Food Inflation Raged at 19%. But energy prices plunged. In response, UK government bond yields spiked, pricing in higher BOE policy rates.

By Wolf Richter for WOLF STREET.

No one ever seems to expect these nasty surprises that this inflation continues to dish out. The nasty surprise du jour was dished out in the UK, where the “core CPI” (which excludes energy, food, alcohol, and tobacco) and the services CPI had scary month-to-month spikes that pushed them to multidecade highs. And very unhelpfully, food inflation continued to rage at an annual rate of over 19%.

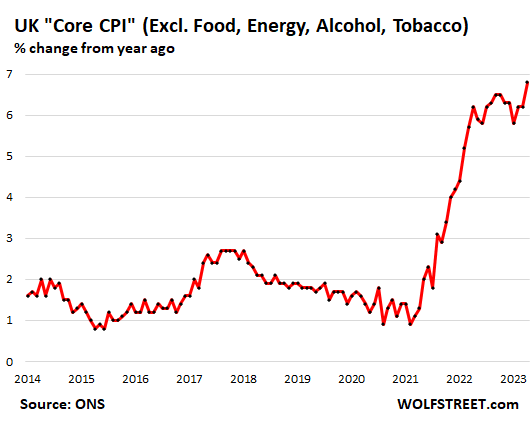

Core CPI (excludes energy, food, alcohol, and tobacco) spiked by 1.3% in April from March, on red-hot increases in the indices for new and used vehicles and for all kinds of services (more on those in a moment). To put this into perspective: a 1.3% month-to-month spike translates into 16.8% annualized!

This pushed the year-over-year increase up to 6.8%, the worst year-over-year increase since 1992, according to data from the UK Office of National Statistics (ONS) today. This reverses several false-hope declines starting in November.

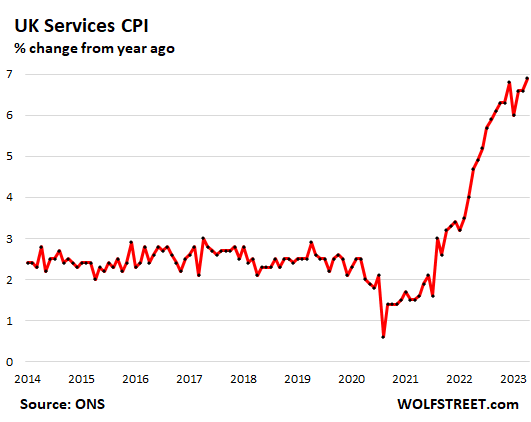

Services CPI spiked by 1.6% in April from March, which translates into 21% annualized! It was powered by massive spikes in the indices for auto repairs, transportation, hospital services, communication, recreation & culture, rents, and insurance of all kinds, and was somewhat softened by drops in energy services.

These pushed up the year-over-year increase to 6.9% in April. Inflation is tough to quell once it reaches services, and like just about everywhere else, in the UK it reached services some time ago, and now on a month-to-month basis, all heck has broken loose.

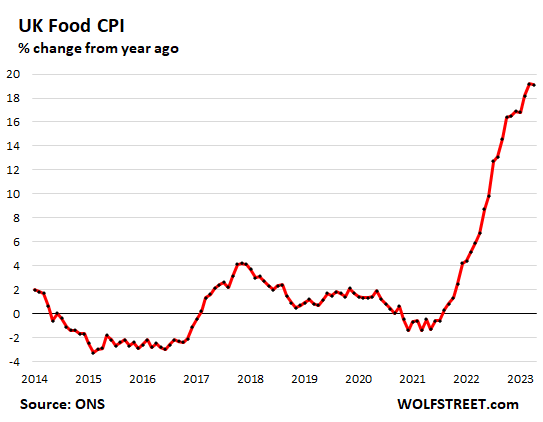

Food inflation continues to rage. For people trying to make ends meet, food inflation is among the worst and daily in-your-face nightmares. In April, the CPI for food and non-alcoholic beverages spiked by 1.4% from March, and by 19.1% from a year ago, nearly the same as in March, which had been the worst since August 1977, according to the ONS’s “indicative modelled estimates” (its actual CPI data don’t go back that far).

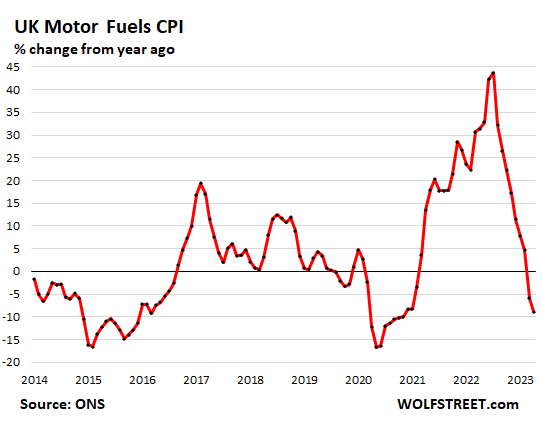

Energy prices dropped. Gasoline prices dropped 9.9% year-over-year, and diesel (which many passenger vehicles use) dropped by 7.7%. Combined, motor fuels dropped by 8.9% year-over-year, after having spiked by as much as 44% last summer. Prices of electricity and household gas also dipped in recent months.

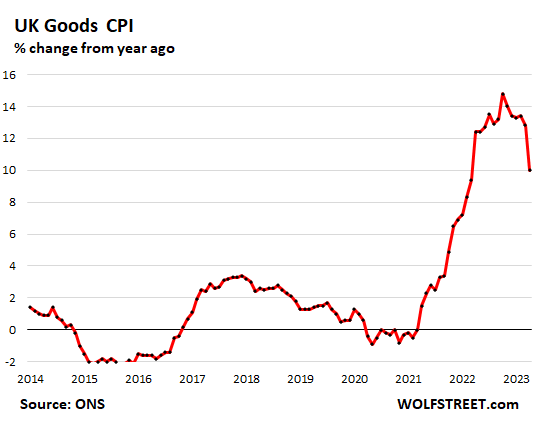

Goods CPI slightly less red-hot. Inflation in goods prices backed off to a still raging annual increase of 10.0% in April, down from 12.8% in March. The index includes motor fuels and food.

As everywhere else, prices of some goods are cooling off (especially fuels), but other goods prices are surging again, after having backed off, such as new and used vehicles whose prices spiked by 2.1% in April from March (28% annualized!). So here we go again, the inflation game of Whac-A-Mole:

| Other Major Components | YoY | MoM |

| Food, non-alcoholic beverages | 19.1% | 1.4% |

| Alcohol, tobacco | 9.1% | 3.6% |

| Clothing, footwear | 6.8% | 0.7% |

| Housing, household services | 7.3% | 1.0% |

| of which owner occupiers’ housing costs | 4.0% | 0.3% |

| Furniture and household goods | 7.5% | -0.7% |

| Health | 7.2% | 0.8% |

| Transport | 1.6% | 1.8% |

| Communication | 7.8% | 8.0% |

| Recreation and culture | 6.4% | 1.4% |

| Education | 3.2% | 0.0% |

| Restaurants and hotels | 10.2% | 0.7% |

| Miscellaneous goods & services | 6.8% | 0.5% |

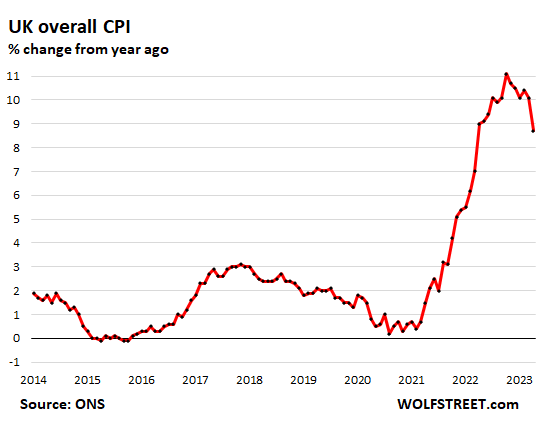

Overall CPI jumped by 8.7% in April, compared to a year ago, somewhat less horrible than the 11.1% booked in October, as it was pushed down by the big drop in energy components.

And yet, the Bank of England has been increasing its policy rate way too late, way too little, and far too slowly to get a handle on this. At its May meeting, it raised its policy rate by 25 basis points, to 4.5%, over two percentage points below the April “core CPI” rate.

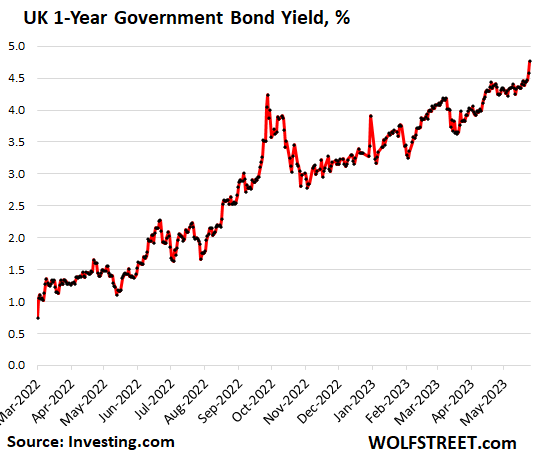

The one-year UK government bond yield, upon the inflation news, spiked by 17 basis points today, and by 30 basis points in two days, to 4.76% the highest since August 2008, now beginning to price in higher BOE policy rates than previously imagined:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

QT acceleration is the solution

Yours is as good as any to place my comment, so here it goes.

UK is in a quandary. No way out of declining living standards, probably noticeably worse than what’s in store for the US.

That’s what you get when combining binge money “printing”, financialization on steroids, offshoring the manufacturing base and purportedly much of the food production, and lax immigration policy.

Government debt is already high and the country has a massive housing bubble financed without 30YR fixed-rate mortgages. Noticeably higher rates will crush the housing market at some point.

Currency is stable – for now – but “printing” is unlikely to be much of an option, as it will risk sinking the currency.

Don’t forget Brexit which caused a fundamental restructuring in many industries.

So BoE has been increasing its policy rates lately, and the rate is ~ 0.7% behind Fed. But for some reason their 10 year bond rate is 0.5% higher. Why this descrepancy?

Speculators being irrational.

Lower investor confidence in the currency and the gilt market. Don’t know how much is owned by foreigners, but the country runs a recurring large trade and current account deficit.

Announced rate targets are usually ultrashort term (like overnight), whereas ten year yields are more market dominated. Possibly ten year gilts are lower priced (higher yielding) because investors are factoring in more inflation. If the central bank is seen as less determined to keep inflation under control (as might be suggested by a lower policy target rate), investors factor in more inflation and pay less for longer term bonds, resulting in higher yields.

So paradoxical as it may seem, a higher policy rate can support lower long term rates.

“And yet, the Bank of England has been increasing its policy rate way too late, way too little, and far too slowly to get a handle on this. ”

Ditto for US? So I checked my Mr Wolf Core pce price index versus Feds Fund Rate and Bingo. US is doing the same thing. I can here the Beegees right now. Its Disco time? 70s and 80s are coming back?

A couple of inflation issues are now being flagged in the UK press – greedflation and shrinkflation. Companies pushing up prices above cost increases because they can, and food amounts getting smaller for the same price. Not as easy to fix this as more than a few experts were smugly predicting a few months ago.

Shrinkflation all started with the Wagon Wheel. It must have shrunk in half over the decades but may have been the first type of snack food to shrink. I remember it as the very first example of shrinkflation in the 1980’s.

I don’t eat a lot of processed foods but eat even less now. That’s where the really insane price increases are. I buy mostly fruits and vegetables, rice, beans, pastas, etc. They’re all still way up, but certain things like chips, the occasional frozen food, etc. are completely out unless massively on sale.

I but everything on sale,try to buy a years supply at a time . Has worked well,

What CEO of a monopoly corporation would not love being in this inflating situation? Note to pricing and marketing dept: “Pour it on every chance you get. I want our quarterly stock report to kick butt. More profit means we can buy back more stock. Take no prisoners.”

Except that CEO also faces suppliers thinking the same way and employees looking for increases that at last match inflation. The revenue side might grow, but that doesn’t automatically translate into profits.

True. But inflation can act as a cover for margin-increasing price rises. It’s harder for consumers to spot excessive price increases when all prices are rising fast.

Central banks at the minimum need to let their balance sheet go back to pre pandemic levels. That bring normalcy.

Agree they need to shrink balance sheets, but the level before the pandemic was not normal. It was just less insane.

Many commonly purchased items are up 20% (my case of beer) over maybe 2 years. But we only see the periodic numbers for overall inflation and think 9% was the worst of it and now it goes down. But the cumulative increases are sticking. And all the other products that have not raised by 20% will follow. Home Depot is a good gauge. I nearly had a heart attack when buying copper fittings and romex. The copper futures are still “higher” but below $4. Yet Romex is still over $100 compared to my prepandemic price of $46. Nothing small about this inflation. As for wages, we had 5% increases that seemed large compared to the last 10 years. Demand has to drop and I hope it happens soon. Still buying beer though.

An example of egregious price gouging.

There was a good article in The Atlantic concerning the costs of Brexit. Two of the standout data points:

— By 2024, the average British household will likely have a lower living standard than the average household in Slovenia.

— On present trends, the average British household will be poorer than the average in Poland by 2030.

Funny how inflation in the UK gets blamed on Brexit. The US didn’t have Brexit, and it got raging inflation. And even Japan, which didn’t have Brexit either, is now getting raging inflation. The BS in the Atlantic is just mindboggling.

But most EU countries have lower inflation than the UK don’t they?

Maybe that doesn’t mean anything, I dunno.

Not that I want to be accused of defending the Atlantic. Jeffrey Goldberg is a fraud.

Julie,

“Most”? LOL. You fell for some media BS somewhere. Who is spreading this BS? AI? It’s easy to check at the Eurostat website.

16 European countries out of 28 had higher CPIs than the UK:

Hungary: 24.5

Latvia: 15.0

Serbia: 14.8

Czechia: 14.3

Poland: 14.0

Slovakia: 14.0

Lithuania: 13.3

Estonia: 13.2

North Macedonia: 12.0

Romania: 10.4

Bulgaria: 10.3

Austria: 9.5

Slovenia: 9.2

Croatia: 8.9

Italy: 8.7

Montenegro: 8.6

Inflation itself isn’t a result of Brexit of course but a lot of import/export that used to happen regularly between UK & EU is just absurd to the point of infeasibility now, so it would have had consequences regardless.

Inflation is now raging in SERVICES.

On that front, then: According to ECB, “the persistence and the extent of labour market tightness [which can lead to services inflation] make the United Kingdom an outlier, comparable only to the US economy,” and they attributed this at least in part to reduced migration flows as a result of Brexit.

Wolf I think you’re a genius and learn a lot from your blog but I’m not totally understanding the resistance to connecting at least some of the UK’s current woes to Brexit…

Not meaning to argue, just keeping the comments section lively :)

Whatsmynameagain,

1. Your claim is false. Here’s the WSJ, just out: “Brexit Was Expected to Slash Immigration. Instead It Hit a Record.” U.K. government has allowed in more students, higher-skilled workers and families fleeing Ukraine and Hong Kong.

https://www.wsj.com/articles/brexit-was-expected-to-slash-immigration-instead-it-hit-a-record-82a7d37b

2. What the ECB is saying is that the UK should practice more wage repression by importing unlimited cheap labor when real wages are already dropping the fastest in decades? Is that the kind of insanity that the ECB now promotes? That kind of horrible brutal cheap-labor doctrine would be another reason to Brexit.

Real wages have been declining since this inflation surge began in late 2021. Sure, the rich love unlimited amounts of cheap labor because it keeps their profit margins high. But for the regular people, declining real wages are a killer. A labor market doesn’t function when the supply of labor is unlimited, but the demand is limited.

We had Brexit in 1776 🦅🇺🇸

Usexit?

Food inflation is due to Brexit. While in most countries food inflation is linked to energy costs it is decoupling in the UK because of missing labour.

Because of Brexit, farms downsize the acre they can farm by 20% or more, because they cant get the seasonal labour they could before due to brexit. Thats the main reason food is getting so expensive.

The second reason is much higher transportation costs due to the retarted, ultra-hard tory brexit the idiots in power made.

The higher and much more complicated brexit is leading regularly to food shortages in many towns in the UK for things like tomatoes. As soon any product has some production shortages the UK is always the first in Europe to feel it and that pushes up prices by a LOT.

The third reason food inflation is so bad is only indirectly because of brexit. Its because the idiot Torys are unable to discuss anything related to brexit and have zero policy in place to deal with anything that has its root cause in brexit. The third reason is 0 governance or more like negative governance that makes everything worse.

Toby,

“Food inflation is due to Brexit.”

BS.

In Germany, which notably had no Brexit or Gerexit or whatever, the food CPI is up 17.2% in April YOY, very close to the UK’s. People need to stop blaming Brexit for everything. I’m getting really sick of it.

Some of their produce is tied up at ports with paperwork, this presumably leads to shortages.

Some of the exporters to UK presumably cant be bothered with the queing at the ports.

They dont have the same amount of seasonal workers, again leading to shortage.

I am sure Brexit a factor alongside the other ones affecting countries in the EU

In Germany, which notably had no Brexit or Gerexit or whatever, the food CPI is up 17.2% in April YOY, very close to the UK’s. People need to stop blaming Brexit for everything. I’m getting really sick of it.

I live in Ireland, Brexit has been a disaster for them, nobody wants to do business with them. Personally speaking, if I buy something on ebay from UK now it arrives with a 25% import surcharge and you dont know until it arrives. DHL/UPS also charge 5 euros for collecting this from you.

Another problem here is that they jack up the price of petrol, food etc when there is an issue but when the issue goes away they leave the price and the govt threatens them but they dont care.

Germany should have left the nuclear plants turned on but after Fukushima they couldnt face the thought of what could happen. They relied too much on Russian gas and got bulled into war and approving sanctions by Uncle Sam

My undestanding from relatives around Leitrim is that it is cheaper to slide over the border to northern Ireland (Brexit land) to buy many things because of the txes in the south (EU) are costly.

It is a lot easier to cross over now a days.

The general rule is that here in the UK If you’re talking to someone about the UK economy then it typically takes less than 20 seconds for “BREXIT” to be blamed.

Another globalist publication, or economically ignorant.

The UK has screwed up “big time”, but escaping the Hotel California roach motel certainly wasn’t part of it.

Accelerate QT. Here in the US as well. The $35B MBS monthly rolloff is not happening. To accelerate QT we should allow the $95B capped limit to be achieved by additional bond rolloff should MBS fall short of its goal.

QT won’t do it, AV. Your congress is spending over $1 trillion a year that isn’t taxes. Which means it’s borrowed and/or printed into existence.

This has been going on since the viet nam war, more or less. It’s finally come home to roost because foreigners don’t want to hold dollar assets any more than necessary. They’ve started trading in local currencies. We are in for years and years of this unless the gov’t can stop spending like drunken sailors.

How come sailors always get the blame for uncontrollable spending???

Maybe because they always piss away money when they get drunk on shore leave?

I think it’s going to be more like $2T this fiscal year.

The Central Bank game plan for inflation in the West is to raise rates enough to assert that they are “doing something” about inflation, but to keep real rates negative. Meanwhile the fiscal side of government keeps deficit spending high and maintaining bloated central bank balance sheets keeps longer term interest rates pinned. Central bank balance sheets will expand again if necessary to monetize deficits and keep real rates negative. Monetizing deficits to pay bills is now entrenched government policy in the West. Demographics and unfunded social welfare obligations make substantial inflation inevitable; the incredible amount of Covid spending and related monetization in the West accelerated the process by five to ten years. Central bank independence is a myth; discipline in government and society are what keep fiat currencies afloat.

Worldwide central bankers don’t care about deficits,they will all default = the RESET. Followed by FEDCOIN,which will be followed by. A worldwide digital currency to replace BIS

Wolf, I just saw you on Wealthion with Adam and as always you are the smartest and most rational person in the room. Is there anywhere I can read more about your economic background? You are by far the most informative person I follow!

I used to follow Lester Thurow before he died. I also followed Martin Zweig before he died. Before that I followed Morton Shulman. Today I listen to Harry Dent.

Harry is great on demographics but like so many they are calling for the markets to crash over 70% and bitcoin to $3000. This may happen at some point but I have been hearing this for 12 years and have grown tired of it. Robert Prector is also interesting but missed the boom from 2011 till 2022. Wolf is so refreshing as he just looks at the data and keeps away from predictions.

Exactly. Glad to see someone gets it.

These policies are all intentional. The corps and the wealthy are in charge and they love their new power to raise prices on everyone else. Blame it on anything that deflects from those in charge who made the decisions — climate change, brexit, russia, china, greedy capitalists, straight white makes, etc…

Also saw the Wealthion vid and am attempting to answer Wolf’s question “when are these drunken sailors going to get sober?” I don’t know but I’ll bet they’ll have one hell of a hangover afterwards.

What shall we do with the drunken sailor?

… Shave his belly with a rusty razor

… Put him in a long boat till he’s sober

… Stick him in a scupper with a hosepipe bottom

… Put him in a bed with the captain’s daughter

But I’m not sure how that translates into economic policy.

These sailors will never sober up ,they will just sink the ship.Can’t wait until politicians are Chinese slaves,hope they end up shoveling pig shit ,or working construction,maybe packing houses.Idiots would figure out value of money .If constuents don’t get them first.

Nothing would happen to politicians.

They made sure that they have 100s of millions for them and for their future generations.

Just pity the common Joe.

It’s a good thing I’m not making the decisions, because the perps would be in a new brand of dog food.

Hey, I hear it was good on toast, rather ironic, after all, didn’t those perps recommend solving inflation with substitution?

1) The Dow Anti : May 12 lo/17 hi 2022, 31,228.22/ 32,689.14.

2) The Dow almost reached the Anti, close above @32,799.92 on lower volume and closed Mar 30/31 gap.

3) In order to move up there must be a weekly close above Dec 2022 high @34,712.28.

4) The Fed will stay put. No hikes til Jan 2024.

There will be rate hikes of the Federal Reserve’s Federal Funds Rate likely in both June and July of 2023.

5) NQ is going crazy.

Nvidia up 25% afterhour on earning beat and guidance after being already up 200% on AI hype. It is Fed’s slow QT that has fueled bubble stocks like this. Crazy speculation and liquidity in the market.

The UK parliament is working a streamlined passage of anti strike legislation. That should take care of the wage side of the wage and price spiral. We (USA) had legislation ratifying a railroad labor agreement to bypass a union membership vote. Seems like both sides of the wage and price spiral are being worked, Nixon did wage and price controls, they even existed in the 3rd century AD Roman Empire after the coinage was completely debased with common metals (their version of Federal Reserve “Quantitative Easing” QE).

Anti-labor legislation of this kind usually leads to unpleasant political consequences — eventually …

Hot Dog Wolf! Just saw you were interviewed by Adam Taggart.

Great job and I hope this helps to bring in more people to your site!

Wholly hot potato or as the term I learned from Wolf whack a mole if you can! I have moles in my yard very interesting creatures voles also I will trap 1 and two more the next day appear.

We had a huge problem when we moved in. Then came Mr. Bubbles McFluffypants (kids named him). He was a stray cat who showed up one day on our property. I thought I was going to have to put him down because unknown to me my dog trapped him on top of some tractor tires for a few days so he was emaciated, and then had these huge gashes which looked like he had been mulled. We gave him some food and water because it looked like he was cleaning himself. He got better. Kids began to hold him and carry him around like a rag doll. I hate cats but love this one. Then we went to get him fixed and the vet calls my wife to see if we wanted to remove the 11 bird shot stuck in him. They did it for 40 bucks. So he has been mulled, shot, and almost starved to death, but he is too tough of a bugger and the best dang mouser, also has killed a ferret, a couple rats, and the moles in my yard. All that to say we need a tough bugger like Mr. Bubbles McFluffypants who can kill this inflation whack a mole! Otherwise it’s going to continue to be a bumpy ride out there. And if they do kill it, I think many of us on here who hate the fed as is would begin to maybe change in our feelings towards them.

I like the message ‘throw a feral cat at inflation’ I think that might trend on Twitter or get some Instagram following.

🤣

Mr. Bubbles McFluffypants for President! Feline Party 2024!

And is your dog now pals with Mr Bubbles McFluffypants?

Why haven’t all of these central bank heads been relieved of their duties. Why are they allowed to fail so badly at their mandates and still have a job? It’s an outrageous insult to the people of the world. All of these clowns need to be fired, yesterday.

The comments from bank of England bailey are straight laughable after this report.

Says bank is on target to hit inflation goal.

Blames inflation on energy costs yet that’s way down

Says inflation is imported mostly i.e. Not our fault.

Nearly 20% food inflation is nasty for lower income families. Don’t see how this ends well for folks in the UK

Without any apologies to that old goat, Friedman, inflation is always and everywhere a distributional phenomenon, and that means conflict.

Resentment and contempt.

How’s capitalism working out? ;-)

That’s a trick question – we don’t have free market captialism, we have corporatism

Never ceases to amaze me the amount of situations people blame “A” based on the negatives cause by the manipulation of “A” and think the answer is more manipulation.

How’s living under a dictator working out? ;-)

Can you show me where this capitalism is, because I would like to move there.

Ugh. Semantics.

Pure, unregulated capitalism has never been the answer anywhere because pure unregulated capitalism just ends up being corrupt cronyism.

Well regulated capitalism has always been the greatest driver of growth the world has ever known. Unfortunately it is hard to achieve due to the moneyed class being able to fool the ignorant unwashed masses to go against their best interests.

We can all argue what “well regulated capitalism” means, but it is quite clear unregulated chaos is only good for the well to do.

Is there anything FED could do to control Raging Inflation in Services? The only option is to crash the Job Market, but that’s going crazy in itself. With a low unemployment rate, is there anything which can negate the services inflation?

Re: UK food inflation – boffins/economists at the London School of Economics have calculated that Brexit has added £7bn to food prices since 2019 – without Brexit, these prices would be 30% lower

But Brexit itself didn’t happen in a vacuum.

British ppl are hugely sick of life in the UK with very high house prices, endless immigration to push property prices up and wages down.

Which the UK has to do because it’s a rentier economy, constantly on the verge of collapse since 1997.

In Germany, which notably had no Brexit or Gerexit or whatever, the food CPI is up 17.2% in April YOY. People need to stop blaming Brexit for everything. I’m getting really sick of it.

Every single one of Wolf’s above comments re Brexit is absolutely correct.

The UK is absolutely dependent on wage suppression to keep the inflation numbers down. There is a government list of the rate for different jobs that allows foreign workers in and they are all set absurdly low.

The simple fact is that the UK cannot service debt at a real positive rate after a 20 year run up in property .

In fact the UK is imo only nominally capitalist. There are very few prices not set by the government. As for when it blows up, it already has. You can’t see a doctor. Chronic housing shortage. Energy costs through the roof. Food at 20% inflation. Government debt servicing costs spiralling up. The (suppressed) 10 year gilt heading over 5% when we are at 100% debt GDP. Strikes by teachers, nurses, train workers, doctors. Tax burden highest since WW2.

The UK population only keeps going because there are public houses serving anti-depressant set every couple of 100 meters apart.

True, but actually booze is a depressant and no, I don’t think it “keeps going” much longer. Those can have already “gone” or are seriously thinking about it, a good chunk are “ok, Jack” and the great (and growing) unwashed have just given up and tuned out/dropped out (and are taking other forms of medication). Just my view from the trenches…

And just a coincidence that the sub sector communication shows the highest MoM inflation.

The UK has recently massively increased immigration.

Higher rates are causing a drop in house prices, which is all the UK does for “growth”.

They can’t raise rates further or housing will blow up. So they live with inflation.

Canada has the same tactic. They have inflation. They increased immigration. Housing is restricted, to act like a pressure cooker, bidding up housing stock.

Both countries are going to have big issues.

We already have Big Issues….you can buy them everywhere…often sold by immigrants..🙄

The analysis methods we use are placing us near a significant topping region in the stock markets (SPX should reach roughly the 4300-4400 region). Then we will likely begin a significant downturn that will take us to the high 2000s. That’s a BIG drop, and it’ll likely be swift (read “crash-like”).

The methods we use are based on sentiment, not some extrinsic factor. So there doesn’t need to be a “reason” for the downturn. That said, the synchronicity with the debt ceiling talks is eerie. I don’t believe it will require a debt ceiling breach to take us down (and I don’t want that to happen), but it could certainly act as a catalyst.

If we do get this large drop starting in the next month or so, it will likely be the next level down for many of the asset bubbles like housing, and will cement that we have entered a long term bear market for equities and likely many other asset classes.

Your call is deflation; are you predicting that fixed income investments will be winners to go along with that?

Perhaps, but only in investments where the underlying bond/company/real estate hasn’t defaulted/gone bust/massively gone down in price or is filled with an immovable tenant.

Middle class standard of living has, as far as I can see, been perceived as falling since the early 2000’s.

There is evident bitterness about that and the desire to find simplistic solutions.

Manufacturing in the UK declined markedly over 1970’s to 1990’s. Yet, the globalisation of supply chains in many areas allowed the importing of deflation from the 1990’s, for a long while. This hid a number of sins and so things felt better between 1997 and 2001, than between 2004 and 2008.

But the last 10 years have seen a gradual further increase in aspirational costs (cue automobile hedonic cost adjustments learnt about on this website) in automobiles, in home prices, in communication costs that were not even dreamed of 30 years ago, and just about every form of insurance.

University tuition fees were £1000 per student, per academic year, in 2000. They are now £9250….

Add to that the economic effects of increased relationship instability, see the divorce rate change over the past 50 years which will most likely parallels the informal relationships out with marriage. These effects, as far as I can see, impact individuals in the their late 20’s to 50’s. Especially if children are involved.

Therefore, the increased cost of aspirations, aligned with the costs of increased proportions of failed relationships, results in understandable financial bitterness. There are, of course, many other factors, but these are some of the main ones.

This unfortunately often goes hand in hand with our cultural myopia and a tendency to take as a personal insult any differing point of view. Therefore, BREXIT is the root of all evil, but no one remembers exactly how much they blamed the EU for their problems before that, and no one has any sensible suggestions about what to do.

Bar, perhaps, a little lie down and then a cup of tea.

Young people today don’t know the meaning of the word inflation. When I was a lad, we had 20% inflation (here in the UK), and today people worry about a measly 5%. Luxury!