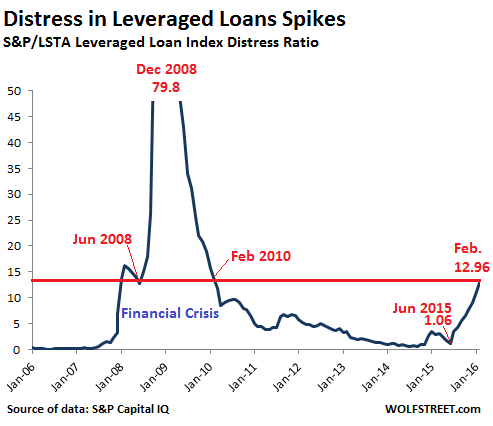

Distress ratio spikes to Financial Crisis level.

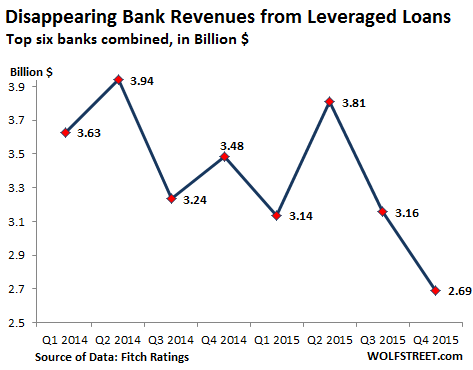

Banks have a few, let’s say, issues, among them: a source of big-fat investment banking fees is collapsing before their very eyes.

S&P Capital IQ reported today that there was an improvement in the “distress ratio” of junk bonds, after nearly a year of brutal deterioration that had pushed it beyond where it had been right after Lehman’s bankruptcy. The recent surge in oil prices seems to have lifted all boats for a brief period. But not “leveraged loans.” Their distress ratio spiked to the highest levels since the Financial Crisis!

Leveraged loans are the loan-equivalent to junk bonds. They’re issued by junk-rated companies to fund M&A, special dividends to the private equity firms that own the companies, or other “general corporate purposes.” They form an $800-billion market and trade like securities. But the SEC, which regulates securities, considers them “loans” and doesn’t regulate them. No one regulates them. This gives banks a lot of leeway.

But they’re too risky for banks to keep on their balance sheet. Instead, they sell them to loan mutual funds or ETFs, or they slice and dice them and repackage them into Collateralized Loan Obligations (CLO) to sell them to institutional investors, such as mutual-fund companies.

Regulators have been exhorting banks to back off. Banks can get stuck with them when markets get woozy just when the loans blow up, as they did during the Financial Crisis – or as they’re doing right now….

The S&P/LSTA Leveraged Loan Index Distress Ratio for February spiked to 12.96 from 11.13 in January, from 9.07 in December, from 7.77 in November… from 1.06 just last June!

It was the highest level since February 2010, when distress was on the way down from the Financial Crisis. It’s where it had been in June 2008, when distress was blowing out as the Financial Crisis was cracking the slick veneer of the banks. Lehman went bankrupt in September 2008. By December, the distress ratio had reached a catastrophic 79.8.

This chart, based on data from S&P Capital IQ, shows that before the Financial Crisis, as the bubble was reaching its final stages, the distress ratio was near zero! This happened again in 2014. Even in 2015, leveraged loans held up well, as junk bonds were already falling apart. The happy times lasted till July, when the distress ratio began to spike relentlessly:

Debt is considered “distressed” when it trades at a yield that is 1,000 basis points (10 percentage points) higher than US Treasury yield. So in December 2008, at the peak of the panic, nearly 80% of leveraged loans were trading at distressed levels. This was resolved when the Fed decided to bail out Wall Street. Folks with advance knowledge of those bailouts, who were buying up those leveraged loans as they were dumped on the market by forced selling, made a freaking ton of money over the next two years.

Now, no one is talking about a bailout. Instead, the Fed is flip-flopping about raising rates. Calm reigns. But not for banks.

Banks, faced with this deterioration in leveraged loans and under pressure from regulators to back off, have backed off. Some banks have already gotten stuck with leveraged loans due to “challenging market conditions,” as it’s called, and could only sell them to institutional investors after heavily discounting them, at a loss to the bank.

Issuance of high-yield and institutional level loans combined plunged from $240 billion in Q1 2014 to $89 billion in Q4 2015, and to $44 billion in January and February 2016, due to, as Fitch put it today, “the repricing of risk.”

The formerly monstrous underwriting revenues extracted from leveraged-loan issuance have plunged too. This chart shows those revenues for the top six investment banks in the sector combined (Bank of America, Citigroup, JP Morgan, Goldman Sachs, Morgan Stanley, and Jeffries):

Fitch puts it this way:

Not surprisingly, some arrangers have had difficulty distributing loans extended prior to the current spread widening. In particular, syndication market conditions for loan exposures to issuers at the lower end of the rating spectrum remain challenging. This creates a negative feedback loop whereby widening spreads give banks pause to underwrite deals for fear of syndication risk, thereby driving spreads wider.

This slowdown in volumes has been particularly difficult for investment banks, which earn substantial origination and distribution fees from this activity. More broadly, this slowdown has also served in part to contribute to challenging earnings performance for investment banks.

Under pressure from plunging revenues and in some cases big losses (famously Deutsche Bank), investment banking divisions have cut jobs and have reacted in other ways.

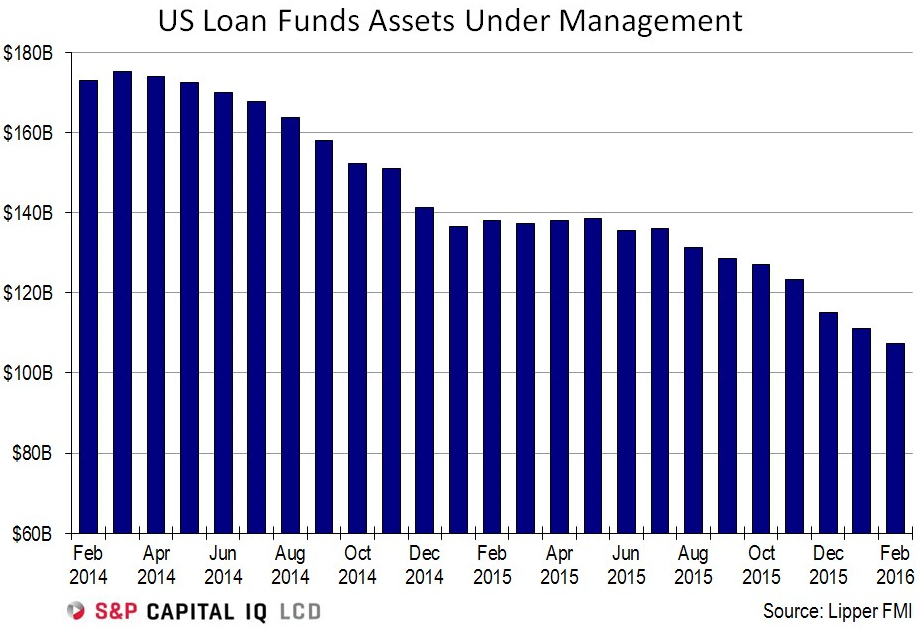

At the other end of the spectrum are investors that ended up with these leveraged loans in their loan ETFs or loan mutual funds. And they’ve been dumping them. S&P Capital IQ today:

Amid outflows and falling loan prices, loan mutual funds’ assets under management fell by $3.92 billion in February, to a three-year low of $107.2 billion.

Loan funds continued to face redemptions in February in response to shaky investor sentiment across the capital markets for most of the month, as well as falling rates.

Outflows and losses over the past two years have whittled down assets under management in leveraged loan ETFs and mutual funds by 37%:

But in early March, a reprieve! Funds “stopped bleeding” over the first two weeks of the month and posted a puny $232 million of inflows. That this is “the best two-week total since July 22, 2015” shows just how despised leveraged-loan funds have become.

Companies are still borrowing billions to buy back their own shares, one of the big drivers behind the blistering stock market rally of the past few years. But it’s not working anymore. The shares of the biggest buyback queens are getting hammered. Something broke in the gears of financial engineering! Read… Share Buybacks Turn Toxic

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Ahhhhh, the heart of the financial fraudster’s “ops”: transactions FEES, NOT “investments”. Duh!

Hillary would bail out the banks. Trump would bail out those banks whose Officers say he is a great guy and would help his friends buy the others. Cruz’s wife works for one. kaisch won’t get elected, and the oligarchs are rapidly underming Sanders so he won’t get elected. The fix has been in since HW.

Oh, and all this will be done with everyone elses money, all the while decrying Socialism and touting how great this open market capitalism really is. Of course you’ll need TPP to get the country back on its feet again. Bill Clinton got rid of Glass Steagal to set the whole thing in motion and Prince Ronnie spent money like a drunken sailor all the while reaping the benefits of North Sea and North Slope oil coming on strong. Of course the economy will be goosed with free energy…..(except this one, because the free stuff is gone).

Maybe we’ll just get NIRP so investors will have to pay the banks to store their digital funds. Now that’s a freaking User Fee!!

The ‘System’ has already rotted. People will need to depend on themselves more, going forward.

Meh, millenial’s would be happy to bail out the financing sources of heir great inventions and lifestyles.

Surely in this piece there’s a Stern Bear warning of some type but who’s head exactly is on the chopping block is unclear?

Unfortunate.

I’m unhappy. I’m unhappy because it really isn’t possible to be an actual investor in this kind of market. One is compelled to be a speculator. Gone are the old days when it used to be possible to put your money into a portfolio of stocks and expect a modest but reliable return. It even used to be possible to put your money into a savings account a get a few percent. Diversification worked. CAPM worked. A beta was a beta. It wasn’t sexy, but it wasn’t all that scary either. These days a pile of corps project lower earnings and their stocks prices all go up. How crazy is that? These markets stink. They’ve all gone over to the dark side. Even putting money into a 401k is like pissing it away. Ratings agencies are reliable only as liars. Regulators rubber-stamp scams. Nothing works.

How corrupt does a system have to be before it becomes dysfunctional and falls apart? It looks like we’re about to find out. Only a fool fights in burning house, and I’m moving out.

I am glad to see that somebody got the message. Capital preservation is a lot better than capital destruction which is what is going on in the markets. They lure you in with some profits and then take it all back plus more.

Agreed Petunia. Capital preservation is the key now since there is no growth to be had. Why do you think the Japanese found all of those safes after the tsunami (even now safe sales are at an all time high in Japan). Abe even tried to shame the elders for hoarding their cash calling them selfish to society in one of his speeches (can not find any link to that now on Google). Meanwhile Corporate cash hoarding is through the roof.

The 401K scam should be investigated. What if everyone took the money they would normally contribute to 401k, paid taxes on it, and then used that money to pay off debt instead? Hoping some of you numbers crunchers will give me feedback but it makes no sense to me for household debt to go up while the 401K “investment” makes no money. Similar to being upside down on a house or car…

Meanwhile my Step-Mother is bombarded daily with desperate calls from Fi***ty telling her she needs to get out of her cash positions and get into bonds for growth (oxymoron). At her age, she doesn’t need growth…she needs zero risk. Keep the money, Honey!

I was on Wall St in the early 90’s and the 401K was already in existence. When I declined the “opportunity” to contribute, they matched 5%, they sent a co-worker to encourage me to change my mind. Instead we had a conversation about a report I had read that explained that the purpose of the 401k was to create a pool of cash that could be taxed or confiscated as the need arose. He added, that the contributions were steered to the company stock ,to increase the price and the compensation of the senior executives. If you add in that it is a full employment tool for Wall St. This covers the entire topic.

Mike Whitney explains:

The key here for the deep-state elites– who control the whole apparatus behind the central bank smokescreen– is inflation. As long as inflation stays low, central banks can continue to conveyor-belt more wealth to the tycoons on top. This is why the economy cannot be allowed to grow, because if the economy grows too fast and more people find work, then wage pressures continues to build which forces the CBs to raise rates.

Elites can’t allow that, because higher rates threaten to sabotage their easy money gravy train. So the economy has to be strangled with austerity so the uber-rich can rake off more lucre for themselves. That’s why the economy is going to remain mired in the doldrums for the foreseeable future. It’s the policy.

This is the hidden motive behind austerity. It has nothing to do with the nagging concern about federal debt or bulging deficits. That’s baloney. It’s about curbing inflation so the oligarchs get a bigger piece of the pie. End of story.

http://www.counterpunch.org/2016/03/23/can-you-figure-out-what-this-chart-means/

A debtor wants inflation- to inflate his debt away. The Fed and government are the biggest debtors.

It is the fear of deflation that has made the FED put 4 trillion on its balance sheet.

The EU is in a similar fix- they must generate inflation

Petunia,

you are correct about capital preservation vs capital destruction. And, all of your comments are very much on the mark.

But, what if you do not have any capital. For 80% of Americans, that is the reality of life. Desire: get rich quick (keeping that wealth is another discussion).

So, what do you do to get money. If you are connected to Central America, you might do what Tony did – I have known Tony for more than 5 years – he owns

and operates the most successful Pizzeria in Southern Vermont. Has a wife and 3 kid – a good family man. The best pizza anywhere. But back to Tony:

He went for the big score and it did not work out. Life is ruined for his family and himself. And, to know Tony as I have, you would not have ever suspected that

he needed to make a big score – his business was great and located at the base of one of biggest ski hills in Vermont.

2nd man indicted in Vermont heroin bust

Posted: Mar 23, 2016 11:52 AM EDTUpdated: Mar 23, 2016 6:34 PM EDT

By WCAX News

CONNECT

BURLINGTON, Vt. –

It was the largest heroin bust in Vermont history, and now another man has been charged in the case.

Tony Lam Peralta, who operates Tony’s New York Style Pizzeria in Bondville, was indicted by a federal grand jury.

The case involves a shipment of 88 pounds of heroin from Guatemala. It was intercepted by federal agents in Florida, and they set up a sting that led to the arrest of Diego Mejia Paredes,

33, in Manchester. He was indicted by a grand jury in Burlington last fall.

According to court papers, Paredes told agents he was in Vermont to visit Peralta.

And agents say phone records and photos on phones establish links between the two men and multiple drug shipments.

http://www.wcax.com/story/31547265/2nd-man-indicted-in-vermont-heroin-bust

You don’t actually believe Tony had never done this before?

Aw the poor banks…..

TheDona

re: “What if everyone took the money they would normally contribute to 401k, paid taxes on it, and then used that money to pay off debt instead? ”

I did not invest while I had debt, ever…even with a mortgage. (Mortgage interest is not tax deductible in Canada) That is what I also imparted to my children over the years. Our employer operated a mandatory pension plan so we always knew we would have a bit of a pension, one day. Not having debt allowed me to retire at 57, and my wife at 55. Our needs are modest due to our chosen lifestyle. We simply never bought anything if we did not already have the money in the bank. We do have a pretty nice place, mostly because I built it, myself.

My good friend down the road from me lost a huge chunk of his investments in 2008. 25%. He was almost 70 at the time and was counting on the money for his retirement. He was forced to subdivide and sell off 1/2 his property with a small rental. He has been kicking his ass ever since.

My best friend invested in RRSPs, (our 401k in Canada), forever. He also did the all-inclusive fancy vacations, the leased car, the toys, the expensive hobbies. He is now pushing 60 and is freaking out because his investments have gone absolutely nowhere. He had to re-mortgage after a job loss and informs me his place will be paid off when he is in his mid ’80s. He argued with me when I told him he cannot retire with debt or a mortgage. (He asked, I answered). I told him to simply do the math with a simple spreadsheet (and add 10% to his costs). It isn’t rocket science. For years he told me gold would go to $5,000/oz. He is always looking for a quick but ‘sure’ investment.

I read this site and realize how smart most of the posters are. I know some are very wealthy and some have had some tough times due to bad luck. I think you have to stick with what you know, and with what you are good at. And while you are doing that you have to accept there are other ‘investors’ out there much smarter, perhaps much more ruthless, who may even possess real inside knowledge of particular companies and/or products. It isn’t a stretch to realize that your money might one day be theirs.

Ant and the Grasshopper was written for a reason. Debt is economic servitude, pure and simple.

“Debt is economic servitude, pure and simple.”

It works for loan sharks. The world has largely turned into debt peons to the banksters, who have grabbed just about everything in sight and still manage to burn their fingers grabbing for more.

Unfortunately zirpnirp makes traditional capital formation an exercise in futility, further increasing reliance on loan-sharking banksters. The same has long since become the case with getting a college education, saving for retirement, buying a house, getting medical care, or any other normal personal financial activity. It’s gotten way too hard to get ahead and way too easy to get behind – and that’s without an actual economic collapse, which one can only presume is still pending.

Huis clos.

Hi Paulo. We too are a 100% debt free family. The peace of mind is worth any perceived sacrifice.

I recently started watching Life or Debt on Spike (also online). It’s about real families with good jobs who have created financial ruin for themselves by over spending and not keeping track of their debt (good little consumers keeping our economy running). None have savings of any kind. Foreclosure is looming.

A business advisor comes in, looks at the household books and lifestyle, and makes suggestions to dig themselves out of the hole. He comes back 4 months later to see if they have implemented his suggestions of running a household like a business. It is interesting to watch how people get in the situation, how motivated they are to make the changes, or not.

I highly recommend this show for young couples considering marriage.

Just remember banker bonus money is just 1 percent of the countries GDP. Think about that when you are standing in line buying your groceries.