Home Capital Group, Canada’s largest non-bank mortgage lender, focuses on “alternative” mortgages, as they’re called euphemistically, that is high-profit mortgages to risky borrowers with dented credit or unreliable incomes, such as self-employed folks or new immigrants, who don’t qualify for mortgage insurance and were turned down by the banks. They include subprime.

Its stock plunged almost 20% on Monday in Toronto. On Tuesday, it dropped another 4% to close at C$32.74, the lowest since September 2013, and down 41% from the halcyon days last November.

Analysts went into a wild and belated scramble to lower their ratings on the stock. It has been the fourth most shorted stock in Canada, with 20% of its free float shorted, according to Bloomberg. Those folks made a bundle over the last two days.

Friday after hours, when no one was supposed to pay attention, the company issued a statement ahead of its second quarter earnings report on July 29 that shocked analysts:

In the second quarter, originations of high-margin uninsured mortgages had plunged 16% from a year ago, to C$1.29 billion. And originations of lower-margin insured single-family mortgages had plummeted 55% to C$280 million.

A warning sign flaring up in Canada’s majestic housing market where prices have soared for years, in an economy rattled by the oil price crash and other issues, and now likely in a technical recession?

No way.

“We think this is an HCG-specific growth issue,” Royal Bank of Canada analyst Geoffrey Kwan wrote to clients, “not an early signal of rising losses or broader housing stress.” However, he did expect industry mortgage loan growth to “slow in the next 2-3 years.”

Just not yet.

The company blamed some changes it had made: It had terminated some of its 4,000 or so mortgage brokers, “which caused an immediate drop in originations,” according to the statement.

It suddenly decided to use a “conservative approach to growing its residential mortgage business.” What had spooked it? What does Home Capital know that we don’t? It didn’t say.

And it blamed “the competitive market for prime insured mortgages.” With mortgage lenders falling all over each other trying to outdo each other to lend in an environment of record low mortgage interest rates and soaring home prices, where buyers outdo each other in bidding wars… what could possibly go wrong?

“We are confident that the steps we have taken in the first half of 2015 were necessary to ensure the continued long-term profitability of our business, in spite of the short-term impact on originations,” explained CEO Gerald M. Soloway.

Home Capital President Martin Reid told Bloomberg, “If we’ve got a broker who’s just not living up to the standards we set, we’ll work with them and try to get it, but if they don’t we’re going to cut them off.” So it’s all just routine. “This time, it just happened to be a few more with a little bit more significant impact to the volume.”

These “few more” brokers that were cut off, of the 4,000 in total, caused this sort of mega-plunge in mortgage originations? He didn’t say. But added, “We don’t think it’s a systemic problem and an ongoing problem.”

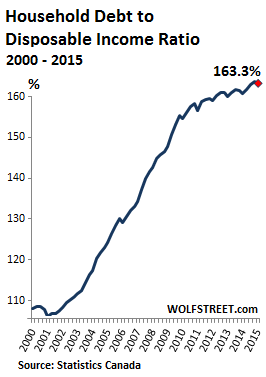

But there may be a “systemic problem” after all. Homes in key markets have gotten very expensive in one of the most, or the most overpriced housing markets in the world. And households are up to the ears in debt, which funded these prices and bidding wars. The household-debt-to-income ratio has nudged up from record to record, now at 163.3%:

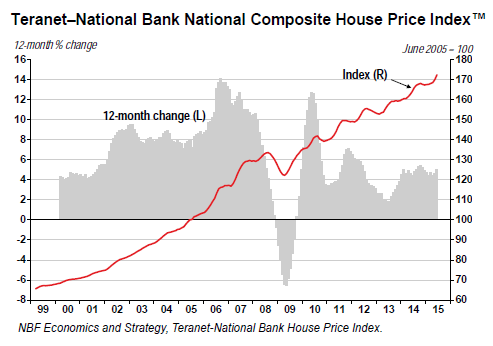

And home prices just keep soaring. The Teranet–National Bank National Composite House Price Index, released on Tuesday by Economics and Strategy of National Bank Financial, rose 1.4% in June, a sixth monthly increase in a row, and was up 5.1% year over year. It now exceeds the peak of the prior housing bubble just before the Financial Crisis by 27%. This is what a truly magnificent housing bubble looks like:

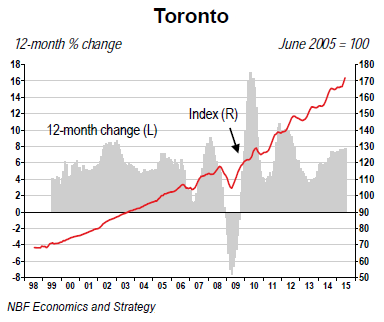

The sub-index for Toronto jumped 7.8% year-over-year to a new record and is now 45% above the peak of the prior housing bubble:

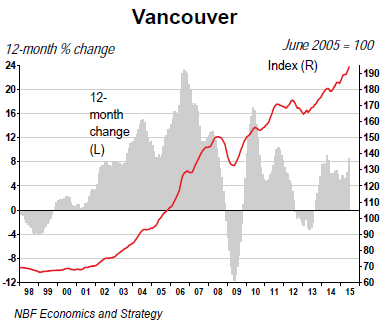

And the index for Vancouver jumped 8.5% year-over-year to a new record and is now 30% above its peak during the prior housing bubble:

While condo prices rose only “moderately” in Toronto and Vancouver with a still delicious increase of 4.7% and 3.2% respectively, according to Marc Pinsonneault, Senior Economist at National Bank Financial, “prices of other types of dwellings were up almost 10%.”

Whether it’s these crazy price increases, the bidding wars that produce them, the elephantine mortgage balances that people with modest incomes buying modest homes have to carry, a growing fear of potential credit losses, the vision of expensive homes being flipped for quick profit…. Whatever it is, the folks at Home Capital are seeing something so ugly that they stepped back from the market in a drastic manner, willing to pay a steep price for it.

There are already enough problems in the Canadian economy. The oil price plunge, job losses, dropping exports, fizzling investments. Now that hope is that the housing bubble doesn’t deflate at the worst possible time. Read… Is Canada Next? Recession Is “Quite Contained”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, this might not be 100% on subject, but I believe the Canadians deserve to know that they’re always welcome in Florida. That’s not to say they can escape the coming financial apocalypse, but at least quality shelter (1,500 to 2,000 sq. ft.) is available here for under $175,000. I’ll add, those in our condo association are amazed at how the people from Quebec have moved in, become members of the board and made fantastic improvements without raising the fees. It’s not like we Americans can afford to lose any friends, especially friends like these wonderful snow geese. Thanks for keeping us better informed.

When I got spanked on my first home purchase (ex-wife nagged me into it over years – we should not have bought – and did buy at the peak in ’07 – and got divorced) I learned a life lesson that is … owning a house is for the rich.

Since then I have found the home ownership discussion with people tends to be fairly black and white … folks who have always been able to clear their property over time as values trend up like home ownership … and those who were new into the market and went underwater or are simply priced out of the market despise the risks of home ownership.

For me, if I can rent a place for 1,500 and buy it for 150,000, why have the liability of ownership? By estimates, that rent is approximate to the mortgage payment. Since I am younger and need flexibility in my career (i.e. oops, TSHTF, time to pack and find another job in another state) renting is vastly more attractive than buying.

Now, if I had a pile of cash, I might think differently. Even then though, I go back and forth as property taxes and crime are things that can change fairly quickly if the local economy goes south.

Regards,

Cooter

I’m in Florida too. I always wondered how all those Canadian snowbirds get so much time off. They are mostly 50/60ish looking and come down from October to March.

Time off? They are likely retired or semi-retired having benefitted from Canada’s, formerly good, pension system (public & private orgs.). That’s changed for younger people so Florida will see less Canadians in the next decade or so. They’ll opt for cheaper places.

Thanks Bob, but there are too many guns and angry poor people down there. Plus, we would lose our single payer medical coverage after 6 months of being out of Province. Plus, we would lose 20% on the exchange.

Nooo, my wife and I will just stay on Vancouver Island where the only gunplay is when I shoot an elk or a grouse. Sometimes, I use a .410 to keep the seals away.

regards

Hah, I am just a few hundred miles north of you … for similar reasons … but health care expenses are nuts on the US side though! I don’t even go to the doctor any more except emergencies. Next time I visit my family or in-laws, I will play catch up.

Rent is very pricey, but property is insane. I will never be able to buy here (or more precisely refuse to buy at these prices). Crime is crazy low for the most part.

I hope to be out of debt in 12 months or so, at which point the wife and I can seriously start piling up some savings. Eventually we think we want to own/operate a commercial property. Not that far along yet … so plenty of time to think/research/change directions.

Regards,

Cooter

Oh I wasn’t talking about full time. I go to the US and Canadian Rockies every year in the summer months. We really enjoy the wild life. In the winter there are as many Quebec license plates as there are Florida plates in this area. Actually, all I was doing with that post was saying, “Thanks Canada for being our friend.”

Pretty much anyone in my neck of the woods with a decent net worth travels south in the winter because they can. As folks get older, the cold/damp is harder on joints/etc.

For example, the grocery stores here look deserted in December when I go shopping, but in the summer the place is slammed. In fact, I think our town population doubles in the summer, but a chuck of that is tourism (and migrant workers in the tourist industries).

Regards,

Cooter

This article reminds me of Countrywide, the CA lender. They saw the defaults before anyone had any idea what was going on because the were lending long to flippers. They also started to unwind their operations long before the big blowup.

Yeah and tanned Angelo sold buckets of turd to sucker BoA in summer of 2007. And Angelo never saw jail…

Call it rich people who swindle millions like Corzinne and Angelo don’t go to jail.

Im gonna change to that name cause too many mark’s lol

Here you go BOC cuts to .5% another quarter point today.

http://www.cbc.ca/news/business/bank-of-canada-cuts-benchmark-interest-rate-to-0-5-1.3152673

2016-2017 crash perhaps?

A lot of the old guys here have been saying there are less people out on the cottages and lakes in Ontario. idk? don’t have one. never saw a use for one. Mind you the gas price here is right back up to 1.23 L where it was before.

Huh. Just learnt HCG owns and/or operates Oaken Financial.

This is interesting to me as a recent seller of the long-time family SFH in North Vancouver, BC, Canada. Prior to closing, I was researching GIC rates online (I know, I know — GIC’s are for brain dead investors…). Oaken continually led the pack with posted rates superior to the big 5 banks. Had never, ever, heard of Oaken before and wondered who/what they were and, more importantly, why they were able to offer 1-yr GIC rates of ~ 2-3% whereas the RBC posted GIC rate was under 1% – way under. Not sure what this all means, especially on heels of this article and recent actions taken by HCG.

After reading this article (thank you Mr. Wolf), and not withstanding Oaken Financial’s, uh, promise of “Educating, Inspiring & Engaging”, I am left wondering if the company would be considered a “safe” place to park some cash over the short-term (ie until after the election here and in the US).

Home Capital Group executives can probably see the spray-painting on the wall.

The chart tells it all. Canadians are rapidly approaching maximum debt.

At some point Canada and most of the world’s developed economies are going to hit that brick wall of debt and their economies will go ‘splat.’

I’d just like to have a crystal ball that can accurately tell me in advance when things go ‘splat.’

When housing and the economy crashed in Alberta, I had very little sympathy for the arrogant Albertans whose oil industry is the dirtiest on the planet. The rich foreigners of Toronto and Vancouver, I hope they loose their shirts as well in the coming crash.

The rest of Canada will be OK, and get through this recession.