There is a misconception about the uncanny ability of very profitable US companies, like Microsoft and Apple, to park their profits overseas in order to dodge US taxes: the money from these profits that are parked “overseas” isn’t actually overseas.

It is registered in accounts overseas, for example in Ireland, but is then invested in whatever assets the company chooses to invest it in, including in US Treasuries, US corporate bonds, US stocks, and other US-based investments. This was revealed to the public during the Senate subcommittee investigation and hearings in March 2013 that exposed where Apple’s profits that were officially parked “overseas” actually end up.

“Tim Cook emerged smelling like a rose, the triumphant CEO of America’s most iconic welfare queen,” I wrote at the time. And so the practice continues in all its glory.

These funds cannot even be “repatriated” because they’re already here — or wherever the company wanted to invest them.

According to a recent report by the Government Accountability Office (GOA), this and other practices give large corporations a big advantage over small businesses and individuals. Some key findings:

In each year from 2006 to 2012, at least two-thirds of all active corporations had no federal income tax liability.

Among large corporations (generally those with at least $10 million in assets), 42.3% paid no federal income tax in 2012.

Of those large corporations whose financial statements reported a profit, 19.5% paid no federal income tax that year.

For tax years 2008 to 2012, profitable large U.S. corporations paid, on average, U.S. federal income taxes amounting to about 14% of the pretax net income that they reported in their financial statements (for those entities included in their tax returns).

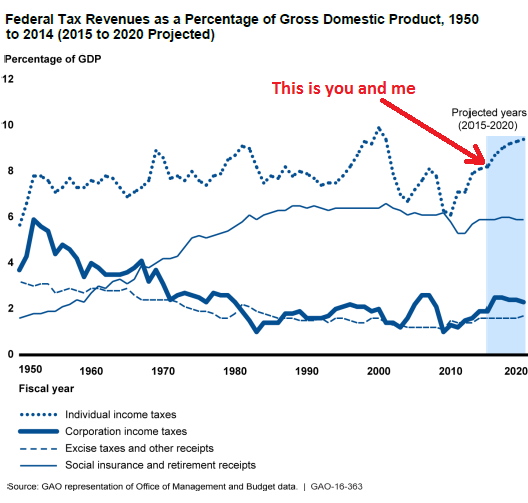

Federal Tax collections from corporate income taxes are now around 2% of GDP while those from individual income taxes are over 8% of GDP and rising. I added the red arrow and label to indicate where we stand:

The report points out the vast difference between the much bemoaned statutory corporate income tax rate of 35%, one of the highest in the world, and the Effective Tax Rate, which is zero for some of the most profitable companies.

OK, disclosure, I’m envious. I wish I could legally do that. As American, my worldwide income is taxed in the US (plus in other jurisdictions) even during the times I lived overseas — which makes American expats the laughing stock of much of the rest of the world. And we have no one else to blame but us; we voted these geniuses in Congress into office.

Apple shares have plunged 32% from June last year, and $282 billion in shareholder wealth has evaporated, on swooning sales and crummy data from suppliers. But still, Apple’s market capitalization is over $500 billion. And Alphabet’s is nearly $500 billion. Along with Facebook, Amazon, and LinkedIn, they constitute the Big Five in Silicon Valley, with a giant footprint on commercial real estate. And this could get very ugly! Read… Silicon Valley Commercial Property Boom Ends, Totally Exposed to Big-5: Apple, Google, Facebook, Amazon, LinkedIn

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Seems like much of north San Jose and militias/Fremont has a lot of empty office space yet these big guys build their own offices in the general area anyway. Maybe because thy don’t want to rent?

This is actually better than I thought. I assumed all of Apple’s money in China was actually in China and they would eventually be ‘encouraged’ to invest in whatever the Chinese government told them to. Seems like they are starting to do that now.

When a large company has systemic advantages over smaller competitors, it leads to monopolies and oligopolies in the long run. Something the Republicans in particular have forgotten is the meaning of “Free and Open Markets”. This doesn’t mean no regulation, as that stokes the natural tendency for markets to form monopolies.

Rather, it means that sensible regulations keep the playing field level. One way to do so is to increase the tax rate on companies that grow past a certain size, say 5% of market share. In the long run, the diversity such policies create lead to more efficient competition, and crucially more innovation. Anytime a company like Monsanto or the new Dow/Syngenta behemoth form, their ruthless practice of stifling small competition has a detrimental effect on innovation and fair prices.

Sadly, these facts of life make our country much less competitive than it could be, besides the fact that it enriches only a few beyond all measure as the 99% slide toward serfdom. I wonder what catastrophe it would take to for the voting public to elect leaders who favor true open markets. For now, just too many are brainwashed by the powerful lobby in Washington which is fighting against gov’t support for small business (think guaranteed loans to start-ups, etc). For the sake of our nation, I hope taxes will rise for the big boys, and not just a little. Breaking up -opolies is always a good thing; it’s one of the only things the science of economics has proven beyond all doubt.

Islander

Huh? Because customers willingly buy more of company A’s product than company B’s, we should punish company A by a higher tax rate? Bad idea. Very bad idea. Stupid idea.

How crazy is it to “level the playing field” by punishing successful companies so not-so-successful companies can “compete”? As long as companies are not violating laws or regulations, customers decide who is successful, not some stupid bureaucrat.

Islander, under your proposed scheme, would you & your friends be the ones buying an inferior products from Company B?

“How crazy is it to “level the playing field” by punishing successful companies so not-so-successful companies can “compete”? As long as companies are not violating laws or regulations, customers decide who is successful, not some stupid bureaucrat.”

Untill you try to apply that logic to the GM bailout, which mostly benefited O bummers pet UAW

And cost the US tax payer 10 Billion $.

RE: “…Untill you try to apply that logic to the GM bailout, which mostly benefited O bummers pet UAW

And cost the US tax payer 10 Billion $.”

*********************************

Indeed this was a bad option, but allowing the normal bankruptcy procedure would have in all likelihood cost the taxpayer much more, when all the consequential aggregate costs are considered, in addition to tying up large amounts of perishable and rapidly depreciating assets for a considerable period of time.

There appears to have been no attempt to conduct an “after action” investigation or autopsy to establish what went wrong and who was responsible/accountable, so that future debacles of this sort can be minimized if not avoided. What “symptoms” have been identified, and what laws/regulations have been enacted to correct the problem when these symptoms are identified? One suggestion is some sort of check list for corporate health [both financial and mental] with mandatory conservatorship and chapter 7 reorganization, with board reconstitution above a certain score. While there are many “red flag” items in the GM case, paying dividends with borrowed money, and looting [recapturing] pension funds stand out.

Another “red flag” should have been the extent to which the taxpayers were subsidizing GM’s labor costs by the “tax credit” [not deductible business expense] for health insurance. Such insurance was part of the labor contract, and had to be paid, even if GM lost money, and therefore had no tax liability to which a tax credit could be applied.

It is correctly observed “at some point the quantitative become the qualitative,” and the corporate leviathans, with the potential to cripple/collapse the socioeconomy if they fail [or even stumble], must expect much greater oversight, verging on public utility status, than the mom-and-pop operations. If they don’t want such tight oversight, then don’t expand to a point where their collapse could threaten the economy.

There was Over capacity in American auto production then, and thanks to O bummer and his UAW crony’s there, is still over capacity in US auto production now. And Ford is weaker because of it.

GM should never have been bailed out.

loosing jobs inn the US supply chain is a painful part of overcapacity reduction.

It is also in the case of GM a BIG straw-man, as those supply chain jobs have all been slowly lost.

GM the American company?? that paid $5M in tax to the US and $ 980+ M to china in the same year.

after the 10 Billion $ US taxpayer bailout loss.

GM that now imports buicks to the US from china. What did the US give GM stockholders 10 BILLION tax payer $ for??? to help it build new assembly plants ib china it seems.

Those US supply chain jobs have been lost, just over months not overnight.

@Chip Davert

Your assumption that because company A’s is “more successful” that their product is “superior” is theoretical. Sometimes it’s the case, sometimes not. A little ridiculous to think that economics is the one science that doesn’t have to be observed working in the real world or cannot not be engineered to perform differently. Those “socialist” Germans do pretty well “engineering” capitalism and not constantly adhering to the “free market” that U.S. Republican, ivory tower economists, financial institutions and other promote but don’t practice.

That’s the general point of this article. That “big” (what you call successful) have access non-product based services that small don’t have, in this case tax-avoidance, that tilt the playing field. Yes, his is all legal. The comment is going a step further to look to restrict this one aspect of non-product based services. That can lead to us possibly buying an “equal” or “inferior” product or diminishing “choice” in the market.

Where there is an obvious place for leveling the playing field tax-wise is regarding advertising. This part of the business world has nothing to do with “superior/inferior” product. Advertising it is tax-deductable. Eliminate the tax-deduction and make them pay full cost after a certain revenue level. More interesting (spitballing here) is increase the advertising “tax” for those over that revenue level who spend more than a certain percentage of their revenue on advertising. Going further is to use the percentage of sales/marketing costs to revenue, investment banking fees to revenue, lobbying to revenue. Search out all those expenses that have nothing to do with “inferior/superior” product. We treat R&D separately from other expenses tax-wise, why can’t we do that the other

Obviously the best thing tax-wise for small business is create a simpler and more flat tax structure so you can eliminate the lobbying that only the biggest “successful” companies can take advantage of.

You theorists need to get to the real, practical world of global capitalism. “Free markets” have been a way to give away U.S. competitive advantage, because nobody we trade with practices it. We’ve been fools. We rebuilt Japan and yet an American car there costs significantly more due to taxes because they practice mercantilism. China as well. Europe has the VAT (import tax).

This commenter doesn’t want to destroy the middle class and ruin small business ingenuity at the expense of big business socialism.

I remember when they told us that allowing interstate banking would INCREASE competition in banking and the consumer would benefit.

Hahaha!! That was a good one.

I’m getting inferior banking services from Bank B now because there is no Bank A.

Except that breaking up the trusts – like oil and big steel – dismantled the very organizations that had delivered more product at far lower costs to American consumers, raising their standards of living dramatically. Just because you say breaking up -opolies is always a good thing does not make it so.

Thank heavens for the original Rockefellers, Vanderbilts and Carnegies. They made American lives much more enjoyable and comfortable far faster than anyone ever imagined. Unfortunately, their fortunes are now put to use working against the very system that created both enormous wealth for them and enormous comfort for the common man.

Wolf, I am a newbie and enjoy your blog – I read them consistently… almost as consistent as I read LeasingNews.org. That said, some of this article misses the mark.

“In each year from 2006 to 2012, at least two-thirds of all active corporations had no federal income tax liability.” Of course they did! Many are pass-through entities and as to non pass-through entities many manage their tax exposure. That means large year-end bonuses to the one or two primary shareholders. In addition, taxes are based on taxable income (no Duh! comments, please) which is cash accounting (generally) and not accrual accounting. I would be more interested in understanding how many corporations with revenues above a certain level pay no taxes, or even better, corporations with highly dispersed (e.g. public) ownership where earnings cannot be shifted to the shareholders via bonuses, above-market rent rates of shareholder-owned properties, or other means. A comparison of reported book income and reported taxes would be interesting as well. As an aside, since I am typing away, it would be nice if entities over a certain headcount or revenue level (by industry) could not use cash accounting for tax purposes. That would solve much of that issue…

“Of those large corporations whose financial statements reported a profit, 19.5% paid no federal income tax that year.” There is the problem child…

The GAO report is linked if you want to check it out further. It’s long, but has some interesting stuff in it. I just quoted parts of the summary findings.

Social security and retirement receipts, ~6% of GDP. So this is additional money coming from you and me, right? So the total is about 14% of GDP coming from you and I?

oops, ‘from you and me’ I’m poor at grammar.

The congressional hearings on most issues are a waste of time. Especially, hauling Tim Cook to Washington to ask him why there is no tax money forthcoming from Apple. If only Cook had the courage to answer, that was the point of all the bribe money, no new taxes.

Gee.

Option B is that Apple is playing by the tax laws and actually owes no taxes.

It’s great fun to get a guy like Cook in front of congressmen who have taken hundreds of millions in “campaign contributions” to pass tax laws, and watch them hypocritically beat up a CEO who is following those exact tax laws.

Why beat a CEO up for following the tax laws? I you don’t like the situation, ELECT DIFFERENT CONGRESSMEN.

People who can not handle “diversity” and different opinions have made comments that Mr. Wolf should censor or ban certain people. These “sensitive” small minded complianers are the ones who should be banned, in a way.

I am TOTALLY LIBERAL and think everybody and anybody should be allowed to write/say what they want regardless or how intelligent of stupid the comment may be. Want to discuss racial inequality? The B*llsh*t of Religion? Go for it.

Therefore, I think Mr. Wolf should ban anybody who wants to ban anybody else since THAT person is the ignorant loser.

If you start your own blog, you can certainly have a comment section where, as you say, “everybody and anybody should be allowed to write/say what they want regardless or how intelligent of stupid the comment may be. Want to discuss racial inequality? The B*llsh*t of Religion? Go for it.”

But not here. This is a finance and economics site. We don’t get into religion, race, warmongering, hatred, etc. So I try to keep a lid on it (though I’m not always doing a good job at it).

There are plenty of other sites that get into those topics. But not Wolf Street.

Wolf,

I appreciate your monitoring of comments. Zero Hedge has alot of good material (some of it BS) but the comments are crazy. They’ve got folks that must sit around ready to pounce on every article to voice their agreement with whatever they think Tyler is trying to say. Many comments have very little insight and often are downright malicious or stupid.

I’m sure it takes a lot of work, but monitoring comments makes your blog more effective.

One comment: encourage your readers to offer personal/local evidence of what you’re writing about, if applicable. I find that very useful when reading comments.

Yes, I love it when readers submit their boots-(stilettos)-on-the-ground evidence and impressions. I love hearing from truckers and railroad folks and anyone out there working in the real or unreal economy.

Thank you Wolf.

Last thing we need here is according to Bible, Ezekiel, Mathew, etc.

Smart, interesting comments are part of a blog’s attraction. In fact (confession time), I may just click on Wolf Street, go right to the comments and rapidly scroll down to see if my fave Petunia has posted something.

Sites that don’t monitor comments become sinkholes for dumb name calling. Who wants to put the effort into an intelligent post that will end up sandwiched between trolls screaming at each other?

Thanks, I’m printing this and framing it. Will probably hang it in my kid’s room.

As I wrote the other day all those running round screaming 1% tax the rich tax the rich. Are willingly being used.

The 1% wealthy people, pay a far to larger a share of the tax collected.

Yet those in the article pay mostly close to ZIP 0. Then sit back and laugh at all the lefty’s screaming TAX THE RICH.

Personal US tax rates at the top, for private earners, are to high, and effective corporate rates , which for many are 0 %, are way to low.

well the money’s not in MY pocket…that’s for sure!!

…….It’s a big club…..and JQ PUBLIC is gettin clobbered……**

**with apologies to the late great George Carlin

Another very persuasive argument for Piketty’s “wealth levy.” http://www.amazon.com/Capital-Twenty-First-Century-Thomas-Piketty/dp/1491534656

Because the wealth of most people are concentrated in their house and vehicle, and these are already heavily taxed, a graduated/progressive “wealth levy” with a high threshold [20X median lifetime earnings?] on all assets, actually or beneficially owned, no matter where these may be physically located, would seem fair and equitable. In order to provide transparency and accountability, it is suggested the “wealth levy” should apply to all individuals and organizations [including religious, educational, and charitable] subject to U. S. law, with documented remission of the amount owed where justified.

The US tax code is insane! I am a Libertarian, with a few nuances from what’s been stated in their debates, and I believe in a modified flat tax for individuals. But for global corporations it is simply a shell game to play to be like companies in chart with Microsoft in first place.

These geniuses in Congress are simply doing what their financial masters instruct them to do to remain in power on Capital Hill, and the two-party duopoly serves these masters perfectly.

I am not sure how to correct this situation, but it works pretty simply: Corporation XYZ operates a bunch of subsidiary corporate entities around the globe to source their finished products. XYZ sells products everywhere, and as they do their books, they put most of the profits into subsidiaries in countries like Ireland. Just accounting shell games – but legal. Shareholders of XYZ are quite content with this tax dodging as it increases share price and dividends!

For individuals, we should scrap the IRS system that is currently in place. 1) the first ‘living wage’ income, of say $24,000 per year should incur no federal tax liability. 2) every dollar of income above ‘living wage’ should be taxed a a flat rate, say at 18%. It should not matter if that income is wages, capital gains, dividends or interest carried, the tax rate needs to be flat! ‘Progressive taxation’ is a myth based on greed and avarice. The truly wealthy pay a lower percent due to our screwed up tax code; that is the myth. Millionaires deserve to pay a higher percentage than the average Joe; that is greed and avarice.

IMO -The current monetary system & tax collection system is unconstitutional & has operated outside of those legal mandates laid out for all to see for 100+ years. Until this situation is rectified, all discussions regarding taxation & money creation do not seem relevant to me. We are searching for solutions while trying to operate inside an illegal framework. That illegal framework must perish first, & then a new constitutionally based system could be implemented.

The entire system was hijacked long ago. It must be reclaimed before real change could be implemented. Our central bank is a private entity & the irs is a private collection entity as well. Personal income tax would not be needed in a properly structured constitutionally based system. It is outright theft to steal a mans labor at the end of a gun in the form of a tax. The majority of this theft currently goes to pay interest to a private bank in a system than has run completely afoul. Until the current system is scrapped, all of these attempts at wealth redistribution & financing a debt based monetary system will continue & attempts to play the game within an illegal system will not change the intended results of the people controlling it.

My opinion is the same regarding corporate taxation in the sense that until we are operating in a constitutionally legal setting, it’s near useless to frame up a tax system that is proper & equitable to all parties involved. Chances of all of this getting resolved properly. About .0000001. See, there is hope :-)

There is one sector that has had near unabated growth for 70+ years with only a few minor hiccups. It currently employs over 22,000,000 people. This does not include “sub contractors”. Some organization huh. Here’s the link.

https://research.stlouisfed.org/fred2/series/USGOVT

Yes; in 1933, the IRS is charted in Delaware as a private corporation. It is not a division of the U. S. Treasury (even though that’s who taxpayers address their income tax checks to on 15 April). IRS Corporate Charter is its official title. This was acknowledged by the late U. S. Representative James Traficant in the Congressional Record March 1993.

There have been numerous court cases showing the IRS to be merely a corporate collection agency for the treasury as well.

Who owns the shares of this private corporation?

I don’t know but in Canada we have many variations of the Crown Corporation which in China would be called a SOE state owned enterprise.

There is a constant drum beat on Vancouver Island for lower ferry fares for cars ( they are among the lowest in the world) and people on the left (most of VI) blame this on BC Ferries being ‘privatized’. To which I ask- which private party owns any part of BC Ferries ( which loses millions)?

The answer- no one. The BC government owns all the shares.

It’s semantics. It’s similar to when a dentist or doctor incorporates. As a single proprietor he owns the business directly, if he incorporates he owns it via the shares.

At one time BC Ferries was a branch of government-then it became a type of Crown Corp.

Bottom line: it’s owned by the government and I suspect the same is true of your IRS.

But if I’m wrong, where do I buy its shares?

Nick

Good questions. When someone starts down the road to discovery, they have to be willing to spend an enormous amount of time & few will do that. There are no simple answers. Information is shrouded by law. Answers are found within the law & the accepted/known application of laws through hundreds if not thousands of case rulings. It appears that the irs has been set up as a trust & as such, there is no way to really know, as a trust does not legally have to disclose their actions, beneficiaries, etc. If you are really interested you can try this link for a starting point. FOIA requests have been mostly ignored or given pat answers with no correlation to USC code.

.

http://www.supremelaw.org/sls/31answers.htm

I have relatives that have conducted an exhaustive search of all aspects of our gov from a legal basis that encompassed many years. They have all editions of Blacks law dictionaries as definitions of numerous terms have changed from edition to edition.

Most everything related to the US, our central bank, or even what type of law we operate under are vague & obtuse & purposely so. When you start asking questions, things get muddy really fast.

Is the UNITED STATES a corporation?

Who owns the federal reserve bank?

What is admiralty law?

What kind of law does the US operate under?

What is the difference between common law & admiralty law?

Why are states, counties, cities, police departments listed as private corporations?

When did a corporation become a person?

What executive order describes our flag?

I could prattle on & on but for the most part, nobody cares. Attempts to answer some of the questions I listed lead to a LOT more questions. When trying to search these things out, one comes across all sorts of nonsense & conspiracy theories. One must look past all the garbage that is out there, read & understand the various rulings in a large amount of cases, seek out the laws cited in various rulings & then try to come to educated conclusions. Not easy & very time consuming. Legalese sucks!!!

For people in the US, try this. Go to manta which has an extensive list of corporations. Search federal reserve bank & see what you find. Search by name your local police department. Search, search, search. What you find is they are all private companies set up as for profit corporations. It’s a mind bender.

I have no idea about Canada so I would never be able to offer any opinions related to their structure.

Well as far as I’m aware, the same corporate criminal elite are running the TBTF banks so naturally I find difficulty calling that change but then again I’m not worthy of a Nobel Peace Prize either, am I?

I think Wolf does a fine job of policing his blog. He usually warns and only bans if someone doesn’t heed the warning. This is not a “me too” forum, the only requirement is to carry on logical discourse. Sometimes we agree to disagree and let reality be the court of final appeal. If you are right I will learn and vice versa. We occasionally get flooded with trolls, especially if the conventional wisdom is threatened in some way. “Do not worry if you cannot meet a man’s argument, you can always call him names”-Oscar Wilde. Keep up the good work Wolf!

Maybe we should have our last names be modified to be Corp. With the advent of AI and Machine Learning, the machines will learn that we are really just corporations and should be taxed as low as possible.

Now that’s an innovation I can get behind.

Profits parked overseas, losses stay at home, and: “boo hoo, we need help if you want this plant to stay open. Concession No. 1…..”

Right on! American tin cup corporations have raised “poor mouth” and begging to an art form…

Paulo

Some companies are domestic (example: your dry cleaner, dog walker and local plumber); some companies are international (example Apple, IBM, Ford). Domestic companies cannot (legally) “park” profits overseas. However, international companies manufacture, perform R&D, sell products and invest overseas, so they have legitimate reasons NOT to bring overseas profits back into the USA.

Just because IBM is headquartered in the USA does not mean all it’s profits belong to the USA (in fact, the majority of IBM revenue is generated outside the USA).

Just because you want other people’s tax dollars does not mean they are obliged to give them to you.

Many companies head quarter in places where they generate minimal profit: Ireland being one.

In fact the usual reason for MOVING HQ is taxes.

Many large US corps are very profitable and pay little or no tax.

And we haven’t got to tax havens, that only exist for this purpose.

BTW: sometimes I feel like the only right winger on this site, but the relocation of corps for tax reasons (inversions) is so prevalent that even I think the US is right to clamp down on them (Allergen etc.)

Don’t worry, you’re not the only one :-)

I always laugh when the debate about corporate taxes starts.

There is only ONE source for paying taxes: you and me. The average Joe citizen.

Companies that pay taxes, however much or however little, first collect that money from US, you and me, from selling us goods and services. The taxes that companies pay (or do not pay) are incorporated into their price structure – their cost of goods. You want companies to pay “higher taxes” then get ready for “higher prices” of their goods and services. Simple math. But then, given who controls our school system, that kind of information would never be taught to our kids. The “problem” in all of this is the somewhat spurious belief that higher corporate taxes are good for everyone. Why not instead get jacked out of shape about the real elephant in the room: the voracious thing we call government, that grows unchecked without restraint and drains us all of our wealth and our future. Government exists today for the sole purpose of wealth transfer – from our pockets to the pockets of all those feeding at the public trough. How about we simply cut government jobs, including contractors, by 25% in the coming year? And then another 25% the following year? Then there would be no clamoring for more taxes, as the size of the beast we feed would be reduced to manageable levels.

RE: “There is only ONE source for paying taxes: you and me. The average Joe citizen.”

While this indeed true, the imposition of corporate income, franchise, and other taxes, which show up in the sale cost of the goods/services, allows the consumer to see and evaluate the true cost of the products, and possibly chose alternatives. Hidden subsidies and costs are never a good idea, and the POS price should show the true cost of production + a fair share of taxes to operate the country + profit, with no additional charges on April 15th.

Last Week, Michael Hudson explained his role in establishing bank branches abroad at the behest of US State Dept.

State ‘s purpose was to lay claim to offshore drug, etc funds flowing to Switzerland from Panama, Liberia, et al.

“So that was my job for a little while … how to make America the criminal center”. [I think that is verbatim[.

goto [starts at 14:55]

https://www.rt.com/shows/keiser-report/341894-episode-max-keiser-910/

What is keeping mega corporations like Apple from taking all this untaxed (by the US) overseas profit and buying the majority of bond issuances with it?

This allows these companies to bring the overseas cash directly back on the onshore balance sheet and it also allows them to pay themselves an interest rate which is an expense. Thus, decreasing the amount of reported onshore profits and decreasing the onshore tax bill.

js

Don’t know if that would pass muster as anything other than tax evasion (illegal).

Of course, “campaign contributions” have been known to yield stranger things.

RE: …Don’t know if that would pass muster as anything other than tax evasion (illegal)….

It would be illegal if they did it directly, however if they deposit the funds in a friendly, nominally independent [quasi/shadow] bank in the tax haven where the funds are domiciled , and that bank buys the bonds, possibly with above market rate interest, which transfers yet more money out of the country to the tax haven, they should have no problem and its very difficult to trace. No reason you couldn’t have a “daisy chain” or cascade of “banks” in separate countries to make tracking almost impossible, and provide warnings of attempts.

Its not illegal to buy the notes with offshore funds, in the US,and hold them, In the US. (the US actually encourages them to do this.)

Where the interest is paid to, and where the funds go, when the bonds are liquidated, can raise Tax compliance issues.

The Amount of US illegal Drug and Tax evasion funds, that have been moved offshore the returned into treauries and many TAX FREE Munis is massive and the IRS/FED know this, they encourage it.

A US corporation does not have to go overseas to avoid taxation. One way is for it to set up its own “captive insurance company”. And, the leading place to do so is VT. See:

http://www.nytimes.com/2007/04/04/business/04vermont.html

You run all of your insurance through your captive at the highest premiums possible. The operating company gets to deduct those premiums, which the captive does not tax in VT. Your VT captive lays off some of the risk by purchasing tax-free reinsurance from someone like Buffett.

Now, your captive can invest its surplus by loaning money back to the operating company. And, these schemes have existed for years.

Like Wolf has pointed out, the results are abhorrent to small businesses, that do not have the size and scale to get involved in this. “Tax avoidance” costs money.

What is all the fuss about??

Apple pays U.S. taxes on profits from sales in the U.S. Their U.S. sales account for about 35% of global and their U.S. profit margins are also about 35% taxed more or less at the full U.S. rate. Therefore the U.S. corporate taxes comes to about 4% of global profits. They also pay taxes in Europe on European profits, via their Ireland operations – albeit at a much lower rate than others in Europe want, and certainly in the U.S. they also pay taxes in places like Singapore, Australia etc.

If the implication is that a U.S. based company should pay U.S. corporate income tax on all it’s global profits, then it shouldn’t have to pay corporate income tax in any other country – otherwise it’s double taxation. Good luck with that! Apple and any company who has most of it’s sales and profits outside of the U.S. would evaluate the cost-benefit of moving to a lower tax jurisdiction. And there are plenty to choose from.

There is no comparison to global income taxes for U.S. citizens. Agree, pretty dumb (I myself am an expatriate who runs an international business) but companies pay taxes on profits (which can be manipulated), individuals on income.

“If the implication is that a U.S. based company should pay U.S. corporate income tax on all it’s global profits, then it shouldn’t have to pay corporate income tax in any other country – otherwise it’s double taxation. Good luck with that! Apple and any company who has most of it’s sales and profits outside of the U.S. would evaluate the cost-benefit of moving to a lower tax jurisdiction. And there are plenty to choose from.

There is no comparison to global income taxes for U.S. citizens. Agree, pretty dumb (I myself am an expatriate who runs an international business) but companies pay taxes on profits (which can be manipulated), individuals on income.”

+

US Corporates can get a TAX CREDIT, on the portion of tax they pay in a foreign state’s, when they repatriate profit.

Yet US citicens are required under FACTA ANd IRS reporting, to pay full double taxation annually, when they work overseas, even for decades.

So FACTA and overseas IRS compliance for Citizens is wrong. Or Corporates are getting a TAX Free ride. Either way the IRS has huge Credibility problem. In the foreign taxation field.

Quick answer is to implement unitary taxation. Basically if 35% of Apples sales are in the US, then 35% of Apples’ aggregate world-wide profits are assumed to have been earned in the US, and taxable at US rates, no matter where these may be stored.

George

Ungood. Your example makes the a priori assumption that profit margins are the same on all sales (highly unlikely).

Now is probably not the time for me to go into my rant about how corporations should not have to pay taxes (THEY SHOULD HAVE TO PAY MARKET-RATE FEES FOR GOVERNMENT SERVICES LIKE WATER, POLICE & COURTS). Currently end consumers pay all corporation taxes (it’s in the price) and the cost of legal corporate tax avoidance. Note: if a company pays no taxes, it’s not paying for police, courts, etc. But I promised I wouldn’t mention this…

More taxes, more regulations more leftist voting tax collectors, with fat taxpayer funded, leftist union mandated pension’s??

Adding another complex. Very expensive layer. To an extremely complex, and overly expensive tax collection entity, staffed by predominantly leftist voting attendees, isnt the answer.

All taxes should be collected in the form of sales tax on retail sales and use. Every person that spends a $ would then know and have to vote for the politicians that establish the rate of theft of their labor.

It really gets old hearing corporations are evil for not paying their fair share. Business’s should not be burdened, small or large, collecting and paying money to the thieves in government.

It time the lazy non-productive citizens that are freeloading off the system reap what they sow. Nothing!

Until our complete tax system is trashed and a consumption based system is in place we will continue down the path to total enslavement by the political elite who use the current tax system to buy off an electorate promising to meet their every need.

I totally agree with your position. It is also telling that businesses have been made to be the collection agent point man for their theft.

I totally disagree with a national sales tax because the tax will be passed on to the sellers not the buyers. I currently live in an area with a 10% sales tax. I don’t buy anything that is not on sale for at least 10% off. I am not the only one. When there is a sale at any big retailer the store is packed, otherwise they are empty. Avoiding the sales tax is a pass time, as is hunting for coupons to avoid it. A national sales tax would be larger and therefore there would be an even bigger incentive to avoid it. The unintended consequence of hiking the sales tax will be lower revenue. If our elected representatives were smarter they would have lowered the sales tax to increase revenue.

Taxing ones labor is pure theft IMO. It diminishes productivity. The more you produce = the more you pay in a graduated system is a bad equation.

I get your point (I think?) but the reality is all tax is eventually passed on to the consumer. The seller would merely be the collection agent at point of sale. Are you assuming that Chlleo is proposing additional taxes? That doesn’t seem to be the case when I read the post & I am also 100% against ANY additional taxation. Eliminate the tax on labor, period. Then a flat consumption tax. The productive will rise to the top & the unproductive will indeed reap what they sow. The amount of money currently stolen from us is way beyond what a functioning society needs.

I did understand that he was talking about a total replacement of the tax base with a VAT tax. But my experience with the local sales tax coincides with the experiences in places like Greece where the tax was implemented. People just don’t pay it, don’t charge it, and don’t even pay it after it is collected. Point of sale leads to weakening enforcement.

We have a working POS tax system. its over 35 yeasr old now

The prime Minister who enacted it, “Even Bank Robbers, pay GST”

When he restricted currency movements.

“why do they need a Swiss numbered bank account, they can get an anonymous numbered account at the local TAB (Government Owned Book Maker)”

You file and pay sales tax Bi monthly now, There is no Set Off/contra to other taxes.

The sales tax department is a separate individual Dept/Module. It has no Interest in anything, except Sales-tax.

Dont file or pay on time, They are apt to walk in, shut you down, and lock you up. Simple, and it works.

greeks dont pay any tax, as greece dosent attempt to enforce, and when it does attempt to. The enforcers can be paid to go away and make sure any court action fails, due to bad preparation, lost evidence etc.

greec is a very poor example to use. Unless it suits your Agenda..

“Point of sales leads to weakening enforcement.” This may or may not come true. All we can do is speculate. In the current social/political environment, you are probably correct. In a brand new system via my utopian vision (that will likely never materialize) I believe it would work. I sincerely believe that the majority would support a system that was much less extractive & complex than what we are forced into now.

All things political & financial are so completely & thoroughly mucked up at this point, that any stop gap measures, new laws, etc. will have unintended consequences. IMO, it must all fall apart for something better to spring up. It’s just awfully sad having a front row seat to the madness while trying to explain the world to grandchildren. Press on regardless.

Petunia,

The biggest problem with a national sales tax, VAT, GST or whatever you want to call it is not with collection, but with creep.

As soon as it is implemented the stinking politicians see a huge new pot of money to spend as they wish.

When that runs outs the next step is to increase the rate of tax. Japan is a perfect example.

5%, then 8%, and next 10%……………

Here in Oz we have a 10% GST, but in order to increase it or change the goods that are subject to tax, all the states have to agree.

So at least we have that protection here.

15% over the ditch it was supposed to stay a 10%.

The states will agree, if they get a bigger piece of the take in exchange.

Even more pernicious is that it is a highly regressive tax which impacts the lowest income individuals the most heavily because they must spend almost all their income on items to which the sales/VAT tax applies.

Only since the tarrifs were replaced with personal income tax has the Bottom be able to make the top pay an unfairly large share of the tax burden, instead of a % based consumption system. Which is what Tarrifs effectively were.

The only thing that justifys one person being charged a higher tax rate ,than another on their personal income is, discrimination, and malicious, vindictive, envy.

If I charge somebody more because they are black, or yellow, that is racist, and illegal.

But richer than average, that’s ok charge them 10 times more, they can afford it.

Fair flat personal income tax, or no personal income tax.

review marginal utility. The idea behind progressive taxation is that the marginal utility [as perceived by the taxpayer] of the amount of the taxes should be equal between individuals. 10% of a minimum wage earner’s income has a far larger marginal utility the 10% or even 50% of Bill Gates income.

https://en.wikipedia.org/wiki/Marginal_utility

marginal utility.

Just another excuse to justify extortion by the envious. From those who have achieved, or whose parents provided for them.

There is no fair nondiscriminatory reason, why any one person should pay a higher percentage of their personal income in tax than another.

Anything other than flat tax, is Communist/Socialist Income/Wealth redistribution by Legislative force (Envious MOB EXTORTION).

Which those paying a higher unfairly extortive tax % rate. Must have the right to resist, by force.

The Globalised Corporates are Gaming on end of the system, and the mob is gaming the other, the only people actually paying for everything, currently, are those labeled “Rich”, By the envious.

Yet YOU want more from those who are already paying an unfairly large share of the tax burden.

Time for YOU to accept and expect, LESS, from those already paying to much.

Flat personal income tax, or no personal income tax should be the way of the future. And no asset based taxes either.

George – Yes the lower income brackets pay more out of their overall incomes, that’s obvious. I believe most of the people that use this as their main point, fail to look at so many other positives. IMO, the positives far out way this one point that to me is not a negative or regressive at all when the entire spectrum is examined. Please consider the following.

First, the higher income person & the lower income person pay the exact same rate, that’s fair. This is important. What is the higher income earner likely to do in a more equitable system like this? They have more money, they will either save or spend it.There would be a huge incentive to save money across the board at all income levels. Savings are the proper foundation & base of an honest banking system (assuming proper monetary system). A strong & sound banking system leads the way to a healthier economy & more opportunities for everyone at all income levels. Your savings are never taxed unless & until the money is spent. Long term, would this not be a huge benefit to all?

.

There would no longer be double taxation in regards to saving or investing, a huge plus for everybody both high & low incomes alike. People in higher brackets would be much more inclined to start/expand a business leading to more opportunities for all. They would be more likely to hire the services of a lower income tradesman creating more income possibilities for all.

Businesses would be able to eliminate everything that is associated with collecting taxes from incomes. The mechanisms are already in place to collect sales tax. The irs could go away. You would no longer be forced to testify against yourself under threat of imprisonment or worry about having your property confiscated. How many people truly understand the tax documents they sign? Another huge plus for all citizens.

Lower income wage earners would be incentivized to spend less & save more. The ones that are motivated are likely to produce more because their labor is no longer being stolen from them at the end of a gun. No man has the right to steal the fruits of another mans labor. Period!! I don’t understand why so many people think it’s OK. Labor is not income. The money that is stolen by force also squandered & non productive.

The funds that are siphoned of all wage earners on a weekly/monthly base (before they have made any purchases) would be continuously available & freed up for them to save or consume as they see fit. Even the low wage earner has money siphoned off the backs of their labor every paycheck. Then they are given subsidies/benefits at the end of the year which has led to a HUGE disincentive to be productive. Gotta keep the income level down so we can get those benefits. This would change.

Many (most?) these days live beyond their means & there is no shortage of laziness to be found. No system will change this.

There was a church in the area that had set aside some of their property for a community garden. They shut it down due to apathy & a lack of participation. Drive through a low income area, look at the newer cars, look at the arable land that sits idle. Many do not wish to work so they can reap what they sow, which is nothing. The motivated individuals that control their spending & increase their labor output have a much better chance to get ahead under a flat sales tax system than what we currently have.

Realize that this system could not work within the framework we currently have & I do no claim that it would. The entire corrupt system of government, money, taxation, regulation, & law needs a complete overhaul. The scope of what needs to be done is huge. It won’t be done. The gov is supposed to be subservient to & serve the citizens & we have been led to a point where it is completely backwards. Societally, where headed to a very bad place. I plan accordingly.

On a bright note, it was 90 degrees today in the shade & my garden is coming along fine.

Enjoy the day!

Businesses should not be taxed AT ALL as an incentive to locate or to remain located in the US… along with their money. After all, who ends up paying “their” tax anyway? Their employees in reduced wages and their customers. It’s not like they don’t pass that cost along in their products and just take the hit.

Businesses should only be charged locally for the local expenses they incur via “user fees” (ex., road taxes within fuel costs).

Winston,

Becomes quite visible this way as well.

Current system – sprocket retail price $1 – tax cost = .77 cents

VAT Flat Tax – sprocket retail price .77 cents + tax cost = $1

Only difference no vote purchased and tax payer see’s the cost of government.

This is the only reason the progressive income tax system exist. To feed those at the trough. The politicians, government employees and the freeloaders. All non-wealth creating drags on the economy.

Well here in Oz the current government is going to try and reduce the amount of tax corporations pay. The estimate is that the tax reduction will be around A$50 to $55 billion over the next ten years.

Ordinary wage earners won’t see a cent in higher incomes from that. Some kind of Oz trickle down bull S ***.

They also want to reduce the amount of tax paid by those making A$80,000 a year or more. Nope, not even a cent for the lower income earners, but wait there’s more.

The energy benefit/allowance for people on unemployment and pensions is going to be scrapped………….

That elimination can be added to getting rid of the non-working spouse tax credit, the medical tax offset, the reduction in pensions for those living overseas, and who knows else over the past few years.

Way to go conservative/labor governments.

I’ll probably vote for the Sex Party – at least they haven’t ‘screwed’ me yet……………………

This is a direct consequence of globalization. If you want to tax corporations, first raise your tariffs. It’s as American as apple pie ( see Alexander Hamilton’s report on Manufactures) and its the real reason the corporatocracy is terrified of the Donald.

Amen, if we acted in America’s best interest not only would we be doing much better so would the rest to the world. 103 years of the Frankfurt School acted out with Kensyian Economics has just about destroyed us. To hell with the One World Order. It only brings chaos and destruction wherever its implemented.

Yea. We gave this a shot with the Smoot–Hawley Tariff Act. Helped to make the Great Depression greater…

If you want to live in a modern world where even people at the USA poverty line have more luxury goods (TV, cell phones & service, private car, refrigerator, inside plumbing) than a 19th century European monarch, you’re gonna have a complex economic system. Get used to it.

BTW if you make $45k ($40k after tax) in the USA, you’re in the top 2% of the world.

And if you are commenting on this site you have electricity, shelter, at least some leisure and you are using a computer that 20 years ago would have cost 100K.

The latter courtesy of capitalism.

RE: “you are using a computer that 20 years ago would have cost 100K.

The latter courtesy of capitalism.”

**********************

While this is correct to some extent, it ignores the critical contribution made by DARPA and Project Tinkertoy. If integrated circuits and modular components had not been available, the MITS Altair 8800 and IMSAI 8080 could never have been developed. https://en.wikipedia.org/wiki/History_of_personal_computers

Many of the triumphs of U. S. economic development are a direct result of initial governmental finance and/or research, which as you point out were then expanded and developed by our entrepreneurs and promoters.

A quick and partial list of such advances includes:

Canals

Rail Roads [financed through land grants of federal land]

Interchangeable parts

automobile/truck industry by building roads

civil aviation [mail contracts and military R&D]

personal computers as indicated above

the internet [another DARPA effort]

shale drilling/fracking [Dept of Energy]

CNC machining

I find your categorization of the development of railroads in the US as a triumph of US economic development quite interesting to say the least. IMO, this view is completely detached from what really transpired.

Thanks for mentioning railroads, one of the earliest government sponsored monopolies rife with fraud & corruption at all levels. It morphed into the conglomerates we have today True capitalism had zero to do with building our rail system with the exception of the Great Northern Railroad which was built by James J Hill & was the only one not to use government subsidies.

Hill paid for all of his land with private funds, paid farmers to farm near the lines using techniques pioneered by an agronomy professor. The farmers reportedly had yields 60%-90% higher than conventional practices. This is the story that should be taught along side the glossed over version we got in school.

Government charters & land grants indeed. The land grants initially totaled 130+ million acres & are still a source of contention today. Check out the Credit Mobilier scandal as but one example of the corruption, fraud, & waste mad possible by government subsizies. For anyone interested in the real story follow the link.

http://www.landgrant.org/forfeiture.html

In the modern world, tariffs dont Tax International Corporations.

They Tax the purchasers of their products, and more importantly, make them less competitive, against the local manufacturers they are normally undercutting, that do possibly pay a tax on their profits.

Tariffs based on total pollution output of the producing nation, Labour and safety standards at point of manufacture, State subsidy’s hidden and direct is what Tariffs should be based on in the future.

Pollution, and poor Labour safety standard tariffs, should be particularly punitive.