The amount of oil in storage globally, not including the various “strategic petroleum reserves” in the US, China, Europe, Japan, and other locations, has grown to staggering proportions this year, as oversupply drowns out tepid demand.

In the US, oil storage is seasonal. A big buildup starting late fall gets Americans and their favorite gas or diesel sipping or guzzling toys or clunkers through “driving season” – late spring and summer – when somehow everyone has to drive somewhere. After driving season, petroleum stocks fall. This pattern has played out this year as well, but with a difference.

Last week, the EIA reported that crude oil stocks rose 7.6 million barrels to 468.6 million barrels, the highest for this time of the year since records have been kept. Crude oil stocks are now 98 million barrels higher than they were last year at this time, when they were already bouncing into the upper end of the 5-year range.

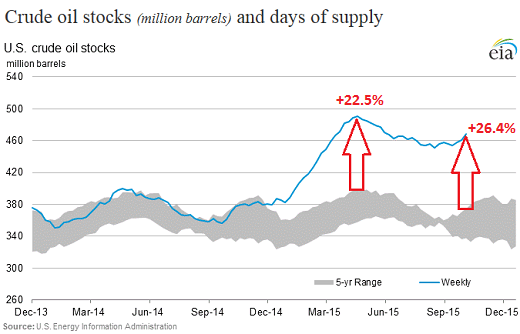

This chart from the EIA shows the out-of-whack relationship between the five-year range (gray area) and the weekly buildup (blue line) this time around:

Instead of getting better somehow, this situation simply got worse over driving season. At the peak of the buildup this year, crude oil stocks were 22.5% higher than a year earlier. Now they’re 26.4% higher than they were at this time last year.

If the inventory buildup this fall, winter, and spring continues in this manner from today’s much higher starting point, we can look forward to a fiasco on the storage front – and on the pricing front. Because at this rate, by April, we’ll be having oil coming out of our ears!

But this is a global issue for producers (or conversely, an opportunity for oil consumers). Here’s Saudi Arabia, which has been pumping oil at record levels to maintain its market share against Russia and the boys from the oil patch in the US and Canada: its inventories are ballooning too.

Matt Smith of Oilprice.com reported:

Finally, a theme of high global inventories has once again thrust itself into the limelight, as JODI data over the weekend highlighted that Saudi Arabian crude stocks have reached a record high of 326.6 million barrels in August. As Saudi continues to keep production elevated, and as it struggles to find a home for all its exports amid a highly-competitive global market (awash with crude), this extra oil is finding its way into stockpiles as exports ease (chart via Oilprice.com):

Add to the calculus the additional supply Iran will deliver to the global market as the sanctions are lifted. Which will come regardless of what OPEC says, Oil Minister Bijan Namdar Zanganeh assured reporters today in Tehran.

He saw no imminent change in OPEC’s production strategy though he urged other members to cut production, presumably to make room for additional Iranian oil, so that oil prices would somehow rise to a range of $70 to $80 a barrel.

Just about all producers want that. Even the world’s high-cost Canadian tar-sands players might live to see another day at this price range. But rather than just go away, this problem, given the ongoing inventory buildup and production increases, is more likely to get really ugly.

For US oil, 2016 is going to be brutal, according to the CEO of oil-field services giant Schlumberger. But then, there are dreams of “a potential spike in oil prices.” Read… The Dismal Thing Schlumberger Just Said about US Oil

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

These producers are living in a bubble …

https://twitter.com/carolelee/status/639521976160272384/photo/1

They don’t understand, their precious customers — the idiots whose borrowing pays off the drillers’ loans including the Saudis — are bankrupt.

The entire industry is insolvent.

“Oil Minister Bijan Namdar Zanganeh assured reporters today in Tehran … he saw no imminent change in OPEC’s production strategy though he urged other members to cut production, presumably to make room for additional Iranian oil, so that oil prices would somehow rise to a range of $70 to $80 a barrel.”

More cuts = more broke customers. No customer has ever gotten richer from a shortage of oil (this makes use of the exciting, self-deluding ‘customers create wealth’ meme).

Endless monetary stimulus, ZIRP, moral hazard, carry trades, direct- and indirect subsidies for drillers … all these things have shifted purchasing power claims from the hapless customers for the Big Men. More QE = more broke customers. Look to Japan: the marginal customer who cannot afford to pay for more imported oil and gas … he might also be Chinese … or Russian … or Greek, Portuguese, Italian or a Cypriot. Trying to fix the monetary puzzle makes the other problems worse. Venezuelan … Philippino … Canadian!

Endless articles about oil production (extraction) … the real problems are all on the consumption side. Energy deflation occurs when demand falls faster than prices, with the one driving the other in a vicious cycle. Read about the banking crisis in 1932. It’s coming and there is no way out of it.

There is nothing like war to help raise the price of oil. Wars are fought on oceans of oil. I always saw the link between our foreign policy in the ME and the Bush family’s oil interest.

Yep… one of these days, when it’s long past obvious, some commentator, is going to finally come clean and say it like it is. THE CUSTOMERS THAT MATTER ARE FLAT OUT BROKE! PERIOD.

This constant data parsing (now so surreal that even Lewis Carroll would be at a loss for words) does nothing more than obfuscate that reality. Any analyst or biz exec who doesn’t begin from this premise is either ignorant or dishonest or perhaps both.

What we need and are sorrowfully missing, is an honest dialogue on where we go from here. The ever deteriorating data can certainly be incorporated for effect and context, but a continuing drumbeat of its slip into the abyss, numbs the senses and creates dissonance. Expecting anything meaningful from the corporate execs engulfed in this morass is also well past helpful. How in hell are they going to fix anything, considering they helped get us there in the first place.

We begin the long hard process of reconciliation and repair by first throwing in the towel on a failed financial and political system. You throw in the towel to protect your fighter, to save him, so he can live another day. And then it’s back to the drawing board.

I am looking forward to the day when the commentary on the go-to websites incubates, invites and encourages meaningful discussions on where we go from here, because “here” is gone.

Not one little word about the 1000 lb. gorilla roaming the oil fields…. Climate Change. We can’t talk about oil consumption and ignor Climate Change. We have to find a way to stop burning fossil fuels…if you believe what science is telling us.

I worked on Wall St. when they were making up the global warming crap. I still can’t believe the number of people that have fallen for it. Wall St. is a big employer of college professors. They buy the research they want, just like they buy the ratings they want. Global warming/climate change is a made up crisis to tax industry and taxpayers globally. Get use to it and move on.

Just because I am telling you global warming/climate change is crap, doesn’t mean I don’t support anti-pollution efforts, which are necessary and a good thing. Maybe you should concentrate on clean/green.

LOL – they’ve “fallen for it” because it’s reality. I’m afraid you’re the one that’s a little behind the curve.

Reminds me of the old farmer, first time at a zoo. The old guy’s at the giraffe pen, looks at the giraffe standing there, grazing a bit. The old guy looks the giraffe up and down, looks it up and down again, and then says: “Ain’t no such animal.” Yep.

I have said it before, but I will say it again, Trump is running for public office because even billionaires can’t make money anymore. The system is so broken he is compelled to intervene. That is the truth. If the economy was structurally sound Trump would be making deals, not running for office.

Someone made the comment on a blog that oil doesn’t produce anything, it just enables more consumption. With all the oligarchs holding 90% of the money and everyone else being broke, no one has any cash to consume. The perfect scenario for the 1%ers. More left over for them to squander at cheaper prices.

Oil consumption also produces Climate Change… Rising oceans, burning western forests, millions of starving immigrants, dying oceans, species extinction, drought, super storms, suffering on a scale we have never before experienced.

The “spike” in oil prices is taking place now due to the (perpetual) unrest in the Middle East. If peace ever breaks out there – don’t hold your breath, however – you’d have it at $25/bbl. It may just get there anyway, even with the ‘uncertainty price correction’ associated with so much of it coming from such an unstable region. As I’ve been saying for months now, all the pressure on crude prices is down. I paid $1.88/gallon for gasoline travelling in New Jersey last week.

Iran, Mexico, and others will not reduce their output to synchronize with lower demand; they will increase it or keep it the same as they are all – along with Saudi Arabia and Russia – dishonest, lying, one-trick pony, SOBs.

Is it just me or are the wheels falling off everything? Oil is down, yet storage is off the wall. Verizon earnings are in, expected Christmas quarter sales of smartphones down. Harley Davidson sales down. Walmart sales down.

Of course inventories have to hit record highs. Demand decreases with excessive offer and lower prices; soon oil will be as inexpensive as air. Unless something dramatic happens and world supply is endangered. And of course, for the life of me, I can’t imagine just what such a scenario could possibly be.

More wheels falling off….. My son works for California Steel in California. They are laying off all of the employees they hired during the last year. This is a first for them. Here is an article from last year concerning their business model during recessions.

http://www.pe.com/articles/steel-751713-california-tamai.html

Pakilolo, I’m very sorry to see that you have drunk the global warming kool-aid. The leaks of the East Anglia e-mails wherein they admit to fudging data to support their computer generated model laid that hoax to rest a few years ago. Science is a discipline that requires a new theory not be accepted unti independent researchers can reproduce independent results. It is not subject to a “consensus” of supporters of said theory. The purpose of this hoax is literally an act of terror designed to keep the public voting (as Petunia observed) to support confiscatory taxes designed to cripple free trade. Such top down manipulation never achieves its stated goals, indeed they achieve the opposite. Prime Movers advance through needs in the market, and even when they are achieved, as in the transition from steam to the internal combustion engines, the changeover took decades to complete. Don’t take the mainstream media’s pablum at face value. Do your own research. Now THAT Pakilolo is science.

Regards, JULIAN

Thank God for your assurance that global warming is a hoax! Now, at last, the glaciers can stop retreating, the Arctic ice can come back, the pine beetle can stop its advance, the wildfires can stop, the heat waves can all just cool it, and Canada no longer has to spend for any Arctic naval bases. Happy, happy news indeed!

IF you would look you would see last year Oct 16 EIA build 8.23m/b Oct 22

7.11m/b its it maintenance season, also refineries buying more cheap oil as in imports and the EIA using a much larger adjustment number in there calculations.Commerical inventories were 1.5 m/b this week half of last week and those are the numbers that get added to global total inventories not what refineries import.Saudi crude inventories went up because there refining capacity took a huge jump,now they are exporting more petroleum products.You all so notice a draw from Cushing.The new normal for inventories is expected to be in the 430 to 450 m/b , just for the fact the US is using more of its own oil now and inventories need to be higher for the supply chain.

If, as you say… “The new normal for inventories is expected to be in the 430 to 450 m/b…” then the new normal might be $40/bbl WTI or less. Just look what happened to natgas.

The new normal for inventories is more a function of more oil in pipelines and more oil storage needing more inventory because of the recent growth in shale and some refineries using more light oil using less imported oil, when more oil is imported it sits in tankers as storage till unloaded while more domestic supply sits in storage in the US.

http://journalrecord.com/2015/10/09/kinnear-new-normal-for-u-s-oil-opinion/ http://swtimes.com/news/state-news/some-oklahoma-dispute-whether-us-has-oil-glut