So how much exactly are the largest US corporations, those in the S&P 500, worried about Greece? The horrific damage that a Grexit might do to the EU economy, global financial markets, the euro, and even, it seems, the survival of the species?

You’d think they’d be quaking in their boots, given the mutual extortion racket carried out via the media through leaks, rumors, and contradictory announcements. You’d think they’d be fretting over every final-final-final-last-chance-deadline for Greece to accept the fine print that comes with more money that will eventually be extracted from strung-out taxpayers in other countries. You’d think US corporations, at a minimum, would start blaming Greece and its side effects for things gone wrong. So…

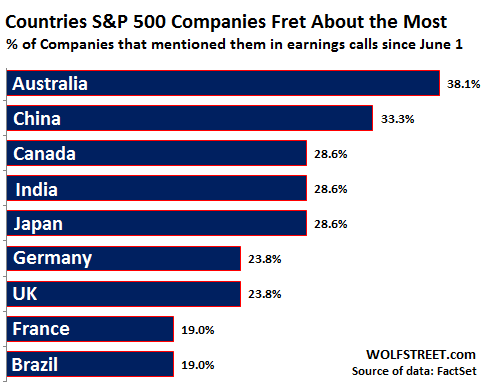

“One way to gauge the level of concern about the situation in Greece is to see how many S&P 500 companies mentioned Greece relative to other countries during recent earnings conference calls,” FactSet said in its latest Earnings Insight. And so it combed through the 21 earnings conference calls held since June 1 by S&P 500 companies – a decent sample – and searched for 50 foreign countries, including Greece.

Turns out, “Greece has not been mentioned in any of the earnings calls.” Instead, there were some other winners, based on the percentage of companies that mentioned these countries:

No. 1: Australia has been getting hammered by a resource bust that includes oil, LNG, and iron ore. There is a tremendous housing bubble in Sydney, Melbourne, and some other cities, accompanied by a mortgage debt boom. The banks that funded it all are heavily exposed. The loans that the Big Four Australian banks – ANZ, Commonwealth, National Australia Bank, and Westpac – have on their books exceed 210% of Australia’s GDP. If a portion of these loans curdle, either due to the ongoing resource bust, or due to a potential housing bust, or both, these banks would not only be too big to fail, but too big to save for Australia [How Australia’s Big 4 Banks Can Sink the Entire Economy].

No. 2: China has entered a hard landing [“China Momentum Indicator” at Hard-Landing Level]. Its stock markets, after skyrocketing for a year despite economic thunderheads all around, have been crashing with relentless brutality. The Shanghai Composite Index plunged 19% over the last ten trading days, the Shenzhen Composite 20%. And the ChiNext Index, where startups perform their miracles, has plummeted 27% from its high on June 3.

A lot of “wealth” that the stock-market insanity had created over the past year got destroyed unceremoniously. Chinese stock markets – like most stock markets these days – are not connected to the real economy or businesses. They’re a separate machine where people go to gamble and have fun. But the “wealth effect” does impact the economy, and so does the effect when it all unwinds. Short-seller Muddy Waters, days before all heck broke loose, had warned that Chinese stocks are the “Largest Pump-and-Dump in History.”

So “buy the dip?” Maybe not. Morgan Stanley warns: “In fact, we think the balance of probabilities is that the top for the cycle of Shanghai, Shenzhen, and Chinext has now taken place.” The report pointed at four factors – “a) increased equity supply, b) continued weak earnings growth in the context of economic deceleration, c) high valuations, and d) very high margin debt to free float market capitalization” – that could hammer the markets down another 30% over the next 12 months.

No. 3: Canada is running at a bifurcated or even trifurcated economy. Its oil patch, particularly the province Alberta, and the oil capital Calgary are getting whacked by the oil price plunge and its side effects. As I wrote earlier today, economists worry – but don’t see the signs yet – of “full-fledged contagion to the rest of the country” [Canada’s Oil Patch Goes Into Convulsions, Business Confidence Plunges to Financial Crisis Lows].

On the other side of Canada’s bifurcated economy, Vancouver and Toronto are on top of an exciting housing bubble of enormous proportions. The banks are up to the gills into it, though this time it’s different, because when it all implodes, it won’t impact the banks much because Canadian households, despite their dizzying debt-to-income ratio, aren’t going to just let go of their mortgages, like many US borrowers did during the housing bust. They’ll keep making their payments, no matter what.

Oh, and the incredible condo bubble in Toronto? Unsold new condos have spiked to an all-time record, while the industry pretends to be in denial [Toronto’s Epic Condo Bubble Suddenly Turns into Condo Glut].

And that India and Japan are on the same level of concern with our corporate heroes as Canada makes us worry even more about Canada.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

CHMC is the Fanny and Freddy of Canada.

I live in Canada and I can tell you first hand, Toronto is growing way to fast, is much to expensive and becoming way to crowded. As I sports fan I go down for games and spend the night regularly, but hotel prices unless you want to stay at a crummy place are also rising quickly. I paid around $800 for a night at an 8 story hotel, with a crummy view just because it was on Maple leaf square. Admittedly it was a nice room, but I wouldn’t pay that much again, the service was average, and the streets are completely congested before and after any sporting event, of which there are many all the time in Toronto. Secondly, just going to see a Jays game and finding parking in Toronto at a reasonable price anymore is a challenge, 10 years ago, $15 and no hassle to find a spot, now most lots are $30+, the good lots are almost always full and with the tall buildings gps doesn’t help you navigate the maze of one way streets to find a reasonably close lot to your event. I still like going to Toronto, but it’s plain to see from the vast new construction, overcrowding and price inflation, things will either pop, as the Austrian’s like to say about our bubble world, or it won’t be worth visiting.

Yeah, downunder is going capsize the entire S & P 500.

Hardly.

If I made a SWAG the mention was probabaly a result of the fall in the value of the Australia dollar against the US$. It has fallen about 20% against the US$ over the past year and is down some 33 cents from its high.

And it is official, Melbourne is the fastest growing large city in Australia with our expected population to hit around 8.4 million people in 2056 to become the largest city in Oz…………..

About 90% of the people that moved to Victoria last year came to Melbourne.

The politicians, land rats, banksters and any other vested interest are continually calling Australia’s housing bubble a situation that doesn’t exist.

The Central Bank (An Australian government owned entity), overseas commentators and economists insist that the housing bubble exists.

The vested interests are at pains to deny that foreign buyers are also not responsible for skyrocketing prices in the inner city apartment and upper bracket income suburbs.

The man in the street is very aware of the bubble and the practices employed by foreign buyers to get around the overseas ownership laws in buying up prices.

A think tank last week detailed the amount of oversupply of inner city apartments and inner area up market homes around Australia. In Melbourne alone the oversupply is estimated at over 112,000 dwellings. Many dwellings owned by overseas investors but with no tenants or not occupied or the interiors not fitted out. The vested interests insist there is a lack of supply of housing.

Just today some shill stated that housing has never been more affordable – bollocks.

Adjacent to my house is a new development being built 5 stories tall with 43 apartments. Across the road a plan is in to build another 30 apartments.

From the ABS. Do these stats look like a bubble:

MARCH KEY FIGURES

Dec Qtr 14 to Mar Qtr 15

Mar Qtr 14 to Mar Qtr 15

RESIDENTIAL PROPERTY PRICES

% change

% change

——————————————————————————–

Weighted average of eight capital cities

1.6

6.9

Sydney

3.1

13.1

Melbourne

0.6

4.7

Brisbane

0.4

3.9

Adelaide

0.7

2.5

Perth

-0.1

-0.3

Hobart

0.5

1.9

Darwin

-0.2

-0.4

Canberra

1.1

3.0

——————————————————————————–

Total value of the dwelling stock

Mar Qtr 15

——————————————————————————–

Value of dwelling stock(a) ($m)

5 468 467.9

Mean price of residential dwellings ($’000)

576.1

Number of residential dwellings (‘000)

9 491.7

——————————————————————————–

(a) all sectors

MARCH KEY POINTS

CHANGES TO RESIDENTIAL PROPERTY PRICE INDEX

◾The price index for residential properties for the weighted average of the eight capital cities rose 1.6% in the March quarter 2015. The index rose 6.9% through the year to the March quarter 2015.

◾The capital city residential property price indexes rose in Sydney (+3.1%), Melbourne (+0.6%), Brisbane (+0.4%), Adelaide (+0.7%), Canberra (+1.1%) and Hobart (+0.5%) and fell in Darwin (-0.2%) and Perth (-0.1%).

◾Annually, residential property prices rose in Sydney (+13.1%), Melbourne (+4.7%), Brisbane (+3.9%), Adelaide (+2.5%), Canberra (+3.0%) and Hobart (+1.9%) and fell in Darwin (-0.4%) and Perth (-0.3%).

TOTAL VALUE OF THE DWELLING STOCK

◾The total value of residential dwellings in Australia was $5,468,467.9m at the end of March quarter 2015, rising $101,308.2m over the quarter.

◾The mean price of residential dwellings rose $8,400 to $576,100 and the number of residential dwellings rose by 38,200 to 9,491,700 in the March quarter 20.”

We have some 25,000 or so people moving to Melbourne every three months. Yet, total housing stock in all of Australia rose by only 38,000 units in the quarter.

There were approximately 1.6 million dwellings in Melbourne (2013) and according to that so called ‘expert’ report an oversupply of some 112,000 units.

Somehow that doesn’t not compute given the vacancy rate is about 3%. If the vacancy rate in the CBD is much higher than that 3% overall average (Given that most of the CBD dwelling stock is apartments it probably is in fact much higher) it means that other areas outside the CBD have even lower vacancy rates.

Walking around the area I live in shows that there are very few, if any, houses for rent and only a few new townhouses as well.

The CBD area in Melbourne doesn’t see a ‘constant’ supply of new dwellings supplied to the market, but one where large increases happen as huge new skyscapers come on the market. This characteristic of new supply usually results in large number of vacant units at certain times.

An oversupply in the Melbourne CBD will have little impact, if any, on the detached, standard housing market in the rest of Melbourne. Apples and oranges.

Using the percentage changes in home prices of a single year to show there’s no bubble is kind of silly. Housing bubbles don’t form in one year. They form over many years, and they’re associated with credit bubbles.

Plus even in that single year you cited, home prices rose 13.1% (!!!) in Sydney and 4.7% in Melbourne, which are pretty steep year-over-year increases!

To see how rapidly home prices have shot up in Sydney and Melbourne over the years, check out the charts – that’s what real bubbles look like:

http://wolfstreet.com/2015/06/08/australias-largest-housing-bubble-on-record-in-4-charts-sydney-melbourne/

come to Auckland New Zealand and we will show you what a housing bubble really is. our exports are going down but we are getting about 45000 new migrants a year into our booming economy. I think they are all here to buy houses or drive taxis.

http://www.stuff.co.nz/life-style/home-property/69220324/aucklands-meteoric-housing-market-not-dampened-by-winter

But we are different, our low wage economy allows us to leverage our houses giving us the vibrant economy we have been promised or something like that I get confused sometimes.

Lucky we are not reliant on Australia or China.

Australians are like Canadians it seems, they will give up just about anything to keep that mortgage going. Luxuries first and then the basics.

And the banks will do what they can to help. Go to interest only, extend the duration and so on, even as a short term thing ease the interest rate, or capitalise it! ANYTHING to getaway from the messy and expensive problem of a default.

Also much of the outstanding balances are years old and repayments are a fraction of income, it is mainly the young loans, under 5 years old, that will/may end up being a problem.

re. the Canadian housing market:

“They’ll keep making their payments, no matter what.”

Someone doesn’t remember the housing bust in the early 1980s. People walked away from their mortgages and homes en masse causing at least one company (Principal Group Ltd) to collapse.

Don’t be too sure it won’t happen again.

I made the payments no matter what until all the money was gone. Everything. I still landed up losing the house. Everything has a limit.

You declare personal Bankruptcy it’s how you get out of it. This tie he CHMC will collapse. 1980’d deya’vu. Just like Peter Pocklington in the west with the Oil bust now. Someone call back to the future cause we’re stuck in the 1980’s all over again ! My thoughts are when this is Harper’s last term. He will get re-elected and will leave early by 2017-2018 ish. By the time he does the country will be an economic disaster and he will have ruined the Conservatives much like Mulroney did in the 1980’s. Expect the crash by that time frame. Mind you all this hangs on Yellen having the balls to hike Interest rates in the states back to it’s natural state of 5 – 10%.

For years and years the economists have told us about the benefits of globalization. A substantial part of what they told us was rubbish, but they seemed so certain and they had so many degrees after their names that we just went along.

Now, the con artists at the central banks have just about run out the string and I think we are about to see the down side of globalization. We have become so interconnected that a bust won’t be geographically containable. A major part of the sales and earnings for American corporations come from overseas. Bank loans are often trans-national. Something will go haywire and the largest line of dominoes in human history will begin falling. Grim-faced politicians will stand in front of microphones and tell us of the sacrifices that we must make to save the wealthy and politically connected. I hope that I’m wrong, but I doubt it.

Most of the paper floating in the system has been marked to model, not to market. The models change daily, weekly, monthly to meet the capital requirements. That is why quants have full time jobs. They make the magic happen by conjuring up a new math function that will make the charts look pretty again. We used to call it the model du jour.

Your comment is right on the money. No pun intended.

It is all controlled by the Bank of International Settlements, International Monetary Fund, World Bank and the Federal Reserve.

The international manufacturing /industrial corporations along with the military complex are also a large part of this system.

The TPP and other trade bills that the US is allowing Obama to fast track will protect the corporations from any liability of any kind- the only way to stop this control is to truly buy as small and local as possible. But that will happen anyway, as inflation continues in the US. People are spending less and less. I was in foreclosure for almost 6 years. I settled all the credit card debt and a second mortgage, without a bankruptcy— they were eager to settle. After I read online that defaults and short sales left the door open to garnishing new assets, I refused to bankrupt and filed my own court responses, without an attorney. It worked. They gave me a 2% loan, going up slowly to 4%. By the way, I’m self employed and the mortgage is for $400K. That’s a desperate lender!

Taxpayers can never pay this debt, and I take no responsibility for it. The debt is really “unsecured” in that the people never agreed to the war spending or other defense and federal entitlements. Social security is not an entitlement- we paid for it.

“…[w]e are about to see the down side of globalization. We have become so interconnected that a bust won’t be geographically containable.”

Indeed we are and indeed we have. This next phase of the experiment will be both fascinating and devastating at the same time.

Economics has become a contemptible pseudoscience that can’t predict what will happen 2 months from now. But that doesnt prevent economists from being treated like little tin gods whose word is law and must be followed however much disaster ensues.

I spent a year in Saudi Arabia as a teacher. My work visa was signed by a Saudi Prince. You cant get anything done in Saudi Arabia unless you get a royal involved and pay a cut. The people there are well aware of just how parasitic the Royal Family is and also how dangerous it is to say anything about it. But the Royal Family keeps increasing in numbers and the degree of their parasitism keeps increasing too. The population keeps increasing and they are getting less and less and becoming poorer and poorer. This will obviously lead to an explosion sooner or later. Too bad! My Saudi students were fine, spirited young men who very much reminded me of their American counterparts and were a lot more sophisticated than you might think.

I really detested the religious establishment though. It was as oppressive as living in a Soviet Block country was back in the Cold War.

I acquired a real loathing of the very idea of theocracy. In the evenings, the Mutaween or Religious Police were everywhere. During prayer times, the shops and restaurants were supposed to kick everybody out for about an hour. Some restaurants had a special corner for hiding infidels but you had to be careful not to be seen. The only form of public business allowed was stores and restaurants. All forms of entertainment were forbidden. Even athletic contests were regarded as private and you needed some kind of connection to get tickets. As far as I could tell, the only genuine form of public entertainment was the public executions they held after the Juma (Friday noon) prayers in Chop Chop Square down in Damaam, If Americans were present, they got pushed to the front of the crowd for a good view. I never went because I had no desire to defile my mind and spirit with such a thing.

You really have to have lived in an unfree country to fully appreciate what it is like to live in a free one. I was never so glad to leave a place as I was Saudi Arabia!

And yet, I liked the people. They seemed good hearted, humanitarian and honest. I remember once being on a shopping plaza near the main mosque during Friday prayers. I was approached by some very young kids, both boy and girl and maybe 6 years old. They asked me something in Arabic. I spoke very little of the language but I figured out they were asking me why ‘I wasnt in the mosque. I said, “Ana Nasrani” (I am Christian”. They then held a conference and came to a conclusion. They each very solemnly shook my hand and welcomed me to their country. It was just precious and I will never forget it. The people deserve better than they are getting from their government or religious establishment!

Thanks for sharing your experiences in Saudi Arabia, Jerry.

Thanks for that Jerry Bear

Nothing really surprising here: Greece is marginal bankrupt country and has been dead, as far as S&P500 companies go, since 2008 when the music stopped.

Australia, Brazil and Canada are three commodity-driven economies and are obviously being hit hard by a massive glut in supply in everything from iron ore to palm oil. Remember until 2013 these countries could do no wrong: permabulls were betting on ever rising commodity prices to keep them growing and growing.

In Brazil’s case this optimism was frankly ridiculous: the country has done squat nothing to solve its old social, political and financial problems. It was just riding the tiger of high commodity prices.

One country I am very surprised not to see on the list is Saudi Arabia. The Saudi are still spending like mad drunken sailors despite oil prices being what they are, and that may account for lack of concern. But this year, for the first time in over two decades, the Oil Kingdom is expected to have a budget deficit. Nothing to fret about: Saudi cash reserves can cover it up, but it may be one of the many symptoms the country is headed for stormy waters.

Their military spending, which S&P500 companies love so much, will have to be reeled in. How long will Saudi Arabia be able to afford a duplicate army in the form of the National Guard? Same with largesse to old clients like Egypt: the junta there has recently gone on a spending spree in Europe which Saudi petrodollars will cover in large part.

Finally there’s the absolutely unsustainable living standards of the House of Saud. Just last year a Swiss limousine company had to take the Saudi royal family to court for an unpaid bill which, according to whom you ask, was anything from ChF 1,500,000 to ChF 2,500,000. And this wasn’t raked up by the whole clan taking vacations to Gstaad, but by a single princess of Royal blood and her entourage over the space of six months. The case was settled out of court by the Saudi embassy in Bern.

The House of Saud is made up of roughly 6000 men (nobody has any idea about the women): it’s easy to imagine how much of that oil wealth goes into propping up their extravagant lifestyles and bad investments.

A report from the road. After the downturn in April freight here at the company shifted to all necessities all the time. For the last several months every time I delivered in Chicagoland I could count on being sent to Lowes in Rockford. This freight seems to have evaporated as Menards did in the previous crash. We shifted to the DC in Shelby IA and that seems to have evaporated too. I am hauling more groceries than anything else. And while work has been steady there has been a Doppler shift on the amount of time allowed to get the load handled, the shift is to the early load times in the window instead of the last dog is hung scenario of the last couple of years. I credit the company for having seen this movie before and the downshift was very smooth and I had a bad week rather than a bad 3 months.

Jerry Bear, thanks much for the first person account of your time in Saudi Arabia. These always fascinate me because of the unfiltered glimpse into places that the media can’t report on without one eye on the Agenda.

The country people should worry most about is the united states of america,what with their QUADRILLION derivatives ,debt amounting tover $200 TRILLION,the warmongering,the police killing citizens,the highly TOXIC food chain,the 50million on food stamps and worst of all the lies which they are told on a daily basis.The last one could be the worst problem as the average joe schmoe is kept in the dark and when the hoof hits the fan shortly ALL HELL IS GOING TO BREAK LOOSE COAST TO COAST

Naw, the USA is too close to home – psychological denial blinds us to our own faults and the disastrous course we are upon, and from which we refuse to deviate.

Jerry the insights into Saudi Arabia are appreciated. They have the largest military spend as a % of GDP in the world , dwarfing the US and China.

I go to Australia regularly and there is a definite recession on its way due to the reliance on Mining and associated industries. What is propping up the property market in Australia and NZ are the hoardes of Chinese escaping the mainland in search of a safe place to put their money. Auckland in NZ is now one of the hottest property markets in the world and the Reserve Bank have called for IRD Tax registration for new owners to be in place by October 2015. The reserve bank has also applied a 20% minimum equity for any new homeowner and 30% on investment properties to shield the banks from a dramatic downswing like what happened in parts of the US! Spain and Ireland.

The Greek situation is pivotal as it’s outcome will be watched intently by the other Southern European counties in Europe and if they do exit expect a domino effect in Portugal , Spain and maybe Italy.

Interesting days ahead.