They’d believed in six years of Wall Street hogwash.

Not that you would have guessed from the stock market, hovering at all-time highs, or from soaring junk bonds, even the riskiest paper: CCC-and-below rated junk bonds skyrocketed since their February 12 low as their average yield plunged from 21.6% to 13.5%. Even the S&P US Distressed High Yield Corporate Bond index has soared 57% since February 12.

Those are miracles to behold.

At the slightest squiggles of the market, the Fed goes into bouts of by now embarrassing flip-flopping on rate increases that demonstrate to the world that they have absolutely nothing else in mind than keeping the stock market inflated and keeping the biggest credit bubble in US history from unceremoniously imploding.

And the ECB is out there with its scorched-earth monetary policies, with negative interest rates and bond purchases, including asset backed securities and corporate bonds, that it has been caught buying directly from issuers. It’s driving even corporate bond yields into the negative. Just now, French drugmaker Sanofi and German household products maker Henkel issued bonds with negative yields, thus getting paid by these hapless investors to borrow.

The idea for bondholders being that you have practically no income throughout and get “most” of your money back at maturity. An idea that is sending NIRP refugees into US assets, driving up their values and pushing down their yields. It all works wonderfully.

But beneath this magic is the real US economy, and there, despite this flood of money and the low interest rates and the soaring stocks, and all the shenanigans to keep the credit bubble from imploding, business bankruptcies are soaring.

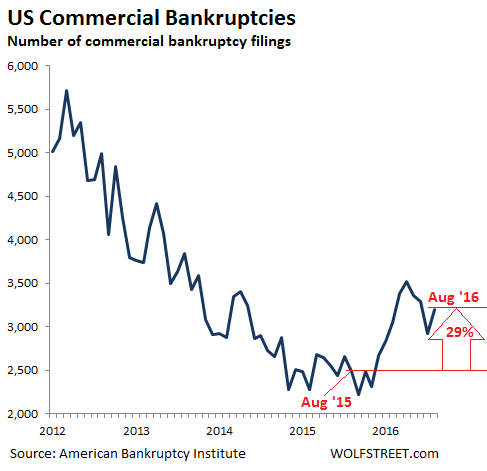

In August, US commercial bankruptcy filings jumped 29% from a year ago to 3,199, the 10th month in a row of year-over-year increases, the American Bankruptcy Institute, in partnership with Epiq Systems, reported today.

There’s money to be made. While stockholders and some creditors get raked over the coals, lawyers make a killing on fees. And some folks on the inside track, hedge funds, and private equity firms can make a killing picking up assets for cents on the dollar.

Bankruptcy is one of the few booming sectors in the US at the moment. But it’s seasonal. Commercial bankruptcy filings reach their annual peak in March and April. Then in June and July, filings typically decline, and they did so this year too. And in August, filings jumped. But the moves are far beyond seasonal.

In August, the worst August since 2013, bankruptcy filings were up 44% from September last year, the low point in this multi-year cycle, and up 29% from August last year:

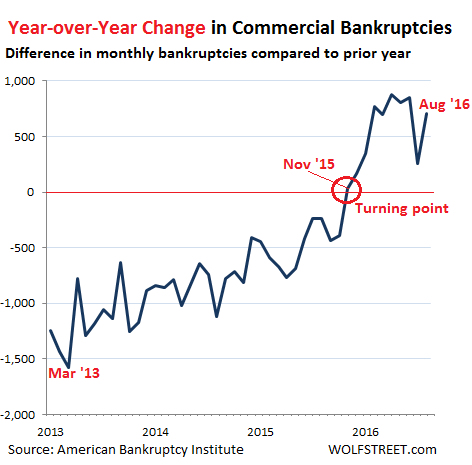

During the financial crisis, commercial bankruptcy filings soared, peaking in March 2010 at 9,004. Then they fell sharply on a year-over-year basis. In March 2013, the year-over-year decline in filings reached 1,577. Filings continued to fall, but at a shrinking pace, until November 2015, when for the first time since March 2010, they rose year-over-year. That was the turning point:

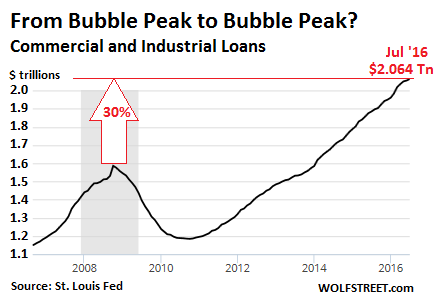

Bankruptcies – and defaults, which precede them – are indicators of the “credit cycle.” The Fed’s policy of easy credit with record low interest rates has encouraged businesses to borrow. And borrow they did.

In October 2008, as the prior credit bubble was beginning to implode, there were $1.59 trillion commercial and industrial loans outstanding at all US banks. Then the Financial Crisis hit, and loans outstanding plunged, many of them wiped out or restructured in bankruptcies. But then the Fed solved a credit problem with even more credit, and as of July 2016, there were $2.064 trillion of C&I loans outstanding, a 30% jump from the peak of the prior credit bubble that blew up so spectacularly:

The end of the credit cycle arrives when businesses can no longer carry the debt they incurred in good times, or when they believed that good times were about to arrive. They’d believed in six years of Wall Street hogwash about “escape velocity” They’d borrowed to be ready for it, and now that debt is sinking them – hence the surge in bankruptcies.

Now the hangover is setting in from the Fed’s efforts to solve a debt problem with even more debt, to gain very little economic growth. And there is a leading indicator of big trouble already fermenting in the banks. Read… Business Loan Delinquencies Rock Past Lehman Moment Level

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Financial “house of cards”…

Central banks are every bit a gang of organized crime. Sad part is when the jig is up they won’t be imprisoned, they’ll remain in a position to continue their charade despite the tremendous harm caused.

How much of these C&I defaults are energy-sector related? There was an article last week on WSJ indicating 65% of these credit defaults were were in oil/gas/natural resource sector. So the credit situation doesn’t seem to be as widespread as it seems. Agree?

I think you’re conflating some numbers. You’re referring to ratings agencies like S&P and Fitch that are figuring their corporate default rate based on the companies they rate (only relatively big companies … those that are big enough to pay for the credit rating and issue bonds). Fewer than 100 of them have defaulted so far this year … so about 11 per month. Of them, about 56% were in energy. Retail & restaurants, and financial institutions were the next biggest defaulting sectors.

But this article is about ALL business bankruptcy filings. There were 3,199 in August and 26,700 year-to-date (compared to fewer than 100 in the S&P default rate). Oil & gas played a role, sure, but only a relatively small one. These are thousands of small companies, such as retailers and restaurants and the like, some of them sole proprietorships, that are getting taken out the back and shot.

“some of them sole proprietorships,”

In other words, small business’s those with fewer than 5 employees.

The NFIB has years worth of solid bonafide statistics, showing that 80% of employment occurs in the small business sector.

This is a sure sign of deep seated, grass roots troubles bubbling to the surface in ever growing amounts, that cannot be ignored any longer by the masses.

A BASIC FUNDAMENTAL that is flashing the loudest of warnings.

According to the United States Small Business Administration’s (SBA) Office of Advocacy, 99.7 percent of all U.S. firms are small businesses. Shocking, right? At least that’s what I thought when I was the research editor at another business publication many years ago. It’s no wonder that in order to get our economy back on track, Republicans and Democrats both argue in favor of tax reform and regulations that help these little guys compete with the big fish. There’s just one problem; depending on the industry, you could have 500, 1,000 or even 1,500 employees and still be considered a “small business.”

In general, nearly all businesses qualify with 500 employees. There are also certain industries that are capped by their average annual receipts, which is closer to passing the smell test. You might wonder why this is even a big deal. It’s important because loans, government contracts and many other tools are put in place to help small businesses compete with large corporations. Of course these tools are also in place to spur growth and innovation.

It may be all for the best. Regulation has destroyed the ability of medium and smallish businesses to cope. Look at what’s happening with airbnb. They are being sued for discrimination, when their hosts are offering private homes- which by the way- are taxed. Why would a homeowner agree to be forced into accepting anyone into their home? Same with many small businesses. The entrepreneurs I encounter are becoming micro-business. One person shops, with occasional friends hired for projects. That’s the future. It also puts the economy underground, which may be the only way for most people to make it. The Deep State deserves what they get. Anyone relying on entitlements ought to be aware their $ could change. The revenues are just not there. After the SDR basket change in October, the dollar will no longer be wanted. There is not enough credit in the world to take care of the US entitlements.

One that I got caught up in is that of Northwest Territorial Mint who filed chapter 11 in April Luckily for me they found my stored metal and supposedly I will be getting it back shortly I reccomend Miles Franklin(Andy Hoffman) for any precious metals business

Thanks for updating us on your travails with Northwest Territorial Mint. Glad to hear that they “found” your silver and that you’re supposed to get it back. I’ll keep my fingers crossed.

You know why? … DEBT …. Debt is spending your future now… there is a natural limit… spend too much … you have no economic future … that is what we face now… no future means the END get it ….

it is all down from here … like falling down stairs … the weak die first but eventually the all die…

why can we have a system that does not overly force or depend upon debt?

debts are the modern chains of slavery. i believe mankind agreed slavery is not good. how long will it take for us to agree debt is not good?

i must believe if regular wage earners had some say in interest monetary policy, the chains of debt would be much less…

‘They are being taken out the back and shot.” If they are bankrupt, the banks lose the principal and future interest. So, it is not in the bank’s interest to force filing for bankruptcy. Resteraunt equipment, especially used, is not worth much, I believe. The banks’ loan officers did not do due diligence.

By the way, I think that small companies, be they sole proprietorships or S corps. would have great difficulties getting a loan from a bank.

Almost to the man, all the “loan officers” that I dealt with over many years had no or little actual business experience. They were bankers first and whatever later. Yes and now small businesses are having difficulties getting any loans .

The diminishing marginal productivity of debt.

The more you have – the more you must have.

Another fundamental that is worse.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crises should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved”.

– Ludwig von Mises

Looks like TPTB elected to go for broke! Pun intended.

World leaders can’t possibly be ignorant enough to not see exactly where this is all headed. And yet, by all appearances, they are willfully driving the global economy into collapse, pedal to the metal.

There has to be a PLAN, wouldn’t you think, whether they admit it or not? Are they really so corrupt and incompetent that they don’t even have a PLAN?

It would actually be comforting to know that yes, the FED and other world leaders know this charade can’t go on much longer, and they do have a PLAN that they are getting ready to spring on us, one that takes into account a future with vastly less energy and zero economic growth, a threatening but brutally honest appraisal of reality.

A PLAN that will of course be painful and traumatic to endure and to enforce, but one that’s coming anyway, in which case controlled demolition is preferable to chaotic collapse.

They have to have a plan like that, don’t they? What’s very troubling is, plan or not, we know our leaders are stroking us, keeping the general public in the dark. Reason enough to feel a little nervous.

NR: Good point. Perhaps the plan is no plan. Or perhaps they believe their own smoke to the point they now believe they are no longer constrained as mere mortals. Sort of a delusional form of “Group Think”. Think Enron for example.

It would indeed be good to know the CB’s plan so that we might make preparations. But, that would be an advantage that they don’t want us to have. They want us regular folks to act as they wish us to act. Taking informed actions of our own undermines their ability to manipulate the bigger game, as they wish it to be played. Given that, as many others here, I plan for the worst and act accordingly. So by keeping us in the dark, they undermine their effectiveness in selling the “escape velocity” narrative and their ability to effectively bring it about.

“It would indeed be good to know the CB’s plan so that we might make preparations. ” Considering that they all cut their eye teeth at Goldman and no doubt have the red phone direct line to management, I think we all know what the outcome is. Greece, Cypress, Italy, Portugal, France, most of the EU, Middle East, Near East, , Brazil and most of South America, Africa….and how many more examples do we need of the helpful team from NY that are driving Miss Daisy to the grave?

The Central Banks have been devaluing currencies for quite a long time. Japan was the first to do so, and we’ve seen what little positive results have been achieved; even so, the other CBs have followed. Nice quote:, ” … the ECB is out there with its scorched-earth monetary policies, …”

Perhaps the PLAN can be seen by China’s World Bank SDR bonds. Could we have a full scale global depression that will shatter fiat currencies? If so, a ‘New World Order’ SDR currency could be put into play.

In 1774, Mayer Amschel Rothschild stated at a meeting in Frankfurt, “Wars should be directed so that nations on both sides should be further in our debt. Panics and financial depressions would ultimately result in world government, a new order of one world government.”

The Euro was an attempt to bring nation states into a common fiat currency. Could there be a reset to bring about a global SDR currency?

Devaluing currencies was never about boosting economy, any such positive effect is temporary until trade channels readjust.

The real purpose of devaluing currencies is to discount the cost of past failures and corruption thus making room for more. This is why all other CBs are following in same footsteps.

The SDR was originally conceived as a way to pay off the national debt: government agents would roam the streets asking Americans what an SDR was, and collecting a $100 fine on the spot when no one could. If that sounds absurd, it is nothing compared to the SDR system, being a “market basket” based on the quicksand that is the various fiat currencies that comprise it. How the hell does anyone know how many yuan China is printing, or anyone else?

“World leaders can’t possibly be ignorant enough to not see exactly where this is all headed. And yet, by all appearances, they are willfully driving the global economy into collapse, pedal to the metal.”

If you are speaking of political leaders, I disagree. For the vast majority, I suspect they are very unsophisticated in financial matters, believe what they are told, and don’t investigate enough to realize that what they are being told is complete garbage based upon garbage models created from a simplistic, garbage economic theory being used worldwide to centrally plan and manipulate the most important factor in any economy – the price of money. Besides, they are being told what they WANT to hear – that you can BORROW your way to prosperity and continue to promise government programs and benefits that you cannot afford in order to be elected or reelected.

For those central bankers who are calling the shots, this is a factor:

“The mystery is how a conception that is vulnerable to such obvious counterexamples survived for so long. I can explain it only by a weakness of the scholarly mind that I have often observed in myself. I call it theory-induced blindness: Once you have accepted a theory, it is extraordinarily difficult to notice its flaws. As the psychologist Daniel Gilbert has observed, disbelieving is hard work.” — Daniel Kahneman who shared the 2002 Nobel Memorial Prize in Economic Sciences with Vernon L. Smith.

Their resistance to change is much like the resistance of the Catholic Church when Galileo said the Earth wasn’t the center of the universe. To admit they have dedicated their lives to the implementation of a fundamentally and grossly flawed theory means a loss of self-worth, and a loss of power, prestige, and influence.

Theory-induced blindness may just be not giving a sh** and let’s see what happens.

I know where I am in that spectrum.

You just described Larry summers. “…if they are not one of ours, then they don’t count…” Keep in mind who he advises.

Regarding the Galileo affair, the strongest claim that can be made is that the Church of Galileo’s day issued a non-infallible disciplinary ruling concerning a scientist who was advocating a new and still-unproved theory and demanding that the Church change its understanding of Scripture to fit his. And, as it turns out, he was only partially correct (no, the sun isn’t in the center of the universe, as he claimed). I would hardly say that this episode qualifies as a good example of “resistance to change.”

The collapse will come after next year’s German Elections and targeted at undermining the economy of their greatest geo-economic-political foe as he seeks re-election in March 2018.

Notice after next year’s German Elections there are no elections in any key Western country (US, UK, France, Germany) until May 2020!

Clearly more than 2 years to “pull it” and then clean up the mess and remodel the place before the people have to be consulted again on something important……

The countdown is on folks, we have 12 or so months to prepare….

I go back to my old argument of the Power of Positive Thinking.. and Group Think.

The culture of the modern world, except in certain fields like engineering is steeped in this notion of the Power of Positive Thinking. In most all organizations you can not be a “What Iffer”. If you want to succeed in any modern organization you MUST go along to get along.. Anyone who raises the proverbial red flag will be thrown out the door rather unceremoniously.

So the PLAN is the one that is in place and even though all of us can see all its follies and even the moral bankruptcy of it. And the eventual bankruptcy of most of these organizations (corporate and political). The corruption and the stupidity must go on because that is what is…

Even if your brain tells you it is wrong and can not go on because you know that there is neither a free lunch nor can you have exponential growth in a finite system.. right now, you are benefiting and to try and stop it would mean you loose your benefits… human nature run amuck… again! End of story..

The cycle will change (is changing) and lots and lots more people will be impoverished. We will see lots of suicides as most of those who were benefiting lose everything and will have no skills to survive in any other type of structure. After all they were just gigantic leaches anyway. Once the host is dead, they have nothing to suck upon… It will be messy but in the end it will clear out the garbage and we will just start the entire process over again..

Thank you, for you put to words thoughts I hadn’t been able to verbalize.

They have a plan: totalitarian government.

Remove cash, use digital. Track & monitor everyone for every speck of energy so they can confiscate it.

Why do people expect the “system” to change? It’s always been about extraction from the masses. It’s the ancient model. Americans bought into the “exceptional” idea that they would be different. The only way to be exceptional is to shut the Deep State down. Starve it out.

If you can find a video of Hank Paulson’s reaction in 2008 you will quickly realise these people have no idea what they are doing.

NINJA mortgages – What could possibly go wrong?

Yes there is a plan, they will take all your money one way or the other.

Another excellent piece of analysis

Wolf any idea of the scheiss dollar probability? Rumours only? Is obama faking the cpi number in order to make d GDP look ok ish? I read the actual was 8% We all know that the fed has no real bullets in the interest rate. So they keep being as hawkish as possible just to keep their “real” bullets intact. Ur web do base a lot of numbers n facts though so keep up the great work.

This is one of the mathematical certainties of basing an economy on debt money.

The simple exponential equation Debt = (1 + interest) ^ years works tirelessly away day after day to leach wealth from the economy into the central banks. Something Abraham Lincoln side-stepped with his ‘greenbacks’.. as it’s easy to avoid.

The FED/ECB/etc has been so successful in this ‘secret’ usury that in order to keep milking the world for more it has had to reduce it’s interest rates to almost zero and beyond: i.e. taking their foot of the exponential throttle for a while and coast, soaking up the wealth.

As soon as any nation signs up to a privately held debt money scheme it is sunk, the issuing bank just has to sit back and wait for maths to do its work, and the FED has been waiting since 1913 for this.

The new twist of course is to start buying up stuff with the funny money which speeds up the wealth transfer and staves off the inevitable crash – so it’s a win-win for central banksters – and a lose lose for the rest of us.

It only remains to be seen if the next crash is as bad as the FED’s first attempt at speeding up the theft – The Great Depression.

The problem with Capitalism is that sooner or later you run out of other peoples’ money to steal.

Yet there is a so called candidate who has become the face of bankruptcy, Trump and to the down trodden easily fooled Fox News masses a savior LOL!

Janet and Trump need wed LOL!

I support Trump but don’t see him as a savior. I just remember what the Clintons were like and know they can’t be trusted.

“When choosing between two evils, chose the one you haven’t tried before.” – Mae West

“There are no necessary evils in government. Its evils exist only in its abuses. If it would confine itself to equal protection, and, as Heaven does its rains, shower its favors alike on the high and the low, the rich and the poor, it would be an unqualified blessing.” Andrew Jackson, the last man with the cojones to take on the central bank of his day wrote. He regarded leaving future generations in debt a sin, and vowed to leave office with the nation debt-free, and kept his word.

His writing seems old-fashioned, but unlike a Janet Yellen, Ben Bernanke or Alan Greenspan, is crystal clear. His comments on Biddle’s Bank of the United States apply absolutely to today’s Fed:

“Gentlemen! I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I have determined to rout you out, and by the Eternal, (bringing his fist down on the table) I will rout you out!”

Yesterday we got a solicitation in the mail from some financial firm offering us a $1400 loan on a signature. The terms were payments of $125 monthly for about 18 months. The effective interest rate was quoted at 43%.

When the media talks about cheap credit and then wonders why nobody is borrowing, they out themselves as being clueless. My credit cards are all charging between 25 and 30%. Maybe that’s why nobody’s shopping.

Most people who accept an offer of credit at 43% are already bankrupt. The financial firms know this and yet still engage in business which is doomed to bring them down. They may make a little money up front, but long term the risk is enormous.

No doubt it is enormous most will default before dissapearing over the border wall back to Mehico and points South

LMAO… my neighbor is an illegal from Mexico with a 8th grade education. He works construction right now making good money. has an escalate Lincoln truck… just financed a new camaro for 38K… walks around with Prada sunglasses costing $450. Bought a bunch of furniture on 24 months no interest. They wife has a new Toyota Camry. Both wife and him with Iphone 6 plus. Just went to Reno and and Universal Studios on the same month. Has payments on Macy’s card for smashing clothes they were, Pmts on Bestbuy card for humongous 60 inch TV and surround sound he has in the living room. I know because he invited me to watch the Olympics ;)

He crossed the border about 5 years ago on foot walking through Arizona desert for days… now has a life style that many college educated young people can remotely wish for… of course lots of credit and many hours of construction work… he works on Saturdays too.

An illegal young fellow working with a union, has better health insurance than I get working for my firm in the Silicon valley, or than many professionals I know. I ride my bike then cal-train to work.

**With cheap credit”** THE AMERICAN DREAM is ALIVE for some people. The Rest of us have to be asleep to live it.

Your illegal neighbor could be easily making at least $20 an hour tax free. He is also on welfare and food stamps, while his wife cleans houses for $10+. If you were making $30+ an hour while having your rent, food, and medical expenses paid for, you too would be vacationing twice a year. Don’t bother to disagree with me. I saw this a thousand times in Florida and New York.

Petunia: You did report these illegal practices? My wife worked as a social work supervisor in our county’s Department of Human Resources for 30 years. People who found out what she did often made the claims you made. But, when she pulled out a pad and pen and asked for particulars, no one could or would, ever come up with specifics. These agencies have very small budgets for investigations. So when you have such information, make sure the agency in question has that information. You may not even have to give your name.

Petunia, you are a bigot pure and simple like most of Trump’s supporters. You see only what you want to see and are blind to anything else, Around where I live, people on welfare I see are on welfare because they are genuinely poor. But they manage to get by. Houses are small, primitive, and built of cinder block but manage to be neat, clean and comfortable with flowers growing outside. Transportation is typically an ancient pick up kept going with a lot of “sweat equity” but people get around. There is a sense of dignity ad pride. That welfare is what makes the difference between poverty and destitution, having to be frugal versus want and hunger.

As long as lower class white people believe their problems are caused by immigrants and welfare rather than Big Business and Big Money, they will continue to live in hopelessness and misery and will be vulnerable to being deceived by dangerous lying demagogues like Donald Trump.

If you have some spare change, you might buy some middle of the road sovereign debt. I did so in the spring of 2015. I paid a 5% premium of 105 (par is 100) and bought 4.75% interest bearing, US$-denominated Mexican “44” (paid off in 2044). These “make whole call” bonds force the issuer to make you whole for your loss of income if the issuer wants to retire the debt early.

I did not feel that great after making the first bond purchase of my life – and went in with heavy cash. The bonds traded down as low as 95 and my self-confidence took a hit.

Now, because negative interest rate bonds are not only for real, but getting bought, the 44’s are now trading at 111. That is what I can sell them today, via Vanguard.

Corporations go bankrupt – but Sovereigns just re-schedule debt. Mexico is not going out of business. Sr. Slim will make certain of that.

Negativism will not make you any money. But, it will make you risk adverse. Debt avoidance at all costs. Cash money at the ready. Bullion instead of spare change. Our personal enemy is not the greed of others. It is fear. If you have done your best to prepare for the worst, then you can do no more.

If we could find an economist that understood the economy all our problems would be over.

Where might we found such a critter?

In some far away university in Outer Mongolia.

The mainstream economists don’t like anyone who knows what they are doing and marginalises them.

Anyone who knows what they are doing makes them look very silly.

Steve Keen who saw 2008 coming back in 2005 is now resident at the University of Kingston in the UK.

A backwater university where he can be safely isolated.

Our debt situation is scary. Perhaps there were reasons after all why so many earlier civilizations frowned upon usury.

Really excellent work, Wolf. Thanks much.

Thanks for the kind words. I’m lapping them up.

:-]

I have been hearing of a financial collapse sense the 1980s, Buy gold . I guess if I could have stood the up’s and downs of gold I would have done OK but like most people my emotions got in the way. But I did okay with real estate and now I hear that that’s coming to a end. When I was younger money cost me as much as ten percent and I was still able to pay on a mortgage and the world didn’t come to an end. Maybe some day the old US dollar will call it quits and sink in to the pit with all the other failed currencies but for now I’ll keep the dollar.