Bankruptcy reveals “opaque ownership.” And freight rates surge.

When Hanjin Shipping Co. declared bankruptcy on August 31, 2016, the world’s seventh largest container carrier, and the largest ever to go bankrupt, threw the shipping industry into chaos. Fully loaded ships were stranded at sea and in legal limbo. Supply chains were disrupted. Hanjin had been considered too-big-too-fail for South Korea, and the industry had relied on a bailout, but it was allowed to fail.

Now that Hanjin is being liquidated and that the logistical nightmares have cleared up, what happened to Hanjin’s 98 containerships – and their “opaque” ownership?

And what happened to container freight rates? They’d plunged to historic lows in the spring of 2016, among rumors that they’d collapse to “zero,” and had pushed already listing Hanjin to keel over entirely.

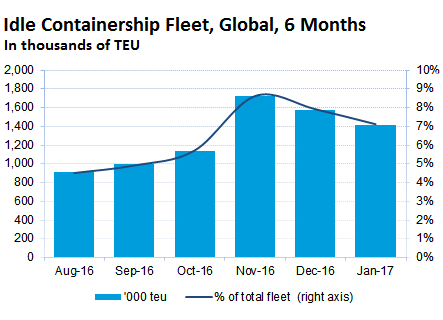

After Hanjin’s bankruptcy, its 98 ships with a combined nominal capacity of 610,000 twenty-foot equivalent container units (TEU) joined the already massive global idle fleet as overcapacity has been dogging the industry. According to Drewry Maritime Research, the total idle capacity soared from 904,000 TEU in August before Hanjin’s bankruptcy to a peak of 1.7 million TEU by mid-November. Nearly 9% of the global fleet was anchored somewhere, waiting for better days!

Since then, idle capacity has been dropping, “in large part due to some of those ex-Hanjin ships being re-chartered,” according to Drewry:

So this is what happened to Hanjin’s 98 ships:

- 4 smaller ships with a combined capacity of 15,000 TEU were scrapped. But only two of them were actually owned by Hanjin, the other two had been leased by Hanjin.

- 31 ships with a combined capacity of 134,000 TEU are now plying the seas for other carriers.

- 63 ships with a total capacity of 461,000 TEU remain idle.

Of those 31 Hanjin ships that have found new operators, only one had been owned by Hanjin.

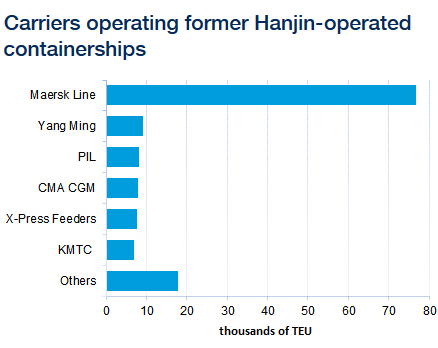

The other 30 are owned by non-operating charterers such as Danaos, Kmarin, and Seaspan, and they’ve found replacement lessors, “presumably at considerably lower daily charter rates than Hanjin was paying.” Maersk Line, the largest carrier in the world, has leased 11 of those 30 ships (combined 77,000 TEU).

These are the carriers that now operate 31 of the Hanjin ships, in thousands of TEU:

In December, the first 16 Hanjin ships were sold at auction for a total of $457 million (list). Drewry adds, “Prices are unconfirmed and based on a variety of sources”:

- 13 smaller ships with a capacity of 4,275 to 6,555 TEU fetched from $4.6 million to $5.3 million each.

- Three ships of Neopanamax size with 13,000 TEU capacity were sold by their owner, Peter Döhle Schiffahrts-KG, for $130.7 million each to “undisclosed interests,” “according to unconfirmed media reports.” One of the three, the Hanjin Europe, “was originally listed as Hanjin-owned.”

- Six sister ships “with similarly opaque ownership” are scheduled to be auctioned off in February.

Drewry estimates that, “accounting for the less than transparent ownership details,” as much as 150,000 TEU of Hanjin-owned ships remain for sale. “With such a glut of containerships already available and limited demand growth, it is debatable just how big a market they can attract even at knock-down prices.”

And this is what happened to container freight rates:

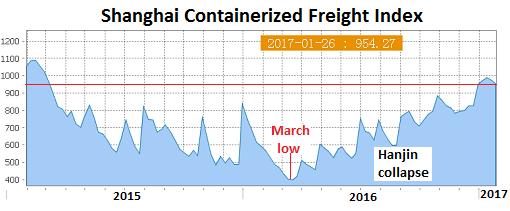

The volatile Shanghai Containerized Freight Index (SCFI), which tracks only spot-market rates (not contractual rates) of shipping containers from Shanghai to 15 destinations around the world, began surging off its historic low in March 2016. In the latest reporting week, it eased off 17 points to 954, after having hit a two-year high earlier in January:

Freight rates had started plunging in early 2015. By early 2016, carriers, desperate to get loads together, were accepting rates far below cost. Last March, there were rumors that some carriers quoted rates of “zero” in the spot market, which marked the low point, when the SCFI, hit 415, down 62% from February 2015! It has now recovered much of that lost ground.

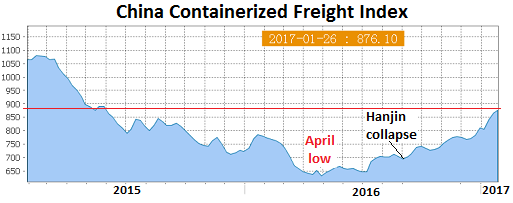

The broader and less volatile China Containerized Freight Index (CCFI), which tracks contractual and spot-market rates for shipping containers from all major ports in China to 14 regions around the world, rose 1.3% in the latest reporting week, to 876, the highest level since April 2015:

The CCFI had plunged 41% from February 2015 to a record low of 636 in April 2016. So it too has recovered much lost ground. And carriers a breathing a collective sigh of relief. It still speaks of depressed freight rates: at inception in 1998, the index was set at 1,000 and has ranged above it for much of the time.

But carriers have been forming ever larger alliances with each other to lower competition on the major routes, allow for more collusion, and push up freight rates. And that, more than the Hanjin bankruptcy, has lit a fire under freight rates.

Wall Street hocus-pocus has done an awesome job. Read… Dow Companies Report Worst Revenues since 2010, Dow Rises to 20,000 (LOL?)

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Did not Amazon purchase some of these ships?

Totally different vector.

Your comment needs a source.

https://mishtalk.com/2017/01/27/amazon-enters-trillion-dollar-ocean-freight-business-how-many-jobs-will-vanish/

WS commenters (or Wolf) are welcome to comment. In the long run, I see this is very typical Bezos.

That said, I live in a rural Alaska community and LOVE Amazon – I spend a hefty pile of money every year with them and am happy for the choice to shop and spend my money for the value they provide. Maybe I don’t appreciate who all they threw under the bus, I am just trying to make my ends meet and buy quality products.

If I may pitch my peppers into the stone soup, MiSh is a great blogger, I followed him for years (second blog I picked up after Dr Housing Bubble back in ’08 I think), but he is very, very bullish on automation. Honestly, I think he is right in the long run – but I kind of have a different angle on it, for different reasons – if I had to butcher it and sum it up, it would be “life is complicated”.

Of all his automation plugs, I think the shipping story above is one of the best ones (I disagree with some of them – but I typically read and don’t post these days – but the shipping angle is a money maker I had not considered) – sans the short mechanical crew – robots don’t fix robots – I’ll take a redneck with a grease-gun and sears socket set any day.

In the broad sense, the tail is going to be the wringer – I might have even gotten this off MiSh’s site, I honestly can’t recall, but think truck automation when you watch this:

https://www.youtube.com/watch?v=Xop2ZVvFd2k

I feel a new legal precedent is going to be required for machines to hurt others in “sensible operation” for this to ultimately be accepted.

SCOTUS watch/bet anyone?

Regards,

Cooter

I thought the comment by Chris was pure sarcasm and very funny, given what Amazon is doing these days. Did I misread it? (hint: Amazon doesn’t buy beat-up rusted transportation equipment. It buys new and high-tech.)

For anyone who has ever been at sea for some time on a large, complex ship, the idea that all of this can be automated is hard to see. The issue with a ship as opposed to driving a car (which by the Howe of THE FOURTH TURNING fame said on HedgeEye that it would take 25 year or more to be commercializable) is the extremely harsh and unpredictable nature of the sea and the fact that Murphy’s Law runs rampant at sea.

Another problem is that the ship is large and it is like the automating a large production line for each ship in many disparate locations. The cost for the automation would be quite high to build the ship and the stuff would still break with high regularity, and then where would you be.

Why does each ship, when it enters port today, give way to a pilot? Because the pilot knows the unique characteristics of that harbor? Are you not going to use a pilot. What if something is broken when you enter the harbor, but it hasn’t show up on the system, which happens? A wet and salty environment is not a hospitable one for electronics, yet electronics will have to be where the salt is, not just in some each to insulate location. What happens if you have a power casualty and something has to be fixed? What if that happens in a heavy sea? What if you can’t avoid a typhoon?

Merchants try to minimize problems and allow machinery that fails to wait until they enter port, but they still need hands to fix these things and still have casualties that must be fixed now.

I worked at sea for 3 years as a damage control officer, repair officer, and engineer; I sailed competitively for about 25 on big boats, and worked in software and the internet for 20 years. They don’t always mix. Technology is not the panacea that everyone thinks it is.

The problem with a busted ship is that you’ve got something that 150,000 tons + and 800 feet hurtling towards a bridge with no one aboard to fix it. I find the techno affinity of people today to be silly. A large freighter that is essentially a small city with navigation, power generation, is not a little car. The environment is no less problematic. What if you are a sailor and you don’t get picked up in a fog by a big containership because you are too low and can’t get out of the way? What if the radar isn’t working properly on that ship — something that does happen. What if the waves are so high that you can’t pick the small boat out of the grass on radar? I could go on.

Mish is a smart guy, remember what Tom Wolfe said, “An intellectual is a person who is knowledgeable in one field but speaks out only in others.” Tom Wolfe As far as Amazon, goes, if I had free, no cost equity capital and very low cost debt capital, I could come close to doing this. Why is Bezos going into transportation, shipping, and groceries, because his core market growth is slowing significantly. He uses his no cost capital to do all kinds of things that others can’t do because their hurdle rate is too high.

Do you think Bezos would keep prices low if he actually succeeded in monopolizing an industry? I don’t think so, but he doesn’t care as long as his cost of capital is low/zero and he can continue to increase revenues. Why given Amazon such a high multiple for being in what are essentially low cost industries. The same goes for Tesla which uses the same capital costs and government subsidies. Wolf you wrote a great article on these buy to rent companies and what they can do with their low cost capital. Charles Hugh Smith just wrote a good piece on this. I don’t know why people give such acclaims to Amazon.

@Pat McKim:

agree, realistic description of the issues involved.

I have been following this topic for some time as I know several people involved with building and sailing these ships. Long ago the Dutch were a naval empire and my city together with Amsterdam had the main shipyard and harbor of the empire.

Just like with e.g. autonomic cars and flying cars the fact that there are serious issues involved doesn’t mean they won’t try ;-) There can be no doubt that the amount of workers on ships is going to decline even further, and some ships are going to be fully autonomous pretty soon especially on hazardous shipping routes. I have worked in IT for many years and share your concerns, it’s just waiting for disaster to happen and probably then we will get better regulations (just like with e.g. flying cars, people will tinker with them until the first one drops through the roof of some important banker or politician …).

Autonomous ships have been an option for some 20 years, with something like the Australian road trains in ongoing discussions, another option is for transit of luxury yachts.

Aside from the usual problems, mentioned earlier, are the consequences of not knowing why something failed before re-booting the system.

https://en.wikipedia.org/wiki/Rena_oil_spill

That was on auto pilot, they were all below in the mess, getting drunk, as it was the captain’s birthday.

Autonomous ships (AKA autopilot) is old, and dangerous, unless full supervised, it regularly kills people.

Even I have one, its useful when you catch fish, whilst single handed trolling under sail. Go to sleep with it on, and take your life in your hands.

I find Amazon to be convenient, yet expensive. And there are quality issues and returns are difficult. I went through an Amazon phase but I’m over it.

What, slave wage rates and terrible working conditions for Philipino sailors aren’t low enough for people like Shedlock?

Here is someone who was never taught to ‘share’.

I like Mish as well, I find he covers a lot of the same issues as Wolf (including shipping which I’ve seen both write about quite a bit).

In regards to automation on the high seas, I just read an article on Bloomberg (from Jan 23) that said you can expect potentially 1/2 of the traditional oil rig jobs to go away as energy producers, particularly during the most recent downturn, increasingly look to cut costs via automation, e.g. the Iron Roughneck made by National Oilwell Varco.

Toisa Ltd., the shipping fleet owned by Greek shipping magnate and noted art collector Gregory Callimanopulos, on Sunday filed for chapter 11 bankruptcy protection, hurt by weakness in the oil and dry-bulk markets.

Party in Beijing after work on Monday, not as big as the one they had when the decision was made to break up Hanjin though.

The top 12 liner shipping companies have lost an estimated 35 billion last year. The biggest crooks of all, COSCO, and its inept management report approximately 1.4 billion of losses. Its far from over. Lets hope it takes all these criminals to Davy Jones Locker!!!!

And the chines state which owns COSCO and is driving this shipping glut, which it intends to do untill it is the only shipper standing in asia, and on its shipping routes fund’s that loss, indirectly, and quiet happily.

It is simply part of the cost of destroying other shippers.

He who controls the ship’s controls the trade.

China intends to control global trade, and the planet, preferably with out a big shooting war, in the process

P45 is, indirectly making it easy for them. Especially by walking away from TPP

TPP was an agreement the US could not afford, not to ratify.

The failure to ratify TPP by P45. WILL hurt, MANY, American workers, long term. Much more than signing it might hurt a few, short term.

Wise words…but probably not a popular opinion to have around here, sadly.

Its safe around here.

put something like that where chinese troll’s or pro chinese mod’s hunt and watch the firework’s.

.

They dont like truth.

Mao always intended to take over the planet.

His Ambition was to do so, without a major armed conflict.

The CCP is not very Communist any more, it is simply a 1 party Mafia state dictatorship, With Waring clans competing for power within it. Very similar to, and even more corrupt than, Nationals china was. Where politics and the will of the party, still trump’s the rule of law.

There are two major Issues facing the West. Militant islam and china.

The west has it head in the sand, over both issues.

If the west is lucky, militant Islam and china, will collide.

Stand clear if they do.

Avoiding the outrageous, corporate dominance of the legal framework of the treaty far outweighs any benefits that it may have conferred to workers in the U.S.

Unless you are one of the select few, we do not know what TPP contained. We might have some guesses. Presumably, TPP was good for the US; the others went along either because their competitors did, or because they saw the carrot of replacing China as a low cost supplier. Still, where does it leave Made in USA?

Should have said: TPP was good for US corporations.

In November 2015, the White House posted the entire text of the TPP on its website. It was a huge package of long PDF documents. I tried to read some of them … there might have been 6,000 pages of text. So forget it. The document has meanwhile been pulled (I just checked the link… you get a “401 error”).

I don’t know when it was pulled – after the Obama White House threw in the towel on it in Nov 2016, or after Trump moved in. Either way, it doesn’t matter anymore.

But I downloaded it all, and kept it.

The removal of it is probably something to do with trump cost cutting house cleaning.

It will be somewhere else.

I think it does matter, especially if p45 only lasts 4 years. The amount of work that went into it and what it really is will still be valid then.

TPP less all the false dog whistle new’s, is a rule book for pacific trade.

Pacific trade needs a rule book, to stop china in particular, gaming the system, and playing others against each other, to advantage, only china.

RCEP is just a license for china to exploit, like all the other chinese trade deals.

“… and I kept it.” ==> GREAT idea!

“Unless you are one of the select few, we do not know what TPP contained. ”

The full text of TPP has been available for months, the link’s to it have been posted here by wolf and myself, may time’s.

The Trump team rebooted the servers without the Obama patch. :)

Only fools bet against T.

Do you have clue how the sale rates and availability of the storage units from these ships are doing?

And what about the HARPEX index? Why nobody talks about this one?

http://www.harperpetersen.com/harpex/harpexVP.do

Honest question. Why. nobody. talks. about. this. one.

The HARPEX Index is superior to the Baltic Dry Index!

By Prieur du Plessis, on March 23rd, 2012

http://www.investmentpostcards.com/2012/03/23/the-harpex-index-is-superior-to-the-baltic-dry-index/

Bezos latest activities expose his greatest fears.

He is out of business if UPS/FedEx blackmail Amazon, or shut him down.

Cyber attack can isolate him from his customers, normal orders flow.

Buying modern ships isn’t going to solve his shipping or delivering

problems. It just increase overhead and complexity.

Drones, are useless for commerce, but wonderful tools for terrorists.

Alexa, has the “freedom character” of George Orwell,1984.

I think that in the next few years Amazon will enter empty department

stores, like evacuated Sears/Kmart and open “Service Merchandise

centers”, to be close to their customers, the old fashion way, in order

to protect themselves from ether disruptions, or the shipping

giants dictate new fees.

Online and old fashion retail will revert to the mean.

Those automated ships can be subjected to GPS blockers and be

re directed to pirates destinations.

Very good point. As Amazon started it’s own delivery service, UPS/Fedex could see the writing on the wall, and might move on to Amazon territory, or be irrelevant in due course. Doubtful that they will end up like Nokia to Apple, but who knows.

Yes I agree with all that. Empty department atores are ripe for the taking….

there do seem to be a lot of ships.

Amazon purchased a NVOCC (non-vessel operating common carrier). Basically a wholesaler of space on ships. It lets them sell that service to their China vendors that are selling directly into the U.S. Very different from owning and operating ships themselves. Maybe that’s their next step, but it would be an enormous one, and they don’t have the container volume for that (yet) because they wouldn’t have any big box customers.

“Amazon purchased a NVOCC (non-vessel operating common carrier).”

Is basically a “freight forwarder”.

Forwarders are still making good money today.

As they are piggy in the middle, fee collecting, brokers.

Most shipping companies/lines aren’t.

Yes that is correct. But despite their penchant for growth over profit, I don’t think Amazon is buying any of the Hanjin vessels. They simply want their piece of the middle as you say.

As of yesterday, one of their ships is lying off the coast here, been around for months, before Xmas.