Alberta Falls off the Chart.

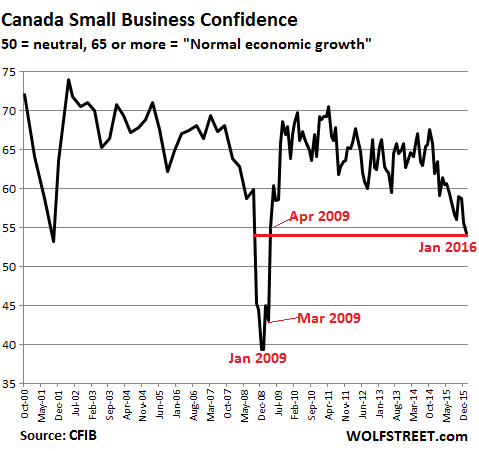

Owners of small businesses in Canada have been feeling the blues for months. And in January, their optimism dropped to the lowest level since March 2009, the trough of the Financial Crisis.

That’s what the Canadian Federation of Independent Business (CFIB) reported. Its Business Barometer has a scale between 0 and 100. A level above 50 indicates that owners who expect their businesses to be stronger over the next 12 months outnumber those who expect their businesses to be weaker.

But: “One normally sees an index level of between 65 and 70 when the economy is growing at its potential.” That’s what the CFIB calls “normal economic growth.”

In January, the Barometer dropped to 54.3, the third monthly decline in a row, down from the post-Financial crisis peak in April 2011 of 70.6, and, as the report said, “about 10 points below the level associated with normal economic growth.” It was the worst level since March 2009:

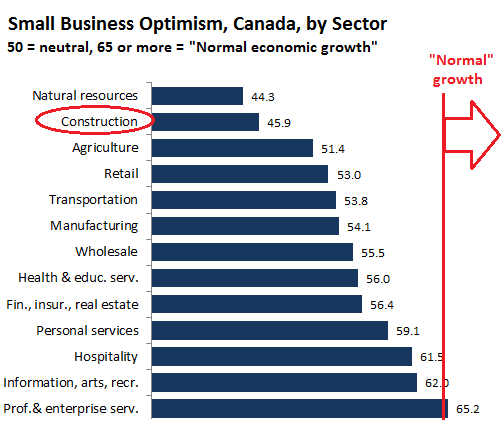

But there was a bifurcation: business owners in the services sectors came out on top. If not exactly gung-ho, at least they were hanging in there; the most optimistic were in the category Professional and Enterprise Services. At 65.2, it was the only category associated with “normal economic growth.”

Business owners in Information, Arts, and Recreation had the second highest rate of optimism, at 62.0, but already below “normal economic growth.” In the rest of the categories, optimism swooned, with businesses in Construction (45.9) and in Natural Resources (44.3) feeling the most pain. And note Retail, a reflection of where the consumer stands:

The survey found that “hiring and wage plans are weak for this time of year.” It specifically blamed the Canadian dollar, whose “freefall is also causing problems – the percentage of respondents squeezed by currency-related costs has reached a record 38%, compared to 10% to 15% in more ‘normal’ times.”

Of the limitations on sales or production growth, “insufficient domestic demand” was by far the most important factor (45%).

And there were big differences by province. Business owners in Nova Scotia led the country in optimism, but at 69.0, the index was down two points from December. Nova Scotia was the only province with an index level over 65, associated with “normal economic growth.”

Business owners in Newfoundland and Labrador, New Brunswick, Quebec, Manitoba, and British Columbia muddled along, with index levels in the low 60s. In Saskatchewan and Ontario, business owners were even less optimistic, at 58.7 and 58.4 respectively.

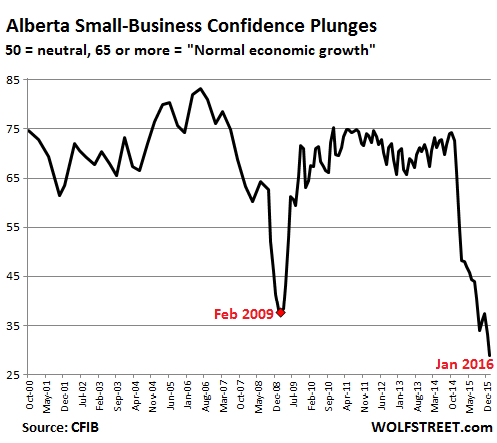

And in Alberta, Canada’s oil province, the index plunged “yet again,” this time 4.3 points, to 28.8, “depths so far uncharted by the Barometer.”

In September, pessimism in Alberta had first blown through the previously worst level during the Financial Crisis in February 2009 (37.4), then recovered a little, only to re-plunge to even lower levels:

The report:

Short-term hiring plans worsen even more with 35% of owners expecting to cut back and only 9% intending to hire. Furthermore, 29% of owners cite that their firms are in bad shape and 19% say their businesses are in good shape – a slight deterioration over the previous month.

Of the limitations on sales or production growth, 71% of the business owners listed “insufficient domestic demand.” That’s a sign that the local economy, ravaged by the oil price collapse, is in a tailspin.

During the Financial Crisis, the price of oil collapsed too, but then rebounded in a V-shaped recovery, and small business optimism along with it, as the chart above shows. But there is no indication that there will be a V-shaped recovery of oil prices to levels where Canadian tar-sands producers, the high-cost producers in the world, can survive. However, there will be plenty of sharp rallies this year and perhaps even next year that then implode again. So Alberta’s economic issues are likely to get worse before they get better.

They’re already bad enough. Statistics Canada just reported that non-farm payrolls in Alberta plunged by 65,200 employees in November from a year ago. And average weekly earnings – for the lucky ones who had jobs – fell by 2.4%, to C$1,130, the fifth year-over-year decline in a row. And it wasn’t just oil: StatCan:

Declines were spread across many sectors, led by construction; accommodation and food services; as well as real estate and rental and leasing.

However, weekly earnings in Alberta are still the highest among the provinces. The average for Canada rose 1.4% from a year ago to C$951.

That’s what oil booms do. Money flows knee-deep through the streets. Wages are high. Businesses are exuberant. It feeds all kinds of sub-booms, including office-tower construction booms that further crank up the local economy. But when the money dries up, everything comes to a halt. People lose their jobs. Towers remain vacant. Construction halts. Loans go bad. Homes no longer sell. Home prices fall. Consumers slash their spending. And small businesses get hit very, very hard.

Already, Canada’s brick-and-mortar retail is spiraling into turmoil. Read… ‘Footprint Rationalization’: Sears adds to Woes of Canada’s Malls

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

I live in Alberta, and I assure you, the mood here is grim . . . Last week I drove up to Grande Prairie for some meetings; while I was there, the company I was visiting (whose employment roll is at less than half of its 2014 count) announced that they are closing one of their regional centres.

If you read the comment sections of newspapers, there is a gigantic amount of incoherent rage at Trudeau and Notley — fury that they are considering bailing out Bombadier (instead of the entire oil and gas sector), rage that the pipelines aren’t being built (though Harper didn’t get them built through his entire regime), rage at Obama. I’m sympathetic that people are hurting, but the peculiar combination of ‘hands off, asshole’ during the boom years, and ‘HELP NOW, ASSHOLE’ during the collapse, is striking. No one at all is interested in confronting the fact that most of Alberta’s energy output is basically the world’s most marginal oil, in an awkward location, and that when prices fall it will naturally become extremely unprofitable; or that going forward, investment is naturally going to be moderated by the fact that profits depend on decisions made in the United States, Riyadh, and Moscow.

Very noticeable out here on the “Wet Coast” and the amount of vehicles with Alberta plates around!

I know a number of people who work in the “oil patch” mainly in the Fort Mac area. Almost all were told during their Christmas break that they would not be coming back and not to call, they would call! I know of only one individual with a unique skill set that is going back. But, he was told that his travel expenses would be paid to Edmonton and that he would have to find his way from there!

Construction is still going strong on the coast with the last of the “Baby Boomer’s” (born; 1946-1954) selling up their big empty nests and retiring to a warmer climate, without having to deal with extreme cold or snow.

The youngest of the “Boomer’s” would be 62 years old now, so I would hazard to guess that the migration is coming to an end. Along with the end of this two decade long construction boom.

It’s a sad indictment of past Alberta Governments who failed to bolster the Heritage fund when oil was at record prices, instead using it as a piggy bank for vanity projects. And of course, many didn’t save for a rainy day…and now it’s flooding.

“The mood is grim”

Yes, and yet the rating isn’t what you’d call grim, more like downbeat. Grim would be under 25.

So take these sentiment surveys with a big grain of salt, business owners have every motivation to be unreasonably optimistic

Very good comment, Nick. It is instructive to hear this from someone on the ground floor.

Here, over on the Vancouver Island coast I think many are oblivious to most world and economic issues. I have absolutely no idea where young people are planning to find work going forward? Locally, we have a lot of construction still ongoing for the refugees from Vancouver, Alberta, and colder climes. They have a pocketful of cash and are relocating. My son is doing fine with a new electrical business after 10 years of Oil Sands camp work. He bailed out about 18 months ago and works on the north Island.. My best friends daughter is a pipefitter apprentice in Alberta. She is still working and doesn’t seem fearful of being out of work, either. I also know lots of trades folks still working full time and commuting from the Island. I understand the stats, but it seems the ticketed and experienced in specialized trades still seem to be employed.

My ex in-laws used to joke that when they lived in Alberta, Albertans used to beileve Aberhart actually put the oil under ground for them. I am not terribly surprised they blame Trudeau and Notely for the current woes. In one sense, it would have been real Justice if Harper could have retained a minority Govt this time around. He could have then carried his own can into oblivion.

Good luck, you guys. I hope you stay working and are doing okay.

Yes… what’s unfolding in Alberta is a great tragedy on many levels. Unfortunately, the entire enterprise was doomed from the get-go. Not only is the Tar Sands venture a despicable environmental disaster of monumental scale and short-sighted opportunism to say the least, it never made any economic sense to begin with. Modern Industrial Society cannot function at nose bleed cost levels or EROEI’s less than 15:1 ratios. Someone, or a bunch of someone’s, knew this, but financial scheming without conscience is the flavor of the day. Unfortunately, every Ponzi Scheme or Conduit Scheme has its day and what’s occurring in the energy sector is also occurring across a spectrum of other commodity markets similarly gamed.

No worries Alberta, the commiseration is about to get more wide spread. Canada as a whole, will circle the drain in due course as credit and energy deflationary forces tighten their grip. The new slate of bandits currently occupying the halls of Parliament and their banker masters are helpless to doing anything about this other than prolong the misery by appearing to be credible and instituting bizzaro financial engineering schemes like NIRP, bail-ins, currency debasement, etc. Sure.. we can blame them and their predecessors, but while the good times (rape and pillage) were rock and rolling, not a peep was heard from the self-absorbed, ignorant population. No one cared as long as the money was flowing. Now… only the blood will flow as a stunned and shocked populace goes hunting for scapegoats.

Despite empty store fronts and very high commercial vacancy rates, developers keep putting up more buildings in Vancouver. They aren’t fully leased and sit half empty from day one.

This is why trades still thinks things are fine, they don’t notice all the empty buildings cause they’re working.

When the losses start to bite hard enough, developers will suddenly awake to the nightmare they’ve created, just like Calgary.

That’s when the trades will also be thrust into reality, again, just like Calgary.

As for retail, malls everywhere in BC are at least 10% empty, but usually more. Popular shopping districts have “for lease” signs everywhere.

Saying that Vancouver is still ok is laughable. I have friends in business and they’re down at least 25% since 2010.

Of course there will be exceptions and those still doing well, but one look at vacancy rates and empty store fronts dispels any illusion of that being representative of the economy as a whole.

Who says Vancouver is still doing okay except for the Vision boys and girls?

From what I can see, and from where I sit, I would think time is running out on getting out. Last night I watched the Global news and winced at the traffic reports and property prices. People are crawling home, bumper to bumper every evening, hours after sane folks have eaten supper. Yes, it is a beautiful city, but the lifestyle looks like hell on earth.

Vancouver has to be the most overrated city in the world imho.

Salaries are low, traffic is probably as bad as in LA. There is no highway system to serve it properly and it is jammed no matter what time of the day is. It has no nightlife, and is mainly a soulless city. There are 2 months in the summer that Vancouver is truly beautiful, after it is just like Seattle, without the industry and the cheaper lifestyle. I remember one November, it rained nonstop for 23 days 24/24 , it was beyond depressing, I never regret having left that place, but I will gladly return there during the summer, although Victoria is a better destination by all measures.

Just like Toronto and rest of Canada.

Vancouver – the San Diego of Canada (nice weather, relatively speaking). I’m afraid this downturn will be vicious. I’m glad I’ll be weathering it, so to speak, quite a ways south of Vancouver where the sun shines most of the time anyway.

Any downturn in construction is felt first by highly paid professionals such as architects, engineers and surveyors as they are called upon first for any construction project to get it off the ground.

Tradesmen are called on later in 12-18 months time when construction actually starts.

So if your a tradie and your local architectural of surveying consultancy are firing, better brace yourself for what coming down the pike in 12 months time.

It then cascades down the chain to restaurants, personal services and retail.

I live on Vancouver Island but I’m in Montevideo Uruguay right now a place I recommend- but I wish I’d taken my half- assed Spanish lessons more seriously.

Before I left VI I ran into about 5-6 people returning from Alberta, where I spent many years.

A prediction- Rachel Notley’s NDP recently ended many decades of Conservative rule.

We are about to see the surprise second act- one of the fastest transformations in Canada’s political history.

Notley is about to morph from Joan Of Arc to the Anti-Christ, by saying one magic phrase: Social Contract

Alberta’s Golden Years, where the Trust Fund was milked anyway, have resulted in the highest paid public sector in Canada ( which helped to drive up pay in BC and Saskatchewan as the arbitration industry used the highest settlement as the base line)

Notley has three choices: introduce a provincial sales tax, run huge deficits or confront the public sector that was an essential ally in the NDP win.

So maybe I’m wrong- with Kid Trudeau saying he’s going to run deficits maybe Notley will say she’s going to stimulate the economy or some such rot, take the middle option and kick the can down the road.

The idea of stimulating the economy in these non-manufacturing places is even worse than usual because as soon as someone buys virtually anything other than a service, the money leaves the area.

“the highest paid public sector in Canada”

Retire at 55, and have your pensions paid out of your private sector neighbors’ taxes.

The overhead costs in Canada kill small business. For every $2 dollars I pay in wages $1 dollar, yes $1 ends up in my employees paycheques.

For crying out loud, Canada Pension Plan (the combination of the employees and employers portion) is 10% ! Add mandated paid holidays (minimum 8 per year), employment insurance (just a tax- not insurance at all), and federal and provincial income tax and welcome to Canada.

Then every thing you purchase has 5% GST (VAT) tax, and with the exception of Alberta (for now) provincial sales taxes of 7% plus.

Socialist heaven for the parasites that feed off the working poor when they go on their foreign vacations, all the while claiming “I deserve it”, “why, I paid into my pension… blah , blah, blah.”

If this resource crunch, in oil, mining, (and lumber too is sick, with a pending U.S. tariff coming this fall) continues, and China is the hinge point, then Canada is going to lose it’s core tax base and no amount of happy talk is going to fix it.

Vancouver is nice for 2 months and that’s it.I lived there for 10 years and the 10 months of rain will depress you for sure.Puerto Vallarta is where I’ll retire.1000 cad a month to live and sunny and warm every day.Its such a beautiful place it makes Vancouver look like hell.The cost of living in Canada is way to high for working middle class.