Credit cards are used as payment method and mostly paid off monthly. But 40% are used to borrow, and some people get in trouble.

By Wolf Richter for WOLF STREET.

The New York Fed today released its quarterly report on household credit, including on credit card balances, credit limits, available credit, and various measures of delinquencies, including transition into delinquencies by age, and we’ll get to them in a moment.

Credit cards: the payment method. The most important thing about credit card data, such as the data from the New York Fed today, is that credit cards are used in the US as an electronic payment method. Many credit cards come with incentives, such as 1.5% cash-back on card spending. The bank that issued the card collects a fee from the merchant, such as 3%, for each transaction, retains some of the fee as profit, and kicks back part of the fee to card holders as an incentive to run more payments through its credit card so that the bank can collect more fees. The merchants that pay the fees ultimately figure it into the prices of the merchandise, which consumers then pay – even fossils who still pay cash.

About 60% of credit card accounts do not carry revolving balances, according to the most recent data from the American Bankers Association. These card holders pay off their credit cards in full every month by due date, or they do not use the cards at all. In other words, 60% of the cards are used exclusively as payment method or are not used, and they don’t accrue interest.

About 40% of credit card accounts had revolving balances, down from 44% in Q4 2019. This is 40% of the number of accounts, not 40% of the outstanding balances.

So even as credit card balances outstanding have returned to pre-pandemic levels, as a reflection of spending, the number of accounts that carry interest-bearing balances has fallen by 10%, according to American Bankers Association data.

Households have lots of debt, but credit cards aren’t the problem.

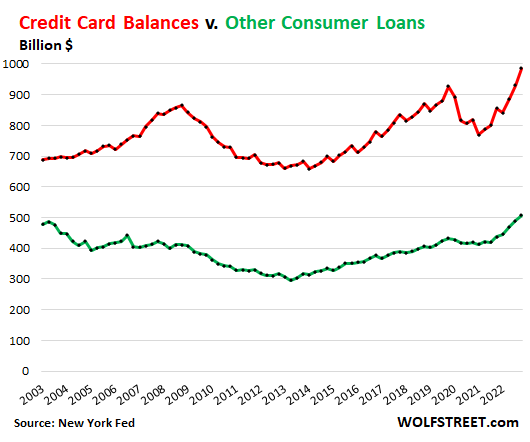

Credit card balances outstanding in Q4 grew by $56 billion from Q3, reflecting the holiday spending binge and inflation that is flushed through credit cards as payment method. This brought total credit card balances outstanding to $986 billion, a new high.

“Other” consumer loans, such as personal loans, payday loans, and Buy-Now-Pay-Later (BNPL) loans, rose by $17 billion, to $507 billion in Q4, having now finally squeaked past the high 20 years ago. Unlike credit card balances, most of these “other” balances are interest bearing, but not all: For example, BNPL loans tend to be subsidized by the retailer.

These are aggregate dollars, not adjusted for 20 years of inflation, population growth, and income growth. In other words, these balances are low in relative terms compared to 20 years ago – and we’ll get to that in a moment:

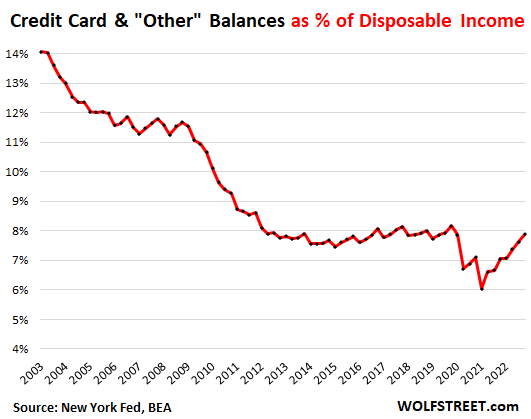

Credit card & “other” balances as percent of disposable income.

Credit card balances and “other” consumer debt combined in Q4, after the holiday spending binge, ticked up to 7.9% of disposable income (income from all sources minus taxes and social insurance payments). But that was up from the historic lows during the pandemic, and roughly back in the normal range in the years just before the pandemic.

Twenty years ago, credit card balances amounted to 14% of disposable income.

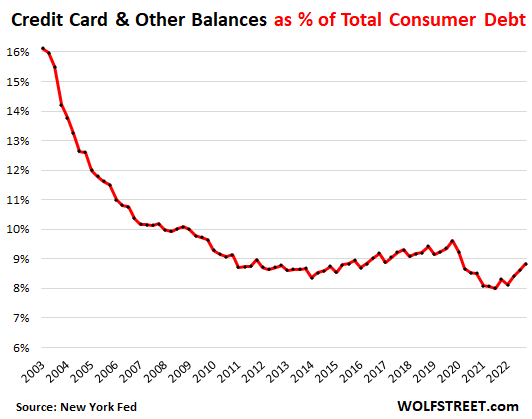

Credit card balances dwindle in importance as debt.

In Q4, credit card balances and “other” consumer debt combined ticked up to 8.8% of total consumer debt – includes mortgages, HELOCs, auto loans, and student loans – roughly in the range of the pre-pandemic low in 2014, but just over half of its share in 2003 when they amounted to over 16% of total consumer debt. In other words, credit cards and “other” consumer loans are not the problem for consumers; they have piles of debt, but it’s elsewhere:

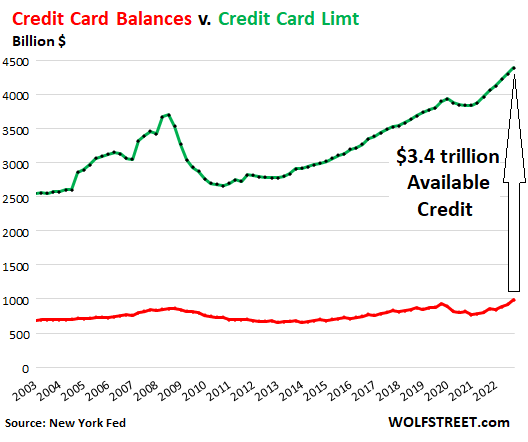

$3.4 trillion in available unused credit.

The chart below shows total credit card balances (red line) which reached $986 billion in Q4, and the total credit limit (green line), which grew to $4.4 trillion in Q4, with over $3.4 trillion in unused credit still being available for consumers to draw on. Alas, with an average credit card interest rate of 20% these days, it’s not a very tempting proposition for many consumers:

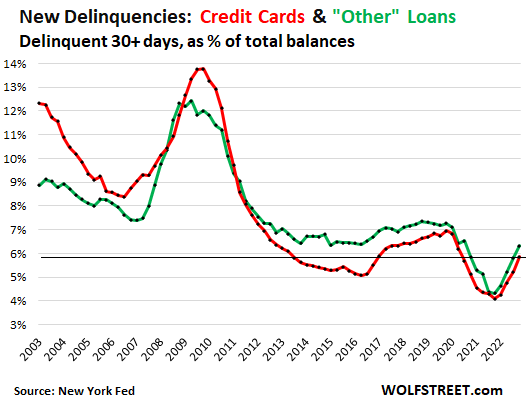

Delinquent balances normalize below pre-pandemic levels.

The pandemic monies handed directly to consumers and the monies that consumers didn’t have to pay, such as via mortgage forbearance and eviction bans, left consumers with a lot of extra money, and many that had fallen behind caught up, creating this historic trough in delinquencies. That phase of the American Dream has largely ended, and it’s back to the normal grind.

Credit card balances that transitioned into early delinquency – meaning they became 30 days or more past due during the quarter – ticked up every quarter in 2022, from the historic lows in 2021. In Q4, 5.9% of total balances were 30 days or more delinquent, but that was well below the 6.4% to 7.0% range of the Good Times in 2018 and 2019. During the Great Recession, delinquent credit card balances spiked to 14% of total balances (red line):

Balances of “other” consumer loans, such as personal loans, that transitioned into delinquency rose to 6.3%, matching the pre-pandemic low in 2015:

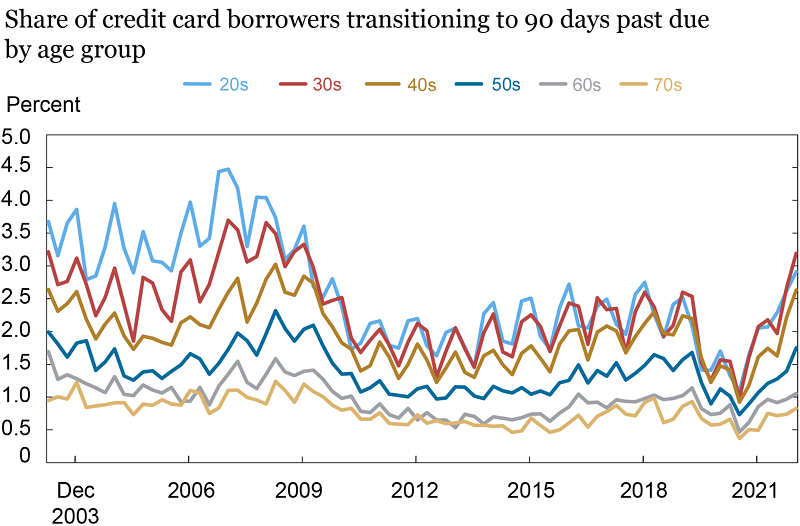

Who is transitioning into serious delinquency?

More borrowers but on average with smaller balances transitioned into 90-day or over delinquencies in Q4 than before the pandemic, driven by younger borrowers, according to findings by the New York Fed released in a blog post today.

The number of borrowers in their 20s through 40s who transitioned into 90-day-plus delinquencies rose from the historic lows to above pre-pandemic levels. More borrowers, but with smaller balances.

The number of borrowers in their 50s who transitioned into 90-day-plus delinquencies rose from historic lows to roughly pre-pandemic levels.

The number of borrowers in their 60s and 70s who transitioned into 90-day-plus delinquencies also ticked up from historic lows, but remain below pre-pandemic lows (image via New York Fed):

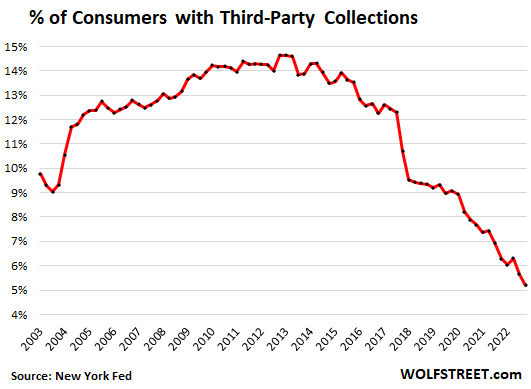

Third-party collections dropped to new historic low.

And as final checkup of the health of household credit card usage: The percentage of consumers with third-party collections – which is where defaulted credit card accounts tend to eventually end up – fell to 5.2%, the lowest on record, and down from 14.6% of consumers after the Great Recession.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

No worries next election cycle credit card debt will be paid off by the Federal Gvt!

Tick Tock the alarm will soon be pulled on the Cinderella economy!

won’t make any difference

CONgress keeps spending and now billions turned into Trillions$$$

and us puppets get to spend in hundreds and thousands

never to retire

The Equifax/New York Fed chart showing age group CC delinquency rates would lead me to believe the 30/40 age group is probably not living the Cinderella Economy. That age group gets squeezed by personal inflation for themselves, squeezed by inflation for their kids, and inflation for their parents who are older and often need help.

Shocking that even team blue would not renew the extra $1,000-$1,600 per child tax credit to help this group, as this group is somehow ignored for endeavors such as unlimited free money to hand out tanks and jets versus give that money to families so they can feed their kids and keep the family environment more stable. Sure my defense stocks are making an insane fortune, yet middle class families have neither team blue or team red on their side and looking at the credit card delinquency data, they are starting to use CCs for everyday expenses.

Kind of twisted to be honest, I get it that capitalism has no soul or emotional morals, yet perhaps there should be a few humanistic limits and/or exceptions to ensure a future for the species???

Just don’t ask ChatGPT, as you won’t enjoy the answers to such questions…HA

Great Post- I’m 50’s and it makes sense for that group as well- trying to “help” their kids AND their parents. Gen X will no doubt suck it up and help both generations, we’ve been financially battle tested 87′- 09′ –Take Care :)

“they have piles of debt, but it’s elsewhere:”

Mortgages is all I can think of…

and with an era of cheap suppressed interest rates, which actually subsidized debt creation, combined with sharply higher housing costs, seems the likely place.

In the past I think Wolf has shown bank balances, I would be interested to see those.

I still believe that the key is going to be plunging home prices. As equity vanishes over the coming year and then people have negative equity, the whole economy will move into a new phase…pain.

I read that in Mr. T’s voice. Good predicition.

” … I pity the fool …”

And that “as pct of disposable income” chart really makes me want to see a straight “disposable income” chart.

My guess is that we all had a “magic pandemic” which besides merely killing over a million people (with all related economic costs, beyond the massively tragic human ones) made “everybody richer” through government accounting, ignored debt, rampant inflation, and unicorn farts.

I think you meant to post this under the most recent article (“Why the Fed can let her rip” — which has the chart of mortgages as percent of disposable income). If you repost your question there, I will repost my reply there, so everyone can see it in the right place.

Meanwhile, here you go…

Vehicle loans are another area. Payments today are astounding, at least to me.

Yep! I am an older, small cherry grower (farmer). I have been spending serious money on repairing and rebuilding my old truck, tractors and equipment for the last couple of years. It is just wildly expensive to replace it and farming hasnt made any money in years.

Theres nothing left to economize on as I am spending my retirement savings, as it is, to keep going (like many others around me).

The US farmer is in bad shape.

I understand that. I have in-laws who farm strawberries in Ventura County, CA.

On the other hand, if you farm subsidized crops it’s a different story. I also have family farming in Minnesota and the subsidy dynamic is different for the crops there.

From what I can see, there are two kinds of farmers:

1- small farmers like you, most of whom are getting slowly ground into bankruptcy (or not-so-slowly, sometimes).

2- big farmers (“agribusinesses”), who are swimming in money.

Too bad it’s not the other way around.

Can somebody put annual numbers to the most heavily subsidized crops (my guess, corn and soybeans…not really direct people-food in mod agribusiness).

Ag degree here from Tx A&M ’80, I left Ag pretty soon after school, now, near retirement age finally discovered diving / servicing pumps in the lakes for wealthy property owners. Sad to hear about the repairing expenses, John Deere and Co, and others, are all hustling the farmers on right to repair their own equipment. In many professions, life has become “hustle others better than they hustle you” to survive and be able to create any kind of nest egg.

History doesn’t repeat, but it rhymes. The consumer isn’t ground zero for this coming crisis – it’s business.

40%+ of the Russell 2000 doesn’t make money. QE and ZIRP allowed for this, as these companies’ singular focus was growth and betting on decades-long outcomes, but the tides have turned.

UE as a result of a blowup of the corporate bond market is what creates the next fallout.

100%- CCC credit and lower was 6.5% summer 21’…16% summer/fall 22′ (around 14% currently)- If 30% were zombies at 6.5% then…..hmmm….

Yep. Anybody know of a good centralized debt maturity calendar available for free online?

(I mean something organized by *date* not company…i wanna know who is going to slam into the debt wall first…without typing in 1000 company names)

Bloomberg terminals have something along these lines but I’m not laying out $XX k per year either…

Cas127,

S&P and others have the detailed and searchable data. But you have to pay a lot of money to access it. Good luck getting it for free. This data is a high-priced highly protected product.

What’s available for free: You can google “maturity wall” — that’s what this is called — and you will get summaries and charts by future year of the billions of dollars in debts that mature in 2023, 2024, 2025, etc., US and Europe, and that will have to be refinanced at market rates at the time.

Funny FYI: I used to have access to some of the S&P data, until one day I said something not very complimentary about S&P’s ratings of MBS during the Financial Crisis, and within hours, they yanked my access, LOL. That’s how it goes in publishing if you don’t toe the line.

Or for that matter, even a fairly thorough BBB/BB/CCC list…it seems like SP is fairly successful at getting long lists scrubbed from the internet (although I haven’t been obsessive in my Googling attempts…)

Household debt is in historic low. No reason to worry about it.

Government debt is high. But the government never defaults so not sure if it’s a problem.

No, of course it’s not a problem. Based upon your reasoning, no amount of debt will ever be a problem. Government never defaults, so it can borrow and infinite amount with no consequence, right? The government also guarantees most mortgage debt and is in the process of enabling student loans to effectively never be paid back, so not a problem there either.

Just think what a bunch of ignorant rubes everyone was before the free money tree was discovered.

There really apparently is something for nothing.

Augustus Frost, you are one smart cookie!

>The government also guarantees most mortgage debt…

This enabled the meteoric rise in residential lending.

MMT = magic money tree

I agree most substantially with Augustus Frost.

Nearly 100% of all government have defaulted over the traditional course of history and there’s nothing different now except that the defaults will be the biggest ever in history.

Federal tax income looks like about $5T, debt about $30T.

That’s 6:1.

I think mortgage rules are 3:1 – 4:1.

I don’t think there is even number for principal payments, since the debt just keeps going up.

The default on the U.S. government’s demand notes in early 1862, caused by the Treasury’s financial difficulties trying to pay for the Civil War. In response, the U. S. government took to printing pure paper money, or “greenbacks,” which during the war fell to significant discounts against gold, depending particularly on the military fortunes of the Union armies.

The overt default by the U.S. government on its gold bonds in 1933. The United States had in clear and entirely unambiguous terms promised the bondholders to redeem these bonds in gold coin. Then it refused to do so, offering depreciated paper currency instead. The case went ultimately to the Supreme Court, which on a 5-4 vote, upheld the sovereign power of the government to default if it chose to. “As much as I deplore this refusal to fulfill the solemn promise of bonds of the United States,” wrote Justice Harlan Stone, a member of the majority, “the government, through exercise of its sovereign power…has rendered itself immune from liability,” demonstrating the classic risk of lending to a sovereign. In “American Default,” his highly interesting political history of this event, Sebastian Edwards concludes that it was an “excusable default,” but clearly a default.

Then the U.S. government defaulted in 1968 by refusing to honor its explicit promise to redeem its silver certificate paper dollars for silver dollars. The silver certificates stated and still state on their face in language no one could misunderstand, “This certifies that there has been deposited in the Treasury of the United States of America one silver dollar, payable to the bearer on demand.” It would be hard to have a clearer promise than that. But when an embarrassingly large number of bearers of these certificates demanded the promised silver dollars, the U.S. government simply decided not to pay. For those who believed the certification which was and is printed on the face of the silver certificates: Tough luck.

The fourth default was the 1971 breaking of the U.S. government’s commitment to redeem dollars held by foreign governments for gold under the Bretton Woods Agreement. Since that commitment was the lynchpin of the entire Bretton Woods system, reneging on it was the end of the system. President Nixon announced this act as temporary: “I have directed [Treasury] Secretary Connally to suspend temporarily the convertibility of the dollar into gold.” The suspension of course became permanent, allowing the unlimited printing of dollars by the Federal Reserve today. Connally notoriously told his upset international counterparts, “The dollar is our currency but it’s your problem.”

Great recital.

Moments come when things shift to a new equilibrium. Principles are things humans try to cling to until the shift is too steep. There is a future state of the world in which you would eat your cat. It’s not a matter of “if,” but “in what future state of the world.” Finance like all temporal human structures has vulnerabilities and breaking points. The best we can do at times is build a glide path to the next thing, or as Tim Geithner put it, spray foam on the runway. We accomplished that it in ’08, and yeah, there were costs that have dispersed across the system. Which of course will invite righteous indignation, from those so inclined. But these are armchair warriors who did not have to fight to he death for a sandwich, as the counter-factual suggests could have occurred.

I agree with your initial point, but think 2008 is a very bad example. Most people knew something needed to be done when the liar loans, synthetic CDO’s, and bogus AAA ratings crashed the financial system. However, these weren’t “temporal human structures” hitting a breaking point, they were frauds that were making some people rich.

The public was understandably upset at the lack of accountability for blatantly fraudulent behavior. Tim Geithner’s statement that “now is not the time for blame” sums up the approach of the financial elite and was absolutely wrong. Enforcement of the law should have been a priority. If the clean-up had been handled more like the S&L crisis, with significant prosecutions, the public may not have such distrust of the financial elites today and their connections to politicians in Washington.

It’s too easy to present some horrific counter-factual to justify bad policy that enriched a few at the expense of many. It allows you to avoid addressing whether the 2008 clean-up was handled in a fair and prudent manner. Even worse, your logic can be used to rationalize almost any conduct.

Gov’t debt IS household debt. Who else is paying for drunken Gov’t spending.

This is fascinating.

As I read this data it (hopefully) reflects a broader awareness of the pitfalls of the Credit Card carried balance poison. And a restraint to go there.

Maybe Americans are getting more intelligent with their finances.

That would be a very positive shift. And past due.

Thanks Wolf.

No, they are not getting more intelligent or more self-disciplined. It’s easy to appear solvent when you have the tailwind of the biggest asset mania in history, the loosest credit standards and until recently the cheapest artificial money in history, and during the pandemic, a version of MMT.

Wait until the financial tide goes out. You are going to see most of the country swimming naked. Either unemployed, crashing net worth, gasping for financial solvency, or a combination of all three.

I think you are both right.

Randy is right in that as the population is getting older people have learned through experience what high CC debt can do to them.

You are right in that we have had a lot of “free” money the past 20 years. For example, mortgage rates were at 8.05% in 2000 trending downward to a low of 2.96% in 2021. I like your example of “financial tide”. We are probably just past slack tide and it will be interesting to see how strong and long the ebb current is going to be. We won’t see the results for sometime.

“most of the country”

I can’t imagine that even the financially disciplined and/or fortunate will escape adversity shortly thereafter. We’re eventually reminded we’re all in this together.

[Informative article, BTW. Kudos.]

Thanks to Wolf and commenters here,,,

WE, in this case the family WE have NO debt…

CCs are paid off ASAP with NO interest and as WR said, WE get the % on every purchase to help with our budget(s).

While I really and truly feel very sorry for those who don’t have the personal fortitude ( or ”whatever” )to control their spending, etc.,

I also hope that they, in this case a whole lotta ”they” can figure out how to to survive and succeed…

WE, in this case WE the ”working” PEONs need to find out the means and methods of those folks who rob us of our part of the wealth, and do our best in spite of those folks who continue to advance on our backs, etc., as folks who actually do the reality work.

@VintageVNvet (ran out of Reply buttons)

I am similarly fortunate now as an adult in the disciplined managing of my finances. What the fed has continued to do since ’08 and now the complete canceling of student loans is galling. I was just making the point that it will affect ALL of us and we should do what we can to influence policies that encourage political and individual fiscal responsibility. Not to disagree with Augustus Frost (I’m a fan of his posting) but to add to his point and to continue the metaphor:

When the tide goes out some of us will be suited but we’re all done swimming.

No, people’s choices with credit are better, if not brilliant. Ridiculous to say, but I presume you were around in ’03-’04 when people were widely buying $5 lattes with credit cards and their (dwindling fantasy) home equity and a blitheness one does not see now. The savings rate was lower. Whatever people did have, they were being more openly careless with.

Again, Augustus Frost is correct! Our citizens are worse off in everyway that even two years ago. It’s going to get freakin ugly.

Our citizens are worse off in everyway that even two years ago. It’s going to get freakin ugly.

Yep.

All these numbers mean nothing. It’s the purchasing power of wages is all that matters. Last I saw, it was the same as it was in 1973.

The government numbers do not indicate the number of people holding two jobs to help the household survive.

In 2019, 10% of the homeless were working full time, minimum wage simply would not cover the cost of housing in their area.

“even fossils who still pay cash.”

I get my rewards (pay off monthly) but I’m a “fossil” when I go out. Not handing my CC to a twenty something with purple hair and four kids to walk away and swipe for me.

Here. Have a wad of cash, darling.

U.S. credit card fraud losses are estimated to be over $5 Billion a year. In addition to Goldman Sachs losses on Apple card, I suspect their decision to abandon a direct to consumer credit card may give us a glimpse into their crystal ball.

Nothing any user of CCs have to worry about unless they are the ones perpetuating the fraud.

Awwww look at me, using what little experience I have to be like Wolf.

It’s not the getting stuck that’s the issue. It’s the time to deal with getting taken that’s more easily dealt with by paying cash.

The only cash I use is farmer’s markets, restaurants (a rare enough occurrence for us anyway), and highway gas. We actually saw a skimmer truck working a gas station on I-95 a few years ago.

“Here. Have a wad of cash, darling.”

But can the kid at the register make change? Math is hard…

What a bunch of mean old bears are on this site sometimes.

Our children are going to get us, and the Chinese are going to get our children.

…but according to a new series of tv ads, it’s Jesus rather than the kids or the PRC who’s going to ‘get us’ (i’m obviously more confused than usual by formal vs. idiomatic ‘Murican)…

may we all find a better day.

He had a show on South Park (“Jesus and Pals”) but it totally bombed. I think people that have been dead 2000 years obviously need a LOT of help getting their message out.

Who cares?

Dinner is $110 bucks. Here’s 7 twenty dollar bills. Keep the change. It’s called “a tip”. The waitron unit is happy and my card ain’t hacked.

I agree with Halibut on this one. In restaurants, I use cash. I’m wondering, could I use a few inexpensive NFTs for a tip?

You’re quite the tipper!

The kid at the register probably writes code in their spare time that would make your Woodstock-addled head swim. STEM proficiency in the young is one thing you really don’t have to worry about.

Chargebacks are your friend and one reason CCs are pretty safe. You aren’t liable for fraudlent purchases.

Exactly. Cash is also king if the merchant charges a fee to use a credit card.

Using cash is old school, fossils use checks.

Hello

There are studies carried out that show that when you go to a supermarket, for example, you spend more with the card than when you use cash.

Not only is it the limit of money that you carry in cash, but when you pay with bills the expense seems greater

I don’t think that’s how it works at the supermarket. I always pay cash at the supermarket, even at Costco ($500!) and use loyalty cards with a fake name so they cannot tie my purchases to me. But I make the buying decisions when I select the merchandise, not when I pay for a cart full of stuff. By that time, it’s too late. So it doesn’t matter how I pay for it when I’m at the cash register.

However, there is one thing: if you pay by cash or check, you have to have the money. If your bank account is empty, you cannot get the cash at the ATM, and you cannot write a check (well, you can, but that gets expensive in a hurry). So if you don’t have the money, you cannot go shopping. With a credit card, no money, no problem. So in that broad sense, credit cards have removed the old discipline that not having money imposes.

Out here in the real world, your opportunities to hand over a credit card to a member of any cartoonish subcultural or demographic stereotype for swiping are rare and becoming rarer. Portable card readers and contactless POS chip readers are prevalent and becoming more so. Nobody is going to steal your Lyndon Johnson-era savings, sweetie. Relax.

My wife and I learned the painful lesson of credit card debt while still young — some 40 yeats ago. Thank goodness.

And that was before the usury-level rates that are allowed now of some 26%.

Shameful.

As of November 2022, credit card interest rates reached an average of 20.4%, according to data from the Federal Reserve Bank of St. Louis.

I never look at credit cards, but I assume another three Fed rate hikes will possibly slow down some spending for some people and possibly impact inventory of retailers and stuff like that.

Between price gouging and all that disinflation, I’m sure the soft landing on the increasingly smooth (foamed) runway will be as soft as butter.

Was in the UK recently, at Heathrow, and saw cases of cigarettes for sale in the Duty Free shop with large signs on the boxes: Smoking Kills.

I’m wondering if there shouldn’t be something similar on credit card applications or advertisements: Interest charges cause catastrophic damage and eventual heart failure.

So, high level, we’re roughly seeing a return to where things were at before stimmies were used to pay down credit card balances? “More borrowers, smaller balances” — implying, as one potential explanation, less big purchases on cards but slowly accumulating everyday purchases and bills that aren’t being paid down, which is not a great sign if that is the case.

Also love the italics, feels like you’re preparing a focal point for a follow-up RTGDFA.

Most of the charts look like a hockey stick! At what point do you say this is a trend upward?

Right now it’s the reversion of an anomaly, the reversion of a pandemic-era distortion, getting back to the Good Times of 2018 and 2019. That’s what it is right now.

Thank You. I am sure the next few months will be interesting.

Wolf, what makes up the “elsewhere debt”?

Student loans, payday loans, title loans, payment plans on consumer items like phones or furniture, etc. Also margin debt on “investments.”

“elsewhere debt” = Mortgages, auto loans, and

student loansSorry, student loans aren’t loans anymore. They’re gifts.

Thanks!

I noticed the NY Fed’s charts of delinquencies where they show student loan debt, that student loan debt dropped like a rock. When govt gets involved, everything including data reporting “goes to heck in a handbasket”. ( Citation Credit to Wolf Richter)

Doesn’t that impact overall delinquency reporting?

Smile emoji

Thumbs up emoji.

OK, found the footnote regarding Student debt delinquencies. Last sentence is telling but would not reflect those in forbeaance. What happens to half not reported as delinquent, if or when forbearance or deferment ends?

“2. As explained in a 2012 report, delinquency rates for student loans are likely to understate effective delinquency rates because about half of these loans are currently in

deferment, in grace periods or in forbearance and therefore temporarily not in the repayment cycle. This implies that among loans in the repayment cycle delinquency

rates are roughly twice as high.”

1) Sixty percent have zero c/c balance, but Millennial delinquencies are the highest.

2) The 30’s in red : there is a line coming from 2011 to Jan 2018 highs.

This millennial line was breached. It might cont to rise forming a new

bubble above 2007 high.

3) Millennial today are the 20’s in 2007, the light blue line, but Gen Z are the in same delinquencies bs, or worse.

4) We are depressed because econ 101 prof predict a bearish Fed after LOL left.

5) If the Dow breach Jan 2022 high bearishness will die. Speculators might

expect 38K/39K Dow and 5,500/6,000 SPX. An UT might fool them.

6) The Dow might plunge when the red hot 30’s become NPL or zombie payers.

All these charts are great. Thanks.

The percent of debt to disposal income was interesting.

It made me want to look into more data about family income growth and can they afford this extra debt?

From the FRED, median family income in 2010 was $60k. Now it is about $90k. That is a 50% increase in 13 years. It was a bit difficult to find the average but what I found said the average household income (not personal) is $102k. That supports some of the rise in the price of house but not all. As we know low interest rates really juiced up home prices.

Just doing some extra calculations. 1 trillion in credit card debt / 124 million households is 8k per household. That comes to 7.8% debt per income? That is total income…not disposable. I am sort of wondering how the NY FED has 8% of disposable? I guess I will need to dig into this more.

Also interesting number. 102k avg household income X 124 million households is $12.6 trillion in income per year.

I am guessing in there surveys, they just asked for the raw numbers of credit card debt and the amount of income each person has?

Good article. Thanks. Forced the sludge in my brain pan to undulate.

Of course, one person’s interest expense is another’s revenue which has become the motivating factor in the long swing of the transition from an industrial to a financialized economy. Rising credit balances and increasing financial precarity are good news to some.

Not the folks who express themselves here but the one’s that seem to matter more to the Fed. The GFC was caused by the total failure of the Fed to reign in the fraudulent debt creation schemes of their pet project, the criminal banking and affiliated financial parasitic industries.

> “The GFC was caused by the total failure of the Fed to reign in the fraudulent debt creation schemes of their pet project, the criminal banking and affiliated financial parasitic industries.”

Yes, but not a uni-cause, IMO. It was a set of feedback loops with many players. People borrowed money voluntarily. They agitated for more cheap credit. Political forces pressured banks to lend to certain borrowers. Bond buyers demanded and got silly yields. LOTS of different folks got what they demanded, which was a rickety structure (lending to un-creditworthy borrowers and on insufficient collateral) that toppled over on them. And on us. All sorts of gatekeepers (including borrowers for their own financial sake and their families’) failed.

I don’t know about the rest of the country, but here in tenant-friendly CA, it’s been fairly easy to pay down/pay off credit cards and other debt (and buy cars, etc) what with the endless eviction moratoriums and stimmies. Free Rent > Stimmies BTW.

We are just now seeing the eviction machine get fired up after 3 years of no/minimal rent being paid by many. My lawyer friend is doing nothing but unlawful detainer work now for property owners. Let’s see how everyone’s balance sheet looks later this year and next.

Should liberate some affordable housing! Tough the sidewalks may get (more) crowded.

After the GFC, my defaulted neighbor and her drug dealer boyfriend (and his felonious friends) held out a long time. It was an incredible threat to our neighborhood. A detective was around asking about the guy maybe murdering his brother. Never was I so glad to see eviction happen.

Wolf where do debt consolidation balances such as lending club, upgrade, etc count? Other consumer?

Yes, if they’re structured as personal loans (and not just another new credit card account). Some people used HELOCs for debt consolidation, which shows up under HELOCs (to be discussed shortly).

“About 40% of credit card accounts had revolving balances, down from 44% in Q4 2019.”

The rates NOW are sharply higher than the interest charged on balances in 2019. To have 40% paying this sharply higher rate is a red flag, even if the number is down from 44% in 2019.

“The data says that 60 percent have zero balances or not use card at all. 40 percent have balances”.

It sounds to me that there is an issue of definition.

As an example:

– I have 5 cards but only use one a month and pay off the balances. I keep the others just to keep the age of my credit old for higher score and never use them. Capitol One card is 20 years old with very low limit, but improves my score by 5 to 10 points (according to Experian predictor). My score is high so no issues there, Just me and my ego keeping above 800

So, am I and the 60% skewing up the data?

I would prefer to see ACTIVE number of cards with zero balance measured against ACTIVE cards with balances. That would show credit usage by comparing apples to apples. I know someone has that data.

Maybe I am confused. The wording may be confusing me. so please no sarcastic and meaningless comments; as I have a true desire to get the numbers right; and I know it is free speech (I served for 30 years to defend that)

It doesn’t matter what data you or I “want.” get used to it.

Saying 60% of credit cards do not have balances is deceptive because of the fact most people have multiple credit cards. Overall credit cart debt is a more accurate measure of consumer credit dependency.

The overall balance is very low in relative terms, as the article points out. And only a portion of that balance is revolving and interest accruing.

There are people with multiple credit cards all of which with revolving interest-accruing balances, and a couple of these cards may be maxed out. That’s a typical scenario for a situation where the borrower falls behind. But the number of people in this situation is relatively small. This is what the article tells you.

Sydney…

you make a good point and observation.

While the idleness of the cards may skew the %s, when comparing points in time against each other, it is reasonable to assume the idleness was similar in both points of time. So the difference in %s is still relevant.

Thoughts on composition effects? Seeing the 90 days delinquent chart broken down by age makes me wonder how much of the improvement over historical norms is a function of an aging population? Good to know the delinquent balances are smaller this time through.

Tangentially related… Can you have be in a “recession” without mass layoffs? What do you call economic contraction alongside inflation related to a proportionally shrinking workforce? Demographics impacts to play out over the next decade interest me tremendously.

Where do you get the chart of “Credit card balances as percent of disposable income”?

New York Fed’s report does not have this chart.

Yes, that’s why people come to WOLF STREET. I get the data (in this case NY Fed and BEA), I do the math (Excel), I provide the analysis. I don’t just copy and paste.

Thanks