Revenues collapsed. Bankruptcy filing hangs over it. This is a money-suck. But hey, it incinerated $11.6 billion on share buybacks.

By Wolf Richter for WOLF STREET.

Shares of Bed Bath & Beyond [BBBY], one of the heroes in my pantheon of Imploded Stocks, spiked by 92% today during the day, and by 350% from a month ago, and then collapsed afterhours and gave up about half of that 350% gain in minutes after the company announced a desperate and ruthless proposal to sell a whole bunch of shares into this rally to raise over $1 billion, diluting the bejesus out of existing shareholders.

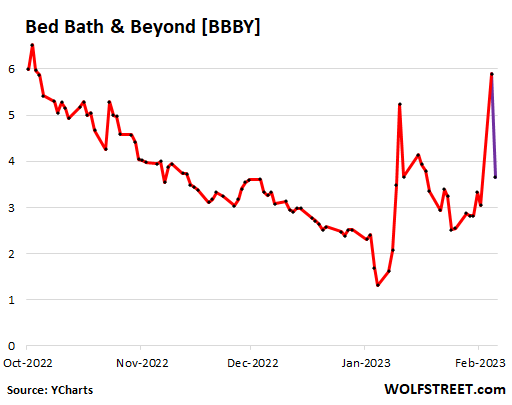

The appropriately lugubrious purple line indicates the afterhours action today that took shares down to $3.70 (data via YCharts):

If the company can pull it off, it would raise $225 million initially through the convertible preferred stock offering and later $800 million through warrants that would require investors to purchase preferred and common stock in the future.

If the company cannot pull off the offering, it said, it would likely be forced to file for bankruptcy protection.

According to sources of the WSJ, the company has secured investor backing for the deal, thereby diluting the bejesus out of the meme-stock jockeys and other existing shareholders. The company also secured a $100 million line of credit from one of its lenders.

Bed Bath & Beyond has been a meme stock queen for a while. It has all the fundamentals for a meme stock: huge losses, collapsing sales, chaotic management, a ruined business model, and a bankruptcy filing hanging over it. But it has a wild stock price, driven by the meme-stock crowd and a huge amount in short interest.

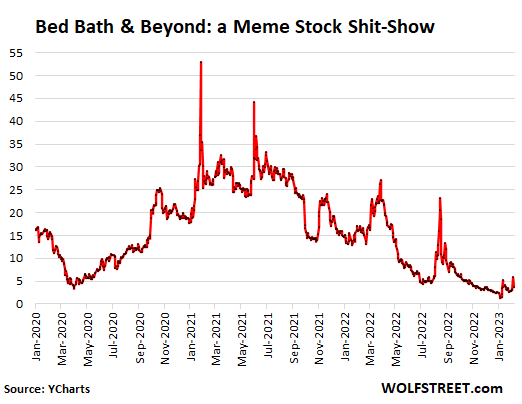

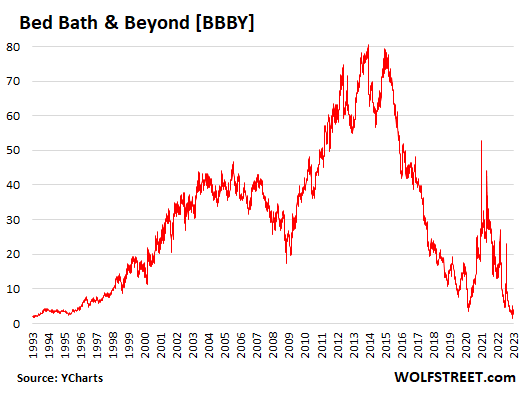

The meme-stock chart.

This whole episode is another reminder that the Fed, the ECB, the Bank of Japan, and all the other money-printer central banks need to remove many trillions of dollars and euros and yen and whatever from the system via QT because there is still a ridiculous amount of money floating around out there, and people are just throwing it around willy-nilly, with all kinds of side effects, including this nuttiness in the markets and the worst bout of inflation in 40 years.

Obviously, the company is doing what it should do. It’s socking it to these crazed existing shareholders; and given how big of a money-suck it is, it will likely sock it to the new shareholders as well. The era of free money has turned investors’ brains to mush, and this is part of the healing process.

The chart below shows the two-year action, the period when BBBY had become a meme stock, with spikes at the close to $52.89 in January 2021. You can barely see today’s 92% spike and afterhours collapse. At $3.70 in afterhours trading, the shares were down 93% from the January 2021 high (data via YCharts):

Killing the company with share buybacks.

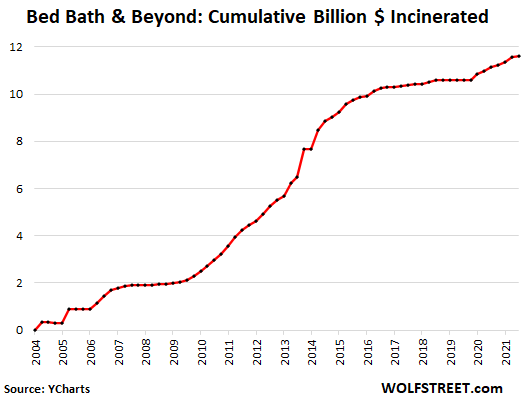

On November 2021, the company bragged that it had incinerated $1 billion in scarce borrowed cash on its latest two-year bout of share buybacks, bringing its total cumulative share buybacks since 2006 to $11.6 billion.

The company could have invested some of the $11.6 billion in its ecommerce operations and in remodeling its stores. It could have used some of the funds to shut down other stores. It could have avoided debt and kept enough cash on the balance sheet to just fly through the brick-and-mortar meltdown that has been raging since 2017, and it would have had enough cash to fly through the next economic crisis. But no.

These are the cumulative share buybacks in dollars that the company incinerated to “return value to shareholders” (data via YCharts):

The buybacks in 2020 and 2021 that incinerated $1 billion in cash that the company now doesn’t have and desperately needs were apparently designed by the ingenious management team, from what I can tell, to speed up the process to bankruptcy.

The strategy appears to be working. The company has been warning multiple times that it might file for bankruptcy protection, including again today.

On January 26, in its 10-Q filing with the SEC, it said it had defaulted on its credit line with JPMorgan, and reiterated that it may have to file for bankruptcy.

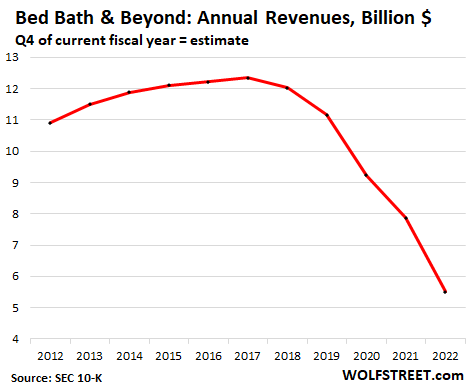

Revenues collapsed.

Bed Bath and Beyond has not yet disclosed its revenues for its fourth fiscal quarter, which ends at the end of February. But we know it’s going to be a fiasco, after its third quarter fiasco, ended November 26, when revenues collapsed by 33% from the already collapsed revenues a year earlier.

With three horrible quarters under its belt and a revenue warning about the holidays, I estimated its Q4 revenues to where total annual sales would collapse another 30% from the collapsed levels a year ago to $5.5 billion. This company doesn’t have a business anymore. You cannot restructure something like this. This is just a money-suck:

Share-buyback besotted investors got what they deserved.

That surge in share price from 2010 through 2015 was paid for by incinerating billions of dollars on share buybacks. Shareholders, besotted with the idea of a retailer incinerating billions of dollars in cash on share buybacks, got what they deserved (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“There’s a sucker born every minute”

is a phrase closely associated with P. T. Barnum,

and

“A fool and his money are soon parted”

Well said.

Also Zero rates / Negative real rates causes Zero Productivity, that causes Zero sum game, that causes conflict of interest, that causes wallstreet to “Pump and Dump” that causes “Fool and his money to get parted”, that causes more economic disparity, that causes America to keep dying.

So I blame QE and Fed for this speculation losses.

There can be a class action lawsuit against Fed from all speculators who during Pandemic bought houses, cryptos, meme stocks, spacs, bonds etc and lost a lot of money.

Lawsuit? Maybe you haven’t heard of “sovereign immunity”? It’s only been around a few hundred, if not a few thousand, years.

And, foolishness is what “causes” a fool and his money to be parted.

Beyond Saving !!

Just another day in the casino where junk is treasured, and quality ignored.

I think it’s good when the ballers lose on these kinds of “bets”. Not in a mean-spirited way, but in “touch a hot pot you’ll get burned” way.

Unfortunately next time there is any economic hardship they will then again have to be bailed out by stimmy checks with our tax money so that they can gamble it all away once again.

We truly are the max debt/stupidity/entitlement/bailout nation. Manifest Destiny.

Somehow these amateurs ,think they can compete with the professionals. It’s like putting a high school football player in a professional football game . You might get very lucky and catch a touchdown pass ,but overall you’ll get eaten alive

High schooler CAN catch a pass or even two Flea, and then will get their legs broken or something similar…

Something similar going to happen soon in various markets coming soon to a theatre near all of us…

While WE can anticipate some sort of ”bath”,,, most will not even have a clue, any clue ”what, when, who, etc., ”

That used to be the first few items in any ”NEWS” reporting in the NEWS PAPERS…

IMHO, that concept is completely gone from the always ”editorializing” news these days…

Wolf could you do an article on car Austin results ,web says they can’t sell any cars thanks your reporting is a breath of fresh air .Will be sending a contribution soon ,hard to do on a fixed income with crazy inflation

Auction

They can sell cars just fine at auctions. In fact, auction prices, after falling through November, have now jumped for the second month in a row. Just got the auction data this morning. Article coming later today or tomorrow. Gotta do the trade article first.

Hot off the press:

https://wolfstreet.com/2023/02/07/used-vehicle-auction-prices-after-plunging-in-2022-rise-again-amid-jump-in-retail-sales-buyers-strike-over-core-inflation-at-risk/

Takin’ care of business?

Wolf, I gotta say, you have a strong way to describe BBBY:

“This company doesn’t have a business anymore.”

“The buybacks in 2020 and 2021 that incinerated $1 billion in cash that the company now doesn’t have and desperately needs were apparently designed by the ingenious management team, from what I can tell, to speed up the process to bankruptcy.”

“Shareholders, besotted with the idea of a retailer incinerating billions of dollars cash on share buybacks, got what they deserved.”

It’s too bad. I reckon the “ingenious management team” should have listened to some BTO, and followed their advice:

“You get up every morning from your alarm clock’s warning

Take the 8:15 into the city

And we be taking care of business (every day)

Taking care of business (every way)

We been taking care of business (it’s all mine)

Taking care of business and working overtime”

Great Song, but now it’ll be stuck in my head for the next 4 hours on continuous playback!

DanRo – …suspect the clever folks in the ‘management’ team got fixated on the ‘…I love to work at nothin’ all day…’ lyric fragment later in the song…

may we all find a better day.

What kind of ancient music is that? Those Millennial and Gen-Z meme investors don’t know about Randy Bachman. Heck, I’m sure some of them don’t even remember his son Tal (“She’s So High’).

728 – thanks for reminding us about, uh, nevermind, I fergot…

may we all find a better day.

You will know we are at the bottom when people are too sick of stocks to pay money for pieces of crap. At the bottom even Berkshire Hathaway and Johnson and Johnson go on sell. We are no where close. Probably find some other interest for a year or or so until things get cheap unless you are a gambler.

Unless there is a gigantic crash, stocks won’t be close to “cheap”.

A 50% decline from the peak will leave the S&P slightly above the 2020 pandemic low, not close to cheap.

Bed, Bath and Beyond should just change their name to Blackhole & Beyond. The speed of change on their stock price and the ability to suck money into the hole can only be rival by a Supernova event.

On the other hand, here’s your living proof that the market is so damn wise and I am not talking about idiot retail investors either, some of the big guys are just as moronic but with a lot more other’s people money to throw into the blackhole..

Another good case study on why share buybacks should be banned, like they were in the olden days.

I agree. Whatever benefits buybacks may have seem to be outweighed by management’s ability to use them for short-term share price manipulation. Particularly now that qualified dividends get preferential tax treatment.

Yep, but that means the market would collapse by 50% or go nowhere for decades. Pinterest just announced junk results but a huge share buyback. There’s hundreds of these companies but this country is too corrupt and degraded to care

Chevron announced it is budgeting about $75 billion for share buyback from huge profits on inflated pricing. Further oil exploration not needed? Hell no, Go Green.

Chevron announced a 25% increase in organic capital spend for 2023. A large portion of which is allocted to development in the permian basin and gulf of Mexico.

Less than 10% of the 25% increase is going towards renewables.

I don’t like banning buybacks. It’s a tool that can be used by the company to generate return for shareholders that defers the shareholder from getting taxed til he is ready to sell shares. Sometimes there are no decent investments to make in your industry and it is the right thing to do.

The problem lies more with shareholders that don’t do their homework in the company they are buying stock in. The company needs to have a long history of putting shareholders interests first. That is what the board should be about.

Agreed. Share buybacks can be a powerful tool to return profits to shareholders. Where share buybacks fail is when management incentives are misaligned from long term growth and are instead focused on short term performance such as the stock price vs long term future earnings.

There are many ways to return dollars to shareholders without using share buybacks. Dividends.

Share buybacks take out smaller shareholders as companies become controlled by fewer and fewer people.

Not good for a competitive economy. And neither are Central Banks that create the Illusion of Wealth.

Anyways. Enjoy the last days of Fiat Empire.

I’m confused. You call share buybacks a powerful tool to return profits to shareholders and then explain very succinctly why inevitably they’ll be disastrous for shareholders. Eventually, no matter how prudent a company’s management has been, it will have new management that will be seduced by the short-term compensation benefits of share price manipulation. At some point, as you explained very well, “management incentives are misaligned from long term growth and are instead focused on short term performance such as the stock price vs long term future earnings.” BBBY is just a current example, the entire airline industry is another one. At least BBBY won’t get a taxpayer bailout.

I do think if interest rates normalize the problem will partially take care of itself. It was the ridiculously low rates that allowed so many companies to play games with their balance sheets by borrowing to manipulate their share price. Maybe a compromise to banning buybacks is limiting them to actual corporate profits as reported on the corporation’s tax return.

Buffet recently did a share buy back, saying he saw no good opportunities to deploy capital because everything was overpriced. He did it via buy back instead of dividend to save the investors on taxes.

Nick Kelly,

I think Buffett is being disingenuous if he said that because shareholders only benefit tangibly if they actually sell their shares and incur taxes. Furthermore, since qualified dividends are taxed similar to long-term capital gains, the top Federal rate is 20%. Presumably, share buybacks increase the stock price, otherwise it doesn’t return any value to shareholders. So why not issue a dividend and allow shareholders to decide for themselves if they want to buy more stock with their dividend at the lower share price?

I realize buybacks won’t increase the share price 20%. However, Buffett is well aware many shares are owned in tax deferred accounts that would not be taxed currently on a dividend. At best, Buffett is really favoring investors in taxable accounts at the expense of investors using tax deferred accounts who could buy more shares at the lower price with 100% of their dividend. If you own shares in a tax deferred account, dividends are always better than buybacks. That’s why I think Buffett’s being disingenuous.

The problem is that while companies tout buybacks as being for the shareholders, they never discuss the degree to which manipulating the share price higher benefits the stock based compensation plans of insiders. I think the conflict of interest between shareholders and insiders is too great to ignore. Maybe I’m too cynical.

Share buybacks are an offshoot of the increased leverage starting in the 80’s when junk bonds first started being widely used in corporate takeovers. The beginning of widespread financial engineering. (There was also conglomeration in the 60’s.)

Starting in the 80’s, many companies added unnecessary leverage as “poison pills” and disincentives to gut a company with someone else’s money.

KKR and Carl Icahn were “pioneers” of this practice, aka “corporate raiders” and leveraged buyouts. The theme of the movie “Wall Street”.

I don’t fully understand the pros and cons of stock buy backs. But I understand not all companies use the vehicle with integrity. When Covid hit in April 2020, Cracker Barrel ceased to pay rent on the majority of their leases. They hired contractors to renegotiate. But what most of the Landlords did not know was CB bought back millions of shares of their stock at the depressed $50 range while asking their landlords to take a haircut.

About 40% of the small and medium size businesses here in the Swamp are “Squatters”. They continue to operate like they are prospering and having booming sales while at the same time they are not paying any rent. I know of a few of these business owners personally. In some cases they are using lawsuits against their Mall owners or landlords to tie up the eviction in court for years. I see this playing out in the next year or so until half or more of the mall stores are closed.

Dividends rule when the are steady and rising

Buffett doesn’t do dividends because of double taxation ,he pays taxes and shareholders pay taxes . So most businesses don’t like taxes

First sentence after “Killing the company with share buybacks,” I think you meant scarce instead of scare.

Great recap, that’s quite the turnaround after hours.

Never understood the appeal of the store, ever. Walmart presentation for overpriced products.

For the love of dog, will someone please just put BBBY down? It’s been writhing like a squashed snake on the highway for almost a decade now.

These companies will not give up until they’ve wrung every last dollar out of everybody.

Are you talking about BBBY or SHF’s?

I agree if the latter. Someone/s do need to put them down.

Scums of the world.

Wish some of these journalists weren’t so moronic.

But it is what it is since everyone has now been bought and paid off.

Yep, Wall Street VC’s or investment banks will play their age old game of buying the bankrupt company for peanuts, loading it up with a huge unmanageable amount of debt, massaging the financials for a few quarters and then bailing out to retail “investors” (gamblers) with a giant profit. They’ll take their winnings and go find another bankruptcy deal, while the company drowns in debt and investors get hosed once again.

Stocks are a sucker’s game and anyone who thinks they can “trade” and make money obviously doesn’t know Wall Street. The odds are way better in Vegas.

That sound like Sears, not this company.

Sears was more than a carcass when Eddie Lampert ruined it.

This company is “toast”.

Sooner or later, people are going to realize, that companies just don’t go bankrupt in an environment such as this FED has created.

Oh, I think BBBY is definitely going bankrupt and close down.

If a company buys stock back and then issues new shares, all they’ve done is steal the dividend from the “muh investments” crowd and given that wealth to management.

There’s no arguing with these brainwashed free-market dopes, though, so the managerial elite will continue to just steal everything. So it goes.

I don’t think free markets are the problem. I think the problem is that we have so many forms of organized crime that are legal and are confused with productive commerce. This is why the under 21 generation are ready for a Stalin. They realize if this is our system, wr may as well all just kill ourselves.

Stephen

What we have is CRONY/Predatory capitalism and the so called ”Free Mkt’ died in the hands of Fed on March ’09.

Before that.

It became worse then, but you thank Greenspan for much of it. He’s the one who led the institutionalization of moral hazard.

Everything’s fine.

BREAKING: More than 50% of all six-figure earners have said they are living paycheck to paycheck, an all-time high, per CNBC.

It’s all “money for nothing and …”

Stock buy backs, SPACs, bitcoins, Robinhood.

Spot the next scam, get in early and get out fast. That’s all that’s left. Good luck.

AI seems to be next one up

nicko2,

yeah, they have $300k equity in their home, $300k in their 401k, plus stock options from their job, and they drive $100k pickups, and they live “paycheck to paycheck?”

People need quit regurgitating this dumb clickbait BS.

Humans have a brain. Use it periodically!

Lots of Americans have lots of money. If you don’t get this, you don’t get the US economy.

Here’s the average wealth per household, by wealth category in Q3, 2022.

The top 50% of households (= 65 million households = 132 million people) are in bold. Look at their wealth.

“Top 0.1%”: $132.4 million

“Remaining 1%”: $19.3 million

“Next 9%”: $4.4 million

“Next 40%”: $768,000

“Bottom 50%”: $70,800.

https://wolfstreet.com/2022/12/21/fed-tightening-reduces-horrendous-wealth-disparity-that-qe-and-interest-rate-repression-have-wrought-fed-data/

The median is way lower. The numbers for the “next 40%” are misleading. I haven’t checked it for the last year (or two), but last I did, median was somewhat less than $150K.

It’s not “paycheck to paycheck”, maybe – depending upon how it’s held, but hardly “flush” either.

Look at it again. This is by category. The “next 40%” category does NOT include any really wealthy households or billionaires. They’re in the top categories. In the “Next 40%” are just the households within that category. So the average and the median cannot be that far apart. Those categories from the “next 40%” and up combined mark the top 50%, and they all have quite a bit to a huge amount of money.

The wealth disparity in the US is huge, mainly between the 1% and the rest. But this idea that nearly everyone is poor is just stupid. America has a huge number of well-to-do households.

There are 22 million millionaires in the US.

Wolf,

“Wealth” is largely predicated upon valuation mechanics, which in turn rely crucially upon the current interest rates (per the Discounted Cash Flow formula).

ZIRP distorted the crap out of these valuation/”wealth” measures (a 20 year delusion created by DC policy, now being unwound).

So while it may sound great that there are (were) $40 trillion in equities value and $40 trillion in residential real estate value…both of those numbers fall very fast as interest rates (one of key components in DCF) normalize (non-ZIRP). It doesn’t happen all at once or with mathematical precision, but the DCF shows the trend and the scale.

So that $40 trillion in equities has already likely been slashed to $30 trillion ($10 trillion goes poof in a year of unZIRP) and the same is going to happen in residential real estate (more slowly).

So those personal “wealth” measures you cite are likely 33% to high *already*, after a mere year of semi-normalization of US interest rates.

That’s is after a single year of unZIRP, with interest rates maybe just 50%/75% of the way to honest/unDC manipulated levels.

A lot of “wealth” is poised to evaporate very very quickly.

Those wealth measures already included the recent declines. These weren’t peak numbers, but Q3 numbers, released late-December. Those wealth numbers are still high, but they’re a little lower than they’d been at the peak:

If CNBC said one plus one equals two, we would ask to see their working. The only reason anyone would watch them is because the other comedies aren’t humorous enough.

Wow, that 30 year chart is a technical traders masterpiece, one giant head and shoulders pattern.

That is an amazing chart .

On the bright side, if you got in in 1992 IPO at $1/share, you are currently up 300%.

What does “living paycheck to paycheck” mean?

A billionaire can live paycheck to paycheck, if he spends enough every day.

The better question is, how many people are choosing to spend beyond their means?

It’s about spending habits.

I would imagine most billionaire’s don’t receive a paycheck!

Some live beyond their needs. Others are only able to pay for necessities like food rent or mortgage school utilities and fuel, and healthcare and retirement if they’re lucky. The job churn may be good for the work nomads, but those who stay w their job, maybe bec they like it, are losing purchasing power by the day. Inflation has made things worse for many households, their struggle is just hidden by statistical averaging.

Most people, even high earners, don’t have access to a lot of “spending cash”.

Most of their wealth is either in their tax deferred retirement accounts or in home equity where it’s not readily accessible.

It’s really hard for most people to save or accumulate meaningful amounts outside of tax deferred accounts.

So, my inference is that many of these people fit Wolf’s definition but feel broke anyway.

It sounds elitist, but $100K honestly isn’t that much of an annual income anymore, certainly not for families living in expensive cities. Many people also waste their money, many a lot of it.

Family expenses:

Max 401K: $22,500/yr

Max HSA: $8300/yr

PITI or rent : $40K/yr

Medical insurance: $21,600/yr – This is why people have to work

Total: $92,400

It is hard to pay for food or much else if you make 100K/yr with $7600/year to spend. Something like retirement savings usually suffers.

I forgot SS and Medicare. On 100K, this is about another 8K.

How many are actually maxing 401k let alone that plus an HSA?

My wife sometimes thinks we are living paycheck to paycheck.

Even though my working salary is higher than average. I am pretty strict about maxing out the 401K, HSA, and ESPP. Our take-home pay is all spent month to month.

Is that living paycheck to paycheck? I don’t consider it.

I have a friend with 2 kids who does the same but makes less. Even though he has a 1.5M house and hundreds of thousands in a retirement plan, the college FAFSA doesn’t look at home values or retirement savings when determining financial need. His kids may go to college on nearly full scholarships based on financial need. He puts any extra cash into his home improvements and shelters it until after his kids go to college.

It’s the gambling attitude that’s still in force. More losses are needed to change this behaviour.

Welcome to Jerome Powell’s HORROR SHOW.

More Blood Bath & Beyond.

BBB needs to file Chapter 7 and be put out of its misery. Instead, unfortunately, they are injecting up to another billion dollars into this failure.

I wonder how much wall st banksters pocketed in fees on all these BBBY deals? At least the banks made money

Bet, Bath & No Beyond?

Yeah, you make a bet and take a bath.

Now we know what the “Beyond” part of the title means: “Beyond existence”

Wolf, first off I love your blog and continuously look forward to housing bubble and other articles. I want to offer an alternative viewpoint to this BBBY situation. I agree this stock was run into the ground by management over the last decade (tritton), however I believe the current management has only been in since 2021 and has been working on a turnaround plan. They announced in Q2 earnings that they anticipate being cashflow-neutral by the end of their fiscal year and have been cutting significant cost in order to make this happen. This company has an amazing asset in Buy Buy Baby that no one is talking about. Instead for the past 6 months (and especially the last month) the MSM has been on a crusade to convince everyone its going bankrupt. I believe there are significant over-leveraged short positions in this company. If someone were to buy the preferred shares from this offering, which could clear the outstanding company debt, and continue the turnaround, this stock could be worth 10x+ what its currently valued at. This is not financial advice, and I agree its a risky play, however I just wanted to point out it is not 100% forgone conclusion that this company can’t be saved and/or bought/merged with another company.

You cannot “turn around” a brick-and-mortar retailer that is failing. No one can. We’re into the sixth year of the brick-and-mortar meltdown — and it’s progressing just fine.

You can buy anything that BBB has on the internet, either at BBB or some other site. That’s where that business is going. Those BBB brick-and-mortar stores are doomed. They will bleed the company to death.

The only hope it now has is ecommerce. I’ve used their ecommerce service, and it’s pretty good. Last time I went to the store was years ago, and they were out of stuff… the experience was already terrible then, during its stock price boom.

Whatever they announced in Q2 was superseded by their Q3 fiasco announcement and that will be superseded by their fiasco Q4 announcement.

To see BBB’s future, the ONLY thing you need to look at are its revenues. If revenues are plunging, there is no future. It means they lost their customers and ruined their brand, and for a retailer, it means there’s nothing left.

Look at my annual revenue chart in the article above! Sears at the same kind of chart. BBB’s revenues plunged by more than half since 2017 — despite inflation!

You have zero inside information in these restructuring situations, and that’s all that matters. You are dealing with a wolf-pack.

The cheap seats (equity) will get hosed. Even some of the pricier (creditor) seats will. It’s a zero-sum, Darwinian game up in there. Conspiracies are fomented and perpetrated, by sharpies against sharpies.

I enjoy the stories of companies like this. They stopped selling certain products for political reasons instead of just trying to prosper. Good riddance.

Wow…I thought it was because they fired the pillow guy.

The pillow guy fell asleep on the job. He was too busy counting the Chinese balloons as they floated by. (most people just count sheep).

Most only count Dollars?

YEP, his products may have saved that guy who jumped?

Two things come to mind:

Teetering on bankruptcy, if they cannot “pull this off”. Yeah, that’s a great investment count me in! (This last sentence is sarcasm in case it isn’t obvious).

The BBB story is oddly reminiscent of Pier One’s death spiral, different name and actors, but the story line seems familiar.

There must be better alternative for one’s money than this flaming, spiralling, mess.

Re: people are just throwing it around willy-nilly, with all kinds of side effects

First off, I can’t offer exacting proof, but it’s my understanding, this current explosion of meme volatility is primarily attributed to non-retail speculators, who are using ultra short gamma hedges to juice volatility. The zero days to expiration option gamers are weaponizing a lack of liquidity, playing a super dangerous game of chicken, intended to spike prices up (and down).

In terms of liquidity, this is like a casino with fewer customers, but the customers playing roulette make huge bets against fewer players, which implies that the casino is betting against itself, in attempt to suck in retail speculation.

The compounded leverage can work short term, but then sequential moves up, with zero supporting volume, is like using a snow making machine, to continually add to existing snow drifts in an avalanche zone. At some point, the avalanche pressure succumbs to forces of gravity, with an unstoppable cascading velocity that destroys everything below it.

Hopefully, the banks and hedge funds playing with excess reserves will become as bankrupt as the trash stocks that being used as pawns. Unfortunately, there’s probably lots of super smart gurus playing this game with pension funds, trusts and all those unexpected entities…

Only when echelons of dumb money (and its sentiment) are painfully cleared away, will things make a more traditional kind of sense (if ever). Meme gambler dollars must be evaporated. The economic engine is still running too hot.

Meanwhile, a second echelon of dumb money is still spending at restaurants, parks, etc., hence, the job numbers are popping. This layer must be impaired as well, else inflation keeps raging. Just not being on the more careless edge will be one’s saving grace. Post-COVID “revenge spending” is, IMO, for fools.

Hi Wolf, does the price action on BBBY have anything to do with what happened to Hertz? I watched from the sidelines as a bunch of crazed gamblers threw their money on the Hertz bonfire during bankruptcy and was pretty frustrated when private equity jumped in to save the reddit crowd.

On that, have you done a summary of what happened there? I’m still incredulous that those shareholders weren’t wiped out!

Thank you for all the great writing and analysis.

For the meme crowd, bankruptcy certainly appears to be a positive for the stock, LOL. If BBBY files for bankruptcy, the shares will get cancelled. Hertz was a rare exception, and it came during the free-money pandemic, when its business briefly collapsed. BBBY will be like other retailers that filed for bankruptcy, where shareholders lost everything, and bondholders lost a lot.

Has the whole world gone crazy? Mark it zero!

When was the whole world not crazy? For what rare moments? Crazy in some form is the norm. Meanwhile, gamers gotta game.

Market skyrockets every time Powell opens his mouth. Does it even matter what he says?

He should just keep his mouth shut. This is blatant manipulation of the market. Why mention disinflation when the last two months of lower CPI could be a headfake? This guy is getting annoying.

This guy is not annoying. He knows what works for his friends and master.

It’s all by design.

Hahaha 10-year yield jumped.

Yes, 10 yr yield jumped surprisingly :-).

I think Powell is following a dovish script since last week.

He is following the same old script since the December dot plot that was then considered super hawkish at the time — did people get a brainwash since then?: more rate hikes (plural = two or more) this year to push the FFR over 5%, no rate cut this year, QT for another “couple of years.” (we’re only 6 months into it, two more years to go… even if there are rate cuts whenever).

The new script will be released at the March meeting with the dot plot. Until then, he will stick to the old script. I have no idea why this is so hard to understand.

I think the signal Powell is sending to wall street is lost to WR.

Powell is saying: dis-inflation has begun. This is what WS wanted to hear and thus rejoicing.

I have no idea what the future hold but I can see what is happening in front of me which are: Powell’s dovish stance and wall street rejoicing for now.

This social media craze to pump and dump bad companies does need to stop. I would hope eventually the retail customer tires of being the bag holder. What’s ironic(or perhaps insidious) is it is the big guys that reap the profits from these pumps. They get to charge borrow rates for crappy stocks and they don’t have to the pay the same borrow rate that smaller short sellers might. Not to mention bigger players can write naked call options way out of the money and just collect the premium.

I’m sure some of these big players pay social media influencers to create this mania since it is so easy for them to profit.

It seems like no matter how clear Powell is about the path forward–at least two more hikes, no cuts this year, and continued QT–those who would jam this market higher will do so because he’s no longer overtly threatening to inflict “Pain.”

As long as he utters the word “disinflation” and doesn’t use the “P” word, he’s considered non-adversarial to the markets, which is interpreted as a green light to jam away. For now, anyway.

The S&P has a clear uptrend line from the Jan 19 low of 3885 to now. Almost to the minute, when this morning’s post speech downdraft hit that trendline, we got the second jam of the day, thereby saving the trendline.

Re: The appropriately lugubrious purple line indicates the afterhours action today that took shares down to $3.70

Closed (appropriately) at $3.01 today and hopefully headed to zero. I forget how delisting rules kick in, but taking this hazardous crap to the landfill is in the best interest of humanity.

Bed Bath and Beyond should be renamed to Big Bloodbath Afterhours at this point.

I wonder what happens to all that crap in the BBBY stores if and when they file for bankruptcy? Same with stores like Sears and Radio Shack. Overstock.com?

Sounds like they are following the same scenerio as Radio Shack. Buying back their own stock, financial engineering on steroids, followed by increasing debt, and finally bankruptcy. Good ridence.