KB Home, one of the largest homebuilders, reported earnings on Tuesday. It was all hunky-dory. Shares rose 3.6% in premarket trading. But then, at 11:30 AM ET came the conference call. And what these folks said about the housing market wrecked KBH. The carnage spread to other homebuilders and torpedoed a big-fat rally in the broader market.

So what the heck is going on in this glorious housing market of ours?

Since the implosion of the housing bubble, we the people bailed out Fannie Mae and Freddie Mac. We had home-buyer tax credits from state and federal governments. We got HAMP, HARP, mortgage write-downs, and banks that were delaying foreclosures to pump up prices. We got the Fed’s ZIRP, QE-1, QE-2, “Operation Twist,” and QE-3, during which the Fed purchased mortgage-backed securities, in addition to Treasuries, to repress long-term interest rates, including mortgage rates, to goose home prices. We got multi-billion dollar fines and settlements from TBTF banks who never admitted any wrongdoing. We got private equity funds pouring the Fed’s free money into the housing market, buying up hundreds of thousands of single-family homes to rent them out and drive up their prices.

After all these trillions and taxpayer guarantees and no-cost capital for Wall Street, you’d think the housing market would be in great shape with first-time buyers, the bedrock of a sound housing market, flooding the scene to buy homes at affordable prices, borrow like mad to equip them with furniture and appliances, and push the economy to the next level.

Instead, home prices have jumped – in some hot areas, such as San Francisco, far above the crazy levels of the prior housing bubble. Homes have become unaffordable for many people. Sales are languishing. And everything is off kilter.

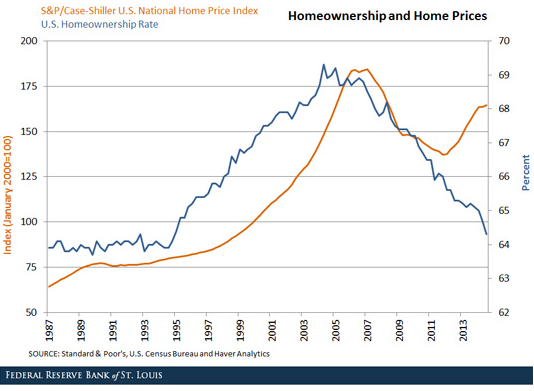

But one thing these heroic efforts did accomplish: they managed to decouple the relationship between homeownership rates and home prices. Ever since the post-war boom, there had been one constant: higher homeownership rates led to higher prices. The principle held during the Financial Crisis when homeownership rates and prices fell in sync. Then, as the heroic efforts to heal the housing market kicked in, home prices began to soar, and homeownership? It dropped relentlessly.

“The first national housing boom in the postwar era that has not been supported by an increased demand for owner-occupied housing,” that’s what a report by the St. Louis Fed called it.

In this chart from the report, homeownership rate (blue line) peaked in 2005 at 69%, “accompanied by a steep increase in home prices,” namely the housing bubble, as depicted by the CaseShiller home price index (orange line).

The biggest decline in homeownership was among households headed by individuals age 35 and under, hence “first-time buyers,” the report explained, concluding that it’s now “possible to have housing booms driven entirely by investors.” And the chart depicts how America has changed from a nation of homeowners chasing the “American Dream” to a nation where Wall Street is the biggest landlord.

This is the environment homebuilders are facing.

So KB Home reported that revenues for the fourth quarter, ended November 30, increased 29% from a year ago to $796 million, due to two factors: deliveries increased 9%; and the average selling price soared 17% to $351,500. Orders and backlog were up as well. Net profit jumped to $852.8 million, a feat accomplished via a tax benefit of $824.2 million. Without the tax benefit, the profit was $28.6 million, up a smidgen from a year ago. Those numbers lit a fire under the shares, and they rallied premarket and in early trading before they lost steam.

At 11:30 AM came the conference call.

CEO Jeff Mezger said that during the prior earnings call, he’d still expected “a slow yet steady recovery” of the housing market, and that gross profit margins would improve sequentially going forward. But the opposite happened. There was a “softening in demand” and “increased pricing pressure” while costs of labor and materials were rising (transcript, Seeking Alpha).

CFO Jeff Kaminski added that the average selling price had increased 18 quarters in a row on a year-over-year basis, but for Q1 he projected it to drop 7.5% to $325,000.

This is the toxic mix that hit them: They delivered fewer homes than “previously expected.” Given “tighter market conditions,” they had to cut prices and throw in more sales incentives. And “cost pressures” were building up in labor and materials.

So adjusted gross margin edged down to 18.7%. It would continue to be lower “for some time,” Mezger said. Year-over-year, Q1 gross margin will “drop significantly,” before ticking up during the rest of the year, but it won’t reach the “goal of 20% in 2015 as we have hoped.”

There was one more thing: California.

The company booked inventory impairment charges of $34 million. Of that, $23 million was for some land in the Coachella Valley area, near Palm Springs in Southern California. The remaining $11 million were for other areas in inland California and also in Arizona. While coastal California is booming, with the Bay Area being “as good as it’s ever been,” the inland areas – the Inland Empire in Southern California and the Central Valley – were “quite a bit softer than they have been.” And so they had to pile on sales incentives and slash prices in “the magnitude of 8% or 10%,” he said. “It hit pretty hard out there.”

And it’s “possible” that there would be “additional impairments in the future,” he said.

Then there’s Orange County, a wealthy enclave. It “softened a little,” he said. He blamed the “Chinese buyer.” Real estate agents were steering them to resale homes because they were a better deal, after new home prices had ballooned so much. And as Chinese demand wanes, “it ripples inland, and the further inland you go the more the ripple is felt….”

KBH had traded in the green for part of the morning, while the Dow was up over 200 points. But word of what was in the script must have leaked out, and KBH soon turned red. The conference call started at 11:30 AM ET. At 11:36 AM, as Mezger was reading off the script, KBH began to plunge in a nearly straight line then zigzagged down further to lose 16% for the day, and 44% for the last eight months.

Other homebuilders, after rallying, got hammered too. DR Horton dropped 4.8%, Lennar 1.7%, PulteGroup 2.5%, and the iShares US Home Construction 2.5%. The Dow began losing its grip at about 10 AM and dove over 400 points peak-to-trough, then bounced off and settled 27 points in the hole.

Broader home sales have been terrible. The bitter irony of the Fed’s handiwork. Read… Last Time Inflated Home Prices Strangled Sales Like This, the Housing Market Crashed

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The aggregate home valuation in the US on January 1, 2001 was $14 trillion. On January 1, 2006, just five years later, it was $23 T (published in August 2006 in The Economist). Obviously, you don’t add 9 to 14 and hit 23 in half a decade if you’re looking at realistic appreciation and new construction. At the end of 2014 Q1, aggregate home value was $23.7 T (according to landdata-fhfa-national-2014q1). So we are essentially where we were, in terms of total home value, nine years ago. But in fourteen years, we have added 70% from where we began at the dawn of the housing bubble.

This is probably a fair valuation in an economy that’s got growth, but we’ve had a pretty static GDP since the ‘financial crisis’, and I reckon ultra low mortgage financing has skewed the valuation up a trillion bucks or so. What Mr. Richter writes is a sad commentary on our system where first time buyers are being left out even with such low interest on fixed rate mortgages.

Thank you for telling it like it is Wolf!

KBH sells cheaper and many say shoddily built homes and may sink more than say Lennar in not so desirable locations like Coachalla and all over Riverside/San Bernadino counties which took a hell of a hit on last downturn.

History does repeat…

Have recently done kitchen, bath, roofing and fencing upgrades on my properties and can say materials have doubled in price in 10 years. Labor not as much and some labor like carpenters are the same as 10 years ago. It’s all about rising prices and stagnant wages everywhere. Low interest rates only go so far.

Do not worry Vespa, all the “desireable” areas in California will have their turn next.

The central question is why after all of the political hoop-de-doo the housing market hasn’t recovered as it should. This one doesn’t take Sherlock Holmes to solve. Simply look at wages. Adjusted for the inflation the Fed says doesn’t exist, wages have been declining for decades. The increases in housing prices have priced John Q and his wife out of the market. They have to struggle to feed their kids. What housing price increases have occurred are in enclaves like NYC and Silicon Valley where wage growth has been real and material. The enclaves of the wealthy such as Greenwich and the Golden Orange, have also suffered little.

Since Greenspan, the Fed as functioned as a sort of Robin Hood in reverse. They’ve taken from the poor with financial repression to give to the rich with QE . So, maybe the term should be “Robin Hoodlum”. What the hell, it’s passed being funny, and I don’t see this changing anytime soon.

Then there’s Orange County, a wealthy enclave. It “softened a little,” he said. He blamed the “Chinese buyer.” Real estate agents were steering them to resale homes because they were a better deal.

Now that’s funny! Blame the Chinese buyers (suckers buying on top?) and RE agents due to new house priced above the resale (time for standing inventory fire sale?).

I lived in Irvine 20 yrs ago and bought new home from Std Pacific and ex-model home from Cal Pacific within a 3 yr period. 1995 was low point in So Cal market which blew up in 1992 and the new standing inventories were priced way below the resales with lot of builder upgrade giveaways which in turn brought down the $ per sq ft for the whole neighborhood. I sense another housing bubble about to burst?

This provides a more clarity on the nature of KBH’s earnings:

http://investmentresearchdynamics.com/housing-look-out-beloooow/

KBH is a viper’s nest of questionable accounting practices. It’s cancellation rate in Q4 was 37%.

Household income is down.

Household debt is up.

Unemployment is up. An increase in burger flippers is not counted.

Household savings is down.

Ratio of average house price to average household income is much too high. It will revert to the mean. It always does.

Is anybody surprised that the real estate market is dead?

It can’t all be supported by wealthy Chinese fleeing the crackdown on corruption.

Two points, 1) to call OC a “wealthy enclave” is about as silly an oversimplification as can be imagined…south and coastal areas are, rather, wealthy enclaves IN the county, much of which is quite poor indeed (most of the densely populated north and central county.)

2) the massive pouring of money into investments as rentals is going to end in an OCEAN of tears…for the investors, tenants, and neighborhoods where they’ve taken root. It’s simple – they don’t have a clue, don’t care to, don’t give a flying fig about the properties or tenants. I know, I just rented a house from such a group (a piece of one of the largest investment firms in the country) and let me tell you it was such a debacle all I could do at a certain point was laugh. Suffice to say that they did nothing about a KNOWN water leak in a wall until the whole wall caved in with the house uninhabitable due to mold…and that was just the final straw of many. And they didn’t seem to care even THEN.

We will have (well, most likely already do) a nation littered with totally un-maintained homes rotting like carcasses, or occupied by the poor souls with no other option than to hold their noses and deal with living in a falling down s hole owned by strangers who literally don’t give an F.

Lovely.

How fortunate that some people were able to sell their stocks early enough before noon to avoid losing the 16% more that others in the afternoon lost.

6 minutes into a conference call/report – WHILE the report is still being read?

???

Totally sounds like insider trading by some of those that were on the conference call – hurrying up to sell, before the report is even finished, and long before the report was made public to anyone else.

I’d really like to see WHO did the selling of their stocks after 6 minutes into the conference call, as to start the immediate price dropping of the stocks.

Rather than bemoan their unfortunate stock drop —

Let’s investigate insider trading that caused the price to drop precipitously that day *while* the report was still being read out to a small audience of people well before the public release of the info.

Not sure if the contents of the report “leaked out”, or if a few of the listeners on the conference call simply made decisions 6 minutes into the call to get on their stock websites or have their secretary call their brokers or whatever, to start selling immediately before the report was even finished…

I think it would have been a few listeners of the report that did the immediate selling, not that the report “leaked out”.

*snip*

KBH had traded in the green for part of the morning, while the Dow was up over 200 points. But word of what was in the script must have leaked out, and KBH soon turned red. The conference call started at 11:30 AM ET. At 11:36 AM, as Mezger was reading off the script, KBH began to plunge in a nearly straight line then zigzagged down further to lose 16% for the day, and 44% for the last eight months.

*end snip*

My guess: combo of insider knowledge and trading algos.