There’s only one thing that has pumped up this market.

Stock indices are frolicking in record territory. The S&P 500 is up almost 11% this year, though the gains came after the election. The Dow has been titillating the entire world, day after day, with the prospect of finally, finally hitting 20,000 after being just a hair shy of it for two weeks. So it would seem that the IPO market would be hot. But for IPOs, 2016 has turned out to be a fabulously terrible year.

That makes two years in a row. Last year at this time, I wrote that the IPO market in 2015 had been the worst since the Financial Crisis. I quoted Sam Kendall, UBS global head of equity capital markets:

“We all thought that we might finally get a year where we would be able to put four quarters together,” he said at the time. “If you looked at the pipeline and how people were thinking about the world, it just felt good. And then the wheels came off.”

Last year, the number of US-listed IPOs had plunged 38% to 170, according to Renaissance Capital. In terms of dollars, only $28.7 billion was raised, down 48% from 2014. By that measure, according to Thomson Reuters, it was the “worst year since 2009.”

But that’s like so 2015.

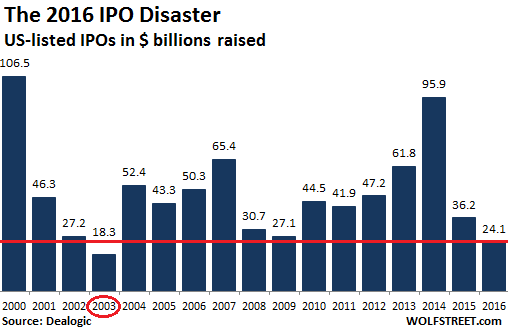

In 2016, only $24 billion was raised in US-listed IPOs, according to Dealogic – the worst year since 2003. Even during the Financial Crisis, IPOs raised more money than in 2016: $30 billion in 2008 and $27 billion in 2009:

Last Friday, Trivago, a hotel search platform, went public at an IPO price of $11 a share, below the expected price range of $13 to $15 a share. There’s little appetite among institutional investors for IPOs. Despite the lowered IPO price, shares closed at $11.81 today, down 2.8%. It was most likely the last IPO of this year.

In terms of performance, IPOs that made it over the last two years haven’t done that badly – just worse than the overall market. The Renaissance Capital IPO index, which tracks IPOs for their first two years of trading (so companies that went public in 2015 and 2016) is down a smidgen year-to-date, despite all the recent stock-market hoopla.

No one likes to take big risks with young companies that often have no earnings, and sometimes no revenues, unless the market will reward them with big-fat gains, pronto.

Here are some salient facts about what will go down as IPO-disaster-year 2016, according to Dealogic:

- Only $24 billion was raised.

- Only 111 IPOs made it to market.

- But 58 issuers have withdrawn IPOs, after last year’s 62 withdrawals. They’d expected to raise over $10 billion.

- It’s not all bad for the ones that made it: 81 IPOs (73%) are trading above offer price.

- The best performer: Acacia Communications, an electronics-semiconductor company, up 189% since its IPO in May.

- The biggest dud: PhaseRX, a biomedical-genetics company, down 73% since its IPO in May.

- Most active IPO sectors: Healthcare, 35 deals, up on average 18%; Tech, 25 deals, up on average 31%; Finance, 20 deals, up on average 20%.

In December 2015, I figured that 2016 could not possibly be worse. But it was. So no I’ll bravely figure that 2017 cannot possibly be worse than 2016. I mean, one biggie like Snap, the owner of Snapchat, which is rumored to be preparing for an IPO, or a few decent-size IPOs would seriously move the needle of money raised.

That doesn’t mean that investors who buy the shares won’t take a big bath. That’s the fear, in this climate.

But the official backlog is not promising: there are 24 filings in the 180-day IPO backlog, for a meager $2.4 billion in expected value, according to Dealogic. The largest one: $500 million, for the Brazilian meat processing company, JBS Foods.

And they better hurry up while the Trump euphoria lasts.

Numerous explanations are being circulated why this IPO disaster has happened two years in a row. Volatility in the stock market is one of them. But other than in the beginning of the year, there wasn’t much volatility, with stocks recovering nicely from a deep swoon in early 2016, returning to record territory until after the election, when they soared to even bigger records. So it’s hard to blame “volatility.”

And there is plenty of risk appetite in the market. Every bit of trash has been bid up. Junk bonds have surged. Money is flowing into the riskiest corners.

There’s however a real issue: Valuations of pre-IPO companies have soared over the past few years. “Unicorn” status – a startup with a valuation of $1 billion or more – once a rarity, is now common: there are 90 VC-funded startups in the US with valuations of $1 billion or higher, including eight with valuations of $10 billion or more.

It didn’t help at all that one of those shining stars, valued at $9 billion, Theranos, went down in flames, fraud allegations, and lawsuits and took its $750 million in equity funding with it. Investors don’t like those stories.

Plus, there a number of large companies that PE firms have bought out during the LBO craze and that they’re trying to exit via an IPO. Albertsons, which also owns Safeway, comes to mind. It has scrapped its IPO in 2015 but in October amended its filing. So maybe 2017 will be the year. The PE firms behind the deal must have a buoyant market to pull this off because over-indebted brick-and-mortar retailers have a tough business model.

And there’s another issue. Much of the power behind the surge of the stock market has come from share buybacks: over the past 12 months, S&P 500 companies spent $557 billion on purchasing their own shares. A huge amount of new money piling into the market. It’s what propped up these lofty share prices for so long.

But these companies are buying their own shares and driving up the value of their own shares. They’re doing nothing for IPOs. Boosting a market with pandemic buybacks doesn’t create the blind exuberance and hope that a large number of big IPOs could feed off. Instead it creates a structurally unsound and overvalued market, ripe for big nasty surprises. And the IPO community sees that too.

But is that buyback boom now going down the drain, putting this wondrous stock market at risk? Read… What the Heck’s Happening to Our Share Buyback Boom?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

While the Fed controls the reigns of money production the upward trend will stay intact, seemingly irrespective of politics. Financial engineering like the share buyback monstrosity are just trend symptoms. The market is just gonna keep going up over time.

What stops it? The last 15 years even war, housing busts, near collapse of the Euro zone, NIRP, hasn’t stopped the rise for any length of time.

Real gold money has handily outperformed the s&p for the last 15 years. Why bother with risk?

15 years is a long time, what’s the attention span of the average adult in the West, 2 minutes at best? I bet that 90% of current stock and RE speculators can only extrapolate the trend from 2009…

And even if you want to educate yourself, it can be tough. In my country all statistics about the housing market from before 1985 are almost inaccessible because – it only goes up since then, no need for the sheeple that trends cannot continue forever.

@shapa:

BTW, in several EU countries the stock market index is still far below its peak from 2001 or so, despite outrageous money printing. The day of reckoning for RE will come too, it just might take longer because it is so important for the voter base and politicians and banksters do everything they can to keep the bubble growing.

Most pension money is precluded by law from being held as constitutional money. That sounds like gold bug rhetoric, but it’s true and really needs to sink into people’s brains.

One sure thing about this market, it has turned fools into experts and experts into fools.

Michael Francis, it’s that way with EVERYTHING now.

there is no such thing as accountability anymore anywhere. it’s all tin foil tigers.

i personally want to apologize to EVERYONE who was ever slimed here with my naive optimism that bad things could inspire change of any kind.

James says humans are like dinosaurs and destined to die off and become a thing of the past like a blip, an experiment. i thought that was harsh. now i agree.

all i can do is dance and fall in love while here now.

merry christmas and happy channukah and happy kwanza and happy winter solstice and last day to ship through the usps for priority mail cookies to arrive.

blessings to you each.

x

I appreciate the apology. It’s more than the Clintons have ever done.

BTW, accountability like charity, starts at home with you. When you meet your maker, it’s not about what we did, it’s about what you did.

oh, PETUNIA… thank you for this:

“…accountability like charity, starts at home with you. When you meet your maker, it’s not about what we did, it’s about what you did.”

you are a goddess who always hits home when you don’t even realize it. i’ve got a big ole smile on my humble face. thank you.

i’m so glad you exist. even if you’re younger than me it’s nice to have a big sister. my own little sister was always like the OLDER sister all my life. telling me to stop spitting at people and to wipe lipstick off my teeth when i always seemed to put it there myself on purpose in the first place.

(smile)

Merry Christmas, mami.

x

Blessings to you as well Kitten, Happy Holidays! :)

thank you my dear, dear Chicken. you’re always such a PLEASURE.

blessings to you and yours for real.

and besos!

x

They are buying their shares back instead of investing. “No more dollars, just shares please”.

Reflation trade is now left up to bankers bonuses?

I hope they get a huge bonus because they are our last hope!

Together with a monetary policy aimed at inflating financial assets, European and Japanese investors driven to insanity by negative interest rates and general euphoria, part of the cause for the explosion of US stock indexes is the number of publicly traded companies in the US has been dwindling every year since 1997 and now stands where it was when Ronald Reagan was negotiating nuclear weapons with Mikhail Gorbachev in 1986.

At the 1997 peak, there were 6797 publicly traded companies in the US. At last count there were 3245, or less than half, and that was back in June.

Given the monetary policy-driven financial boom of the past seven years, one would have expected the trend to stop if not to invert, but it wasn’t the case: publicly traded companies have disappeared from indexes at such a pace not even Silicon Valley and Biotech “pipedream” IPO’s could fill the gap.

Given a growing percentage of Americans’ pension funds and long term savings are invested in stocks, one has to wonder what happened.

Guy Rolnik over at the Pro-Market blog has an extremely interesting article on the matter: https://promarket.org/are-we-all-rent-seeking-investors/

To cut a long story short and by not giving Guy credit for his usual great insight and research, the general trend is toward rent-seeking, which is accomplished through the double means of hunting for government-sanctioned monopolies and forming de-facto monopolies through shareholding patterns.

What about anti-trust? As seen all over the world, anti-trust authorities are a complete joke and their actions exclusively dictated by political, not economic, considerations.

To get back to more pleasant endeavors, one of my pet peeves in the past few years was jet.com, the online retailer which was supposed to beat Amazon at its own game.

Until early in 2015, jet.com was potentially one of the biggest unicorns out there, with rumors about IPO’s flying thick and thin. Then everything went quiet until it started to transpire Walmart was negotiating to buy jet.com lock, stock and barrel.

Walmart threw a whole lot of money at jet.com: $3 billion in cash plus $300 million in equities.

At the time Jet.com proudly advertised it was processing 25,000 daily orders. Amazon processes the same number of orders in 10 minutes, and only on the North American market.

I am not taking away anything from jet.com founder, Marc Lore: he gave his investors a nice return in a relatively short time without turning a profit and by fully abiding the law. While he never publicly stated so, his goal all along was not to wage war to Amazon, something that would have required a completely different level of capitalization, but to build a company interesting enough for one of many ailing brick-and-mortar retail dinosaurs to buy it off his and his investors’ hands for a handsome profit.

“What about anti-trust? As seen all over the world, anti-trust authorities are a complete joke and their actions exclusively dictated by political, not economic, considerations. ”

Lets see what this new administration does about that. The elimination of competition is at the heart of jobless America and little interest in creating business enterprise. Dimes to donuts was the old saying. Efficiencies is the talk, monopolies is the walk.

One can not make America ‘great again’ with the same old promises the last president never kept.

Spot on. The quickest and most painless way to bring back jobs and growth is anti-trust enforcement, breaking up banks, preventing huge acquisitions, etc.. Profits will suffer, but jobs and competition will flourish. The lazy Fat Cats don’t like competition though, and if they see any move against Big Business and monopolies they’ll fight it with their fat wallets.

I suspect there are excessive expectations about job growth these days.

Little is known that the US are still the fourth steel producer in the world, producing over twice as much steel as Germany. Yet the US steel industry continues to lose blue collar jobs despite production having stabilized over the past five years at around 82 million metric tons/year after rebounding spectacularly in 2010.

The reason is the steel industry is becoming heavily automated: humans need not to apply.

One may believe automation is merely confined to heartless corporations, but automation is just as tempting for small firms as for giant corporations. The advantages are just so many, and they keep on increasing with every new firmware iteration or product improvement: FANUC of Japan has whole lines of “Robomachines” as they call them aimed at small firms or even workshops. I’ve seen them at work and they are incredibly impressive, they make you wonder if Isaac Asimov wasn’t too tame.

Wolf and his contributors have long called attention to this revolution, which will be not merely economic but social, and for which nothing can prepare us.

And monopoly rent seeking, the big pharmas. Patent medicines. Big chunk of the $3.2T health care portion of US GDP (2015?) Wolf pointed out in the article on the health care monster no one wants to tame, is monopoly rent. (patent seeds are also monopoly rent seeking model) When you subtract out of GDP the rent seeking in various sectors, US economy is shrinking, and has been for years. This shows up in the massive polarization.

I think, the trend in recent years was to go private and avoid the hassle and cost of Wall Street. If the parallel trend is to make the rich richer and the poor poorer, then it make even more sense: the rich can invest in private equity instead of the stock market.

Thanks for the update about Jet.

I did investor relations back in they day. Did many IPOs. Used to be fulfilling marketing the company story to the buy and sell side and brokers, when stock picking was a thing. Can’t do that to a market of HAL 9000s.

Just eye-balling your bar graph, it looks like a 7-year cycle in IPO offerings, with 2000, 2007 and 2014 as peak years. Any idea what could be driving such a cycle?

The last dying gasps of the Obama economy. Enjoy it while it lasts. January 20th, we enter a brave, new horrifying world.

Speaking of new and old and horrifying worlds, I was watching the Medici’s series on Netflix. Bankers buying their way into the Papacy and replacing all the cardinals with their banker buddies and blowing all the church revenue on expensive homages to themselves. Something about it had such a familiar and terrifying feel to it, haven’t had the nerve to see how it ends.

You’re 8 years late to The Party:

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2016/05/31/20160301_obama_1.jpg

Now it’s crystal clear the details of change POTUS was promising. There’s still an amazing number of people out there that consider it all great, that is so bizarre.

Very few start ups are profitable even after a few years in business and going public is the holy grail for many start-ups, but the reality is more likely that you get bought out. But most just go out of business.

Side Note about a recent posting about homes sales:

I just saw that November home sales in the US were the highest since 2007. Something about locking in interest rate……

http://www.wsj.com/articles/u-s-existing-home-sales-rose-in-november-to-new-postcrisis-high-1482334472

Concerning the home sales report: what is fascinating – and I don’t have an answer yet – is that the spike in home sales as reported by the NAR was not duplicated by a spike in purchase mortgage applications, as reported today by the MBA. Purchase mortgage applications are up only 1% from a year ago.

Obviously, there is some timing difference between what is considered a “home sale” and a “mortgage application.” But something doesn’t quite compute. If homebuyers wanted to lock in a mortgage rate, purchase mortgage applications would have shot up, but they didn’t.

So were all those additional home sales cash deals? Because now rates are higher? Which would be the opposite of the expected. Or because foreigners are buying? Or institutions are buying and financing these deals at the institutional level?

I might check into this topic later today.

You might want to check sales in places that had big natural disasters, like the one in Baton Rouge, LA. These people buy new homes with the insurance money and move on. We know of someone who did just that. They lost a paid off house which was destroyed. They bought another place and sold the old house for the value of the land, which was also for cash.

Could be closing date related. I mean timing. If the close happens in November, there’s a good chance that many of the mortgage applications originated in October. But, I think rates did not start to jump until November. May be there’s a lot of cash purchases? It’s worth a closer look as it’s the first time since the crash.

“21% were all cash.”

Wolf, the process of those November sales closings started long before November, so I’d imagine that it simply has to do with November sale closings originating a month or two before the rate run up. We won’t see the sales effect of the November rate increase until January or February sale closings reports, although the November mortgage origination numbers may be a hint.

My wild guess is that Jan and February numbers will still be up, since it’ll reflect those rushing to “lock in” rates in Nov/Dec, and I’ll likely use March or April sales numbers as a bellwether of where things are going.

http://uk.reuters.com/article/uk-eurozone-banks-italy-montepaschi-offe-idUKKBN14A1NT

Thanks!

Would also be interesting to see where most of the ‘cash’ deals occur.

Are they mostly in speculation hotspots like CA?

Let’s hope for American taxpayers that this is really cash buying because that means less risk for taxpayers who ultimately guarantee the mortgages, and more risk for the speculators ;-)

Nicko,

I will be enjoying the increased whine of the liberal hoards on Jan 20th.

I’ve never seen a group of people who whine more than conservatives have for the past 8 years. The irony is that most of their whining is about liberals, who they then chastise for whining themselves. Dumb, oblivious, hypocrisy at its finest. Thanks Mikey.

Irredeamables.

All you must do to realize your dreams is paint targets on people’s backs then kick back and watch.

No worry. Next year will be the year of drone maker IPOs, followed by IPOs of drone hunters. It will keep the stock markets aloft.

Robots, to displace irredeemables.

add robot hunters and hackers to the IP options ;-)

And maybe CIA-Google will allow the public to participate in one of its new outfits that builds terror drones for ISIS (sorry, for “moderate rebels”…). That must be a juicy opportunity ;-)

No one is talking about how the record trade blocks this year. Used to be only large banks would make risky trades like that, now all the little banks are piling in.

http://www.wsj.com/articles/banks-fight-for-block-trades-amid-stalled-ipo-market-1481055596