“Large amounts of potential and realized losses”: Moody’s

The US junk-bond market, after years of record-breaking issuance, has nearly doubled to $1.8 trillion since late 2008, one of the miracles the Fed’s QE and ZIRP performed. Those were the good times. Now Fed-blinded investors are cracking open their eyes.

It didn’t help that the week was punctuated by some juicy bankruptcies, including steelmaker Essar Steel Algoma, which filed in the US and Canada – for the second time in two years and for the third in 25 years – as it struggles with over $1 billion in debt. And Millennium Health, a malodorous mess I wrote about in July [“Leveraged Loan” Time Bomb Goes Off, JP Morgan Did It].

Energy junk bonds are sinking deeper into the mire. For example, natural-gas driller Chesapeake Energy’s 6.625% notes due in 2020 fell 7 points last week to 58 cents on the dollar. Or the misbegotten Occidental Petroleum spin-off California Resources; according to S&P Capital IQ LCD, its 6.00% notes due 2024 dropped to 64.50 cents on the dollar.

Beyond energy, specialty chemicals maker Hexion’s 6.625% notes due 2020 fell to about 81 cents on the dollar. And Mallinckrodt Pharmaceuticals, based in Ireland, with its US headquarters in St. Louis, Missouri, got hit by a tweet from short-seller Citron Research, after it took a break from eviscerating Valeant. As Mallinckrodt’s shares plunged, its 5.625% notes due 2023 dropped from 94 before the tweet into “price discovery,” with quotes around 85.

When tire-maker Titan International reported sharply declining revenues, its 6.875% secured notes due 2020 fell three points to 82.25. Scientific Games, which caters to lottery and gambling organizations, also reported crummy quarterly results; its 10% notes due 2022 plunged six points early in the week, to about 81.

Then there was Men’s Wearhouse whose blood-soaked investors are ruing the day it acquired Jos. A. Bank. Its shares have been getting hammered relentlessly since Friday a week ago, and its bonds are now down to 85 cents on the dollar.

Sprint’s 7.88% notes due 2023 plunged over 5 points to 84.50 cents on the dollar. Satellite communications company Intelsat Jackson, the US subsidiary of Luxembourg-based Intelsat, is edging closer to the brink, with its 7.75% notes due 2021 dropping nearly 5 points to 53 cents on the dollar.

You get the idea. S&P Capital IQ in its LCD HY Weekly described the junk-bond debacle this way:

Bad news amid low-volume, jittery market conditions led to some big downside movers again this week. Broad momentum was also negative amid signs of retail cash outflows from the asset class and higher underlying US Treasury rates after the blow-out November jobs data skewered bonds.

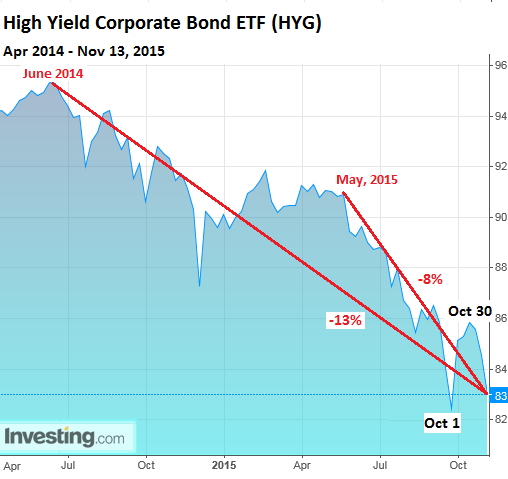

The junk-bond based High Yield Corporate Bond ETF (HYG) has fallen for eight trading days in a row. It’s now just a hair above where it had been on October 1, at the bottom of the summer panic. It’s down nearly 8% since May and over 13% from its recent peak in June 2014. The ballyhooed rally in October has once again turned out to be just another sucker rally:

Not that these junk bonds have been issued over the past few years to fund productive activities that would generate cash flows with which to service the bonds. Far from it. According to LCD, in 2015 so far, the proceeds from 46% of the newly issued junk bonds were used to refinance maturing bonds, paying early investors with money raised from new investors.

Another 30% of junk bond issuance was used for M&A. Valeant is a prime example. It’s teetering under $38 billion in debt and has a tangible net worth of a negative $33 billion. If it craters, the bloodletting among creditors will be brutal.

And 16% of the junk bond issuance was used for “corporate purposes” and “other,” such as share buybacks, special dividends back to their private equity owners, and even some investments in productive activities, while 4% was used for LBOs.

The number of “distressed” bonds (defined as bonds whose yields are 10 percentage points higher than Treasury yields) has ballooned, Moody’s pointed out: there are currently 616 distressed bonds, over six times as many as last year, and the most since 2009.

This “massive increase” in distressed bonds “anticipates a rising default rate,” Moody’s said, as these companies have trouble raising new money to pay earlier investors.

The problem is moving beyond distressed bonds. Year-to-date issuance of dollar-denominated junk bonds is down 16%. But it’s much worse at the lower rated end. Over the past six months, the average monthly issuance rated Ba1 to B2 plunged 30% year-over-year, and issuance rated B3 or lower plunged 56%.

Many of these companies are essentially locked out of the credit markets and face default when the money runs out. Investors, who for years took huge risks to get a little extra yield, just as the Fed had wanted them to, are now feeling the pain.

“The burst in distressed corporate debt issues and the general rise in high yield interest rates has left investors sitting on large amounts of potential and realized losses,” Moody’s said. Those losses in market value since last year amount to $112 billion.

Of these losses, $50 billion are on energy bonds. The remaining $62 billion are on junk bonds issued in other sectors. And this is “pointing to more widespread poor performance among industrial firms.”

Moody’s warns: “Any potential rebound in high yield corporate issuance and debt valuation will be limited by the ongoing softness in global heavy industry activity.” So any rallies will once again be just sucker rallies in the darkening saga of the Fed-induced junk bond boom.

What’s next? A credit crunch. And Moody’s offers unnerving comparisons to 2008 and 1999! Read… Last Two Times this Happened, it was Mayhem

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

We shouldn’t forget the derivatives multiplier that boost profits and bonuses I the good times and losses in the bad.

James Rickards in Currency Wars gives some figures for the loss magnification of complex financial instruments/derivatives in 2008.

Losses from sub-prime – less than $300 billion

With derivative amplification – over $6 trillion

The derivatives loss multiplier was 20 in that case.

You are quite correct Keith and Jim Rickards is a man of insightful knowledge with much experience who many people should take more notice of. The latest news from the G20 is that leaders AND the IMF have considerably downgraded their views and optimistic forecasts from their meeting last year. Much has flowed under the bridge since then and bankruptcies & defaults are accelerating within the corporate sector, not just in the west, but also in China – The central banks are now down to the final last options which will quicken the demise of the current “Fiat” monetary system which along with 100% of all fiats before them going back 2,000 years have failed. There are already very little yield returns & this will contribute to the destruction of this “totally manipulated and controlled” environment.

Isn’t it way past time where the business community & Wall St stopped hanging from every “carefully crafted word” uttered from the Fed who really haven’t got a bloody clue – They are now hamstrung with not a clue. The futures & options (derivatives) market is at an utterly ridiculous & “never-before even contemplated position” which is highly unstable and untenable.

Corporate, hedge fund managers etc should stop wanting to be blind, wake up, smell the roses & start taking safer positions for their investors who stand to lose a lot more than 2008 this time around, instead of worrying about the best risky returns to keep their highly paid jobs. It’s only going to get worse from here & I mean in the “NEAR” future!

I have read both Jim Rickards books and would give Michael Hudson’s book “Killing the Host” 5 stars.

No fiat currency has stood the test of time.

No civilisation has stood the test of time.

Let’s hope control is wrestled from the banksters so both don’t fail together.

Indeed Keith – Jim Rickards is intelligent reading. No matter about all the current digi-currencies which will be made “null-in-void” when Governments impose their own to enable total control over all transactions & everyone’s finances. They are “ALL” and still will be “fiat” and will fail when the “re-set” happens because they are “based on & purchased with debt”. The only “true” & tangible backing has been & always will be Gold (unless someone discovers unlimited supplies on planets or moons) which would make these PM’s as common as dirt. (Always a possibility I suppose).

MarkG,

Nope, even if you add planets of resources, the distribution of elements follows a log scale. See Nucleosynthesis:

https://en.wikipedia.org/wiki/Nucleosynthesis

The short version is that as small elements combine into larger elements, they PRODUCE energy. This pattern rolls over at iron and elements above CONSUME energy. This is why stars die and also why heavier elements are significantly less common – the engine that creates them runs out of fuel.

And this excludes the energy to get there and back, which is really the wall humanity is racing headlong into …

I read Rickards when his book came out a few years ago. He did a TON of interviews (20?) on King World News before he published. If you go back through those archives, it is hours of listening and goes into a lot of stuff he didn’t get into as much in the book.

NOTE: I Just looked and they are all gone. In fact, his name doesn’t appear anyone on the site at all anymore.

Anyway, I haven’t seen him consistently interviewed to that level of detail since – would love to hear/see more if anyone has sources!

Regards,

Cooter

Shame, I was going to look at those interviews.

I saw a recent video of him on Money Morning and he doesn’t look very well at all.

You mention that all fiat systems have failed. It follows logically that all sound money systems have also failed, because they were abandoned for real reasons.

See: http://www.pragcap.com/why-no-one-should-support-the-gold-standard/

for some arguments why this is the case. But really, having an inflexible money supply would have prevented, for example, the funding of WWII. (They circumvented this on paper by issuing bonds, which is a de facto form of currency issuance, since they at some point have to be paid back).

Yes, UCDE, as your included article implies – “Almost no mainstream economists” support a return to the gold standard. Personally, I wouldn’t pay an ounce of attention to most “Mainstream economists, financial advisers & “so-called” experts – Look where they’ve got us? Apparently we are in recovery mode since 2008 – lol. – Isn’t it such a shame that all government finance ministers are merely politicians and not professors of economics which should be the case – This also goes especially for the likes of the head of the Fed. If only they all had a fraction of the knowledge of Joseph E Stiglitz, we would all be better off today.

Your logic is flawed. Your presupposition is that it is the system that failed. I would argue it is people who are the problem.

Hard money standards are ABANDONED for looser credit/monetary expansion. Fiat systems FAIL because they collapse in a heap after rampant credit expansion. But, technically fiat could work – if people weren’t greedy/corruptable/selfish/stupid. But people are and so here we are.

I will conceded that hard money/gold standards do have issues (particularly matching economic growth/contraction to monetary growth/contraction), but it becomes a debate of which values are most important and which are most harmful.

Personally, the most interesting angle on this subject that I have read in recent years was a ZH post:

http://www.zerohedge.com/news/2012-11-24/goodbye-petrodollar-hello-agri-dollar

I advocate printing its following chart:

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2012/11-2/Agri%24%204.jpg

and sticking that on the fridge. When global trade collapses, the countries who can’t feed themselves (i.e. net exporters of food) are going to be in for a very rough ride.

Regards,

Cooter

In Florida there is a glut of rental apartments coming on the market. The rents are really high, higher than a mortgage payment for a similar property. The rents will have to come down because wages are actually falling in my area. I can already see the bonds for the corporate landlords having problems in the very near future.

Definition: Bondzi Scheme: This “massive increase” in distressed bonds “anticipates a rising default rate,” Moody’s said, as these companies have trouble raising new money to pay earlier investors.

You’re right Dave – See my Twitter Post – http://www.marketwatch.com/story/limited-room-for-policy-makers-to-respond-to-economic-shocks-moodys-warns-2015-11-10

Not just the HY bond sector in trouble –

U.S. Treasuries (6 month) recently sold for a paltry 0.065% return

The 3 month bills sold for 0.0% yield for the first time in history!

If you think that is bad, the 1 month bills have sold at zero yield in 5 of the 6 most recent auctions. In the secondary market, some bills have traded at negative yields!

Now the Fed is seriously considering pushing rates negative?

War on cash.

Look out below.

CrazyCooter and Keith –

Jim Rickards is still very active with his regular contributions to many publications. At present he is in Russia. Here are a couple of sites which may be of interest to you –

http://jimrickards.blogspot.com.au/2015/09/threat-of-cyber-war-other-reasons-to.html

http://jimrickards.blogspot.com.au/

With regards to the overall subject of using gold as a “backing” or “back-stop” for a global currency, of course there would not be enough physical stuff to meet the need now, but what I was advocating was a system at least partially backed by gold as is what the Chinese are intending with the Yuan. (But with strict adherence to well devised protocols and measures in place so as not go down the previous path). There really is no other “solid,tangible material” which would be suitable & which cannot be “created” by man. But as has been pointed out, the previous “Gold Standard” was floored in many ways and became unsuitable & corrupted mainly due to manipulation and loop-holes – Human greed will have to be severely constrained, because that is what always leads to destruction.

One must remember that everything is controlled by the global Elite who control “The World Bank Group”, (includes The World Bank), IMF, BIS and all those associated with these organizations where the criminal banksters control our economies.

In saying all that, I am of the belief that the “extremely forward-thinking Chinese” along with the Russians have grown very tired of playing second-fiddle to our corrupt and forever exploiting domination and the Chinese have for years been planning their entry into the high-rollers’ arena. They have put a large spanner in the works of the Elitist’s plans.

Is it any wonder China, Russia, India, the BRICS and all our central banks have been hoarding as much gold as possible over the last few years – because they all know where we are headed.

I’m in agreement with the Anarcho-capitalists – government is not a necessary evil, it’s just evil. Trading Communist Elites for Neo-feudal Elites will not solve the problem.

We had un-regulated, trickledown Capitalism in the UK in the 19th Century.

We know what it looks like.

1) Those at the top were very wealthy

2) Those lower down lived in grinding poverty, paid just enough to keep them alive to work with as little time off as possible.

3) Slavery

4) Child Labour

The beginnings of regulation to deal with the wealthy UK businessman seeking to maximise profit, the abolition of slavery and child labour.

Where regulation is lax today?

Apple factories with suicide nets in China.

A leopard never changes its spots.