This has never happened before, ever.

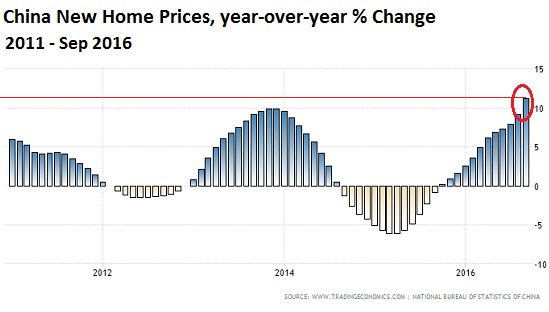

As a consequence of a dizzying buying frenzy in September, the average price of new homes in China soared 11.2% from a year ago, after a 9.2% jump in August, the National Bureau of Statistics reported today. It was the 12th month in a row of year-over-year gains, and the largest increase on record.

The average price of new homes rose in 63 of the 70 cities in the index. It dropped in six cities and remained flat in one. But all heck broke lose in tier-one cities: In Beijing, the average price skyrocketed 27.8%, in Shanghai 32.7%.

This comes after authorities have unleashed a tsunami of liquidity that triggered a record borrowing binge. In response to the prior deflation of China’s house price bubble, and the social unrest it began to entail as folks saw their life savings evaporate, the People’s Bank of China cut interest rates six times in the eleven months leading up to October 2015. The benchmark mortgage rate dropped to a historic low of 4.9%. Last month, the medium- and long-term loans to households, mostly mortgages, ballooned by 571 billion yuan, as the total value of new homes sold (a function of price and volume), according to Bloomberg calculations, soared 61% year-over-year, nearly double the increase in August.

The chart by Trading Economics shows September’s record surge. Note the 6.1% decline in March 2015, the sharpest decline on record – hence the panic at the time among Chinese authorities to stop the collapse and reflate the bubble:

But for months, local and national officials have fretted about the resurgence of the housing bubble. It is debt-fed, and thus highly risky. Once prices turn south, the shrapnel would not only hit the banking sector but the real economy. Given the large proportion of Chinese savings tied up in housing, the people aren’t going to be amused either.

So in trying to put a lid on the bubble, at least 21 cities have imposed property curbs, including larger down-payment requirements. In Beijing, for example, the government ratcheted up the size of the minimum down payment for first-time buyers to 35%, the highest among tier-1 cities. Some also imposed limits on purchasing multiple units, a popular form of speculation, like buying stocks in the US.

Most of these new limits took effect in the first week of October. And this likely triggered the last-minute buying frenzy in September, ahead of the restrictions.

To show that the new curbs are having an effect in tamping down on the housing bubble, the freaked-out government did something it had never done before: with the whole-month data for September, the National Bureau of Statistics also released preliminary data for October. And prices are suddenly plunging.

For example, the average new-home price in Shanghai dropped 2.5% in just those days since the end of September, and in Beijing 3.7%! If this rate of decline were to continue for a few months or longer, it would cause all kinds of fireworks.

The National Bureau of Statistics commented that the market “apparently cooled” in reaction to curbs implemented in some cities.

But how much of this is just short-term showmanship as the government tries to manipulate the price into what it thinks is the survivable level – whatever that may be, but high enough as to not crush the property sector, one of the last remaining growth engines of the Chinese economy.

Doubts are already cropping up, given the liquidity sloshing through the economy.

“The curbs will show their effect in the initial two-to-three months, but in the longer term idle capital will still likely flow to property in the largest hubs as ‘safe-haven’ assets,” Xia Dan, a Shanghai-based analyst at the Bank of Communications, told Bloomberg. The impact of the restrictions will abate as “liquidity is so abundant in a credit binge,” she said.

These curbs bite temporarily until people figure out how to get around them. And that won’t take long.

What would really deflate the current house price bubble in China and bring it back to earth? Draining the liquidity from the system.

But that would be a shock to the economy already over-burdened by debt – an unknown portion of which is bad debt on the banks’ books, by some estimates up to 20%! Trying to crack down on credit expansion – the fuel that the economy lives on – would likely produce some very ugly results. For policy makers, there is no longer a good way out. Market forces certainly won’t be allowed to clean up this mess. The thing to do is to kick this can down the road as far as possible.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I have been writing about the US crash and “recovery” for 6 1/2 years. Bubbles do not just end with a gentle release of air from the balloon. They burst and then all hell breaks loose. Can the Chinese govt. interrupt the crash as the regulators did here in 2009? They think so. I don’t. If they continue to tighten lending standards, sales and prices will plunge. Then what? A repeat of the last year? Wait until Chinese sellers come out in force. Can you restrain them as they did with stock sellers? Dream on.

“Then what?”

back into the stock market, just like last time, then that will burst and then back into RE.

that seems to be the cycle.

It’s hard to believe that people are stupid enough to fall for this again, but this just shows that stupid has no national boundaries, especially when it comes to real estate.

One needs to remember until 2000 or so housing bubbles tended to be highly localized, exceptional events. Housing in itself was seen throughout most of the world as an alternative to investment grade bonds: it didn’t pay that much but the risks were negligible.

I don’t remember which industrial-grade crook during the Dotcom burst proposed the creation of a housing bubble to drive GDP growth and provide the infamous “wealth effect” but that was the beginning of the end for housing, which was converted from a safe haven for risk-averse savers (or a place to live and work) into just another asset class to be speculated upon.

Fifteen years is a relatively short time as far as assets go so people in most markets have only seen one burst, so they delude themselves into thinking housing is “different”, meaning it doesn’t go through the same lean cow/fat cow cycle as any other asset. Yes, even stocks: just look at the one year graph for AAPL.

In the case of China I’ve noticed that a big part of the local investment mentality is “Make as much money as you can damn right now because you never know what the Communist Party will come up with tomorrow”. So if there’s a bubble that gives massive returns (and I’ve seen and cashed on the returns on the stock bubble they had in 2014-2015), people pile into it in a way even us Westerners find unbelievable.

What would really deflate the current house price bubble in China and bring it back to earth?

A real excuse to do so. Like a global economic crisis. Because then people would “understand”. This is where Europe and the US can do their part. Although the Chinese Central Bank would complain about the Fed raising interest rate, deep down they want it to happen, so that they can “crash” the economy while having a boogeyman to point to.

Mutually Assured Globalization Destruction!

I just love the smell of napalm and Aqua Velva wafting in the early morning air.

I was in China, Beijing specifically, just last week and saw some of the realty craziness myself (ok it’s hard to see anything with the smog, but you know what i mean;) Had the pleasure of visiting a working class suburb and remembered to ask some locals about apartment prices. 1mm yuan for a 90 meter apartment seems reasonable for a modern city, but this was in a blue collar neighborhood far from the city center.

My thought is they are trying to fake it until they make it. After all the country has made incredible advances until now, and no one seemed too worried about a crash, though a few guys budded into our conversation to complain of high rents.

The reality is that China has built nice housing for its citizens. I wish them luck in whatever happens next.

Look at Japan as another example. They’ve wasted tons of money but their transportation system and infrastructure is world class.

Murica though… LOL. I live in the Bay Area, and let’s face it, the public transportation system in this place is absolutely third world.

These alarmist articles always highlight Beijing, HK, Shanghai and other Tier 1 cities. They do not represent real estate affordability in most of China. In these cities prices can run over 30,000 RMB a square meter. That’s like looking at Park Avenue in NYC and the Bay Area in San Francisco and assuming all of America is the same.

I spent 4 days recently on the Yantai-Weihai peninsula, not too far from Beijing. New homes there run 3000-5000 RMB a sq. meter. In Penglai there were new waterfront homes in this price range. These are decent Tier 2 and Tier 3 cities that more accurately represent what the average Chinese home buyer experiences.

Also, most cities have special affordable housing for lower income families and rent-to-own programs for those with even lower incomes.

No it isn’t “Third World”. It’s just not competitive with all the money and effort poured into freeways. Caltrans in the 1990s ran an exhibit at Bank of America in Concord, about the $777 million dollar replacement of the 680-24 “Tee-Intersection”. And that’s just one section of road. BART is patronized to overcapacity, but there is no easy way to expand it.

Nairobi has no subway system, no freeway network. That would be “Third World”. No comparison to the “Bay Area”. Remember, people read this from around the globe. Don’t sensationalize stuff.

Cairo, Egypt – most decidedly “Third World” – has a great subway. I used it back in the late 90s when it was brand new. The only spic-and-span place in the entire country, it seemed.

Didn’t I see last week that China was going to build a new Cairo next to the existing one?

Yes, seems like it.

I live in rio de janeiro, florianopolis brasil, tahoe, and the east bay. The difference as one reader.alluded is is freeways for cars. Most older countries particularly those with poor eminent domain dont have good.freeways. the bay area has excellent freeways and a mass transit systems that are mediocre for the most part. I think the bay area is much better than rio or.sao paulo, and id prefer to paris or london as i prefer to drive. paris has great subways but lousy freeways, same with london. Youd think the internet would allow people to spread out and would enable a more distributed system, but everyone wants to live.in.the.big city. Bay area isnt great and isnt lousy, but would prefer.to most other govt systems. If u dont like the traffic of the city then move.out.

china is like oz. They try to slow the bubble but cant without crashing so they go back to feeding the beast. Eventually real hyperinflation will take over. With a crash debt laden assets at the same time. That will kill the those assets.

Good reporting, Wolf, and I admire your numbers. I cannot quite flesh it out, in a logic and reason way, but I think back to the rolling explosion (so it seemed) that was the financial crisis of 19987-98; Russia, Indonesia, Korea, Japan…they have all changed, and China…huge changes! Are we in such a much more complicated place in a much more, increasingly complex world, that financial crises cannot have worldwide distance, only local explosions contained by walls of money set in place by foreign entities, unwittingly dampened contagion by the size of financial entities? (e.g. Apple’s factories in China, as a small example)

Wow this is really something. China house is a big winner on stock markets!

“Given the liquidity sloshing” is a very accurate illustration. As you have perfectly informed your readers of Chinese money pouring into Canadian real estate, so too has it made its way into the automotive market, where those children of foreign Chinese real estate owners are now being gifted Porsche SUV’s, as now the status symbol BMW’s just don’t cut it anymore. Working in Markham, Ontario, There are more Chinese teenagers driving $100K cars than I have ever seen.

are anecdotes the truth or just anecdotes?

the zero bound sum game conundrum.

i hereby claim copyright.

While the bubble is inflating people get the true joy of Capitalism.

Making money while doing nothing.

You use your money to make money.

Hard work is a fool’s game.

Do you ever see Warren Buffet getting his hands dirty?

The successful capitalist rides on the back of other people’s hard work.

“Do you ever see Warren Buffet getting his hands dirty?”

No, but i did see that slime ball beg for a bailout…..isn’t that the same thing? And it was at that point i realized who W.B. really was.

+++++

I rarely pray, but if there’s one wish is that he lives long enough to see his empire finally crumble. Ain’t gonna happen obviously.

“The benchmark mortgage rate dropped to a historic low of 4.9%. Last month”

and i say, so what? as I’ve read here and has been parroted at almost every website that talks about China and RE, there can be no bubble cause in china most pay all cash for RE.

so why would the rate even matter then?? OR HAVE WE BEEN MISLEAD?

I live in Vancouver and the residential market peaks traded off commodities in 1974 and in 1980. Following the latter, high-end such as “British Properties” fell to, repeat to, 1/3 of the high. Ordinary nice like in Kerrisdale fell in half.

A friend who managed fixed income went to Tokyo in late 1989 when that bubble was on. Some king of a tour for fund managers. He came back and excitedly reported “It is just like the Vancouver Stock Exchange, only huuuuge”. Tall developed properties trading at high valuations. Next door not developed but touted as being “next” to something. Similar to getting some “moose pasture” claims next to a mining discovery.

All bubbles reach a “gossamer limit” and crash.

Bob Hoye

So, what’s going to happen if governments keep fiddling with markets like this? If they keep piling these fake values on top of each other surely it would all come crashing down…but they don’t want that to happen, except they don’t know how to keep it from happening except by imposing fake value and worth on the market.

It feels like they’re just putting off massive problems down the line but if they keep doing that, can they really stave off a market crash in the future? It doesn’t seem like it and yet the crash keeps not happening and life is relatively normal, except everyone is very nervous.

I’m a new comer to all this market stuff, so can someone explain it like I’m 5 years old?

Japan had a massive real estate bubble that burst in 1989, it has never really recovered.

The US had a massive real estate bubble that burst in 2008 and they used complex financial instruments to spread the damage throughout out the West. The global economy has never really recovered.

The countries that escaped 2008 have engineered their own real estate bubbles, which have already collapsed or will collapse soon, e.g. China,

Australia, Canada, Ireland and Spain.

We’re all turning Japanese.

Just imagine if the human race were capable of learning from past mistakes in a globalised world.

You will find commentators in Canada (until recently) and Australia are still in full new paradigm mode and wallowing in blissful ignorance.

Globalisation never stood a chance; the human race is too thick.

“If I am making money now and will make a good bonus at the end of the year, what else is there?” the cretinous human being.

Just as well we have a technocrat elite in independent Central Banks looking after things.

Does anyone know what they do all day?