It dumped on already puking shareholders a surprise disclosure of huge losses that exceed its capital, amid reports of widening SEC investigation.

By Wolf Richter for WOLF STREET.

B. Riley Financial – a financial services firm that includes an investment bank for small caps, a wealth management firm, a provider of retail liquidation services, and financial consulting – has been steeped in various allegations by short-sellers since February 2023. Bloomberg, based on sources, then reported an SEC investigation. And B. Riley’s stock had crashed.

But today, the stock [RILY] crashed another 52% as the company surprised already puking shareholders by reporting preliminary financial results for Q2, including a huge loss that exceeds its capital, while Bloomberg reported this morning that the SEC investigation was widening. It also suspended its dividend.

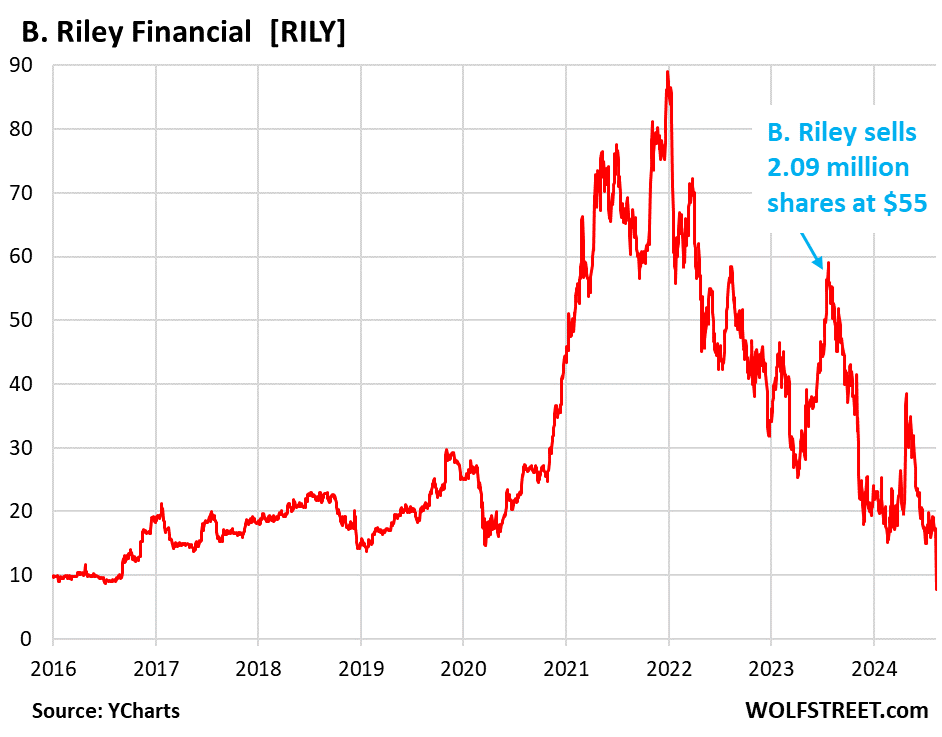

The 52% plunge today is just a dip on this mindboggling chart. B. Riley had become a meme stock in 2020. In less than two years through the end of 2021, the shares spiked by 400% to a terminal high of $89 during peak Consensual Hallucination, as we’ve come to call this phenomenon. At that point, the company had a market value of $2.4 billion. By November 2023, share had dropped by 80% to $18, therefore earning their entry into our pantheon of Imploded Stocks. After the rug-pull this morning, the stock trades currently at about $8.

Also note the hilarious moment (blue in the chart above) when the company skillfully leveraged market delusion by selling 2.09 million shares in a share offering on July 28, 2023 at $55 a share, extracting $115 million from the hapless public. August 8, 2023, so seven trading days later, was the last day shares closed above $55. A month later, they’d had already dropped by 16% from the price of the share sale, and what followed was the continuation of the rollercoaster ride to heck.

Bloomberg reported this morning about the widening SEC investigation:

“The US Securities and Exchange Commission is assessing whether Los Angeles-based B. Riley adequately disclosed the risks embedded in some of its assets, people familiar with the matter said. The agency is also seeking information on the interactions between founder Bryant Riley and longtime business partner Brian Kahn, the former chief executive of Franchise Group Inc., the people said. Franchise Group, or FRG, is one of B. Riley’s larger investment holdings.

“The inquiry includes a review of possible improper trading by other insiders, said the people, who asked for anonymity because the probe hasn’t been announced by the agency. Another topic regulators have asked about is the movement between companies of receivables due from cash-strapped retail customers whose repayment might be doubtful, the people said.”

And B. Riley reported this morning that it would likely book a net loss for Q2 of $435 to $475 million, or $14 to $15 per share.

The net loss would more than wipe out its equity capital of $300 million that it had reported on its Q1 quarterly report. The loss includes these write-downs and charges:

- $330-370 million in write-downs of:

Its investment in Freedom VCM, “the indirect parent entity of FRG.” Franchise Group’s retail brands still include Vitamin Shoppe, Pet Supplies Plus, and furniture seller American Freight, after having sold Sylvan Learning earlier in 2024.

Its Vintage Capital loan receivable, “which is primarily collateralized by equity interests in FRG,” it said. “The Company is in the process of completing the valuation of these items which could impact these estimates,” it said.

- $28 million impairment charge of its investment in Targus [which sells laptop bags], which B. Riley had acquired in October 2022 for $250 million.

- $25 million charge “related to a valuation allowance for deferred income taxes.”

It also disclosed today:

- No more dividends — in order preserve capital.

- Total outstanding debt as of June 30, 2024: $2.16 billion.

- Cash and cash equivalents: $237 million.

- Total cash and investments: $1.1 billion

- “Operating adjusted EBITDA” (income before interest, taxes, depreciation, amortization, and all the bad stuff): $50 to $55 million.

B. Riley said in the disclosure:

“The reports concerning Brian Kahn, FRG’s former CEO, and his alleged misconduct at [hedge fund] Prophecy have continued to create additional challenges for this investment [FRG], despite the fact that these allegations are unrelated to FRG or B. Riley. Ultimately, we believe these developments have materially impacted the execution of FRG’s business strategy, including its ability to divest or otherwise monetize certain assets.”

Riley Financial came about as a publicly traded company in June 2014 via a reverse merger with Great American Group, whose shares were traded over the counter. Great American’s name was changed to B. Riley Financial, and B. Riley founder Bryant Riley, became Chairman and CEO of the combined company. The combined company continued to trade over the counter. After the reverse merger, B. Riley acquired MK Capital Advisors, a wealth management firm.

Long ride up the promo-curve to peak Consensual Hallucination. In July 2015, B. Riley’s stock was approved for listing on the Nasdaq under the ticker RILY, where it traded thinly for around $10 a share as a micro-cap with a market cap of about $150 million. But pretty soon the stock promos started, and the thinly traded shares took off. Then the meme stock crowd got a hold of them in 2020 catapulting them during the era of Consensual Hallucination to $80, before they kathoomphed.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I am sure the insiders made plenty of money.

We have a new form of capitalism….

1. Government takes debt to transfer and spend

2. Fed liquidates debt to prevent interest rate price discovery and to keep borrowing costs low

3. Wall St sells a dream for this liquid cash holders

4. Operating companies comply by projecting rosy scenarios to lift stock price

5. Insiders reward themselves

6. Then problems emerge and stock tanks

A convoluted game to convert public debt to private wealth.

How does it all end? Here are some things that can happen

1. Social unrest due to growing inequality

2. Private wealth in the form of govt debt is decimated by inflation

3. Tax increases to reduce deficit…resulting in deep equity valuation correction

May we all live in interesting times :)

What’s weird is that money is flooding into commodities like gold, which seems to suggest that we are either about to see another explosion of inflation in the 50% range, or the speculative bubble that used to be an “everything bubble” is now a “literally everything including your mom’s kitchen sink” bubble. Hard to tell either way.

The inflation camp seems to be relying entirely on a) governments continuing to rack up massive debt forever and b) driving interest rates to 0 to give the speculators an even bigger pay day. I’ve been in the $50 Trillion asset bubble camp, but who knows? They might be right.

Or maybe an extended war in the Middle East.

“1. Social unrest due to growing inequality”

Never gonna happen, this is America not France.

I’d bet that something similar was said in Versailles round about 1788 or so.

When the populace has nothing left to lose, they lose it! G. Celente

never say never, though it won’t happen as long as people have money. And people have quite a lot of money. Or credid, same thing :P

Unrest comes in many forms. Isn’t always people up in arms.

UK and France are interesting current examples to observe.

The polarization of society, the politics of today are already excellent examples of unrest.

Of course none of us wishes for that. Would be in there interest of everyone to collectively solve our current problems

With Lazy Boy Recliner company stock up 4000% since it’s low in 2009 we may have a while yet before the SHTF…

Jail time coming…?

The buyers of this garbage should be put in jail, for their own security.

You forgot the criminal money managers that buy this junk with your retirement, college etc funds. They even charge you a commission. It’s like buying a condom for the rapist.

I don’t know about #1. Social unrest sounds like a lot of work for the current generation…

Typical “hopeful” but TOTALLY untrue wealth man’s meme. Take a walk in the slums where hope for any decent kind of future runs very thin.

They aren’t far away.

Great comment. Debt is publicized and wealth is privatized with excessive money printing. Always the same story. Not just in US but in many other countries.

“Debt is publicized and wealth is privatized with excessive money printing.” True. This just tells you what team to be playing on if you want to win.

B. Riley also had a half-dozen “baby bonds” trading on the market as well. Their prices have collapsed as well.

Looks like a PE fiasco without the PE arm insiders buying their partner companies with dept and ipo money plus these baby bond tickers. I have no idea what a baby bond is vs a bond

The CEO put his name on the company and fleeced fools who wanted to turn his company into a meme stock.

As of March it looks like they had enough assets to cover their current liabilities.

I don’t know if they can weather the storm, but at first glance it seems similar to PLTR where you had crazy speculation, a very attached CEO, and a gigantic loss in stock price.

Maybe I’m just bitter I missed PLTR, but I kind of want in.

Let me have it. What am I missing?

PLTR at least has some mysterious software sold to government through unknown connections reaping fat profits. This stinker got nothing but debt now. Attached CEO means nothing. One meme doesn’t justify another meme.

Looks like the investors won’t be living the ” Life of Riley”.

How about adding Intc and wolfspeed, wolf, to your imploded stocks. 2 of the welfare cases for the gubmint cheese that are to lead the semiconductor manuf. renaissance in America.

Intel’s biggest plunge came during the dotcom bust, 23 years ago. It imploded long before I ever opened my Imploded Stocks pantheon.

Wolfspeed is in it. There are about 1,000 stocks in it. I just haven’t written about them yet. I just write about one or two every now and then.

I just think these 2 have particular significance due to the billions in gubmint cheese doled out to them. Anyways, thanks for your reply as I know you are very busy.

GG:

Look at the list of companies that received a bailout in 2008/2009.

That’s when they officially, publicly rescinded the business cycle.

Heck, some of those companies completely disappeared… look at GM: the current chart begins in 2010.

The height of the automotive bubble was about mid-1960s (on an inflation adjusted basis), 2000 on a nominal basis, and post dotcom: Headed to 0 (WITH a TARP).

Ethanol fiasco (1:1 ROI…or so they say) gets LOTS of Gubmint Cheese and still going…..loses big money, too, but keeps most of the Iowa prairie corn area employed. Talking Decades of that ‘Program” now, I think.

And…

Think drill baby drill gets more cheese than anyone else “private” or is up there with the top ones….

Now go hit another rally. Do you get a badge for each like the Croix de Candlestick? I worked with guy who had SEVEN!

Wolfspeed at least seems like a real company making real things. That these real things are very narrowly applicable to the burgeoning EV market would go a long way to explain its boom-bust cycle; with of course the market mania magnifying the peaks and valleys.

It’s not that they aren’t real companies making real things. These companies get taken private, the books are sanitized, they’re loaded up with massive debt and then IPO’d to all the idiots out there gambling against the house.

The VC, PE guys, their lawyers, the underwriters, and maybe a few dirty corporate officers make off with all the cash and the gamblers end up like all gamblers do.

“…you can’t cheat an honest man…”

“…if you can’t beat ’em, join ’em…”

“…who knew?…”

recon in the smoke/SWOT always.

may we all find a better day.

How many layers of ownership do you really need for a pet store?

Pet stores and furniture stores…stay away

For ANY “business”……

Just enough financial engineering (including your question) to ensure discouragement, beat budget constraints, or confuse any honest regulator or journalist……I though every econ fan/investor here knew that……before or after reading this website a while.

Sorry if that was just rhetorical….I have a “too literal mind”….and miss snarky things.

The word ‘pantheon’ always makes me think of naked statues. Sorry.

And naked statues make me think of the saying that “when the tide goes out…”

The Pantheon of “who’s swimming naked.”

You do realize David WAS designed to make all men feel better and also remove one of the more common (not all wives, thank the gods) husband torturing/confusing notions.

Not having enough money is the REAL tough one.

Try as I might I just can’t feel sorry for people who lose money on these obvious scams.

Investing in momentum and memes is like playing slots.

Sort of related from Canada: Headline Globe and Mail Biz section

Aug, 12

‘Real estate insolvencies set to surpass levels during financial crisis.’

This is about corporate developers not individuals. Specifically, at the current pace 2024 insolvencies will exceed levels during the GFC year of two thousand and nine by 13 %. Even more ominously they will exceed 2023 by 57 %.

Oddly, this does not include outfits that have gone bankrupt and are in receivership. Not surprisingly, experts think many of the insolvencies are on the way there.

Who has ever heard of this company? Or Great American Group (with fitting acronym GAG)?

They have several preferreds which also tanked as well if you want to speculate!

I have read some awful things about the CEO way before this.

Budget deficit climbs 10% in July; interest payments eclipse Medicare, military

I love reading stories like this where the suckers get fleeced and it all goes to hell. It’s the epitome of what this country is all about: liars and the fools who believe them, cheats and the dupes who give them their dough. Is this a great country or what?

Cynicism is easy. Where, according to you, is it better?

Uruguay. The country that actually works. They have almost completely replaced their energy consumption with renewables. They have one of the highest voting participation rates of any country in the world. They do not suffer from any of the economic idiocies that plague neighboring Argentina. It’s a chill, sensible country like a Latin New Zealand.

I guess you’re just being cynical.

But how does one assess a culture where liars are considered to be winners, hero’s even, and those who got cheated are called fools by default?

My answer is: sick and destined for collapse.

More sickening is that it has a lot of followers. Like here in Europe where i live.

Often this type of crap is institutionally owned and found in things the ‘dupes’ and ‘suckers’ have no control over like 401K, retirement funds, etc.

Did the SEC just discover this matter? Haven’t they known about it for a full 10 years going back to 2014 yet allowed this ‘company’ to operate just as it always has in scamming ‘investors?’

I started watching FRG when they owned Liberty Tax–which even before FRG took it over was a cesspool of corruption and CEO malfeasance. Then FRG unloaded Liberty Tax on another bunch of private equity guys–except the new PE ownership group of Liberty Tax couldn’t sell any franchises for years because Liberty’s books were in a shambles.

I need another bottle of Cuervo. This B. Riley guy sounds like POS to me but there’s a lot of them out there. I could use a ride to the store.

The Wreck of the Penn Central railroad was the beginning of what we are seeing today.

I knew this firm was full of crooks when they turned GREE loose on the public.

MW: Traders see big interest-rate drop around corner, at risk of underestimating inflation

Just don’t let anything happen to American Freight! I love that place!

I will take a small scratch or dent for 50% off my appliances any day!