But the Economy is Bogged Down.

Consumer debt in Canada’s debt-fueled economy rose to a new record of C$1.67 trillion in the second quarter, according to Equifax. That’s up 3.0% from the prior quarter and 6.3% from a year ago.

Excluding mortgages, consumer debt rose 3.4%, to C$21,878 per borrower on average. Folks 65 and over splurged the most with money they didn’t have and ended up increasing their debt by 8.2%. But Millennials had trouble. Their debts barely rose, and their delinquency rates have begun to jump.

Equifax Canada, which based this report on its 25 million consumer credit files, doesn’t appear to capture the full extent of Canadian household debt: Statistics Canada’s most recent quarterly report pegged “total household credit market debt,” which includes mortgages, at a record C$1.933 trillion, up 5% year-over-year.

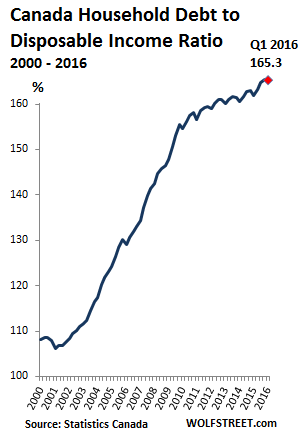

This gives Canadian households one of the highest debt-to-income ratios in the world. The ratio started soaring relentlessly 15 years ago, supporting the housing boom that barely took a breather during the Financial Crisis – a boom that now has turned into one of the globe’s most phenomenal and riskiest housing bubbles.

Piling on debt to move the economy and the housing bubble forward was encouraged by record low borrowing rates. So at the end of the first quarter, the level of consumer debt was 165.3% of disposable income. It’s so high that it’s regularly subject of ineffectual hand-wringing in Canada’s central bank circles:

Equifax points out that in the second quarter, consumer installment loan balances, such as credit cards, soared 7.8% year-over-year, auto loan balances 7.6%, and mortgage balances 7.6%.

But for all this consumer borrowing to spend on cars and other consumer goods and to splurge on “experiences,” such as dining out, or to buy homes, or deal with higher prices, what is the Canadian economy getting out of it? Turns out, not much.

GDP adjusted for inflation peaked in January 2016, according to StatCan which reports GDP monthly. By May, the last report available, GDP has fallen 0.84% from the peak in January. And on a year-over-year basis, GDP was up only 0.98%. This puts Canada into the same slow-growth bog that the US economy is mired in.

Central banks and governments keep enticing consumers to pile on debt to boost the economy. But it’s not working anymore.

And now there’s a price to pay. Overall delinquency rates are rising (up 4.1%). Millennials, which Equifax defines as 18-25 year olds, are struggling. Equifax lamented that Millennials only added 2.1%, or C$167, on average to their load of consumer debt, now amounting to C$8,203 (not including mortgage debt). It seems Millennials either don’t want to or can’t borrow enough to crank up the Canadian economy.

But delinquencies on their debts jumped by 11.7% from a year ago, to 1.8% of non-mortgage balances outstanding. That’s twice the delinquency rate of those over 55 (0.9%).

And there were big differences by province. Delinquency rates on consumer debt excluding mortgages, eased off in some provinces but soared in the three oil-bust affected provinces from low levels to not so levels:

- In Alberta, up by 40%, to 1.4%

- In Saskatchewan, up by 23%, to 1.2%,

- In Newfoundland, up by 19%, to 1.3%.

The oil bust first mauls companies. As layoffs cascade through this industry where wages are relatively high, unemployed workers and contractors without contracts are usually able to make ends meet for a while. But then, their resources reach their limits. This is when the oil bust is beginning to exact its pound of flesh from consumers and their lenders.

“It looks like it is a fairly persistent situation, so we’ll probably see these increases for a while until the region will adjust to the new economic situation,” as the report explained.

And the report had a special word of advice for Millennials: “Millennials should be reminded to practice good budget and money management habits.”

Which begs a crucial question: In a debt-fueled consumer economy where even large increases in consumer debt produce only minuscule, if any, economic growth, and where record low interest rates are required for consumers to be able to service their debts, who or what is then going to prop up the economy as delinquencies rise and lenders get nervous? Not the Millennials that everyone had been counting on – not until they jump into another debt-fueled miracle.

Commercial real estate in Calgary, the epicenter of the Canadian oil bust, is collapsing at a breath-taking rate. Read… How the Oil Bust is Crushing a Downtown of Office Towers

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

All these financial experts where do they get their education to be able to give advice on financial opprrtunities looks like their following the rest of the so called experts computerized

Borrowing loans to pay debt and do on where’s it Going to end who owned the money borrowed

It’s paper money worth nothing but the general public is paying their hard earned cash to support this banker joker regime a plaque in today’s society

“Which begs a crucial question: In a debt-fueled consumer economy where even large increases in consumer debt produce only minuscule, if any, economic growth, and where record low interest rates are required for consumers to be able to service their debts, who or what is then going to prop up the economy as delinquencies rise and lenders get nervous? ”

Wonderful question, the answer is nothing. “What is unsustainable will not be sustained.” – Milton Friedman

yeah, right, “folks” (whatever they are) 65 and older “splurged the most with money they didn’t have”. Yeah we bought a lot of toys and trinkets–or maybe we paid the average $12K/yr for necessary meds that Big Pharma keeps jacking up prices on–like one i have to have that in 2 years has gone from $80 to $310/mo but my $700/mo “insurance” I can’t use anyway decided isn’t life-saving enough to cover. What world are you living in?

Statement: This gives Canadian households one of the highest debt-to-income ratios in the world.

Should read: This gives SOME Canadian households one of the highest debt-to-income ratios in the world.

Statistics are misleading, especially when applied across an entire country or race. As far as I’m concerned this is when over-indebted Canadians learn all about life lessons and living within their means. They might even learn to spell, ‘boo hoo’.

Of course many Albertans were left with a debt sandwich when the oil price collapse hit, but those who have been through previous oil busts knew all along it would one day end, and would do so with little warning. Friends of mine simply pulled the plug and retired when the bottom dropped out. To say they are ‘well-fixed’ is an understatement. People forget reality when they are caught up in the hype of advertising and conspicuous consumption. Some of you might know I live on Vancouver Island. I am astounded at the RVs; all towing trailers with toys, or boats. This has become normal and expected summer reality, as are the fancy/large ‘starter homes’, unbelieveable complex and expensive autos, dinners out, etc. Who needs a $60,000 pickup truck?

My parents were children of the Depression. I grew up listening to stories about my Dad’s life in rural Minnesota. My Mom’s family was so poor in New Brunswick she wouldn’t even talk about it. While they did very well later on in life, the habits stuck with them….washing out plastic bags, saving containers, never wasting food, restaurant meals for a treat/event, only. Consequently, I packed my lunch for my entire life whatever job or career I worked at. I have never had debt, and I also retired quite young. This generational wisdom has been passed down to my children. They are now in their thirties and their only debt is for a mortgage, and in my son’s case to build up his business as well as his home purchase. He bought his home when he was 25.

The Canadians I have known and worked with don’t have debt to speak of. One aspect of our culture has been to always pay your house off, free and clear, as soon as possible. I beleive this cited level of indebtedness is a result of our modern culture and ever-present advertising. You know the old saying, “A fool and his money……..” (No, this is not from Ben Franklin or Sam Clemens)

http://www.phrases.org.uk/meanings/a-fool-and-his-money-are-soon-parted.html

“This is quite an early proverb in the English language and, as such, might be thought to contain the wisdom of the ancients. The notion was known by the late 16th century, when it was expressed in rhyme by Thomas Tusser in Five Hundreth Pointes of Good Husbandrie, 1573:

A foole & his money,

be soone at debate:

which after with sorow,

repents him to late.

The precise wording of the expression comes just a little later, in Dr. John Bridges’ Defence of the Government of the Church of England, 1587:

If they pay a penie or two pence more for the reddinesse of them..let them looke to that, a foole and his money is soone parted.”

Phrasefinder is also on…

Copyright © Gary Martin, 1996 – 2016

Unfortunately, it has been established that the prudent will pay for the profligate – as well as for the incompetence of central banking academics. I do not think that the financially illiterate population rationalizes it that way, but still enjoys the fruits of moral hazard being thrown out the window.

It is even more scary to think that the debt levels reported are average.

Wrong…it comes from a Beatles song…..

Well said. Sounds a lot like out family.

What is kind of interesting is that according to Equifax’s numbers, mortgage debt is only 10% of total household debt: 1.93 total, 1.67 other than mortgage. This statistic seems odd to me.

Another anecdotal observation is that in Toronto, house prices, both single and semis, are still going 120% of asking, even in the doldrums of summer, when the market usually takes a breather. Condos are still selling generally at 100% of list or less, something that has prevailed for years now. Of course, it’s always easier to price condos due to the consistency and conformity of the offerings, and especially in view of the large number of units available.

Canucks might wake up, although it’ll be too late, when the C$ falls down to C$0.15 or C$0.20 to the U$.

Ontario alone pays out C$1 billion per month interest on its accumulated debt!

What will support a debt ridden society? “Who or what is then going to prop up the economy”? Helicopter money will. Of course, if it doesn’t, there is no coming back. In the desperate times to come, governments will make deals with the devil that could easily collapse their societies. Follow Japan, it is decision time there and the devil is making deals. The coming year should tell the tale.

It makes me wonder that maybe when interest rates were higher and people got a decent return on deposits, could have been the catalyst which formed the backbone of spending.

I remember back in 2009, Bank Term Deposits were paying 8% interest and many people I know who were savers spent the interest on holidays and new cars and paid cash. Now they’re screwed.

Canada is no different from other “developed” economies. (Does Canada even HAVE an “economy”? Isn’t it basically a welfare state supported by the wealthy working in resource extraction?)

Though it may be some time coming because of never-ending cheap credit, the other, and crucial, shoe to drop – job losses – is next.

When it all crashes, it is going to be a doozie!

Higher interest rates would up the economy

Being in debt limits/prevents buying power for new purchases.

People with savings aren’t going to willingly deplete savings just because interest rates are rock bottom. Just because saving rates are next to nothing does’t mean there is no point in saving or that savers are going to stop saving.

NIRP probably will cause savers to gradually stop saving though … at least that’s my impression from Europe.

Agree that higher interest rates are in general good for the economy, because it means only productive investments are feasible; a company has to think about how they are going to pay back the yearly interest on that loan. In our current ZIRP/NIRP environment, the most idiotic plans can be funded and you get all kinds of malinvestment. Even worse when central banks start buying company bonds and stock, even if they are close to junk – like the ECB does. In such an economy the most criminal cronies do extremely well and ordinary business will crater because ‘nothign works’.

The Canadians should never have let their “Central Bank Governor of the Year 2012” Mark Carney go.

They should get him back: he never saw an interest rate cut he did not like nor a QE spigot he could not turn wide open. He could get the millenials to go into debt.

Mario Draghi did it: here in The Netherlands the housing bubble is alive again, thanks to almost zero interest mortgages.

“So at the end of the first quarter, the level of consumer debt was 165.3% of disposable income.”

If that includes mortgage debt it isn’t high at all. Netherlands had consumer debt of 270% a few years ago (only Greece was worse; at that time car loans and student loans were still relatively small), it is probably even higher now.

As other have said, these numbers mean very little if you don’t know what the debt is used for, although I’m pretty sure most of it is for unproductive “I want it all and I want it NOW” type of consumption (mortgages, car loans, student loans that are largely blown on other things than education itself), and in some cases to pay the bills for government extortions like e.g. healthcare insurance.

Also, the averages can have some value if you look at the trend over many years, but often the variation within the population is huge. In my country the average and median amount of savings are worlds apart (more than 10x difference). And until some years ago, the people with the largest debt often also had the largest savings – because of the idiotic Dutch tax system that strongly rewards mortgage debt; in such a situation debt-to-income ratio on its own tells you very little.

There are only 6 countries in the world with a higher debt-to-income ratio: Sweden, Ireland, Netherlands, Norway, Denmark, plus Australia. It’s a problem in all of them….

Households in the 5 European countries pay a higher percentage in taxes in return for higher levels of free or nearly free social and other services. So their disposable income is relatively lower, but their expenditures are relatively lower too. Canada is more like Australia.

All 5 European countries are under a central-bank imposed negative interest rate policy – and thus mortgage rates close to zero. That’s not the case in Canada or Australia.

This is reported by Equifax, and includes household debt, but not mortgage debt. That would be sky-high.

Assuming that Wolf is right in the comment above, with mortgage debt added the debt load in the Netherlands is still higher than in Canada – so mortgage debt in Canada must be pretty small relatively.

I don’t know the exact numbers, but in Netherlands over 90% of total debt is mortgage debt. Creditcard debt and personal loans are relatively small, student debt and car loans have started to take off in the last few years and although they might become a major problem, the amount of debt is still tiny compared to the Dutch mortgage debt.

It’s interesting to note that housing bubbles clearly occur almost irrespective of absolute interest rates (although steadily declining rates and NIRP/ZIRP are a pretty sure recipe for creating a housing bubble), foreign investors (none of that in e.g. Netherlands and Denmark) or population density (Netherlands and Oz are almost opposite compared to all other developed countries).

In most of the major housing bubble countries political decisions were a major factor, like strong fiscal incentives to take on maximum mortgage debt in Netherlands and Denmark, homeowner subsidies and shifting downside risk from buyers to taxpayers (US, Netherlands), laws that encourage buy-to-let (UK) or house flipping, or lack of oversight that makes RE attractive for black money streams from criminals or foreign investors.

As a Canadian with zero debt , my thoughts:

1. Everything now is driven by immigration. Raising your population by 1% every year (350,000 on 35 million) just from immigration means all kinds of industries get fueled, starting with housing but all the way down to cars, and furniture etc.

2. There really is no excuse what with cheaper education and public health care than in the USA.

3. Like everywhere we need a recession to smack people back into some form of reality. The restaurants are full, even with high taxes and lousy food.

Canada is a rising super power. Plenty of raw resources, plenty of land, friendly immigration policy, and hosting the world’s top cities (Vancouver, Calgary, Toronto). This downturn is a buying opportunity.

Canada is a dump. It’s got some of the coldest weather on Earth. When the immigrants find this out, they will go to BC or maybe Toronto and that’s all of Canada right there. The socialism is over burdensome and will lead to huge social upheaval – or just plain jane tax cheating. There is not much to like relative to other countries. A bit of space, but not much to do with it unless you’re a hermit who hibernates.

Are you Canadian? And live in Canada?

yes