So where will this go from here?

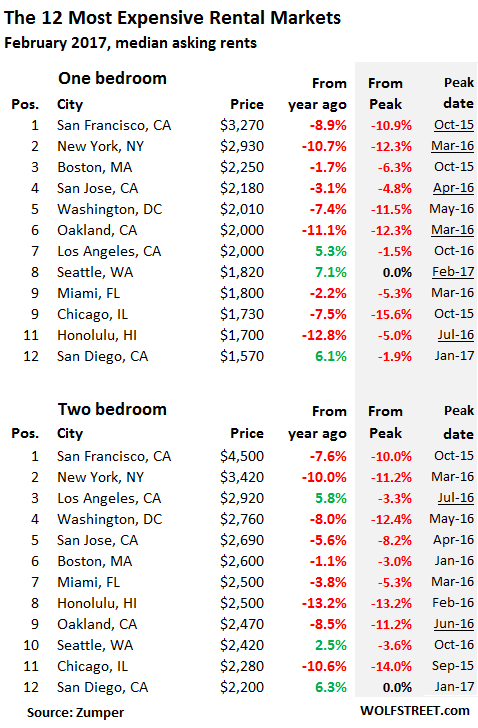

In February, rents in nine of the 12 most expensive US rental markets dropped – or plunged.

In San Francisco, the most ludicrously expensive rental market in the country, the median asking rent for a one-bedroom apartment dropped 8.9% from a year ago to $3,270 a month, and 10.9% from the crazy peak in October 2015. Two-bedroom rents dropped 7.6% year-over-year to $4,500, and 10% from the peak, according to Zumper’s National Rent Report.

The last time rents declined year-over-year in San Francisco was in April 2010 as the housing bust was hitting bottom.

But these asking rents do not include incentives, such as “1 month free” or “2 months free.” Incentives are rare in the generally overheated San Francisco market – except during times of stress. Now, with new apartments and condos flooding the market due to a historic construction boom, incentives have become common. With “1 month free,” first-year rent of a one-bedroom plunged 18% compared to a year ago!

Zumper tracks asking rents in multifamily apartment buildings. Single-family houses for rent are not included but are ultimately impacted by multifamily dynamics.

In New York City, the second most expensive rental market, rents are plunging even faster. The median asking rent for a one-bedroom dropped 10.7% from a year ago, and 12.3% from the peak in March 2016. Rents for two-bedroom apartments plunged 10% year-over-year and 11.2% from the peak. And there too, landlords are luring buyers with large incentives. With “1 month free,” asking rents plunged in the 20% range.

Incentives work like big reductions in asking rents but their purpose is to obscure these reductions and make the market look less stressed than it is, in the hope of keeping rents from plunging further. There is also the hope that tenants will stick around past the first year, at which point they’ll pay the rent without incentives.

The dynamics in New York and San Francisco have infected other over-priced markets. The table shows the 12 most expensive rental markets in the US. Nine are experiencing year-over year declines. A lot of red ink where for the past six years there used to be luscious green. The shaded area shows the change in rents from the peak, and when that peak occurred. Note the Bay Area cities of San Francisco, San Jose, and Oakland, all in the red:

Even in rental la-la lands Seattle, Los Angeles, and San Diego, clouds are beginning to waft over the horizon on a monthly basis:

- In Los Angeles rents have been inching down – for one-bedrooms since October; for two-bedrooms since July.

- In San Diego, rent growth has flattened out on a monthly basis and one-bedroom rents made the first tentative steps down.

- In Seattle, annual rent growth was in the high-single digits through the fall of last year, but is apparently hitting some resistance and has flattened out on a monthly basis. While one-bedroom rents eked out another record in February, two-bedrooms are now down 3.6% from their peak in October.

The multi-year surge in rents in San Francisco and Silicon Valley, which in turn has stimulated phenomenal construction booms, has left these markets in a quandary: the market has become too expensive for the people in it, just when a flood of new units is washing over the market.

“We just don’t have enough renters to pay $4,000 and $5,000 a month for Class A units, and that’s what’s being built,” explained Stephen Jackson, senior VP at global commercial real estate services firm JLL, in an interview with Bay Area real estate publication The Registry.

He pointed out that from 2011 through 2015, rents in Silicon Valley soared 64%, though they’re now declining, under pressure from affordability issues, especially for middle-class earners. Though Silicon Valley wages are high, they’re not nearly high enough for these rents:

“My prediction is that housing costs have peaked or are peaking, so we’re going to see rents continuing to level off in most municipalities in the Bay Area or declining from the top of the market — people just can’t afford it anymore, and it’s the same thing with single family homes.”

Affordability is where booming housing markets hit the wall.

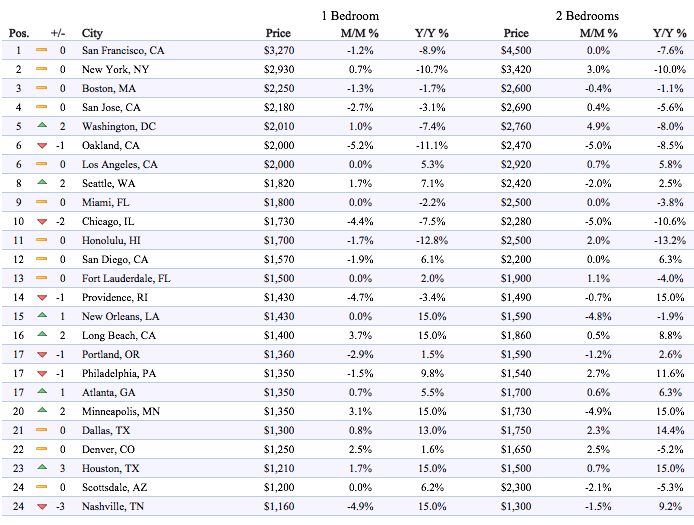

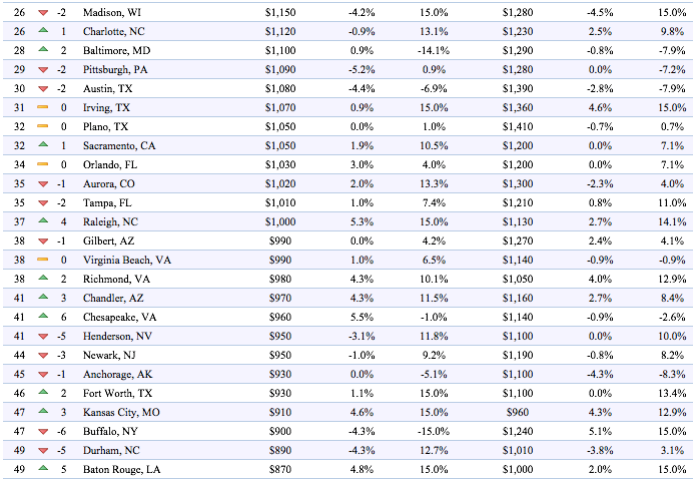

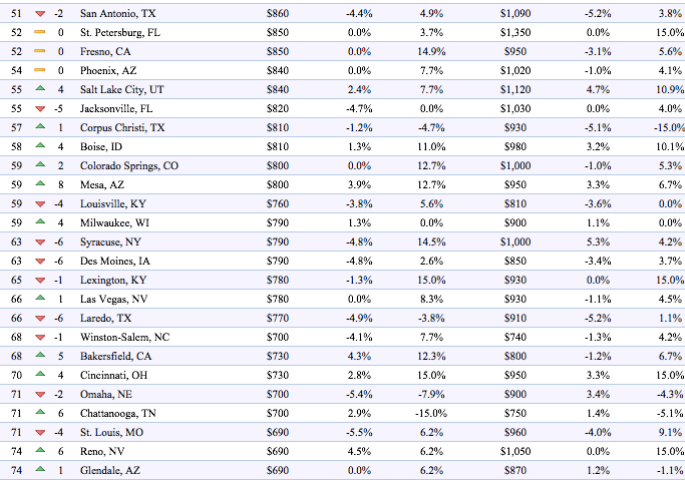

But big rent increases, some well into the double digits, are migrating to other large cities. Here is a selection of year-over-year rent increases in “mid-tier” markets (mid-tier in terms of how expensive rents are):

- #15 New Orleans, LA (1BR +15.0%)

- #16 Long Beach, CA (1BR +15.0%)

- #20 Minneapolis (1BR +14.9%)

- #21 Dallas (1BR + 13.0%)

- #23 Houston (1BR +15.0%)

- #24 Nashville (1BR +15.0%)

- #26 Madison, WI (1BR +15.0%)

If you live in New Orleans, and your rent jumped 15% from a year ago, your cost of living surged far beyond what the national averages of the Consumer Price Index might suggest.

Real estate is local – as demonstrated by this phenomenon of plunging rents in some markets and soaring rents in others. But the gap between a 15% annual jump in rent for a one-bedroom in New Orleans and the 11% plunge in New York gets averaged away in the national numbers.

On a national level in February, the median asking rent for a one bedroom apartment declined 0.1% from January, but rose 2.1% year-over-year to $1,142, according to Zumper. The median two-bedroom rent declined 0.4% from January but rose 1.4% year-over-year to $1,353. These increases are down from the 3% to 5% range of increases common over the past few years.

So where will this go? In August last year, on my list of the top 12 markets, there were four cities with year-over-year declines in two-bedroom rents. Now there are nine. Given current trends, it is likely that Seattle and Southern California will see year-over-year rent declines later this year. It will turn the whole table red. And it will spread to other cities.

Rental dynamics increasingly impact the broader housing market. Homeownership rates have spiraled lower as potential first-time buyers are renting instead. And America becomes “Landlord Land.” Read… So Who’s Pumping Up this “New Normal” Housing Market?

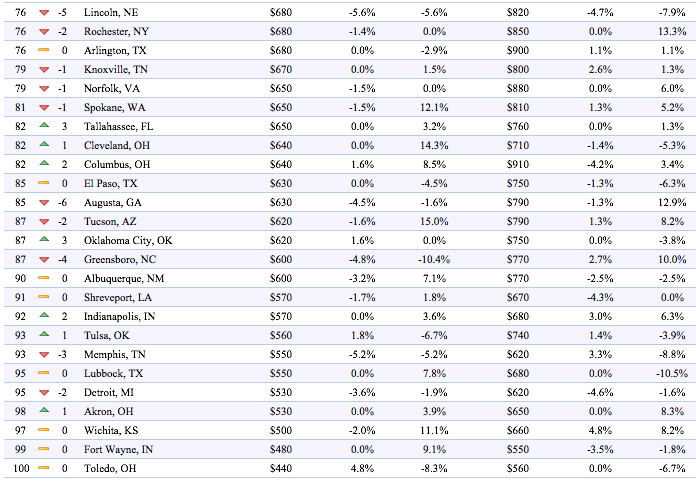

Below are the top 100 rental markets in February, in order of the amount of rent for one-bedroom apartments (tables by Zumper, click to enlarge):

Answers are trickling in. Tough luck for New York, San Francisco, and Miami. Read… How Much Money Laundering is Going On in the Housing Market? A Lot

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

People are still scraping by: https://www.theguardian.com/technology/2017/feb/27/silicon-aa-cost-of-living-crisis-has-americas-highest-paid-feeling-poor

I am not sure how true the above article is, but there’s one engineer who gets paid 700K a year and he can’t purchase a 1.7 million house. I call that BS. If I get paid that much a year, I say it’s pretty darn easy to afford that price on a 30 year mortgage.

I couldn’t comprehend both :

1) How an engineer gets paid $700K even in SV

2) Why he cannot afford $1.7 million house

That said i am in Fremont and trying to buy a house for last years hoping the fix is just around the corner. Even in Feb 2017 Redfin shows 1700 ft houses listed at 900k selling for 40-50 K over asking in a week or two.

I make decent money but cannot comprehend who is able to afford these 1960s un-updated houses

Investment entities who plan on updating and flipping and/or renting them out

This maybe true. But a 1 million dollar house would rent for <=3500 / month in Fremont.

Why wouldn't they snap 2 or 3 300-400K houses in other parts of the country to rent for 1500-2000 a month…

Because Bay Area Real Estate ALWAYS appreciates so its a great investment

Really though, I guess there’s a lot of people out here with a lot more money than us???

He is 41 years old. For a top flight engineer at a networking company I think that’s achievable. But I did some simple calculation i.e. a house at 1.7 million. Let’s say over 30 years he has to fork over 3.4 million (interest, etc, not sure how real that is). You divide that up by 30 without downpayment and it comes to 113333. That’s only one third of his after tax compensation. If that’s me, I’ll probably still be able to save half AFTER paying for the mortgage.

The Twitter guy though I think is a realistic example. If your wife does not work, it’s going to be tough with 3 children with just 160K. But then again, the solution is simple : don’t have 3 children!!

People in Murica seems to think that life is a never ending chocolate box that keeps giving. This is one massively entitled country. It’s almost time to leave soon me thinks.

Yeah the 160K twitter guy with a family is probably a good example of how it gets tough. I would say that I think a lot of the people that arrived in Silicon Valley between 2008-2011, were probably a bit sheltered to the cost of living. It was expensive, but housing costs were held down a bit in that span.

So they new people arrive, take their job at Apple, Google, Facebook and make good money. They start to save for a down payment, and maybe target 100K to 150K for a downpayment on say a condo. Then during the course of saving up, that down payment need balloons to 200K to 275K and their rent increases massively. In hindsight they probably would have scratched together whatever they could to buy into the market, even just a 1BR condo.

Same thing for kids. Your budget in 2011 looks feasible when you decide to have a child. But then in 2014 you have a 2 year old and the expenses explode (e.g. massive day care cost hikes).

Yeah… of course. Kill the family values in America. Saying the solution is to not have a family, it is just too simplistic and plain depressing. I suppose only gay couples and Dinks are suitable for homeownership in Sf Bay area and silicon valley.

The solution should be: Total ban of homeownership for non-residing foreigners. No Chinese buying homes if they are not personally going to live in the house… no excuses.

Freeking GREED. I can’t way till I get out of this hell bay area. All you have is broken communities, everybody stressed out, non-courteous, trying to one up each other, fake it till you make it types.

The best deal in America is finding a six figure job in a smaller, less-hip city. Everything is cheaper, traffic and crime lower, and housing is reasonable. The ONLY reason to live in a large city is a 2-5 year tour of duty while young to gain experience not available to your elsewhere (e.g. banking in NY or Chicago, tech in SV, etc). If you plan to have kids you’d be crazy to tie your sails to these areas. The peaks and valleys of property prices are so steep that you’re handing over your future choices to the whims of the Fed induced steroidal business cycle.

Let me let y’all in on a secret.

Engineers are on the *expense* side of the balance sheet and essentially never get insane cash flows (salaries plus bonuses plus options plus whatever) – sans the occasional right place, right time stock option bit.

Who does make that kind of salary is on the *revenue* side, and it is a function of growing revenue, sales, and that sort of thing – usually as a percentage of this or that – commissions, what have you.

With this in mind, consider the following “parable”.

Two top students of a large urban, wealthy high school, who are life long friends, enroll in the same top notch engineering school as CompSci. Both are smart, hard working, and all that. One is highly social, one is not – pretty much the only difference, good families, good backgrounds both of them.

In the first two years, one does well with technical classes, labs, math, science, and what not – the other does well with beer, girls, and frats. They help each other for a while, good friends, but they sort of split out of necessity at some point and lose touch. Eventually the academic under performer changes majors – and chooses Business Administration as a field.

Both eventually graduate and ironically end up at the same company, at different times, under different circumstances.

The company is in the right industry, a high growth industry, and both folks are very successful in their respective, but very different, paths.

Sudden changes hit the industry and management circles the wagons and runs a pilot project to attempt to shift the company into a new market to avert a huge crisis.

For the first time in almost ten years – the two friends meet – in the same meeting, both with little notice about their roles in this special project with such importance to the future of the company.

Who is the boss?

Engineers don’t make 700k a year – no one is that special for a discipline which anyone can effectively learn (being smart isn’t a super power). You make that kind of money because you can BS your way thought complicated politics, build relationships and more importantly leverage, and learn how to manipulate the system for personal gain.

Regards,

Cooter

Cooter- You have evidently been in good sized private industry.

“All the real talent is siphoned off into the Arts and Sciences, and that leaves the dregs to put it all together.”

-Bucky Fuller

Other than that, Wolf brings hopeful news to this North Bay fixed income small nest egg senior.

Sounds a lot like the one-liner continually repeated all around Cambridge MA about how ‘so many MIT grads end up working for Harvard grads’.

Look, these fabulous numbers thrown around as salary of engineers are nothing but lies. I work with systems such as Spark and Hadoop which are big data and supposedly so in demand, and big shortage for people who understand these systems, and I’m darn good at them; yet, I am still not able to negotiate even $200K, let alone $500K. The only type who can command that kind of salary are the management type, and not engineer type. These are lies spread around for many reasons. Show me one person other than some big wig in Google or Facebook who can command such salary.

And with $700K per year income, the bank and mortgage company will kiss your behind to give you that $1 million.

Stop believing in such horse crap. And if you believe in that horse crap, then I have a few bridges we can negotiation real good price on them.

Jeez, people say and believe whatever they read.

I am the President of a small boutique company that provides contract SW engineering services worldwide. We are an Oregon C corp and 200k/year (gross) is easily doable for our SW engineers.

One of our guys pulled in over 550k one year and wound up putting over 70k into his 401k… Which got us in trouble with the IRS — Took two years and about 10k in fees to our tax firm and lawyer to fix that one. This was in the late 90s. (We watch the 401k contributions more closely now… lol)

I know osr.com has much higher rates than ours, so I would expect their principals to be pulling down more.

—-

700k is pretty high. But 300k to 400k might not be out of line for someone with the title of principal or fellow. Or someone like a corp buildmaster/process guy.

BrianC: here’s the link from PayScale: http://www.payscale.com/research/US/Job=Software_Engineer/Salary/a5e48575/San-Francisco-CA. Median salary for software engineers is $110K in San Francisco which is so expensive to live in.

You have to be god, or own your own company to pull in $700K or even $500K. Build masters at company’s like Apple who can not rest even 2 hours a day since if the build breaks they are screwed might be able to make $300K. If it is a software engineer who goes around the world and demos and sells software, then he might sell so much that his commission is $500K. Companies won’t pay that kind of money with all the H1-B visa employees laying around.

And why bother to take all those difficult math and science courses to get an engineering degree when you can become a civil servant and do just as well, if not better?

http://www.msn.com/en-us/news/us/outcry-over-firefighters-making-up-to-dollar400000/ar-AAnL7VU?li=BBnbfcL&ocid=DELLDHP

ERG: Unbelievable; a firefighter making $400K a year. They are not even worried that people have found out they are being paid that much. Average firefighter, and I know a few of them, can hardly solve the simplest math problem that even junior high school kids solve with ease.

My husband works in the financial industry and consults with clients. Last year he told me of a young single female client who was a doctor making around $250K a year. She complained of not being about to afford San Francisco and upon closer analysis of her expenditures, it was determined that she spent about $10K/month on going out to eat, entertainment, recreation, soul cycle etc. Add that to her $3600/month studio apartment and the picture is clear. Young people spending inordinate amounts of money on unnecessary things that they deem necessary means they never have enough money no matter how much they make. In the words of Notorious B.I.G. ‘Mo money mo problems’. HA!!!

You would actually go a bit in debt each month spending 13.6k on a 250k income before paying rent, student loans etc.

Hence her need/desire to move out of San Francisco.

The doc has 10K of discretionary spending a month, wow! And that is post tax…

“The children now love luxury; they have bad manners, contempt for authority; they show disrespect for elders and love chatter in place of exercise.”

Attributed to Socrates by way of Plato. Times change but people don’t.

But man, $10k/month in spending on discretionary items is crazy, to the point where I have a hard time believing that number, especially for a doctor who presumably works 50-60 hour weeks.

Oh — I can believe it. I have watched friends spiral into that hole. Usually there is a Divorce/Bankruptcy combo at the bottom of it… ::sadface::

Re: Excess spending habits and rental units.

Just what are the general specs for these “Class A units”, and what other classes are there?

Poverty seems to trickle UP, so today’s class A renter will likely be ready for a lower class pretty soon?

BTW- I always liked Socrate’s, “There is no evil, only misunderstanding”……Broadly interpreted, it’s kinda true.

I dated an ER doc in the late 90’s who was making 240k per year. Worked two full time jobs but her medical liability insurance bill was over 100k per year. Only in Merica—

Now if you are trader for the Vampire Squid your liability is covered by the Company unless you are the designated fall guy, but your cocaine bill may well equal my friend’s insurance expense. LOL

Re:Docs and wealth-

The prophet-like Ben Carson was worth over $10M NET when I checked him out early in the primaries….potentially a LOT more now.

So, I’m now certain HE doesn’t “tithe” (as was his simple tax plan), and of course all that money didn’t come from “doctoring”.

No matter how big a fee-for-service he could command.

For 700k a year I could buy a Dodge Sprinter rigged as a camper and live in it while saving like hell. In two or three years I could retire…

The article didn’t say he couldn’t afford; it just stated that the house he looked at sold in 24 hours.

So I’ll put myself out there to be burned at the stake.

We’re two tech workers in Seattle. We make about 200k together though with some volatility from stocks. Take a third and get to 133k. We’re at 11k a month for savings (retirement), healthcare, housing, food, etc. I think we spend 2k on utilities + food + health for just us, so 9k. I’d want to save a third of that for retirement so our budget for house including maintenance and taxes is 6k. I want to start right off the bat admitting that I consider myself upper class – we are privileged as heck. These numbers are beyond anything I thought I’d have as a kid. We were looking at moving to Indianapolis until recent events and we could afford such amazing homes.

In an ideal world in Seattle, we want a short commute (< 40 min driving one way with mild traffic or an hour if we can take transit, working in two different parts of the city) and for the 2 kid bedrooms on the same floor or above us. We don't have kids yet – but the average cost of daycare given that we both want to keep working is $2200/mo. So $4400 if the kids are close together or $2200 for a few years. I'm not sure how to account for the kids between that and college savings and the like, but lets just say over 30 years, we want to budget 3k/mo, so now we're at 3k. Most of the houses that fit our wants are closer to 1 million – a $200k deposit, a commission, and then a 5k mortgage and wherever property taxes and maintenance will be year after year. Compromising by living next to the highway (not close, NEXT) and a bit further out, we can make things work and I think we will. I'm a little wary that eventually our jobs will be outsourced in some form in 15 years meaning our pay will go down, but we can't worry about that yet realistically.

Looking at real estate for the last year, most of the things that fit our criteria are more like 1 million. Going to these open houses and following what happens, usually they go 100k+ over with limited contingencies within a week and a half, especially if they are close to public transit that exists or is coming in the next 10 years. We'll either own or rent a house this year, I'm positive, especially if we live with the highway in our backyard (those houses still go for 700k+) or we just deal with a weird commute. Overall though, between lower our expectations (no light rail access, some older houses, no views, no giant yard or no living in the city), it makes you feel humble after thinking of yourself as very well off.

My best advice:

If you have kids, get a full time nanny, over owning a home, the peace of mind is worth it.

I see no reason WHATSOEVER why people such as you describe yourselves to be, should ever worry about being “burned at the stake”.

You are FAR short of being able to wage any of this unilateral class warfare program we have going, other than by voting for it.

The very best of luck to you!

Demand is collapsing in Seattle and prices are just beginning to fall.

My advice is to read this blog:

http://www.mrmoneymustache.com

He’s more extreme than I am, but his advice is good. I kind of started out that way when I graduated from college and picked up my first job.

Having savings to ride out lifes ups and downs goes a long way to being able to sleep soundly at night. In 2009, at the start of the Great Recession, I didn’t have a billable event for 9 months. (I’m 100% commission.) But the kids and I had a lot of fun that summer!

Amazing how the BLS can never seem to find inflation. What a total fraud our financial system had become.

The BLS is BuLlShit!

1) Rents are up

2) House prices are up

3) Medical co-pays / deductibles are higher

4) Food is expensive

5) Public transport , e.g. BART is more expensive with ever crowded cars and always getting delayed.

6) Medications are up

Now trivia (useless clothes – everyone has too many, cheap trinkets), cellphones devices & coverage , TVs etc. might be cheaper but those aren’t everyday prices.

I just CANNOT accept that there is not at least 5-10% inflation at least in the bay area.

Does anyone know if BLS tracks inflation or CPI per zip code or state/areas..? (I can’t see why it won’t be feasible computationally)

BLS tracks inflation by city – but it’s a month behind the national figure. For example, according to the latest figure (see link), CPI in San Francisco in December rose 3.5%. Remember that housing is under-represented in all US inflation numbers. On the other hand, if you live in a rent-controlled apartment in SF, your max allowed rent increase last year was linked to the national CPI, and so it was low.

https://www.bls.gov/regions/west/news-release/ConsumerPriceIndex_SanFrancisco.htm

To get the other cities, you can Google for example >> San Jose consumer price index

Wolf, my son just rented a studio in brand new high rise building in downtown Portland and he got a 2 month free rent incentive. Most of the building seems to be filled with short term occupants via air-bnb.

Thanks for the info. I’m starting to hear quite a few of these anecdotal tidbits.

Well – housing in Portland is going through the third big wave of crazy since I moved out here in the early 1980s. The builder I purchased my current home from two years ago, is selling the same floor plan for 100k more in a location about 300 meters away. I keep thinking it can’t last, but it does.

Rents are rising substantially as the gentrification wave heads east… The Oregonian has had several articles about people being displaced. If I remember correctly, two people died this winter from hypothermia after being evicted after their rents increased and they couldn’t afford shelter.

—

Also – You wouldn’t be the Bike Ninja that occasionally posts on bikeportland.org would you? :)

It’s driving us crazy, because we want to buy here in Portland, but these prices just don’t seem sustainable.

Why buy it when you can rent it for half the monthly cost?

Buy later after prices crater for 65% less.

I rented in the PDX market until two years ago. Then I ran the numbers and discovered I could buy a 3 bedroom house for about ~$300/mo *less* than I was paying in rent for a two bedroom apartment. So I (and a loan service company) own a house…

Along with house prices, rents in the PDX area are (or have been) going up a lot.

—

*** I had money for a significant down payment…

Now add in you losses to depreciation, taxes and insurances and you could have rented it for half the monthly cost.

“If you live in New Orleans, and your rent jumped 15% from a year ago your cost of living surged far beyond what the national averages of the Consumer Price Index might suggest.”

Of course the CPI studiously avoids this problem by using Owners Equivalent Rent to measure housing costs. I was stunned to discover that this means calling current homeowners and asking them what they would pay to rent their house, unfurnished. Naturally the answer has nothing to do with costs of housing (after all these people haven’t rented in years if not decades), but it is a fantastic way to keep the reported CPI low year after year.

We Own and operate around 200 Apartments in the Brooklyn NY Area,

I see rent flat lineed not up nor down.

If your own and operate apartments, then wouldn’t it be to your interest to make people think that rents are not going down? My land lady flips when I suggest that I might be moving out and starts swearing that rents have not gone down, and all I have to do is look at Craigslist to know that rents have gone down.

Rents are falling fast in Manhattan and Brooklyn. You’re not paying attention.

Hi Wolf, Just found your site and very much like what you put up. If your interested in a more legitimate indication of inflation check this out, http://www.chapwoodindex.com/ . He has a fairly rigorous system for data collection and makes some real world observations on inflation. I heard him say, “If your living in a major metropolitan center your probably experiencing 7-10% inflation rate per year”. Cheers

“If your interested in a more legitimate indication of inflation check this out, http://www.chapwoodindex.com/ . He has a fairly rigorous system for data collection and makes some real world observations on inflation.”

His “rigorous system for data collection” is literally just polling his friends for what items they purchase the most, and keeping track of the prices his friends report. It couldn’t be less rigorous, except perhaps if he jotted down their answers on a napkin instead of putting them into a spreadsheet.

Want to see his 500 items? Thankfully he’s kind enough to list them: http://www.chapwoodindex.com/chapwood-index-items/

List includes (this is exactly how they are listed, by the way):

*T-Bone steak

*Filet at Steakhouse

*Country club member fees

*First class airfare

*Luxury box rental

*Botox

*Horseback riding lessons

*Tourism (real accurate description)

*Non-profit (again, real accurate description)

I mean, I know as a middle class American, inflation in horseback riding lessons, botox, and country club membership fees are just KILLING me!

So he takes his items and then weights them by price. So that $1000 first class airfare item? That’s far more important than the chicken you buy every week, because it costs more, and the index is price weighted. So if the price of chicken went down 10%, but the price of the first class airfare went up 10%, the index will overweight the impact of first class airfare and reflect a cost of living that’s up almost 10%… while the CPI would reflect the fact that chicken is purchased far more often than first class airfare, and so the cost of living would actually be down, not up.

““If your living in a major metropolitan center your probably experiencing 7-10% inflation rate per year”.”

If the rate of inflation is 10% per year, then real GDP growth is VERY negative and the economy today is much smaller and less productive than it was five years ago. While the economy is clearly not the best its ever been, the economy according to Chapwood belies even the most basic common sense.

The Chapwood Index doesn’t pass the sniff test. And if you believe we have six senses (we actually have more by I digress), it certainly doesn’t pass any of those tests either.

Our grocery bill doubled in the last 2 years. We don’t buy anything fancy and the groceries are basically the same items over and over. Our big splurge is soda and bakery items. That’s a 50% a year inflation rate to me on food. I can’t think of anything I buy which is dropping in price.

“Our grocery bill doubled in the last 2 years.”

I’m sorry, I don’t buy it. That’s a ridiculous claim you can’t back up.

Average price of bread (white) per lb in 2007 was $1.15. In 2016, it was $1.35. That’s an annualized rate of… about 1.6%.

Ground beef (100%) per lb in 2007 was $2.63. In 2016, it was $3.62. Annualized rate of 3.2%.

Chicken is 3%.

Eggs (grade A, large) is… 0%.

Milk… 0.8%.

Bananas… 1.2%.

Coffee… 3.1%.

What do you know… more or less in line with CPI.

Concerning coffee: as any coffee lover knows, if there is a fungus in Brazil, or too much rain or not enough rain, or if something else is going on in the coffee-growing world, traders will use this to drive up the price, and it will spike.

So my 3-pound pack of coffee jumps from $12 to $19. But eventually backs back down. It currently is at $15 or so. So the average movement of 3.1% per year over time might be correct (I don’t know), but it doesn’t reflect the large price variations experienced at the store.

Same with beef, chicken, eggs, milk, and some other items … they go through similar ups and downs. So what people see on the grocery bill might not reflect the national average numbers.

I too doubt a doubling of the grocery bill in two years (unless you moved from a cheap location to an expensive location). I certainly haven’t seen that. But grocery bills can rise much more than 3% a year (I do much of the grocery shopping around here, so I know).

Petunia, Soda? I don’t even touch sodas anymore. I used to buy this supposedly green juice from (greenmachine); and when I did a research on it, I found out they put synthetic fiber in it to make it thick to look like thick juice with fiber. Can you imagine consuming such a chemical poison as healthy juice?

Here’s a few I can remember off the top of my head:

Jam was $3.50 now $6.99

Muffins(4) were $1.99 now $3.99

Breakfast sausage $1.99 now $3.99

The soda oddly enough is the same price or less on sale.

You can’t?

Food is down and falling

Housing is falling

Fuel prices are falling

Basic materials are falling

Petunia said –

Here’s a few I can remember off the top of my head:

Jam was $3.50 now $6.99

Muffins(4) were $1.99 now $3.99

Breakfast sausage $1.99 now $3.99

The soda oddly enough is the same price or less on sale.

Where do yo shop Saks ?

Smucker’s Concord Grape Jam, 32 Oz Walmart$2.36

Deflationary spiral: You are the only one with X-Ray vision :). The rest of us are not that privileged.

My favorite inflation statistics this year is Cheetos Extra XX Flaming Hot. It’s up more than 10 percent this year and it’s not funny.

Not funny AT ALL. It’s probably the farthest thing from “food” on the shelves, but the little critters are sure fun to chomp.

To gauge rent inflation, why would they poll homeowners? Most renters don’t rent a home; they rent an apartment. So why not reference information on apartment rentals which is readily available, timely, and accurate.

If the sole reason is to understate inflation, why isn’t this blatant manipulation gaining more press coverage? It seems a lot of people out there would be interested in hearing about the rents they pay. When they understate inflation, it hurts the renters because their problem goes unnoticed.

Actual rents are included in the CPI, I believe– just at a smaller weight to “owner equivalent rent.” And it should be noted that actual renters are far outnumbered by homeowners, hence the weighting.

If you’re trying to measure increases in the cost of living, particularly housing, why would you exclude homeowners, who are about 2/3s of Americans?

But if you include home prices, you’re including part shelter, part investment– and the BLS wants to ignore the investment aspect, hence owner equivalent rent. It’s not perfect, but it’s probably a relatively close estimate.

——-

That all being said, I know posters here like to point to Chapwood, or ShadowStats for their inflation numbers, but they’re bogus, using bunk methodologies. While the CPI isn’t perfect, it’s probably the most consistent and accurate methodology there is. It is near impossible to come up with a truly accurate and representative number that reflects the “true” cost of living based on the price movements of tens of thousands of items in a dynamic economy.

ShadowStats methodology? Take the CPI number and arbitrarily add about 5% on top. Real legit statistics, right there. I think you need a degree in econometrics to come up with that one.

Chapwood? The creator polls his friends on their most purchased items and consolidates them to create the index. Some of the items that are included? “Lunch” — real specific! “First class airfare” — wow, this guy has some interesting friends for this to have been a top 500 item. “Paper towel holders” but not paper towels?

According to Chapwood, inflation has been running about 10% a year for the last few years. If this were remotely true, than by definition REAL GDP would be significantly lower today than it was in 2010, and the economy would be producing about 75% of what it was producing in 2010. If you believe that, I have a bridge to sell you in Brooklyn.

Does everyone buy that 0.3% Soc Sec COLA calculation this year as “real life”? Or am I the only one here over 62, in which case you probably figure it was too much?

We got THAT much? I thought we didn’t get any increase at all yet again…

Shadowstats actually uses the Fed’s prior method of calculating inflation, before they changed it to reduce benefits to everyone on SS.

If they tracked actual housing prices instead of the bastardized “owner equivalent rent,” Greenspan would have been forced to jack up rates drastically by at least 2003, instead of telegraphing a sloooooow series of quarter point increases that took almost three years to complete. By the time the Fed raised rates high enough to slow the mania, most of the damage had been done. A prime rate of 6%-7% by early 2005 would have snuffed out most of the housing bubble before it got out of control.

“Shadowstats actually uses the Fed’s prior method of calculating inflation, before they changed it to reduce benefits to everyone on SS.”

No, this isn’t true.

The “prior methodology” claim was debunked when two BLS researchers calculated CPI under the old methodology and it did not match Williams’ (Shadowstats creator) results.

Williams himself confirmed that he just takes the CPI reported by the BLS and adds a fudge factor on top to represent what he thinks would be closer to the old methodology. It’s not legitimate.

“I’m not going back and recalculating the CPI. All I’m doing is going back to the government’s estimates of what the effect would be and using that as an ad factor to the reported statistics.” – John Williams

I rent a large 2 storey shop-house on the west coast of the Gulf of Thailand for 4,000baht per month (US$114 at the current rate). Two minutes to the beach. Works for my retirement plan.

Beautiful Bob that almost makes me want to move I’m on the Med coast in SW Turkey and I pay nearly 200 USD You’ve got me beat brother :)

That’s where I plan to retire too. Not necessarily Thailand, but South East Asia. Good weather, GREAT food, cheap medical (although not necessarily the best), but the diversity, etc makes is easy not to get bored.

RE is all about location, location, location.

Don’t forget credit, credit, credit. Easy credit lifts all boats even RE in so so location.

When you say location, location, location, you are overemphasizing it by 2/3. Yes, true, but eventually all will crumble, and the hot locations will get burnt far more than others.

That’s the line that real estate agents love to use.

“Location” is just another marketing technique to get the target to pay far more than the property is worth.