Let them buy toxic, rent-based, synthetic structured securities.

The housing market has been healed by the Fed’s bold actions, we’re told incessantly. We’re also told that the Fed is still keeping an eye on it because it might not be healed enough. Prices have soared over the last three years, and in some cities, like San Francisco, they have soared far beyond the prior crazy bubble peak. So we admit grudgingly that the Fed’s six-year money-printing and interest-rate-repression campaign, designed to inflate every asset price in sight even to absurdity, has worked.

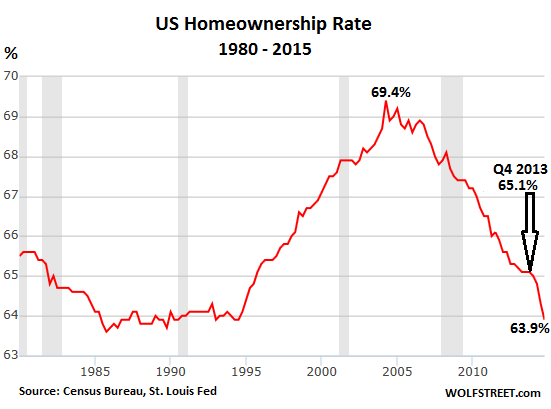

However, an essential element in a healthy housing market – people who actually live in homes they own – has been dissipating. The homeownership rate peaked in 2004 at 69.2%. It was during the prior housing bubble. Speculative buying drove up prices beyond the reach of many potential buyers. But an industry that knew no scruples helped and lured folks into homes and mortgages they couldn’t afford and would never be able to pay for.

But as prices rose, even those methods were insufficient to keep the boom in homeownership going. And homeownership rates began declining in 2005. During the housing crash, the decline picked up speed, then meandered lower in a more leisurely pace. But now the trend has jumped off the cliff.

Homeownership in the fourth quarter dropped to 63.9% on a seasonally adjusted basis, the lowest level since Q3 1994, according to the Commerce Department. In all of 2014, homeownership plunged by 1.2 percentage points, the largest annual drop in the history of the data series going back to 1965.

The collapse of the American Dream is accelerating. This is what the “healing housing market” looks like in one heck of a relentless chart. Note the record-setting plunge in 2014:

This record plunge in 2014 hit younger households the hardest. In the age group under 35, the homeownership rate dropped 1.5 percentage points to 35.4%; in the age group 35-44, it dropped a phenomenal 2.1 percentage points – in just one year! – to 58.8%. These are the age groups where the first-time buyers are concentrated. And they’re being sidelined.

Since 2008, homeownership has been fading in all age groups. But in these two age groups, it plunged respectively 6 points and 7.9 points!

And the bitter irony in the report? The vacancy rate in the rental market dropped to 7.0%, the lowest since 1993. America is turning into a country of renters.

The nearly free money the Fed has graciously thrown toward Wall Street since 2008 has fallen on fertile ground. Private equity firms, REITs, and other Wall-Street-funded institutional investors of all sizes have plowed hundreds of billions of dollars into hundreds of thousands of vacant single-family homes, took them off the for-sale inventory, and moved them over to the for-rent inventory. This powerful buying spree by mega-landlords, concentrated over a three-year period in select markets has driven up prices and pushed out potential home buyers.

But these potential home buyers can rent these homes now. An apartment building boom has offered alternatives too, often in central locations, rather than in distant suburbs, reducing commutes and fuel costs and allowing people to live near the urban excitement. Millennials have figured it out too.

Meanwhile, the idea of “owning a home” – the American Dream – has transitioned from being a comfortable place where people live in harmony and thrive, or tear each other’s hair out over unexpected expenses and heavy responsibilities, to being a highly leveraged asset. An asset whose price is being inflated by the Fed’s bold actions. An asset that can be flipped and laddered individually or bought commodity-like in large quantities to then be rented out to those who didn’t benefit from the Fed’s largesse.

The asset can be structured into a REIT and sold to the public via an IPO. Or it can be sliced and diced and glued back together into triple-A rated synthetic structured securities backed by rent payments, possibly one of the most toxic securities out there, that then will be shuffled off into bond funds that the public holds in their retirement portfolios. And there are a myriad other ways in which this single-family buy-to-rent scheme can be monetized by powerful players in what used to be a mom-and-pop market.

Ironically, the people who directly or indirectly end up with these securities that are backed by single-family homes or rents may well be the people who pay rent to live in those homes. This sort of twisted and securitized homeownership may well be the industry’s new American Dream.

And there are other dreams that are dissipating in America as the terrific oil bust is revealing sins committed and false promises made in good times. Read… “Oil Capital of California” Declares Fiscal Emergency

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Meanwhile, the idea of “owning a home” – the American Dream – has transitioned from being a comfortable place … to being a highly leveraged asset. ”

Indeed as younger people are unable to save enough money for downpayment burdened with student loans and often stuck in low paying service job with little benefits. But without the young people buying small SFH or condo then move up to bigger SFH in suburb as they have children – what will happen to the housing market if starter and decent SFH are out of reach and often owned by “investors”? I mean you take away the demand by buyers who intend to stay who for now are often outbidded by all cash deal investors (thanks to ZIRP and QE to some extent) as will the investors keep on buying at same pace or will supplies do not get soaked up resulting in stagnant price?

I worry about my own teenagers as how they can afford to live in a comfy suburban homes when they grow up. It took me 3 years of working as an engineer to buy a townhouse in SF Valley north of LA and in the 80’s a college grad can land decent paying job even with liberal arts degree. No wonder so many 20 and even 30 somethings live with their parents…

Some of my friends and I have converted cash savings into SFH’s and condos during the past few years. When returns are high single-digits or greater, plus potential price appreciation, it hasn’t been that risky. We can ride through price downturns.

But, like many segments of our society, you are either in the game or out of the game. Unfortunately for too many Americans, they’re out of the game of home ownership entirely. I saw recently, millennials are being attracted to places like Buffalo because home ownership is possible for them.

I would be afraid to buy a house today. You lose mobility and that can be a killer. I just saw that Norfolk Southern is closing its offices in Roanoke, Virginia. All 500 employees can keep their jobs but must relocate to either Norfolk or Atlanta.

Now Roanoke is a middling city of about 100,000. You have 500 well paid railroad management employees having to put their homes on the market in a town that has just lost 500 of its best paying jobs and you think you can sell or even rent them? To whom?

The America where people are secure in their jobs and communities is long gone and yet mortgages remain a long term commitment that an employer can invalidate on a whim or some new management reorganization plan.

I totally agree that the best asset these days is mobility. My son saw us lose our home and doesn’t think of home ownership as such a great thing. I have advised him to be open to the possibility that his career may include time in other countries as well. I have no intention of ever owning again.

Wolf,

Thanks for your efforts on this blog. I would like you to consider that the falling home ownership rate is a good thing in this environment. Like others have said, in this economy mobility is important. I think many families have run the numbers and decided they do not make sense. The bust in 2008 was not long enough ago to be forgotten by some. I hope this next one brings the speculators to their knees.

Looks to me that the rate of ownership is falling back to where it was before the govt made it too easy for the unqualified to get a loan. The need for mobility precedes the housing affordability issue and can be handled by a little planning and creativity: nothing new there at all.

What is missing now are J-O-B-S. Real jobs. Until there is a return of real employment opportunity, dont expect very much from the middle class. Mom and dad’s basement will have to do for now.

With a 15% tax deduction in a 401k plan combined another 5% in a self directed IRA, who needs a home for savings?

Plus, you can retire sooner and have more fun in the process.