The much improved (or rather less horrible?) trade deficit was one of the reasons GDP was much stronger than expected.

By Wolf Richter for WOLF STREET.

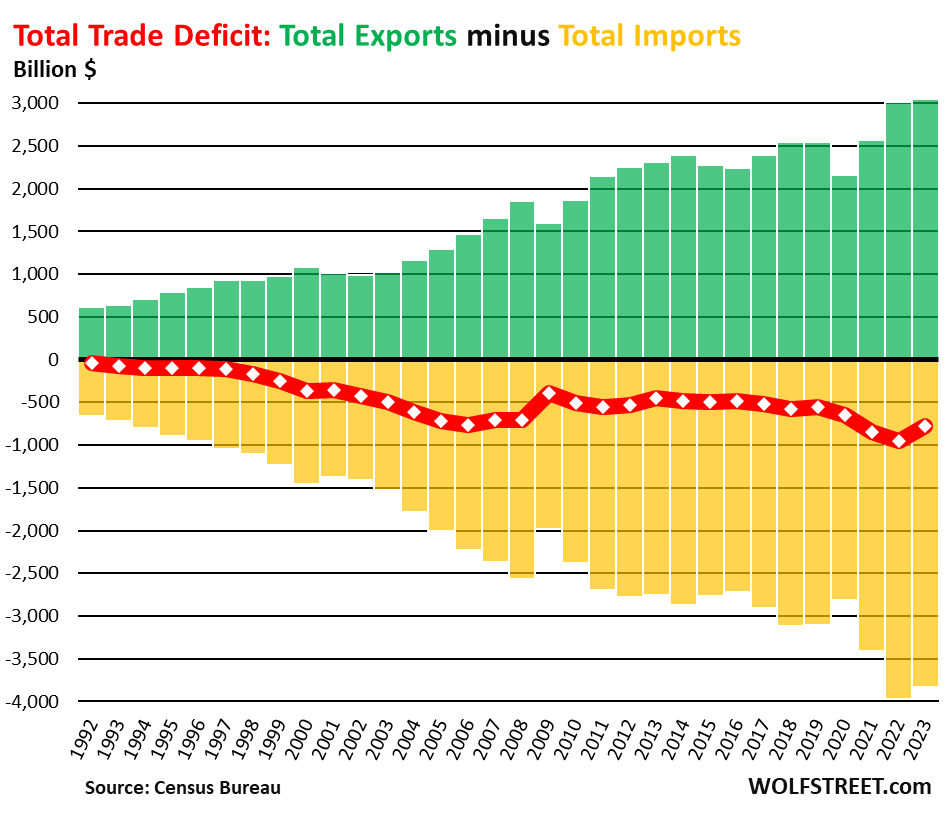

The US trade deficit in goods and services in the year 2023 improved by 19%, or by $178 billion, from 2022, according to the Census Bureau today. “Got less horrible” might be a better term. At $773 billion, the total trade deficit was the least horrible since 2020, due to an improvement in the huge goods trade deficit and a jump to a record in the services trade surplus. More on both in a moment.

The trade deficit (“net exports”) is subtracted from GDP – and the smaller trade deficit amounted to a smaller deduction from GDP. This smaller trade deficit was in part responsible for the surprisingly strong GDP in 2023.

The chart shows just how huge international trade is for the US, with over $3 trillion in exports of goods and services in 2023 (green, added to GDP), and nearly $4 trillion in imports of goods and services (yellow, subtracted from GDP). The red line represents the trade deficit, total exports minus total imports.

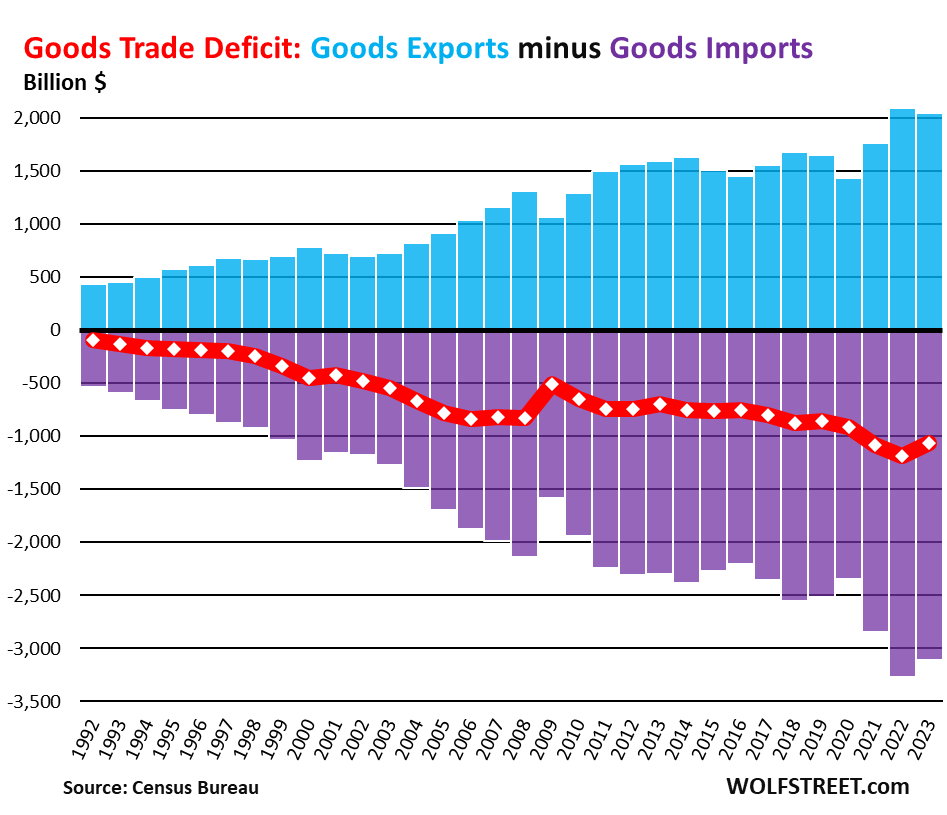

The goods trade deficit got less horrible in 2023.

- Exports of goods (blue) fell by $39 billion to $2.05 trillion.

- Imports of goods (purple) improved by $161 billion to $3.11 trillion.

- As a result, the trade deficit in goods (red line) improved by $121 billion, to $1.06 trillion.

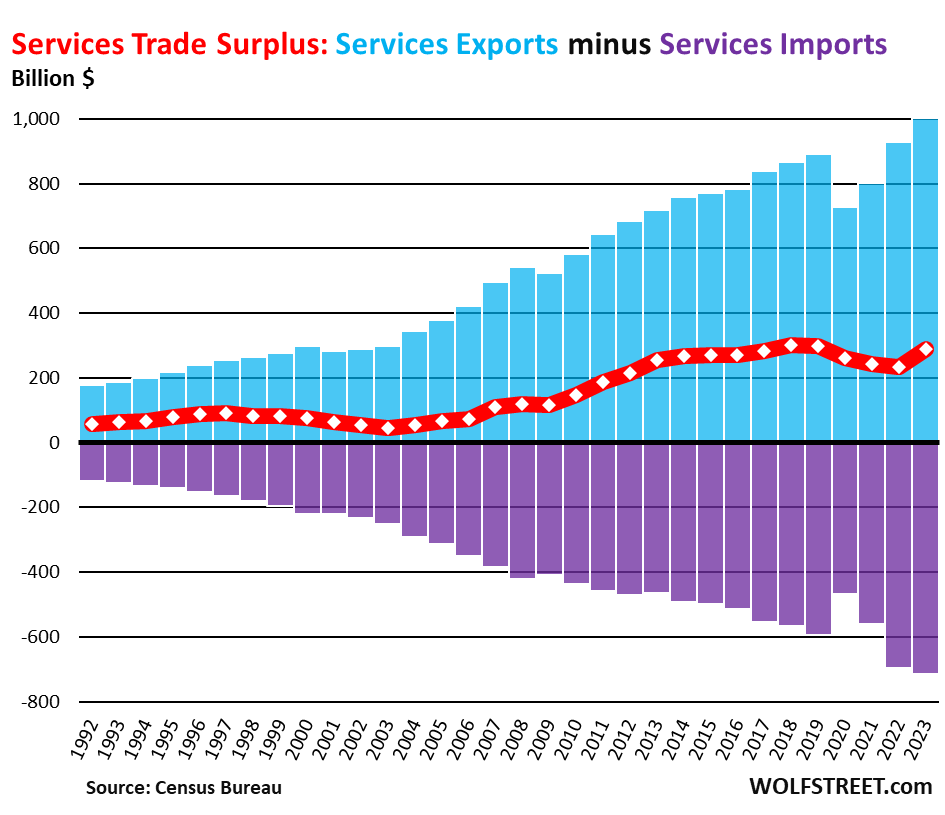

The services trade surplus jumped.

- Exports of services (blue) jumped by $74 billion, or by 8%, to a record $1.0 trillion.

- Imports of services (purple) worsened by $18 billion, or by 3%, to $714 billion.

- As a result, the trade surplus in services (red line) jumped by $58 billion, or by 24%, to $288 billion, the third best ever, behind 2019 and 2018.

Spending for international travel is part of the trade in services. Americans traveling overseas and spending money overseas on lodging, restaurants, tickets, etc., counts as imports of services. Foreign tourists, foreign students, foreign business people, etc. spending money in the US on lodging, restaurants, tuition, tickets, etc., counts as exports of services.

Much of international travel came to a halt during the pandemic. By 2022, most of the travel restrictions were lifted or loosened, and travel in both directions rebounded. And 2023 was the year of “revenge travel” for Americans, and their spending overseas was a big factor in the worsening services imports. But foreign tourists, students, etc., also returned to the US in large numbers, and their spending helped push services exports to a record.

We note that the trade surplus in services of $288 billion is dwarfed by the trade deficit in goods of $1.06 trillion.

The US goods trade deficit, by country/region.

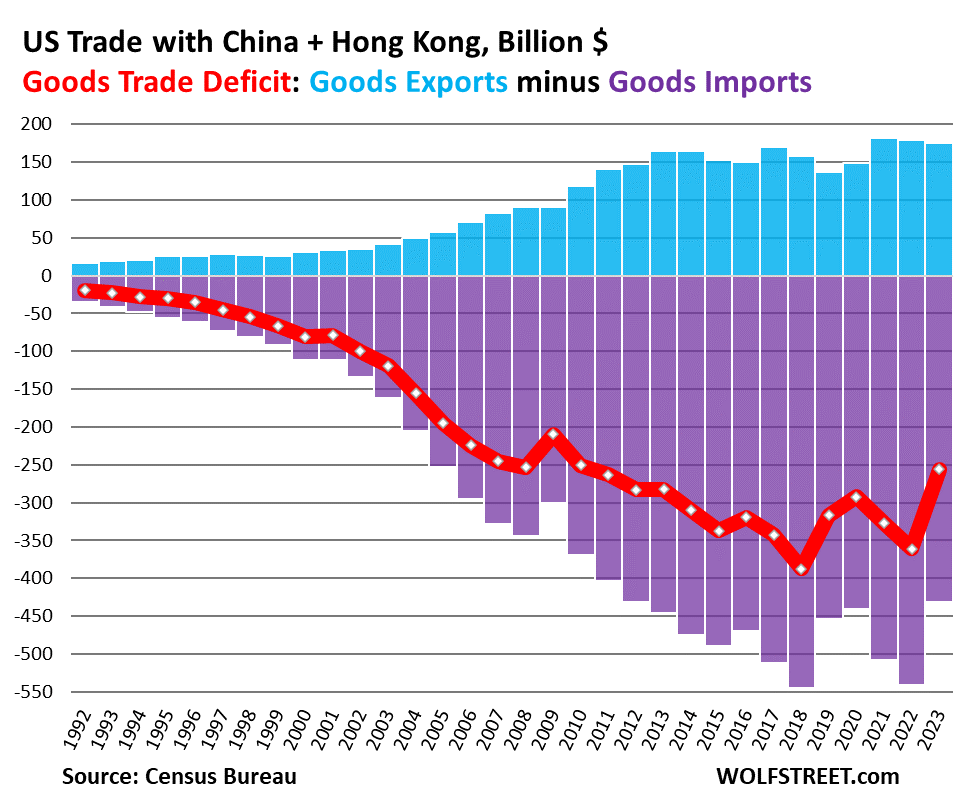

The US continues to have the worst goods trade deficit with China plus Hong Kong, which we now treat as one country. Nevertheless, in 2023, the goods trade deficit improved to the “least horrible” level since 2010:

- Imports of goods from them: -$110 billion, or -20.3%, to $431 billion, lowest since 2012.

- Exports of goods to them: -$4 billion, or -2%, to $176 billion.

- Trade deficit in goods: -$105 billion, or -29%, to $256 billion, lowest since 2010.

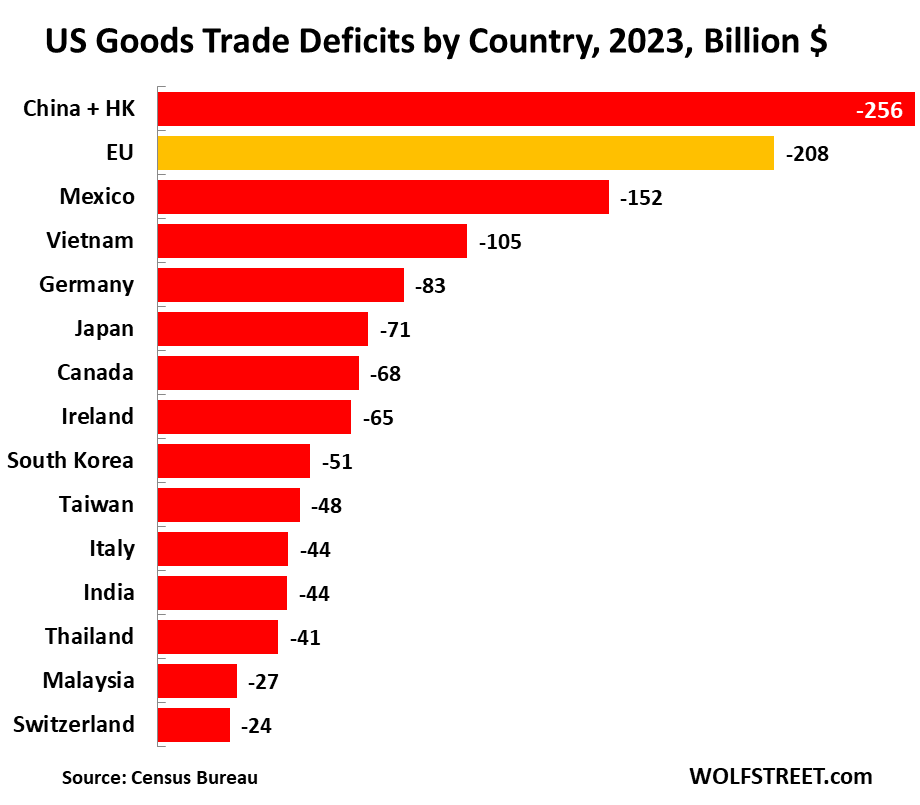

The 15 trade partners with which the US has the largest goods trade deficits.

The opaque nature of international trade, such as trans-shipments through third countries, trade invoicing via third countries, etc., produces special effects, such as Ireland, which actually doesn’t export much to the US, but in which many huge US companies have entities through which winds the paper trail of their imports into the US. Vietnam has moved way up on the list in recent years as it has become a major transshipment center for China’s exports to the US to dodge US tariffs.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Boy Wolf, you’re just full of good news lately.

In this case: “less horrible” news 🤣

Wolf,

Any thoughts on what might be a good denominator to help place that still enormous goods import number, in the context of total US goods consumption (versus, say, GDP… which by including services like housing, medical, gvt svcs, education, etc. really minimizes true US dependency on imports for actual physical items).

It would also be great to see that superior ratio measure over time.

The US is still a lot more vulnerable to intl trade flows (and their inputs like interest rates, FX rates, foreign gvt policies, and currency investor attitudes) than it has been historically.

The imports/GDP metric really obscures that.

Althought the trade deficit is a lot less, the US imports more from Mexico than China now. Does the trade deficit take into account all the money migrants (legal and illegal) send back home? It’s money that is not being spent in America; not right away, anyway. They might buy an American product in Mexico or India, but I would guess most of it does not benefit the businesses stateside. According to an article by the WEF, migrants sent almost 800 billion in 2022.

China buys very little from the US, and Mexico buys a huge amount from the US, and so the Trade deficit with China = $256 billion, and with Mexico it’s $152 billion.

Canada is the #1 US exports buying country ($353 billion). Mexico is #2 ($323 billion).

China bought just $147 billion.

master XI is sure bankrupting and limiting critical exports

poor merika – once a great country

Of course, that is a benefit too, in that we’re “exporting our inflation.” If the money stayed in the U.S., it would chase goods and services here, rather than in Mexico.

I sent a lot of (untaxed) money back to the U.S. when I worked in Arab countries. I didn’t see anything on the WEF website about this.

All Illegal migrants send most of their money back to their country of origin. Being in the construction trades and having to work with the job stealing scum I know this for a fact. It’s insane 20 or 30 will live in a house. Mattresses will be all over the floor. They spend minimal amounts of money to survive here, send all there money back to their country of origin. They work here to make as much money as possible then go back to their country of origin where purchasing power is much greater than here. Most send enough money back to buy homes free and clean. And they don’t come on their own, it’s well planned they are recruited and have lots of help getting here.

I read that we imported more from Mexico last year than from China for the first time in about 20 years.

Yes, but China buys very little from the US, and Mexico buys a huge amount from the US, and so the Trade deficit with China = $256 billion, and with Mexico it’s $152 billion.

Canada is the #1 US exports buying country ($353 billion). Mexico is #2 ($323 billion).

China bought just $147 billion.

Manufacturing costs in China have increased.

Thanks, fixed.

It seems like China makes most of our “stuff”. Is this part of the deficit? Our companies buying products from China slapping their name on them (Apple) and then selling them in the States. Or is this excluded from the deficit?

1. “It seems like China makes most of our “stuff”.”

No. RTGDFA

2. Everything that is made overseas and is imported into the US is part of imports and therefore part of the trade deficit. But it’s not that simple. An Apple product assembled in China contains parts that are exported from the US to that plant in China. That’s why you have to look at all the flows (imports and exports).

I’d be interested to see how much of this trade is all taking place within the same multinational. Seems suspect to call it trade if it’s the same company (Ford Mexico trading with Ford USA, for example).

If it crosses the border it’s an import/export by definition. Doesn’t matter who makes it. If Ford assembles cars in Mexico and ships them to the US, that’s imports, and that’s precisely how the US got this huge trade deficit.

The biggest maker of Apple products in Chinese is Taiwanese. The plot thickens. Kinda like musical chairs to see where the money is going to sit. Labor costs in China rose and a lot of low end manufacturing like textiles and shoes went to Thailand, Cambodia, and Bangladesh. However, these countries are not far enough up the evolutionary ladder of manufacturing to run the companies. They just perform the labor. Many of these companies are Chinese. The merchandise truthfully carries the Label Of Origin of a non-Chinese country, but the profits end up in Bank Of China. We live in a complex world. “Follow the money” is hard to do. My Chinese relatives are right in the thick of this, and keep me up to date.

I think all EEUU is Drunken Sailors if you see the amounts

The U.S. is a mature economy; China is not. Once China achieves the status of being “mature,” it should post a trade deficit of its own as its products are manufactured elsewhere, in places like Vietnam, India and Africa.

Or the USA, labour is cheaper there;)

So “maturity” is per se defined by perpetual goods trade deficits…forever?

What happens when goods exporters get sick of accumulating IOUs (invested in ZIRP’ed US Treasuries), buying land in a declining goods producer, etc.?

In the end, intl traders must rely upon the trade of “goods” (that much eventually grossly approximate balance (not financial paper promises – Treasuries/securities/land ownership) that can be diluted away (USD printing), or legally voided (reduced permissible foreign ownership).

Intl trade is precisely *that* – trade.

Germany is a very mature economy with a huge trade surplus.

Perhaps not a great question but how well does GDP by itself measure anything? It seems that all the goods and services are not equal such as financial services. That might be not be the best example but seems like a country strong in goods as part of GDP might be considered stronger.

I had an economics professor in college who used this example to show why GDP can be meaningless without context.

If, instead of you mowing your lawn and your neighbor mowing his lawn, let’s say that you pay your neighbor $1,000 to mow yours, while he pays you $1,000 to mow his. GDP has now increased by $2,000.

Perhaps. The example that you have presented as normal is in fact absurd when examined in a rational manner. I would never pay someone 1000 dollars to mow my lawn. Good god man, get a grip.

Life is a jungle, no matter how much we pretend it is much more civilized.

Substitute paying $X per week for mowing and receiving $X per week for babysitting instead of each doing their own. Increases GDP (and income tax base) by 2X per week.

Is this why college professors are professors, because they’re too dumb to do anything else?

The reason you’re able to post this is because of services — lots of services, from your broadband or wireless provider via the gazillion services that make up the internet, to the software on my server and to me providing this service.

Without services, there would be no electricity, no housing, no running water, no vehicles, no transportation, no computers….

BTW: The US is HUGE in food and energy products. The US is the biggest producer of crude oil and petroleum products and of natural gas in the world, and a huge exporter of all of them. The US is huge in a bunch of other goods. The US is the second largest manufacturing nation in the world, behind China. Over the weekend, I’ll post a list of what the US exports.

The German, Russian, and Chinese economies are decelerating at a remarkable rate. The US economy is building capacity out of necessity.

Does this mean that the Fischer hypothesis that posits that world trade will be equalized by an adjustment in the relevant currency valuation. The dollar should have declined in value as industrial America was decimated by the transfer of production from the pesky final market to the desperate market in open competition with the domestic market.

Of course one has to realize that Fisher was under enormous pressure to develop a popular hypothesis. One more adjacent to the popular perspective as justification,

GDP seems to be valuable for experts who assess macroeconomic trends.

But how does it impact the average working stiff?

Of the 30 countries with the highest GDP per capita, the United States is 26th in life expectancy (77.2 vs 81.3 average) while being 8th in GDP per capita.

1. “But how does it impact the average working stiff?”

If GDP tanks, the working stiff is going to lose his job.

2. per-capita GDP: The other 7 are small tax havens and financial centers?

Since vid & vax USA life expectancy for men is 74 years in 2023. Glad to spend $2000 per season to have 1.5 acres mowed & trimmed in 20 minutes by local crew. Your comment reminded me at 71 to spend lots more money. Keep SMiling.

To be fair, the life expectancy deficit (I should trademark that…..) has to do with guns, calories, and ignorance.

I think history has found that when societies have become rich, fat, and complacent they become foolish..

The three year solid-looking rise in Goods Exports is Good news, not just Unhorrible news. Physical production is what we need, not more “services”.

I agree that America looks tattered, still beautiful, whose beauty has more to do about it’s culture an enduring quality.

Assuming that the toxic increase in inequality in America, it’s beginning to feel like the fossilized aristocracy of wealth that we rejected in the first place. Yeah, George’s foot on your tolerance.

Dollar has appreciated quite a bit the past year or so. I wonder what the numbers would look like when it is exchange rate adjusted. Strong dollar helps reducing the inflation but no one is mentioning this. Once the interest rate drops, the dollar will drop and import price will go up and inflation might go up.

That’s silly.

1. The DXY was 103.9 at the beginning of January 2023, and at the end of December 2023 it was 102.4, so roughly flat to down for 2023. The dollar appreciated in the year 2021 and 2022 through Sep 2022 and then fell for three months, and then wobbled up and down and went nowhere.

2. This is a dollar economy, and the dollar is the dominant trading currency, and most products that are exported from the US and imported to the US are paid for in dollars. There is no exchange rate involved in terms of the US.

Wait, I thought the meme here was that the dollar was becoming worthless and BRICS, Bitcoim, gold or whatever were going to take over.

It is hard to argue against people arguing against themselves.

China is not our enemy from my perspective:

that love is the most precious and illusive ingredient.

dang – “…love is elusive, this I know now…”

Rodney Crowell – ‘Ashes By Now’

may we all find a better day.

Good information Wolf. So, looks like international trade is still humming along. Good, because when goods and services stop crossing borders, troops will.

Dxy is not the right metric when it comes to imports that affect CPI. How many currencies in dxy are the major trading partners of US? I still believe that once interest rate drops, the exchange rate of dollar will weaken against major importer currencies and trigger inflation.

The WSJ BUXX looks similar, and it’s trade weighted and includes the currencies of all the major countries the US trades with, so all the currencies in the DXY plus those of China, Hong Kong, Mexico, Russia, South Africa, the Turkish lira, the Korean won, and a bunch more. I just like to cite the DXY because everyone knows it.

The WSJ BUXX ended Dec 2022 at 96.64 and ended Dec 2023 at 92.94

I have always had a skeptical eye towards trade deficit worries. For literally my whole life the U.S. has run an official trade deficit. For literally my whole life I have heard doom and gloom about those trade deficits. I am old enough to remember the 1980’s when talking heads were on TV saying American adults should have their children learn Japanese because that was going to be the language spoke in America due to our “huge” trade deficits with Japan.

In reality, in the intervening 40 years, a larger percentage of Japanese school children have learned American English than American children have learned Japanese. Not even close.

I think trade deficits are overrated for a couple of reasons.

1. I don’t want to say that trade deficits do not matter because they can, they really can matter, but as it has been for the past few decades, they don’t matter. The U.S. trade deficit of the past 60 years is nothing more more than an indication that the USA is a very rich country and they want cheap things and they want to see their friends succeed at minimal cost to the USA.

As a long example, I will point to a comparable situation. There was a group of 4 friends I used to hang around with a lot. We used to go out to eat and drink and enjoy each other’s company all of the time. Three of us were relatively wealthy. Not rich, but relative to the 4th, we were millionaires. We were childless, he had a young child. Furthermore, the birth of his child had caused his wife some physical complications. She was forced to leave her job and couldn’t work in a comparable job for comparable wages. The other three of us were married with double incomes (no kids).

So when the four of us went out, it was a major expense for him. He had a child and a sick wife at home. The other three of us had none of that.

As a result, whenever we went out, the three of us would pay. The 4th never paid. If we insisted on fairness and him paying his share, he would never go out. He literally could not afford it. Our trade deficit with him was large. The three of us valued his company so we paid his share. It was a pittance to us, the money literally did not matter, we valued his company more..

I feel the same about the trade deficit gor the U.S.. For example, we run a trade deficit with Mexico. In terms of the U.S. economy, the amount if the trade deficit with Mexico is a pittance. It is not a significant sum.

In return for running a trade deficit with Mexico we get a more stable country on our border*****. Just as I benefited from my friends company (for a pittance), the U.S. benefits from a stable Mexico (for a relative pittance).

***** Note: I know there is a problem with our southern border, but that problem has little to do with Mexico and more to do with the unstable economies of Central America. If the Central American economies were as stable as Mexico the problem would be miniscule and easy.

2. I don’t believe the trade deficit numbers reflect reality. I don’t mean this in a crazy conspiracy way. I don’t think anyone is hiding or changing anything. I just think that a lot of what the U.S. is good at exporting is really hard to measure. Goods are really easy to measure. Economists have had centuries to figure out all of the ins and outs of measuring the importation and exportation of goods. Not complicated. Easy.

Exportation of services is a bit tougher. It is much harder to accurately measure and much more subjective. Don’t get me wrong, I am sure economists are trying their hardest to accurately measure the impact of stuff like services being exported, but I just think it isn’t as solid as goods.

Also, one of the things the U.S. exports is expertise. That is extremely hard to properly value. I am quite sure it is not properly reflected in trade deficit accounting.

Furthermore, there are many intangibles that go into dealing with the U.S. that are definitely not reflected in the trade deficit. American culture matters even if it is not on the trade deficit ledger.

Where I am going with all of this is that the U.S. is a wealthy country. The lowest level of worker in our country still has it better than a peasant in Vietnam working for a monthly salary that every American would laugh at in order to produce our cheap clothes. We can afford trade deficits in order to gain other benefits. Also, I don’t think the trade deficit balance properly reflects the benefits gained/lost by what the U.S. makes compared to other countries.

Basically, it is complicated.