Rate cuts cannot fix the structural issues crushing office & retail CRE. But industrial, fueled by ecommerce, is in good condition.

By Wolf Richter for WOLF STREET.

Maybe Commercial Real Estate has hit “bottom” – as property giant Blackstone’s president and chief operating officer, Jonathan Gray said in January during an earnings call, which then was echoed by other CRE fund managers with lots of troubles in their portfolios. Or maybe it hasn’t.

Parts of it are in deep trouble, such as office, retail, and lodging, including for structural reasons that have nothing to do with interest rates and cannot be cured with rate cuts. Multifamily is not in as bad a shape, though problems abound amid numerous defaults and oversupply in some markets (oversupply of housing is exactly what consumers need, so this is a good thing for the economy but not for lenders and investors). And industrial, such as warehouses and fulfillment centers, is in good shape, though the bloom has come off the rose too.

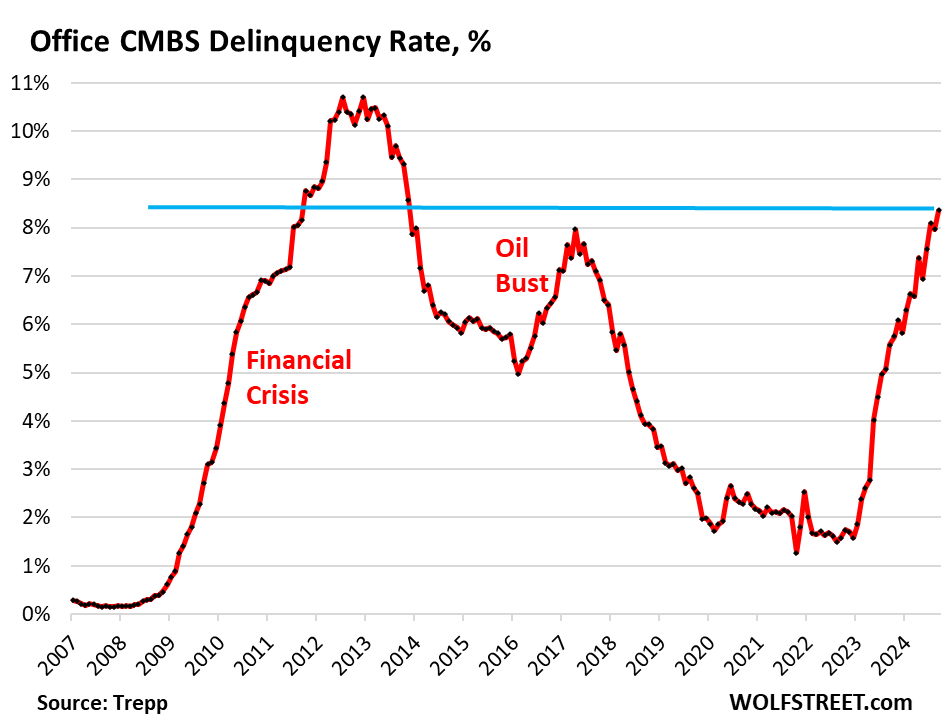

Office CMBS.

Delinquency rates of office mortgages backing commercial mortgage-backed securities (CMBS) spiked to 8.4% in September, the highest since the peak years of the Great Recession from August 2011 through November 2013, according to data by Trepp today, which tracks and analyzes CMBS.

The delinquency rate has now surpassed the spike that followed the American Oil Bust from 2014 through 2016, when hundreds of companies in the US oil and gas sector filed for bankruptcy, which devastated the Houston office market in 2016.

The office sector of CRE faces a structural problem: A huge office glut after years of overbuilding amid massive hype about the “office shortage” that led big companies to hog office space as soon as it came on the market with the hope they’d grow into it. Now companies realize that they don’t need all this office space, and vast portions of it sits there vacant and for lease. Rate cuts will do nothing to address these structural issues, though they might help some borrowers refinance a maturing loan on a building with adequate occupancy.

Mortgages are considered delinquent by Trepp when the borrower fails to make the interest payment after the 30-day grace period. A mortgage is not included here if the borrower continues to make the interest payment but fails to pay off the mortgage when it matures. This kind of repayment default, while the borrower is current on interest, would be on top of the delinquency rate here.

Loans are pulled off the delinquency list if the interest gets paid, or if the loan is resolved through a foreclosure sale, generally involving big losses for the CMBS holders, or if a deal gets worked out between landlord and the special servicer that represents the CMBS holders, such as the mortgage being restructured or modified and extended.

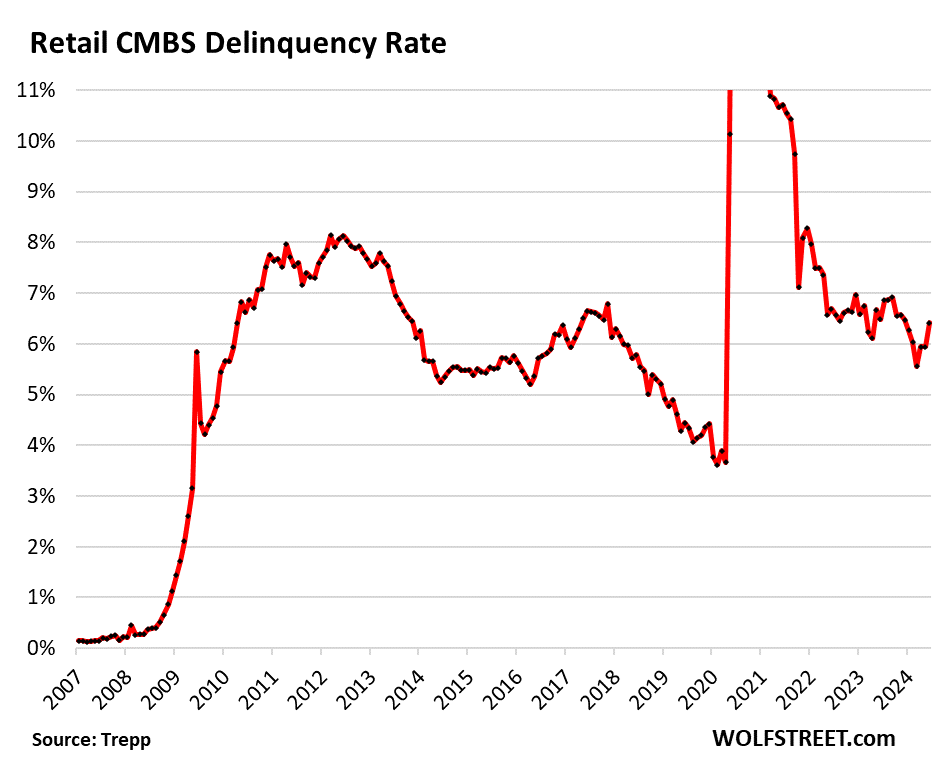

Retail CMBS.

The delinquency rate for mortgages backed by mall properties spiked to 7.1% in September.

Mall properties and other retail properties have been in trouble for years, as ecommerce is taking their business away, a phenomenon that we’ve called the Brick-and-Mortar Meltdown since 2016. And even the big mall landlords have all been defaulting on mall loans and letting the affected property go back to lenders.

For example, Simon Property Group [SPG], the largest mall landlord in the US, has trimmed its mall count for over a decade, including by defaulting on mall loans and walking away from several properties. In June, it began walking away from another mall, the second largest mall in Pennsylvania, the 1.7 million square-foot Philadelphia Mills outlet mall. The loan came due, and SPG failed to pay it off. In July, it emerged that it was negotiating with the special servicer to hand the property back to the CMBS holders.

Countless retail chains, from Sears on down, filed for bankruptcy, and many were liquidated. Zombie malls sit abandoned until a developer can bulldoze the buildings and build housing on the property.

This is the structural problem of brick-and-mortar malls, as Americans have changed their shopping patterns with a relentless shift to ecommerce. Department stores have been totally crushed, with only a handful of survivors that have all slashed their store counts of the years.

No rate cut ever is going to stop ecommerce from continuing to take over a big part of the retail business.

Exempt from the meltdown have been strip malls anchored by grocery stores, and service establishments and restaurants among the other tenants.

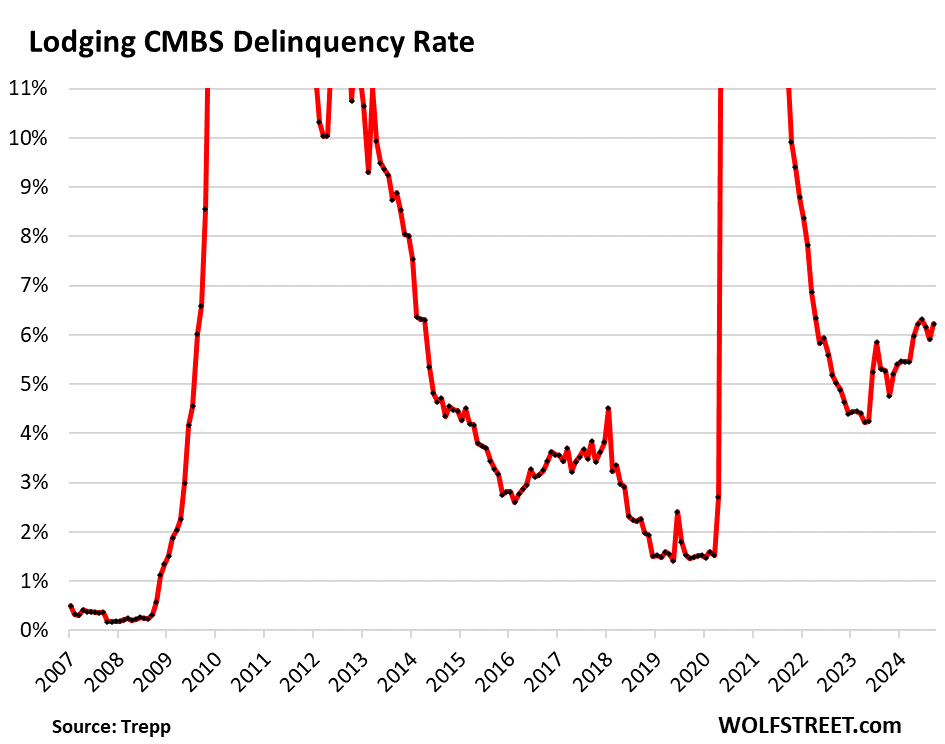

Lodging CMBS.

The delinquency rate for mortgages backed by hotel and resort properties rose to 6.2% in September, after declines in the prior two months.

During the pandemic, when many hotels were shut down for a while, the delinquency rate had spiked to 24% in June 2020. During the Great Recession, it topped out at 19% in September 2010.

The structural problem in lodging is that many American and foreign tourists choose to spend the night at vacation rentals rather than hotels. In touristy cities, vacation rentals are everywhere and have taken a substantial part of the lodging business in those cities, often bypassing the hotel taxes, and hotels ended up with high vacancy rates. The nefarious effect in those touristy cities is that a portion of the housing stock was very quickly converted into lodging, which distorted the housing market even more.

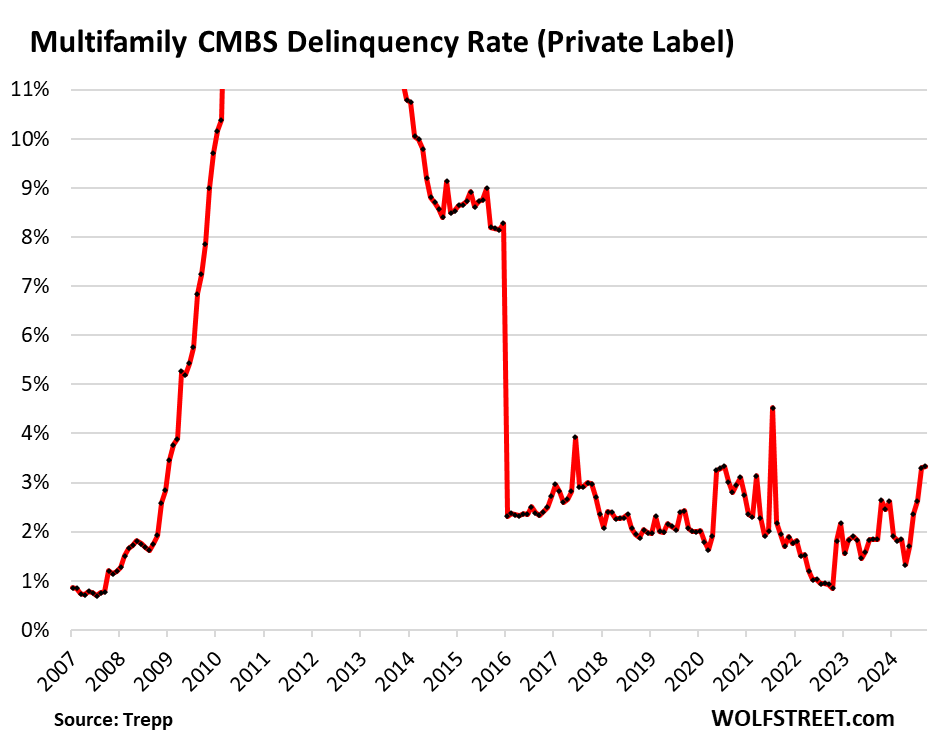

Multifamily CMBS.

The delinquency rate of CMBS backed by mortgages for multifamily buildings was roughly unchanged in September, at 3.3%. During the Great Recession and Housing Bust it topped out at nearly 17% in early 2011.

There have been a number of big mortgages that defaulted over the past two years, but CMBS reflect only a tiny portion of the multifamily mortgages.

The US government is on the hook for over half ($1.1 trillion) of mortgages backed by multifamily buildings. The remainder is spread across private-sector lenders, including banks and insurance companies. Private-sector CMBS, CDOs (collateralized debt obligations), and ABS (asset backed securities) combined hold only 3.2%, or just $67 billion, of the multifamily mortgages. CMBS alone represent an even smaller portion.

The small universe of multifamily CMBS is why each major delinquency moves the needle up a lot, and each major resolution moves it down a lot. This occurred in January 2016 when a $3-billion delinquent loan was resolved when Blackstone and Ivanhoe Cambridge bought the Stuyvesant Town–Peter Cooper Village residential development in Manhattan (11,250 apartments in 110 buildings) and paid off the delinquent loan, leaving that big vertical line in the chart:

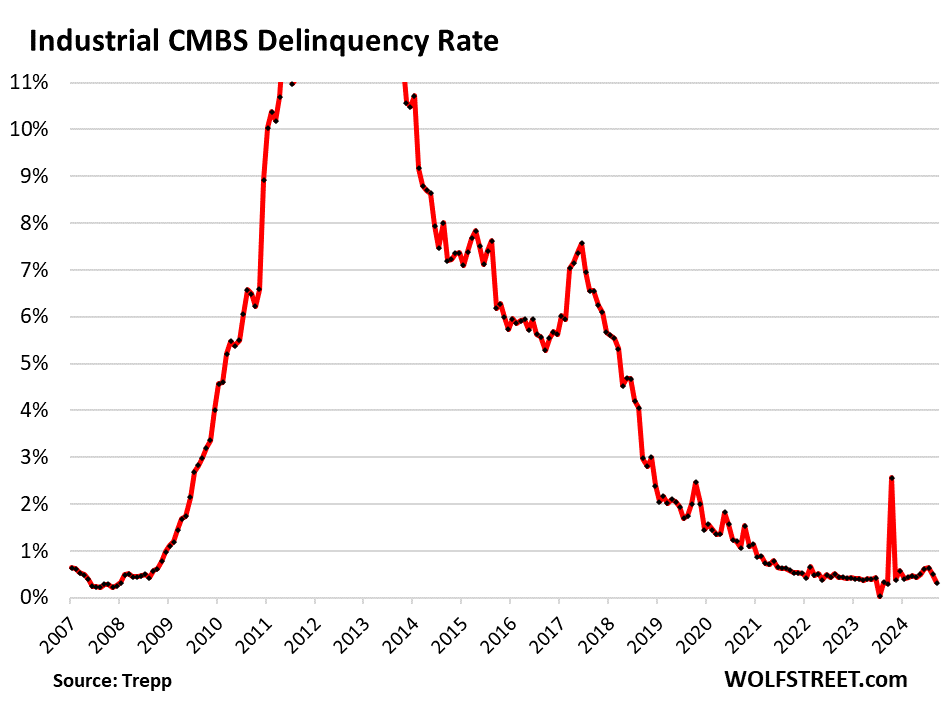

Industrial CMBS.

The delinquencies for mortgages backed by industrial buildings – warehouses, fulfillment centers, etc. – dipped to 0.3% in September, which is historically low. During the Great Recession, the delinquency rate topped out at over 12% from late 2011 to mid-2012.

This industrial sector reflects the counterpart of ecommerce; it’s the brick-and-mortar part of ecommerce. All major ecommerce retailers and third-party platforms – Amazon, Walmart, Macy’s, Target, Home Depot, Best Buy, Costco, Kroger, and many others, and specialized retailers such as Wayfair, etc. – have set up ecommerce fulfillment operations across the US.

During the pandemic, there was a massive boom in fulfillment centers which brought on a lot of supply. That boom has now faded, leaving the sector with some oversupply and rising but still relatively low vacancy rates – 6.1% in Q2, below the 10-year prepandemic average of 7%, according to Cushman & Wakefield. Asking rents, after spiking 50% from Q1 2020 through Q2 2023, haven’t moved much since Q2 2023. But ecommerce is stronger than ever, and there’s no structural collapse of demand as there’s in the office sector.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So much for CRE shills claim that “we bottomed.”

Thanks for this article.

Keep your CRE off of me.

Much sad news, buildings sitting empty. Reminded me of my mother, every year she would “can” peaches and cherries. Now all the mason jars sit empty in the cellar covered in dust.

No big deal, tear down the stupid buildings and build another stupid building…a few weeks and done…..refreshments anyone?

It looks like it is turning into not a big deal? I am amazed a bank can sometimes hold a vacant property for a long time.

I remember during the HB1 that there were 3 strip malls built near me and finished in 2008 in areas where new subdivisions lots were being built but went bankrupt.

Those housing lots and those those strip malls sat empty for 7 to 8 years. The housing lots were sold in an auction but a For Sale sign never was placed on the strip malls. After about 8 years somebody bought the housing lots and started building homes again. The lots are now full of houses and slowly the strip malls started to fill up from 2018 to now.

Anyway, the strip mall sat empty for almost 10 years and they were kept up and looked brand new year after year. I always wondered who could build a strip mall, provide maintenance and power (little because they were empty) and wait 10 years before getting any revenue.

I wonder what happens with utilities in that scenario.

If they don’t keep the heat (gas) going, pipes will freeze in the winter. Electric would need to be maintained too. Who’s paying those utility bills?

To most everyday joe, this CRE mess is a nothing burger for them since it is effecting residential market or their employment status, disposable incomes..etc.

The big question is if or at what point does it become something even normies would care about, especially if it looks like it won’t simply disappear with easing of interest rate or minor QE here and there…

“…since it is NOT AFFECTING THE residential market…” There, fixed it for you.

My local mall is a ghost town. Maybe 50% vacant, with a few tenants moving to smaller footprints but I asked one if they’re getting a break on rent by doing so and they said NO! Macy’s is gone, but the Ross still has customers. GNC just closed down, not sure how they lasted this long as I never saw customers in it ever. Popular sushi place also closed down, always had a line so that was surprising.

All these stores and restaurants closing represents loss of jobs and income but we are told by Krugman and other scum that its the best economy ever.

I get your overall point but I think it still local.

I was in Toronto a few months ago and we were in 2 malls and they both were packed with people, and VERY few vacancies.

Upstate NY, our local malls are doing “OK” at least the big ones. For sure down on people in them and some store openings, but nothing terrible (yet).

Visited our relatives in Florida, their local mall? Not so good. 20+ percent vacancy, the movie theater in the mall was in a state of total disrepair, graphiti on the outside. not good.

Related: Below an online ad from a well known lender. Name of same omitted.

‘Need Cash for the Holidays? How to Unlock your Home’s Equity.

Experts Urge Americans To Access Home Equity Before It’s Too Late

Turn Your Rising Home Equity Into Cash You Can Use

Want Cash Out of Your Home? Here Are Your Best Options

Your home value could go down anytime. Borrow now while it’s high!

To which they could add: ‘Visit a fulfilment center soon! ‘

But I guess that’s the warehouse.

“Before It’s Too Late”

I used to get mailers like that from Ameriquest Mortgage all the time before the Great Recession. I am glad that it went broke.

@ChrisFromGA if Blackstone really believed CRE has “bottomed” in January they would not have sold the NYC property at 1740 Broadway for $185 million (a $420 million loss) this past March (and they would be buying).

With rarre exceptions I think most real estate in the US is still overpriced with most office and retail WAY overpriced with the percentage of people working from home and shopping from home still increasing every year.

@Phoenix_Ikki I agree with you that “To most everyday joe, this CRE mess is a nothing burger for them” When I was in High School Chrysler was still making two ton land barges that got 9mpg and before the (first) bailout things were tough for people in the auto industry but like the CRE problems today the auto industry problems didn’t the everyday joe (or everyday apartment owner) in 1980 or in 2008 whe both Chrysler and GM gotbailed out.

“most real estate in the US is still overpriced”

This.

Amen to this and sadly, still doesn’t seem to scare off some FOMO buyers or diehard believers in certain part of the country, reduce demand sure but still plenty of suckers are willing to pay over $1M for a crapshack in many parts of SoCal

Everyone “buying” a $1mm crapshack is not a “sucker” If you want to make big changes to a home (like putting a second garage door in the back of your garage to park your race car trailer in the back yard) It makes sense for some people to go from paying a landlord $5K/month to “rent a home” to paying a bank ~$5K/month to “rent $1mm” so you can “buy” a crapshack (and not need to ask anyone before you replace the electric stove with a gas one or move the walls around…

Wolf was in the auto business and may wish to comment on this and correct my recollections. Regarding the Chrysler bailout, the company that was bailed out was hedge fund Cerberus. Chrysler was basically gifted to any buyer by Daimler. Daimler underinvested in it and discarded it when Daimler decided that that its merger with Chrysler was not a good fit. For a time, Chrysler was the most profitable part of the merged Daimler Chrysler. Similarly, Chrysler was recently the only profitable part of European auto conglomerate Stellantis. Cerberus made out as it acquired the financial services businesses of Chrysler and GM.

Chrysler didn’t get bailed out like the banks did. It went bankrupt in 2009 and defaulted on $4 billion in secured debt and lots of unsecured debt. Shareholders got wiped out. Bondholders got a haircut, some of them big haircuts. During bankruptcy, all its assets were sold to a new company. And the debt got only partially paid off from the proceeds of the sale. Normal bankruptcy stuff. The new company with new stock emerged from bankruptcy with DIP financing from the government at 21% interest, though private lenders would normally have provided the same DIP financing. Much of the new stock was sold to Fiat out of bankruptcy. TARP also bought stock. The company also got other financing from the US government to get back on its feet. All of that got paid back. TARP invested $11 billion in its new stock and booked about a 10% loss on them when it sold the share.

With bank bailouts, the stockholders and bondholders were bailed out and the bosses and employees got HUGE bonuses for 2009. Those were the REAL bailouts.

The old joke… how do you pronounce “Daimler Chrysler” in German?

The “Chrysler” is silent.

Thank you for that informative report.

1) The stevedores strike disrupt interstate commerce. That’s against the law. Transport and warehouse will slow down.

2) Precision AI and GPS can unload containers from a ship, load on a self driving truck, unload in a port parking lot, before unloading on a train or a truck.

3) Stevedores making $250K/$500K per year plus a cash envelopes to prevent an Italian strike, or dropping container by accident, will fight tooth and nails to preserve decades of extra privileges.

4) Port strike, Helene death toll, higher oil, Long beach clogging, consumers anticipating shortages, the never ending ME might start

a new wave of layoffs, prepared already by HR. BLS might discover more new immigrant in the labor force. That will overpower layoffs and lower hours of work.

Average dock worker salary in USofA: less than 21.00 per hour. So perhaps some stevedores make half a mil. That kind of top pay moves the average even higher. The median salary of a dock worker(and median is a better indicator of a non normal distribution) is even lower than the average.

East coast…try twice that. West coast almost twice east coast. Follow the strike negotiations.

I think that as a general rule, life is usually a bit tougher for those who can’t buy their own lobbyists…..but don’t quote me.

The ILA strike seems to be getting less attention than it deserves from the stock and bond markets.

Michael Engel-

A quick settlement anywhere close to the asking price would continue an inflationary trend in labor relations, and a longer altercation leads to potential supply shortages. An AP article also reports “limits on automation” demands. Apparently these exist in the current contract.

From the consumer’s standpoint it’s “heads you win, tails I lose.”

However it evolves, inflationary effects puts FOMC in a bit of a bind as it considers November and beyond, doesn’t it?

I don’t think the strike is illegal as it isn’t governed by the railway laws. Law allows Congress to intervene and impose a contractural agreement via the commerce clause.

Congress seemingly included only railway workers because they apparently have no foresight (or likely are purposely negligent as to not harm potential votes)

Will be interesting given it’s an election year.

FWIW…I suspect the next 3-5 yrs will be one of many strikes for labor negotiations. This was started in 2022 and cemented in 2023 with the UAW. Sentiment is inflation drove profits and this must be shared, which will result in more inflation.

My guess is the only thing that will halt it is a severe recession with high unemployment and that’s not good for anyone.

Should be under ME post…(a bit surprising for him, also….GPS and AI!….I wouldn’t work under crane with trusted friend operating engineer)..but equally worthless post in either position here.

Many years ago, I was buying shares of Macy’s. The thesis: shares were trading below book value bc Macy’s RE holdings were worth a lot more than what the market was pricing.

Glad I no longer hold that position.

It’s all got to hit the fan at some point. Stocks, real estate, the EVERYTHING BUBBLE. S&P 500 market cap almost $57 TRILLION, and of course, three companies supposedly worth $10 TRILLION. Yeah, right. Nvidia is worth three Berkshire Hathaways. Yeah, right.

Standing firm that the S&P is a LOCK to see 4500 again, and 4000 is a coin toss. One down month since last October. No government intervention to keep stocks pumped up before the election. Yeah, right.

So where does all that wealth flow? Gold, silver, cash, buying small countries? Clearly there will be a move out of the market at some point and those first out will likely cash out, wait until they think it is close to bottom, and then jump in and then ride it back up. Unless taxes significantly go up to fund the deficit then wealth will keep accumulating and of course if taxes go up that will likely drive more spending.

I am making the assumption wealth will continue to grow and not be spent among those that own much of the wealth.

“Wealth” doesn’t exist in a zero sum pie the way you’re describing.

All it takes is a change in mindset and the wealth evaporates. It doesn’t need to flow anywhere else.

“All it takes is a change in mindset and the wealth evaporates.”

I respectfully disagree. Whatever most people are demanding, or ascribing value to, the wealthy can front-run into it, position themselves in the food chain before the masses, and will have more of it.

That’s not the same thing. The bagholder may be someone else, but the “wealth” has still evaporated.

May take some flack, and no current model of understanding is perfect, but I will try to help. “Clearly there will be a move out of the market…”

It has something to do with a fundamental misunderstanding of “true” wealth. Evaluating it strictly in monetary units is for common consumption.

It’s simple and practical. As adults, we have to learn to balance a checkbook as we don’t learn it in school. Invest in 401k is the next “sophisticated” step and 99.9% stop there.

So the metric, money as a proxy for wealth, can evaporate, but the tangible assets don’t disappear. Stock market is investing in money metric, not asset itself. How many of you hold certificates of stocks? You have those units of measurement tied up in someone else’s investment fund.

Wealth is the asset, under control, put to productive use. Buying into it can be a profitable illusion.

I strongly suspect, not necessarily believe because I don’t have the info necessary to do so, that at high levels this is well understood. Money exists as a productivity siphon. Sure you can participate, but rarely control, and never escape.

Again, none of this is complete, but there is a point at which a person breaks into the next level of financial understanding, usually by scaling wealth to no longer caring about the $$$, and only caring about the assets, because money no longer matters.

If you’re not there, you CANNOT understand this crazy idea, because you simply don’t have the experience required to generate the epiphany in the 1st place.

So yes, the wealth always flows to the land, the metals, the buildings and businesses, the oil, the timber, the industrial plants. The cash itself is an arbitrary exchange.

And if I get “well send me that worthless money then” replies, my response:

Gladly sir, in exchange for your gold, land, oil, and or business. But never in exchange for market paper. That’s the substitution.

One more thing: wealth creates its own spiral. Once you cross a threshold, you generate the paper so quickly you can’t reinvest it fast enough or you spend it (good part).

So the “diversify into other paper assets” begins. Why? NO ONE WANTS TO HOLD THE DEPRECIATING NON INTEREST BEARING PAPER NOTES THAT UNDERLY THE ENTIRE SYSTEM IN WHICH IT IS DENOMINATED!

Turtles up and down.

Money is the hot potato in a game of musical chairs. The assets are always there and the market is the portal.

Greatest resource of All? The people involved at every level. We require the assets to survive.

Ace: you state “Standing firm that the S&P is a LOCK to see 4500 again, and 4000 is a coin toss.”

I just checked. The 52 week low for the S&P is 4103.78 so yes it could very well go below 4000 in even a mild recession even though it hit another ATH of 5767.37 on Monday. How many ways can one say “overpriced”?

It’s hard to imagine lodging having trouble in southern California, room rates have gone through the roof since Covid.

yes, we’ve seen that too, but you can get rooms — that’s part of the problem, they jacked up rates too much and now they can’t fill their rooms.

Hotel cartel doesn’t want to fill their rooms ….

Monopoly Round-Up: How Chain Restaurants and Hotels Collude to Screw You

An antitrust complaint around hotels suggest that what’s happening in the economy is systemic price fixing. The Antitrust Division and the FTC are updating the law to stop the bad behavior.

Matt Stoller

Mar 31, 2024

The CRE is mostly owned by REITs, so, they will hand back property to lender when they can’t get refinanced, seems by and large privatized losses but those panic first panic best so I’d think reits would want out of properties sooner but who wants to preside over transactions genersting massive losses

SF just hit another record for office vacancy at 37%

They need to find a way to revitalize Market St because it’s just a depressing part of town now.

If you want to go to a depressing downtown, go to St. Louis, Tulsa, Oklahoma City, and many others, especially after 6pm, but even during the day. That’s depressing. They’ve been depressing for many years and now got a lot worse. Market St is a beehive of activity compared to those places. But sure, there’s an office glut in SF, just like there is in Dallas and Houston and many other cities. It will take many years to resolve that issue.

According to Hollywood, downtown Tulsa is now cool. With Sylvestor Stallone’s new show ” Tulsa King” the midwest oil town has taken on a new luster. His character lives in a suite at the Mayo hotel and does shady business deals from the swank rooftop bar and pool.

His character was originally bummed at being exiled from NY by his pals in the Mob, but he quickly comes to like Tulsa and it surrounds.

Depressing…

… Visionary, people like Wolf Rickter is sometimes all that is needed to bring life where their once was none,

Wolfs gambling hall and saloon and spicy chicken wings…..an excellent idea, just say where and when.

Not a depressing cloud in the sky.

To get the largest crowd, free all of the prisoners at “wolf jail and moderation facility”.

You had better not be at the same facility as I am or you are gonna get shanked.

Going after Dustoff’s sign-off just to post something you felt was “cute” was last straw…..above attempt doesn’t help either.

Tulsa is featured on the show 48 hours. about solving homicides. Many shows are filmed there. They have a record homicide rate. The downtown there looks like a ghost town.

It’s not just the malls. A lot of retail space is still sitting empty from businesses that were killed by the malls and megamarts. Small to medium sized cities have a lot of empty retail, and no matter where you live you can only support so many antique shops, vintage boutiques, and coffee houses.

I’ve traveled through towns across America, and Europe, and it’s depressing to see how many places have been shuttered for decades. That retail is never coming back. But the banks can’t sell at prices anyone will buy at because the mortgage they hold is for many times it’s current value.

Sure they can sell. Assets are sold for “losses” all the time, typically when total losses (carrying costs + future value projections) hurt the financial projections more than selling at a one time loss.

Saying banks can’t sell is naive.

Low prices cure low prices.

Here in the PDX area we recently had two big chunks of bad CRE news. U.S.Bank is leaving its namesake tower, the largest office building in Portland, built for U.S. Bank 40 years ago when it was the headquarters of the firm. Then Salesforce announced they would be leaving their namesake building in Hillsboro Or. A strange location for sure as it is a gleaming 20 story glass tower in the middle of a field surrounded by hay fields with tractors. I can’t imagine either of these finding enough new tenants to make a difference.

When big mall operators walk away from mall properties, leaving them to the lenders aren’t there recourses for the lenders? If the lenders auction or sell for less than balance owed, wouldn’t they be able to go after the “big operators” for that deficit as long as the operators aren’t in bankruptcy? Or do lenders not bother to recover deficits from sale/foreclosure?

A lot of these commercial mortgages as non-recourse loans absent some sort of fraud or intentional wasting. The lenders usually leave it up to a special servicer to resolve the default on their behalf through some mixture of loan modifications or foreclosure on the collateral.

Not if the mortgage loan is a “non-recourse” loan, which is many, if not most CRE mortgages. The property mortgaged is the sole collateral.

In exchange for the non-recourse feature, a higher interest rate is negotiated versus a loan where the borrower is personally/corporately liable.

@Imposter most big commercial loans over the past 30 years have been “nonrecourse” meaning that the lender agrees to just take the collateral if the borrower defaults (aka decides it no longer makes since for them to make the loan payments) and unless there is fraud, waste or misrepresentation (aka triggering the “bad boy carve outs”) they won’t take legal action to collect any deficiancy if they sell the property for less than the balance owed.

MW: Wall Street’s ‘fear gauge’ surges, set for best day in a month

The strike is the news and wages are a small part of it.

The fight over automation is the issue. Automation will happen or America will be left behind.

We either embrace automation or pay more for everything.

The unions know an eighth grade skill set is history and they will fight change every step of the way.

Inflation and supply issues are the order of the day and one should invest accordinly.

CRE will be effected as labor and materials cost more. Just like factories, data centers, etc., etc.

Get ready for inflation and recession.

Bear Hunter-

“The fight over automation is the issue.”

The word “Luddite” comes to mind.

The unions will only “oppose” technology to the degree that the capitalists want to keep all the economic benefits for themselves and make the workers “pay” for the increased productivity with job losses…

Averages don’t mean alot in commercial. This sector will be a mess for a decade, especially older assets.