This market (“Dow 30,000”) assures Fed rate hikes.

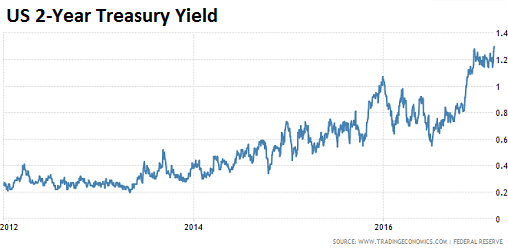

The two-year US Treasury yield just shot through 1.33%, the highest since June 2009, when it had briefly spiked from 1% to 1.42%. And that had been the highest since November 2008. It eventually hit a low of 0.16% in September 2011 (via Trading Economics):

This surge in yield is a sign that the bond market is adjusting to a rate hike in March, to more rate hikes later this year, and to more rate hikes next year. The 10-year yield has returned to the 2.5% neighborhood, on its way to take out the recent high set in mid-December of 2.6%.

When yields rise, bond prices fall. So these movements can be painful for the “public” that is holding $14.4 trillion in Treasury securities. The bond market has now gotten the memo after a whole slew of Fed doves have come out this week to flaunt their hawkish sides.

Yesterday, Fed dove Lael Brainard, member of the Fed’s Board of Governors, told a Harvard University audience not only that the fed funds rate should be hiked “soon,” but also that unwinding QE and shrinking the Fed’s balance sheet should enter the discussions.

The bond market took her seriously, though it had ignored Boston Fed president Eric Rosengren who has been making the same noises since last fall. He is specifically worried about the highly leveraged bubble in commercial real estate, and what it might do to lenders once it begins to unravel.

Also on Wednesday, Dallas Fed President Robert Kaplan put a rate hike on the table for March. For him it wasn’t “soon” but “sooner”: “We should begin the process sooner so we can ensure that it is gradual and patient.”

San Francisco Fed President John Williams said a rate hike would be seriously considered at the next meeting and that he sees no reason to wait any longer. On Tuesday, another inveterate dove, a very influential one, New York Fed President William Dudley said that the case for a rate hike has become “a lot more compelling.”

Fed Chair Janet Yellen will speak on Friday. This is the last day on which, according to the Fed’s own rules on public communications, they can try to jawbone the markets before the FOMC meeting on March 14-15.

In response to this onslaught of pronouncements, federal funds futures are now pricing in an 80% chance of a rate hike in March, up from 20% last week.

What’s different this time? Stocks.

The Fed watches the stock market nervously and tries to inflate stock prices as part of the “wealth effect.” And stocks have soared from new high to new high, despite the rate-hike clamor. And that’s different.

For the past six years, even the mere suggestion of removing “accommodation” entailed sharp reactions in the stock market, and soon the Fed felt it had to backtrack. Hence the often stunning flip-flopping.

When, in December 2015, the Fed finally managed to hike the target for the fed funds rate one notch and suggested four more hikes in 2016, it crushed stocks globally for the next eight weeks. It wasn’t until there was concerted flip-flopping on rates by one Fed governor after another that stocks bounced off their mid-February lows and surged for the rest of the year.

But since the election, everything has changed. Stocks shot higher, and when the Fed finally raised rates in December, stocks continued to shoot higher. This comes on a backdrop of surging inflation, with the Consumer Price Index in January up 2.5% from a year earlier.

There’s already intense hype about Dow 30,000, come hell or high water on interest rates. It’s as if the stock market is suddenly using the threat of tighter monetary policy – higher rates and the unwinding of QE – as another reason to rally.

That’s what’s different this time. And as long as this prevails, the Fed, years behind the curve, will try to catch up a little before it’s too late so that it has more room to react at the next major crisis.

The Fed’s target is currently 0.5% to 0.75%. Raising the target one notch in March and two more notches later in 2017 would lift it only to a range of 1.25% to 1.5%. This is still extremely stimulative. With inflation at 2.5%, it’s still better than free money for those that have access to it. Even the 10-year Treasury yield offers zero return after inflation. Inflation could continue to rise, and the Fed would have to scramble to not fall even further behind.

But higher rates are a reality check. They impact leveraged asset bubbles in dramatic ways. All sectors of commercial real estate, including office and multifamily apartments, have soared for seven years on low interest rates. This includes a historic construction boom in urban centers. Home prices have surged. In many markets, affordability is already a huge issue. But when mortgage rates rise, as they have been doing since last summer, affordability eventually becomes a block that the market cannot get around at current prices.

In this manner, higher rates percolate through the real economy that has become immensely over-leveraged after eight years of scorched-earth monetary policies. And they will ultimately impact stocks.

But the longer the stock market ignores the rate hikes and continues to soar, or at least manages not to get crushed under their weight, the Fed will see no reason to slow down its efforts to catch up from being desperately behind the curve. And that would be a phenomenon a whole generation on Wall Street hasn’t yet seen.

Not that the real economy is all that hot. And now this, for the first time in the US since the Financial Crisis. Read… Oops, this Isn’t Supposed to Happen in a Rosy Credit Scenario

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What will this do to the commercial real estate companies when rates rise? Aren’t they already locked into a low rate which they borrowed at? It seems like it would slow down new developments?

Many of these loans are based upon the LIBOR rate + a certain amount.The LIBOR rate is not fixed

3 month LIBOR was around .4 for 5 or 6 years. A year ago about .63 recently 1.06 so the trend has definitely been up. Not a good sign for the commercials.

Raising the fed fund rate by a measly 0.25% was equivalent to an Armageddon not long ago but Armageddon didn’t happen the last two times so then why make a big fuss over rate increases? I think that’s the sentiment for now. Besides, with bond prices falling where else to invest but the stock market? After all investors are salivating over promises of 4% gdp growth, a big corporate tax cut, and government spending going forward. I think we have an interesting recipe.

Yeah, give us a 100 bp increase and then we’ll definitely see who’s naked.

(a measly 0.25%) one hundred dollars or one billion dollars.

(with bond prices falling where else to invest but the stock market?) Huh? Bonds and stocks have a correlation.

Interest Rates Matter.org

I was explaining what I thought the current myopic market psychology is. My view is that the fed thinks that it can control the stock market and create the so called wealth effect by pumping credit. But who is controlling who now? Looks to me that the market is controlling the fed. Suddenly within a week the odds of a rate hike rises from around 20% to over 90%. But the market participants believe that between the fed and the new administration they’re get protected and risks don’t exist. Of course this false sense of security can last a while.

BTW, I also believe both interest rates and debt matter.

Yahoo! Rate normalization vs Globalization aka ‘the fix is in’.

Keep those rates rising!

Trump saved the world. Sorry about the people who bought in and might / will take a capital loss if they sell as opposed to hold to maturity. Artificially low rates help the few at the expense of the many. Your interest expense is my interest income, which I will spend, providing rates continue to rise. So will lots of others.

Long long ago, the mafia set the bar. Las Vegas was the first ‘bank’ to own. Then came the mafia and pension funds. Today, globalists, playing a long game copied them. They pounced on opportunities such as the Great Recession, promoted bogus theories such as ‘the only way to lose is if you don’t go big enough for long enough using printed money’ and negative interest rates and the rising idea that cash is for criminals. They took took control of central banks. Academics, who provided cover with their supportive theories, were recognized and promoted if they bought in. Politician were simply bought. The rest of us were sheep.

It’s too soon to declare victory over this ilk, but they are on the ropes.

Had Hillary won, negative rates in the USA would have arrived during her first term. The middle class would have subsidized them via the sucking of savings to support the oligarchs who thrive on low rates and the underclass who provided cover by getting free stuff paid for by central bank monetized debt.

cdr-Some of what you say is true, however it is spun, just NOT in my chosen direction. My turn.

Being a liberal snowflake godless media programmed scum of the Bernie genre (the Clinton machine totally disgusts me), and retired, and having a very modest US note/bond brokerage “time tuned” ladder including Tips and I-Bonds, (further backed by some land), that I CAN hold to maturity (I consider my small 4.35% 30yr holding a little “annuity”), I won’t be one of the ones you get to rudely cackle at while spending all their money. I hold NO stocks. Bailed completely by S&P 1250 pre-crisis. No regrets. ALL my money came from selling a home I built myself, ground up, over 14 years, then using all my 401K after 55, and luckily sold in’06 to a very rich guy…top dollar.

That said, a lot of these artificially blown up assets WILL be coming down, I don’t see how it can be avoided, I don’t know which ones or how badly, and there is likely to be investor pain everywhere, probably enough to cause recession and more pain. Again it irks me that you cheer this. “Yahoo?”

So the government has the power to tax and print, unlike many money- power/corporate ruled States, the “corruption in high places” Lincoln feared is now true, and the lazy stupid free stuff loving underclass just may act out, since there is NOT 40 hours of work for everyone, and they need to live….or would kinda like to. Over $90 Trillion in net household wealth here, we ought to be able to work something out?

By the way, how do you figure it was that so MANY people got so lazy and so stupid since Reagan, not to mention so many suddenly needing to be JAILED. Look at the charts! Strikes me as rather odd. I doubt it was a matter of “hey buddy, you want to go live in a ghetto and do NOTHING but screw off?…as I you might suggest. The B actor/puppet also started BIG TIME deficit spending and union busting.

I like the Manhattan+ level alternate energy/efficiency project with the ENEMY being fossil fuel burning. REAL WAR! Paid for with TAXES on you know who. IKE and FDR levels.

Especially the Death Taxes….love the sinister ring to that.

So, neither of us knows what will shake out, but I personally enjoy watching TV actor puppet Trump (Reagan #2) trash GOP integrity (such as it is), albeit knowing full well Pence/Ryan will be smarter and more dangerous, at least to the more easily programmable peasants.

On a finite ball in space, I consider excessively wealthy EDUCATED people seriously mentally ill. Especially all your oligarchs. And believe me, there is ABSOLUTELY no jealousy involved here. I don’t want to be that ignorant or sick.

I think future generations would rather have a fiscal problem to solve, rather than climate change, or if you don’t buy that, simply disappearing fossil fuel and toxic waste from lack of regulation.

OK, off soap box, sorry I had to let go of the fact we are both just animals, sharing the same planet at the same time….nothing more, nothing less.

What? Touchingly insane, or naive, but in trouble without question.

“Your interest expense is my interest income, which I will spend, providing rates continue to rise. So will lots of others.”

Most Americans have less than $1000 in savings. Most Americans are carrying significant debt.

Rising interest rates will hurt more Americans than help.

So, your vote is for Hillary and negative rates so the underclass can get free stuff financed from borrowed and printed money and paid for by those who got screwed for saving. Or do you favor the uberlords who need low rates to make more billions? Or are you someone who trusts the Fed will keep the stock bubble blowing forever?

On a truly level playing field, e.g., football, there are rules and scoring limits….all enforced. A very gifted running back can’t figure out a way to try to run past the goal line and far into the stands to score 7-12 points, (even though it would be much more difficult at away games). And possibly even quite interesting, media and fan wise, considering the current “reality show” epidemic.

IMHO, Tom Paine was our major founding father; It was his ideology the soldiers actually fought and died for, not simply Washington’s good leadership. Yet, there are few statues of him, and his writings are not shared with such reverence as the other written foundations of our country’s core principles.

I wish Corporations were still treated like the were in the late 1700’s, early 1800’s. Often very useful, but dangerous to society.

Bigly Sad.

There are a number of effects from higher rates that no one can argue about.

1.Higher rates mean that it is more expensive for corporations to borrow money .This creates two primary problems.

First it will raise the breakeven return required for future projects. The higher the breakeven returns,the less the investment.Less investment translates directly into less future cash flows .

Corporate buybacks have been the consistent source of demand for stocks for a number of years .If corporations borrow money to purchase their own stock,this increase in interest rates will raise the cost of stock buybacks.

2.Higher rates mean that the discount rate used to project the present value of future cash flows goes up.Simply put this means lower P/E’s,ceteris paribus

3.Higher rates ,especially on the 10 year bond are often used in comparison with the dividend yield on stocks.The higher the 10 year rate the more that dividend stocks need to adjust to be competitive.This adjustment can take the form of a higher payout or lower stock prices.Many stocks are already paying out a large % of their free cash flow.

4.The higher the rates the more that it costs local ,state and federal governments to service the debt.Many cities and states are having trouble balancing their budgets..Higher rates are just going to exacerbate this problem.

The markets do not seem to care about deficits at the Federal level,so even greater deficits caused by higher rates may not much effect

5.Higher rates mean larger monthly payouts for home buyers.The more that home buyers have to pay to service their mortgages,the less money is available for other purposes.

Yet with low rates, savers subsidize borrowers, who can afford to spend profligately, at least until they debt out and can not longer afford to borrow even at low rates.

Low rates are simply having a sale on money that’s no different from having a sale at a department store. Only this sale has lasted 8+ years and world class fraudsters have successfully convinced nearly everyone it is a new kind of normal. Your savings is their resource to plunder.

Negative rates, which were on the way if Hillary won, would allow taxation to be built into government spending if borrowing supported it.

Wolf you write many articles that are interesting and 99% I am in full agreement with.

But on this occasion I think that the DOW & the S&P are rising because of the smart money moving out of Europe that need to park it some where. We have a bond bubble which is going to burst, There is so much uncertainty around the EU\Euro at the moment that many investors are moving to their default position and the flight to safety has began into the US. The bet is that the bond bubble is going to burst so they are parking in equities.

I think the DOW could double when the herd realise that the problem is in the bond market. If you look at the EU TARGET2 there seems to be big capital moves into Germany from Spain, Portugal and Spain causing large imbalances besides trade. There has already been BRIXET and this year should one other European country vote in an anti Euro party then investors will realise that the EU is not a permanent political structure…. so who is going to honour the bonds?

Germany is going to be a big loser because they are never going to be paid back from Greece, Portugal and Spain because mathematically its impossible. The west has finally arrived at its demographic cliff which incidentally I believe that, Merkel in her stupid naivety let in 1.5 million Muslims into a Christian nation, thinking she can turn these illiterate individuals into taxpayers because Germanys demographics are the worst. You have to keep the Ponzi scheme going that you are committed to.

Here in Britain the Lords are trying to frustrate the BREXIT process by forcing through an amendment to secure EU nationals the right to stay which is mental. History is clear on this, when the economy turns down hard the Polish will be hunted down in the streets because the British will be looking to blame someone for their lose of jobs, their house, their pensions etc. It happened in Germany when they blamed the Jews and in Boston when the Irish would get beaten up.

This is inevitable to me communism had to fail and her sister socialism has to fail too. In the end you always end up with too many takers and not enough makers.

My observations of what is going on here in the UK is that their has been a major shift in trust away from the state. BREXIT crystalized this when the BBC, ITV, & Sky sided with Cameron,s REMAIN camp. Many folks avoid the BBC now and many UK media outlets.

The government is broke, roads are not being repaired, hospitals are closing, there is rebellion in the Police and prison departments. You can not get a doctors appointment and our justice department don’t make just decisions anymore because it is about saving money. It is the same throughout Europe and this is why there is so much rioting in France and Italy. There was rioting in France for two weeks and the BBC reported it once.

This is going to end in violence. People only force through change when they feel the pain. I have tried to warn my friends but they just switch off because they just want to extend and pretend.

During 2008, there was a problem in the bond market too. Did you hear about those MBS? Did the stock market double?

I am not saying that the stock market can not double. It could triple, but saying bla bla bla about “smart money” is ultimately BS. A lot of “smart money” got hurt during 2008 too and were ultimately saved by your tax money.

And why can’t you move to cash to park your money? In the event of deflation, it’s probably what you want to do.

Don’t normally comment, but I love the website and I do enjoy the more bleak outlook :)

Being based in the UK I fear I do have to disagree with the general thrust of the Jerry’s comments. I’m in my late 30s and everyone I know is employed, in fact there appears to be near “full employment”.

I agree with younger job seekers there might not be but generally it seems pretty good. At my firm we struggle to find people.

Also I’m not sure there is any resentment for our fellow Europeans working here. In my experience they are often doing roles or working harder then we would ever want to.

The Brexit thing has been a huge shock and unlike the Trump joke doesn’t disappear after four years.

Finally, Jerry I do agree that I think the rise is US stocks is more to do with uncertainty in Europe/brexit/euro than anything else.

Interesting times indeed.

$60 trillion in total US debt. 3 hikes totaling 0.75%. That is $450 billion a year in extra payments. It begins to add up after a while.

That’s not how it works. As the value of bonds goes down for the lender, the value goes up for the borrower (also in real terms, assuming a component of the interest increase is an increase in inflation). In the short run the rise in interest rates could well be a positive for both corporate borrowers and the public sector.

If I borrow $60 trillion for 10 years at 1% then I made a good deal if the rates rise to 2% in teh next year. I wouldn’t be the one carrying the burden of that rate hike (for a while).

Technically speaking, if inflation were to increase and not go back down in the foreseeable future, then this would be a huge net positive to all overleveraged entities which include the government and the leveraged buyback wonderland corporations (shareholder value will have been created).

I think this is the bullish argument for stocks atm. Real rates are probably falling as the fed is behind the curve. This is a net positive for borrowers, net negative for lenders.

I believe 50yr and 100yr new issues are bullish as well. If you owe a debt in euro currency what is your liability if euro depreciates to zero? So many purveyors of fear.

Julian,

I’m going to put on my ‘teacher’ hat for a few minutes. I’m going to teach you the base fundamentals about financial analysis without stressing anything financial. That’s lesson 2 and you will need to get it from a more formal setting.

Each of the following situations is different yet they interrelate…

1) Imagine you have cash to lend. None has been lent yet. Do higher rates benefit you or do lower rates benefit you?

2) Imagine you already have lent some cash and you plan to hold the debt until maturity. You can’t resell it. Do rate changes affect you?

3) Imagine you have already lent cash and you plan to not hold to maturity. How do rising or falling rates affect you and the value of your loan in the marketplace?

4) Imagine you have a fixed rate borrowing. How do rates affect you?

5) Imagine you have a floating rate loan and rates are rising. How does this affect you? What if the loans are for slim margin high frequency trades? How will this affect your trading?

6) Imagine you run a central bank and you have been talked into printing endless money to support governmental borrowing. You use gobbledygook to dismiss those who criticize you. How do rates changes affect you? How would negative rates make a difference?

7) Imagine you run a central bank. All your friends are academics or people of influence who prosper from low rates and/or theories that support the need for low rates, or governments who like to borrow at low rates. How does this affect your opinions of low rates?

8) You sell investments or run a company that pays executives using stock buybacks to affect stock prices. How does this affect your interest in low rates?

Perspective matters.

cdr, thank you for your comments which is really helpful!

Mom and pop investors put huge amounts of money into STOCK ETFs last month that usually signals the top https://www.google.com/amp/www.cnbc.com/amp/2017/02/02/40-billion-in-etf-flows-shows-investors-looking-past-hot-stock-market.html

I wonder at which point an ETF could become a systemic risk, or at least a significant market risk in their own right. In a real market hickup, all these mom & pops could force the ETFs to liquidate in size in a thin market.

David Stockman wrote about how etfs tend to sell off with a higher losses than the underlying assets in major panics. I am setting back and waiting to see it go in to reality.

Nah, there are new players other than Mom and Pop. Foreign CBs. And they too can print. Dow to the moon.

Any rise in interest rates by the Fed will impact the economy ….negatively. Period. The Fed feels boxed and lacking credibility so they naturally jawbone about raising rates. If they do raise in March, it will be many months before talk again of rate increases.

Essentially, they have painted themselves in the corner and are trying to inch our as the paint dries. But what if it doesn’t dry fast enough?? Whoops, wet paint on the shoes (e.g., tanking economy), time to pull back and sit in the corner for awhile longer.

Yes, the Fed mandate is t blow bubbles and pop them. Great work if you can get it, they’re well paid for their expert opinions.

First time yesterday, us newscasters changed their pronunciation of mexico to mehico, how brilliant these academics are….

Off topic, but have you noticed how bad censorship on Yahoo has become? Even a hint of negativity and your comments are removed. Up to just 2-3 years ago, each of stories would have at least 200 comments; now it is like 18, 20 comments per story.

If I post any of the comments I post on WolfStreet, they will be deleted instantly. Are we sure Stalin is dead? I have a feeling he is running Yahoo.

Wolf: Thanks for providing a free and uncensored medium.

Hate to disappoint you. This site is not a free-for-all either :-)

I try to tamp down on vicious ad-hominem attacks on other commenters or our authors, too much political flame-throwing in any direction, trolling, name-calling, etc. I don’t want this comment section to turn into a war zone. But “negativity” as well as “positivity” along with more or less polite and fact-based disagreement are welcome.

It should be informative and fun for all.

And we love boots-on-the-ground and industry insider info.

Wolf: Filtering out that sort of post is given for any sites; otherwise, the site becomes unusable.

But you are not censoring posts according to your opinion and taste; that’s the important part.

Wolfstreet definitely has one of the more informed and courteous comment sections in the finance space.

Back when I attended the Blah Blah Blah School of Business, we studied a quaint concept called “the business cycle”. Anyone here old enough to remember that? :) It has been apparently canceled by the CB’s – but the idea was that markets and economies could overshoot high and low, and then there SHOULD be a healthy adjustment back to equilibrium. Healthy because it corrected excesses, wiped out inefficient operators, and reallocated capital properly. It would take like 18 months and while “healthy”, was also painful to some. Greenspan arrived on the scene and convinced everyone that through CB magic they could never feel pain again. Of course, you can’t get something for nothing, and all they have been doing since the 90’s is kicking an ever-growing can down the road (While, oops… funneling the little guys’ wealth off to the CB’s “constituents”… Oops, didn’t mean to do that – just happened… So sorry…). Having the Fed doves finally admitting they need to raise rates is kind of scary because it means the “can” has become the size and weight of a full septic tank and they just can’t kick it no more. So their plan is to drain the thing, just a bit, until they can gather ’round and start kicking like hell again. But it may not smell so good around here while it’s draining.

There was a business cycle, but it was still very much Fed-induced, right from the early days, when they engaged in open-market operations, and even then there was severe criticism about it. The difference today is the magnitude, a natural progression now seemingly without restraint.

Even during the Congressional debates prior to the creation of the Federal Reserve, Senator Elihu Root said ‘If you create this, you will have created an engine of inflation’.

In the words of Pink Floyd I have become comfortably numb.

“What’s Different This Time? Stocks”

And English language was much more civilized.

“Do you still feel as I do ,” New York governor Franklin D. Roosevelt wrote a friend on August 5,1929 “that there may be a limit to the increase of security values?”

And this particular friend-Alexander Dana Noyes, financial columnist of the New York Times-replied:

“My readers would often write to say that they had accepted my judgment, had sold their stocks in 1928 or early in 1929, and had thereby missed their chance of making a fortune.

Reasoned judgment has been discredited so often in the past three years that it may as well be suspended for the present and that, whatever underlying convictions may be entertained, it is just as well to go with the stream, while watching the longer horizon carefully.”

So,let’s suspend reasoned judgment which has been constantly discredited in the past 9 years ! YAY !