Oil Bust Contagion Spreads

Retail sales in Texas, based on sales tax collections as reported by the Texas Comptroller of Public Accounts, have been booming since March 2010, the low point in the Great Recession.

Sales tax collections jumped 44% from $18.3 billion during the first 11 months of 2010 to $26.3 billion during the same period in 2015! The state government was ecstatic. Retailers were happy. People were spending money they didn’t have on things they preferably didn’t need, and in doing so, were paying lots of taxes. The state was firing on all cylinders.

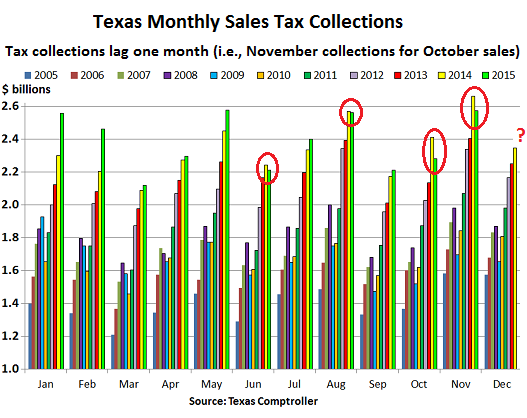

Sales tax collections aren’t a perfect indicator of retail sales. Not all sales are taxable, such as food products (flour, sugar, bread, milk, eggs, fruits, vegetables, and similar groceries), though many edible goods are taxable, as are most other goods. Taxes on motor vehicle sales and rentals are in a separate category. And collections are raw data, not seasonally adjusted, so they can only be compared to data from the same months in prior years. But they’re an unvarnished approximation of the movements of retail sales.

That retail boom in Texas coincided with the oil boom, when WTI traded above $100 a barrel for part of the time, and fracking became the new miracle activity that ate up billions of dollars every year and knew no limits. Drill, Baby Drill.

When the price of oil began collapsing in the summer of 2014, retail sales continued to soar. The meme emerged that, sure, certain aspects of the Texas economy would be hit by the oil price plunge, and there would be some layoffs, but it would be contained, and the vast diversified Texas economy would keep firing on all cylinders and overcome the struggles of the oil patch. And that meme was correct – until suddenly it wasn’t.

The first hint arrived in the June sales tax collections. Collections lag sales by one month. So collections reported in June were on sales that occurred in May. And those collections, instead of rising on a year-over-year basis, as they’d done every June since 2009, suddenly fell 1.4%.

It broke the perfect trend of year-over-year increases every month since the low point in March 2010. But in July they rose again. Then in August, they fell 0.4%. Something was amiss. But in September, sales tax collections rose again, and observers breathed a collective sigh of relief. It had just been a brief dip.

But then came the October collections: they plunged 5.4% year-over year; and now November collections that fell 3.3%. Two months in a row of declines; four months of the last six, and the first declines since the Great Recession low of March 2010.

WTI now trades at around $35 a barrel, a seven-year low. Today, another Texas oil & gas driller, Cubic Energy, filed for bankruptcy. The entire service and manufacturing sector that supplies the oil & gas industry is in depression. Tens of thousands of people, including director-level engineers, have been laid off in the state. In November, this number was estimated to have hit 56,000. Since then, numerous layoff announcements have echoed across the state. And as the oil bust is getting worse, it is now slamming retails sales.

This chart by “David in Texas,” based on data from the Texas Comptroller, shows the year-over-year boom in sales tax collections since the Great Recession low in early 2010 (orange columns), which has now run into trouble. The four months of year-over-year declines are circled in red, (yellow = 2014, green = 2015):

But it hasn’t hit the brouhaha about the Texas housing boom yet, though the first effects may be rippling through Houston right now, as smaller oil-patch towns are e getting hit.

The November issue of Texas Monthly had this exuberant cover about the “Great Texas Housing Boom”: $100-bills blowing out the chimney of a home and settling on the lawn as some guy, presumably the seller or the entire housing industry, is raking them in as if they were fallen leaves, while a young family watches the spectacle with incredulous body language:

“David in Texas” added this bit of color:

You wouldn’t get any sense of economic decline in the Park Cities area of Dallas, though. There is a big concentration of hedge-fund and structured-finance types, so sales of super-luxury cars (Bentleys, Maseratis, Lamborghinis and the like) are still going strong. Real estate (at least residential) in the area is still going nuts, too. From what I hear, Chinese capital flight has discovered Dallas as well.

But contagion has a nasty habit of spreading far beyond the origin of trouble.

Oil & gas junk bonds were the first ones to crash, starting about a year ago. It would be contained to oil & gas junk bonds – that was the meme at the time. Early 2015, hedge funds and PE firms touted them as a “lifetime” opportunity and a rally ensued. But that rally collapsed. Over the summer, the energy junk-bond contagion spread to other sectors, and the stocks and bonds of many junk-rated companies outside energy have gotten mauled. On Thursday, a bond mutual fund imploded, the first since the Financial Crisis.

“It’s contained – until suddenly it isn’t,” I explained on the radio show, Stocks and Jocks, where we discuss the junk-bond fiasco and how it is bleeding into the stock market. Read… How Junk-Bond Contagion Hits Stocks

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Anybody who has recently lost a job and gotten another knows that incomes are going down not up. Prices in the stores were good on Black Friday weekend but are now up from there. Overall, unless the sales get really good in the next two weeks, holiday sales will be down this year too.

Outside of government, I do not know anyone who has been gaining income since the 2008 bust. You are lucky if you are not losing. I see nothing but stagnation and retreat in most every industry outside of government protected and entertainment.

On the flip side, Obamacare has dramatically raised insurance costs, medical office costs, out of pocket costs and complexity for NO extra medical care. This is a huge barely visible dead weight loss. Add the energy sector losses including forcing coal companies into receivership and I wonder just where this “hot” economy stuff is.

I laughed at the quarter point increase today as insignificant, but not so much as thought it through. Personally, I think another quarter point trashes the economy because it is so fragile. Housing is the last area the middle class is enjoying any positive news and it depends on all the other things like interest rates, incomes and jobs that are anemic.

traditionally, prices go back up after the 2nd weekend in December to make the late shoppers pay for their procrastination. I also believe holiday sales will be down. Who said “it’s the economy, stupid”?

Last time around low oil prices lasted 18 years, 1986-2004. It was long enough ago that people forgot how much money was lost so they returned to crazy lending. Oklahoma might have boomed more than Texas, now the bust there is worse as well.

Wolf’s contribution begins after the 60 minute point in this interview on Stocks and Jocks:

http://stocksandjocks.net/show-archives/bonds-junk-bonds/

Thanks, Winston. Great people at Stocks & Jocks.

Timely article, here’s a bit of detail: the discount fashion retailer stein mart, with 44 stores in texas, has reported very bad numbers there for over six months now, a trend that is accelerating. They blame this on the oil bust. The rest of their stores are doing fine as of Q3, with the north east booming even. But the more exposed their upper middle income clientele is to the former oil fields, the worse their stores do. It’s the same for other retailers.

And since Texas has been such a growth story there is bound to be lots of overcapacity which could accelerate a downturn. I’m glad you’re keeping an eye on the situation, mr. Wolf.

Neiman Marcus just reported bad numbers for the last quarter. Their flagship store is in Dallas I believe. Even the better off are cutting back.

I live in Texas and have been waiting to see the fallout. It seems to be hitting now. In the past month or two I’ve heard of more and more layoffs, some of them senior employees with many years at the company.

Most of the gains in well-paid blue collar jobs during the pseudo-recovery were in the oil and gas industries and the businesses that served them. When oil recedes demand for steel, transportation, chemicals, etc falls too.

There will be other fallout in unanticipated areas. When Texas catches cold, the ski areas in CO and NM start sneezing. Not only does tourism fall, but second home sales go up. People who bought land planning to build vacation homes just stop paying the taxes and let the state take it.

When we talk about Oil and Texas and Oklahoma and fossil fuel prices, we don’t ever want to face the 500lb gorilla in the room. CLIMATE CHANGE!

You are so right! We are sure that the climate is changing, but who knows or cares whether it’s getting hotter or colder? I hate those crazy skeptics who point to the geologic record and mention that the last ice age ended about 12,000 years ago, so that the earth should naturally continue warming for the next 138,000 years. It also pisses me off when they point to the fact that half of north America has been underwater for the majority of the last billion years. What ignorance!!! /sarc off

If you really believe in your post, the most effective way to erase your poisonous carbon footprint is to stop breathing. ;) My belief is that the lower oil prices are a side effect of the global economy being wrecked by our technocratic leadership. One more war and a few decades from now, the earth will be much more sparsely populated and true playground for the elites as envisioned in Agenda 21.

Little tidbit from the car biz near Vancouver, BC,

The flyers these days are full of car ads, page after page.

Here’s two that caught my eye. These are in $C

1) 2014 Chevy Cruze, low ,miles, loaded.. (etc.) 13, 888

Two pages later…different dealer

2) Huge inventory reduction!! New Chevy Cruze, 30 to choose from, 13,888

I almost feel sorry for the first guy, or whoever put that ad in, but my point is that in this case ( unique?) the new car price has met the used car price on the way down.

Am I the only one who develops a painful knot in the gut whenever the word “contained” pops in the news now?

I live in Austin, Texas and am closing on my third Texas property next week. Am I crazy? Maybe, but I am planning long-term 10+ years out and am only risking a few months of pay. Property prices don’t swing as much in Texas because of the high property taxes taking a large chunk of each mortgage payment.