An alternative to a restructuring in bankruptcy court.

By Wolf Richter for WOLF STREET.

Distressed debt exchanges are an alternative by companies to restructuring their unmanageable debts in a bankruptcy court, if they can get their creditors to agree to what are usually haircuts of some form. Distressed debt exchanges are a form of default, though they’re not always included in default rates.

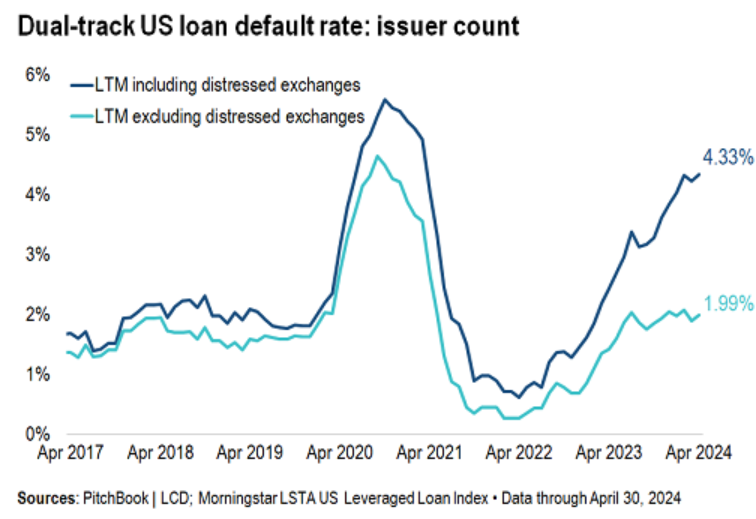

But when distressed debt exchanges are included, the default rates are much higher. And the number of distressed debt exchanges has surged since the Fed started hiking interest rates. And thanks to the ultra-loose financial conditions despite the Fed’s tightening, investors are eager to work out deals.

Hard defaults and bankruptcies in April. In terms of leveraged loans in the Morningstar LSTA US Leveraged Loan Index, the default rate in April by number of companies ticked up to 1.99%, which is above the 10-year average of 1.61%, according to LCD, now a unit of PitchBook. Included in April were:

- ConvergeOne Holdings, which provides cloud computing, cyber security, and other services through its subsidiaries, filed for a prepackaged Chapter 11 bankruptcy, after it failed to make payments on $1.23 billion in leverage loans.

- Xplore Inc., a Canadian rural broadband service provider, deferred interest payments on over $1.2 billion in leveraged loans (most of it in USD).

Distressed debt exchanges in April. But when distressed debt exchanges are included, the default rate by issuer count rose to 4.33%, according to LCD.

Two companies with leveraged loans in the Morningstar LSTA US Leveraged Loan Index conducted distressed debt exchanges in April:

- Rackspace Technology Global, an Apollo-backed cloud computing service provider, got most of the holders of a $2.3 billion first-lien leveraged loan to agree to haircuts via three debt exchanges.

- City Brewing Co., which brews beers and makes beverages under contract for other brands, got a majority of holders of its $850 million in senior secured term loan B to agree to a debt exchange, which cause S&P Global to downgrade the company to D for Default (our cheat sheet for corporate credit ratings by rating agency). LCD notes that “the term loan B lenders that elect not to participate in the exchange will have a reduced claim on collateral, diminishing their recovery prospects.”

LCD tracks both, the leveraged loan default rate without debt exchanges (1.99%), and with debt exchanges (4.33%). Chart via LCD/PitchBook:

Leveraged loans – the issuers are “junk”-rated companies with credit ratings of BB and below – are generally secured by some collateral.

Banks originate many leveraged loans, but they don’t keep them on their balance sheets because they’re too risky; they sell them to investors such as loan funds and institutional investors seeking to increase their returns; or they securitize them into Collateralized Loan Obligations (CLO) that are then bought by investors. Sometimes banks get stuck with leveraged loans as yields jump and investors vanish suddenly, and then the banks eventually have to sell those loans at a discount and take some losses. But they do sell them. So when leveraged loans go bad after they’re sold, it’s investors that take the losses.

Private credit has been aggressively going after the leverage-loan business, competing directly with banks. And this has been a booming business, and investors are on the hook for any losses, not banks.

Leveraged loans are traded in the leveraged loan market and are tracked by the Morningstar LSTA US Leveraged Loan Index.

Since they come with floating interest rates, their interest payments increase when the Fed hikes its policy rates, unlike fixed-rate bonds, and so they hold their value, which makes them attractive for risk-tolerant yield investors during times of rising yields.

But, but, but… Rising rates, and therefore much higher interest payments – precisely why they’re appreciated by investors – also make it more difficult for the already junk-rated borrowers to come up with the cash to make those much higher interest payments. And so stressed build up, default rates rise, and debt restructuring follows.

Nevertheless, thanks to the ultra-loose financial conditions, and similar to the dazzling boom in junk bond issuance so far this year, leveraged-loan issuance has soared from the ashes in Q1, reaching $325 billion, according to LCD, just a hair below the free-money record of Q1 2021, and nearly five times the volume of Q1 last year.

Distressed debt exchanges are also a growing thing in the junk-bond arena. A shining example we’ve covered here was the distressed debt exchange by Carvana, proposed in March 2023. Moody’s considered the transaction a “limited default.” Carvana got its unsecured note holders – PE firms led by Apollo that had bought the unsecured notes for cents on the dollar amid bankruptcy talk – to agree to exchange that debt for new 2nd lien secured debt, but for an amount that was much smaller than the face value of the unsecured notes.

The PE firms made money on the deal because they’d bought the unsecured notes for cents on the dollar. And with the new 2nd-lien secured debt, they also ended up higher in the capital structure. The exchange wiped out $889 million in debt – which Carvana booked as a one-time gain (debt forgiveness) in Q3. Everyone came out ahead in this deal except the investors that sold the original bonds for cents on the dollar to the PE firms.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The widening gap is interesting.

I’m guessing lenders are getting better at anticipating defaults and decided to get ahead of them by making it policy to engage in DDE deals sooner?

“decided to get ahead of them by making it policy to engage in DDE deals sooner?”

Hmm.

I don’t know…if you were getting some piddling amount of interest (4-5%?) on the front end of a junk bond/”leveraged” loan issuance (we should probably just call them “junk loans”) and then *also* getting some serious impairment imposed later (coupon payment deferral, maturity deferral, outright haircuts to one or the other) maybe lenders would have been much better off just skipping the junk loan in the first place.

The point of lending is to get 1+ x, not 1-x.

But all this is just the poisoned fruit of ZIRP (and more evidence of American economic decline…as companies are only surviving at low-to-no-to-negative interest rates on their engorged-but-lifesaving-debt).

The Fed’s flood of flatulent fiat (at the behest of DC’s nattering nabobs of negative interest rates) purposely created an environment where crap companies (doomed to default, explicit or obscured) could borrow at tiny rates.

All at the decades-long expense of existing dollar savers, corralled into high risk kill zones while seeking non-zero yield.

Ah, the wonders of innovation unveil a new layer of subterfuge and fancy terminology, as the search for yet another tranche of bag-holders proceeds. I am reminded of he delightful confections cooked up circa 2008 to layer n the opacity. At bottom, somebody loses and somebody walks away with the dregs. Somewhere at the bottom of this pile is money put up for a promise ultimately unkept. Seems like nothing is a flat-out default any more. And AI will dig out all kinds of little tactics to shift losses around in capital structures.

I looked this up in Investopedia, and pasted it all exactly. Sounds like AI dealing with a human “tap dancing” line? Try it if you doubt me.

What is capital structure simplified?

Capital Structure

Capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. A firm’s capital structure is typically expressed as a debt-to-equity or debt-to-capital ratio. An error occurred.

NBay – gotta laugh to keep from cryin’…best.

may we all find a better day.

“Seems like nothing is a flat-out default any more”

This is a big deal indeed if credit default swaps (definitely a very useful product, in theory) are to mean anything.

I do wonder how the credit default swap market is currently doing given the ever increasing numbers of crypto-default “restructurings”.

I’m sure every deal’s legal documents cover specific contingencies…but you can’t have a liquid, tradable market made up of a bazillion bespoke deals – without standardized terms/expectations, you don’t have a market.

Any credit default participants out there? Available to shed light?

Business development companies come to mind. I can’t wait for PPI and CPI inflation numbers Tuesday and Wednesday, and what you write about it. To get back to your article today it seems not being aware of how different defaults are listed skews the data.lots of risk out there. Thanks Wolf.

This “extend and pretend” crap has been going on for a while. Hey, life is good, right? Crypto crapcoins are making a comeback, and meme stocks are soaring! What could possibly go wrong? We all just need to drink the Kool-Aid. Uncle Sam and the Fed will take care of us ignorant sheep.

“…the lottery’s for rubes, I’m an ‘investor’!…”.

may we all find a better day.

The “Glass Bead Game.”

I am impressed Dr. /Mr. /Mrs. /Miss. C. Callahan, I never expected Hermann Hesse to appear in these comments, it is a very apt analogy.

The fact that PE has been picking up the increased business vs the banks is alarming especially without knowledge of how large the doubt out there is . Liquidity finding the way to distressed loans!

DM: Major American restaurant, Red Lobster, to abruptly shut DOZENS of outlets as it considers Chapter 11 bankruptcy

The popular chain has been hit by expensive leases and high labor costs. It is reportedly eyeing up a possible Chapter 11 filing to restructure its debt, allowing it to discard long-term contracts and renegotiate new leases. It comes after the company last year reported record losses of $11 million.

The distressed company gets a hair cut? it seems it’s a bit more drastic, in many cases like removing a limb or lopping off its head.

But even the head can be tossed around, and the gamblers jump with delight.

The old debt holders are the ones that get the haircut (by losing part of their principal) — though it often looks more like an arm-and-a-leg-cut than a haircut. The companies get debt forgiveness.

The term “leveraged loan” seems to me to be a tautology. To me “leverage” means borrowing and loan means borrowing as well. Can anyone distinguish “leveraged loan” from simply “leverage” and “loan” as singleton terms? I’d also be interested in the etymology of “leveraged loan”.

Maybe they should be called “over-leveraged loans.” The borrowers are junk-rated companies — so they already have too much debt and not enough cash flow, which is why banks don’t hang on to those loans. They’re just too risky for banks.

The term leveraged loans may be from the “Junk Bond King” era when Milken at Drexel Burnham Lambert in the 1980s came upon the idea of leveraging their junk bond portfolio by borrowing against it to buy more high risk debt.

When I searched around for him it seems many PE funds are now mortgaging their debt portfolio (leverage on leverage again).

This is not going to end well.

“Leveraged loan” is just marketing speak (and a stupid, redundant name as you point out).

If everybody just starts calling them what they are, junk loans, that name will stick.

(As a side note, *very* broadly speaking the distinguishing factor between bonds and loans is that the former are unsecured and the latter are secured by protective collateral – and, in theory, much more restrictive borrower covenants. But ZIRP-driven madness stripped away a lot of the covenant protection for lenders. And ZIRP grossly over-inflated collateral values)

There are senior secured 1st lien bonds that get paid off first during a bankruptcy and may have 100% recovery. And there are unsecured bonds that may face near wipeout in a bankruptcy. And there is everything in between. Bonds can go across the entire spectrum, just as loans can.

Wolf,

In your opinion should the expanded supply of leveraged loans start increasing credit spreads?

If so, how would you think about timing?

It’s the other way around: because credit spreads are so narrow (=HUGE demand), companies went on a borrowing binge to take advantage of those narrow credit spreads. Same thing with junk bonds:

https://wolfstreet.com/2024/05/10/junk-bond-issuance-nearly-doubles-ytd-amid-feverish-demand-in-la-la-land-and-ultra-loose-financial-conditions/

How would you gauge the supply of dumb money (meaning investors chasing crap like this)?

Any idea how much of that money is still out there?

Two things are infinite: human stupidity and the universe; and I’m not sure about the second

Considering that junk debt rates got down to 4% (half of early 90’s Treasury rates!!!) I would say there is a *lot* of dumb/desperate “money” out there.

(Money starts losing its “moneyness” as its falling value accelerates downward…just ask the Weimar Wallpaper Hangers Union).

Hiding in plain site in pension funds and 401K target funds.

This explains a lot about why bankruptcies do not seem to be contributing to unemployment more than normal. A lot of these firms with leveraged loans would have been liquidated in the past instead of being refinanced.

At least it sounds like privatize the profit & privatize the debt (the private being the PE firms), rather than privatize the profit & socialize the debt. Unless I’m missing something.

Also, the original investors who had to accept the first highly discounted buyout by the PE firms- were these investments stocks or bonds? (I guess they could file capital losses on either).

So we should short Carvana’s stock? Up 300% in 6 months.

Just don’t. Shorting is a fools game. Limited gain potential with limitless loss potential.

If you must, buy a call option at the same time to limit losses.

DM: Walmart slashes hundreds more jobs and announces major change for employees in latest cost cutting drive

Walmart is cutting hundreds of corporate jobs and is asking most of its remote workers to get back to the office, weeks after it slashed thousands of warehouse jobs across the country.

“Hundreds” out of the 2.1 MILLION employees Walmart has, with 1.6 MILLION in the US alone??? 🤣 You people ever turn on your brain before you spread idiotic clickbait??? That was a rhetorical question.

This policy change affects all Walmart employees as stated.