A 4% drop will put the Nasdaq back to Nov 2021. Amazon, Tesla, and Alphabet already back where they’d been 3 or 4 years ago. Nvidia -24% from peak.

By Wolf Richter for WOLF STREET.

Rate cuts are coming, they’re going to happen starting September 18. The stock market’s dreams are getting closer. Until July, rate cut mania whipped the market higher, and now that these dreams are lining up to become true, it’s getting ugly in some big corners of the stock market.

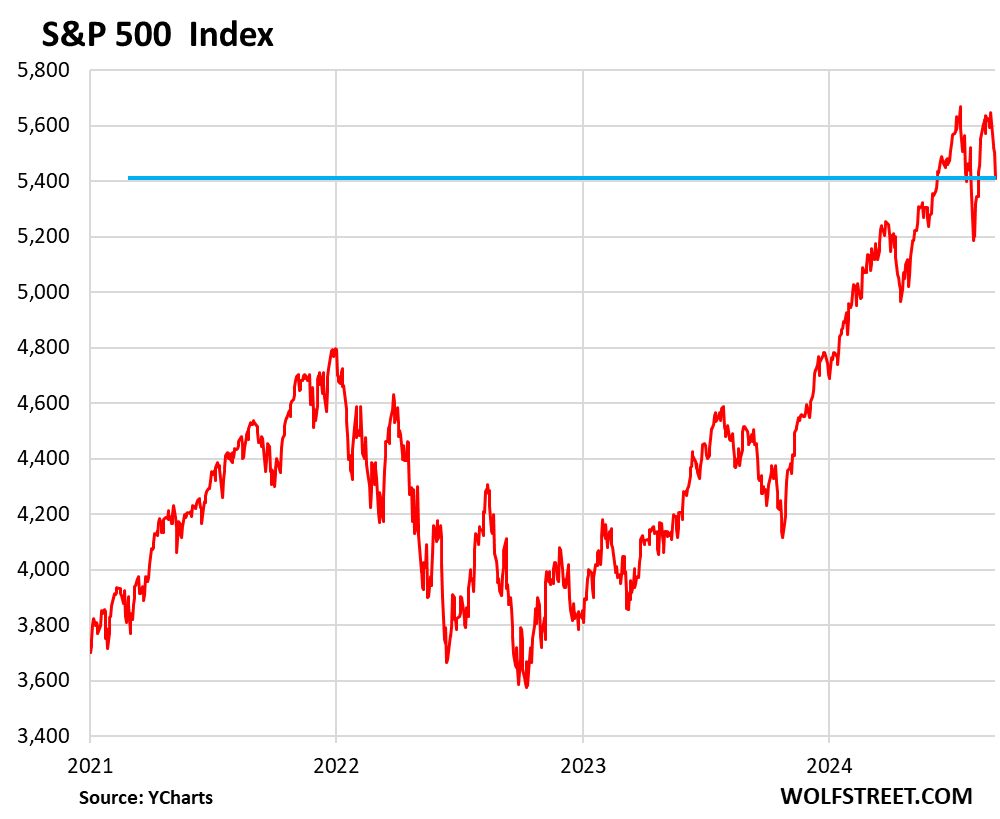

The S&P 500, after digesting the jobs report on Friday, fell 1.7% for the day and 4.2% for the four-day week, the biggest weekly drop since March 2023, to 5,408. But it’s still relatively well behaved, down only 4.6% from the peak in mid-July, compared to the nuts and bolts we’re going to look at in a moment (all stock data via YCharts):

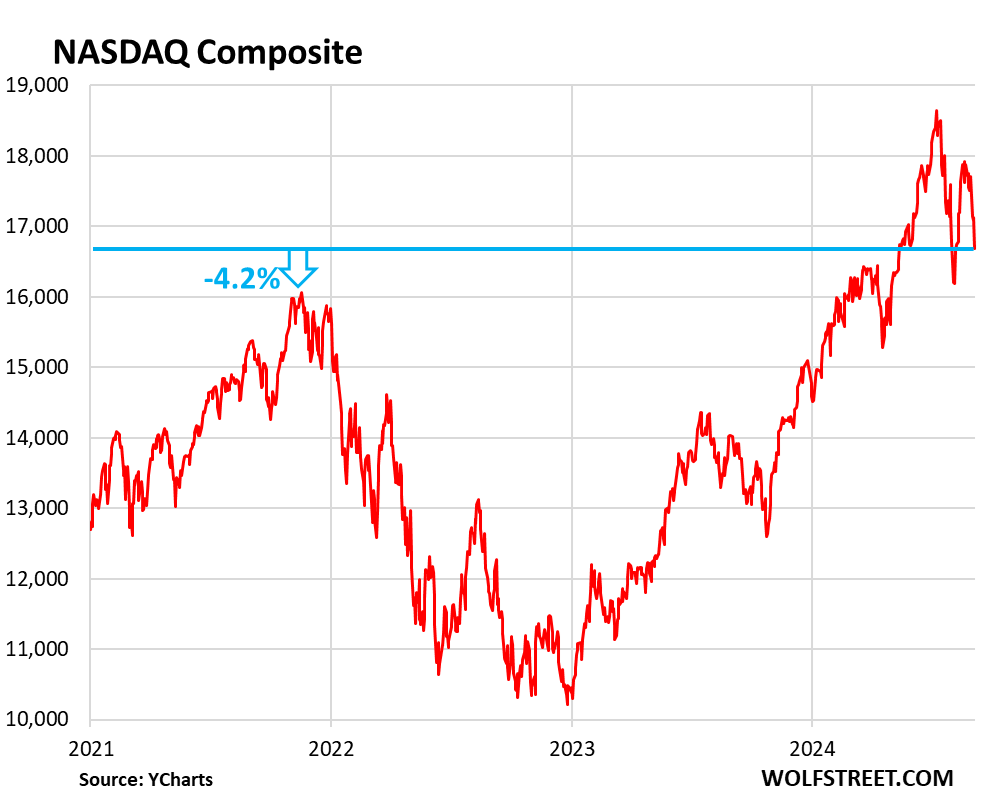

The Nasdaq Composite dropped 2.6% for the day, to 16,691. It’s down 5.8% for the week and 10.5% from the peak on July 10.

If it drops another 4.2%, it’ll be back where it had been in November 2021, nearly three years ago, separated by a 36% plunge and a generational – meaning once in a generation – rally of 81% in 19 months.

In light of the drop on August 7, which is now just 500 points away, there’s a make-or-break quality to this curve.

Semiconductors got crushed. The VanEck Semiconductor ETF [SMH] plunged 4.1% on Friday and 11.7% in the four-day week, and is down 23.6% from the July 10 peak. There it is again, this make-or-break quality of the curve.

![]()

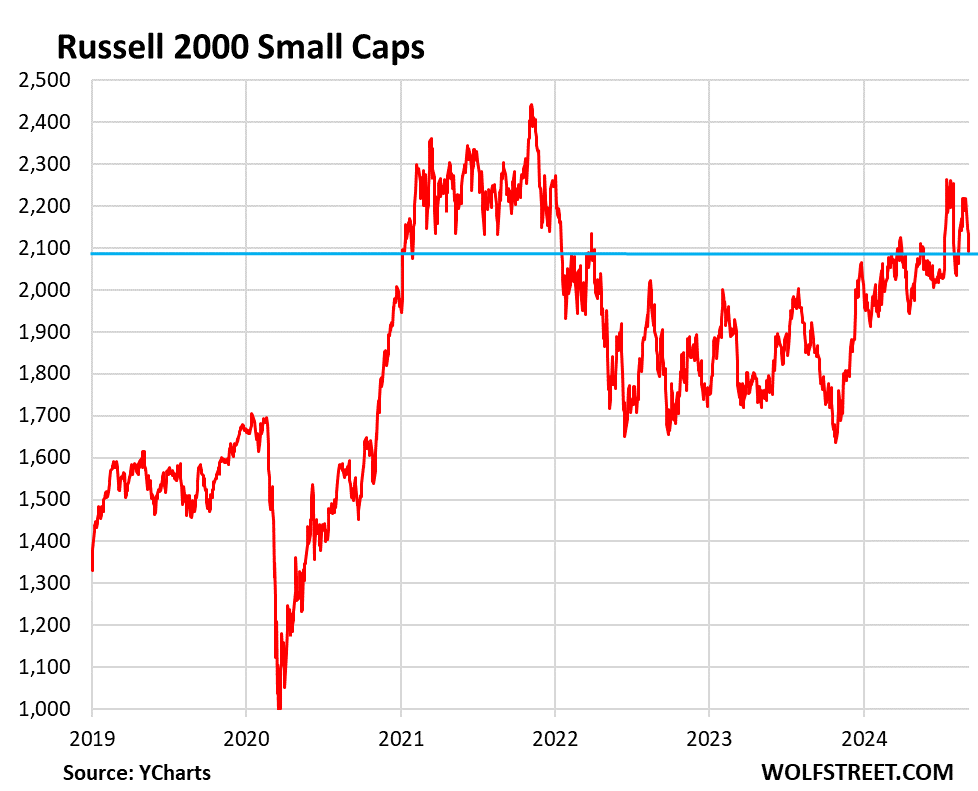

The Russell 2000, which covers the smaller 2,000 stock in the Russell 3000, fell 1.9% for the day. It’s down 5.7% for the week and 14.4% from the peak in November 2021, and back to where it had first been in January 2021.

These are 2,000 stocks and they’re not all that small, they’re just not the top 1,000, and in that part of the stock market, it’s a mess:

The Mag-7 stocks – Amazon, Alphabet, Microsoft, Apple, Nvidia, Tesla, and Meta – combined by market cap dropped 2.9% for the day and 6.1% for the week and are now down 14.9% from the peak on July 10.

Just these seven stocks combined have lost $2.54 trillion in market capitalization in the two months since the peak. We’re paying attention to the Mag 7 because they’re so huge – their combined market cap is still $14.5 trillion (down from $17 trillion on July 10) – and because they have such a big impact on the overall stock market wealth due to their magnitude, and because they had such a huge run.

Each gridline in the chart below marks $1 trillion. From the beginning of 2019 through the peak on July 10, the Mag 7’s market cap spiked by 386%, or by $14.5 trillion. The years 2020 and 2021, when the Fed printed nearly $5 trillion and threw it at the markets, was a fantastical time for stocks. But since then, the Fed has been doing QT, shedding $1.85 trillion. And that was rough in 2022 for stocks. Then AI mania came to the rescue in 2023 and through July 10, 2024. But that is now blowing over too.

And there it is again, this make-or-break quality, with the August 7 low point just a breath away. Rate cuts are such a doozie. And they haven’t even started yet.

For six of the Mag 7, the peak was on July 10. For Tesla, it was in November 2021.

| Mag 7 | $ Share Price | % Drop for the Week | % Drop fr. Peak |

| Amazon [AMZN] | 171.43 | -4.0% | -14.2% |

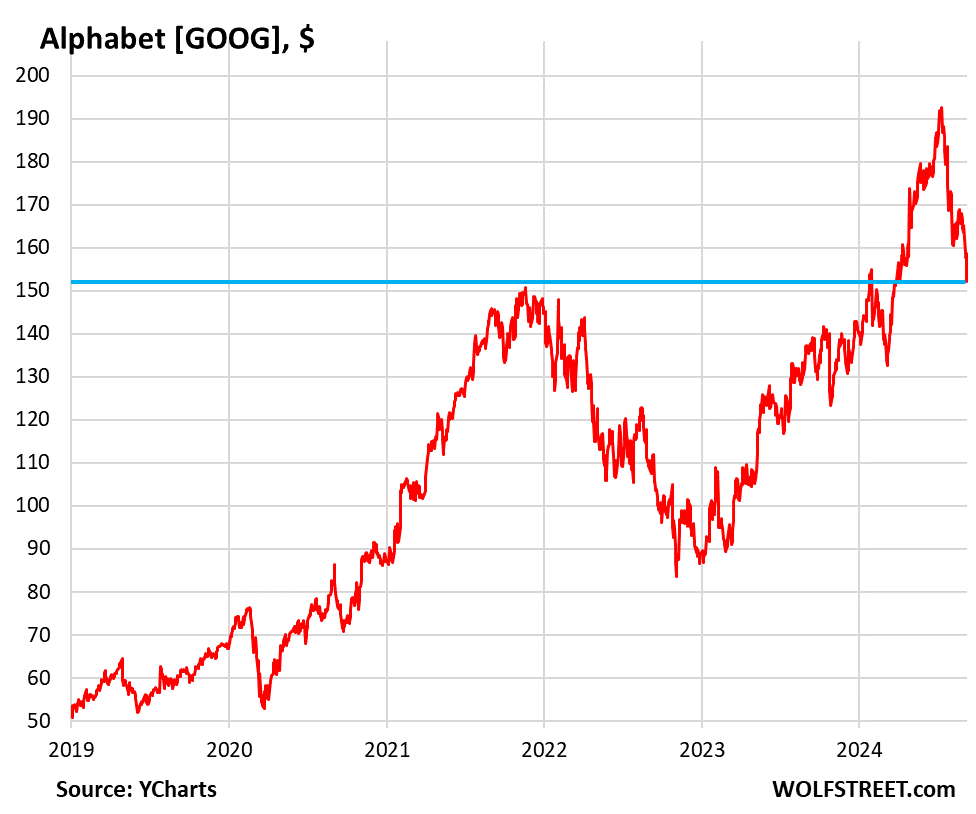

| Alphabet [GOOG] | 152.16 | -7.8% | -21.0% |

| Microsoft [MSFT] | 401.68 | -3.7% | -13.8% |

| Apple [AAPL] | 220.89 | -3.5% | -5.2% |

| Nvidia [NVDA] | 102.70 | -14.0% | -23.9% |

| Tesla [TSLA] | 210.89 | -1.5% | -48.6% |

| Meta {META] | 500.50 | -4.1% | -6.4% |

Three of the Mag 7 – Alphabet, Nvidia, and Tesla – have dropped by over 20% from their peaks; Tesla by 48.6% from its November 2021 peak and by 19.9% from July 10. So we’re going to look at those three standouts more closely, plus Amazon, which is back where it had first been four years ago.

Nvidia’s market cap has now dropped to a still gigantic $2.52 trillion, giving up $406 billion during the week and $800 billion since the July 10 peak.

This stock and the company’s revenues and earnings were powered by the fantastical AI mania that befell the world and which appears to be running low on juice.

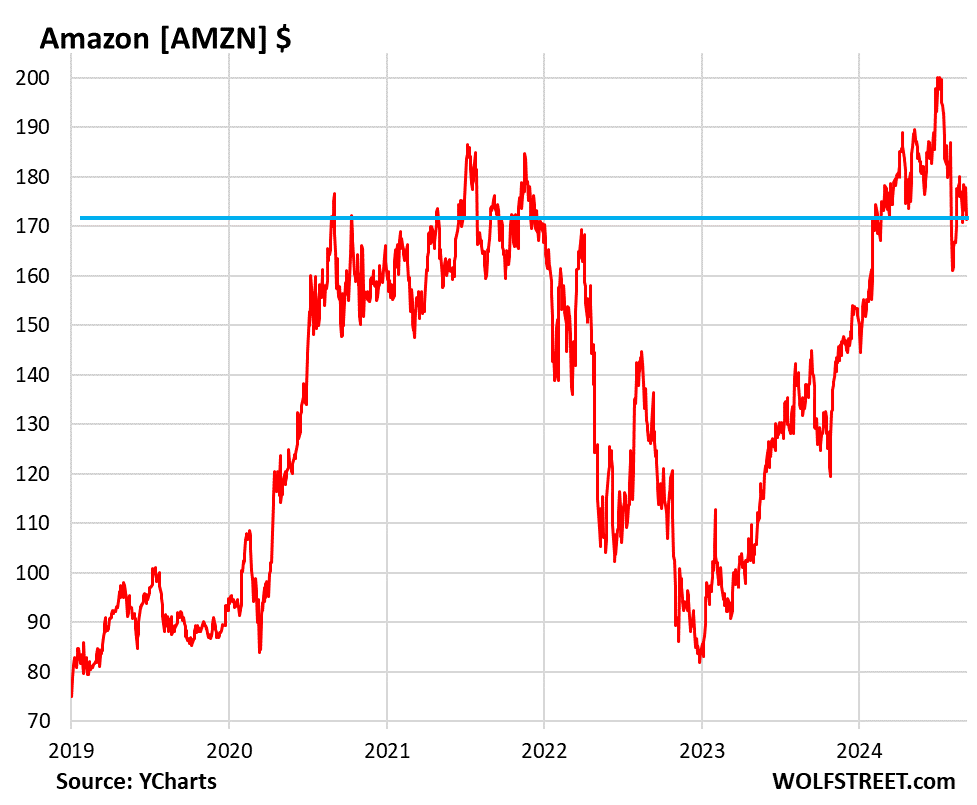

Amazon has dropped 14.2% from the July 10 peak, which put it back where it had first been just about exactly four years ago, in September 2020. Note the plunge and then the 100%-plus surge in between. A lot of fun was had by all.

Alphabet, down 21% from the July peak, is now just a hair above where it had first been in November 2021:

Tesla is down 48.6% from its peak in November 2021, and is back where it had first been nearly four years ago, in December 2020. Obviously, those buy-and-hold investors who bought in 2019 or before – on the eve of Tesla becoming a big profitable global automaker – are still up a whole bunch, but they gave up about half of their erstwhile gains over the past three years:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So… Wanting is better than having.

It’s the the journey, not the destination. Now that the cuts are here you realize she’s here to stay and your life is ruined…oh the misery…and the market drops?

The markets turned into a Ponzi scheme, disconnected with real economy. Or ….. dollar and other currencies turned into Ponzi scheme themselves after all CBs printed gazillions relentlessly.

Rates are important, no doubt. But earnings are more important, and these past few quarters they’ve been tepid. Tepid is a relative term. When stocks are bid to the moon, earnings better be fantastic and growing.

They haven’t been. Even nvidia is showing signs of slowing down. Analysts have been asking when are nvidia customers going to show profits from spending billions buying their chips? They aren’t getting an answer, except to be patient and wait for it. That doesn’t fly on wall street. They want now, this quarter.

Elon Musk may be the world’s best stock story teller. Even his shtick isn’t working. His announcements about self driving taxis isn’t raising tesla’s stock price any more.

You are right. But I think the financial markets got completely disconnected from the real economy since pandemic. I expect another crazy bull rebound and new record(s) in NASDAQ this week.

I think we should admit: Bulls, asset (stock, cryto, re) holders and debt holders won. Others lost.

You are right about the printing and ponzis. It’s nothing new. Every bull market is like this. You can find books over 100 years old that sound just like today. That’s why you buy the right stocks and hold them thru all the talk like this.

The price charts tell you when to sell. Not somebody on the internet with an opinion.

This kind of reminds of the saying…don’t ever meet your hero. Market fever dream about rate cuts and the Sept one is pretty 100% in the bag and this is how they act? How ungrateful, either that or they are throwing another temper tantrum to pressure a bigger rate cuts in Sept?

Either way, I anticipate market will recover right around Sept FOMC, never count those BTFD buyers. Not to mention unless you bought Mag 7 at the top, a lot of people are still sitting on some huge gain and waiting for a slight correction to reload perhaps.

Exactly. It’s purely a pressure campaign for more easing than is currently warranted.

FOMC members are multi-millionaires living in their ivory towers & gated mansions, far removed from the economic struggles of ordinary Americans. Despite publicly saying they’re “data-dependent,” their primary window into America’s economic health is through the stock market, where many of them own substantial investments. The “Federal Reserve Put” has been defacto official policy from the 1980s through 2020.

Once you give the markets an inch, they will always ask for MORE.

The Fed should reduce by 50 or even 75 points. America is falling into depression! Give Wall Street bigger megaphones.

Ha ha

If it continues to drop the next couple of sessions you can be sure hacks like Siegel and many of the YT doomers will be screaming for large and multiple rounds of rate cuts. It’s disappointing to see even Stiglitz calling for rate cut and blaming inflation the FED raising rates causing more inflation…you can’t make this crap up

Yeah, I was surprised by Stigliz’s position. I didn’t see any mention of services inflation in his recent interview.

This is a serious question. I am genuinely curious to the answer.

If you consider “hacks like Siegel and many of the YT doomers” to be hacks, why are you following them?

Don’t get me wrong, I agree with you that they are hacks. My question has to do with the fact that if you consider them hacks, why do you care what they say?

I think they are hacks so I never concern myself with what they say. Why would I?

Why do you?

I ask that question simply because I see so many posters here worrying more about what the hacks say than what the FED is actually saying. They spend more time reading the hacks opinions than they do reading the actual words of the FED governors.

That doesn’t make sense.

I am not following them but this is something you see pop up based on feed algo and comes up on article suggestion…etc

My bigger concern is, if there are enough of these hacks echoing the same thing and actually have influence on WS and some of the FED members then it could potentially alter their actual policy

Came here to say this. The S&P500 is back to where it was just three months ago, boo-hoo. What a joke!

Right. I don’t think Jamie Dimon will be cutting back on his Starbucks anytime soon.

When stocks rise 30% in a year, it’s expected. When they fall 10%, some type of injustice has occurred, deserving of full media attention and Fed action.

Hard to believe though that Nasdaq hit pandemic lows in the 6,800s in March 2020, which equates to a return of 240% plus over 4.5 years. It will be interesting to see how the market reacts when those cuts happen. Will the casino march on?

My bad. An increase of over 140%.

Tech stocks have been in one perpetual raging mania for the last 30+ years.

Web 1.0, Web 2.0/social media, mobile & smart phones, cloud, work-from-home, and now A.I.

Every 3-5 years, the industry will find a new buzzword to hype. They’re the best snake oil salesmen in human history.

You forgot crypto/blockchain, nfts, cloud computing, and the metaverse.

Vast majority is a total scam.

Cloud computing better known as cloud storage is a completely normal, functioning successful business. Theoretically, if u are online, you don’t need any resident storage. And your data is secure from damage, theft, fire, etc.

Crypto a whole different story.

It’s also insane to see Nvidia benefitted back to back between two bubble hype, first Crypto mining then now AI. I don’t think we have seen anything like that with just one company in recent history

Yes, and don’t forget about the metaverse! :-)

What’s interesting is whom sat on the sidelines, and how much potential money they could have atm.

Yeah 2022 was a train wreck, but If say you just rode out from 2014 until today, you’d be sitting pretty. S&P index returned something like 200-230% in that time period. Doubling your investment in 10 years, and 4 of those years were really scary, that’s pretty awesome.

That would be me. I guess that I am a glass half-empty kind of guy. I have spent too much of my adulthood thinking the next financial disaster is right around the corner and I need to protect myself from it. I would have been better off going for broke.

I think you are offering up a fallacy if false choice. There are other options than sitting on the sidelines worrying about the next crash and going for broke.

There are more middle of the road strategies.

For example, I have spent the past few years invested mostly in Berkshire and some defense, oil, and pharmaceutical stocks all bought at opportune times while still maintaining a healthy cash reserve.

Granted, I haven’t done as well as thise purely invested in the nutty stocks such as the Mag 7, but I have done pretty decent overall and I am not worried about sudden crashes as thr companies I own are legitimate profit makers.

I should also note that currently I consider Berkshire to be richly valued. Same with defense stocks. Pharmaceuticals are a mixed bag right now. It is important to select the right companies. I think oil stocks are cheap currently.

Again, I am not looking to get instantly rich, I look for solid plays for the long term without much drastic downside. I am not saying the stocks I invest I won’t lose money, just that they won’t get crushed and lose 80% of their value.

I’m a long holder of ETFs, with extra bias to technology. I need to admit that I was a bit at unease that there was too much to the moon too quickly (not holding directly NVIDIA etc), but hard to object the up :).

Now things are going more back to normal. Good corrections for the future sustainable growth. Anyway, my way of thinking about all this.

Now packing for a week mtn biking trip, no signal whatsoever. Markets can wait.

Ride safe. Ride fast. Don’t forget the sunscreen lotion.

Thank you, that’s the plan :) So excited thinking about this trip that I’m shaking even right now.

Your ETFs may have held Nvidia though. Therefore it was like you owned several shares.

Most of the gains were the big 7

Pretty well behaved bubble by historical standards.

Russell 2000 is down 30%+ when adjusted for inflation. So are S&P and Nasdaq.

Maybe inflation takes the wind out of the valuations vs outright drop…..although that can’t be ruled out either.

Russell 2000 chart is particularly interesting. It’s almost back to flatlining for the year, but with two 10%+ pops in July & August that later fizzled out.

For historical perspective on both bubbles and inflation, the annual GNP of the USA was $280 Billion dollars exactly 100 years ago.

In 2024, in just one stock, NVDA, the market cap dropped $400 Billion in one week and $800 Billion since July, to have a market cap of $2.5 Trillion. The market cap had gained about $2.8 Trillion in the previous 2 years.

Yes, the population was 1/3 of today, but still …

Trillion is the new Billion. How soon will Quadrillion be the new Trillion?

$1 compounded annually at 3% inflation for 100 years would = $19.22 today.

But the return per $1 compounded annually at 6% for 100 years is $339.30, at 5% it’s $131.50, and at 4% it’s $50.51 Intuitively, these seem unexpected, considering the small differences in rates. But shop for the best rate and plan to live another 100 years.

The compound return on gold for the last 100 years is 4.9%, from $20.67/oz to ~$2500/oz. If continued at the same rate for the next 100 years it would be $298,874.47/oz.

Caution: one is an investment, the other a speculation – YMMV.

Numbers are fun, but I suppose all that really matters is that you have enough to eat and a place to live.

Its all about liquidity. M2 shows a slight uptick in liquidity but a slight uptick isn’t a trend.

So my question is, where will the liquidity come from to run the market higher?

Some suggest that lower interest rates will move money out of the bond market into stocks? If that happened, then wouldn’t that drive real rates higher?

Seems to me that for anything to really change would mean the Fed to change from QT or neutral back to QE and add liquidity back to the banks to then lend out.. Otherwise, they are just hoping that someone is desperate enough to borrow at these still short term historically high rates.

Will a 0.5% less in interest rates make any real difference?

“M2 shows a slight uptick in liquidity but a slight uptick ”

If you cash in one $200K CD and buy two $100K CDs with the proceeds, M2 goes up by $200K. M2 has other quirks and is useless the way it is configured.

What is your preferred measure of liquidity?

The queue at TJMAX.

didn’t know that

thanks for the info

what do you use for a gauge of liquidity?

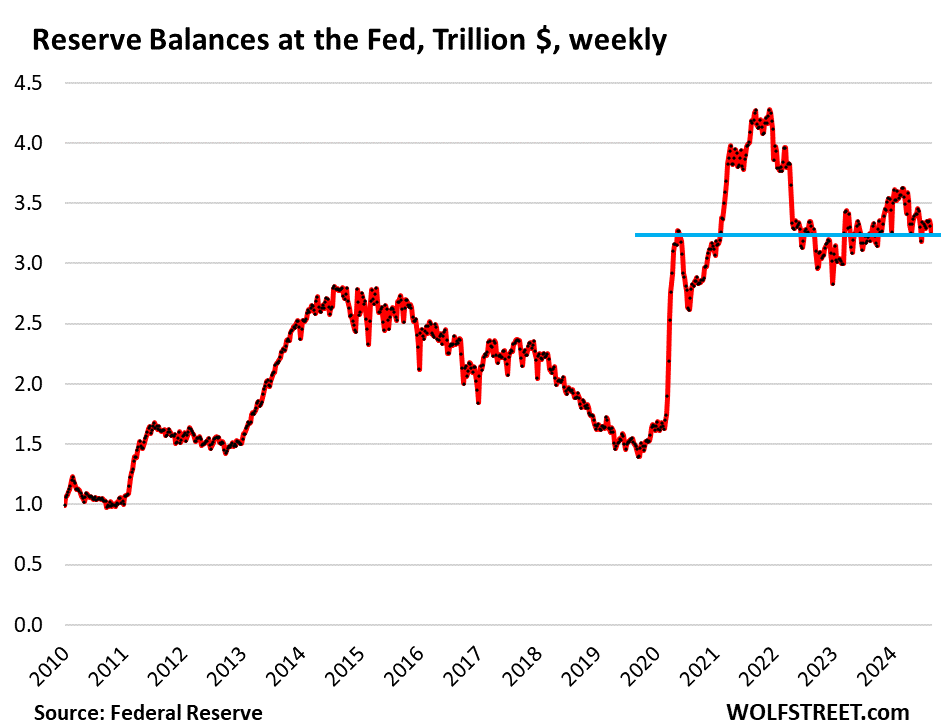

What really matters is central bank liquidity. So we look at their balance sheets.

Dr Lacy Hunt’s favorite measure of liquidity is this chart

The link you posted is for “reserves” on the Fed’s balance sheet. You could have posted my chart here because we have discussed this endlessly (see first chart below).

Reserves are cash that banks have put on deposit at the Fed. Reserves are ONLY PART OF BANK LIQUIDITY. Banks have a lot more cash that they don’t put on deposit at the Fed, but they buy repos with it or T-bills and keep a bunch on hand for daily needs.

The only reason why reserve balances are so big is because the Fed pays banks 5.4% in interest on them. There was a time when the Fed didn’t pay IOR, and reserve balances were very low, essentially limited to just the required reserves.

In addition, these forms of bank liquidity don’t include money market fund liquidity, currently $6 trillion.

So these are the reserves whereof you speak:

At a MINIMUM, you have to include ON RRPs which reflect mostly money market cash on deposit at the Fed. So I have a chart of reserves plus ON RRPs, which gives you a better picture — both are liabilities on the Fed’s balance sheet. Combined, they plunged by $2.3 trillion during QT, from $5.9 trillion to $3.6 trillion.

The mag7 lifted SPX, but RSP the equal weight ETF didn’t care. The whales sent the mag7 down to get them at a good discount.

RSP Alcaraz island is Aug 2/14. Next week traders might swim with the sharks to the island, near or below Jan 2022 high.

I’m not sure the stock markets tell us anything these days.

I did notice another story in the train of the great US economy being less and less able to produce stuff.

NASA’s artemis program aimed at getting back to the moon on top of the 1 Billion dollar per copy SLS (which has flown once) has hit a road block. The new transporter tractor platform needed to move the stacked booster from the assembly bay to the launch pad is 3 years behind schedule and 6x over budget with design not yet fully complete and construction not yet started.

The original contract for 350 million called for the transporter to be delivered by 2023. The price tag is now 2 Billion and delivery is hoped for in 2026 or 2027. Without the transporter the new version of SLS rated to lift moon mission elements to a translunar trajectory, cant fly.

Thankfully we have SpaceX and unless the environmentalists and hostile factions in the government manage to shut SpaceX down or arrest Musk or have him killed, we can hope that Starship will make it to flight status in the next year or so.

Interesting to compare SpaceX to Boeing – private enterprise to government enterprise.

“Interesting to compare SpaceX to Boeing – private enterprise to government enterprise.”

Both are private enterprises. The difference is that SpaceX’s shares are not publicly traded on stock exchanges, while Boeing is publicly traded under the ticker [BA], and has been a terrible stock since 2018.

I realize you’re just clearing the air about their official statuses, but I think danf51 was referring to Boeing in a facetious manner because of all the government handouts they have received.

LOL, SpaceX’s revenues from its rocket launches are also from the government. At least Boeing builds civilian airliners, and SpaceX doesn’t.

The real reason for all the cost overruns is the govt doesn’t have anyone on their side capable of overseeing the projects effectively. The govt employees like to boondoggle projects because that allows them to ensure they will be around longer. There is no incentive for efficiency.

Most govt projects outlast the initial technology by a decade. In other words, by the time the project is delivered, the technology is generations old. Trying to explain to them that you are substituting something better and cheaper is a waste of time. Been there, done that.

The difference between Boeing and SpaceX (when it comes to rockets) is that Boeing makes its money from the rocket development process and SpaceX makes its money from the launch business. Boeing is deeply incentivized to to bill for change orders and even overtime. SpaceX on the other hand loses money during the build process so its incentivized to manage those costs accordingly. I live right next to Kennedy Space Center and just about everyone in my neighborhood works for NASA, SpaceX, Boeing, Lockheed or Blue Origin.

Boeing was an engineering firm, but now it is run by Wall Street financiers with a shirt term outlook, so the engineering suffers. The short term outlook has corrupted the company so much that it can no longer engineer. It has spent too much time focusing on the wrong areas and it can no longer come back.

SpaceX is still an engineering firm led by engineers (which is better than Boeing), however it is a corrupt engineering culture that views regulations and oversight as obstacles to be bypassed and ignored as much as possible rather than boundaries to be respected.

Neither is good for society long term, but SpaceX is vastly superior than Boeing on the short term.

“Thankfully we have SpaceX and unless the environmentalists and hostile factions in the government manage to shut SpaceX down or arrest Musk or have him killed, we can hope that Starship will make it to flight status in the next year or so.”

This statement is pretty hilarious, have you carefully looked at their track record? If not, I kindly recommend you check out common sense skeptics on YT. They have done their homework detailing Musk’s Space X track records

Are you are pissing and moaning? ….but if it makes you laugh, then all is forgiven, one free trip to Mars for you.

You are burying your head in the sand. Which is dumb. Phoenix_Ikkibrought up legitimate complaints and you waved your hands but not legitimately address them at all which is a joke in itself.

Do better or continually be laughed at.

From Space.com today. “According to Elon Musk SpaceX’s Starship megarocket will start flying Mars [not the moon] missions just two years from now, if all goes according to plan.”

“These will be uncrewed to test the reliability of landing intact on Mars. If those landings go well, then the first crewed flights to Mars will be in 4 years,”. I know Musk is sometimes prone to exaggeration, but I may live to see a human on another planet after all. Go Elon!

Does anyone want to make a bet on these timelines? I am willing to bet a lot of money they won’t happen in thr time frame Musk says they will. Does anyone want to take the other side of this bet. I am willing to put significant amount to of money in escrow.

Musk has long gone from innovator to hype salesman.

Goldman had a chart last week that the visits to ChatGPT site/app collapsed. I guess the novelty wore off.

Nvidia will go back to $40 where it belongs (if they keep revenues up). But then the margins will collapse and it will be back to $20 (a still respectable half a Trilion company).

I don’t agree with the AI bubble, but that was misleading. ChatGPT switched domains, and Goldman missed the obvious source of that drop, intentionally or not.

The last two times the Fed started a rate-cutting campaign due to a weakening economy and labor market (2000-2004 and 2007-2009) the stock market fell 50 to 85%, depending on the index.

The 2020 drop and rate cuts were due to a completely unexpected, unprecedented, (and overblown) global health emergency and would not have happened otherwise as the economy and markets were very strong in late 2019.

Now as the Fed begins to cut rates again, it’s hard to expect anything but a similar result in the markets as those previous experiences.

Ol’B is correct.

Rate cuts spook the market almost every time. We should expect a considerable pullback during this cycle.

For sure AI is overhyped, but computing isn’t. There is nothing that won’t involve more computer control and info in the future. There are companies in computer hardware that work behind the limelight on the nuts and bolts, not literally, making switches, routers, testing stuff for the big guys, etc. Not household names. But the pull back in AI hype has pushed at least one of them down to a PE of about 13.

Computing power is most definitely limited. Even Google has a finite limit on the number of records it can search. And then there is the timeliness element…waiting.

Trivia re large numbers: the lowly deck of 52 cards has so many permutations the odds that the same deck has been dealt in history are vanishingly small. The number of grains of sand in the earth is nothing by comparison. The number of atoms is a bigger nothing.

The late I. Asimov wrote about this.

I didn’t say it was unlimited. I said there is nothing that won’t involve MORE…

But, But, My RSU’s and Employee Stock Purchases priced at the 2021-2023 highs!!!

Bartender, please hold that 5th $15 beer….

Finally! I get some tax capital losses this year on my taxes. Thanks Fed!

Remember you can only deduct $3000 in capital losses in any single year but you can carry them forward!

Seriously, Wolf’s awesome charts still show the Mag 7 is up 4X since 2019 and Nvidia is up 20X. Still crazy and room to fall.

Bartender, please add my 5th and 6th $15 beer to my tab and throw in an overpriced house.

The party must go on.

It is not a make or break moment for the stock market IMHO. It is an interval rather than a cliffhanger.

These losses will be recovered in equally spectacular fashion quite soon, propelled by the same dynamics and stocks as before.

Alas, 6,000 on the S&P 500.

It fell apart in late 21 as rates rose, then in late 22 fomo front-running took hold on the idea rates would come down soon, and then it’d all be great.

But I can only assume the often correlated recession which accompanies rate cuts, wasn’t factored in.

We now have massive risk concentration in 6 or 7 big tech sector hyped up stocks, priced in rate cuts, and continued massive expectations which any kind of recession will impact.

What could possibly go wrong?

If AI is so good, why isn’t it selling itself? Why is it in adverts on TV? Why are MS sending me emails about it?

Apple were on the iPhone 3 by now, and that’s assuming “AI” was launched with the hype surrounding it in 2021… I still can’t buy a legitimate AI package to do anything, it all still seems very beta, or caveat laden, or full of limitations.

Anyone still got some omniverse, VR, or NFTs to sell me too?

I’d have been left in the Stone Age according to the hype there.

Why is MS sending you adverts?

Cuz MS wants $$$

What had MS always wanted? lol

You have a PC there that could land 22 airplanes and do 40 peoples taxes in an hour. It doesn’t work without MS windows, which now you could buy for $10.

MS wants you to buy AI software so they can go back to making $100 a head. They want scalps man! lol

Roaring Kitty meowed yesterday BUY GAMESTOP and sure enough that worthless stock went up more than 6% in a single day!!!

When I was reading your sentence “and sure enough that worthless stock went up more than…” I was already looking forward to seeing “60% in a single day.” But no. Just “6%.” If all it did was inch up 6% after Roaring Kitty meowed, we’re cooked, LOL

MW: GameStop’s share price – Videogame retailer and meme stock GameStop Corp.

GME 6.83% reports quarterly results on Tuesday. The stock is still up this year, and GameStop has raised money and tried cut costs. But the last time it reported, sales fell and it put up another loss, amid an ongoing shift toward online gaming. And as the company takes to an approach of bare-bones earnings releases without any analyst calls, the biggest spectacle could come from the reaction of GameStop’s retail traders themselves, after meme-stock lord Roaring Kitty’s return brought renewed fervor and volatility to the company’s share price.

6%? His cult must not be in heat to listen to his cat calls anymore

Someone took away the catnip.

That guy should be in jail for market manipulation, IMHO.

86% of the time the stock market has risen 8-12% after rate cuts.

No statistic was given right before rate cuts, perhaps some huge hedge funds are just maneuvering to get rid of the people who are DQ’d for quick starting the race! 🏃♂️

If you’re a buy and hold kinda person, this is all just a blip.

If you’re all in cash then you don’t care.

If you subscribe to Bengen’s rule of 4% then maybe you don’t care either?

If you’re all into bonds then Wow, you may have an amazing next 2 years, but really? Wtf haha

Interesting if NVIDIA is the next Intel. I remember working there in the 1990s for the 2:1 splits every 18 months. Missed market opportunities, poor leadership and commodification, among other things virtually took an icon company and turned it into a meme. Tax payers money now flowing in to “free market” companies. Free markets are good, I guess, until you aren’t winning.

Wolf, you said:

The Nasdaq Composite dropped 2.6% for the day, to 16,691. It’s down 5.8% for the weak and 10.5% from the peak on July 10.

The Nasdaq is down for both the weak and the strong actually… or maybe the week… whichever you choose ;)

Thank you as always.

CNBC Friend Goosbee saying we will do several cuts in coming multiple meetings. Even though he doesnt have Vote rights till 2025, he voted in July meeting. Must be on behalf of someone.

I hope some common sense prevails in FOMC Sept meeting.

They sure can be gradual and patient on downward path. Like they were while going up…

If they’re as gradual and patient on the way down as they were on the way up (highest inflation in 40 years) we’ll have one hell of a recession next year.

The sooner they start lower rates toward the new lower bound, the sooner the Fed will be pressed to implement QE to address a weakening economy. The Fed doesn’t have sufficient fire power with rate cuts alone.

Remember, six years of ZIRP did nothing to spur the economy during the pre-pandemic period. They needed money printing to avoid recession, and that was before any COVID issues arose.

The economy is running on empty heading for a recession, if it is not already in one. If Trump looks like he will win in November the market will crash. Reason: he will hire Musk to cut the Federal budget by 20% or more. Whole agencies will be targeted for elimination. The economy will sink like a rock. There will be no stimulus money to continue the current bubble economy. The Fed will be moribound as it cannot start QE without reignighting inflation. Frankily, I will feel sorry for those who lose their jobs as a result of this through no fault of their own, but not any of the Wall Street crybabies that will see their portfolios decimated.

Musk cut government budgets???? LOL that guy got immensely rich on government budgets (EV incentives, regulatory credits, SpaceX, etc.). His companies hugely benefited from the stimulus money too. That guy has wrung many billions of dollars out of the taxpayers. He’s just going to enrich himself and his ilk further.

@Wolf: You summarized it so well. I’m constantly amazed that there are gullible people who lap up whatever the politicians say even though they have seen broken promises over several decades.

Confirmation bias is real. People believe whatever they want to believe!

This is true though. A new Trump admin will be similar to the British Tories in the UK, more hardline and minus the diplomatic language. But the name of the game, cut social spending, cut deficits, austerity for all…. except for the billionaire class.

Musk hates incompetence. He will hate Trump once he actually has to seriously interact with him. He might stage a coup and take over the government as he took over Twitter.

@nicko2,

Tories cut no social programs, and Trump will also cut nothing, the left will scare monger social spending cuts and pushing granny off the cliff, and spend the nation into oblivion. At least if past is prologue.

Musk wouldn’t cut government waist, he would privatize it and profit handomly, as would every billionaire in on his charade…

“Government waist” — that’s good.

“I take a size 32 but a 34 sure feels a lot better.”

You trade in and out, capital gains says hello to you, unless you are small potaotoes. The Bigs borrow and rarely sell.

$NVDA, 3 trillion market cap, doesn’t participate in the manufacture of said technology besides direction, ok, is this space cadet leading the bison?

It was classic buy on the rumor, sell on the fact until July as rate cut mania became closer to reality. Will 1/4 point cut be greeted with a yawn, or will a 1/2 point cut arouse alarm that the economy is in bigger trouble than previously thought?

Given the FOMO attitude many now exercise after so much moral hazard encouragement in the face of risk, I can imagine rate cuts will create a very strong wait and see effect as people think much much cheaper borrowing is just 6-12mo away.

I can see a bit of a mess unfolding whatever the FRB now does.

Unintended consequences ftw!

WOLF – while Musk may be rich – he does have companies that employ workers who actually produce things – i.e. TESLA (unlike gov’t workers who produce nothing). His observation that a large number of workers at TWITTER were not needed proved true – workers left and same amount of work got done.

Have worked at many companies where layoffs or reductions in force were rare – WHY? We only hired the workers we needed and ALWAYS looked for efficiency. Govt has no incentive to look for efficiency – hence why it is bloated, sucking up $ from our taxes, and NEEDS a businessman to streamline it.

“ His observation that a large number of workers at TWITTER were not needed proved true – workers left and same amount of work got done.”

Have you been on Twitter since he bought it? No moderation, scams and p_rn abound, a massive loss in advertising, downtime/lag issues, live streaming repeatedly not working, etc.

Every tech company over-hired during Covid, but Musk didn’t just trim the fat — he excised vital organs due to his hubris and constant deep seeded belief that he’s smarter than everyone else.

@WIZ Musk is so good that he laid off 12-14k engineers in April when Tesla stock went down like a rock. Now Tesla is scrambling to hire people again.

That’s exactly what we want. A guy keyed up on Ketamine making hiring and firing decisions based on his mood swings – not only in his companies but all across the government. /s

Isn’t it nice to be able to say what you want without getting suspended or canceled….free trip to Mars for you too.

No thanks to Musk. Twitter prior to Musk did not allow extremists to have a field day in their platform – Sensible.

Not any more. Sad!

Also, I don’t live under a rock and don’t want to go to Mars. LoL.

@Sean Shasta,

Twitter also censored people who expressed factual data both about the pandemic and regarding the Hunter’s laptop at the request of the Federal government, everyone should be very concerned about that, the extremist propaganda circulating on all forms of social media on both the right and the left is a lot less worrisome than government censorship.

OMG: Hunter’s Laptop.

Want to chase bigger fish, like whales?

Why did Qatari money bail out the Kushner building, which was heading for foreclosure?

The heavily mortgaged purchase of the 5th Avenue NY building for a record price by Jarod Kushner threatened to wipe out the family fortune as the market soured. His scheme to add many floors of condos on top was impractical, to put politely. All US investors had passed on it and so, very politely, had the Qataris.

Then after Qatar was physically blockaded by the Saudis and the Emirates, the Qataris changed their minds. Then they got unblockaded.

Take a look.

@Nick Kelly,

Sigh. If direct intervention on the part of high level administration leaders either to blunt criticism of the administration or to knowingly spread false information is not enough corruption for you, I don’t know what can be done.

Musk only used around $20 billion of his own cash to buy Twitter. It’s mostly for his own personal enjoyment; twitter is circling the drain of irrelevance.

Unfortunately, a bunch of banks have lent him money too! Don’t care about the personal investors who threw good money after him. Lol.

Twatter/X has never been more relevant than it is today, but there is nothing ‘enjoyable’ about running that company.

That is quite a crazy statement that government workers produce nothing. Have you ever filed a title to claim certain property? Have you ever had the government resolve a dispute between two parties peacefully?

Dumb, ideological statement. Do better.

Be like Buffet. Sit on your mountain of cash, keep your powder dry. Go play some golf, breath the ocean air. The markets will correct, the bargains will be mad.

How far can stocks really drop if nobody knows how and when QE will be used?

By leaving future use of QE unclear, the Fed gets a huge benefit. Wall Street crybabies and their following get to price stocks in the stratosphere, under the theory QE will be used to support asset prices, again. It’s rational.

On the other side, conservative hard money folks (many are here) can believe the Fed won’t print money any more. Accordingly, they believe future inflation and long term interest rates should be low. That’s also rational.

It allows the Fed to keep everybody happy with their investments. Stocks get a continual bid at the margin, and long bonds get a continual bid at the margin.

If the actual intended use of QE were clarified, or if QE parameters were put in place, there would be lots of unhappy people who invested incorrectly.

IMO the everything bubble is a result of unclear monetary policy, which allows narratives to thrive across the board. For the sake of transparency and prevent further buildup of risk, the Fed should define the limits of QE and money printing in broad terms, at least. If the Fed won’t do it, Congress should.

We don’t want to mislead folks who don’t understand the intricacies but have their life savings on the line.

If you actually listen to what the FED says, monetary policy is quite clear. In fact it hasn’t been more clear in my 54 year lifetime.

However if you use other sources of information that are looking to take advantage of you than monetary policy is probably muddled because it is run through thr filter of what the information source wants versus what the FED has actually said.

Use better information sources and you will be better informed. Unfortunately there are many people who are not looking to be informed, they are looking to have their nutty preconceived views reinforced. Which are you?

If you have actually paid attention, you will know that the FED has made it quite clear that going g forward that QE is the last resort, likely never to be used again. They have re-opened various facilities that were successfully used in the past that were abandoned.

But you have your windmills to charge regardless. You will cling to past mistakes and always assume they will be the norm going forward. You need someone else to blame for your failures.

Installment at fool.com today says Ken Griffin (Citadel) and David Shaw selling Nvidia and buying the Russell 2k.

🤣 Someone is hyping the Russell 2000 again to manipulate their book their way. It never ends, does it?

I can’t attest to the veracity of the authors reporting but someone talking their book is pretty standard practice in my experience.

Why do you care what others are doing? Serious question.

ROFL….Ken Griffin (Citadel).. now that’s the pillar of trust and non self serving advice I will absolutely count on

MW: The drama is heating up over Kroger’s planned merger deal. What will its earnings say?

Higher grocery prices have worn out consumers and cramped their spending elsewhere. Over the past two years, they’ve been a flash point in the debate over how much companies took advantage of 2022’s spike in costs to simply keep charging shoppers and pad profits. This year, they’ve become a core election-season issue.

This week, we’ll get quarterly results from the company that U.S. antitrust regulators have tried to make into a symbol for two years of consumers’ inflation anguish — supermarket chain Kroger Co.

Kroger KR -2.06% — which runs supermarkets such as Ralphs, King Soopers and its namesake stores — reports quarterly results on Thursday. Those results will arrive right as it tries to defend itself and its planned $24.6 billion merger with rival Albertsons Cos. Inc. in court, after the Federal Trade Commission sued to block that deal earlier this year.

The FTC has alleged that the deal would push grocery prices even higher, hinder competition, product quality and consumer access, while leaving workers with less bargaining power. Kroger has disputed those claims, saying the deal would actually push prices down.

But as Bloomberg reported last week, the trial has revealed that the company, at least for some period of time, raised prices on milk and eggs to a greater level than what was necessary to cover its costs. Kroger, according to that story, said that account was based on a “cherry-picked” email that doesn’t reflect its “decades-long business model to lower prices for customers by reducing its margins.”

Kroger’s profitability has ticked higher over the past two years. But as a grocery chain selling lots of perishable items, its net margins have generally hovered in the low single digits.

But elsewhere in the food industry, executives over the past two years have said they’ve been to keep prices higher with little pushback. Through 2021 and 2022, profit margins for S&P 500 companies rose to historical levels, and stayed elevated through much of last year.

Merger or not, Kroger’s stock price is up around 16% so far this year. And while availability issues around GLP-1 drugs offset demand from wealthier shoppers during its first quarter, some analysts like the company with or without Albertsons

If they are going after price gouging, they should focus on cases involving anticompetitive behavior or lack of transparency.

We shouldnt blame a business for attempting to increase profit levels. That’s their job. If you don’t like it, don’t buy. That’s sends the strongest message.

The traditional, stereotypical reason for buying competitors is to reduce competition. It is

inherently ‘anticompetitive’.

Maybe Wall Street wants lower rates to short the market?

1) If the Fed cuts by 0.50% and SPX rises to a new all time high Trump

will blame the Fed.

2) If in Sept SPX is red and Oct is deep red Trump wins

3) If the Fed stays put due to a rising CPI and SPX rises to a new all time high Trump will complain about Biden’s Inflation.

4) If Trump wins and Judge Juan Merchan throw him to a state jail president Vance and Ilan will drain the swamp for Trump.

I have never understood how the Trump Cultists cannot see that Trump is the literal definition of “The Swamp”. It amazes me at their failure to see the obvious.

United States of Insanity, we just need a name change to this country to fit what’s taking place now in politics, economy and social as the norm, then it will make a lot more sense.

Didn’t Musk learn “Don’t bite the hand that feeds you”?

Maybe he will confine his “efficiency hunt” to companies without X in the name? Something like the Newsom carveout for Panera Bread buddy.

A few days ago, Wolf wrote a column titled “Bloodletting In Semiconductor stocks” where he talked of the Nasdaq top in mid Nov ’21 and what happened afterwards. In it he used NVDA as the “Whipping Post(er)” stock to show the irrational exuberance that occurred. Here are a few stock price data points to consider…

Split Adj Non-Adj

NVDA – 11/19/21 – 32.99 (329.90)

NVDA – 10/14/22 – 11.23 (112.30)

NVDA – 06/18/24 – 135.58 (1,355.80)

NVDA – 09/05/24 – 107.00 (1.070.00)

As you can see back in the fall of ’21 everyone was saying NVDA had gone up too much too fast and was overvalued. The stock price dropped by about 65%. 18 months later it had climbed almost 1200%.

Everyone now says it’s climbed too high, too fast and has already dropped 25% in the last few months. It may fall another large %, I don’t know, but the underlying story still exists. Most people have NO idea what is possible and what an AI future may look like.

I like to use the Sci-Fi movie “Blade Runner” as a concept that we are moving into a world where, interactions with kiosks with animated people, that can speak in any language in real time and offer instant and CORRECT info to the questioner. Maybe it’ll be in transportation hubs all over the world, maybe it’ll be interactions with intelligent robotic machines. This is but ONE of a myriad of possibilities that WILL be coming our way at some point.

When I read a presentation from NVDA in Dec 2017 discussing this and more is why I invested more money in one stock (100 shares @ $200) since split 4/1 and 10/1 than I ever had before. I had always liked to diversify and keep my initial investment to about $5G or under.

Even though I kept selling bits all the way up, during the 10 month drop 0f 65%, I didn’t sell, and in fact was 1 point away from a limit buy order being hit.

IMHO, the Future Big Picture NVDA story is still intact. They have built a HUGE moat around their platforms, software and chips. Their massive hoards of cash are leading to incredible outlays in R&D. UNTIL something drastic changes I will be holding on to my last 500 shares (of the 4,000 shares my initial investment turned into).

Just MY opinion… YMMV.

Is there an an absorption rate, of sorts, for the rate say per 100,000 new immigrants per month that have been added to either of the two census of the total employed? Three month average, seasonally adjusted of course.

An odd business story: both political camps agree they won’t let the Japanese buy US Steel and its old blast furnaces. The Japanese want to invest 1.5 billion, keep the jobs, and maybe save it. What is the problem?