The “impossible trinity.”

The authorities in China are in a desperate juggling act, trying to keep a growing number of rotting oranges, porcelain plates, burning torches, and explosives in the air all at the same time. But it’s not working very well anymore.

Thursday morning, the People’s Bank of China injected 340 billion yuan ($51.9 billion) into commercial banks via reverse repurchase agreements, after having already injected 440 billion yuan on Tuesday. As 190 million yuan of prior reverse repurchase agreements – a type of short-term loan – have matured, the net injection of cash this week amounted to 590 billion yuan, or $89.7 billion, the most, according to the Wall Street Journal, since February 2013.

If the purpose was to prop up confidence in stocks, it worked only for about an hour then failed miserably. The Shanghai Composite Index plunged 2.9% on Thursday, to 2656, the lowest since November 2014. The Shenzhen Composite plunged 4.2%, the ChiNext 4.6%. The Shanghai Composite is now down 13% since Monday morning and 49% since last June.

Part of this ongoing massive cash injection is in preparation for the Chinese New Year holiday starting February 7. And part of it is to keep everything afloat in a sea of liquidity, even as this liquidity is draining out the back in unprecedented quantities.

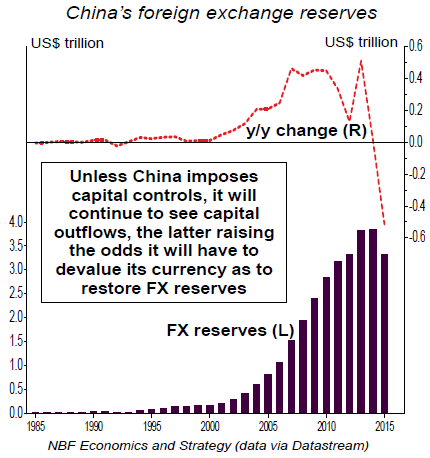

To fight the effects of capital flight, China has been selling down its vaunted foreign exchange reserves, which plunged by $108 billion in December, the largest decline ever. For the year, they fell $510 billion, or 13%, to $3.3 trillion, the lowest since November 2012. Money is fleeing China [read…. What Will China Dump Next, After Treasuries, to Keep Control?]

Much of this money is landing in the US. For example, plans have now emerged for a Chinese company, using Chinese money, to build a development in San Francisco that consists of two towers – including the second-highest in the city, behind the under-construction Salesforce Tower – and some other buildings, which are all part of a dizzying building boom here.

The Chinese real-estate investment company Oceanwide Holdings bought the site at First and Mission for $300 million a year ago. Now the San Francisco Business Times reported on the new plans. The project is expected to have 1 million square feet of office space, 778,000 square feet of residential space, and 251,000 square feet of hotel space.

This is just one example of Chinese money arriving in the US. It’s happening nowhere more than in Los Angeles. And it’s happening in Oakland. It’s happening in Dallas. It’s happening everywhere. That influx in Chinese money to fund all kinds of real estate projects comes with big advantages for Chinese investors who want to get a US green card.

Whatever the motivation, Chinese money it is. The PBOC pumps it into Chinese banks. Chinese investors take it out, one way or the other, bypassing, if they have to, the regimen of capital controls. And to keep the currency from plunging, Chinese authorities have been selling foreign exchange reserves to mop up the yuan these Chinese investors are selling.

But there’s a hiccup in trying to juggle all this.

“China is learning, the hard way, about the impossible trinity,” wrote Krishen Rangasamy, senior economist at NBF Economics and Strategy in a note. “You just cannot have free capital flows, a fixed exchange rate, and independent monetary policy all at the same time.”

Policymakers can only pick two from the three available tools.

By opening its borders to foreign investment and keeping a currency peg with the US dollar, China effectively surrendered monetary policy independence. The massive amounts of capital inflows during the boom years propped up asset prices including real estate. With the latter and more generally the economy as a whole now treading water, those flows are reversing fast.

To prevent the yuan from depreciating in synch with those outflows, the People’s Bank of China has two options. Either sell USD on the market to support the yuan (i.e. run down its currency reserves) or impose capital controls. Neither of those options is sustainable.

The PBOC can keep going for a while, but at a high price and with the knowledge that ultimately it efforts will be doomed:

And imposing even stricter and broader capital controls to stem the outflow is the “exact opposite” of China’s intention to integrate its currency more into the global markets, not only as a payments and trading currency, but also as a reserve currency.

A third option is to allow the yuan to float freely (i.e. allow a sharp depreciation) which would give back control of monetary policy to the central bank and eliminate the need to run down reserves to support the currency.

But that option exposes China to the risk that the yuan will plunge, “thereby hurting confidence in the currency and creating a death spiral.”

It would also create some magnificent fireworks in the global markets. And it would expose China to an additional end-of-the-world anathema: the growing number of hedge funds that bet against the yuan – what China might call “vicious” shorting – would walk off with big fat gains.

The tsunami of Chinese money in US real estate may have come just at the nick of time, at the peak of a seven-year commercial real estate boom that is now showing some very big cracks. Read… Office Market in Houston Melts Down

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The image of a frightened child with wobbly knees, holding the hand of the Mighty USD, comes to mind.

The Chinese like to talk a big story, but without free access to the U.S. consumer market, there would be no “mighty” China.

And when the U.S. was most vulnerable China got played. The Fed is now the largest holder of U.S. debt and any sales by China will be easily mopped up. Especially with rising U.S. rates. After all what do you get when you sell U.S. debt ? U.S. dollars.

Capital controls will be the least loss of face than depegging the little yuan.

I have a question. If the PBOC is a State Central Bank. Can they not just erase that debt and then start all over? I mean supposing they are not obligated under BIS rules to keep the Ponzi Scheme going?

which debt exactly? but don’t forget there’s no free lunch – someone ends up paying, whichever way you try to dice it

They have been, and still are.

They created a muni Markett, they replaced loans owed to banks by munis, with CCP guranteed bonds that the banks can deposit with the PBOC for collateral.

The bonds are in perpetuity. The munis can now enter a cycle of issuance to pay interest. Until the PBOC quietly buys the bonds and cancels them, which is the CCP plan for these munis.

Trillions of debt deleted, which nobody really notices in the very opaque chinese system.

They are doing the same for state owned zombie companies, loans become state guaranteed bonds, lodged with the PBOC for collateral by the banks that get them, that eventually get brought by the PBOC, and disappear.

Chinese state industry’s are being propped up like this to deliberately destroy western companies, that can not compete with that level of free financing.

The only way to stop it is to TARRIF china for unfair trade practices. which nobody wants to do. Yet…

Yes, Richard, by the laws of logic they most certainly could go that route there, but… if they do it, it would instantly expose the world wide fiat paper currency system scam for the total fraud that it is!

Say you’re playing the board game Monopoly, and it’s getting down to where you have 75% or more of the “cash” and holdings, and you suddenly decide to leave the game with all the stuff that you control. How will that impact the other players? How will they react to your action? That is sort of like what would happen out here in the real world, with its overtones of a fictitious medium of exchange in play. You would be violating the rules of the game and pissing off lots of people.

China would instantly be pounced on by the other players of the rigged up game who got stiffed by them, don’t you see? The “leaders” of China are all well aware of what’s going on, they’re in on the scam, but they’re now firmly locked into playing the rigged up game to its conclusion. The only winning strategy is to not play the game at all. Once you join the mob, with its fiat paper currency/electronic bookkeeping entry financial system scam, you can’t get back out of it, except by dying.

“Once you join the mob, with its fiat paper currency/electronic bookkeeping entry financial system scam, you can’t get back out of it, except by dying.”

Not quiet, and this is another place china is digging itself deeper into the hole.

china has started reducing bank reserve requirements, to increase credit/liquidity.

Fractional reserve banking, which gives the banks the ability to create vast sums of money, from air. Is one of the corner stones of the fiat cheap credit system.

If the reserve ratios are slowly increased eventually to 100% banks will only be able to lend what they have, or have borrowed from elsewhere.

Causing a huge decrease in unreserved debt.

An increased demand for credit, so rise in deposit rates, and the currency issuer, again in control of circulation volume.

Due to the amount of existing debt, it would have to be a gradual process, but it can be done.

As long as you have the long term political will to do so.

” The Fed is now the largest holder of U.S. debt and any sales by China will be easily mopped up.” That’s a pretty glib way of saying “monetizing the debt,” as if that worked well in the past.

Does this mean the IMF should not have told China the yuan

will qualify as a reserve currency with Special Drawing Rights?

“the IMF should not have told China…”

All theatricks (sp), no meat. Tell me what other currency in the IMF basket is pegged to any other currency. None, nadda, zero

I guess the Chinese are really stupid for wanting the blessing and SDRs

Whatever – you really don’t want to hold the currency of an economy requiring capital controls.

This brings back images of the Japanese buying up overpriced real estate all over Manhattan in the 80’s. That didn’t turn out well for them and the Chinese will fare no better. I can already foresee Trump bragging about all the money he made off of the Chinese.

Yup.

I remember the flap over Japan buying Pebble Beach. My response was ‘what are they going to do? Pack it up and ship it back to Japan?’

But actually, I think the buying frenzy of U.S. real estate by foreign money may have already reached it’s peak.

History repeats…

Japanese RE and stock market went up and away (parabolic) to crash in 1989 ushering in the 25 yrs of slow growth and referred as “sick man of Asia”.

The women all had and still have good new shoes, the family’s all had and still have good new cars only the over leveraged suffered.

Employment prospects are not what they were but are they anywhere thanks to china.

There are a lot worse places in Asia than its alleged sick man to live.

Yeah, and Chinese money is still coming to Australia – Melbourne in particular.

Still good demand for property in selected areas. Sydney is too costly and better buying in Melbourne.

The impact of Chinese buyers is even being felt in the baby formula market here. Chinese want this stuff and will pay high prices for it resulting in shortages for domestic consumers.

These is so much of the stuff going to China that exporters of fresh vegetables to China are having trouble finding space on planes!

Read all about it:

http://www.theage.com.au/business/retail/government-powerless-to-stop-daigou-formula-hoarders-20160128-gmg6jo.html

And for those that keep track of RE in Australia and Melbourne in particular:

http://www.domain.com.au/news/melbourne-house-prices-up-145-per-cent-in-2015-20160127-gmc46h/

(Guess we’ll have to postpone that bubble bursting for a while yet.)

In my little neck of the woods there is more activity going on now. Two houses have finally sold: one ‘cheap’ one at around A$600,000 and the million dollar plus house went under contract. The former took about 6 weeks and the latter I have no idea.

Three houses and one unit came on the market: a super cheap unit down the street from us for A$380,000 plus, a house two streets from us by the park for A$580,000 plus, and two other houses near each other about 700 meters from us – one for A$845,000 plus and the other around the A$600,000 area.

Now that the school holidays are ending the activity in the market should pick up. MY SWAG is that the unit will probably go first as there are few other properties for that price in the local area. Another 400 – 500 meters up the road towards the village and the price would double.

Location matters……….

You wouldn’t be a property holder in Melbourne by any chance? lol

Yes, just like millions of other people and so what.

The RE market here is just like almost every other country in the world: some places are cheap, some places are priced at the median, and some places are very expensive.

Some places are going up in price and some places are going down.

In general prices here in Melbourne are going up except for what you yanks call condos in the CBD area.

Why?

As I have posted before: demand.

Melbourne’s population is growing by over 100,000 people per year. The housing stock is not keeping up with the demand (Except in the CBD condo market where huge projects are coming onto the market).

Areas where new immigrants are buying (Chinese, for example) have soared in price as have houses near the CBD.

Some of these places have have prices increases larger than the median price of a house in Australia over the past couple of years.

Why?

One reason is that the immigrants like to be where other immigrants from the same country are living.

Second is because of the good schools in the area. If you can get a house in one of the good public school zones you can save yourself the cost of sending your kid or kids to a high ranking private school.

That will save you around A$500,000 or more in schooling fees per kid. Two kids and you save yourself a cool $A1,000,000 or more. Spend A$1,000,000 on a house in these areas and the cost of schooling is included in the house. The house is then “free”.

Third, areas close to the CBD save a lot of time and money on transport.

The roads here have some of the worst congestion during peak hours I have ever seen. During morning peak hour it will take you over one hour to drive half way to the CBD from where I live. (30 klicks or about 20 miles). And again during the evening return.

Public transport is unreliable: buses and trains are late, they get cancelled for any number of reasons, and they are crowded.

Public transport costs time and money. Move to an area near the CBD and these costs are also included in the house.

A one year train/bus pass will set you back A$1520 a year for zone 1 & 2 which is a trip from most outer suburbs. What is your time worth? Spend 3 hours a day traveling to work in a car and pay all the costs or in a train and pay the tickets…………..

Buy a house for A$1,000,000 or more near the CBD and cut your travel time by half or more. What is 375 hours of less travel time worth to you over 10 years? Is it worth paying A$1,000,000 for that compared to a place out in the sticks for A$500,000?

Unfortunately most schmucks don’t have the funds for a nice house in the nice areas and end up buying one out in the sticks (their time is worthless is that respect) which leads to more sprawl and overcrowding on the roads and trains.

And lastly, compared to Sydney the median price of a house here is about $A300,000 cheaper………

We’ll get a correction one of these days and prices will fall. It will be a result of falling demand: fewer people moving to Melbourne.

Finally, we do not have ‘cheap’ money here in Australia like most other places in the world. Our Adjustable rate mortgages are around the 6% area.

Banks have increased their margin on these type of loans by about 1.8% since the GFC……………

People have cheaper loans now, but they should be a lot cheaper. Banks have made a fortune off these loans over the past 8 years or so and that is why the price of their shares have soared and the miners tanked.

So the fact that prices/loans have increased despite the high interest rates defies those calling for correction from this aspect as well.

“The impact of Chinese buyers is even being felt in the baby formula market here. Chinese want this stuff and will pay high prices for it resulting in shortages for domestic consumers.”

This problem is so bad across the ditch we have to limit the daily purchase amount per buyer, whole family’s line up, each buying the maximum per member, paying with a different card.

People on in Mainland china dont trust the product packaged in china, or other Asian states.

A compay was caught recently falsely labeling packaged in china, as made and packaged in NZ.

So does this mean the only people that will be able to afford to buy a house in hot US markets are the Chinese?

Expect slow downs.

Many who had the money and ability to convert RMB to USD already bought housing even with the limit like $50k/person per year. Exchange rate was in their favor till recently. Add to this talk of capital controls or stamping out those who go around $50k/yr rule, and it all points to slow down of once vociferous Chinese appetite for houses.

Yep – many of the all cash Chinese home owners may soon learn that RE price is based on supply & demand and local affordability and they bought at peak with any losses to come…

I don’t know how sophisticated the average Chinese RE investor is, so it is hard to know if they are smart or lucky.

But it seems to me that the higher the price of the RE they buy the higher the carrying costs, more taxes and maintenance expense.

This is money they must also extract from the homeland. At some point, if it becomes difficult to export cash or buy USD, they will have to bail out at any price or lose the property. It seems to me this may be a trend in the future if the Chinese govt is serious about cracking down. All that bid up RE is coming right back down.

These buyers may also not be able to get any tax benefit from owning a property or selling at a loss if they have no US income.

Been to China about 25 times from 1998 to 2008 to do business. Exchange rate was 8 RMB to 1 USD for a very long time (2000 to 2006) and dipped to 6:1 in late 2013 and creeping up recently to 6.5:1 meaning it can easily go up to 7 on its way to 8.

http://www.xe.com/currencycharts/?from=USD&to=CNY&view=10Y

China the world’s factory is facing severe head winds with factories closures of its once stalwart export growth engine and nasty outcome is displaced workers who often end up with backwages and unable to find another factory job – this is commie cadre’s WORST nightmare as it can easily lead to violent protesting. Add to this CAPEX heavy and heavily invested steel, cement, shipping, etc. industries which are still state-owned with interest in keeping the “iron rice bowl” alive. Therefore the commie cadres wanting stability and their own neck with devalue like crazy and deal with its “milder” consequences of having started the trade war especially with Asian neighbors.

And here comes the “competitive” devaluation to maintain industries/jobs as the days of strong USD may come to an end when Chinese, Europeans and Japanse are busy in devaluation spirals…

So, what’s the timeline for this sequence of events?

I’m dumbfounded with the enormous amounts of money that seem to be sloshing around in the world. Like other posters, I remember the Pebble Beach purchase by the Japanese, who I think, later sold at a loss. $300 million for a plot of land in San Francisco? Martin Armstrong thinks 2015 was the peak of the “echo bubble” in real estate, and there will be a subsequent 20 year decline. And yet, from reading, it seems like everyone is piling into US real estate. (although it also seems like average, non “hot” area, single family residences are not benefiting) So, what’s going on Wolf? And just where does the middle class invest their hard won money these days? Thank you.

From what I read yesterday, I believe the FT, a big chunk (~55%) of Yuan external sales for “harder” currencies is really a pay-back by Chinese companies of U.S dollar loans because of the apprehension that the USDolllar may appreciate more vis-a-vis the Yuan as the Fed raises the interest rates.

Or the devaluation of the Yuan ?

I am not sure how any of these currency issues will play out. China is a monetary sovereign nation. It can write a blank cheque to pay for anything for sale, including overseas real estate. IMO it’s doing that regardless of local RE values because the assets can decline in value at NO LOSS to China. After all it’s all cyphers in accounts to begin with. So 20% off free is nothing to worry about, even 90% off the same.

China’s yuan devaluation against the US $ is also of little import. They hold $1.4 Trillion at the Federal reserve. That is money in the bank. Remember bonds held in the Fed are savings accounts for the buyers, [a debt instrument for the Fed] but all savings accounts are an asset and a liability. at the same time.

China’s real problem is its resource base. With 55% of its agricultural land too contaminated for cropping, it’s water poisoned, etc its resource base is diminishing rapidly. All economies which export only get numbers in accounts to pay for that. Meantime they use real resources to make the products they sell. This is the genius of the US in play. They get to use resources of other nations and all they have to do is mark up accounts with numbers to pay. numbers available to infinity.

It’s a pity few understand this arithmetic. It’s going to cause great grief across the planet, no exclusions.

wait… China can’t buy anything overseas with yuan. It needs to sell yuan and buy dollars (or other currencies) first or sell its foreign exchange reserves. With the proceeds it can buy stuff overseas. But selling yuan and buying dollars pushes down the yuan,and possibly very sharply. So the PBOC props up the yuan by selling its foreign exchange and buying yuan. You see the conundrum they’re in?

It can print all the yuan it wants to, but it can’t print dollars.

Yes, I do believe that. But Yuan can buy Australian, Singapore, Hong Kong and NZ dollars as well as US dollars. The US dollars cost more especially today, but they can always raise enough Yuan to meet the bill. The US is more important than the other markets singly, but it has $1.4 Trillion sitting in the Fed, which is being depleted as you say. But I don’t think they Chinese authorities need to be too concerned there.

It’s only when real resources start to get short that they will hit a wall.

I’ve seen a report that private companies are borrowing Yuan to meet their debts. but the government could simply advance them that money. Instead they are just adding to the debts.

There will end up being a debt jubilee, particularly when the understanding dawns that all loans today are fiat based, thin air material. that banks can issue for free -to them.

Will not the resulting rise in inflation and manufacturing costs cause more labor strikes and malcontent among the masses?…

Inflation is good news. Everyone is trying to get some! Runaway inflation is not good news. If the risk of strikes etc threaten the acceptance of the Party, whatever they do that prospect will be No1 priority. The RMB numbers are small beer in comparison.Stock market gyrations are peripheral issues for China.

I bet they will, just as Iran has done in the past.

Well OK, But;

“Is China Complicit in North Korean Currency Counterfeiting?”

http://www.heritage.org/research/reports/2006/04/is-china-complicit-in-north-korean-currency-counterfeiting

“…A considerable amount of circumstantial evidence points to Chinese complicity in North Korea’s counterfeit currency networks. The nature of the evidence, especially the ease with which North Korean counterfeiters were able to relocate from Macau to more secure offices inside China, indicates that China gives aid and asylum to North Korean counterfeiting operations as a matter of policy….”

If this is true then it’s the wild card.

DPRK counterfeiting is a pain. It isnt that good and hasn’t been since the Japanese proved they were doing it. By enlarging the bill till Every pixel was the size of an A4 sheet, printing it, they laying it out on a gymnasium floor. No fake plate is that good. Computers at work.

The DPRK were allowed to debase the US through Macau and now on the mainland by the CCP as long as it is annually not to much..

The people in the US still dont understand. china is not a friend, or a friendly trading partner, china is the enemy, destroying you from within, with unfair and unbalanced trade. US consumer debt = chinese profit.

The real issue is the amount of CNY that has been printed and used by CCP to pay accounts, releasing it into into circulation. With out adjusting the declared cash in circulation # to reflect this.

Effectively PRC State forgery.

What happens in china when people realize there is 10,000% more of the stuff in circulation, than they think there is

Zimbabwe II, and another revolution?

Actually, D, those counterfeit 100’s seem to be pretty darn good. Right paper, right press. Please check out this article;

http://www.vanityfair.com/style/2009/09/office-39-200909

This, combined with what the Japanese have observed of NK navel ships carrying the stuff to Chinese ports is off the top..

Oh, some of the US people realize it. We can’t afford housing partially because of Chinese investment for laundering and partially because our own banks and TPTB buy all our housing for speculation, respectively. Speculation fueled by excess money influx. Some big speculators funded by Chinese money, including Blackstone. The houses sit and rot while our homeless population increases. Etc etc.

They were very good until they Japanese enlarged every pixel to A4 and compare them to the original plates.

Now they have a program that can do that by scanning a note, checking the S# against the destroyed list in circulation list. Which also tells them where that S# was last time it went though a fed or CB machine.

So they aren’t good any more even with correct paper and ink.

Everytime the change the signature they change the plates and a time after they tweak them, just little.

DPRK forgeries, no longer good enough to fool, the fed, SS, or the big CB’S.

The Majority of the DPRK cash, never enters the US System either. As it gets detected, and confiscated from the exchanging entity’s.

Vegas collects a % of local funny money, per hour, that it has to had over to the SS, and absorb the cost on.

A lot of Asian drug-lords and Hoarders, outside Japan, are holding a lot of DPRK toilet paper, that will never come to the US.

How much of the Chinese alleged US cash Hoard, is DPRK funny money?

The one thing they will never do, is repatriate it to the US, to find out.

D, So do you mean the US’s ATMs and banks’ and stores’ cash counting machines now detect it? They would have to, otherwise it would go into circulation very well.

If so, yeah, I guess it would now stay mostly in Asia. ?? What if it is deposited in an Asian bank then changed and wired to the US?

Are you sure it isn’t part of the illicit money coming to the US from China?

If you smuggle the forgeries into the US you can push it into the system, Slowly. Depending on what outlets you have, Payday loans.

Since the events in the links you supplied, it has become a lot harder, to push a lot funny money into the system, as they are more aware what they are looking for. That’s how Vegas man got caught.

Cash goes from Vegas casinos to the SS, and then to the fed, so it can be checked now, as opposed to in and out over the counter in Vegas.

Money machines, and a lot of banks particularly those with counter cash holding machines, are the same, the cash in them comes straight from the FED and all incoming goes through the SS to the fed.

Any upmarket entity’s cash counters will detect most issues and the SW in them is updated regularly. Further up the food chain you go the more aggressive and expensive the Machines. There are regs that bigger volume movers must have high quality machines.

Dumping Funny money in an Asian bank, then wiring it to the US gets you money, and leaves the bank concerned with a big problem, if you gave them a lot.

Much of the chinese “cash” that has come to the US and other Hard currency western markets, is from loans, secured against air in china. It gives china not the US a problem, when the loan goes bad. As settlements between banks are electronic or through checked by the SS fed, currency swaps.

A lot of the world has US $ that never come to the US, if it comes electronically it still not a US problem. As the bank that sent it has the funny money. Just like getting a loan in Asia and wiring it to the US the cash is free in the US, and Asia has the problem.

The Casinos in Macau, working with the banks mentioned, and the DPRK, were handing out funny US $, when people cashed out their chips.

Asia loves US $, 1, 5,10, 20’s, and Electronic ones, every bar-girl and store in Asia knows US 50’s and 100’s are Probably funny.

They send you somewhere else to change it.

The forgers problem has always been, how to get the funny paper out there. Which is why you can buy it for 20/30/50 on the dollar.

DPRK is/has forging/forged billions over time, so has a huge distribution problem.

If I want to change US $ Cash in my (Advanced Economy) country. I need 2 forms of photo ID and proof of address.

Yet I can deposit a US $ Cheque, into anybody’s account, and walk away, no questions. Go figure.

Find Escobar, Saddam, Gaddafi, or Guzman’s stashes, and you will find truckloads of funny money. Lots in iran as well. Hate to think how much is in Russia.

The way the system works now DPRK, is still winning, but the entity’s outside the US holding, are mostly the ones loosing, not the US, which is the DPRK target.

Thanks for explaining that D. I’m very interested in the way Chinese money moves. I live in California and housing expenses are outrageous. It seems the more Chinese money gets invested in Ca real estate the more homeless we have and those of us who do have housing are stuck in place. I would so like to see the whole real estate thing crash so I can move and others can have a home. Meanwhile a lot of these houses stand empty and rotting for years. There is nothing left to a lot of them. Even the framing is rotten. Infuriating.

I think I got that you live in NZ or Australia. If so I imagine you know exactly what I’m talking about. At least those coutries are starting to protect your housing stock. Ours hasn’t done any thing AFAIK.

American globalized corporation’s, were behind the US, WTO OPEN UP YOUR LAND MARKETS push. Which coincided with the first Hong Kong Capital flight, as what was going top happen post 1997 became clearer.

Look at all the nations that complied. The boom bust bubble that have occurred, and the untenable Urban, outer Urban and Rural land prices in those nations, then look at the outer Urban and Rural markets in Nations that did not comply.

When small farmers, who used to be able to, and are retaining their margins, can no longer make a profit after land taxes, due to ridiculous land values, something is wrong. Municipalities have ridden, and helped drive these boom’s, as every land revaluation, increases their tax take.

Yes Au and NZ are at last taking more serious steps against foreign speculators, however the horse has well and truly bolted taking all the gold with it.

We now need a 70% reduction in property values or a 400% increase in average wages to return to anywhere near the housing affordability we used to have pre 1986.

Average Houses, are now appreciating annually, greater than the average single take home wage.

That, is Untenable and unsustainable..

Gold and western land values, have both been hyped and manipulated into the stratosphere, by globalist corporate vampires.

The governments and Munis, willingly helped them.

“Ours hasn’t done any thing AFAIK.”

OH, except to do the same thing and sell derivatives from the RENT on those empty houses. That pension plans invest in. Pigs.

So, it comes back to the US. The corporations love that but the people here never have.

Yup. I know a sheep farmer on the coast here who makes around $200 a year total profit with his flock after taxes. He keeps the sheep so he pays less taxes and can afford to live in his family home.

How the hell much money does one person need to be satisfied? That’s rhetorical, you don’t need to answer that…

the first half of that makes no sense – China can print rmb, but only by devaluing the rmb that already exists – nothing is ‘free’. holding others peoples debt certainly is money in the bank (and money is just debt, of course), but that doesn’t mean it won’t lose a significant chunk of its value before you get around to spending it

“China can print rmb, but only by devaluing the rmb that already exists ”

You miss something.

In the US the amount of cash in circulation is accurately reported even though they don’t know where it all is.

In china the CCP has been clandestinely printing and circulating cash for years.

The official circulation figure if you can get it, is actually only a % of the total in circulation.

One of the larger CCP fears is that the real number comes, out before they are in the SDR and have fooled nations into loading up on CNY as a reserve.

And yes they will continue and increase clandestine CNY printing as things get ugly inside china.

As long as the CCP can keep handing out pink chairman Mao’s they think they can keep a lid on china. As they have a choice, buy or shoot to ensure peace and order, on the streets of china

When the real number comes out, CNY is going through the floor.

Only honest nations have the cash printing issue you outlined.

china is not a financially honest nation, never has been.–

The number of times this idea crops up is amazing and a little frightening.

All African countries are sovereign and almost all have their own currency- (Zimbabwe just gave up its – you can buy the the hundred billion note as a curiosity for a dollar or so from coin shops. It went to the $US.)

The rest of them print their own currencies and most of them have no ability to buy in that currency whatsoever. In fact you can only place a collect call if you are phoning from them- the international phone system won’t give them credit.

But what is incredible is the idea that because you are sovereign you could print value- which is how these countries with no credit got that way.

It’s not a free ride. The economy has to have value and the government has to have its full faith and credit worthiness intact. A main issue is that relating expenditure to taxation is an outdated idea, dating back to sovereign money, pre 1971. Today tax is not used to pay for anything. It has uses but raising revenue is not one of them. For an economy to grow the government has to deficit spend, to put money in citizens’ pockets, and for jobs and infrastructure. The total spend should be guided by the economy’s performance. The limit should be the output gap, when the economy would be operating at full employment, little to do with taxation.

It goes without saying, no government should borrow in a foreign currency. That way lies trouble! If it needs foreign currency, then buy it on the spot market. never borrow or save. Completely unnecessary.

China plays the long game. Very long. By running down it injects fear about growth into global markets. That enables China to mop up. It’s not the more recent high prices purchases that matter, so much as what China already owns.

Euther that or China us taking a massive gamble to avoid going broke.

“Euther that or China us taking a massive gamble to avoid going broke.”

No china has a problem, that it shares with its global vampire corporate allies.

They, with O bummers help, gutted the hated white American middle class, without first finding a replacement for it.

It is a big problem, as the hated white American middle class, turned out to be the goose, that lays the global golden eggs.

Thats why there is no demand middle class America is over-leveraged and cant take on any more. Its Millennial children dont want to play the same game as their parents. Another problem for china and its Vampire allies.

Whats left of the middle class in the ANZAC States and the Pacific rim that is signing on to TPP, along with their children, see it, and wont lever up to support china any more.

A serious anti china sentiment, is building in the region, just as it did, anti france.

For different reasons, the result will be the same, made in france or china on the label, is a death sentence for that product, in that region.

No point in having the biggest army and most money on the block, if nobody wants anything to do with you, or your products.

China still hasn’t learnt this.

The US is still suffering from its misdemeanors after Vietnam, but is now seen as a savior, to protect the region from china.

Even Napoleon Bonaparte knew, and wrote “Beware the Dragon”.

The US did not heed his warning, the whole global community, must, and will, now pay the price, of this US failure.

The Chinese authorities will try their best, but the result will be a total mess. When Governments see this they simply blame “evil foreigners”.

China has a massive army and will use it to restore national pride. If it doesn’t, there will be another peoples revolution.

History does tend to repeat itself.

Here is the most important thing to take away from all of this noise and crap going on; DO NOT EVER get involved in a system of false weights and measures!! It will only lead you to your doom if you do that!

World history is replete with examples, both glaring and small, of how and why fiat currencies fail. But those lessons though they may be well learned at the time, are not taught to the young so as to keep them from making the exact same mistakes too! There is always a new sucker born every minute who will dream and fantasize about how he/she will be able to game the laws of Nature and beat the system. That will never happen, for Nature always holds all of the trump cards (no pun intended there!) and no one can win at that game!

very old culture, not much originality of thinking.

hard to keep track of what an economy of 1.3 billion is up to.

i’ve decided it’s useless to try. i do know one thing: they can’t seem to get off the deflationist cut costs the boss gives you a paycheck enough to get you a bus ticket home and a bus ticket back to work mindset.

countries that went communist tended to have an insensitive capitalist class.

Just a comment on all the chatter about China devaluing the yuan, my comment being: devalue against who?

No one in North America or the EU buys much from China besides budget Walmart stuff, clothes shoes toys etc. where China’s competitors are Malaysia, Cambodia ( just bought sandals and that’s the name on them) Vietnam, etc.

What would it take to put China on an equal footing with countries that are where it was fifteen years ago? Can it turn back wages that far?

China already competes on price alone- this is a tough position to improve by cutting prices.

A different situation would be another devaluation by Japan. The car situation is very competitive and is about to get ugly. GM in particular has never taken the small car seriously. Back out trucks from the Big Three and what have you got? Well the 500 and its small all right.

Notice how nasty the truck ads have become? Ten or maybe even five years ago you never heard an ad MENTION the other guys truck- now one ad showed our truck towing the other guys truck.

Was I hallucinating or did I read that GM was getting 40 % of its profit from China?

If so- look out.

GM expects Americans to buy BUICK’S, MADE IN CHINA.

Problem being. O bummer and his union clan. keep getting tax dollars to keep GM alive so it can do this.

Whereas the only big 3 US auto company, not to need US tax dollars in the O bummer auto industry bail out. Is still being discriminated against, and not supported.

There is a horrible corruption message in that.