Watch out for the costs of housing, medical care, and gasoline.

By Wolf Richter for WOLF STREET.

Social Security benefits are adjusted for inflation – the Cost of Living Adjustments or COLAs – based on the “Consumer Price Index for Urban Wage Earners and Clerical Workers” (CPI-W), released by the Bureau of Labor Statistics. By this measure, inflation was 6.9% in October.

Alas, the COLA for benefits in the year 2022 was based on the third-quarter average CPI-W, when inflation was still lower. And so the COLA for 2022 will only be 5.9%, nevertheless the highest since 1982.

As part of the efforts of reforming Social Security, there are now proposals in Congress – including a Bill by Rep. Al Lawson (D-FL), that include provisions to raise revenues – mostly focused on raising the Social Security contribution cap – and provisions to “improve” benefits, including by switching the COLA calculation from CPI-W to CPI Elderly, or CPI-E.

CPI-E is designed to reflect the purchasing habits of people 62 years and older. The weights of the items in the basket are adjusted to reflect the typical purchasing habits of the elderly.

The biggest factor in the difference is housing costs (“shelter”). It accounts for 36.8% of the weight in CPI-E but only for 32.5% in CPI-W. Housing costs have been soaring in reality, but the CPI has been slow in picking them up. But that has now started, and CPI for housing costs have started to rise and will continue to rise in 2022, and this will accelerate CPI-E more than CPI-W in 2022.

The second largest factor in the difference is medical care, where the elderly spend a lot more. And there are other major differences where the elderly spend relatively more.

In the other direction, where the elderly spend less, and where weights in the CPI-E are lower than in CPI-W, are gasoline (no more daily commutes, thank god), vehicle purchases, education, and the like.

The table below shows the major categories, accounting for about 73% of total CPI-W and 75% of CPI-E:

| Relative weights | |||

|

CPI-E |

CPI-W |

Points difference |

|

| Shelter |

36.8% |

32.5% |

4.3 |

| Medical care |

12.2% |

8.5% |

3.7 |

| Household furnishings & operations |

5.1% |

4.7% |

0.4 |

| Food at home |

7.4% |

7.7% |

-0.3 |

| Apparel |

1.9% |

2.7% |

-0.8 |

| Motor fuel |

2.2% |

3.9% |

-1.7 |

| New & used vehicles |

5.2% |

7.1% |

-1.9 |

| Education & communication services |

4.2% |

6.1% |

-1.9 |

The differing weights produce a different inflation reading, and proponents of CPI-E say that it produces a higher inflation reading, which would produce higher COLAs.

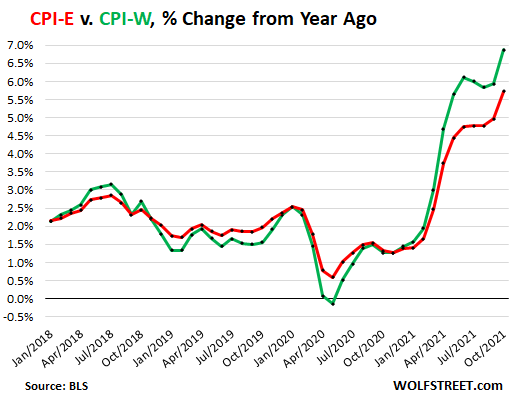

But this year, CPI-E is going massively in the wrong direction and the COLA for 2022 would get crushed. The CPI-E for October was 5.7% (red), while the CPI-W was 6.9% (green):

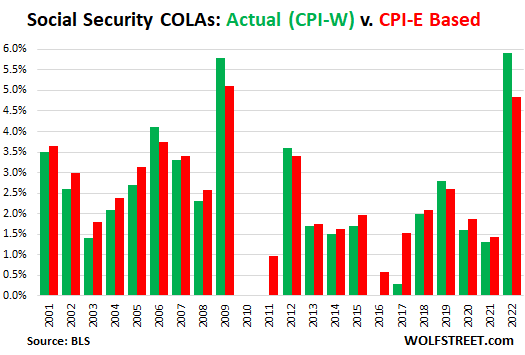

And the COLA under CPI-E for 2022 would be 4.8%, based on the average of CPI-E in Q3, compared to the actual COLA of 5.9%.

COLA calculations would be based on the average CPI-E readings in Q3 of every year. So I calculated COLAs based on CPI-E going back 22 years to 2001 (2000 Q3 CPI-E readings). Over the entire time, COLAs based on CPI-E would have averaged 2.4%, while actual COLAs averaged 2.3%.

So on average, CPI-E would be a slight improvement, and every little thing helps retirees.

In most years, the differences are not huge and go in both directions. But there were sharp divergences: in 2022 and 2009; and in the other direction in 2015 and 2016.

In 2022 (based on Q3 2021 CPIs) and in 2009 (based on Q3 2008 CPIs), gasoline prices spiked out the wazoo, and given that motor fuels weigh less in CPI-E, that index didn’t move as much as CPI-W. and the COLAs based on CPI-E would have been substantially smaller.

Also in 2022, soaring housing costs were not picked up by the CPIs in Q3 (though that has now started), and this pushed down the CPIs in Q3. Given that shelter weighs so much more in CPI-E than in CPI-W, it pushed down the CPI-E further than CPI-W. Hence the massive difference of 1.1 percentage points in the COLAs for 2022:

- 2009 actual COLA: 5.8%; CPI-E COLA: 5.1%

- 2022 actual COLA: 5.9%; CPI-E COLA: 4.8%

The opposite happened in 2016, based on Q3 2015 CPIs, and in 2017, based on Q3 2016 CPIs, when gasoline prices plunged following the collapse in the price of crude oil as part of the Great American Oil Bust. Note that COLAs do not go negative, but bottom out at 0%:

- 2016 actual COLA: 0%; CPI-E COLA: 0.6%

- 2017 actual COLA: 0.3%; CPI-E COLA: 1.5%

Switching to CPI-E this year would have meant an even colder shower for the purchasing power of Social Security benefits.

But if gasoline prices ever plunge again, then CPI-E COLAs would look better. And when the housing cost surges get picked up by the CPIs in Q3 2022, then the CPI-E COLA for 2023 is going to look better.

Overall, over the next two decades, a shift to CPI-E will likely produce slightly higher COLAs on average, and every little bit helps for folks living on a fixed income and struggling with surging inflation. But there will be years with nasty surprises for CPI-E COLAs, and years where things turn out better for CPI-E COLAs.

Overall, the shift to CPI-E would not change much, and my advice would still hold: If you don’t have a big nest egg, work for as long as possible after receiving benefits – even a part-time gig helps – because the actual increases in your costs of living will outrun the COLAs as you get older.

Here’s my discussion on the Status of Social Security and the Trust Fund, Fiscal 2021: Beware of Vicious Dog, and how the biggest COLA since 1982 has already been eaten up by inflation.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think it was announced already. You will get nothing, and be happy.

Extremely cynical but completely accurate.

I wonder what is the likelihood that this bill passes?

Happy choosing assisted suicide when your cost of living completely outruns your benefits, maybe. LOL. Of course, that is the plan, since starting during the Reagan Administration the cost of the government was shifted from the rich (who already had huge tax loopholes by then) to the majority of Americans.

That has not changed in any significant way since. If you are truly rich, I could teach a class on legal tax avoidance, so long as you are willing to invest your funds in foreign countries and live off of constant “borrowing” in the USA. For your children, that tax avoidance would be even easier by your use of trusts and foreign entities.

As of now, the trillionaire families live charmed lives. They can get constantly bailed out when their financial entities fail by their “Federal” Reserve, but they do not have to pay US taxes, except for property taxes on real estate in the USA and those are paid by their entities, not by them.

How do we calculate the increase I get ssi and ss

The COLA does not increase the financial capacity of seniors, by definition. It merely attempts to ‘keep pace’ with rising costs. Congress, of course can increase benefits to whatever level it thinks is proportionate. A fiat currency gives Congress that power. It is pay for all the way.

Better if they deflated the money supply and kept benefits the same

Exactly. Plan for no increases because the Medicare premium increase will eat it all up one way or the other.

This is a “let’s pretend we are doing sth about it” type of move. What the country has to focus on instead is in bringing healthcare costs down from 18% of GDP to 10%, slightly above what Spain and Italy spend with better outcomes and an older population.

Let them eat cake! And drink cola!

J,

Drink cola indeed! Consider that our Wallyworld just raised the price of their house brand cola from 67 cents per two-liter bottle, to…wait for it…88 cents.

Sneaking up to a 30% jump….

A retired saver still has options. I bond savings bonds as of October 1st yield 7.12%. There are numerous ways to earn dividends over 4 or 5 percent in diversified funds or blue chip companies.

You don’t have to chase tech stocks or bitcoin and risk losing it all. Companies that pay dividends long term paid them throughout the last 2 recessions.

If the switch is made, don’t be surprised if the historical lead of the CPI-E vs CPI-W vanishes or reverses. The statisticians will be under enormous pressure to cut costs … as we’ve already seen in the CPI.

Exactly! They just fudge the numbers to get what they want, kind of like the county assessor.

This is close to real life. A retired saver has 1 million dollars in an IRA in CDs with average interest rate of 1%. But because of inflation his real return is minus 5% so $50,000 purchasing power was stolen.

Now his social security payment is $2000 per month or $24,000 per year. And that is how Uncle Sam can and most likely will be able to pay his social security obligations.

Let the Millenials and Zoomers pay for it. They can afford it. With all the $Trillions they made on Bitcoin and Tesla. Boomers cannot let their lifestyle slide. What’s next, selling the Corvette?

Social Security is close to a pay as you go system. All I am saying is government fiat system is in such a state that they have to run negative real rates to pay obligations. I don’t see that changing without change in monetary system.

Uncle Sam could also cut our military budget by half and stop the wars.

That alone would make the U.S. solvent.

This is long overdue. The apac wars in the middle east have bankrupted Americans while apac member’s incomes have never been better. Europe is about to get a wake up call out of the Ukraine and we need to stay away from that $***$how. Let them pay to keep their socialist paradises.

Speak for yourself, I work for Raytheon.We’ll sell to anyone in the mood for it.Yemen has been good to us.

Heh, the current mess in the Ukraine is courtesy of the US which has been pretending that the Ukraine is a NATO member. Which is the main reason for the current Russian build up due to the arms, ‘advisors’ and other stuff sent by the US & NATO needed to unfreeze the civil war (started by an US backed coup since the EU strawman was getting elected instead of the US one, for added hypocrisy the US spent $5 billion+ to influence/manipulate that election, the EU $500 million+). The Russians have also told the US (and NATO and the EU) that they’ll annex Ukraine before the Ukraine become either a NATO or EU member if it ever looks like the Ukraine can join either. It is just that the US, as befitting of the caveman with the biggest club, cannot imagine others not cowering before it and thus doing as the US demands.

So we are heading for the next Turkish missile crisis (better known under the name Cuban missile crisis) where we got within 15 minutes of the US starting WW3 since the US could not accept that Russia was copying them. Except this time the US will pull back, if they push the Russians to annex the Ukraine, like they did with Georgia in 2008 since the Ukraine isn’t that important to them while it is close to existentially important for the Russians.

But how would you find another suitable external enemy on which the system depends.

It can’t be China, that would be like cutting off your arm.

Stop it! You are making sense! We have always been at war with Eastasia.

Who will stop it? Perpetual war machine is extremely profitable to the MI complex and everyone in DC. Why will they stop it and send the savings to peasants?

I wonder how much Darth Cheney made off of all the invasions and atrocities? The guy should be nicknamed “Daddy Mercenary.”

Not the only Sith in town.

Who ate/has been eating dollars in Libya war, Iraq war, Syria war, war against terror, war against covid, war against drugs?

It’s the one and only thing that is keeping Dollar reserve status.

We don’t make things other than trouble anymore.

The Gov’t will do the same to everyone. It’s not about generational competition. Only a fool would go down that road. Even the politician knows to stay away from a generational discrimination base constituency. The common issue to all generations is the loss of purchasing power by de-basement, inflation and time value of money. If we can not agree on that we will lose the republic.

Tax code is probably the best example of how the government works. What could be done in one page or say 10 pages with some kind of simple flat tax or sales tax is somewhere around 100,000 pages with lobbyist’s desires and social engineering throughout.

Was reading Japanese had a screwed up tax code that was one reason for their bubble and crash. They had some strange legacy laws on real estate and also on inheritance taxes that caused people to avoid taxes.

Old School,

My ‘Modified Flat Tax’ only needs one paragraph.

Again, as the code is now set, workers who are successful and well paid have up to a 37% rate of income taken from them by the IRS. Long-term capital gains have a 20% maximum tax rate.

Why the disparity? Because that’s how Congress wants it.

I will defend lower cap rate. Corporate earnings are already taxed. If corporate rate is 21% and cap gains is 20% it works out to about 35% tax rate combined.

the point of the lower capital gains rate is to encourage people to take risky investments. but if the fed is going to backstop all risk, then it shouldn’t be taxed lower.

@ Old School –

a lower corp tax rate than an individual tax rate favors a collective, or creature of the state, over an individual ………..

is that a good thing for individuals?

The young are in debt, they benefit from inflation.

US is a gerontocracy of the old asset owners who don’t benefit from controlling inflation. The population that’s sacrificed is the asset less retirees on fixed incomes.

They should just stick with CPI-F. Where F means fake. I suppose there’s a past tense four letter word that might be appropriate as well. Can someone please make a real measure of inflation, like Wolf’s F150 metric.

Social Security is going up, but Medicare Part B is going from about $140 a month to about $170 a month. That didn’t last long.

Yeah, check how much regular health insurance is going up.

Is that because of the bottlenecks? /s

mine went up by 15% and i had it good.

I haven’t seen a doctor in 20 years, and mine still keeps going up. Who’s paying for what?

And not a whisper from CONgress as to why it’s going up. PURE RAPACIOUS GREED. Has anybody ever been to a business aside from a hospital where they don’t even tell you the prices of what is going on, then slam you with a bill that only Jeff Bezos could pay? The HELLCARE system in the US is broken – unless you’re Jeff Bezos, of course. He loves it that way.

Exactly, it’s a big waste of money.

I rather just pay taxes to support Medicaid, Medicare and VA and be done with it. That’s already 7% of GDP, close to what Italy and Spain spend in total with better outcomes and older population.

They just have to learn to do more with less. The type of feedback the sector badly needs.

Regular health insurance isn’t just going up, its leaving (along with its “beneficiaries”) to countries like Panama where the cost of living in general is still within reach of a retiree.

The current increase can push beneficiaries up into higher tax brackets while they are getting less real spendable income. They not only get a higher medical premium, but they can also pay more taxes on less actual income. This is because most beneficiaries only qualify for the standard deduction, which doesn’t allow them to deduct the premiums from taxable income.

A person getting $1000 – $170 gets $830, but pays taxes on the full $1000, assuming their combined income hits the taxable incredibly high income of $32K.

Social Security is a labyrinth of financial repression. What they give you with one hand they take away with the other.

But you can continue working,make 18,600 ayear

Not all of Social Security income is taxable. I think only something like 80%, and that was increased years ago I think by the Big Guy.

Reagan started the taxing of SS in 1983.

148.50 is what it is in 2022. They just raised it.

Part B is going to be $170.10 in 2022.

There goes most of my SS raise!

It just went to 148,50, I thought that was it. Yikes!

I sense in the last half dozen Wolf articles, the drums are getting louder. We have Wolf to thank for breaking down the daily music into words much easier to understand. Mind numbing music written by mad men.

Jeremy Irons played a role where he stated that his job at the company was to know the future. We sure could use his service and skills right now. 💸💸🤔🤔

Know a Fed Governor, and front run policy….

I hear it works, and if you get caught you are only in the news for one day.

He also said he couldn’t hear the music anymore, and threw everyone else under the bus to save his own company’s skin when he lost that soothsaying ability.

Are you sure about what you said?

Think it was more like “my job is to see the other guys get f**ked instead of us”.

Investopedia:

“Baby Boomers have an average of $152,000 saved for retirement, according to the 19th Annual Retirement Survey of Workers conducted by the TransAmerica Center for Retirement Studies. This is not nearly enough to last through retirement. Based on information from the Bureau of Labor Statistics, adults between ages 65 and 74 spend, on average, $48,885 a year.” That’s an average, which is weighted by the rich retirees who start flipping $100 bills into the wind as soon as they walk out the front door in the morning. The median is probably significantly less.

“Research by the Insured Retirement Institute (IRI) also suggests trouble for many retiring Boomers. IRI found that 45% have no retirement savings. Out of the 55% who do, 28% have less than $100,000. This suggests that approximately half of the retirees are, or will be, living off of their Social Security benefits.”

According to the TransAmerica Center for Retirement Studies survey (2019-2020): Retirees have a median of $123,000 in household savings (including home equity). That is, 50% of retired people (including boomer cohort) have less than $123,000 saved, including value of their home (hard to resist capitalizing this).

Soooo, my age being 70, there are reasons to envy and be angry about the richer 50% (trust fund babies, people worth millions and having 100k+ annual income, etc.), or people who have scammed the system and / or get undeserved benefits. But on the other hand, thinking about the lower 50% of my cohort (boomers), the above stats give reason to think “there but for the grace of luck and fortunate circumstances, go I.”

There is a lot of social engineering around the tax code once you retire. Maybe that’s the way it’s got to be. If all you have is social security you probably will be living close to tax free. If you squirrel away enough to have a $100,000 gross when retired you are going to get taxed pretty heavily unless you planned decades in advance to dodge the tax man.

I think Sam Walton and Peter Theil are two that found some provisions to outsmart the tax collector.

But if one doesn’t own a house, and inflation spikes for a few years (rent, food, other basics), the social engineering rebates may reduce in real dollars to the point that many elderly have a real tough time making ends meet.

Stated differently, “73% of Baby Boomers have less than $100,000 for retirement.” Good lord, as a Gen Xer I have more, and I don’t feel remotely prepared. I’m actually counting on a life of poverty in my older age, after the system bleeds me dry through all sorts of schemes – that’s the feature when rich parasites control everything. “You will own nothing and like it.” That’s their goal, and they even said it.

The way I say “f*ck you” back to the system is by not paying for healthcare aside from taxes going to Medicare, Medicaid and the VA. That should be enough to cover the entire population, close to what Italy and Spain spends with better outcomes and older pops

62 and older ? that’s gonna include the Weimar Boy at the Fed.

And he only has $80 million or so in net worth.

Might have to cut down on the filet mignon ……. not

Being 70, you must remember when Fed Funds (savings interest rates) were moved to meet the inflation rate.

Did you know it wouldnt happen this time? Me neither.

Who did know, and who seems confident (long stocks and real estate) that it will never happen again?

Who hijacked the Fed? Cui Bono?

From what I see the fiscal situation gets really bad between now and 2030. I expect more Fed intervention kind of like Draghi’s “do whatever it takes to save the Euro”. If you are a central banker you can’t let people lose confidence.

Government can do nearly anything if it makes it though the lawmaking process. I see some of the provisions in the BBB house passed law at setting the stage for government to be able to fund itself in the future.

I read there is a provision that makes banks report nearly all banking activity to the IRS, plus the massive expansion of IRS. Government has a funding problem and it’s going to be a tough slog for people to keep most of what you earn.

Government spending ultimately has to be paid either by taxation, inflation, or debt default.

The provision in the BBB has been removed at least temporarily to my knowledge but agree it will come back in some form.

It’s one of many options government’s has available to plunder the citizenry, similar to a mob extortion protection racket but disguised under political propaganda.

AF

Your first sentence is missing one thing…..time.

The payback time is key. A country is immortal. A given country can pay back its debts over centuries.

Countries have time to spare.

Most people seem to have internalized the notion that debt must be repaid within human or corporate productive lifetimes.

The time period for both averages out to about forty years.

Governments can spend outrageously because they have outrageous amounts of time.

Not sure this is true although I see it repeated a lot. Seems like history shows countries pile in debt and then have a Minsky moment when they realize they are busted and then standard of living for citizens immediately drops.

I am thinking France in 18th century and Great Britain and Soviet Union in 20 the century. Maybe through in Venezuela too. I think last stage before Minsky is dishonest accounting with money to hide debt obligations can’t be repaid in real terms anyway.

it’s not so much that they have to realize they’re busted. it’s when foreigners no longer want their currency or any debt denominated in it.

the fed’s actions have been “do whatever it takes to save the markets” not the “dollar.”

the two are polar opposites.

Historicus – yes I totally agree.

A turning point seemed to be the 2008 financial crisis. In the PBS documentary you have quoted before, one of the Fed guys said how surprised they were that QE worked so well. The documentary described the Fed planners as having thought of it as a novel and experimental idea, not knowing exactly what would happen. I’m not sure if that is a lie, but it’s possible that they were surprised. And the fact that it worked so well in some ways, (especially saving some of the TBTF asset holder’s asses), the QE was like an addictive drug.

It’s like taking one’s first dose of MDMA, and Wheeeee, yes! I gotta get a long-lasting supply of this stuff!

qe is like a cortisone shot. it appears to work well initially, because the negative effects don’t come until later.

we’re now seeing the negative effects staring us right in the face.

Very Good analogy JW:

, Had the very shot of cortisone, first thing,,, to my lower back after a fairly serious injury due to bending below my ankles because the one handing up the bundles of redwood shakes,,, ( five bundles to the ”square”,,, each at least 80# due to 2.5” butts ) could not lift any higher…

Took the ”shot” of cortisone first, and it absolutely did quiet the pain,,, for a week or so…

Been ”dealing with the pain” ever since…

SO, do NOT recommend cortisone injections or any other short term synthetic pharmaceuticals for anyone able to get focused on long term and very much better others.

Agree 100% with cortisone shots.

But I used to make redwood shakes in HS. We got a buck a bolt when the buyer’s truck showed up. The old piece of 6-7 ft dia redwood old growth lying on a friend’s father’s place was free to cut up.

But an 80# bolt with 2 1/2″ butts? Damn!

In 2008 the fed didn’t have a clue what to do. They bailed out the system because most of them were heavily invested in it. QE was adopted because the Japanese had been doing it for years, and the fed with all their fancy PHDs, didn’t have any better ideas.

When you have the printing press the solution to every crisis is to print money to fill the hole. Wall Street knows the the Fed has to do it and gets in the front of the line.

I just want to nominate you to the top of the FRB Pet,,, certainly it won’t happen,,, but to this old guy, you have, at least, a very wonderful understanding of the realities for those of WE THE PEONS…

Thank you for your many comments!!!

historicus

“Who hijacked the Fed?” The Bank for International Settlements?

My elderly mom had a pain in the ribs and (being recently post-op in that area) went to the ER for about an hour. It was merely a cramp or such. Her medical is subsidized, but on her bill it said $9,000.

I wish government’s “good intentions” were balanced out by good financial acumen. Instead, at least since LBJ, good intentions (at least in some beholders’ eyes) are overdone (poorly designed programs, not well funded, throw money at problems) resulting in bad feedback loops inducing systemic weakness. The bill is dispersed but when and how does it boomerang back? Or have the politicians figured out a perpetual motion machine?

Nearing retirement, everything I have and am, is designed to sip resources. It is beautifully set up in all ways, except some barbarian will come and upset the cart for a vile program’s sake. Wrong planet, I guess. All those who did not prepare will now get Stalin-like housing going up all around, blighting this place. Where is the planet of wise, temperate, efficient, frugal and free people?

Note that in the US, for an insured patient (be it private or public medical insurance), the amount a provider bills is completely meaningless. You have to see what the insurance company or program actually ends up paying once the bill is settled between the provider and insurer.

Read an article once where Amish were getting screwed by hospitals because they don’t believe in health insurance and therefore were getting charged many multiples of what insurance pays. Plus Amish have higher levels of expensive genetic issues because of not being in the sweet spot of gene pool.

Evidently there are more genetic diseases if you are at the tail ends of gene pool. ( Too narrow or too wide)

so a hospital will bill $100,000 but the insurance company will only pay $12,000. but if you are uninsured, you get the bill for the whole $100,000. they know most won’t pay, and even if you will, you can negotiate it down to probably close to the $12,000 blue cross would have paid

Jake,

In every other business, except healthcare, if you don’t charge everybody the same price, it’s considered consumer fraud.

that’s not entirely true, but your point is taken. fedex and ups rip off individual shippers and small etsy type sellers, while giving sweetheart deals to big companies. they need to be much more heavily regulated.

maybe so in some places OS,,,,

but I can testify from close association with several Amish families, several of whom had elders who had never been to any ”hospital” or any other medical services delivery places during their entire lifetimes.

When they and their kin did have to go to hospital for various and sundry reasons, including the reasons you cite, they paid cash and left ASAP,,, Including one elder, never before at hospital, whose back was broken when a tree fell on him; he went in hospital for one day, then went back home and sat in a chair for a month,,,, then got up and went back to work…

He died a couple years or so later, and was in ”bad humour” for most of that time according to his daughter and daughters in law, from whom we were getting fresh pork and sausage at the time.

(( And as was their custom, the ”children” built a small home adjacent to and connected to the family home for his widow!!!))

Sorry, can’t resist leap:

“The Road to Hell is Paved With GOOD INTENTIONS” was a very popular quotation with a lot of the WW2 veterans I have known, including several with multiple ”doctorate” levels of education.

Don’t know where they could of gotten that idea???

Futzing with typical GUV Mint SNAFU and so forth maybe???

VVNV-appears these days to be a common state of affairs among those with great expertise in one or a few areas believing that their previously successful expertise is readily exportable to many other areas they have not actually worked in (see the rise of ‘business management’ school- graduates in their level of current societal influence). Corporate or public support for these folks being garnered by their preceding public success (real and/or PR, and to reprise an old lyric of Bonnie Raitt’s, ‘what is success?’). A resulting situation of being ‘book-smart’ while not having to encounter and work with the dirt and often bloody-knuckles results of the ‘hands-on’ experience. Not that the talented can’t be effective outside the areas of their initial triumphs, but the situation is much more of a coin-flip when individuals are making judgments and policy with little-to-no actual hands-on experience of that which they are administrating…

may we all find a better day.

If people understood how hospitals price/bill for their services they would demand change.

Those numbers, the “billing rate” are just literally made up and are used in the negotiation of pricing contracts with insurance companies. The insurance companies typically pay 10%-15% of that amount as the “contractual” payment. But if you get such a service and don’t have insurance, you are billed this purely fictional amount.

It’s is ridiculous and untenable.

Phleep.

Except for far too few, they have been changed from “people” into “consumers”….and NOT for their benefit at all.

Was definitely the result of a long public-private partnership effort…mostly private.

This is just one proposed bill but there will surely be many, many reform proposals over the next decade or so as the program nears the inability to pay out 100% of promised benefits. At this point it’s hard to tell really which will stick and what hit benefit payments will take. Anyway, be ready for all sorts of ideas to be thrown about in the years to come.

Of course, the earlier the politicians address the issue, better and more flexible solutions can be implemented in time – but with our dysfunctional political system don’t expect that to happen. Can kicking has now become a national sport.

If they taxed all income they would have plenty of money. Funny how the poorer folks pay the tax on all their income, while the richer folks pay on very little of their income.

Petunia, Amen, as I have lived at both ends of the income ladder and find the upper rungs less intrusive of income and assets. We are in a strange world these days. Rental property that incurred zero income, a loss via tax law with depreciation tables, then the assets were sold for a zero gain on equity. I can’t imagine what large rental owners are racking in, tax free.

The poor folk get a much better return on their money in retirement compared to the rich folk. That’s how it’s designed. So, if the cap is eliminated, will the rich folk get an even bigger check in retirement? They would if the current structure would be applied. The increase would be at a diminishing return.

JH

Your argument is that of an apologist.

What you say might be true, but since we went to fiat system in the seventies the plight of the average person vs. the top 1% has gotten terrible.

To OTB below,

I did not have an argument and I am not an apologist. Only stating how the system works in response to Petunia’s post. I only wanted to give a complete picture. An argument that I would agree in Petunia’s favor would be if lower income individuals have lower life spans, then it’s easy to say that the lower income individual does not enjoy the length of benefit that the higher income individual does and therefore needs to be adjusted for the benefit of the lower income individual. Think about the person toiling away at near minimum wage for 30 years, then dying at retirement age and never collecting a penny. As stated somewhere else in the tread, the whole system would need to change and there is not the political will to do so. I’m all for it though.

For OS below, historically the SS system worked great for many lower income people, and I agree since the 70s and more specifically the financialization and the beginning debt binge of the 80s onward, that the lower income demo have been decimated. I just wish there was honesty. Kids need to be told that to really get ahead, they need to understand how currency is created and set yourself up as close the creation as possible so you can skim as much as you can for yourself. That would be more honest than work hard and go to school.

First, you’re confusing income vs rich (wealth). You can have lots of income and not be rich. And vice versa. But I’ll stash that aside.

Second, true, those with more income pay a smaller % of their income in social security. But you’re looking at that tax in isolation. Of course, those with higher incomes pay many multiples great % of their income in total tax than lower incomes. Consider also that since social security has a limited max benefit, a cap, there should also be a cap on how much you have to pay in.

” a shift to CPI-E will likely produce slightly higher COLAs on average, and every little bit helps for folks living on a fixed income”

In a democracy you have to get elected, and if you have more oldies than youngies, you need the votes of oldies. UK is way ahead of you guys in this.

Admire your work on the intricacies of indices!

I worked on housing and construction indexation for the UK Govt in the inflation raged 70’s.

Can you imagine a ‘stepwise multiple regression’ with multi factors done manually, then transcribed to punched card for a 2 week wait for corroberation from the Govt’s only available mainframe?

Ah, happy days, not.

Paging Petunia…

The social security system needs to be revamped to provide a tax free income to the elderly based on their contributions. Medicare also needs to be free because it was a prepaid annuity during the worker’s lifetime. Anything less than this is a scam.

If voters don’t insist this be done, it won’t be. Get on the phone, internet, and instead of complaining here, vote accordingly.

i suspect that someone who only worked the minimum 40 quarters in a low wage job will draw way more out in medical costs than he paid in.

That is the case because there is a minimum payment. But someone who only worked 40 quarters may have been child rearing, ill, or working under a different system.

Also, many government workers who put in more than 10 years under SS get screwed by the system. I also think that’s wrong. They earned all their benefits and should receive them all.

If that is true…..So what ?

Let’s talk instead of the unchecked plunder by the plutocrats.

Now there is a REAL example of taking out WAY more than was put in.

A lot of these are stay-at-home Moms who worked after the kids flew the coop.

Petunia, seriously what would campaigning or petitioning do? You appear to be a bright, intelligent, and practical person.

Instead of trying to sink more time into a completely dysfunctional and hopeless political system, why not (at the minimum) make grocery deliveries or drive Uber with that time instead?

Both of those jobs require more than 40 hours a week to make an average wage. Why retire to work a $hittier job?

I can’t believe the number of voters who vote to increase their own taxes and give higher wages to public servants than they make themselves. Just stop doing it. Stop donating to political campaigns too. Vote third party to show your dissent as well.

Petunia, just about every politician that is stumping for office makes the “promise” that they will change the system to help the elderly , the poor, lower taxes and fix Medicare. But guess what happens once they get in office…..if they go against the status quo, they get tarred and feathered (or worse).

Both parties really have the same goals and that’s primarily get in office and claim your golden egg.

AA,

Joe ran on a promise to raise SS for lower income beneficiaries to 125% of the poverty level. Now he doesn’t remember and the dummies who voted for him believed him, when he has never kept a promise. Vote accordingly.

Petunia, of course he can’t remember. He works off a script that someone else writes for him. We should be dreading the day when he forgets how to read.

Petunia, the democratic process in the US is irreparably broken.

Why bother?

I’m betting that my SS will be less than what is now. It’s a game and us on Main Street are not allowed nice things like food, housing, health care. There’s plenty of money for wars.

Thanks for the info wolfstreet.

“You pompously call yourselves Republicans and Democrats. There is no Republican Party. There is no Democratic Party. There are no Republicans nor Democrats in this House. You are lick-spittlers [kiss-assers of authority] and panderers, the creatures of Plutocracy.”

Jack London’s “The Iron Heel” (1908) – a seminal dystopian science fiction novel.

How much has changed. How little has changed.

For the 62+ crowd here, does that percent mix in CPI-E accurately reflect what your consumption looks like today?

I am not that old yet… my children are still very little. So my basket of goods has a separate bucket called “Paw Patrol toys, Cheese Quesadillas, and Chicken Nuggets” of which I spend a non-trivial amount of my monthly income on…

Seems like the two largest things in the CPI-E basket are highly variable among individuals:

Shelter 36.8%

Medical care 12.2%

For shelter, some elderly might spend almost nothing: government assistance; owning home in an area with minimal property tax; living with relatives (like myself – living in my Thai wife’s house in Thailand, and paying no rent).

Similarly, medical can be a huge percentage for some, but only in the low single digits for others who have prioritized health earlier in life and been lucky enough for that to pay off in reduced costs later on.

A lifetime spent lowballing and gaming expenditures on various areas of the basket is how a lot of people get to a comfortable state of reduced economic hassling in old age.

I noticed that debt servicing costs do not seem to be a category of the CPI. It would be interesting to see that separated from basic expenditure costs.

Low property tax, high home and auto insurance due to hurricane risk, they raised the HOA fees, rising utility costs, maintenance and repairs: roof repairs, new carpet, lightning surge damaged appliances, water damaged bathroom floor, plumbing leaks and clogged drain pipes, house painting, A/C repair or replacement, cracks in the driveway.

Cheaper than paying rent.

Social Security system and inflation measures are very antiquated. With big data they could generate more accurate inflation data by recipient’s address if they wanted, but politics would keep it from being honest

More people need to plan to follow your plan. Live in a high net earnings area while working and retire in a low cost area. It’s a form of arbitrage.

You make a good point about the composition of the average elderly household. We still have an adult child living at home, and so do a huge proportion of older retired folks. Some older folks have moved in with children or other relations. The household consolidation is not reflected in these CPI figures.

Single retired women are now the largest group in danger of becoming homeless. This is because women make less over their lifetimes. The income data proves it.

They should have stayed with their husbands then

Women married at least 10 years get to participate in their ex-husbands SS benefits. It’s the women that are low wage and never married or had short marriages who are really hurt by the system.

But I do agree with your point in general. Marriage has been devalued by the feminist movement and it has only made women poorer in general. In a certain minority community, only one in four women marry and 80% of their children are born out of wedlock. But you are a racist if you point it out.

JK

Misogynist much ?

JK, I live in a 55+ community. From my observation, about 1/3 of the homes here are women living alone (I’m not making this up).

Most are widows, some are divorcees. None that I know of are up for murder charges (LOL). They all seem to have lots of money and drive nice cars (BMW’s, MB’s, Volvo’s etc).

I own my home. Property taxes are $2700/year. My CPA promises me my first IRA required minimum withdrawal won’t cost me much. This coming tax season will be the proof. I believe only 50% SS is taxed. Thank God my health has been good. I live on about 1/2 SS check. I spend most my time at home looking after my self directed IRAs which I enjoy doing.

I think this is pretty standard for a single retiree.

P.S.

I have not been withdrawing from my IRAs until now. My tax bill has been $0.

What will it mean? The same thing the 1995 Boskin Commission meant and was designed to do: “adjust” inflation figures away from reality.

An existing fudge – substitution: when people can no longer afford beef, they’ll buy chicken.

Recent headlines:

Beef prices are up 20% since last year—here’s why

There’s a major chicken shortage all across the country, affecting your favorite fast-food chains and restaurants and their wings, tenders, sandwiches, and more.

I can afford a little beef, but I’m not paying these prices. It’s not hard for me to adjust. My cousin raises beef and it’s not the farmers who are getting the jacked-up profits.

I bought 4 lbs of chicken breast for about $10 at Aldi’s, smoked it on the grill with Ozark Perfume (Hickory). It’s good for about 6 dang tasty salads (I’m still pulling some lettuce from the Fall garden).

I’ve got a pond full of catfish and deer being pests. It is possible to be poor with style.

Where I live you can buy three 4 oz tuna steaks for $5.19 at Aldis.. Very good pan fried or done on gas grill. You can eat more but 4 oz is all you need at a meal.

Trying their scallops for first time as a treat $11 per pound. Hope they taste as good as they look. That can be four servings. Not too bad for good seafood treat.

Way off subject but at least it’s about food. Here is my thing in the works. Squirell dumplings and gravy and a huge butter nut squash cubed and roasted with scotch whiskey basting until sugars carmelize and greasy back green beans with cornbread. Strawberry /rhubarb pie. Hillbilly Heaven.

Beef is up 80-100% who wants to work in slaughter houses worst job. In country did out of high school

Just saw an NYT article talking about how people have pretty much burned through their stimulus money and how terrible that its. I’ll bet we’re going to see a lot more noise about another stimulus package, especially if the stock market eats it.

If they have billions of dollars to resettle refugees in our country, I want a check too.

Agree

At least $16 billion. Read it is a cluster as evacuation was so chaotic that only about 25% are vetted. Remainder just got a quick background check and shipped to your town. Sure it will be no problems with fitting in.

Your first problem: reading the NYT

Reading the New York Times can be very helpful as you know what lie the swamp is feeding the people.

You can also predict the next war(s) by tracking who the NYT is vilifying. I swear they are the house media for CIANSADIAONIETC.

Well, maybe now people will finally get back to work.

I remember my grandmother’s (and that generation) saying she used during the Great Depression:

Use it up, wear it out, make it do, or do without. Only in my boomer retired days today, it might be – do without health care, transportation and eating out – and “I will like it”

Doesn’t matter they are taking back the COLA with increased Medicare payments, how about capping that, or deducting the charge for say one year?

“If you don’t have a big nest egg, work for as long as possible after receiving benefits – even a part-time gig helps – because the actual increases in your costs of living will outrun the COLAs as you get older.”

Yup, that is the bottom line.

CPI-W or CPI-E … most retirees just don’t care.

So many retired people own homes that are paid off and appreciating rapidly. A reverse mortgagte is the answer, expecially since many homes are appreciating faster than the reverse mortgage loan balance.

Why should a retiree care about CPI-E or CPI-W when they can do a reverse?

A reverse mortgage is God’s way of telling you to sell the house and move.

God help you if you are late with a property tax payment or don’t keep the bushes trimmed. House gone, YOU GONE TOO.

Old guys can pay that easily from Social Security payment. That will never happen.

If dementia sets in, a lot of forgetting can happen. Never say never.

When the numbers are cooked it doesn’t matter if they use CPI-W, CPI-E, or a ouija board. The result will be the same.

SocalJim, with a reverse don’t you have to agree upon a future sale price of your home which the reverse mortgage income payments are based off of?

Wouldn’t it make more sense for the elderly to pull out equity from a HELOC over a ten year draw period and either refinance or roll over that debt ?

Offsetting any increase of Social Security checks in 2022 is consumer price inflation, that may exceed the increase, and a huge +14.5% increase of the standard Medicare rate. Mainly to pay for inflation and a very expensive Alzheimer’s drug that doesn’t do much

All these people complaining that the $22 increase in Medicare premiums will eat up their Social Security COLA. Really? You are either liars or terrible at arithmetic because I will still see more than a $100 increase even after accounting for the Medicare premium increase.

Escierto,

The Part B increase is only the beginning of the increases. If you have supplemental medicare insurance every separate policy goes up too, the amount depends on what state you live in. Even if you only have a medicare advantage plan which only costs the Part B premium, the deductibles go up for those. I have seen deductible for free advantage plans that are over 7K and 11K per year.

So that $22 increase turns into thousands more than you might be receiving very fast.

I just got my insurance companies letter on Medicare changes. All Medicare deductibles are up 10 – 15% across the board.

My wife has supplemental plan F (commonly called Medigap insurance) which covers ALL Medicare deductibles. In essence all we pay is the $144/month Medicare fee (going up to $177/month). BUT, plan F costs us $400+ per month and that will be going up this year as it does every year.

I have Plan G which costs me about $227/month and has a $203 deductible, going up to $227 annual. That $227/month will be raised also.

Between the Medicare entry costs and our supplemental plans, we pay roughly $9 K annually in premiums.

Then there is Part D drug plans for both of us. They cost $22/month each in premium with $435 annual deductibles. My wife has two expensive Level III drugs (Spirva and Prolia) which cost us about $2 K out of pocket. The rest of our drugs are generic. There are no generics for the two Level III drugs.

We are blessed that we can afford. If we couldn’t then we would have to sign up for Medicare Advantage plans and have restricted choices if something went really wrong.

My Medicare Advantage plan is unchanged from last year. I don’t see what the big deal is.

You better start praying you don’t get cancer or some other grave illness, because then your deductibles per year will become a very big deal. If you have to go out of network for anything, you better have a pile of savings to keep you alive. This assumes they won’t mess with your pre-approvals, which they are notorious for doing.

Otherwise your “freeish” plan is great.

SS gives a little, and Medicare takes it back plus some.

Wake up, anyone relying on these morons for income in the future are going to be lost.

The best thing a Boomer could do is to start hoarding gold and cash, and hiding it from Uncle Sam and the HELLCARE system for the soul-crushing poverty that is coming their way.

YOUTUBE is full of channels that say to buy gold. I get it, but how does one really safely/securely hold gold?

Buy coins or bars. Keep it in your safe. But the premiums are high on the physical gold pieces right now. Silver is a better deal, or other rare metals.

The Wall Street PIGS sure seem excited today. Is there something I missed to lead to an almost 1,500 moonshot in two days? Jerome Foul is probably whispering to his buddies to go long, that he’s not doing chit to stop the rampant inflation that’s destroying the masses. If I could see what the FED is trading, I’d know what they have in store. I’m sure it’s not anything good for those millions of people sleeping on the concrete and in the bushes across this once great country.

if you asked, they’d say it’s because of “investor confidence” that omicron is not a big risk. as though there are no other issues in the economy.

I guess they forgot to mention that the 50 million BBL of crude released from the SPR couldn’t rally any U.S. refinery buyers and has several foreign bidders. This is due to refiners already under crude acceptance contracts for the next foreseeable few months.

What a political show that was.

That oil will be bought and traded around and won’t have any impact on U.S. gasoline prices going forward. Oh, crude is rising as the Omicron strain issue is diminishing worldwide.

The only purpose of these theatrics was to talk down the price of crude oil. And that worked pretty well, I hafta admit.

Wolf: Agree, the theatrics worked, but only for a short while. Crude prices are heading back up gain.

It is always a “political show.”

Oil prices are set by one man on the planet… the King of Saudi Arabia. Been that way for decades now. The Saudis use oil as a tool of their foreign policy… the same way we use our money and our military… the same way the Chinese use cheap labor.

Figure out what the KSA will want to do next and you can make a lot of money in oil. Right now KSA seems to want to let prices run hot for a while. Neither the Iranians nor the frackers seem to be using their profits from high prices to cause big problems for KSA. If that changes… then so will the price of oil… quickly.

Assets will continue to go up for the immediate future. You guys are in a echo chamber. You are correct, but to early to go home the music is still playing.

i’m happy to continue stacking physical metals. i want nothing to do with dollars, or equities.

Wolf: I might get a COLA this coming year but like in the past my Medicare Premium will be increased and, hence my Net COLA will only be 1 or 2% if I’m lucky. A little game the Gov. plays.