre of Mount Gox. When a big pot of crypto currency can just vanish caution is advised. Whose to say some ‘intelligence agency’ doesn’t have a worm that can make it all disappear?

30 years ago my £1 was worth a lot more about 97% more now its worth about £0.10 …. Banks are sods, free trade is where it is at and as the value of Btc is this high with only 1% of people using it, the value sorry to say will rocket. Governments need to get a wiggle on and offset their deficit :-)

There is no Comex or LBMA allowing central banks to dump paper contracts of Bitcoin into the market to keep the price suppressed as they do with gold and silver. If the metals were allowed to trade based on supply/demand fundamentals they would be moving up like the crypto currencies

If the price of gold and silver were ‘suppressed’, there wouldn’t be any available to buy. It would have the same effect as price controls.

As it stands, you can buy as much as you want at the spot price, anytime. Alternatively, if the price were ‘manipulated’ too high, markets would be flooded with gold and silver, with scarcely any buyers.

Oh, so that’s why premiums skyrocket when gold and silver are manipulated downward thru the Comex. Wait, what…

Two words: hardware wallet.

This way you don’t lose your coins in a Mt. Gox type situation.

Regardless, these computer-mined cryptocurrencies are still inherently worthless.

“This is being played with real money”. Wrong.

Its “being played” with fiat currencies. There is only physical gold and/or silver that answer as “real money”.

Being played is the absolute correct term.

Cryptocurrencies are nothing more nor less, than de facto digital currency and thus yet another fictitious form of wealth, with a computer system as its counter party.

But you can pay taxes with euros. Can you with them with bitcoins? Here the main difference.

Yes, Switzerland accept BTC as payment for government bills and Japan have said that BTC is now a currency :-)

Spot on. Not everyone awakes at the same time. The arguments about gold vs fiat, and crypo vs. fiat are very similar.

What gold fans dont see is the new technology is the post crisis (2006-2009) answer to manipulated fiats/gold etc.

The difference is a gov can threaten to take our gold, and has done so in the past (be it in USA or Nazi Germany etc; but…

it CANT BAN INTERNET (blockchains). It can ban exchanges, but not possession of something it does not recognize yet. It simply can’t.

Look at Japan, Australia, EU…they will have to adopt if they want to survive!

However, 90% of altcoins today is scam and will not survive, similarly to dot com.

Lastly, there are “coins” backed by gold and rubies.

I did not know that. However, I would not be able to sleep at night if the little money I have managed to save were bitcoins.

You can consider it another fiat currency if you feel like it, but I think that for the time being I am gonna keep my euros. (;

I think Japan recognized Bitcoin as a commodity, not a currency. Crazy Japanese wants to pave the way for new financial products based on Bitcoins. This bubble is just beginning. Stock market is so 2016, there’s new casino in town.

http://asia.nikkei.com/Markets/Tokyo-Market/Bitcoin-getting-interest-paying-accounts-in-Japan

“it CANT BAN INTERNET (blockchains). It can ban exchanges, but not possession of something it does not recognize yet. It simply can’t.”

You are underestimating governments. It doesn’t need to “ban the Internet”. Governments move slowly but they will sooner or later control this, if anything, to protect people from other people.

It is extremely naive to think that this thing can just work and go mainstream, and remain out of governments’ grasp. It’s software for crying out loud. It can be hacked and will be hacked. Government can shut down entire mining farms if it wants to. And in Bitcoin’s case, there are a handful of farms monopolizing the mining. Hardly decentralized.

If it’s not the government, then it’s gonna be some other group who will take over and control this thing because when there is enough financial rewards involved, the big sharks smelling blood will get in on the action. Believing that this is truly decentralized and democratic is extremely naive. Again, it’s just software and hardware. Convenience is always a double-edged sword. You can transmit “money” quickly? This implies a trojan program can also spread quickly.

The internet myth ;

” Yes, Switzerland accept BTC as payment for government bills ”

The real world reality ;

Actually CH does not accept Bitcoin for either tax payments or any other government bills .. ( nor does Japan ) Only the city of Zug CH … is considering accepting Bitcoin as payment for SERVICEs only … such as electricity , water etc ( not taxes etc ) and even that is a future possibility not the current status with CH as a whole taking a dim view and considering blocking the use of Bitcoin as payment for any government services on the horizon

Ahhh the joys and fertilizer of internet myth propagated more often than not by the entities most likely to benefit from them .. knowing full well the majority of internet users will take what is posted at face(book) value .. rather than taking a moment to research the facts

In general, when some media announces commercial entity X now “accepts” Bitcoins, it usually means a 3rd-party proxy is involved for converting the Bitcoins from the buyers into “conventional” cash as payment to X. X never actually sees the “color” of the Bitcoins, let alone own any and obviously, doesn’t want to. So in most cases, “accepts bitcoin” is misinformation and propaganda.

Why not? Both are fiat currencies backed by nothing but trust of the gullible. At this point, my trust in fiat is about the same as in bitcoins. Thanks, central bandits.

When I can go to my local grocery store and pay with gold or silver, I will consider it money. Until then, it is just another commodity valued in fiat dollars, the real money.

Please realize “true” definitions.

Money MUST satisfy ALL seven following conditions, to be classified as “true” money, if ALL seven of these conditions are not satisfied by a substitution, then that medium can ONLY be classed as a currency. Which is NOT money.

1/ Unit of account

2/ Medium of exchange

3/ Be easily portable

4/ To be durable

5/ To be divisible

6/ Must be fungible

7/ Must be a stable store of value

To each his own definition.

Mine:

1. Must be exchangeable for beer.

LOL … Awesome definition of currency.

Hey in the end times, beer is going to get you through times of no money better than money is going to get you through times of no beer.

You or anybody else wouldn’t want to. Bad money drives out good, so the least desirable money would be in circulation at the greatest velocity.

In the late ’60s, none of the grocery stores, or any store for that matter had enough coins – there was a severe shortage, because they were mostly silver, which was being hoarded because the dollar was severely debased relative to silver. You were always asked if you had exact change.

The only solution was to start banging them out of cheaper metals, first with 50% silver content, then zero silver content. Just like the Roman Empire, or Tudor England, etc etc.

This. So much this.

Right now a hobby that exists is “coin roll hunting” where you get rolls of dimes, quarters, or half dollars from your bank and go through them looking for silver ones.

Silver dimes etc are getting rarer and rarer. I’d consider hoarding those far sooner than I’d consider messing around with some kind of “coin”, bit or otherwise, that I can’t hold in my hand.

And before that I’d learn to brew beer.

Until Yellen debases the dollar into worthlessness, in which case producers will demand a real medium of value in exchange for their goods and services. Green FRN FedBux backed by nothing won’t cut it when that day comes around.

I’m starting to think of pulling out of supperanution as I feel like they are gambling with other people’s money instead of investing it. Gambling is a losers game in the end. The worst part is someone else losers your money for you

China.

They are trying to get out, they have gotten around the hurdle set up by the authorities. They were pouring through.

And they are holding th currencies.

During the early moments of gaming the Chinese authority hurdles they bought things, meloubre real estate. Now they don’t bother. They buy and hold.

The supply of these coins has collapsed as the price as increased.

“The supply of these coins has collapsed as the price as increased.”

Hence rapid price escalation at the margins. And when someone wants to trade these things for real money, they’ll see rapid price collapse at the margins.

Probably pure speculation, like anything else like it in the past. It’s human nature. Things would have to be pretty dire in China for a person to move their savings into essentially… nothing.

My guess is it will end in tears for a lot of people.

Annnnnnnnnd ITS GONE

A fiat “currency” created out of thin air and backed by nothing?

The counterfeiters at the Fed and central banks will not appreciate such competition. These cryptocurrencies’ days are numbered.

it is the other way around, imho. Central banks cant stop people. They will try…

But greed can destroy people. Bitcoin and cryptocurrency are just software. And like all software, it can be and will be hacked.

These cryptos would be better if they were backed and convertible into something except the full faith and credit of the people. And my grandfather said never to bet on people. A computer algorithm to mimic scarcity and diminishing supply does not cut it.

At the current price, 1 BTC equals 36 barrels of oil. I’d rather have the oil or 1.5 ounces of gold, which historically is equivalent to 15 – 30 barrels of oil.

Me too

FYI, there are cryptos backed by gold and precious stones (rubies etc);

Pants down No thanks it’s most likely just gold plated tungsten anyway Stowing foil hat now :)

Hey guys – these things are exchange networks with very unique attributes. They are a new asset class, the biggest thing since the Internet. Their ultimate value is immense. They are just starting. Every diversified portfolio ought to have a small amount.

Berta maybe, maybe not I’m still on the fence and granted I’m alittle old school but it just seems too vulnerable/ controllable by TPTB Is anyone foolish enough to believe the bankers will actually just sit back and allow these cryptocurrencies to move in on their territory without bloodshed I sure dont Look at what they do to precious metals on a daily basis

The bankers are worried about it for sure. They have their own attempt at a blockchain cryptocurrency. It’s called Ripple. If you believe the banks will win (which banks? which country? banks working together? ) then that is your coin. Otherwise Bitcoin is your “tool”, as intosh below says.

To me, blockchain is a tool, just like the TCP/IP protocol is a “tool” that makes the Internet work. Bitcoin is the Napster of blockchain. It is the pioneer of this new technology but with an ill-conceived business model. When the dust settles, corporations and companies, new and old, will use their “own” version/implementation of blockchain tool to provide regulated/standardized/accredited/legitimized products and services to the mainstream mass market. And Bitcoin will likely suffer the same fate as Napster’s. But in the meantime, some people will make a lot of money riding the bubble, and inevitably, some other people will lose a lot of money by betting on the wrong dog in a horse race.

After Donald Dump was elected president of the USA, I started thinking about the different ways in which people could launder money. For me, Bitcoin was at the top of the list and I was going to buy some. By the time it took to set up the coin wallet, the price had gone from $460 in November to $1000 in the early part of January, so I bought Ethereum instead. I didn’t really know much about it at the time but the idea of cryptocurrency has always intrigued me. I bought $130 worth @ $8.49/Ether. Needless to say that investment is now $1,400!

I don’t like any crypto currencies, but Ethereum is probably the best of the cryptos right now. It is the best long term bet because it will be used as the token for the block chain document systems being deployed for import/export documents and other financial contracts.

sounds like a short term capital gain if you convert to cash.

Will these ‘investments’ be taxes like gold and silver or Long term?

I will on long here and say that if you asked anyone under 40 if they would like bitcoin or gold and silver in exchange for $1,000. the looser would be a real asset.

Strike that 2850

There’s nothing intrinsically monetarily valuable in crypto-concurrency or tulips. The “price” of either is mass-psychologically driven and ephemeral.

https://en.wikipedia.org/wiki/Tulip_mania

There is nothing intrinsically monetarily valuable in gold or tulips. The price of either is mass-psychologically driven and ephemeral.

The historical time frame of the delusional worship of the shiny gold metal is longer, but its actual use value hardly extends beyond trinkets and jewelry. Bitcoin actually has more use value— as a fairly secure medium for instantaneously transferring wealth around the globe.

It is secure until it isn’t.

Rule #1 – When it comes to internet /virtual /digital security the only thing you can be secure about is that ultimately there is no such thing as internet / virtual /digital security

Rule # 2 – The reason why is that ANY code created by man or a machine created by man can be broken by another man or machine created by another man and will be the moment the rewards outweigh the effort and risks involved

Rule #3 – Therefore Cryptocurrency is a tragedy of epic proportions waiting to happen

FYI ; Rules # 1&2 are straight out of the NSA handbook . Internet/Digital/Virtual security at best is Security Theater verging on illusion

As for

” but its actual use value hardly extends beyond trinkets and jewelry ”

… sorry TH but thats pure Digital worship verging on uninformed delusion . Gold has value well beyond trinkets and jewelry from technology to insulators … whereas Bitcoin should the platform become relegated or worse hacked into has ZERO value … period

And THAT is spot on.

It’s always interesting when a discussion degenerates to religious name calling. I couldn’t agree more with your rant about digital currencies— Bitcoin is secure until it isn’t. Which doesn’t change the fact that gold is valuable because of fashion rather than use value. The industrial age wouldn’t exactly come to a screeching halt if it was no longer available.

So imagine yourself wandering the mountains of Wyoming 50 years after the collapse of Western industrial civilization. Somebody offers you a 10 pound brick of gold in exchange for your best obsidian arrowhead that came from Oregon. Is that block of shiny metal going to put venison on the spit? You’d draw your bow and tell the scoundrel to hightail out of sight.

Constantine the Emperor issued intrinsically almost worthless coinage, like our current coinage. At that time tax collection was privatised, so tax collectors were given jurisdiction over certain territories to collect taxes according to official rates.

The tax collectors by law had to accept tax payments from citizens in the debased coinage issued by the State, but had to submit the face value to the State in gold.

Why do you think he did that?

Very related.

When my grandfather introduced me at an obscenely tender age to the nursery business in the early 80’s, one of the Holy Grails of the floral business was the Semper Augustus tulip cultivar, which became the poster child for the Tulip Mania, with bulbs changing hands for as much as 5,500 guilders each and future contracts at the height of the bubble going for as much as 10,000 guilders. It’s widely considered the most expensive ornamental plant that was ever traded.

The Semper Augustus effectively disappeared from history at the close of the XVII century but its mystique lived on, and there have always been rumors it survived somewhere. To this day dedicated Internet boards will have the occasional Semper Augustus survival thread.

In the late 20’s the botanists at the world-famous John Innes Institution in Norfolk discovered the cause for the striking streaks in several tulip cultivars were due to a virus, which was properly identified and described only decades later as the Tulip Breaking Virus (TBV).

By combing through crumbling Dutch records and combining these records with advances in biochemistry and plant propagation it was discovered the Semper Augustus had a pretty unique story.

Dutch botanists were apparently aware tulip streaking was not caused by a naturally occurring mutation or human selection and started to willingly introduce “rectification” in other cultivars by various means. To both increase the number of bulbs available for sale and hasten the spread of TBV they used bulb grafting on massive scale.

Semper Augustus appeared in 1637 as a TBV-induced mutation and was replicated quickly by grafting.

However, as any modern day bulb fancier will warn you, like all TBV-mutated tulips have not only a limited lifespan, but are extremely difficult to propagate and they have an extremely limited genepool, meaning cultivars are usually short-lived.

According to a large Dutch commercial grower who spent a large sum to track down the “final truth”, the Semper Augustus probably went extincy around 1660 already.

Modern botanists have “reconstructed” the Semper Augustus in the two forms that existed in the XVII century by careful selectiive breading of streaked varieties: the end results are the Wakefield Flame and the Adonis Flame. When bulbs are available they sell for about US $20/each.

Fate, it seems, is not without a sense of irony.

Any nefarious activity going on in IT departments at companies is probable all in the “mining” of crypto currencies. Most managements have no idea what goes on in the IT department and any IT guy with excess capacity can make a lot of money mining new crypto currencies.

Just a symptom of the problem – which is that, due to years of ongoing worldwide expansion of the money & credit supply, there is no longer any real grow-based “investing”.

All that is left is speculation – BETTING.

The creators of WannaCry malware are transferring their loot to Ethereum to cover their tracks. Just kidding.

It is the bigger scam orchestrated by the central banking cabal that drives all kinds of insanities that no sane mind can explain.

Estimates range from 80 to 98% of Bitcoin volume is China-based, both in trades and mining of ‘coins’. It’s supposedly a vehicle to move money offshore, at least until the Chinese government stomps on it.

In about 2 minutes flat it could go to 100 – or maybe 10.

The image of the man from the UK sitting outside Mt Gox office in Japan for weeks, hoping to get his money back should not be forgotten either. Most of these trading exchanges are in remote places, or don’t even offer an address.

In the case of Etherium, it doesn’t offer an address other than Zug, Switzerland, but it’s ‘non-profit’, has a market cap of 55 billion dollars, and if you donate money you get a unicorn; in what form it doesn’t say. I would hope it’s a real one.

Their mission statement:

“Ether is a necessary element — a fuel — for operating the distributed application platform Ethereum. It is a form of payment made by the clients of the platform to the machines executing the requested operations. To put it another way, ether is the incentive ensuring that developers write quality applications (wasteful code costs more), and that the network remains healthy (people are compensated for their contributed resources).”

It seems to mean ether is money, and the application is shareware.

Sign me up!

Ether, a liquid that evaporates into thin air, and under right conditions condensates back into liquid. An apt name for an above mentioned scam.

But the smart minds of western governments are on the job protecting their honest, hard-working citizens. Oh, never mind, just reading too much MSM.

That scan just bagged me a cool grand, from $100 investment! I’m a big fan of that scam.. ;)

unless you converted the crypto currency to cash , this is just a paper profit.

The weak link in these digital currencies are converting to cash . If you do not have an exchange to sell them you can place them on craigslist (sarc). Some vendors do take the currency directly so you can get 300 lattes at star bucks . Anyways congratulations on your windfall.

According to Coinmarketcap.com statistics between the U.S. exchanges such as GDAX, Bitstamp, Kraken, Bitfinex, and Gemini are showing USD/BTC trading at roughly $73 million over the past 24-hours. Japanese exchanges are also trading $73 million USD worth of JPY/BTC per day between Bitflyer, Coincheck, Zaif, and Quoine.

Volume from China is a touch lower as traders see $45 million in daily trades with Huobi, BTCC, and Okcoin volumes. China was once the global leader in bitcoin trades in 2016 but that all changed when trading platforms halted withdrawals and added fees to every trade. Just behind China is Europe, as total percentages of overall Euro trading is around $31.4 million between three major European bitcoin exchanges.

++ and if you donate money you get a unicorn; in what form it doesn’t say. I would hope it’s a real one ++

If unicorn’s were ever real ….. that’s the horse with a horn on the front of its head …… then they have been dead a l o n g time. To call something a start up is trying to start up a unicorn about sums up their intention. Its dead.

Interesting article listing the chain of events and factor powering the recent surge of Bitcoin price:

https://qz.com/981814

In brief, it’s the crazy rise of altcoins (fueled by ICOs) and then, speculators diversifying to Bitcoins.

that …Flow of fiat into BTC, to diversify into other cryptos…makes BTC an equivalent of USD among fiat. Once its more widely accepted, it will solidify its status as base crypto, and reduce volatility/improve “value” stability, thus attracting more fiat flows.

The odd thing about bitcoin and altcoins is that while some of them have a limited supply build into their algorithm, the number of such cryptocurrency schemes is unlimited. In spite of what people say about it being a deflationary currency, in reality inflation is thus build into bitcoin but to which level will be only determined by preference and faith. How will it be decided which of these currencies people will give put trust in? How will this change over time, with new technologies, security breaches, government interference. Will we see some rising then disappearing, and being replaced by others? Medium of exchange, ok, but there is an insane amount of untestedness in these which would make me very hesitant to ever use them as a ‘store of value’

These price increases are the result of insiders trading online with themselves, while pretending to be different arms-length individuals, at ever-increasing prices. That is the bait. They wait for suckers to be drawn in. This is what drove the price of bitcoins sky-high several years ago; it was a bot trading with itself at ever-increasing prices, do a search online and you will find some news articles about this.

Re: Coin shams

That is correct. For this reason the price of bitcoin and similar scam techmologies will never collapse: people who hold coins will always continue to drive up the price by faking arms-length trades. As long as suckers exust, they will be drawn in. The game will be over only when the big bitcoin miners, mostly a bunch of punk kids in china, decide to cash out completely; it only takes a few of them to collude so as to have a majority. This majority has the power to make all “coins” become worthless overnight. For now, they keep cashing in at a nice rate. When that stops, they cash out. This is worse than the tulip mania!

When there is still a semblance of law and order, we will still be using fiat currency.

When there is no order at all the only currency left will be all physical: food, water, fuel, sex and bullets etc. Who cares about how many buttcoins you have by that point?

THE FED

Is very interested in the Blockchain itself, and various bank’s are live testing systems using it. .

The Blockchain (or a variant) will eventually be taken over by the mainstream as another leg. The private cryptos to date are simply Dutch Tulip bulb’s.

There is probably and opening somewhere, to base a global crypto, on a held solid commodity basket.l

That would however upset the fiat SDR Basket, and they would not like that.

Bitcoin price is pumped by governments corruption, that will never stop.

If you like what the corrupted banks and the governments are doing around the world on a massive scale by all means support their ‘solutions’ and ban Bitcoin. But just before you do that make sure to check what banks and government did in Cyprus , Greece, Argentina, Brazil and many other countries

The money, your money, will ultimately end up in their pockets years later through careful engineered financial systems that you were not educated about in school but which they master and perfect for centuries.

The problem, is the corrupted system and the global corruption amongst people in power not Bitcoin.

Bitcoin is the solution because it is not owned nor controlled by them

“The problem, is the corrupted system and the global corruption amongst people in power not Bitcoin.

Bitcoin is the solution because it is not owned nor controlled by them”

What absolute drivel.

Bitcoin is useless, without the Internet.

Ultimately the Governments control the internet, as they can if they wish, shut it, or selected parts of it, down. .

I like how these crypto’s are so often quoted in terms of what they are “worth” in $$$’s

doesn’t that mean they are in essence worthless and it’s the $$ that has the real “value”?

LOL EXACTLY. And that’s the elephant-in-the-room type irony I can’t stop thinking about when Bitcoin advocates try to convince the world how these digital bites will replace the “worthless fiat currencies”.

Central banks probably ‘HFT’ pump/dump BTC on exchanges already.

While fiat (usd) is still king, and prices are set in usd not btc, they’ll mis-value btc with their monopoly money usd.

The more usd they print, the less valuable a usd is worth.

That naturally makes a btc cost more usd.

More ‘demand’ pushes btc further up.

They can make btc appear volatile and skim out other people’s real usd wealth.

They could crash btc tomorrow and then buy more btc cheap with YOUR money (that they print AND make from selling on the rise)

I’m fairly sure the Central Banks are still king over cryptos while cryptos don’t set any prices, and are valued against the most over-valued fiat of them all, usd.