Icahn gets totally crushed by Hertz, goes for More Pain.

Hertz Global Holdings, the giant rental car company which also owns Dollar and Thrifty, got crushed on Tuesday, as is so often the case, by an otherwise boring accounting entry.

Depreciation of its cars had to be adjusted. Depreciation of the rental fleet is a huge expense in the industry: for Hertz, 29% of its total expenses. Depreciation is supposed to bring the value of these cars down to what they can be sold for when they’re scratched and dented and have 37,000 miles on them. Depreciating the fleet just a little less aggressively would boost earnings for a little while and is a very tempting strategy.

But a few quarters later, when the cars have to be sold, reality comes home to roost.

This accounting entry also shows how ever so slowly the rug is being pulled out from under the booming auto industry.

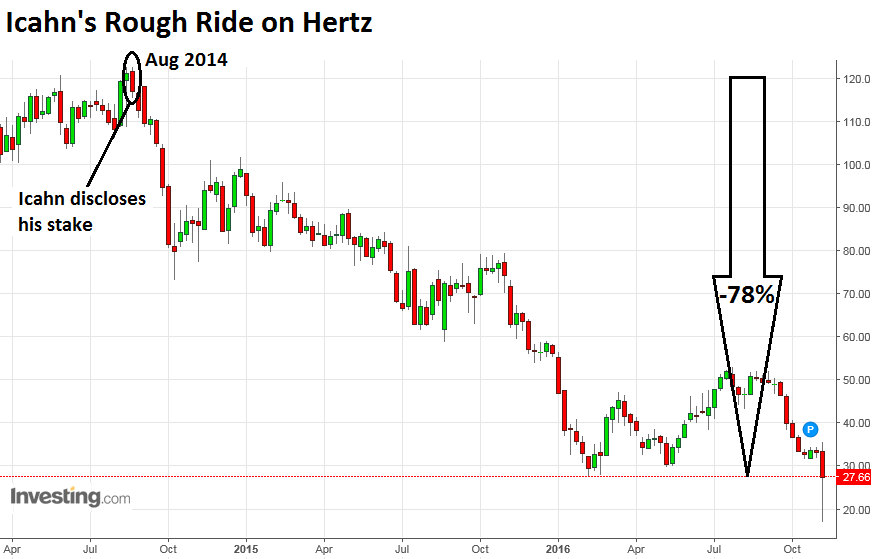

Hertz shares plunged 52% in the morning to a low of $17.20. Then the company’s largest shareholder, Carl Icahn, stepped in with great fanfare and single-handedly worked a miracle. He’s got a lot on the line. He disclosed with his media-savvy fanfare in August 2014 that he’d acquired an 8.5% stake, which he since raised to nearly 16%.

Today, he “swooped in to purchase another 15 million shares,” raising his stake “by more than a third,” according to MarketWatch. And after this relentless buying, shares recovered and ended down “only” 22.5%, and down “only” 78% since he disclosed his initial stake in August 2014:

It was still the worst day since its IPO in November 2006 when private equity firms ML Global, Carlyle Group, and Clayton Dubilier & Rice – which had bought it from Ford the year before – flipped it to the public near the peak of the last bubble. Ford had originally bought Hertz in 1988 thinking it could get a huge captive customer that it could stuff with its excess vehicles or whatever.

Spooked by the issue of depreciation – and declining used car values, which would hit the entire industry hard – investors dumped Avis Budget Group as well, and its shares dropped 9.5%.

On Monday night, Hertz had reported that earnings per share in the quarter had plunged 81% under GAAP to $0.49! Revenues edged down 1%. It cited falling rental car volume, falling rental rates in the US (down 3%), and falling values of the cars in its fleet.

Due to lower resale values in compact and mid-sized vehicles in the US, it increased the depreciation per vehicle by 14% in the quarter. The depreciation expense for the quarter for its US fleet rose 16% to $462 million. Its global depreciation expense rose 10% to $695 million.

It also slashed its forecast for the rest of the year. “Adjusted” earnings might be as low as one-fifth what its previous forecast.

Hertz, which is junk-rated and has $14.9 billion in debt, saw its bonds getting creamed too despite general euphoria in junk-bond land.

For example, its $800 million of 5.5% notes due 2024 (rated B/B2), which it had just issued in September, and which had traded as high as 101 cents on the dollar on October 10, and which closed at 96.5 cents on the dollar on Monday, fell to 88 cents on the dollar by mid-morning on Tuesday, but then perked up a little to close at 90.45, according to Finra data.

Its $500 million of 6.25% notes due in 2022 (B/B2) dropped 6.75 cents to 94.75 cents on the dollar by midday and closed at 95.75. It was their worst one-day drop since they were issued in early 2013.

Hertz had already been forced last year to restate earnings due to accounting “errors,” that cost CEO Mark Frissora his job. On November 9, 2015, while reporting another sordid earnings surprise, it slipped in that it would have to restate its earnings from 2011 through 2013 and continue an audit that had already found $87 million in errors.

And it said that it had been advised in June 2015 that it was being investigated by the SEC. Its shares plunged the most in two years.

Whatever those issues were and are, now Hertz and the entire auto industry have a new problem: declining values of used compact and mid-sized cars.

According to Manheim, the largest auto auction house in the US, wholesale values of compact cars fell 3.4% in October. Its overall index declined 2% in October and is now up only 0.6% from a year ago. But Manheim warned that its index “does not account for overall inflation in new vehicle pricing or the shift to higher trim levels.” So the index may rise due to inflation “even as commercial consignors report less-than-satisfying end-of-term lease residuals or lower repossession recovery rates.”

Based on other measures, it said, “wholesale pricing has shown some easing of late, but it is not particularly weak. This is in line with our beginning-of-the-year expectation as we fully expected the wholesale supply challenges would be more daunting in 2017 and 2018 than in 2016.”

So this is just the beginning.

There had been signs. A number of analysts were getting antsy, including the NADA Used Car Guide, a division of J.D. Power, which warned in April that 2016 “will mark the biggest jump in the supply of used vehicles in the US market in eight years due to a dramatic increase in off-lease maturities….”

This supply of used vehicles from lease turn-ins and other sources coming on the market is already pressuring prices in some segments. High wholesale values – which soared after the “cash for clunkers” program that had taken a whole generation of cars off the market – are part of the foundation of the auto boom that lasted through 2015. But now companies, including Hertz, are admitting that this foundation is cracking, and Icahn may be in for more of a very rough ride.

The automakers are already singing the blues. “We continue to match production with demand,” Ford said to explain plant shutdowns and layoffs. Read… It Starts: Shutdowns, Production Cuts, Layoffs at Auto Plants

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

About a month ago I sold a kayak to a guy who arrived with wife and kids in a 2104 Mazda 5 SUV. He’d recently paid 12,000 for it and it had 12, 000 kilometers on it. So he paid less than half price for a car barely broken in.

Why such low K’s? It probably didn’t sell the first time until 2015.

There’s a lot of mark- to- market coming up with this industry, and of course Mazda holds value well.

The Forbes site of 14 cars not to buy has 3 imports and 11 domestics.

Jeep scored a trifecta- with Patriot, Compass and Cherokee.

Re: Mazda holds value. Of course I mean relatively. And this guy clearly got a deal no doubt because he bought privately and had 12 K in his hand at the right time- probably from a HELOC.

The point being that makes other than Mazda depreciate faster- so if this guy could score this with a Mazda, how will the others fare at 3-5 years old?

For Hertz to have its 14.7 billion debt secured by inventory of cars, it would have to own 500,000 with an average value of almost 29K apiece.

So I guess there is a lot of real estate? Good will?

Hertz purchased 350,000 vehicles just in the US in 2015. So you may be close with your estimate of 500,000 units globally.

The cars are usually funded on a revolving line of credit secured by each car.

http://ir.hertz.com/2014-11-14-Hertz-Announces-New-U-S-Rental-Car-Fleet-Strategy

But also, some of its bonds may be unsecured, and the proceeds may just be used for “general corporate purposes.” I doubt though that it has a lot of RE.

They built a very nice GLASS building just south of me in Estero, FLorida.

I can imagine their electric bill. My home is $375/month and my office building is $650/month due to our wonderful Sunshine.

He keeps on Buying and it keeps on going down.

Whats he making on his option trades??

So many times these guys play both sides of the fence.

In spite of the fundamentals of the auto industry, I feel bad for Hertz. They are being singled out for bad accounting, when that could be applied to most of the corporate world.

Is it bad accounting or dishonest accounting, I’m not sure but there’s a huge difference in my mind. Perhaps that’s the reason for some rebound from $17

Travel industry seem to be one that requires some disposable income, which has been vacuumed up by WS and their tentacles that have been nurtured based on false premise as opposed to pruned as therapy for an out of control cocaine habit.

@ Nick Kelly, thanks for your comments. In Thailand, people I know sold a 2 y.o. Mazda 3 and were offered about 40%. That’s shocking in a country where even junkers are flogged with sticker prices of > 100,000 THB / $ 3,000.

Overproduction with new cars being parked somewhere is another ripe issue in Europe. Disused airfields… PArked cars deteriorate rapidly. Not sure if it’s condensation inside the engine? My own ’91 Toyota never recovered from sitting for 8 months in L.A.

The crazy Krauts decided to abolish all conventional vehicles by 2030. No vote, no industry consultations. Now they are proclaiming “zero emissions verhicles”. Which don’t exist.

There used to be a massive “dumping ground” for cars near Swindon, where Honda and BMW factories are located and which served not merely for locally built cars but the Nissan’s and Toyota’s built way up north in Burnaston and Washington.

This “dumping ground” was cleared in late 2015.

Now car manufacturers are dumping their cars in Spain, as apparently the land there is cheap enough and the authorities don’t ask many questions as long as taxes and fees are paid.

It is AMAZING what goes wrong with a car that sits for a few months.

Item: once when I was budget shopping i looked at a Toyota. I asked the guy if I could my plate on and take it around block. No.

Hmm- can I move it back and forth in driveway? Yes.

But it won’t move. He’d left the hand brake on for months and it wouldn’t release.

Item; I’m in Midas but the poor lady in front is being quoted 2K or something- she’d gone on trip left BMW in garage, but had just driven through puddle. Discs corroded or something.

Item: the thermostat will quickly rust in shut position if left for months. Car will overheat, damage engine.

Item: the car battery will be junk after about 6 months. I learned this after removing a near new one from a car I was junking. Six months later I went to get it charged- shot. The discharge- charge cycle keeps it fresh.

If you are going away for a few months, get someone to start car once every two weeks, run it for ten minutes and ideally drive it around block or at least move it a bit. And don’t leave the hand brake on.

As one of those who lives as independently of economic gyrations as is reasonable, vehicle prices are of concern relatively infrequently.

We own vehicles chosen for long-lasting reliability, for over twenty years.

My Buick has nearly 300k miles on it now and still looks good, runs and drives like a top. Not bad really, considering 17 salty winters this car has not been babied and the undercarriage is beginning to reflect it’s age.

$75k for basically the same car new IMO would be WAY TOO MUCH.

You ain’t no chicken – you a wise owl.

“…….300K miles and still looks new……..considering 17 salty winters…….”

I’m throwing the “BS” flag, dude. If it survived “17 salty winters” it’s because you kept it in the garage during the winter and drove a beater. Or they only laid down the salt once in a while, when the roads were iced.

How many years does it take to rust a car in the DC area, if yours is an Mercedes then I can understand your skepticism.

And, I didn’t claim the vehicle still looks new. Your reading comprehension apparently is weak?

How will the purchase of these used cars take place? Auto loan or cash? Most people haven’t got the cash. Without availability of loans, prices head south petty seriously. I only buy used and I have gotten some very good deals lately.

Saw my 1st Tesla on the beltway late morning today, a Model S. Admittedly, I only travel the beltway once a month every month but it was an interesting 1st sighting and to think it was sporting California tags WUWT?

There is a really nice, huge, Outdoor, Big Box, mall in the Bonita Springs area of South West Florida which has a TESLA recharging station in the parking lot !!!. Really.

There are usually 4 to 5 cars there, plugged in, while the drivers shop in around 75 nice stores, from Bass Pro Shop to every restaurant imaginable.

My son LOVES going there to walk around. Nope, not for the Bass Pro Shop but rather to look at the TESLAs being charged since he loves them.

Sorry, Son, daddy ain’t going to buy you a TESLA. HA.

I’m up in Sanford and the City provides a few charging stations downtown. They always have Teslas attached. I guess it makes the locals think that downtown must be slick if the rich folks are hanging out there.

Must be nice to be able to afford a Tesla, not have to pay gas, and get the gov to pay for your juice.

AND you get a parking spot close to the store.

Supposedly Icahn, that old fox went home after the Trump victory and bought 1 billion dollar worth of stocks, meaning whatever losses he has from Hertz has probably been wiped off.

North Georgia, Gainesville. I am seeing more and more cars for sale in yards sometimes a vacant lot. My guess is the dealers are not giving much in trade. Not in the car business so just a guess.

Agree, I think prices of lightly used cars should be approaching buyers market. I know a couple of guys who go to dealers auctions who’ve been doing well.

I bought an Impala 6 months ago at Hertz after looking for 3 months at dealerships and private parties. I was surprised at the high prices, dealers were well above Blue Book and private sales were at or above as well. I found no advantage in having cash as loans were so easy and pushed so hard. On their website, Hertz had the Blue Book price listed with their price 2-3 thousand below it. If you’re in the market you should check it out, especially now that prices are coming down. Enterprise prices were consistently higher than Hertz. This was in Houston.

Easy loans on second- hand private sales? Is the ‘easy’, easy to get or easy as in a good rate? I’m sure the 29% loan is easy to get.

The reason you can get great deals around here if you have cash is that low interest loans only exist for new or almost new cars on lots.

I think this is why so many people end up in the black hole of personal finance -the lease.

However I would try Hertz over a lot that only sells cars.

if they’re selling new cars low down to general credit, there are trades, and sales prior. buying new instead of leasing or end lease buy.

therefore, more used on market = supply greater than gross demand = declining prices.

and off-rentals are beat cheepos, not hondas and toyotas etc.

seen any used tire joints lately? any wonder where those tires come from?

car sales are post-peak, but the financing lives on.

car parts, anyone?

Hertz was once a reliable, high quality service. Now, trash cars with 40k on them, dirty interiors and reliably inexperienced staff.

There is almost always something wrong with a car I rent from them – major (engine problems) or minor (weird noises). Or, even worse, no car at all when you arrive!

I frequently travel to several cities and juggle rentals. Only Avis has maintained standards and most importantly many of their staff have been around for years. Hertz now recruits young, inexperienced staff that come and go.

My last Hertz rental agent had fingernails so long she could barely type on the keyboard- they were neon colored and covered with glitter!

It’s usally more expensive to rent from Avis for a reason (new cars, and trained staff!).

Man I wouldn’t want to own Hertz! Heavy price competition – thank you Priceline, etc! Rising costs – thank you mark to market on used (largely undesirable) cars and a huge debt load.

I rarely rent cars now but the last month I rented one in Arizona – costs seemed high, especiallly at Hertz, so I did the Priceline thing. Here was a surprise I got the same Hertz rental at half the price Hertz was quoting on their website. Hmmmmmm…

Uber is probably also making a dent in their business customer market. When visiting a city now it’s more practical to use Uber instead of renting a car and dealing with parking. In the past you had to book a car for the full day and it was expensive. It may be a small factor but it’s another negative one – seems like they are all negatives….

Missed it though – should have been short.

That’s a great point about Uber eating into their business of short-term rentals. I have no data on this, but I’m sure the rental industry is worried. I don’t think it has a big impact yet. But it might be gnawing away at it at the margins, and gnawing deeper into it.

Tons of used cars on the market, from new trade ins to cars that are being repoed. Once again, too much easy credit is creating significant problems.