The Numbers Report, part of the weekly premium publication, Oil & Energy Insider, compiled a series of data points that make for a worrying outlook for the oil markets. Here are some of them:

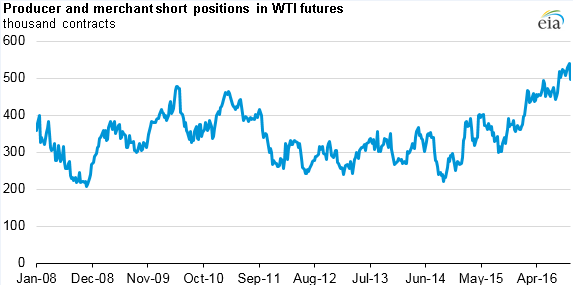

Short positions on the rise

- For the week ending on October 11, the number of short positions on WTI rose to more than 540,000 contracts, the highest since 2007.

- Producers take short positions to sell future production, locking in prices at some point in the future in order to mitigate risk. As the EIA notes, banks can require producers take such positions as a prerequisite for securing a loan.

- Aside from mere speculation, a rising number of short positions can be an indicator that producers are confident that they can make money at the current futures prices.

- But they also are a bearish signal for oil prices, lending weight to the notion that prices will not rally very much in the near-term.

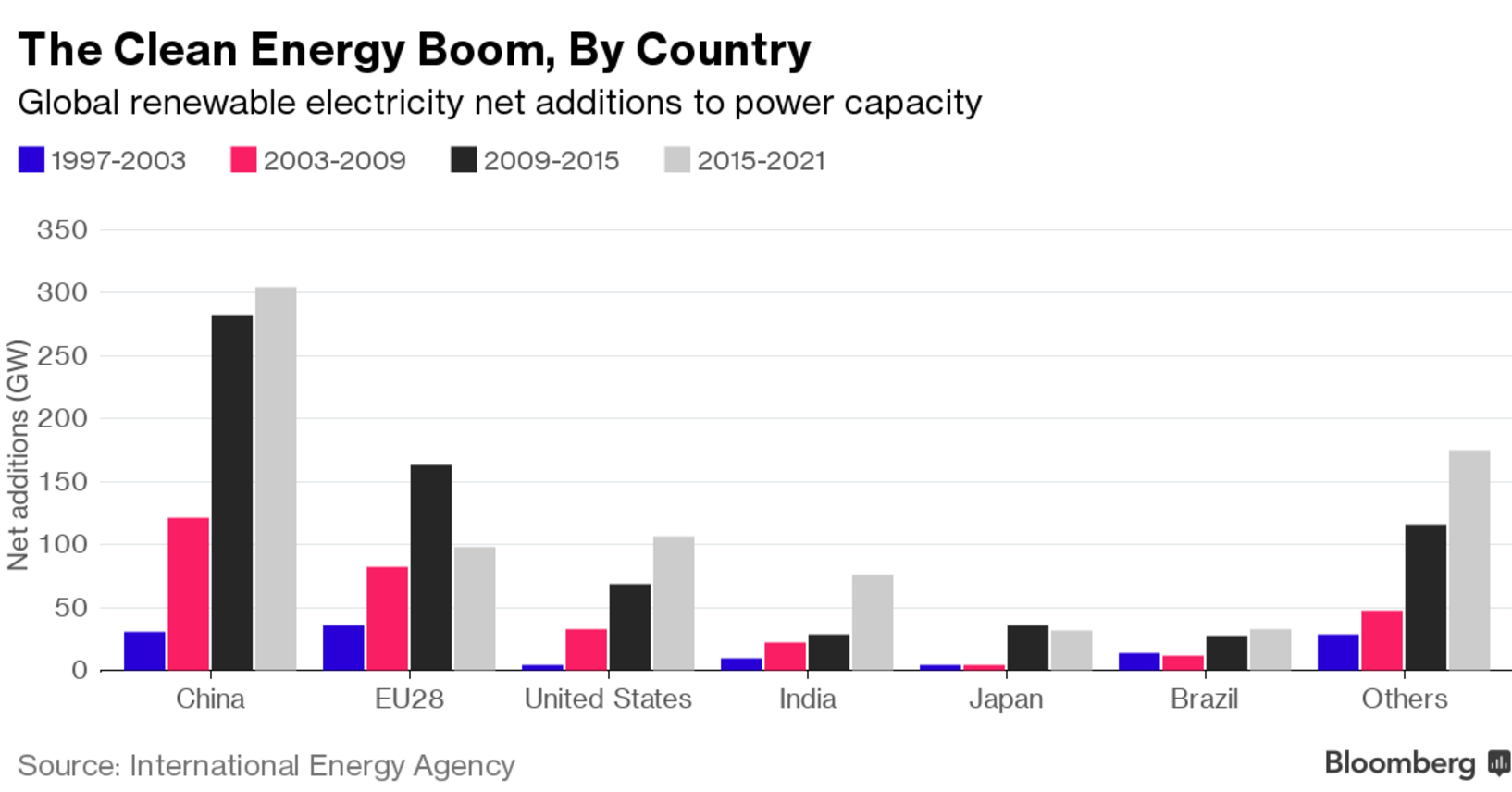

Renewables overtake fossil fuels

- For the first time ever, renewable energy added more electricity capacity across the globe than fossil fuels did. The IEA estimates that in 2015, 153 gigawatts of renewable capacity was installed, about 55 percent of the global total.

- About 500,000 solar panels were installed every single day in 2015, on average.

- The IEA expects renewables to make up 42 percent of the market by 2021.

- Much of the growth will take place in four countries: the U.S., China, India and Mexico. The EU has a lot of renewable energy, but its growth rate is a bit lower than the others.

- “We are witnessing a transformation of global power markets led by renewables and, as is the case with other fields, the center of gravity for renewable growth is moving to emerging markets,” IEA Executive Director Fatih Birol said.

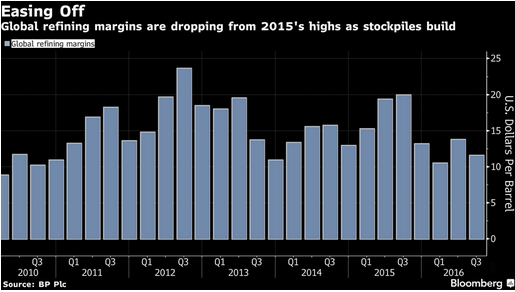

Refining margins declining

- The massive stockpile of refined products sitting in storage around the world continues to weigh on refining margins.

- Margins were down 42 percent in the third quarter compared to a year earlier, averaging just $11.60 per barrel. Aside from the first quarter of this year, refining margins in the third quarter were near their lowest levels in years.

- That is a stark difference from 2015, which was an excellent year for refiners. The falling price for crude combined with strong demand saw margins spike to $20 per barrel. But as refiners ramped up output to take advantage of that opportunity, they churned out record product. And as demand softened, inventories built up.

- Low refining margins will take away one of the few sources of strong earnings for the oil majors, which are set to report third quarter numbers in the next few days and weeks.

Oilfield services turning a corner

- The top oilfield service companies have managed to put a halt to the enormous job cuts that were forced upon them by the worst oil bust in decades. The four largest OFS companies cut 140,000 jobs over the past two years, according to the FT.

- But in the third quarter of 2016, employment figures remained about the same at Schlumberger (NYSE: SLB) and Halliburton (NYSE: HAL), the two largest firms, and only down by about 2,000 at Baker Hughes (NYSE: BHI), the third largest.

- The rig count is back up and oil prices have seemed to stabilize at $50 per barrel, with more work promised for OFS companies as drilling picks up.

- Schlumberger’s CEO Paal Kibsgaard struck a strong and optimistic tone in a conference call with investors, claiming that “we have indeed reached the bottom of the cycle” and are planning for the “recovery phase.”

- He also stated that Schlumberger would only look at profitable projects, a warning to oil producers who have demanded lower rates for services. Kibsgaard’s comments suggest that oil companies will no longer be able to squeeze savings out of service companies.

OPEC deal is underwhelming

- Even if OPEC somehow agrees to cut its collective output to the lower end of its proposed range at 32.5 million barrels per day, the deal would only cut into existing excess supplies by 11 percent, Bloomberg says.

- The cuts will bring global inventories down in 2017 by just 36.5 million barrels over the course of the entire year, which is hardly a game changer.

- Even that level of cuts could be too much to ask for OPEC – it would require reductions of 900,000 barrels per day below September levels.

- The problem becomes even more difficult as Nigeria and Libya are ramping up disrupted output. Iran too is targeting higher production levels. All three nations are exempt from the cuts. More recently, Iraq also demanded an exemption and is hoping to boost output.

- In short, even the best-case scenario for the OPEC meeting won’t be enough to spark a strong rally in oil prices.

Widening contango a warning sign

- The spreads between near-term oil contracts and those for delivery a year out are widening again, a trend known as contango.

- The contango is a symptom of short-term oversupply, as crude for front-month deliveries need to be discounted because of the glut.

- In other words, the futures market is showing signs of a persistent glut, lending evidence to the notion that oil prices might not rally for quite some time. The IEA does not see balancing until the middle of next year.

- The WTI and Brent time spreads are at their lowest point since January – less than -$4.00 per barrel – a time when crude crashed below $30 per barrel because of oversupply fears.

By the Numbers Report, part of the weekly premium publication, Oil & Energy Insider.

Improving battery technology and the coming wave of electric vehicles will cause a problem for global oil companies: demand for oil as transportation fuel will dry up and send investors fleeing, according to Fitch Ratings. Read… EVs May Send Big Oil into “Investor Death Spiral”: Fitch

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It’s time to start investing in renewable energy and get us off of the dependence of O&G. If we bring down our reliance we become a cleaner more efficient civilization that can get off of our dependence on foreign energy and manage our own destiny.

Different issues for me. Increasing the amount of renewables would be a generally sensible goal to achieve, without any doubt. But “investing” is different. A POTUS Trump would very likely follow the same old O&G path.

We taxpayers have been ripped off enough through renewable energy. Trump at least will end the handouts. We’ll go with what is cheap and makes sense.

How is it that many people seem to be unaware of the huge handouts that the O&G industry receives and has received for a very long time? Remember when “Deadeye” Dick Cheney let the O&G industry write the Bush Administration’s energy policy in secret? This taxpayer would like to see more investment in the renewable sector.

Ben, nothing new is cheap in the infancy, none at all. Efficient, more productive, using less natural resources, job creation are better suited for the new.

It’s all about politics and money at stake. The US has so much invested in fossil fuel, the political friction or inertia is significant. Based on a documentary I watched, China is way ahead and is moving much faster in this field. This situation is really no different from what we typically see at a much smaller scale at the corporate level in any field. For instance, in high-tech, Intel has invested so much in their PC microprocessor’s technology that they have been using the essentially the same foundation for their processors for smartphone and it failed. All that legacy tech that Intel were not willing to abandon was making their processors for smartphone totally uncompetitive — they are extremely bloated and energy inefficient.

“China is way ahead and is moving much faster in this field”

Right. But they’re erecting/projecting NPPs and CPPs as well. Their demand is huge and the air pollution problem is quite obvious. Have to catch up AND phase out old CPPs at the same time.

Negatives:

Crude has seen draw downs almost every week.

After removing the sanctions we’ve added Iran’s oil to the market, and the US invaded Libya recently. Their oil production has been going up now. Assuming this isn’t a coincidence, we’re desperately adding any oil we can find to the market. Prices may stay low for the time being, but this is not a good sign about future production.

Just a reminder that hydro-electric power is a renewable. It is a form of solar power. The sun evaporates moisture from the reservoir and surrounding area which rises and turns into clouds which cause rain which renews the reservoir.

This is a big factor in Canadian politics because Quebec is a major user and exporter of hydro-electric, including to the US, and it wants a carbon credit for every watt.

nick kelly, there are “rabid” environmentalist in this country that say even hydro-electric energy conversion is bad.

“even hydro-electric energy conversion is bad.”

It is. The dams severely interfere with fish reproduction, notably salmon but also others. Sport and commercial fishermen are notoriously right-wing, conservative in one of its only positive connotations.

Any large-scale human activity like energy production is certain to compromise the habitat of important species. The trick is to compensate, conserve, preserve, and manage, which generate costs the producers would naturally prefer to externalize. Since there are no market-based solutions, government regulation is essential and must be strict to be effective.

Your best option is still to optimize the use of your freely-provided fusion reactor, conveniently situated 152 million km away, well out of the reach of corporate predators. The externalities involved are the most easily managed.

There are down sides to every thing humans do in mass. The large hydro dams not only impede fish but many are silting up behind them at a rapid rate causing them to be much less useful. I have read that the area behind the large Glen Canyon dam is so large and to shallow so that in the heat of the summer the evaporation is more than most of the remainder of the down stream demand. It should be torn down as is detrimental to the remainder of the down river users. So not all dams are good ideas.

Try damming up the really big rivers like the Missouri and the Mississippi and you impede barge traffic besides the amount of farm land that would be underwater.

I may be wrong about this but I don’t think the Mississippi has enough vertical drop to be a good hydro candidate.

PS: Niagra has been providing power for a 100 years now.

Where is the problem there?

I want a carbon credit for not talking about the election as I have in past years…….

Change your name to Tesla. Tesla posted Q3 profit but what it doesn’t explicitly say is that those so called “profits” include 150 million in carbon credits. Have they even been paid out? What a racket!

Tesla is only euphemistically ‘profitable’, since it is deeply dependent on federal welfare handouts. If it weren’t for corporate socialism nobody would ever have heard of Elon Musk.

Everybody with money got that way with the carried interest rules of taxation. They are all on the dole.

….or Edison or Einstein or the Louisiana Purchase. Government handouts have been our heritage since inception. Free markets are a contrived theory, never have they been productive or substantiated. The dollars in our case or trading currency has to come from someplace. If the dollar supply was not increased without the private debt increasing there would not be much expansion in the country’s G.N.P..

This article is a VERY short term prognosis for crude oil/gas sector.

EROI is what REALLY matters when viewing any metrics of oil/gas.

All EROI means, is the amount of oil “burned” to produce 1 barrel of oil.

Energy Returned On Investment

At the inception of oil production (circa 1900) this metric ratio was very favorable at approx. 1 barrel “burned” for a return of 100 barrels.

Todays EROI is debatable, but most aggree that it is close to 1:25 and bleeding lower. This ratio does not have to reach zero to be ineffective however, once the EROI reaches 1:5 the jig is up.

And then there is plain old ROI (return on investment). ROI is low for those with conventional production and a few shale players, and negative for a lot of the shale producers. The jig is indeed getting dicey.

Meanwhile trash and sewage flows down rivers and out to sea, woosh just like a commode.

Who’s talking about that?

Not nearly as bad as it was in the 70s and 80s. I swim in the Bay nearly every day. Old-timers at the swim club have gruesome descriptions of the substance they swam in back then. Now it’s still not great. But the floating unspeakables are gone for most part. And no one has died recently from ingesting the water :-)

After returning the 36′ portable boom yesterday morning, went by Menards and picked up memory gel foam mattresses at Harrison. Jumped into the pristine Buffalo National River swimming hole in the evening, water was still pretty warm for Oct, elk were bugling all around. A beaver was also swimming laps around, just wondering what the ‘ell is that in my pool. The leaves are turning brown on hickories, oaks are still green. This is one unusually warm fall.

“Who’s talking about that?”

You are. Seinfeld reruns get more attention.

On a related note:

Two-thirds of wildlife may be gone by 2020

http://fox59.com/2016/10/28/sixth-mass-extinction-two-thirds-of-wildlife-may-be-gone-by-2020-new-report-says/

TPTB are gearing up a campaign to deny that wildlife and snow ever existed. You might like to hedge ski resort and safari futures.

I’m looking out my window at a parking lot full of pick-up trucks and SUVs. My guess is the market (in terms of working citizens) are betting against significant increases in oil prices.

Have a look at fracking sand suppliers.

If fallout from Fukushima does it first. Oh, wait that is our fault too.

The thing I would short first is the North Pacific fish stock.

Got Tuna (pre-2011)!?!

Yes, unsustainable practices such as urban sprawl and road construction in Africa and other similar undeveloped countries, etc.

Another argument supporting globalization financed with debt.

Drillers … service companies … lenders … futures contract speculators … shippers … extraction cartels … none of these matter at all. What matters is the end-users and their ability to stump up for fuel.

Because they cannot earn anything by using the fuel the end-users must borrow in order to pay: substitute earning. Having borrowed since the auto age began in 1908 the hapless customers are sadly tapped out. QE and the hunt for yield has not helped with credit flowing away from end-users toward rent seeking tycoons and the giant banks.

The entire oil industry is insolvent and there is nothing to be done about it.

The next step will be an attempt to ‘bankrupt-proof’ the industry by nationalizing it … but pumping fuel at a loss in order to squander has not worked and it is not going to work going forward. The government is at best a proxy for the broke customers!

Look for totalitarian governments and hard rationing in the US and elsewhere. The US imports half of its fuel and the imports are out of reach of the nationalizers. If the US cannot afford to pay off its own drillers it will certainly be unable to pay those overseas.