After years of money printing and pandemic stimulus, it’s hard to wring all this liquidity out of the financial system?

By Wolf Richter for WOLF STREET.

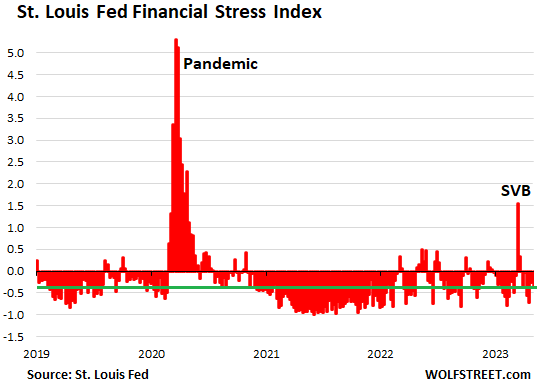

Financial conditions and lending standards have become less loosey-goosey than they were during the free-money era when deposits paid 0% interest, and banks borrowed from their depositors for free. And “financial stress,” which spiked briefly during the SVB collapse, subsided again and returned to loosey-goosey, but just a little less loosey-goosey than during the free money era. It’s like the partying is over, but now they’re just relaxing in la-la-land, instead of suffering from a hangover.

The weekly St. Louis Fed Financial Stress Index, one of the products that came out of the Financial Crisis, measures financial stress in the credit markets and was designed to indicate when another financial crisis might be at the doorstep. It dutifully spiked when SVB collapsed in mid-March, but only briefly and not very much, and then settled down again in la-la-land.

A level of zero indicates normal market conditions. A level above zero indicates above-average market stress; below zero indicates below-average market stress. It’s below zero: -0.35 per the latest release on Thursday. During the SVB collapse, it was above zero for two weeks, on March 17, when it spiked to +1.54, and on March 24, when it fell back to +0.34. Then it returned to the negative readings of la-la-land (green line = current level):

The big rate hikes last year led to a series of mini-spikes into above-normal but still low levels of financial stress. Not this year; the rate hikes didn’t add financial stress. This year it took the sudden and messy SVB collapse to add financial stress.

But the First Republic collapse just caused financial markets to yawn. Same-old same-old already?

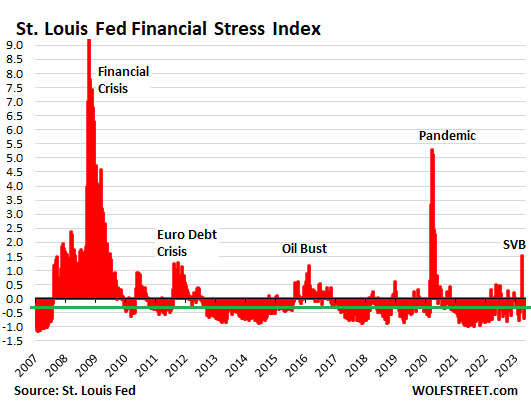

The St. Louis Financial Stress Index tracks 18 variables: a variety of Treasury yields, corporate bond yields, Treasury spreads, corporate bond spreads, SOFR spreads (which replaced the LIBOR spreads), and other spreads, plus indicators such as the VIX and the Treasury 10-year breakeven inflation rate.

During the Financial Crisis, just after the Lehman bankruptcy, the index spiked to +9.25, so that’s about six times the value during the SVB collapse (+1.54).

We also see the euro debt crisis show up in the US credit markets in 2011-2012.

And we see the US oil bust that started in 2015 and sent dozens of US oil and gas companies into bankruptcy court. The Fed had kicked off its rate-hike cycle in December 2015 despite the core PCE price index being at 1.1%, well below the Fed’s 2% target. Spooked by the turmoil in oil-and-gas credits, and with inflation below target, the Fed paused for a year, before continuing. (Green line = current level).

Financial conditions a little less loosey-goosey.

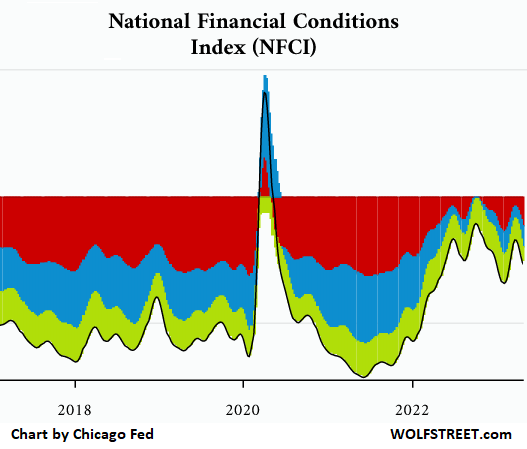

The broader Chicago Fed’s National Financial Conditions Index (NFCI) shows a similar situation: “financial conditions loosened again,” it said for the latest reporting week, as the index dipped to -0.28, with all three sub-indicators – risk (red), credit (blue), and leverage (green) – contributing to the negative reading.

The index too is constructed to have an average value of zero based on data going back to the 1970s. You can see that the free-money party was surely a lot of fun, but that it is now over, and now financial conditions are just relaxing in la-la-land, instead of partying in it.

You can see the SVB collapse in that little dent on the right. But financial conditions remained less tight than average. And the First Republic collapse didn’t even register (chart via Chicago Fed):

So, despite the rate hikes and QT by the Fed, financial conditions are still looser than the long-term average, though they have become somewhat less loosey-goosey than during the free-money era.

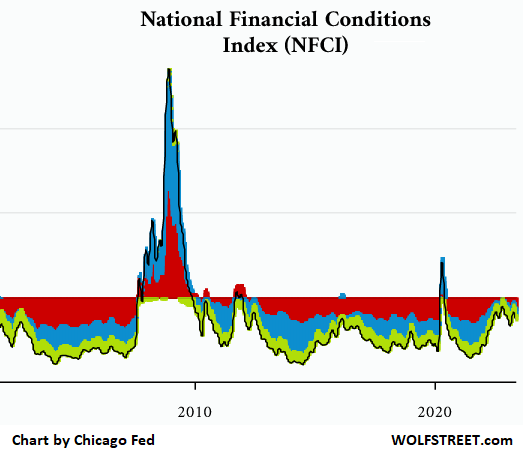

The long-term view shows what happens when financial conditions actually tighten: we see the Financial Crisis, the Euro Debt crisis in 2011/2012, the the oil bust, and the spike in March 2020.

Demand for bank loans drops, amid higher rates. Lending standards tighten.

The quarterly Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) for April 2023 was also released last week.

Loan demand is down from businesses and consumers, which makes sense because interest rates have risen, and borrowing has become more expensive and isn’t a freebee anymore. There was less demand from businesses for commercial and industrial loans and for CRE loans. In terms of consumers, home sales have plunged, so there’s less demand for mortgages. And there was also less demand for auto loans.

But wait… these are banks reporting on auto-loan demand; the automakers’ captive finance companies, which are the biggest auto lenders, have been offering subsidized lower rates to stimulate volume on certain models.

For example, Ford Credit is offering 3.9% APR for 60 months on 2023 Ford-150 XLT pickups. But Bank of America is now advertising a new-vehicle rate of 5.99% APR for 60 months.

In other words, these loan officers might simply be reporting that their auto lending business has further shifted away from the banks to the captives.

More loan officers on net reported tightening lending standards across the board, except for consumer mortgages backed by the government, which is the majority; for them, lending standards have remained unchanged.

Loan officers started tightening lending standards in July 2022. But they tightened after having loosened lending standards for five quarters in a row during the free-money era. They tightened from a very loosey-goosey base.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It has been about one year since Fed started tightening and just reached what some have called mildly restrictive. Now if theory is right it takes about a year for policy to get into the system. Patience is required unless you want to gamble.

The safe play is to collect 5% while seeing if Powell can slowly let the air out of the bubble.

It takes about 12-18 months for changes in monetary policy to impact inflation, they say.

But the impact on financial conditions can happen before the rate hikes even begin, in anticipation of the rate his, which is what happened in late 2021 and early 2022. And then we saw the big rate hikes themselves trigger some financial stress last year, but it all subsided.

“It takes about 12-18 months for changes in monetary policy to impact inflation, they say.”

Yeah, I call bullshit on “they” and them. We saw how quickly their loosey goosey bullshit set fire to asset prices.

Yes, you’re right, 12-18 months might was a bit long. It took about 11 months, counting from March 2020, to see the first significant signs.

Some locations saw an almost 20% increase in real estate prices from March to September 2020. The stock market lit off like a bottle rocket just on the news of the FED’s deranged plan. The 12-18 months lag lie is a cop out so they can entrench inflation even more.

Absolutely agree.

Rates are instantly transmitted, especially in a world where everyone is speculating and information is fluid.

But they will continue to use that meme to justify doing nothing while inflation is still raging above interest rates even wen measured according to their own biased methods.

Depth, I’d say the locations that saw the 20% increase by September 2020 was more due to the “work remote” meme than anything else. But the increases in the year following that were absolutely due to printing.

Regarding stonks, the S&P recovered all of its COVID losses and then hit new all time highs in August of 2020. So it took only 5 months, and that’s while the economy was largely shut down. That was 100% the result of money printing.

You will be sirprised how fast a liquidation panic due to a debt ceiling standoff can “drain liquidity from the system”.

Trillions of it.

Picking up 5%’s in front of a steamroller rolling downhill isn’t for everybody.

Due respect, but I’d rather pick up 5% on Treasury Bills than risk losing 20% on stocks, real estate, etc.

IMO the Fed has broken the real estate market….it is more illiquid than ever.

Then the bond market….with the fake yield curve and its illiquidity issues

Next is the stock market with about 5 stocks running the entire show.

There is STILL too much money in the system…..still roughly $4 Trillion extra if one assumes the pre COVID money supply growth trend.

We need further QT….serious QT

and we need a formula driven monetary policy that is predictable……start with FF must equal 3 month moving average of YOY legitimate inflation index.

Me too. I’ve never trusted stonks, especially in the last three decades. Anyone partaking is feeding the beast and part of the problem. I have no sympathy when things go wrong. Outside of a primary residence, I’m with you on real estate.

Treasuries are the absolute worst investment during times of high inflation. If CPI doesn’t come back over 5% it will be fine, but that’s a gamble in front of a steamroller indeed.

I don’t think t-bills will end up being the best play, but since we don’t know the outcome of policy it is an ok way to sit tight.

Last time inflation got out of hand t-bills protected your buying power while stocks and long term treasuries got smoked for a decade.

“Treasuries are the absolute worst investment during times of high inflation.”

Explain please.

@MM

The best case scenario is inflation falls well below 5% and the treasuries you buy actually start making you money. Nobody buying them is making any money, they’re getting the illusion of extra nominal dollars that are worth much less.

Most on here believe real inflation is higher than 4.9 – especially if you’re a renter, rent will be the majority of your expense and that is increasing at a rate of nearly 9%! Your landlord alone is extracting twice the treasury yields from you

Owing hard assets or businesses is the way to go. Don’t be a lender for pennies lest the streamroller of price increases mows you down

Losing one or two percent to inflation in t-bills is better when the asset market is bubblicious and many classes are fixing to lose over 50% peak to trough. If inflation does take off again then the assets are still going to lose value because nobody can produce reliably without predictable input costs.

“Nobody buying them is making any money”

Nonsense – the average yield on my T-bill/CD ladder is over 5% right now. I’ve made quite a bit in interest income so far this year.

I could pay off my 2.7% mortgage faster, but why would I do that when I can earn almost twice the yield in T-bills?

“illusion of extra nominal dollars that are worth much less”

Ok, I kind of see your point. I don’t completely disagree; I just dropped a significant amount of cash on solar panels to eliminate my electric bill and shield myself from rising energy costs. This investment was directly in response to inflation.

But most folks don’t have this option, so what else are they to do with their cash? I get that real rates are still technically negative, but 5% treasuries seem like the least-bad option right now.

I agree renters are probably screwed.

Nice, got my Musk panels in 2019 while the rebate was still hot. $13.19 electric bill last month

Primary residence is very important during these times. If you didn’t buy between 2008-2020 the boat is way far in the ocean now. Is it worth submitting to 9% rent increases though? Imagine living in NYC shelling out 4 grand a month and come January your house boss asks for $4350 to renew. Madness.

If you can’t find a time machine the tough correct choice imo is to pay the upfront cost and reap the rewards next decade. As far as other options, I’ve been looking into $JEPI which is a JPMorgan fund that runs out of the money covered calls on resilient, dividend paying equities. Top holdings include Walgreens, Mastercard, Coke/Pepsi, Amazon etc. all businesses that will benefit and rise with inflation, both in share price and cash flow to you. Currently yielding 11%. I have a two year goal of 1k shares which will cover most non-debt living expenses

Stonks are the biggest ponzi scheme if they don’t have realistic values or devidends.

I have my 401k sitting in a cash account earning over 1%.

I get stuff all the time telling me to invest it, I was thinking in what?

Usually, the steam roller analogy applies to chasing small gains that entail a risk of huge losses. Collecting 5% guaranteed while waiting to see how things play out does not risk huge losses. So, I’m confused as to what your point is.

Maybe he is worried about hyperinflation? 5% is not enough compensation for that particular risk. Not that it’s likely to happen though, but then again a huge sudden shock to the system might happen and then it’s dollars for everyone.

Locking oneself into 5% to the upside as far as inflation goes, is pure folly in our brave new world.

Used to be a prudent move, but now it’s strictly picking up nickels.

Puzzled by the fear mongering about 5% Treasuries here…just stay on the short end (1 year) and inflation/continued soaring T rates will have a pretty limited effect.

It is *long term bonds* (including Treasuries) that take the worst price hit when interest rates/inflation soar.

On the short end, you get your money back in a year to re-invest at higher rates. That seems like a much better risk than mega stocks selling at 25+ PEs (you can only conquer the Earth once, and Apple/MS/Google can’t have revenue in excess of GDP…(which is a joke, for the humor impaired)

I agree with Cas127, though I’d consider even shorter durations such as 3 and 6 months if you’re concerned about inflation taking off. I don’t think you’re not locking yourself in with short-term treasuries.

“Locking oneself into 5%”

Who says you have to do that? You can ladder short term products and chase rates higher.

Nice article by Wolf. Interesting, useful comments.

For myself, looking at an environment of global and domestic uncertainty, bank theft when it comes to demand deposit/savings interest rates vice credit card rates, multiple asset bubbles, FRB avowed/committed goals for combatting inflation – the decision process is not binary. Not allocating entire portfolio to short term bills – but 5% in a liquid asset (for 28 weeks) is not insane (I understand the overall real value loss) while I maintain some stonks footprint in either dividend producers or companies identified as short to mid term gainers, 10% gold royalty companies as a hedge – and waiting for asset bubbles to implode. Lotta cash sitting on the side losing value every day – but I don’t need it and my expectation is that there will be good asset opportunities here or aboard sooner rather than later.

The hard part is all the political uncertainty – risk writ large IMO.

The 5% TBills is the safe bet. Everyone needs to move their bank deposits and CDs to TBills.

The resultant run on banks will cause real tightening.

Or it may cause Fed and FDIC to consolidate banks and bailout merged banks!

Fed failed to tighten because it knows that whole system is now an interlinked house of cards that will collapse together.

I use treasury direct linked to my credit union, if my CU doesn’t want to pay more than .1%, they won’t get my money except when I pay a bill or buy something.

And not seeing much weakness in junk bonds. There’s little fear in this market.

I think the Junk Bond thing is coming, especially if earnings keep heading lower. This earnings cycle wasn’t as bad as expected, but perhaps the fun has just begun?

Anyone notice that the housing ATM wealth illusion machine is dying in la-la land? And the only direct way to revive it is to reverse interest rates towards ZIRP again, which is going to be unpalatable with 4-5% sticky inflation for at least 2023 and possibly much of 2024, although I suspect pre 2024 elections will cause the (M)ighty (M)onopoly (T)yrants to open the free money flood gates to avoid political fallout and thus loss of un-elected powers.

“Cash-out refinances” are gone with 80-90% of mortgage holders locked at rates well below the current 6% range today. That gravy train has left the station, at the tune of $430 billion of “illusion wealth” in six short quarters.

And the HELOC can’t replace it at a 24x less “cash out” rate per quarter, at seen in the latest data per Bloomberg:

New York Fed researchers said that 14 million mortgages were refinanced between the second quarter of 2020 and the fourth quarter of 2021, during which $430 billion of home equity was extracted through cash-out refinances.

In another sign that consumers are tapping into available credit: Balances on home equity lines of credit increased by $3 billion at the start of the year, rising for the fourth straight quarter after declining for nearly 13 years. Some borrowers who locked in lower mortgage rates may prefer to tap into their equity through a line of credit instead of refinancing their mortgages into a higher rate, New York Fed researchers said.

Last week seven companies filed for Chapter 11, all with the same reason: can’t roll over their debt.

Seems you have a point.

Bankruptcy filings have been at record lows. Time for them to move up. But the “7” filings is peanuts.

The record low in bankruptcy filings occurred in 2022, with 387,721 total bankruptcy filings that year, compared to 774,940 filings in 2019, the last year of the Good Times; and 4,762 Chap. 11 and 15 filings that year, compared to 7,320 in 2019.

When I took those economics classes, they said “6 to 18 months” delay between the Fed Policy and the Real Economy.

I would not be surprised if the the price of 30-day paper moves a lot faster than the price of milk.

The question for today is, “Will Team Transient prove to be the winners?”

I graduated from High School in 1973. That’s why I kind of expect inflation to be over 10%. Once you get used to something like that, you stay used to it. Single-digit inflation is regarded as Temporary. Double-digit inflation is regarded as normal.

The current situation does not look like 1975, but it does not look like 2005, either. I expect 4-6% inflation for the next 2 years, minimum.

You should bet on Team Expectation. They run the markets.

Maybe people are using the money originally intended to buy a house to spend on services and foods and travel. They probably give up buying a house and rent instead.

Fiscal, monetary and Fed balance sheet remain highly stimulative. Real rates remain somewhat negative; fiscal deficits are projected at two trillion dollars; and a Fed balance sheet of over eight trillion dollars is still sitting there. Just because the Fed has stopped expanding its balance sheet doesn’t mean it has exited the Treasury market; simply maintaining an eight trillion dollar balance sheet requires large volumes of regular Treasury purchases as the debt matures, thus continuing to pin interest rates on Treasuries. The Canadian CB is letting maturing government debt on its balance sheet roll off without buying more; the Fed is still buying Treasuries in very large volumes. Add the immense and unprecedented Covid monetary infusion into the real economy and you have four sources of major stimulus in the US economy and a near crack-up boom. A bank panic could have short circuited the effect of all of this stimulus but the Fed outsmarted Wall Street with the BTFP and filled a giant hole in bank collateral values with the world’s greatest parlor trick. If the Fed had been caught flatfooted (as in 2007-08) the outcome could have been very different. The big spending party will therefore continue until the Covid money train eventually loses its head of steam and the Fed stops buying such large volumes of Treasuries.

Occam and Wolf…

Question:

Though I dont doubt the Fed is buying “some” Treasuries, do not their purchases have to be weighed against their Reverse Repos to get to a net effect?

Thank you.

BoC, BoE and ECB all stopped buying to allow full roll offs. No devastating consequences. The fed is too timid and as such our balance sheet remains the most bloated

Right on appletrader, got to shed mbs and move the market towards fundamentals,.have to get Mr market off the happy juice. It has to happen to drop equities/ home prices. Dragging out the pain is more destructive to the economy & society.

Powell has no fortitude to do this.

Occam, longstreet:

The Fed’s Treasury holdings are down by $550 billion or by 10% from the peak, and they continue to fall at a pace of about $60 billion a month:

This balance sheet is a sick, twisted joke. And this is just the treasuries.

DC

The yield curve is a sick “twisted” joke…

why do long maturities NEVER cover current inflation? (anymore)

The Fed has no business in the long end as far as their “official” duties and dual mandate is concerned.

longstreet,

The problem are investors trying to front run the Fed. The Fed’s purchases would not be enough if everyone refused to buy 10 and 30 year treasuries at current rates. The Fed cannot be the only owner, or the market collapses.

Blame investors playing along.

Wolf:

If the Fed buys treasuries with one hand but is conducting reverse repos with the other , they must be netted against each other to get the net effect, correct?

Understood…..the balance sheet is slowly declining.

The Fed only buys Treasuries to the extent that the roll-off is greater than $60 billion a month. There are ALWAYS on NET about $60 billion a month in Treasuries COMING OFF the balance sheet.

If $70 billion mature and come off the balance sheet, the Fed will buy $10 billion to make sure that on net, $60 billion come off.

So let me repeat: THE FED IS SHEDDING $60 BILLION A MONTH IN TREASURIES, ON NET.

It doesn’t matter what it buys. What matters is the amount of the roll-off. Maybe the roll-off is too small, maybe it should not be capped or whatever. But that is a different issue than what you’re talking about.

RRPs are completely different. They’re contracts (Reverse Repurchase Agreements) with an overnight maturity. Under the RRPs, the Fed takes in cash but doesn’t sell Treasury securities; it posts them as collateral when it takes in the cash. RRPs drain cash from the market. RRPs are why your money market pays you 5%. It’s money-market cash on deposit at the Fed, earning 5.05% currently.

Wolf…

very good. Thanks for the clarification.

The reverse repos are collateral, not actual sales.

Got it.

The RRPs are CONTRACTS. The Fed’s Treasuries are collateral for the money markets. The cash the Fed gets from the money markets is a sort of a loan from money markets.

@Wolf

The Fed should let $80 billion roll off every month then considering current trends in spending.

Does this partially explain the yield curve? If the Fed isn’t outright selling longer dated maturities, then the balance sheet runoff is primarily short-term treasuries and the market has had to digest this additional $550 billion in short-term debt.

That’s not how the dynamics of the bond market work.

The reason the yield curve is inverted is because everyone in the bond market, including the effing banks that collapsed or are in the process of collapsing, believes or believed that the Fed will pivot, and they kept buying long-dated bonds, thereby pushing down their yield. These effing banks were big buyers of Treasuries in 2022. Other investors were too. They all believe that CPI will be 2% by the end of 2023 or at the latest in 2024, and that the Fed will cut to at least 2%.

And banks have collapsed because of this stupidity. Serves them right. We need at least five more regional banks to collapse and annihilate their stockholders and bondholders so that the lesson can finally sink in.

The Fed is hiding about $5 Trillion in long maturity securities having taken off the market by purchasing MBSs and long maturity Treasuries.

Imagine if $5 Trillion in long maturities were out in the market….looking for a bid…..what would the long end look like?

Prior to 2009, the Fed had nearly zero long paper.

The Fed wants the inverted yield curve to FORCE investors to take more risk in real time.

Wolf, excuse me, but wouldn’t five more effing bank failures only favor the odds of a fed pivot?

Broad stock market is very expensive on a historical price to sales ratio. Broad housing market is expensive on a price to income level. Can the Fed control the situation and get things close to a long term mean without causing people to panic and over shooting to the downside?

Well, one must try is what I’d argue, but both markets need a discovery mechanism and rolling off.long dated mbs is essential

No, the Fed can’t and that will prove the folly of forever avoiding recession. Extend and pretend until it bows up in your face. Investor panic is less consequential than social panic.

It isnt the Fed buying large amounts of Treasuries, it is the fact that the Treasury is not able to sell enough Treasuries to finance the deficit due to the debt ceiling. So there is a loss of supply in the debt markets. This is propping up the markets, as money that would be going into the debt markets is in the equity markets and even real estate.

The big pivot will happen as the Treasury is finally able to issue a ton of debt and that adds supply which will cause Treasury bonds to plunge (yields to rise) and will suck money out of other investment classes. I think over 4 months, the net impact between Fed reducing the balance sheet and the Treasury selling bonds to get the balances back to normal could be in the range of 1 trillion. (400 billion for financing additional debt, 600 billion to bring balances back up to normal levels at the Treasury accounts, 300 billion of Fed QT). Notice that the Fed QT is actually the smallest part of this, the extreme measures that the Treasury takes once it hits the debt ceiling and stops increasing the debt are much larger in magnitude in terms of how they impact the financial markets.

I think that really smart big money is using this time before the debt ceiling to unload assets.

The Fed has driven short term rates much higher and everyone keeps talking about short term rates, but long term rates are where the real work of QT will really happen. Long term rates should be at 6% right now, with mortgage rates at 8%.

It does appear that Australian and Canadian price falls have stopped. For how long I don’t know. Is it a dead cat bounce or a floor. Sydney has even been recording rises of late.

Both countries are running massive immigration numbers and there seems to be a worldwide lack of listings… I am also reading about banks increasing mortgage year lengths to prevent forced sales.

The media here in aus have really ramped up the mainstream stories about future price gains, housing shortages etc. of late too. I suppose these respective countries will throw the kitchen sink at keeping prices up but it still amazes me…

The more prices rise, the more likely CBs will have to raise rates I’m thinking. It’s still to loosey goosey…

When does reality catch up to these markets or is it I that need to catch up with reality… I guess time will tell…

“Banks increasing mortgage year lengths” !! – i recall reading, quite a few years ago, about mortgages in Japan , where they were multi- generational

in length i.e they were expecting their children to eventually pay it off.

A case of Japan leading and the rest of the G7 following ?????.

The most boomer-ish idea would be to import migrants to offset the boomer population decline so their housing market doesn’t tank.

Every single policy enacted – any policy to even be considered – benefits the wealthy at the expense of society as a whole. The criteria for the FED scammers is always “how can we pretend to do what is right while making ourselves even more wealthy?”

The FED was and is working always for Wall Street. Anthony Sutton wrote some informative books about Wall Street.

The stop in falling real estate prices is the seasonal bounce that occurs in spring. We shall see if the fall continues in July/August

It’s fall in Australia. Not sure what that means for their RE market though.

It’s in your comment ,very subtle

As always correct and nothing to add or comment on.

The yield spreads between Baa/Aaa corporate and US Treasury bonds shows that party is still going on and everyone is dancing in la-la-land.

This inflation is going NOWHERE and mostly will surprise everybody with spike ups.

It’s the spring selling season, so there’s been a bit of a stir, but compared to past spring seasons it looks like a dead cat. And if this season is so weak, the next one should be even weaker. People are not that stupid to buy at these prices and interest rates after all.

People are very, very much that stupid. That’s why we have this bubble in the first place.

They’re not buying at these prices and interest rates because they can’t qualify.

From the M2 money supply graph, the Federal Reserve conjured up $5 trillion of money. Reportedly the Chinese have about $800 billion of treasuries they are selling and they have been buying gold. Perhaps the Chinese disinvestment in US treasuries could be very helpful in eliminating 15% of this excess money still causing immense consternation and destruction of the population years after the alleged need for “liquidity” (billionaires’ welfare).

The Chinese buying gold! Those idiots! Don’t they know the price of gold will never be allowed to rise significantly?

Presumably they’re not buying gold based on price expectations so much as part of the program to increasingly diversify their reserves away from $USD in anticipation of sanctions or seizure.

Yeah you are probably right. Maybe China, Russia and the others can buy up every ounce available. Uncle Sam is supposed to have a big hoard of gold – at least that’s what they claim. Whether it’s true, who knows?

Some years ago someone made an observationg. Gold prices did have a daily cycle to them. The price of gold did rise when only the Shanghai and London exchange was open and the price did drop whem the New York exchange opened.

Shanghai and London deal with gold that is to be shiped, New York mostly futures.

Maybe it is still so, and that tell us?

As long as the US government is throwing gobs of money at everything and the kitchen sink (Inflation Reinforcement Act) I have a hard time believing that inflation is going to be meaningfully reduced anytime soon.

Even worse, this inflation in dollar terms is being exported all over the world, and since everything in the global financial system is interconnected, the inflation thus created abroad will eventually feed back to the US.

I for one find it hard to imagine an end to this doom loop.

Since everyone loves the “hangover” metaphor, let’s discuss what that really is. Withdrawal. You can avoid withdrawal by tapering off and the slower the better. I’ve heard many discussions with solid logic behind them that something catastrophic should have happened by now. I thought the same thing, everything just seemed too good to be true.

Is is crazy to think a soft landing is possible eventually? At first I didn’t think so. Assuming we are lucky to avoid any massive events in the next few years, maybe it is possible. The real question would be is that what policy makers actually want?

It all depends on inflation. If it somehow goes away without the banks fighting it, then yes, then there will be a soft landing. But I don’t believe in miracles. It is also clear that no bank or government wants deflation.

So I fully support the Wolf thesis of *relatively high inflation and relatively high interest rates for a long time*, barring the appearance of a black swan.

In some ways it just seems illogical to think you can run loose monetary policy for more than a decade and then have a perfect landing.

If I heard an analyst correctly, he said there has never been a case of interest rates being less than 2% that did not end up with poor outcomes for society. Are you really helping society by financing extremely granite, marble, or quartz finishes for a dwelling at zero percent real rate?

The idea with stimulus and QE was to pull consumtion forward. Now, how much can consumption be pushed forward in an economy based on growth in consumption?

Low or little growt, that is little growt in consumption is an issue itself. Now, how to arrange a soft landing? There is not much room for tighening before there is little growt.

There is plenty more economic stress on the way. The Fed and Treasury, big banks, corps and individuals will have to deal with those as they come.

The Fed is painted in a corner. No more QE, rates will have to stay in the realm to maintain a strong dollar, and the economy will have to fare for itself.

The dollar is under an existential threat. It’s for real and is not going away.

Aren’t the small banks being propped up with BTFP though?

Chances are when that ends, their collateral will be worth even less as interest rates will be higher and treasury rates higher.

The pain is being pushed down the road but surely in 6 months time it’ll be evident this ticking time bomb is approaching?

Moral hazard goggles have everyone waiting for a pivot.

So they’re blind to the reality. Until it’s literally on their noses.

That’s if interest rates don’t finally get through to people by Sept/Oct time…

The one good part of the pain being pushed down the road is that with each passing day, the banks’ low-interest long bonds become one day shorter. The longer the pain is dragged out, the better the banks’ bond holdings become due to this shortening plus the higher rates they get on new bonds. It comes down to a race between the bank failing or the “shortening” winning.

Current fornication with the promise of future virginity. I hope Powell stays the course, but he creates a new program to bandage over the misdeeds of the past to avoid paying the price for his actions. Thing about bills is they come due eventually and must be paid. My definition of reality is “that which has consequences when ignored.” We’ll see.

If monetary policy was tight, the FED wouldn’t need an O/N RRP facility.

Stockman said it best. “The Fed is all tangled up in its underwear”.

Looking carefully at the individual elements in the charts, all three sub-indicators did not contribute equally, as leverage remained healthy right through Covid to today (or should I say unhealthy?)

During the GFC, monetary flows, the volume and velocity of money, fell. During the current period, monetary flows have remained expansionary.

The Fed has to break stuff to stop inflation. This idea that there is a soft landing possible is total nonsense.

You can tell Buffet never bought into the QE means you ought to leverage up business model. Currently has $130 b in cash earning 5% waiting for something of value to purchase.

Last time in the GFC he deployed all his cash (except his $20B cushion) and even issued a small amount of stock to purchase BNSF. History in financial markets rhymes I think.

Despite all the expectations that a settlement will be reached in the debt ceiling debate, I think there is a substantial chance that there will be enough holdouts by some of hardliners to get at least a short term default. If that happens I would expect a spike in rates on all federal debt. But, there is also a chance of a deal that puts things off for a few months until the end of the fiscal year. Regardless, the debt markets are not showing much fear of a default anytime soon.

The Republicans cannot be trusted to bargain in good faith as some Rs believe a default will hurt the Biden Admin and increase the odds of the Rs retaking the Senate and WH. Some members of the Freedom Caucus have stated that stopping the nation’s debt from going any higher via a default is patriotic. Meanwhile, McCarthy has been neutered by the Freedom Caucus. This is not your daddy’s Republican Party that we are dealing with. I hope to be wrong, but there’s more than ample reason to be very concerned.

How else do you propose we curb out-of-control federal spending?

You can’t get sober without going through the hangover phase.

“This is not your daddy’s Republican Party we are dealing with.”

Or…….as Barry Goldwater said, “Mark my words…”

Desert

I, in retrospect, believe that the Trump Tax Cuts, particularly the cut

of 35% top margin to 21%, were part of a concerted effort by Trump and the Freedom Bunch to “Starve The Beast”. If Biden had been rational, he would have realized that with Trumps Cuts, he inherited a Deficit Budget, and that “Build Back” was not Fiscally Responsible at the Start of his administration. He would have Adjusted his plan, the way Clinton did at his start, and kept the Deficit under control.

Prior Events and Subsequent events to Bidens starting office, added to the Deficit. Leaving Biden having to either 1)Print Money, or 2) Borrow Money.

If everything is weighed, with what has happened the last 5 months, with the beginning of Debt Ceiling, the Treasury hasn’t been able to

issue New Debt to Refund Old Debt. I suspect that Money Printing has been the Option!! And if at some point the Ceiling Lifts, more Debt hits the market, Bond Prices Drop, Effective Interest Rates Rise,

regardless of anything Overt the Fed Does!!

“You can see that the free-money party was surely a lot of fun, but that it is now over, and now financial conditions are just relaxing in la-la-land, instead of partying in it.”

Amen Wolfman. Scratched all the hair off my head wondering how they got away with this. Hope the younger generation learns something from this.

Could it be that with high fed balance sheet tightening is not working as expected? Fed is paying boat loads of interest on IOR to maintain fed funds rate and money paid on IOR is flowing back into system and is actually accommodative.

You need to look at this much more broadly, as was pointed out here by many who hold yield investments: higher interest rates create cashflows for yield investors (savers, Treasury bill holders, money-market holders, etc.), and many of these people will SPEND this new cashflow. These people hold now about $20 trillion in relatively liquid assets that used to generate nearly no cashflow that now generate let’s say on average 4.5% in interest = $900 billion a year in additional cashflow to be spent. This is HUGE. People are finally making money again, and they’re feeling good about it!

Yes, savers are making (and spending) a lot more money. Thus creating more dollars to purchase goods and services. I don’t see this discussed elsewhere, and it is a large number.

I think the increased cash flow is making it harder for Fed to lower inflation. It is quite the corner they painted themselves into.

dougzero

Indeed…… holders of dollars getting a fair return is indeed an “economic engine”, but it is not the preferred “engine”. The government wants to be the spender of money borrowed cheaply. We are in a short spell of the lender actually getting something for the lending, opposite of the monetary “theatre” conducted by Bernanke, Yellen and Powell … until last year.

Here’s a riddle for you, is a saver really a saver if the saver is spending?

I doubt all of the interest income is being spent on a current basis.

crazytown,

A “saver” is a type of investor — one who invests in savings products, such as savings accounts, CDs, money-market funds, and Treasury securities that are not directly exposed to the ups and downs of the markets.

In this context, the word “saver” doesn’t have anything to do with squirrelling 10% or whatever of your income away.

Crazytown

Retirees certainly spend that interest, but middle-aged people probably don’t.

C Town, Juliab

As a retiree, yes I’m finally making a decent return on my nest egg, but I’m not spending hardly any of it. One, I can get by on my retirement check for now. Two, I live a fairly low watt lifestyle that doesn’t require too much to maintain it. Three, after years of near zero returns and the fed cutting rates 150 basis points in a snap of the finger I’m not taking this new found wealth for granted. Its still under the rate of inflation. Maybe in time I’ll loosen up and spend some of it but I’ve had the rug pulled out from under me too many times to throw caution to the wind for now.

juliab:

Another “saver” here. I don’t need the increased interest income to support our lifestyle. We had plenty of cash flow prior to the interest rate increase to support ourselves and still continue to squirrel money away. Just because I have more income doesn’t mean I ramp up my spending. I never, in my life, ever spent a bonus check. We invested it. When I got a promotion, we bought what we termed “a prize” to celebrate the moment and then went back to normal. That’s how you build wealth…

People who are addicted to a certain lifestyle find it hard to change. I don’t pursue money for the sake of hoarding it…. it’s mostly as a “just in case” reserve so we don’t end up not having choices when the inevitable physical deterioration gets the better of us. Plus, if it outlives us, we can pass that advantage on to our kids.

My parents were children during the Depression. I heard the stories and saw the effects on their health from not having adequate protein in their diets, proper vitamins during their growth years, shoes that actually fit their feet, and living in homes (Chicago) during the winter with little to no heat. I’ll run in front of steamrollers all day to pick up nickels as my Father used to say… “Nickels make dimes. Dimes make dollars.”

We were a “tortoise” in acquiring assets. Never went for the big hits as we found early on that, while you’ll never hit a home run if you don’t swing for the fences, you can still remain in the game by hitting singles and doubles.

Umm, that money is more than eaten up by inflation, so in real terms the returns are probably worse than the ‘good times’. Savers still being screwed, just not as obvious.

ALL money gets eaten up by inflation. If you lose 20% in the stock market and inflation is 8%, you lose 28%. If you invest in a 5% CD, you lose 3%. That’s the choice.

YEP, Wolfman. Cash is King once again. This lifetime saver is spending all interest $ that come in. All I ever wanted was 3 to 5 %.

Yep I’m one of them having no cash flow for several years using cash only. I now am getting income and am spending that income on some upgrades like gifts to kids (they buy cars and houses) and some needed home improvements and maintenance. My income has quadrupled and I’m net positive after several years

My wife and I really enjoy giving our children, their inheritance, while we are still alive. The dollar amounts are adding up, putting bigger smiles on our faces.

Another source of major stimulus! All systems are firing. Why would this party ever end? When the momentum finally dissipates my guess is that 30% aggregate inflation from Covid’s start will be the price that we will all pay for the Covid helicopter money drop. Better get the 5% return on cash while you can; the rug might get pulled sooner than we all think even in the absence of a pivot.

I think this is how increased interest rates result in fiscal stimulus via the interest income channel, especially as the volume of US national has increased over the years.

If this is correct, any simple and direct inverse relationship between rates and inflation is no longer an accurate model.

Isn’t this by definition going to induce even more inflation, that could also force a bull market because people will spend all that money?

Where’s the fix to the situation? Still sounds like we’re on the perpetual cusp of a crash as the market prices rise anyway.

Who is paying the higher rates? Where is that money coming from? Are the interest rate payers spending less to offset the payments to savers who are spending more?

Higher rates are paid by:

– Governments, and they’re NOT spending less, obviously, LOL. Federal, state, and local debt amounts to about $35 trillion

– Companies, and their spending and investment priorities are governed by various factors, such as the wish to increase revenues and profits (or reduce losses as it were).

– Consumers, mostly those borrowing money to buy vehicles and homes. And so far, they have not been spending less.

I have to admit that this is counterintuitive to me. I have always just assumed that people who put their money into things like HYSAs, Treasurys, and money market accounts are not trying to make money to spend, but rather trying to grow (or simply maintain, when real interest rates are negative or neutral) their savings. I’m sure not spending any of my yield–if I did, the real value of my nest egg would decrease.

Is this spending really common, outside of obvious situations such as retirees who by definition are now spending their savings?

Wolf

I agree with your later analysis of “Savers”.

I, tending to be one, look at the better of

the Worse Options.

I have created the start of a T-Bill and T-Note

ladder, inspite of the spread between 8%

Inflation and 5% T-bill rates.

The Stock side is still to frowthy, PE’s are

still too high, and while Bidens Bunch tell

us the Economy is growing, Yield Curve

Inversion is a reliable Indicator, and Government

Statistics on Economic Growth and Inflation

I don’t trust!!! Lies, Big Lies, and Government

Statistics.

Ill buy CD’s, not long, after this month and the

Ceiling business. And wait for the NBER Recession

Numbers to finally call it, before I even consider

the Stock Market, then 4 to 5 months!!

There is something called the “interest income channel” which is a fancy way of saying, “interest paid on debt.” Mainstream economists have downplayed its significance. I saw an article by a leading MMT theorist who says that since there is more debt, and thus more interest paid, then that is actually inflationary: https://stephaniekelton.substack.com/p/more-on-the-interest-income-channel

That says higher interest rates can actually be inflationary. Economists look at interest rate stimulation of the economy as being linear – lower interest rates highly stimulative, high interest rates restrictive, in a straight line. But it may be that that line is not linear – there could be a bump in the middle, until real rates become very positive, at which point, restriction kicks in. I’m speculating but, Kelton has more observations on it above.

The same has been said about LOW interest rates: They’re DEFLATIONARY because they cause overinvestment and overproduction, which brings down the price of goods.

This is why inflation is such a tough nut to crack. There are two sides of every movement, but it’s ultimately a complex combination that prevails.

My own two eyes tell me what’s going on, and the roads are as packed as ever and people are spending like there’s no tomorrow. Hordes of people everywhere, doing everything.

The FED has once again made a massive policy error by prematurely stepping back the rate hikes. They simply erred on the side of entrenching inflation, yet again. Wouldn’t want to actually err on the side of doing something right for a change…

This is why a pivot is priced into everything, because the FED has shown that they are weak in spite of tough talk. They think jawboning then not following through is somehow going to get the job done. It’s not. Actions are what get the job done.

Jerome Powell makes Arthur Burns look good. The damage that Jerome Powell’s FED has done to society is incalculable. Jerome Powell should have been FIRED a long time ago, and every single crooked FED member who shares his deranged economic ideas shitcanned as well. QE should be illegal. It steals the future of the young and parks it in the bank accounts of the already obscenely wealthy.

Don’t forget the corrupt politicians had trillions to blame too.

The Fed told the politicians:

“We have this covered. We have the tools.”

All policy decisions including interest rates are made by the 12 member FOMC (Federal Open Market Committee) at the Federal Reserve and zero are made unilaterally by Federal Reserve Chairman Powell.

Now, at pseudo-equilibrium, they can step back and evaluate whether they put their foot in it, or are up to their neck in it. If services inflation doesn’t come down by late October, I think they’ll be focusing on minimizing waves.

PS I saw an article saying the current population 41 yo and younger holds $14.2 trillion in wealth, and the population 42 yo and older holds $144.2 trillion. I don’t know the historical norm here, but this ratio seems pretty messed up.

Many of the youngsters are no fans of capitalism (or of entitlements for the retired). Bernanke and Geithner created a political disaster.

DC

“It steals the future of the young”

If the “young” knew that their financial environment and future was being ruined , the attention would shift from the world ending due to “climate change” to concerns over their financial future being ruined by reckless central bank machinations.

This has zero to do with rate hikes, it is about the massive balance sheet. Once we clear the debt ceiling issue the Treasury can once again issue debt to finance the debt and that will drain money out of equities and real estate. The QT to date has been a tiny trickle. The Fed is unwilling to really do what it takes to take inflation.

Depth Charge

Consider that Powell was threatened at the end of Trumps

term with being fired!! He didn’t know thru the first 3 quarters

of 21 that he would be reappointed by Biden!! If you were

in his position, unless your independently wealth, you tread

softly to hold on to your job until its locked in, Confirmed!!!

After Powell was confirmed, he was much more aggressive

with Rate Hikes, cutting back on the buying Action of

Bonds by the Fed, and letting the Existing T-Bills and Notes

Mature, and not buying more.

Admittedly timing could have been much better in raising

rates. It needed to happen earlier, in early 21!! But if you

were in Powell’s shoes, uncertain of your future reappointment,

rationally what would you have done??

“People are finally making money again, and they’re feeling good about it!”

SERIOUSLY???

My cable and my car insurance are both going up over 10% starting next month. A jar of mayonnaise that was $3.99 in 2016 is now $5.99.

An 8 pack of Dial soap that was $3.49 is now $6.99. A box of friggin Cheerios is $5.99.

I am NOT feeling good about it.

So even if I people are earning 4.5% on a CD, the corporations, many of which are seeing record profits right now as most Americans are suffering, are taking it right back.

Only way to beat them is being debt free. Hard to do when starting out in life.

There’s a lot of price hikes that you can mitigate with a little ingenuity.

I cut my cable/broadband bill from over $200 per month to $40 with Verizon 5G home and streaming. We pay $8 for Discovery+ and there’s plenty of free TV available on a Roku (one is “Freevee”). I don’t give a rat’s pattoot about sports ball so no subs there. Already had the Roku, so no cost there either. The Verizon broadband came with free hardware (modem and router) and the monthly cost is guaranteed for 5 years. I also have a discount from my ex-employer that cuts 7% off that fee as well as my mobile service. Pro-tip: If you’re currently employed, see if you can get a discount on your wireless service. All you need is a corporate email and you’re golden. Both AT&T and Verizon offered it. I signed up over a decade ago.

Mayonnaise can be found on sale for $3.99 (at least here in Snotsdale, AZ) with a grocery “club” card and playing their quantity game (buy 5 but it’s a variety of items, so not that tough, to save another buck per item). That’s Best Foods Olive oil mayo, not some generic crapola. We shop less often and buy up sale items of quality for the month. If you’re over 55, many grocery stores have “senior discount day” that you can save an additional 10% over their normal “sales” if you’re geezer grade. It’s not uncommon for me to “save” 35% on purchases by using their dopey card. On geezer day, it’s higher. I don’t use the apps… plus we stick *mostly* to a shopping list. Not a geezer? Many stores have military discount day or first responder discount day. Ain’t rocket surgery and takes maybe 30 minutes a month.

My sister’s car insurance (I’ve taken over her finances) went up $95 for a 6 month term. Her policy was priced at 8K miles per year. I lowered it to 7,500 miles per year (the car mostly sits) and offset the increase within $6 per 6 months.

Pharma: I get most of my maintenance drugs from the website of a guy who owns a sportsball team in TX (figure it out). What costs $60 a month at the local drug store (with insurance) is <$16 for 3 months. Others are almost as dramatic. You do have to shop as, on rare occasions, your insurance will beat their pricing – but not often. We put money into an HSA (Health Savings Account) when I was employed. Our out of pocket (presently) is near zero.

If you drink beer, there's some good deals on Bud Light! /s

I am quite enjoying the 5%. Despite all the hoopla and arm waving over inflation (items you don't ever buy can inflate out the wazoo without impacting you one iota), we're doing quite well and, despite "erosion" of our savings, our savings are going up faster than any of the stonks without any of the risk…. and our cash flow is the highest it's been in awhile. As an added bonus, our 401K/IRA income this year will exceed our RMD requirements with absolutely no risk (other than the U.S. Goobermint going bankrupt).

Life does take a little planning folks…

What about clever folks who came into this inflation having already figured those things out? There’s no silver lining here.

Ace, you can get the Aldi’s version of Cheerios for around $1.65. I can’t tell the difference between the two.

Aldi’s is okay. They have their own brands which are cheaper than the nationally known big name brands. You can buy a 10 ounce bag of potato chips for $2.29 as opposed to paying $3.99 for a 7 3/4 ounce bag of Lays. I don’t eat frozen foods anymore because they have gone up in price so much–and the portions are smaller (shrinkflation.)

It’s a blessing in disguise. I don’t need the high levels of saturated fat and sodium.

I haven’t eaten empty (indeed, unhealthy) “entertainment” foods like potato chips for decades. Ditto mayo. It is uplifting to learn to say no to yourself, and build health and savings. The purpose of food, IMO, is to support your metabolic activities, health and energy, not to anchor to like an addict, and then be disappointed about. I have lost weight in recent months. Every bit of that is earned self-respect. I like how my gut and bank account look.

You need car insurance but get with the times and cut the cable, TV is mostly garbage and commercials are just propaganda trying to get you to spend more money.

I can’t do without cable, I wouldn’t have any internet. I need a desktop and a monitor. I still can’t get used to a smartphone, with all the tapping and swiping. But if I feel like they are price gouging me, I’ll have to cut the cord.

See if Verizon 5G home is available at your address. It’s stable, comes with the hardware (modem and wifi router) as part of the subscription, there’s no contract, and it’s as fast as the $150 a month cable I had per “Speedtest”. I ran them side by side for a month (V offers a risk free trial month) and found the Verizon worked better. C#x was intermittently down or speed throttled.

I pay $40 per month for the 5G service, with no data cap. Some of my neighbors hooked a better deal and pay $25 per month (I was an early adopter). Guaranteed for 4 years not to increase. The only hitch is 5G is line of sight, so proximity to a tower is important. However, we’re in the boonies and it’s just fine.

Your first post sounded like cable TV, do you really mean internet service? You can get internet from the cable company without also having TV, but they don’t always make it easy to cancel TV.

Ace,

1. Even regular 4G gives my cellphone 17 Mbps. That’s my broadband backup if electricity goes out or if my fiber service fails. I can run my entire system for about 10 hours on the batteries I have, and cellphone provides the connectivity.

2. That’s fast enough to do anything most people ever want to do, including streaming. But you need to get an unlimited data plan. And I’m not sure what that would cost you.

3. Comcast has broadband-only at a much lower price. As have other cable-TV providers. We had broadband-only for 15 years.

Because the average American is stupid, myopic and impulsive. If people actually went on buyer’s strike, as they should have two to three years ago, this wouldn’t have been a problem. But Americans will spend every dollar they have and then every dollar they don’t have but can borrow. So companies raise prices to meet the availability of credit.

Einhal,

Yes, you nailed it. Americans complain about inflation and price increases, but don’t want to do what is necessary to get inflation down: go on a buyers’ strike. They keep spending and paying whatever until the Fed forces enough of them to cut their spending because they got laid off.

If millennials really wanted to get home prices down a lot, all they would have to do is organize themselves in the social media, chat rooms, video games, email, etc. ALL OF THEM, and agree to not buy any houses at all for five years. That would work. But Americans aren’t made that way. They won’t do that until the Fed forces them to.

Hahahah, you are no exception, we are all like that, Europeans, Asians, etc. All people are driven by the same fears, doubts, greed. That’s why this inflation is a global problem, not just an American one

… “all they would have to do” … is organize an entire generation to not buy houses for half a decade…. mmmn kay

Has that actually happened outside of America?

Consumerism is part of American culture. Telling American to withhold their buying habits is “suicidal”. Most Americans I met aren’t willing to buy less.

They buy, because they can.

I am the “finance manager” for my family since I pick which cellphone carrier, internet provider etc. Currently, we pay $80 a month for internet (promotion price, 2 years contract), and $180 for 4 cellphone lines (with AT&T). My parents complain poor reception from a discounted cellphone provider, so I have to switch with a brand cellphone provider.

Meanwhile, our house is 100% solar, so we don’t have to pay extra electric bills, other than financing our solar system.

I don’t see there are any other ways to reduce my utility bills. Any comments?

In what world is consumer spending an economic problem?

Why whack the consumer if they are dutifully spending it? If they did sit on excess cash and hoarded it, that might be a seen as a bit of a problem. But spending? To the extent that it is excess cash they are spending, praise them! The fault in that case lies with inadequate supply. It is production that is failing to do its part in meeting demand. The idea that the gov should kill demand by whacking workers is madness on the face of it. Spending increases money velocity, which could fuel growth if and to the extent that production could rise to the occasion.

Btw I very much doubt this theory of pandemic stimulus fueling consumer spending. How much exactly did the average consumer pocket in stimulus in the last three years? 5-10k? How is that supposed to fuel spending a year or so later still especially given the price increases in the last 18 months?

Is there anyone here still clutching stimulus dollar bills aching to spend it?

“How much exactly did the average consumer pocket in stimulus in the last three years?”

You have your blinders on. Several trillion dollars in stimulus went out, including $800 billion in PPP loans, and a bunch of money was sent to states and municipalities to be spent, and big companies got a whole bunch to spend, including $50 billion just for a few airlines, etc. There were the forbearance programs that allowed borrowers to NOT spend money on their debt service (which continues to this day with student loans). There were the rental aid programs where the government paid landlords to let tenants stay in their apartments without paying rent, and they could spend this money on other stuff…

In addition, there were ultra-low interest rates that allowed homeowners to refinance and take out cash, in conjunction with the artificial boost in home prices these low interest rates produced. So this home-ATM money is still out there.

Bunch of other stuff. I can’t believe you don’t remember.

Ace,

Um, well, the other way around: Because people are making money and felling good about it, and spending this money they made, corporations feel like they can raise prices out the wazoo and get away with it. That’s the kind of inflation we now have.

My favorite olive oil “Barito” imported from Italy, and Spain just went up to $13.95 from $10.95 because of a draught in southern Europe. All 15 to 20 items (food and non food) items I purchase every week are up 15 to 20% in the last month alone. These government inflation figures are bogus numbers designed to trick the American public into a stupor. I believe my figures from my wallet. Not Bull s$it from the government.

While I don’t doubt that the government massages the numbers, I think part of that is psychological (and I’m guilty of it myself). We notice the things that have gone up dramatically, but not the things that have stayed roughly the same.

It’s much the same phenomenon as thinking you got unlucky by hitting every red light when in reality, you don’t think of or notice the green ones you pass.

The only thing that has stayed the same is bananas and Target tshirts. My favorite orange juice went from $5.79 to $7.99 overnight. Klondike bars used to go for $2.49 and they’re now selling for $5.79 at Publix. We told my son we aren’t buying popsicles anymore because they went from $3 to $6.50. Don’t get me started on eggs. It’s not a few things. It’s my entire grocery cart.

My rent went from $2200 to $3500 last year. Car insurance is up at least 10%.

I agree the numbers being posted are a joke. I wouldn’t notice if a product or service I buy went from $10 to $10.50.

Whitten, that doesn’t really counter my point. My point is that the increases have not been evenly distributed. So while eggs at Costco have gone from $3.39 to $6.99 (and now back down to $4.99), some things have gone up very little or stayed the same. On average, prices are up substantially. But it’s not 20-25% because some items are that. Some are much less.

Pretty obvious to me that the fastest way to stop inflation and reduce the deficit at the same time is to raise taxes. But of course our politicians are too cowardly to do the logical thing.

Sometimes it takes a long time and more context for learning to actually sink in. About a decade ago, my macroeconomics professor did a lecture where he boiled down America’s unsavory financial trajectory to two paths: Raise taxes, or inflate away debt.

I think it coming clear now which is the preferred path.

Mainly on the Plain

BS. REDUCE SPENDING!!!! b

But taxes are going up – just like the price of everything else. But while I can cut back on other things that have gone up in price (eating out etc), I can’t cut back on how much taxes I pay.

Cities and towns squeezing every penny out of residents is yet another way we’re all becoming poorer.

Raise taxes? Please explain a bit more please? Increased revenue at federal level where would that cash flow to? And how should one raise taxes? Corporate? Personal? Social Security? At the moment I don’t see federal government fiscally responsible so more cash to them may be more destructive. If the plan can work great. And why would the government need more cash to implement the plan ?

Any tax. Take back the money provided in the stimuli and tax credits and tax cuts that produced free money. Don’t respend it just reduce ongoing deficits or pay down the debt. Obvious.

Interesting that FTX/Alameda Research (Stanford connections) > SVB > FRC ETC are all rooted in California. San Fransisco has become Detroit.

California ( Newsome, Pelosi, FineStein – will be found at fault for this pending US financial crisis.

You’re dreaming if you believe that crypto will cause a financial crisis. Crypto can go to zero, and it won’t cause a financial crisis. The crypto holders are all over the globe, as are VCs that invested in crypto startups and that have collapsed and will collapse, and there will just be a lot of very unhappy campers.

Farmington State Bank (MoonStone). Google it. Spokane (spokesman.com) Review. Follow the threads in the schemes.

Federal prosecutors have seized $50 million from the one-branch Farmington State Bank that they allege in court records were deposited there as part of FTX founder Sam Bankman-Fried’s wide-ranging scheme to defraud investors through his massive cryptocurrency exchange business.

Prosecutors unsealed court documents recently that they seized funds on Jan. 4 as part of a multicount indictment.

Federal prosecutors charged Bankman-Fried, who once headed the third-largest cryptocurrency exchange by volume, with several counts, including wire fraud, commodities fraud and fraud against investors.

As part of that investigation, prosecutors alleged that Bankman-Fried deposited several million dollars obtained through those activities at the 26th-smallest bank in America, Farmington State Bank, which has operated in the same one-story building in the small Washington town on the Palouse since 1911.

Do you understand that “$50 million” are just peanuts for a bank? Deposit flight at SVB was counted in the 10s of billions PER DAY.

Wolf said it best,but unless a crypto bank causes billions + in withdrawals it’s not even noise to pay attention to.

SVB didn’t fall apart because of crypto, it’s because they attracted the same type of folks as crypto investors – also a result due to SVB’s own decisions.

The most likely reason that SVB to fell apart was because it was a scam.

Then look up Moonstone’s c-suite and see if it lines up with Wa.gov folks – like – Suzan “Suzi” LeVine was Democratic Party Fundraiser for the Obama-Biden 2008 and 2012 campaigns.

I will give it a c-theory attitude. But. Inslee is a native of the Palouse area aligned with Nwesome in nearly all pacts 2020+ and- you know what they say? Follow the money.

Can you rewrite this in English? It’s not clear exactly what you are alleging here.

Please never lose the entertainment value of crypto people believing they’re important

Pending Crisis

Weigh also the fact that SVB, Silvergate Bank, and Signature

Bank were all regulated by State Regulators, and not subject

to Office of Comptroller of the Currency (OCC) Regulation.

New York and California State Financial Regulators were

much looser in the their regulation of banks. They actually

were promoting Crypto Investment.

Silvergate, a California Bank, actually had a cash movement network, Silvergate Exchange Network, which facilitated the movement of

funds between Crypto Institutions. Signature Bank in New York

used Silvergates cash movement network!!

Im afraid there is more to unwind in the Banking situation

with Banks which were involved in the Crypto Sphere, and we

have not seen the end of this!! Its a complicated Web!!!

The Fed has said repeatedly it’s data dependent. Retail Sales for April comes out Tues and will give a look at recent consumer spending. PCE price increases comes out Fri, May 26 and the employment report Fri, June 2. All of these will determine the Feds next interest rate move at their June 13-14 meeting. They will keep rates near present levels as long as inflation is higher than 2%, unemployment is under 4.5%, and there are no major financial destabilization events, or other geopolitical blowups. This could go on for months, if not years.

Agreed.

And since inflation cannot fall to 2 percent with these rates, they will keep rates at these levels if inflation does not go up. If it goes up, they will raise the interest rates again, but below the state of inflation. So obviously something unexpected will have to happen to throw this train off this track.

There will be no landing until a crash follows

“And since inflation cannot fall to 2 percent with these rates”

Sure it can. You think there is some kind of rigid mechanical connection between inflation and rates?

Of course there is a connection. Inflation in the US reached almost 10 bp when Fed rates were still around 2 bp. It was the same in Europe, but after rates hit 5 bp. Inflation fell to around 6 bp. Of course, falling energy prices also contributed for the decline of part of the inflation.

But central bank interest rates are unlikely to rise above inflation, hence my comment above

I think 5% is enough to get the job done on inflation. There is so much debt that if rates stay at 5% for a year or two the economy will crater, especially real estate. Powell just about blew up the banking system by getting behind the curve on inflation.

He went from not even thinking about thinking about raising rates to 5% too quickly. He basically wiped out the equity in the banking system, but its hid with hold to maturity accounting.

“Retail Sales for April comes out Tues and will give a look at recent consumer spending.”

No they won’t. They will give an idea about how retailers’ revenues are doing.

Consumer spending is far bigger, and the amount that consumers spend at retailers is only a portion of overall spending. Services are two-thirds of consumer spending, but retail sales don’t include services.

Yes Wolf, the historical use of Retail Sales to judge the health of consumer spending has been disrupted by the Pandemic (when consumer spending radically shifted to services). But recently the historic trend has reasserted itself and Retail Sales report will give an early indication of the health of the consumer. This can be additionally verified when the PCE report comes out 10 days later.

Retail sales are GOODS. Spending has shifted from GOODS to SERVICES. Services are two-thirds of total consumer spending.

The Eye Doctor near us wanted to charge $320 for an annual exam. We told them to take a hike. They weren’t covered by any ins plan either. What moron would pay that fee?

Costco

The Fed told the politicians:

“We have this covered. We have the tools.”

Raghuram Rajan, current University of Chicago econ prof, former Indian central bank chief and someone who raised the alarm about the Great Financial Crisis at the 2005 Jackson Hole conference ( https://www.wsj.com/articles/SB123086154114948151 ), said the Fed lacks credibility on inflation due to Quantitative Easing now being part of the standard playbook, of which tolerance of inflation is one tenet: https://www.ft.com/content/86275542-fe94-4f4e-ab0b-c7325ba7fa4b

Since it is part of the routine playbook, any financial stress is seen as one step closer back to QE.

Additionally, from the article “A key element of the Fed’s new framework, adopted in 2020, was that it would no longer be pre-emptive in heading off inflation. The old mantra, that if you are staring inflation in the eyeballs it is already too late, was abandoned.

…

Central banks also acted in ways that undermined beliefs about their rate-raising resolve, as when the Fed stopped rate increases after markets started swooning in late 2018.

…

But central banks again find themselves with the wrong kind of credibility — namely the assumption that they will tolerate inflation. No wonder markets continue to price in Fed cuts, even as the Fed insists it will not turn accommodative until inflation is tamed.

…

It is not unthinkable that ageing populations, low immigration, deglobalisation and China’s slowing will plunge the world into a low-growth, low-inflation environment once more.”

Finally, it could be that because the medicine to combat inflation is painful, it takes a long time for society to be willing to take it. It was ten years before Volcker did his huge interest rate increase. It’s unclear if real rates are even positive yet.

Central bankers are a cancer and scourge upon society. There is nothing secret about it. They are narcissistic maniacs who think they are Gods:

“Fortunately, ECB Governing Council member Vitas Vasiliauskas was on hand to allay those fears. “Markets say the ECB is done, their box is empty,” Vasiliauskas, who heads Lithuania’s central bank, said in an interview with Bloomberg on Tuesday. “But we are magic people. Each time we take something and give to the markets — a rabbit out of the hat.”

https://wolfstreet.com/2016/05/14/ecb-admits-were-the-magic-people-in-a-clown-show/

“But central banks again find themselves with the wrong kind of credibility …..”

In a system that boasts of “checks and balances”, who checks the Fed?

Re checks & balances – this has been an illusion for a long time. The vast majority of federal officials are hired, not elected, and can’t be voted out for being incompetent.

CapitalOne and probably others allow you to create “virtual” card numbers that you can lock and unlock separate from your actual card number.

And I don’t condone paywall crashing but some internet archive sites occasionally have snapshots of such articles.

I’m not sure digital cash can be peer to peer without being blockchain. You need a boss like in a CBDC to stop counterfeiting, roll back fraudulent transfers, and police shenanigans.

“Finally, it could be that because the medicine to combat inflation is painful, it takes a long time for society to be willing to take it.”

This always is the case, for everything. I’m actually surprised that anyone is willing to fund climate change mitigation before the Earth’s temp has risen less than 10F!

And this will be the case for the giant debt levels, growing structural deficits, etc. It is just much less painful to kick the can….

The incentives are still skewed. Asset-rich, cash-rich folks are holding all the cards, to a level that is societally unhealthy. They can bet long via equities and short via treasuries, and hoard their housing. They are sittin’ pretty, awash in liquidity, while others are struggling and dipping beneath the waves. This can lead to long term damage. Yet the Fed is complacently letting this situation drift, IMO.

Fed policy for the last 14 years has allowed and encouraged the rich to get richer and the poor to get poorer. Eventually, the civil society breaks down and we are all a loser. END OF STORY

“This can lead to long term damage.”

Lead to? We’re already there. Just look at the massive homeless camps everywhere, hollowed out middle class, etc.

Are there homeless camps? Sure. Are they everywhere, no.

The middle class is doing just as well as they have always done. They have gotten raises. They have very low mortgage payments if they bought during the past few years.

The underclass is not fairing as well, just as it always has been. They should get better raises and better deals at work. If they don’t, they could be the next wave of homeless. Pay people a living wage, provide health services as needed and there will be very little homelessness.

J

Finally ! A voice of reason without the frenzied hyperbole.

Pay them for DOING JUST WHAT? Do you understand what a job is and that it is for the purpose of getting something done for the employer?

Might look different if we have an asset price collapse due to inflation. We are only 14 years past the SP500 being 666. World is going to look different if SP500 falls to say 1000 and housing market craters by 50%. Asset holders will be crying the blues like everyone else.

“an asset price collapse ”

Do the pensions and insurance companies have to “mark to market” their commercial real estate/ downtown office building holdings?

Not “marking to market” for banks (SVB) or even the Fed (MBSs) is just a form of hiding losses……and reality. IMO

Remember back in 2009, both CON gress and the financial industry pressured the FASB to modify the mark to market accounting for toxic assets?

Don’t worry folks, it will happen again in the next derivatives crisis. Banks and other companies will be allowed to mark to magic all sorts of assets. Losses will become gains, and gains will become super gains. Muppets don’t know the difference either way.

The Federal Reserve has NO LOSSES WHATSOEVER when it holds assets to maturity and so-called ‘mark to market’ based on early churning of assets is absolutely irrelevant.