“Overall shipment volumes are persistently weak.”

When FedEx announced its quarterly earnings today, it included some telling tidbits. In its largest segment, FedEx Express, domestic shipping volume edged up merely 1%. In its smaller FedEx Ground Segment, shipping volume jumped 10%, “driven by e-commerce and commercial package growth.”

Sales by e-commerce retailers jumped 15.8% year-over-year in the second quarter, according to the Census Bureau, and companies involved in getting the packages to consumers and businesses have seen growth in those segments. For the rest, not so much – as the goods-based economy is getting bogged down.

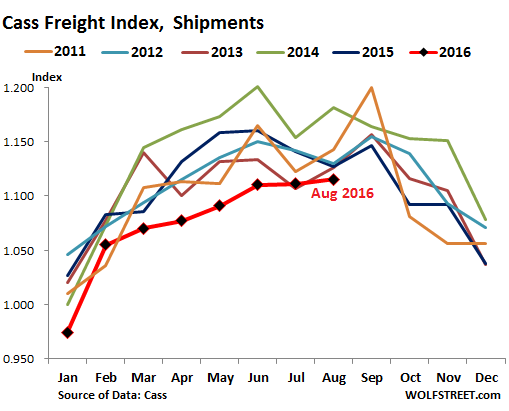

And this has been showing up in broader shipping data. The Cass Freight Index for August, released today, fell 1.1% from a year ago, to 1.115, the worst August since 2010! The 18th month in a row of year-over-year declines!

“Overall shipment volumes (and pricing) are persistently weak, with increased levels of volatility as all levels of the supply chain (manufacturing, wholesale, retail) continue to try and work down inventory levels,” Donald Broughton, Chief Market Strategist at Avondale Partners, wrote in the report.

The Cass Freight Index is based on “more than $26 billion” in annual freight transactions by “hundreds of large shippers,” according to Cass Transportation. It does not cover bulk commodities, such as oil and coal but is focused on consumer packaged goods, food, automotive, chemical, OEM, and heavy equipment.

It’s not seasonally adjusted, so it shows strong seasonal patterns. In the chart below, the red line with black markers is for 2016. The multi-color spaghetti above it represents the years 2011 through 2015. So here’s how dismal the “economic recovery” has looked in 2016 so far:

The report pointed out the growth in e-commerce – the one aspects of the goods-producing economy that is hopping. But it also said that the transit modes servicing the auto and the housing/construction sectors were weak. Both sectors are crucial to the US economy.

And rail, as has been the case recently, caught the brunt of it. According to the Association of American Railroads carload traffic – which includes commodities such as oil and coal – fell 6.6% in August from a year ago, and intermodal traffic (containers and trailers), fell 4.8%.

The tonnage shipped by truck rose 2.6% on a three-month moving average basis. But truckload volume fell 3.5% in July, leaving the three-month moving average down 1.6%, according to Broughton. “No matter how it is measured, the data coming out of the trucking industry has been both volatile and uninspiring,” he says.

Trucking in “mixed” condition – tonnage up, load volume down – and railroads in the tank: hence the worst read in the freight sector since 2010,

Plenty of culprits. Weak demand is in part caused by inventories that had been rising so sharply, starting in 2014, that the all-important inventory-to-sales ratio reached Lehman crisis levels (my chart for June). Recently, businesses have been trying to whittle down their inventory levels by reducing orders, and this is impacting the freight sector. Given that inventories remain at very high levels, and the inventory-to-sales ratio at crisis levels, both the high inventory levels and the draw-downs, along with their impact on freight, are likely to continue.

Broughton adds, “We remain concerned about elevated levels of cars on dealer lots, and we acknowledge continued efforts to streamline finished inventory in most machinery sectors.”

This is the problem with the auto sector: sales have started to cool, even as production hasn’t yet. Something is going to give. If sales don’t pick up miraculously, production will be cut, further hitting railroads and trucking.

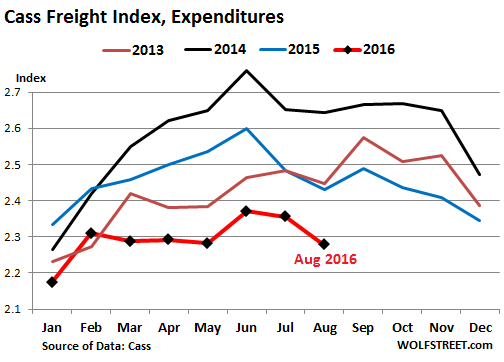

With freight volume in this precarious position, the freight expenditures index dropped 6.3% in August year-over-year, to the lowest August since 2010:

The report blamed the swooning freight expenditures in part on lower fuel surcharges that shippers have to pay, as diesel and jet fuel prices have declined (though they’re currently down only slightly from a year ago). And then this gem:

We continue to see this weakness as driven by the excess of capacity in most modes: trucking, rail, air freight, barge, ocean container, and bulk.

“Excess of capacity” – or overcapacity – is a term that has come to haunt the global economy, after eight years of QE and zero-interest-rate policies, during which the cost of capital and the idea of risk got manipulated away, and when the alcoholic fumes of money-printing clouded executive decisions and projections. Now there’s a real-economy price to pay.

Overcapacity has wreaked havoc in the container shipping sector, with carriers cracking under their debt. Read… Why Hanjin’s Zombie Collapse Won’t Be the Last One

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

With regard to E commerce:

Online purchases of certain goods is a no brainer, as far as I’m concerned. Although, when I need accountability and service I buy local.

Here are two examples. I need a new motor for a metal lathe. I have reviewed products and decided on what motor I will buy. This saves me 2 trips to town…possibly as many as 4 if you include research and product pickup. This would entail a total of 8 hours driving with associated costs, and that is if the product is suitable and does not need a return. Online, it will be delivered by Canada Post to my house, where the rural postal lady will then tease me about the weight of the box as I unload it from her car. The other example is that I now need to replace a compound mitre saw. Online, the price is virtually the same as from a local store. (approx $800.00 cdn) However, if there is a warranty issue I would like to deal with a local tool supplier. There most likely will not anything wrong with the product, but it is cheap insurance and works out to be the same purchase cost.

Online buying is great for directed necessary purchases for those who dislike the shopping experience. Freight is still required, but it bypasses two stops along the way as well as warehousing and inventory overhead.

Buying shoes? Probably not a good idea.

Increasing productivity and efficiency in a world full of cheap money….every “investment” that attracts this money soon becomes loaded with excess capacity.

Can’t it be said, globalization has been an environmental disaster?

“Can’t it be said, globalization has been an environmental disaster?”

A friend who is a resident of Shanghai pointed out the truth of that statement. He says much of China’s advantage in manufacturing costs results from broad disregard of the effects of pollution. That country is an environmental disaster. He was amazed at the environmental cleanliness during a driving tour we recently did of the Middle Atlantic states.

Hmm, i take these statistics with a grain of salt. For example electricity consumption does not correlate so directly with economic conditions anymore, as CFLs, LEDs and better insulation have naturally reduced demand.

As for wholesale shipping, the same principle applies. Boxes and products are often smaller now as an adaptation to the Amazon phenomenon. This could easily account for a few percentage points off ship volume over the last few years!

I think it’s important to distinguish between the goods-based economy (in lousy shape) and the service economy, which includes healthcare and finance (in good shape, for the wrong reasons).

It’s a small “Your margin is my opportunity” world. Low(er) wage labor is but a single example, lax environmental laws (dirty diesel, etc.) another and the list goes on.

I totally agree that health service etc doing well isn’t good for the economy. Just today I paid 88 dollars for Typhoid vaccine, which costs 15 in Bangkok. That’s why I’m getting the rest of my travel immunizations there next week. What costs over 2000 in the states is less than 300 in bkk.

What a shame that millions are entering debt serfdom due to inflated medical costs just so a few .001% of us can get filthy rich.

As to shipping vol, we are also using less paper, have smaller batteries, printers, PCs, need less paint etc etc. So I respect this data more for short term trends and assume that long term we need less shipping per capita.

Looks like a peak from here … peak sales, peak shipments … peak oil, peak credit, peak waste-carrying capacity, peak coal, peak topsoil fertility … peak war will be a doozy. Peak bankruptcy is sure to come followed by the end of the idea of solvent companies. Of course, the wishful thinking crowd believes the peak will be followed by a rebound, “just like always.”

How does that work? If people buy the junk (‘goods’) they are poorer and can’t buy more. That’s why sales are dropping right now, the markets are saturated and the customers have spent themselves into the poorhouse. If they don’t spend they aren’t getting poorer but there are no sales, either.

What was it Oliver Hardy used to say? “A nice mess you’ve gotten me into, eh?”

Wolf,

Has there been any impact to Oakland or LA ports?

Oh us cwazy twuck dwivas get so busy sometimes we don’t have any time to comment on what’s going on, please excuse us. I’m south of Raleigh, NC and it’s a bit tense around here. Hope nobody got caught up in a mess like Charlotte, rocks being thrown and bricks tossed off overpasses. Traffic stopped, cars hijacked, trailers broken into and freight set on fire. Has Julian checked in? I’m heading to Plymouth, IN, thankful to avoid Charlotte.

They’ve been running me triple screamer hot, finally low on hours. Recently ran down to Dublin, GA then up to Atlanta. Then lassoed on a tanker endorsement load to Memphis. Back to Savannah to Fayetteville and now onto this Indiana load for Monday morning. The pumpkin has set up a lot of little pumpkin patches around the country for us to p/u and drop off trailers. Then sent us all a message via Quail-comm about how they’re boosting short haul pay, short hauling, yuk. Boosted long haul pay is a much better deal than that, if you’re going to sit for hours loading and unloading, at least it should go over 1200 miles. They pay me about a dime more than usual top-level because I have two million accident free miles. But they’re running me hard, maybe I ticked off a planner… luv it, I can stress a planner out hustling freight, except for the electronic log cops and well, getting older. I did get an application with another company but have not filled it out yet, surely they didn’t hear about it. This company was saying that they run a lot of Arkansas to Wisconsin and Minnersoater out to Salt Lake. But now they talk like only TX and home every weekend, yuk. A number of carriers send me recruiter stuff, even Wal~Mart has talked… I was really planning on doing a rotation with another driver, three weeks on three off for a while to catch up on chores at home… anyway

Here’s a few things that caught my eye that you folks might be interested in, related to Wolf’s sharp analysis… the struggle for small trucking businesses is about to get difficult.

http://www.ccjdigital.com/capacity-crisis-rate-boom-likely-in-the-coming-year-experts-say/

Capacity crisis, rate boom likely in the coming year, experts say

The coming ELD mandate, combined with several other factors, will restrict industry capacity and drive rates upward, the panel said.

The regulatory swath barreling toward the trucking industry — highlighted by electronic logging devices and greenhouse gas emissions standards — combined with likely increases in fuel costs and an uptick in freight could push the trucking industry into a full-fledged capacity crisis as soon as late next year, says FTR economist Noel Perry.

Perry spoke Wednesday at the 2016 FTR Conference, noting that despite the current downward trend of shrinking truckload pricing, carriers likely will be forced to ask their shipper customers for sizable rate increases starting late this year and through 2017 and 2018. …

Vehicle automation to dramatically change trucking landscape in the coming decades, forecaster says

http://www.ccjdigital.com/vehicle-automation-to-dramatically-change-trucking-landscape-in-the-coming-decades-forecaster-says/

… Perry estimates that a fully automated tractor-trailer would save fleets’ more than $1 a mile in operating costs. About half of that comes from driver wages, with the rest spread out among lower insurance costs, better fuel economy and higher productivity of automated trucks. …

Indicators: ‘Trucking conditions’ improve on heels of better freight

http://www.ccjdigital.com/indicators-trucking-conditions-improve-on-heels-of-better-freight/

… Market conditions for trucking companies bounced upward in July, according to the latest Trucking Conditions Index from FTR. The index’s higher reading reflects “improved market prospects” for carriers, FTR says, stemming from better growth in the U.S. economy.

As the firm has noted in recent years, regulations set to take effect next year should tighten the industry’s capacity and push the index higher, equating to better leverage for carriers in rate negotiations.

“The freight market is doing slightly better than just treading water, but there is still a disconnect between activity in the spot and contract markets,” says FTR COO Jonathan Starks. “This is a result of the slow growth environment that we are in right now. You use your contract carriers whenever you can. There just hasn’t been enough extra freight to spill over into the spot markets. Plus, shippers were able to use the big drops in spot rates to help put pressure on on their contract carriers. I believe that those conditions will soon be turning, especially for van freight.” …

Van, flatbed rates skid again in August, reefer sees small uptick

http://www.ccjdigital.com/van-flatbed-rates-skid-again-in-august-reefer-sees-small-uptick/

The for-hire trucking industry’s total employment grew by 3,400 jobs in August, according to the Department of Labor’s monthly employment report. The DOL also upwardly revised July’s gains to 2,200.

http://www.ccjdigital.com/indicators-trucking-adds-3400-jobs-in-august/

Navistar quarterly loss widens as sales slide

http://www.ccjdigital.com/navistar-quarterly-loss-widens-as-sales-slide/

Maybe the great pumpkin jumping into the E-commerce delivery gig was a good move. Digging deeper into the Watkins & Shepard deal it looked more like buying someone else’s headaches to me, but that’s above my pay grade. But this could be a sign…

Trucking company Schneider National pursues IPO -sources

http://www.dailymail.co.uk/wires/reuters/article-3793540/Trucking-company-Schneider-National-pursues-IPO-sources.html

Watkins – Shepard Trucking Lays Off 28 Workers in Missoula and Fontana

http://newstalkkgvo.com/watkins-shepard-trucking-lays-off-28-workers-in-missoula-and-fontana-california/

(Never buy a used pumpkin truck, maintenance is neglected until they shine them up to sell)

Trucking Mergers Pause, But More Consolidation Expected

https://www.trucks.com/2016/09/20/trucking-mergers-paused/