But bank stocks have skyrocketed over the past three months.

Citigroup hit back at Goldman Sachs, after Goldman Sachs had slammed Citigroup in September. Citi analyst Keith Horowitz, in a note to clients, downgraded Goldman from the already dismal “hold” to a rare “sell” rating, citing Goldman’s valuation. He said Goldman would need an additional $4 billion in full-year revenues above current estimates – which, according to Reuters, are pegged at $32.3 billion – to get to a return on equity (ROE) that would justify the valuation.

“While we expect Goldman will see improved trading revenues going forward, the path is relatively uncertain and the bar is relatively high,” he wrote.

Goldman is scheduled to report earnings on January 18. So time to take profits and move on, according to Citi.

Shares of Goldman Sachs have jumped 55% since early October when the possibility of a Trump victory started moving into the foreground. Stock market participants have been betting that Trump would be a boon to Goldman, and they drove up the stock price. It was one of the big winners of the “Trump Trade” (via Investing.com):

By now, Goldman’s former executives are accumulating in the Trump administration. So the bet might have been a wise one in that regard. But the “Trump Trade” has gone a long way and has recently been sputtering. So the risk/reward relationship of owning Goldman shares, at this nose-bleed price, has flipped, according to the analyst.

While at it, Horowitz also downgraded Comerica to “sell.” Shares of the bank have soared 43% since early October and are up 128% from a year ago. He clung to his “buy” ratings on Wells Fargo and Bank of America. It had been party time for banks in general since early October: the KBW Bank Index (BKX) has soared 32% in those three months.

Trump’s victory played a role, particularly his campaign promise to loosen banking regulations. This coincided with the Fed’s new determination to nudge interest rates higher, which would allow banks to make more money in the near term, especially if the yield curve steepens, with longer-term debt carrying higher interest rates, which would raise lending margins for banks. But this steepening yield curve could pose big problems for banks down the road.

But is there more to Citi’s downgrade of Goldman?

In September, it had been Goldman’s turn to downgrade Citigroup, from “buy” to “neutral.” Analyst Richard Ramsden, in a note to clients, cited the prospect that Citi might miss its profitability goals.

“Despite investments in higher return businesses like credit cards, we do not see a path to a meaningful inflection without an improvement in the macro environment,” he mused.

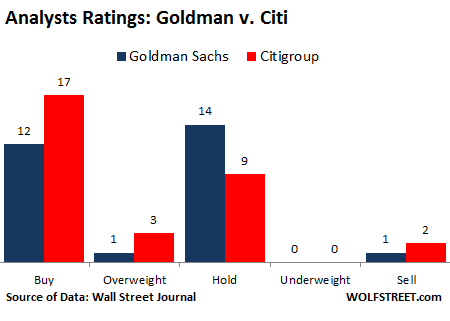

Analysts are all over the place on banks. Here are their ratings, based on Wall Street Journal data, of Goldman and Citi. For many analysts, “hold” is as close as they’re going to get to an outright “sell” rating. And “consensus” is not exactly the right word to describe this:

Goldman’s Ramsden justified his downgrade of Citi in September with the same concerns over ROE, figuring that “growth in higher return businesses and expense discipline will not be enough to take ROE all the way to its 10% ROE target.”

Tit for tat? We’ve seen that before. During the Financial Crisis, banks belatedly got bearish on each other, slapping each other with downgrades, back and forth, sort of like a circular financial firing squad. It took them a long time to get to a sell rating, often long after the shares had already collapsed. And they were right, even if late.

So Citi’s early warning might be a breath of fresh air. However brutal, so to speak, that downgrade to “sell” may have been, it dented Goldman’s shares only briefly before they recovered almost all the way and closed down only 0.07%.

Now a friendly chat among billionaires who presumably see eye-to-eye on business dealings. Read… What 1 Million US Jobs? Dreading a Trade War, China Sends Alibaba’s Jack Ma to Trump for some Fence Mending

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Now let me see, how does that old line about honor among thieves go…….?

Whichever bank is first to brown nose L. Ron Trump will win.

The first to get a negative tweet from L. Ron Trump will lose.

There could be serious money in consulting for companies to help make them twitter-resistant. No ideas about the constant alarm bells, though.

“L. Ron Trump”? Some connection to Hubbard?

Yeah, we need to get up to speed so I did a search. Donald Trump is eerily similar to his hero L. Ron Hubbard, the founder of Scientology — both are narcissistic, autocratic, money-obsessed, pathological liars (and “wanna-be” sexual conquerors)

http://www.rawstory.com/2016/09/drinking-the-orange-kool-aid-cult-expert-says-trump-is-like-rev-jim-jones-but-far-more-dangerous/

I’d call it Orange Gatorade instead. It’s warmer again, wonder if the frogs start singing again? Trrrrrump! Trrrrrump! Trrrrrump! Trrrrrump! Trrrrrump! I swear they were…

These capitalists generally act harmoniously and in concert to fleece the people, and now that they have got into a quarrel with themselves, we are called upon to appropriate the people’s money to settle the quarrel.

Bank bailouts coming up.

Repeal and replace! Repeal first, ohhh, we’ll do the other later. Build wall now, Mexico will pay later. Ethics checks are so PC.

“Ethics checks are so PC.”

Ethics are for losers because of their suboptimal ROI. That’s why adopting actual ethical standards for your publicly-traded business will only get you sued. Wall St. guarantees it.

That’s where your friendly Business Ethics Consultant comes in. Their job is to use all the available PR tricks you can afford to make it appear that you’re into all those goody-goody socially-responsible librul things, while at the same time assuring your investors that you do indeed have the morals of a famished barricuda.

All the best companies have them.

As for consulting, well. if you can’t be part of the solution, there’s plenty of money to be made in prolonging the problem.

Bush WH ethics lawyer says Trump plan is so flawed, if he doesn’t fix by Jan 20 he “will be in violation” of the law.

https://www.bloomberg.com/politics/articles/2017-01-11/trump-s-meaningless-ethics-plan-assailed-by-watchdog-groups

Quite possibly January 21 impeachment proceedings begin.

How is that manufacturing renaissance and reverse offshoring going to happen when one reason for the loss of it was the above mentioned fine institutions?

Wasn’t it Petunia who mentioned the name for Citi, (when she was in the tech biz), was Shitti Bank?

Me? I have my dinero in a credit union. I hate banks and always have. I would never invest in one out of principle. I’m afraid to even walk into one; worried about catching something, or being ripped off. Crooks and Bandits, all…and have been from the ’30s. Maybe always?

Buy Wells Fargo? Come on, was this before they got caught setting up phony accounts?

regards

I don’t know, I kind of think of Citi’s downgrade of Goldman as more of a firing squad on a circular shower mat. So it turns out Trump is more into trickle-down loosening up than we ever knew.

In fact I think I’ll pass on asking Golden for my share of Trickle-down relief. Since they’ve gone after cutting the ethics rules there’s no telling what the kakistocracy will shower you with. God, I cannot believe what’s happening to the country.

L. Ron Trump’s Kleptocracy will somehow manage to manipulate the “too big to jail” bankers for his own benefit.

The upgrades and downgrades are just the meaningless antics of the very minor profits centers of legally corrupt funding power.

I got a mailer from Chase bank yesterday in the mail. Chase is offering cash referral payout to REFER CUSTOMERS WHO DEPOSIT $15,000 OR MAINTAIN $15,000 FOR 90 DAYS!

Can anybody say “major liquidity event” imminent?

Paul

My neighborhood Chase branch has been hounding me for years with their mailers. They want me to deposit my money there. They promise, time after time, to give me $500. “Enjoy up to $500 on us,” the mailers say on the front. It goes like this:

1. $300 if I set up a checking account with direct deposit.

2. $200 if I put in $15,000 and leave them there for 90 days.

3. $500 if I do both.

The mailer hasn’t changed since I first started receiving them. That was shortly after Chase moved into the location that had previously been occupied by Washington Mutual, which collapsed during the Financial Crisis.

I don’t think it’s a sign of a liquidity event. They’re just trying to rope in customers to be able to extract fees. That’s just business – the $500 is booked as customer acquisition costs.

Aloha Wolf…..I just say..” Book em’ All Dano “…lololol

I think Citi Group should leave the USA. They just announced their plan to end mortgage servicing because they cant abide by the law. The bank outsources jobs and layoffs off American workers. They just put thousands of people out of work and back on the government dole. They may have repaid their TARP but the American people are paying for inflation the banks caused. After announcing people will be laid off the CEO issues a political statementhttp://www.businessinsider.com/citigroup-ceo-corbat-on-trump-immigration-ban-2017-1 .