“The so-called car recession”: Ford, AutoNation wave red flags

It was the second warning in two days: auto sales – last year one of the few booming sectors in the US economy – are exiting the freeway and turning south on a road full of potholes. And that would come at the worst possible time.

The debt-fueled growth of this economy is already fizzling. On Friday, first quarter GDP growth was revised down to 0.8% on an annualized basis. “Annualized” means that if this awful pace continues, growth for the year will be 0.8%! Second quarter growth was a meager 1.2% annualized. For the first half, annualized growth amounts to 0.9%, the worst in four years.

Business investment in equipment and structures, residential investment, and government investment all declined. Trade added a smidgen. But the inventory draw-down we’ve warned about for over a year, given how business inventories have bloated to crisis levels, has arrived with a vengeance, slashing 1.2% from GDP growth.

What kept GDP growth from falling into a hole was a big bout of consumption (up 2.8%), led by debt-fueled consumer spending.

Now, the auto sector, which has propped up GDP growth for years, is slowing down. For the first six months, total car and light truck sales, at a seasonally adjusted annual rate (SAAR) of 17.5 million vehicles, are lagging behind last year by 100,000 units. Over the first half, fleet sales to rent-a-car companies and big fleet buyers were up industry wide. But retail sales fell 2%.

On Thursday, it was Ford that waved a red flag. Global sales were up 6% in the second quarter. But they’re struggling in the US, where it paid out 28% more in incentives to move the iron. So cost of sales and other expenses rose 8%, and net profit fell 9%.

It added some nuggets:

[T]he competitive environment has increased as growth has slowed and the retail industry demand has weakened. This has resulted in higher industry incentives, with a retail industry sales rate that has declined in three out of the last four months.T]he plateauing of industry volume and the so-called car recession are having an effect on incentive levels overall that goes beyond what we had expected.

This is combined with an overall industry level in the United States that we now believe will be lower than we had planned, driven by lower retail sales. As a result, we now expect to see lower industry volume in the second half of 2016 compared with 2015.

Since Wednesday morning, Ford shares have crashed nearly 10%.

On Friday it was AutoNation, the largest auto retailer in the US with “373 franchises and 263 stores in 16 states, representing 35 manufacturer brands,” as it said during the earnings call. Ford might get tripped up by a company-specific problem, but AutoNation is a gauge for the entire industry.

It reported that second quarter revenue inched up 4% to $5.4 billion. Quarterly net income fell 2.6% to $112 million. Because it repurchased 1 million of its own shares, earnings per share rose 0.8% to a record $1.08. So what were some of the big factors in this 4% sales increase?

Dealership acquisitions (its business model) and price increases.

New vehicle sales in the quarter, including sales from newly acquired stores, edged up a tiny 0.5% to 85,654 vehicles. The average revenue per vehicle retailed rose 3%. So much of the gain in dollar-sales of new vehicles came from getting a higher dollar figure per vehicle.

But same-store new-vehicle unit sales dropped 4.5%; and used vehicle sales fell 1.3%.

The company is trying to “manage” costs, it said during the earnings call (transcript via Seeking Alpha). It cut new-vehicle inventories to get ready for leaner times – by 6,000 vehicles in the quarter, lowering same-store new-unit supply from 76 days to 70 days. The goal is to cut this further.

And then there are the ballooning incentives to prop up sales in a slowing market. AutoNation lashed out at automakers for “irrational behavior in the marketplace,” particularly volume-based incentive programs. During the earnings call, the word “irrational” to describe manufacturers’ incentives and volume expectations was used nine times.

COO William Berman added the words “unreasonable” and “unattainable.”

Despite industry retail sales being down in the second quarter, certain manufacturers – in particular, Ford, Chrysler, and Nissan – set double-digit growth targets that were unattainable. Where we felt these targets were unreasonable, we did not pursue them.

CEO Michael Jackson explained:

So if I look at how the first half of the year has developed, well, from a market point of view, that’s exactly where it is, with retail in the second quarter down, let’s say, 2% at retail. But it took considerably higher incentives for that to happen.

So are consumers maxed out? They’re not reacting appropriately to all these incentives. They should be buying more. But they’re buying less. Is this, as Ford had put it so eloquently, “the so-called car recession?”

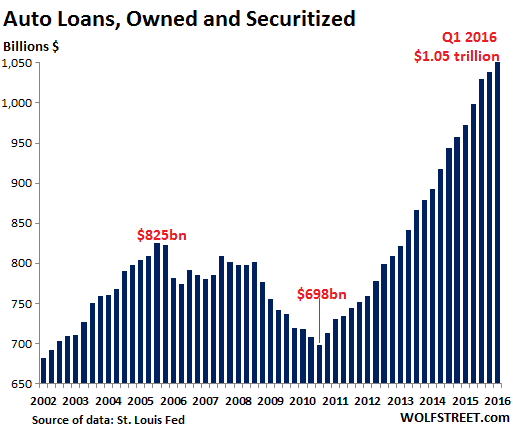

Auto loans with super-low interest rates, maturities up to 84 months, and loan-to-value ratios of well over 100% have made everything possible, including higher prices and record sales. This debt-fueled buying binge caused total auto loan balances outstanding to skyrocket:

But at some point, consumers are gasping for air, banks get leery, bank regulators, such as the Office of the Comptroller of the Currency, begin to fret over these loans, and subprime auto loans are starting to cause indigestion.

The white-hot auto sector is a large component of retail sales and of manufacturing. It impacts transportation by ship, rail, and truck. It includes services and finance. The auto sector is huge and spreads across the entire economy. When it slows down, it will pull the rug out entirely from under this already languishing economy.

Numerous brick-and-mortar retail chains have already collapsed and gone bankrupt this year. Now Claire Stores is heading that way. As in so many cases, it’s owned by a private equity firm, which is now scheming to get unstuck. Read… Another Retailer Leveraged Buyout Bites the Dust

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Infinera, a billion/yr telecom equipment company, just announced their revenue for the remainder of 2016 will be down 32% from expectations. This follows their Q2 2016 with record quarterly revenue. As an industry insider, I last saw this in Q3 2008 and Q4 2000.

I’m waiting for the word “lumpy” (as in “demand is a little lumpy”) to emanate from Cisco.

Cisco, along with Sun Microsystems (may it not rest in peace), are/were the most incompetent, wealth-destroying entities of the modern world (I know from the inside) ….. besides the U.S. “government” and Fed.

The only stuff of note to emanate from Cisco has been foul hot air.

Cisco? Oh yea I remember them.

All I see these days is Arista and Juniper

but wait people!

Uber and Lyft are currently offering positions (bent over that is..) to drivers who are willing to step into a subprime loan, to volunteer their time, as nonprofits thus assisting them to maintain their (uber) overpriced valuations.

I just wonder how much these companies have accelerated this problem…

Uber in alliance with sub-prime auto loan tout/shark Satander from Spain the land of bank graveyard – it’s not going to end well…

Both Uber and Lyft drivers with new cars and crushing monthly payments were featured on SF area TV news complaining about their situations. Don’t these people do the basic math before committing to buying cars for use as gypsy cab for pittance?

I came across mad max Uber driver in a brand new Nissan Sentra couple of months ago. He looked late 20’s. Poor chap will get his license revoked or fired by Uber then saddled with high interest car loan.

My crystal ball tells me …. this is just the natural reincarnation of feudalism, with differences of course. Think about it.

depending on which flavor you desire, red or blue.

“And then there are the ballooning incentives to prop up sales in a slowing market. AutoNation lashed out at automakers for “irrational behavior in the marketplace,” particularly volume-based incentive programs. During the earnings call, the word “irrational” to describe manufacturers’ incentives and volume expectations was used nine times.”

Trust me on this, automakers have been doing this at very least since 2003, when the 2008 Financial Crisis was unconceivable and the following, still ongoing stagnation was nothing more than fiction peddled by tinfoil hat wearing conspiracy theorists.

There was a very definite change across the whole industry around 2003, a switch from a model based on volume and margins to one wholly based not merely on volumes, but on ever-growing ones as well.

But if you think automakers are guilty, you don’t know motorcycle manufacturers.

In 2009 Harley-Davidson was saved by an emergency loan at 13.5% interest from the effective bankruptcy of its financial arm which threatened to drag down the whole group. H-D has always been a darling of the political establishment in the US (even the Reagan Administration helped it out, a lot) and such high a interest reflected the conditions the firm was in, loaded to the brim with loans gone sour, repossessed motorcycles (most thrashed by the owner before the repo man arrived) and a whole brand, Buell, Milwaukee didn’t really want and didn’t really need.

Fast forward to 2016 and you’d think the industry learned something from a cash machine such as H-D going almost the way of the dodo and for the same reasons (pathological stupidity). Here are a few examples from my email inbox:

1) MV Agusta (Italian brand partly owned by Daimler AG): no money down, first payment after six months

2) Triumph: 1.99% fixed rate EAPR on “selected models”

3) Honda: no money down, first payment after two months, 60 months (5 years!) loan. Some “selected models” further benefit from 1.16% fixed rate EAPR.

Just by comparison, the average car loan requires a down payment (it varies according to brand or model but usually not less than 10%) and carries at very least 4% EAPR, albeit the industry average is around 6.5%.

We all know that Albert Einstein defined stupidity as repeating the same thing over and over again and expecting different results each time. What the great physicist hadn’t factored in was the fact when you are sure of a politically-motivated or even taxpayer-funded bailout you can… dare to be stupid.

MC: I’m not a motorcycle guy, but flirted with the idea seriously mid 1990s. At that time, I guess boomers were in denial about aging and bikes were a big part of that. Harleys were going for 20%+ over sticker and you had to get on a waiting list for the opportunity. Since so many of my friends were putting $15,000 to $20,000 into their bikes, I set myself a budget of $20,000 for photography equipment. All of which I still have and still works BTW.

I guess some people use their bikes as primary transportation or as a back-up. But for those who are just hobbyists, I am of the opinion that incurring debt and paying interest for hobbies is foolish.

Here in Europe there was a very definite shift in the motorcycle market around 2003.

Before, new or used, it was an 80% cash market, even for brand new high end models. Sometimes it was literally a cash market as the New Age Bolsheviks had not started denouncing cash as the work of Beelzebub and driving it underground.

After that date it became an 80% finance market. Now, I have been buying, selling and repairing bikes since I was 15 but I have never seen something as insane as the tactics used between 2003 and 2008 to push customers into taking out a loan to buy a bike and to have them change it every couple years.

Needless to say the business model was volume, not margin, based and when volumes fell off a cliff during 2008, dealerships were wiped out, a phenomenon exacerbated by manufacturers multiplying their franchises everywhere under the line of reasoning that sales would continue increase well into the 2010’s and hence there would be room for everybody.

Just to make an example Honda dealerships in large Southern European cities such as Rome or Barcelona were selling smaller scooters at cost or even at a slight loss due to those “ballooning incentives”. A disaster in the making, and it was, despite Honda brass swearing in 2006 that anybody dissenting with their analysis of booming sales “into 2015 at least” was peddling fiction.

Before you ask these snake oil salesmen were not tarred and feathered, nor paraded around on a donkey while wearing a pointed hat and a sanbenito. They left Honda with large bonuses and have been peddling their “booming sales” narrative to eager shareholders and activist investors in other consumer companies ever since.

In other sectors like smartphones and laptops similar tricks are popular. Sell the product at a loss while making money on the financing (and hope people keep paying, or otherwise dump the risk with another party) or something even less related to the product.

If the ECB has its way it won’t be long before cash payments are refused everywhere and you can only buy consumer goods with a credit card that pays the “debtor” 1% per year – or maybe even more – as a favor for “saving the economy” :-(

Would be a nice trick to wipe out all wealth of the middle class (for those irresponsible citizens who refuse to “invest” their savings in stocks, bonds or RE). I’m sure the ECB and EU have hordes of bureaucrats working on the details.

Over the last 10-15 years, expensive Canon and Nikon lenses were often a pretty good financial investment as long as you treated them with some care. Over the years many of those lenses accumulated more “value” than e.g. a savings account, this in addition to the payoff for photography hobby of business ;-)

NHZ: Good point. I treat my equipment with loving care. I have every camera and lens I have ever owned. Perhaps my wife can benefit when I’m gone, because I can’t bring myself to trade or sell any of it. Even though I have a science education and a good understanding of optics, there is still something magical about a good camera and an even better lens. I can still get that “Christmas Morning” feeling with a new camera or lens. I think my wife still thinks that I am going to open a camera store. :)

In the years leading up to the Financial Crisis, auto production overcapacity in the US (and the inability to shed this overcapacity) led to big incentives to stimulate sales, no matter what the cost, to utilize this overcapacity. It led to huge losses, and when sales began to decline, it ended up killing the US auto industry. Two of the three big automakers went bankrupt. Many of the biggest component makers went bankrupt. By the time the component industry emerged from bankruptcy, much of it had moved to China.

Trying to fill overcapacity by throwing big incentives at a declining market is industry suicide – and automakers know this. But once it starts, it seems they can’t stop it because they have to keep up the idea that their company is growing, in order to prop up the stock price.

Here in central New York Ford is offering huge incentives. Feduke ford has 3 2016 Fusions Hybrid Energi (plugin’s). 2 have $6000 off (I got that much off from Nissan on their hybrid Altima), a third is listed as $10,000 off from Ford, before Federal $4000 rebate, before any dealer discount. These are $35000 cars and don’t seem to be selling.

Wow. Those are bigger incentives than I thought.

But, but, but… I can send $1000 to TESLA right now and get on the waiting list for 2018..!! Along with maybe the Fed rebate if I make it before the sales quota is met. And that’s a $35k car going for $45k! So discounts, schimiscounts – you gotta get to where the real action is.

i was in eastern canada last summer and the loans offered were 8 years and low rates. but rates are immaterial if the price embeds the rate. i’d rather sell you a 20k car for 28k at 1% for 5 years than……

i think the us automakers will be okay because they have a financial portfolio underpinned by low cost of funds. but if they can’t move the iron, they’ll have to slim down, which is the chicken that lays the profit eggs, at least until the ripple effect of less employment, etc etc. gets mr trump elected, etc etc.

but i digress.

Carmakers will be fine for one simple reason: 2008 changed everything.

The list of manufacturers which should have gone burst or at very least gone through very stormy waters was long: GM and Chrysler of the US, FIAT of Italy, PSA of France, Volvo and SAAB of Sweden, Mazda and Isuzu of Japan… the only country which let a carmaker go burst was Sweden. All others rushed to the rescue directly or indirectly.

While carmakers such as VAG and Renault are partly State-owned, every single one of them is effectively a ward of the State. I’ve often heard Americans complain about Chrysler being bailed out twice in the past four decades. Yes, that’s rotten enough but not as rotten as FIAT and PSA, both of which have been kept afloat one way or the other for decades and keep on being helped “under the table” (for example by tax breaks you cannot have, period).

We’ve all heard the justification: thousands of jobs are at stake directly, and if vendors, contractors etc are taken into account we may well be looking at a major crisis. That’s very touching and considerate, especially considering when it’s small firms going burst or laying people off nobody rushes to the rescue with wheelbarrows full of tax money.

Einstein never said that, along with so many other things. It’s nearly a cottage industry, the “Einstein said that..” -stuff:

http://paleofuture.gizmodo.com/9-albert-einstein-quotes-that-are-totally-fake-1543806477

You want a piece of candy for that?

Ford has it coming. All the police, state motor cars, and other public vehicles are usually all Fords. So they made sweetheart deals with government agencies to move all those cars. Can’t wait to watch Ford finally fail. Especially since they sold engines to the Nazis. Losers, all.

In my area, the government employees are all driving brand new vehicles that are Ford, GM and even Nissan. So are cops. THAT”S what fueled the good ’15 for Auto makers. Now, it’s back to normal. They won’t exist soon….they deserve to go.

Yeah yeah yeah, but the VA spent 20 MILLION dollars on ART WORK. Including a $600,000 sculpture at the VA center for the BLIND… hahaha I can’t make this shit up… I’m laughing while crying bloody tears…

While I, cannot get the doctors appointment congress said I could… the VA Choice program, was turned into a bureaucratic pretzel, so you have to wait as long, or longer, while weaving through red tape because the VA is so tight fisted they cannot turn loose of any dollar that doesn’t fit their agenda, which is, bonuses for turning us down and ‘saving money’. Yup, those bonuses that were supposed to have gone away… they’reeee baaack.

It seems like gov pukes got plenty of money, the rest of us are searching through the garbage cans… you can’t buy if you got no job. Period. These young’uns forgot the lesson of Henry Ford… if they were ever taught it…

F*k ’em all. Burn it all down, start over.

Go Trump, reset the currency, its just time.

So true. Frag ’em.

“Berrrn it. ” – Mel Gibson in ‘Braveheart’

I can feel the tremendous anger building up in this country and I fully sympathize. But Trump is a leper messiah, a crazed megalomaniac who can hardly wait to get his finger on the button and bring about thermonuclear Armageddon. He is not “The One”. The One hasn’t appeared yet but I know he will come. This nation has a way of producing great leaders when the times are most desperate and dark. Have faith and hope my friends and do not surrender to despair! Government of the people, by the people and for the people shall not perish from the Earth.

Factoring in population size 2000’s sales were superior compared to 2015’s. One of the many signs of how poor this country is getting.

And a sign that cars are lasting longer than they used to – and that people keep them for longer than they used to. Quality has moved up in quantum leaps.

Wolf: Good point about the quality. My 1972 Grand Torino Sport had a 24 month/24,000 mile warranty for a reason. And that reason wasn’t that it was a quality product.

In my closest town, there have been at least 5 new car dealerships built in the last few years. The local Ford dealer/owner has two big dealerships, and is now renovating and relocating his original one. Honest to God, the new Dealerships look like mini-Mormon Temples, with huge front entrance pillars, soaring foyers, and offices with hushed atmosphere. Their customers are, of course, footing the bills with their 6-7 year finance plans. Me? I always think (so and so owner), as I know them all, is making too much money. Then, buy used.

I drive an MC, by the way. I use it to scoot 50 miles each way into town on a beautiful winding 2 lane hwy. I use it for light grocery runs and business for 6 months of the year. It is considered small at 500cc, but when I was a kid it would have been thought of as very good sized. It is more popular in Europe than in NA, and I (Honda owner), and my Moto-Guzzi friends absolutely chortle at the goofy looking seniors riding their Harleys, or the latest child-proof 3 wheel Can-Ams (2 wheels in front). The latter can sell as high as $40,000 +. I paid $6,000 for brand new, paid cash, and spent an extra $500 buying tweaks for fit and form. Of course many of the grey hairs need to grow a tied-back pony tail to seal their freedom. What a weird culture.

My other ride is a 30 year old restored Toyota PU 4X4 which I use for construction and hauling my boat. I paid $6,000 for it years ago and just spent another $3,000 this past winter fully restoring it. The plan is to go for 40 years, and then we’ll see if driving is even an option for society. We may all be walking by then the way things are going. Sometimes the ‘service engine soon’ light comes on. It has one of the first rudimentary computers built for cars. I found out that if you take a paper clip and short out the two plug terminals the light blinks a morse code list of 10 options which you can then look up online and see what has gone wrong. An intake hose clamp had fallen off the on only time I had to do this. My wife’s Yaris has to go to the local mechanic for basically the same investigation. A Prius, Leaf, or new Ford? Send it to NASA.

At 63 the only vehicle I have driven for the past 34 years (my wife has a 16 year old Ford Explorer) is a 1970 Datsun 240Z. For the cost of foregoing cars payment the 240Z is completely restored. For most in town commuting I ride my bicycle. Have lived in the same middle class neighborhood for 34 years. The long term owners with assets who actually own their houses drive older well maintained vehicles. The renters sprinkled in the neighborhood drive late model expensive vehicles. The renters come and go. Many are evicted.

I live in a city and use Uber deluxe drives. Half the price of a limo, much cheaper than owning. It’s the future.

Seems to me I remember in the early 2000’s neighbors on either side of me cashing out of their home equity to purchase base $20K Harleys at above MRSP prices,,,,then throwing another ez $ 10K into ungrades/modifications. Here in the Pacific NW the ” riding ” season is so limited it does not even qualify as even a hobby item. Add taxes and insurance it became a very expensive garage item. 3 years ago I bought a very low mileage 04 Softail from the original owner who had over $30K invested (04 Dollars) for $9500. Craigslist used bike prices are at give away prices in my area. Local HD dealership is a ghost town on any given day. The typical ” sales event ” days of a garage rock band and free hot dogs is pathetic, Us old Harley guys are dying off and just to old and broke to play anymore.

Polaris thru their Indian and Victory lines have eaten into HD new sales.

I feel that even with extremely low interest rate financing….the sticker prices continues to escalate and stagnate wages we have arrived at the point that actual reduction in interest rates become meaningless. That’s why the Fed cant and wont raise rates…the most elastic industries…housing and vehicles ….are screwed. Autos the trend is to gradually just move the finance period out to infinity. Bikes/Boats/RVs not so much. This strategy only works until it doesnt…we are almost there.

I always took issue with the notion of an expanding economy. Why do TPTB and the NWO crowd always push the education of an MBA in the direction “the economy is only good if it expands at 2% or better and inflation is at about 2%.” If you apply the rule of 72, at 2% all the money you saved 36 years ago is worth ONE HALF of its original purchasing power. So much for retirement savings. They set the hook into you and you bought it. But how fast does your money disappear when they report the real level of inflation at 5%- or 7% or above 10% as it really exists?

Your savings and the value of your in hand cash is HALVED every 14 yrs, or 10 yrs, or 7 years. You can bet your raises did not keep up at the same real time level. So your buying power DROPPED year by year.

Agreed. The Rule of 72 ( how long it takes money to double) is a good rule of thumb. But, many people forget to take taxes into account. When you got 5% interest in the money market, subtract 40% for income taxes and you wind up with 3%. That was when real inflation was about 5%, so you lost 2% in purchasing power every year.

Today, what is the time value of money invested at 0%. 72/0 = zero. Real inflation for stuff you need is 3%/yr, which equals the annual shrinkage of the purchasing power of savings.

Now, take the case of negative interest rates. The Rule of 72 can’t handle that ( or I can’t handle that). Just add the storage cost of savings to the effective annual rate of inflation.

This is not a new concept. Money stored in a bank in any form (physical or electronic) was to be made into a wasting asset. No longer a storehouse of value. Rather, something like an option on value. Use it or lose it. See:

http://blog.supplysideliberal.com/post/56754781054/silvio-gesells-plan-for-negative-nominal-interest

Money storage fees to destroy your bank savings. “Negative usury”. If you are barred from converting bank savings into physical cash, what are you going to do. The only way to continue to saving is to convert bank money into something tangible by way of purchase. Forced consumption.

Try using a rule of 72 curve in quadrant I and mirroring it into quadrant IV, that should be a good approximation of the degradation of principle at the set rate.

Remember the quadrants are: 2 – 1

3 – 4

You can also use future value at negative rate. That works.

You need a HP 12C.

calculating declining purchasing power is not a task for for an hp 12c. it’s arithmetic, and you don’t need to know the exact answer, just the fact.

to paraphrase ronald reagan: does your dollar buy you more than four years ago? here and there, yes. generally, no.

Not all cash is created equal. Use USD, buy a Canadian house for a 20-30% discount. That is winning. Better deals can be found in developing markets, where some currencies have depreciated 40% or more.

We need a radically different basis for our currency. I would insist on a fixed value for our currency. Start by estimating the value of everything in the nation, divide it by the total population and let that be so many units of currency. The money supply would only increase if the estimated wealth of the nation increases and by only that amount. I would also ban compound interest and replace it with simple. You cannot have a large proportion of your money supply in exponentially increasing accounts (i.e. compound interest) without the total supply increasing exponentially too (inflation). I would also require all money to have a physical token somewhere and whoever has that token owns the money. I would also block all forms of speculation too. This can’t happen now but maybe after the revolution……

P.S. I don’t support a gold standard because the price of gold relative to the value of everything else is anything but stable.

The problem is that the effects of Cash for Clunkers is petering out. For a few years, the used-car market was much tighter. That is no longer the case. I strongly suspect that sometime in the next two years, the US Government will start Cash for Clunkers II to eliminate the competition from used vehicles. The problem is it will have to be twice as large.

cash for clunkers seems so ancient history. how about cash back for buying? 30% oughta stimulate, like a meth binge.

Ford dealer here is offering $10,000 of MSRP for a truck and you get a “free” Ford Escort for two years as part of the deal.

I bought a used 1 yr old Audi A3 from a dealer in SF area recently to replace my daughter’s A3 TDI which is planned to be bought back due to the diselgate.

It has been 11 yrs since I bought a car from a dealer as I’ve been buying used Audis/Volvos at wholesale prices from my employer’s fleet (about 3 yr old ex-sales person cars). The dealer advertised the car in Craiglist with monthly payment only – guess that old trick of how much monthly payment can you afford is still being used.

I cannot fathom people buying brand new cars with 6 to 7 yr loans as I suspect many of these folks might skip out on paying same monthly payment 3+ years and let the banks take possession. The irony is that people and banks in particular could have learned something from the sub-prime mortgage disaster that ushered in the 2008 crisis…

My Canadian brother in law buys repo luxury vehicles from California and gets them shipped up north. Very good bargains to be had in tough times.

It’ll be interesting to see how sub-prime auto defaults play out. Repo-ing somebody’s car is frequently a huge hit to keeping a job. If the industry repos too many cars at the same time (and you know it will), you end up with square miles of unsellable used cars and (…wait for it…) billions of bad debt. Anything with used car salesmen involved scares me; with tens of thousands of used car salesmen, it simply terrifies me.

I’m a little fuzzy on where car debt is actually held – I’d guess this will look like securitized mortgages with stuff being sold all over the place.

Maybe it’s time to introduce “car stamps” (like food stamps) – turn owning a car into a human right.

Auto loans have been securitized since the 80’s, as well as, credit card debt. I understand there are CDOs with mortgage and auto tranches. There aren’t enough bad words in the English language to describe that creation.

Perugia

I don’t have a problem with securitization per se, and I fully understand 2007-8-9 demonstrated they are highly toxic in the wrong hands with improper supervision.

Their are (at least 2) fundamental issues working against capitalism here:

1) investors (ALL OF THEM) want better-than-average return on their investment – few (2-5-8%?) even know what due diligence is – fewer actually perform it on investments. Unfortunately, the vast majority of investors are ignorant & lazy (aka willing victims).

2) Capitalism cannot exist without appropriate external controls (call it government regulation), AND THE US GOVERNMENT RARELY PROVIDES THIS BEFORE IT IS TOO LATE. Tweaking regulations is used by politicians to raise campaign contributions – not to prevent future problems (example: unregistered derivatives present huge counterparty risks; here we are 8 years after 2008 and the problem is even bigger, and there still is no regulatory requirement to register or trade derivatives on a regulated exchange).

it already exists, if you can breathe, you can finance a car.

Yeah, at a subprime rate.

No thanks.

Self employed don’t take chances.

I live in a semi-rural area full of Audis, and high end new cars. People live in double wides here.

It’s a mirage.

Why do people want new cars- you can always buy shiny equivalent miles for half price, and very good miles for 20% of new.

I understand not having the cash- I’ve bought 500 buckers.

My advice when buying second hand – beware beware of leaking head gasket. It can be hard to spot early on and effectively dooms any car worth less than 3K.

Modern cars run hot for several reasons and have small rads and electric fans- problematic.

I did two HGs on Nissan Micra when I still did this stuff and then I jumpered the fan so it ran all the time. Then she ran cool.

Test drive for minimum ten minutes- 20 better, then undo rad cap with rag. A little pop is normal if car was started cold but if coolant erupts, she’s done. Also look for bubbles in coolant for a minute during warm up. Oh and as I found out AFTER buying a 1500 bucker, look for the gray remains of a gasket sealant additive ( Barsleak etc. ) on the underside of the hood where the rad puked out the ‘cure’

But moving back to why buy new car -I’m perfectly happy with my 2001 civic- bought for 3300 at 217 K- now at 255K with about 400 into it repair- rear brakes, battery. Looks good, so why was I tinkering mentally with kicking tires??

Because in my sister’s words when she got a new car: ‘It would enhance my allure’

Oh right- to enhance my allure I’m looking at Lambo etc.

But believe it or not everyone driving a new car thinks people are looking at them- when 99% of the time no one cares! Although Escalades DO turn my head, in a way, all those chrome do-dads….

I’ve got to hand it one guy I met at a coffee joint- outside he had a really nice 61 Beetle, California plates and chicks were swarming the thing!

I asked him what he valued it at and he said about 9500.

If you want attention for cheap…

Nick

Let’s stipulate both you and your sister have great allure.

However, I buy new cars because I don’t want somebody else’s problems. I don’t even want to know what a head gasket is, or if one leaks it’s a bad thing. I especially do not want a rad cap rag. I want 100.0000% dependability.

The relationship between people and things is very complex: some do want a new car to enhance allure; some want a 550i as a reward for years of hard work. I do it for myself.

I’m rather partial to BMW 550i, which has a substantial zoom factor (even though it only gets used for 2 seconds on the freeway on-ramp). Besides, if nobody buys new cars, you eventually start running out of used cars (think Cuba).

Even worse than the used-car problem: If fewer than 15 million new vehicles are sold per year on average in the future, you can kiss the US economy goodbye.

Now we’re at 17.5 million. So that would be a big drop.

It’s great to buy used cars for a number of reasons, including that it keeps trade-in values high so that more people can afford to trade their perfectly good 3-year-old cars and buy a new one…. It keeps the money moving.

Wolf

GULP!

Are you saying Government Motors (or the UAW) may need more taxpayer money?

Before most of GM stock got sold at a loss, our smarter-than-everyone-else-in the-room president promised taxpayers we’d make a profit on the last bailout (Osama is dead and GM is alive!). Additionally, GM retained about $40B of deferred tax credits (worth about $10-15B against future profits) in bankruptcy (99.9% of the time these get washed away in bankruptcy).

It hasn’t gone that far yet. Last time it happened, it took years before GM and Chrysler toppled. I doubt that it will get this far this time. GM is in much better shape. (Chrysler is another story). The bankruptcy has helped GM shed a lot of its obligations.

[QUOTE]. I want 100.0000% dependability.[/QUOTE]

Depending on what you buy you can’t even get that from new cars. Each of the last 3 BMW’s we’ve had didn’t make it through the warranty period without needing some kinda work. My last Ford truck had a bunch of issues while still under warranty.

For someone like you, I recommend used cars less than 5 years old. If you want reliability, get a Toyota/Lexus. They’re better than Honda these days (though Honda isn’t bad). If you have to drive German, don’t drive used. They’re simply not built to last.

Nicks talking about ancient cars. Which is fine if you like working on them. A 5 year old car can be had for probably 1/2 new and depending on the car will have at least 5 years of dependable driving left in it.

To be blunt Chip- it sounds like you have more bucks than I do- as some of my lefty friends ( I do have some) tell me I’m the poorest right winger they know.

BTW: I don’t know about Bimmer, it’s one I haven’t owned- but I know folks who have major problems with brand new cars.

For a while Subaru was handing out head gasket additive to owners of very low miles units. My brother had his Foresters done at 45K.- three K bill.

To continue being honest- I’m always a little surprised when a guy doesn’t know the basics of how a car engine works- that poor old 4 stroke engine is our main slave.

I know you don’t want to know, but the head is the detachable top of the engine where the valves are found- they admit the air fuel mixture and remove the exhaust gases. Between the head and the main engine body containing the pistons is a gasket, a rectangular flat washer that seals the metal union like a washer in a hose.

If it leaks, pressure from the explosions inside the cylinder enters the coolant, which is circulating an inch or two away, and vice versa, coolant now enters the cylinder. In the end game- so much coolant enters it stops running.

If you’re ever driving behind someone, and suddenly his exhaust emits a white cloud- it’s steam where coolant has entered the cylinder.

It was time to replace my 16 year old car recently. The used car prices were very high for anything reliable that I was interested in. Vehicles with 100K and 150K miles on them for 20% discount? Some that are right near their timing belt replacements and other large maintenance bills?

You are shopping dealer lots- mistake one

WARNING ! WARNING ! to anyone & everyone reading this post DO NOT remove a radiator cap after a vehicle has been driven for 10-20 minutes. Even with a rag.. Coolant is pressurized at 15PSI to lower the boiling point. Never remove a radiator cap on a motor vehicle until it has cooled all the way down. That usually takes at least an hour. I think Nick must be thinking about the non-pressurized overflow.

Pressure raises the boiling point, not lowers it. 15PSI is the typical pressure a pressure cooker works at. You wouldn’t try to force off the top of a cooker at full pressure would you? Likewise don’t try to force off the cap of a hot radiator unless you really love the idea of major scalding injury…..

The US is all about making the monthly payments. That’s all that’s keeping it going. But even this will eventually hit a wall.

Pub

I somewhat agree financing has come to be less than the benefit it was supposed to be.

However, you do not have to finance acquisition of things. You may still pay in cash, gold, silver.

Financing came about (almost as a privilege) to make acquisition of things easier for responsible members of the American middle class. And, oh by the way, make money for banks.

As with other aspects of life, as soon as the government got involved, financing became available to the not-so-responsible and the not-so-middle class (example: the $1 trillion lent to 18 year old college students). Banks didn’t really care because the government had invented deposit insurance and a bunch of other “too good to fail” supports.

Run this scam long enough and you eventually run out of other people’s money.

Ptb

I did type your name correctly; spell-check made it even more correct.

I have a question for experienced car buyers:

Is there a pre-payment penalty on car loans?

If I can make the best deal possible (new or used) to get the price most heavily discounted by agreeing to finance the car (even at an annual interest rate of 50%), can I make the deal and then, say after one payment, pay the debt off in full without penalty.

I have no clue because I pay cash for everything.

You can usually prepay at no penalty. My bill always has the payoff amount on it.

There are increasing numbers of web sites that allow the buyer to research a specific year, brand/model and MSPR against a national data base to see the distribution of monthly payments actually negotiated by car dealers and buyers (this gets reported to the state DMV).

I use this before buying (I explicitly show it to the dealer). Dealers know about these sites, and if they know you are using one, it tends to eliminate noise in the financial negotiations. This is an incredibly powerful tool for evaluate your deal.

I worked in the industry, and I’ve never heard of a prepayment penalty.

Early payoffs are done ALL THE TIME.

When you go to a dealer to trade in your 2-year old car that still has 4 years left on the loan, the dealer will be eager to work a deal and pay off the old loan in order to sell you another car. Nothing happens unless you move the goddamn iron. A prepayment penalty would hurt the industry. It’s unimaginable.

Many auto lenders are “captives” – that is they belong to and/or are controlled by the automakers, such as Ford Credit, which is part of Ford Motor Company. Their job is to help move the goddamn iron (and make a ton doing it), not nickle-and-dime customers with prepayment penalties. And other finance companies have to compete with them.

Petunia is right: often the current payoff and a “good through” payoff date are on the bill/coupon.

If you want to pay off an auto loan, make sure you get an accurate payoff amount, and make the payment before the date indicated, or else it gets complicated.

When friends ask me, I always recommend your strategy!! Be tough on negotiating the price, but tell the dealer upfront that you’re going to finance. This way, the dealer will think that he can make up for his lost profit by setting you up in an expensive loan. A few days later, after you take possession of the car, pay off your loan. People do it all the time.

HOWEVER: if you get 0% or 1% financing on top of the best price you can negotiate, you might not want to pay off the loan. It’s free helicopter money :-)

Wolf

Since you worked in the car business, I’d appreciate your insight:

Do car dealers (which I understand cannot be owned by manufactures) really care how or if a car is financed? Do dealers get any financial incentive to encourage customers to finance as opposed to paying cash? Do dealers adjust their sales price based upon financing?

I understand if the captive financing company (Ford Credit, BMW Finance) gives you a 0% or 1% deal, you’re crazy not to finance.

Chip, I posted my reply below. I didn’t want it to be in a “skinny column.” So check a few comments further down.

If US automakers struggle, that doesn’t mean auto industry is going out of business. Top four models of cars are Toyota and Honda. European imports are fastest growing, expected to be up 30% by 2020. May not bode well for Ford or GM but the auto aftermarket is rocking and rolling. Look how many people put money down for a future Tesla that isn’t fully designed. Car culture is not going away any time soon.

Ennyman,

The auto industry never went “out of business.” I went bankrupt and restructured. Big difference. Investors lost their shirts. Taxpayers got shanghaied into the bailouts and into the cash-for-clunkers program, and not just in the US. Hundreds of thousands of people in the US lost their jobs.

Ask the stockholders and bondholders of old GM how they’ve fared. Or stockholders and bondholders of AC Delco or any of the other component makers that went bankrupt.

We’re talking about a financial and operational mess that will impact the US economy. We’re not talking about cars disappearing from the face of the earth.

i look at a chrysler 200 and i see a car that costs 6k to make.

i look at a ford focus and estimate 8k.

if you want a 5 year car, them’s the ones.

In UK, i read Ford is considering closing factories and raising prices in. uK to combat £1Bn Brexit blow.

My father inadvently bought a Ford car. For his it was an awful mistake. We went to Denmark on holiday and loading cars onto the ship was done by crane. As we looked at the underside of the car as it was being loaded, my mother said “your father is hoping they will drop it”.

ML: Your Mother’s comment is priceless. All autos are much better today than they were in my youth. We used to say FORD meant “Fix or repair daily”, or “Found on road dead”. :)

Sounds like another round government style Crony Capitalism is in order

A. bail out on the taxpayers back

B. government ownership with a new car Czar

C. bankruptcy screwing the suppliers, putting them into bankruptcy and/or out of business

D. screwing the stockholders/investors pennies on the dollar (if they are lucky)

E. implements a new improved cash for clunkers program

F. or all of the above

catblue442

What you describe for cars is pretty much vanilla socialism – definition of which is state ownership of production & control of distributing profits.

Crony capitalism is better used to describe the US financial industry (Don’t like a regulation? Buy/contribute to enough politicians to change the rule.)

Chip Javert, this is in response to your questions (I didn’t want to post this in a “skinny column”:

State franchise laws regulate who can own dealerships. These laws are designed to protect dealers from manufacturers. This is Tesla’s problem in some states that do not allow manufacturers to own their own stores. Exceptions have been made. For example, in Tulsa, OK, Ford made a deal with the state and with ALL ford dealers in the city and bought them out, and ran all stores together as a corporate entity (late 1990s). My understanding is that this was a disaster. It then went back to individually owned dealerships.

Car dealers make very little money selling new cars. Finance and insurance sales (F&I) are critical income sources. Dealers shop car deals to different lenders, from captives to local banks. They want the lowest buy-rate. Then the dealer figures a higher interest rate for the customer. The spread is dealer profit. For example, if a bank offers to finance X deal at a rate of 3% for 60 months, the F&I sales person might offer the customer a loan with an interest rate of 6%. The 3 percentage point spread, applied to a financed amount of $30,000 over 60 months is a good chunk of money in an otherwise low-profit-margin business.

REMEMBER: the interest rate on your car loan is NEGOTIABLE!!!

Yes, dealers don’t like it when customers pay cash. But it’s still better than not making a deal.

So a dealership might make you a better deal on the purchase price if it knows it can make up for it in F&I. The trade-in is another way for a dealership to make money on the deal. But if something goes wrong with the trade, dealers can lose money on the deal.

Back in the day, manufacturers’ incentives were usually either a cash rebate OR low interest rate financing through the captive. So you could choose whether you wanted for example a $3,000 cash rebate OR 1.9% financing in a world where normal low rates were 8%

This has changed. Today a big part of the incentives are volume-based and are paid to the dealer, rather than the customer. And you could get overlapping incentives. Generally 0% financing AND a good price on the car is a great deal. Maybe it’s month-end, and the dealer HAS to get a certain number of units over the curb in order to get the big incentive payment, and so they go crazy on price. If $300,000 is at stake, who cares about losing $3,000 on a sale.

No demand, no problem! Just have companies pay consumers for buying their stuff, disregard any consequences, problem solved.