Ecommerce booms. Years of brick-and-mortar meltdown get compressed into a few months.

By Wolf Richter for WOLF STREET.

Just how hard it is to even track the sudden collapse of brick-and-mortar retail sales when many stores are temporarily shut down and when the Census Bureau was operating at reduced capacity, was made clear in a special note when the Census Bureau released its report on retail sales today. The store locations across the US are normally contacted in various ways, including by email, regular mail, and phone calls. But this time, most of it was shifted to email and online. Stores that reported $0 sales were “tabulated with $0 sales as long as the company was viewed to be representative of other companies in the same industry.”

The hot and the near-dead all averaged out:

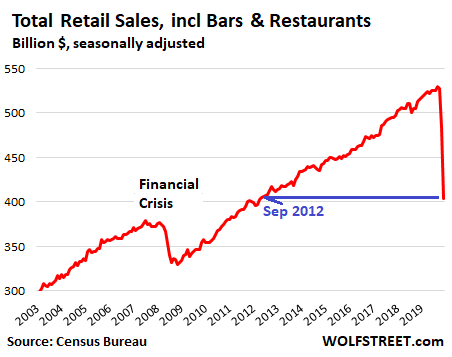

Total retail sales – which averages out the segments where sales soared and segments where sales collapsed to near zero, and we’ll get to them in a moment – plunged 16.4% in April from March after having already plunged 8.3% in March from February, to $404 billion, seasonally adjusted. This was down 21.6% from April last year. It was the lowest total since September 2012:

Where sales were hot — or at least not plunging.

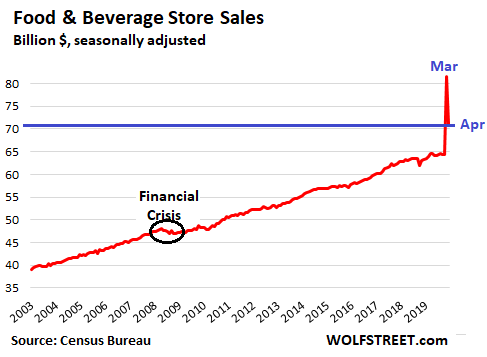

Sales at grocery stores and beverage stores had spiked in March by 28% year-over-year to $82 billion after consumption shifted from restaurants, offices, and hotels to households. This was peppered with bouts of panic buying, hoarding, and contemplating empty shelves. But in April, these dynamics settled down somewhat.

Sales at these stores dropped 13% in April from March, to $71 billion, but were still up an astounding 12% from April last year – “astounding” because the grocery and beverage business is marked by persistent slow growth that is a function of population growth and price increases. That’s why grocery and beverage stores are considered “recession proof” – note the barely perceptible down-tick during the Financial Crisis. People will always buy food though they might skip other purchases. But what happened in March and April shows to what extent consumption suddenly shifted:

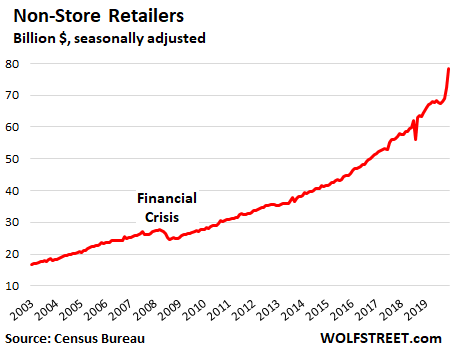

Sales at non-store retailers soared. This category overlaps partially with ecommerce but includes catalogue and mail-order operations, door-to-door sales, sales at temporary stalls and at vending machines. Powered by the boom in ecommerce – no matter how the other segments in this category fared – sales jumped by 8.4% in April from March and by 21.6% from April last year, to $78 billion:

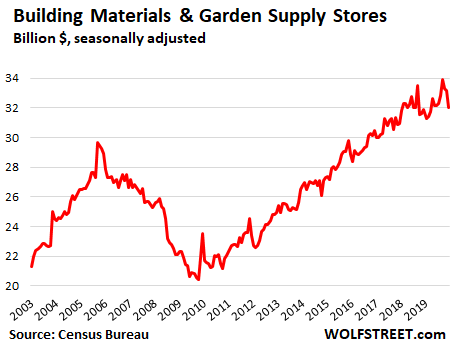

Sales at building materials, garden supply and equipment stores (includes hardware stores and stores like Home Depot) fell 3.5% in April from March, to $32 billion, but was still up 0.4% from April last year. As lousy as this is, in the current environment, it’s a huge accomplishment:

As for the rest, it was between ugly and beyond ugly.

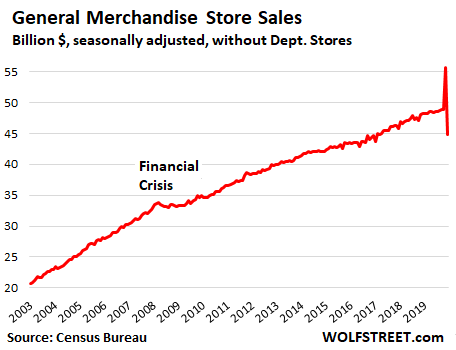

Sales at general merchandise stores without department stores (Walmart and Costco are in this category) had spiked in March on panic buying and in April fell 19.5% from March to $45 billion, giving up all the March gains plus some, and were down 7.3% from a year ago. Department stores are in this category, but they’re special, they’re approaching the end of their life cycle for other reasons, so I removed them and displayed them separately further down.

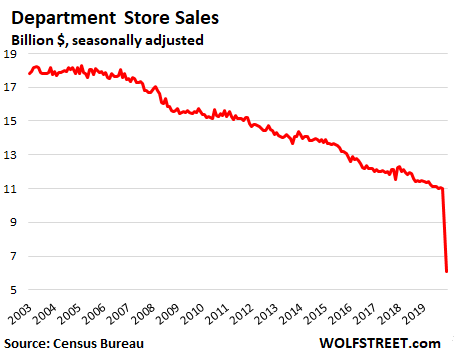

Brick-and-mortar department stores turned into zombies. Sales at department stores have been declining since their peak in 2001. Many iconic stores, including Sears and Bon Ton, have been dismembered in bankruptcy court. Luxury department store Neiman Marcus filed for bankruptcy last week. JCPenney will file for bankruptcy shortly [update: Long Wait is Over: Zombie J.C. Penney Files for Bankruptcy in Deal with Distressed-Debt Funds. Department Stores Are Toast, Done in by Ecommerce]. Lord & Taylor is planning to liquidate all its stores. Other department stores, including the largest surviving one, Macy’s, have announced wave after wave of store closings – for years.

Brick-and-mortar department stores were zombies long before Covid-19 appeared on the scene. Now the process is compressing the structural shift from many years into a few months. But Macy’s, Nordstrom, and others with a strong online brand can thrive as ecommerce retailers if they don’t screw it up by expense-cutting their online operations into ruin.

Before Covid-19 came along, department store sales had collapsed by 45% from $20 billion a month at the peak in 2001 to 11 billion a month earlier this year, despite two decades of inflation and population growth. Then in March, sales collapsed 24% from February, and in April sales collapsed another 29% from March, to just $6 billion:

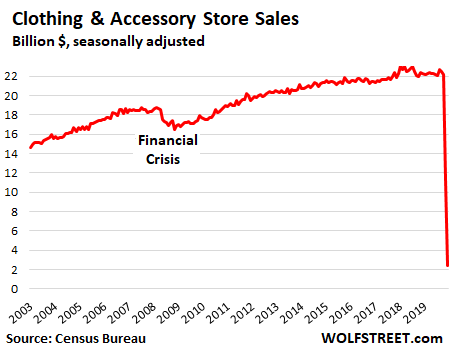

Sales at clothing & accessory stores fell to near-zero. Sales at brick-and-mortar stores had been stagnating for two years. They were shifting to ecommerce though many pundits had said that people would never buy clothes online. Then in March sales collapsed and in April collapsed further. Over the two-month period, sales have collapsed by 90% to just $2 billion:

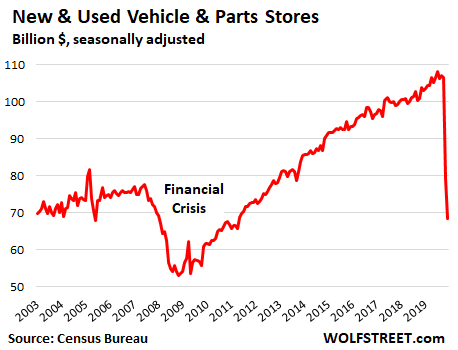

Sales at new & used vehicle dealers and at parts stores plunged 13.6% in April from March and 33.5% from April last year to $69 billion, a number first seen in February 2000 – a yes, back to the good old day of Y2K:

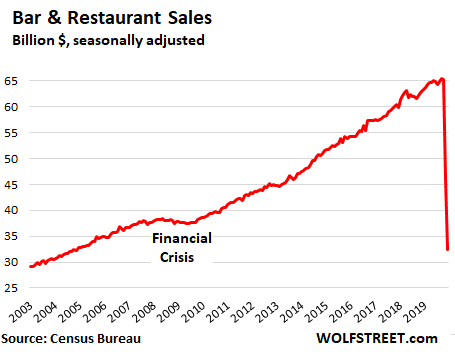

Sales at bars and restaurants collapsed by 30% in April from March, to $32 billion, the lowest since 2005, and were down 49% from April last year. Sit-down operations have largely been shut down, or have changed to take-out and delivery operations, which can keep at least some cash flowing. Most bars were closed. Other food services operations that weren’t relying on sit-down service, such as sandwich shops, are trying to wend their way through this, though lunch demand has plunged in many locations as people are working from home or have been laid off:

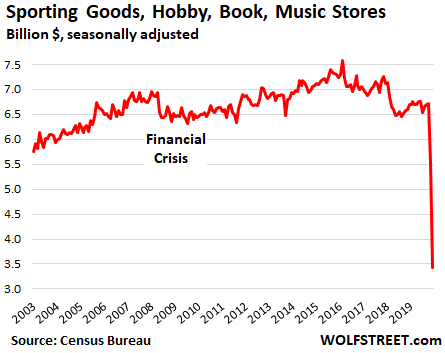

Sales at sporting goods, hobby, book and music stores plunged 38% in April from March and 49% year-over-year to just $3 billion. But even before Covid-19 hit, sales at these stores had been swooning. In 2019 and 2020 through February, sales were back where they’d first been in 2006:

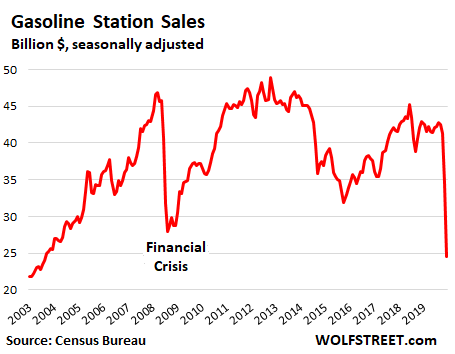

Sales at gas stations – which includes junk food and other stuff people buy at gas stations – plunged 29% in April from March and 43% from April last year, to $25 billion. This is a function of both, declining demand for gasoline as commuting has fallen off drastically, and the plunging price of gasoline at the pump. Sales at gas stations have now fallen below the low of the Financial Crisis and are back to 2003 levels:

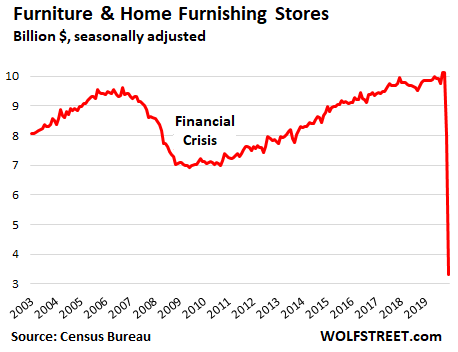

Sales at furniture and home furnishing stores collapsed by 59% in April from March and by 66% year-over-year, to just $3 billion:

What we’re seeing here is how the Covid-19 crisis compressed the brick-and-mortar meltdown that has been going on for years into a much shorter time span. Many of these stores were already on the ropes, with their business model under relentless attack from ecommerce. And this crisis will cause many of them to shut down permanently now rather than a year or two from now.

And ecommerce was booming before Covid-19 and has suddenly taken on a new role and a new magnitude that often exceeded the capacity of the fulfillment infrastructure. Companies have spent billions of dollars every year building out their ecommerce infrastructure, but no one was prepared for this.

The “Insured unemployment rate” in California spiked to 27.7%, “continued claims” hit 4.8 million. In terms of “initial claims,” Georgia & Florida moved into 1st and 2nd, ahead of California. Read… Week 8 of the Collapse of the U.S. Labor Market: Nearing a Previously Unthinkably Deep Bottom?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, you are seriously needing to get some more and bigger mugs for us wolfer fans!

And, to be sure to indicate as least SOME of the crazy lines, straight and otherwise,,, going so fast to ‘heck’ and beyond… etc…

Thanks for your work putting this and so many other ”metrics” into the kind of visual aids that I, and I suspect many others, can now be helped to understand the damage now happening, etc.

Like they said in Jaws, “I think we’re gonna need a bigger mug”.

And maybe change the slogan a bit. Just add “But then again sometimes it does.”

For anyone who hasn’t yet seen the 15oz “Nothing Goes to Heck in a Straight Line” glass mugs that everyone here is complaining about as being too small and ridiculously wrong, have a look:

https://www.wolfstreetstore.com/wolf_street_store/shop/home

I have two; perfect size for a 14.9oz nitrous can of Guinness.

This fact has been replicated many times.

And, obvioulsy, given the above, it can easily handle any 12oz can / bottle.

Perhaps

‘Theeey, walked through the corn, pulled by greed to the river’ (Mannfred Mann…mangled)

Or

‘When they unfolded that melody, I heard a sound like lies be’en told to me’

( Thunder, Backstreet Symphony, no misogynist undertones intended, lyrics mangled again)

And finally:

‘The Markets… They promise to love you for evermore’

(Abba, again mangled)

and one last…

‘So you see, Sir, my pack of cards served me as Bible, almanack and prayer book’

(Tex Ritter, Deck of Cards, exact)

Close, but no cigar. The confusion is understandable. Tex (Woodward Maurice) Ritter was a big deal in movies and cowboy/country music, but it was T. Texas Tyler (David Luke Myric) who recorded “The Deck of Cards.” Tyler’s recitation is well worth a listen. I assume it’s available somewhere on the interwebs.

Nice post!

Would be interesting to plot these against the % of stores that are physically open to get a judge of appetite

Wolf, Thanks for the good post.

At least the bankruptcy attorneys are going to have a good year. Anyone interested in an over under bet on GDP at -40% for 2nd qtr? I will take the over.

Hard to see any silver lining in any of that data.

Well, the G claimed a 21 trillion 2019 GDP on maybe 6 trillion in retail sales (ahem), so I’ll take the under, with claimed GDP down 20% to 25% yoy despite the utter collapse in retail sales.

Which does bring up the bigger, older question of how good a metric the alleged GDP is.

I know that retail sales leave out a fair amount of economic activity…but over 70% of GDP?

I would like to see someone cobble together (in non retail spending) the other $15 trillion in claimed GDP.

(This is a big deal because most gvt programs are pitched as a “mere x% of GDP”…but the truthful % soars if GDP is an inflated BS number)

Not to mention the fact that alleged growth is a lie if GDP is falsely inflated (a state of affairs that I would argue is closer to the felt reality of a majority of Americans over the last 20 yrs)

That big spike in food and beverages was probably my liquor purchases.

We were definitely tuned in to the hive mind!

Plop, plop, fizz, fizz…oh what a relief it is.

Really makes you feel like going to the bathroom.

It is a real hoot in Canada as every place is screaming for Billions of Dollars and the government is sprinkling around a few million to each group of handouts.

Joe : Try over $ 200 Billion but then again according to Mr. Fancysocks budgets balance themselves. Lol

All kinds of attachments to this money to even qualify. Poorer wage people were given a government incentive not to work while still bringing in non citizens for farming.

Interesting term: ‘non citizens.’

Hmm, what are some near synonyms?

Trudeau reminds me of some giggling 5 year old at Christmas tossing presents out from under the tree every which way. The thrill of it all, giving away presents, he didn’t buy or wrap. Every day here in Canada he announces some group or other getting more money. As a saver, in Canada, I am starting to wonder what my savings are worth, when you can toss it like lettuce in a salad? Unfortunately, I think I know what the Canadian dollar will be worth when this is over…..

You better spend it or lose it.

I can see that coming for what Trudeau is spending.

Since everything is taxed, straight confiscation of people’s savings wouldn’t surprise me.

The give away is shocking. Me being a pensioner I was surprised the Old age security top up of 300$ was cut off at the 125K income level!!?? I’d rather see it go the lowest level.

I wrote to our rep that I would rather see the registered retirement income fund allow 100% no tax penalty on withdrawal if the total income was below the claw back level of 80K/year as they a suppressing interest rates so ones funds earning will be reduced in the future. In the USA they get a no tax on their IRA mandated withdrawals for one year, a 32K gift to those with big retirement savings.

Well the governments reasoning is that all the countries are providing stimulus so we are relatively at the same place compared to each trading partner and this cash give away will replace the money destroyed in the coming bankruptcies so it should even out!!??

At least the government is helping B&M setup their e-commerce sites quickly so they can start to recover. Look at shopify stock up 100% worth more than our biggest bank RBC. There is a long/short for ya!

Well I just ordered a hair clipper so much for the barbershop here as I’m getting to look like Santa and not going back there for a while or the gym whenever it opens. Less to the resto-bars but then might get a BarBQ so the money will still be moving around but in a different direction. If find when you order online often it is junk that goes soon to the dumpster so having a store to actually see the merchandise and kick the tires will still be worthwhile if one has particular needs and is a comparative value hopper.

They are never going to repay any of this debt it will be inflated away gradually so the economy creeps along if one can believe it will grow eventually.

I think it is time for one of those biblical debt jubliees in a few years as we do a master reset.

How far back must you go to find the same level for department stores, clothing & accessory, sporting and hobby, furniture..?

The available data doesn’t go back far enough. It goes back only to 1994. Back then department store sales were around $14 billion a month; clothing & accessory store sales about $10 billion a month; and furniture store sales over $4 billion a month.

Correct me if I’m wrong but these look like straight lines to HECK!

Yes, I need to fix the writing on the mug.

vindicated!

… now if events could only transpire re: everything else i’ve been wrong about …

Nothing goes to heck in a straight line, until it does.

Might want to add waterproof stickers that say “Until it does” to the shop.

I need another mug that reads – “…but sometimes it does go straight to heck!” And, please, keep version one available.

Or perhaps a set of shot-glasses? I need shot-glasses for when I’m too “liquidated” to chance lifting that heavy mug again.

The mug represents the adjusted line to heck. GAAP reporting of the path to heck may deviate.

These REALLY look like NNTaleb’s graphs of Happy Turkey Meets Thanksgiving. This is a major end of something.

I am waiting for the dead cat bounce to show up at the end of Wolfe’s vertical straight lines!

Wolf

Worse than the financial crisis. S&P bottomed at 660. The virus seems to be not as bad in all my readings, with most being fatal with other health issues. My sister is pulling through on day seventeen. On about day eight she experience some anxiety with breathing. First couple of days with 103 fever. She is sixty one with no conditions. It was very scary with all the initial readings in the beginning.

I wish her a smooth return to health!

“SP bottomed at 660.”

Which was close to a 60% loss from Oct 2007 1540 high…that 1540 high taking 5.5 yrs to be recouped at max ZIRP.

And as you say…this time will be worse.

I wish your sister all the best and a speedy and full recovery.

Prayers are going up for her.

I hope she is pulling through.

For the first time, I finally feel like I have somewhat actionable information regarding the virus after listening to the first 45 minutes of Joe Rogan’s 5/14/20 podcast with a very smart nutritionist lady. She made it very clear as to why some people are affected and others are not. But I am disheartened to read that your sister in on day 17 of the virus :-(

When you are older with other conditions- money will not save you. My cousin by marriage (a lovely man) was a retired Senior VP for JP Morgan- corporate investments. He lived in a lovely brownstone in Brooklyn. He slowly suffocated in a Brooklyn hospital over the course of 10 days due to ventilator shortages- peak week- as Cuomo was on the news begging for them. Don’t let anyone tell you these things did not happen. A truly horrific way to go. A nurse let him gasp goodbyes to his sons via cell phone- it took another 4 days to die alone. There are not enough images/videos of this slow painful death in the news to scare people into the simple act of respect of wearing a mask- to protect others – from R3 exponential exposure.

The core reasons for the scale of the disaster in the US are a mix of cultural bent (consumerism, sense of exceptionalism, entitlement, Randism, and “technology will save us”), and systemic (low wages, health care that does not put people first, and consolidation of a just-in-time food chain).

Add in the cult of personality, poor upkeep of the educational system, transition to oligarchy and a country that still flies flags from a civil war 150 years ago, and you have the kindling for a 4-alarm fire.

One example of this cluster-F confluence: Everyone thought China was low-tech when back in February their government told farmers to plant all, plant now. They were correct. Meanwhile, we plow our food under, because we did not have strategists in place or the will to divert factories into saving the food- canning/drying needed to preserve the crops for our impending food shortages. That it is just one example of the lack of foresight and solid management that endangers us as much as this disease- well into next year.

As for me, spouse and I started our Victory garden seedlings in February.

Looked around for any clearance on men’s clothing but all my favourite shops carry 80% unsold women’s stock, barely anything for me. So anyone with a wife/girlfriend with apetite in high-fashion brands – there are lots of stuff out there, but hardly anything for gents. Makes one wonder if the pre-crisis shopping behaviour was really that crazy for some ‘mall girls’.

Men have been driven out of department stores years ago. We were not supposed to go in there unaccompanied by a woman. Even the Macy’s men’s store turned me off last time I went in there about a decade ago (it’s gone now). Once I figured that out, I started buying ALL my clothes and shoes on line — including from Macy’s. It’s a breeze.

Only if you are a wolf in the big city.

Us small city sheep folk have to waste a lot of time because deliveries take a long time, a week or more, and returning ill fitting clothes is a hassle.

oh so true.

‘High quality, slim fit, elegant, super 120’s wool suit’

Size, honestly, 40′ regular.

…. but you still end up looking like uncle fester when you look at yourself in the mirror..

re: “… Us small city sheep folk have to waste a lot of time because deliveries take a long time …”

Delivery times are up across-the-board. I’d never spring for it, but word is Prime deliveries aren’t guaranteed any more. FedEx has bungled a couple deliveries to me in the last couple months. UPS and USPS seem to be the most reliable.

Let’s not forget that stagnant wages led to a boom in secondhand clothing. Dept. stores had a shrinking base- the middle class.

and no, i have connection or financial interest.

They just produce good run of the mill shirts and shoes.

I have owned and operated both an ecommerce and brick and mortar store since 1999.

There are many reasons for the collapse of brick n mortar. One of which is saturation of the market. The retail market is morbidly saturated and has been for over 20 years. That is the number 1 problem. High rents and the high cost of running a business are others points, which is why new business start ups will go down the toilet.

Yes if anything the pandemic simply accelerated the process that was already set into motion .

The other thing that will happen in retail is no more big box stores. They’ll all disappear. So will buying on consignment and carrying huge inventories.

When I opened my store, people were happy. They spent money freely and no one complained about prices or anything. FF to 2020. Everyone is miserable. Everyone is penny pinching on things they never used to penny pinch on.

Ecommerce. In my professional option through my years of experience, will continue to grow until it hits a wall and dies. I’ll give it 10 more years. It is no different then “catalogue shopping” of the 1970s and 80s. Doesn’t anyone remember what happened to Consumers Distributing??? Bankrupt.

Ecommerce cannot escape the cycle of business.

M.C.

Thanks for your observations.

Only one thing I quibble with. You said: “Ecommerce cannot escape the cycle of business.” Ecommerce is not a business, like a retailer is a business. Ecommerce is a process. It migrated from PCs and laptops to mobile devices. It’ll migrate to whatever the next platforms are. So the business cycles don’t apply to processes. That said, someday something better might come along, like ordering by just thinking about it :-]

3d printing. But i have the feeling that that will take many years

Hello, thank you Mr. Wolf. I’ve been a reader of yours for years.

I am merely speculating. To me internet shopping is not something new, it’s the evaluation of shopping. Maybe I choose my words of description incorrectly by calling it a cycle. I don’t look at is as something new.

Victoria Secrets used to do big in the 80’s and 90’s with mail-in catalogue shopping. Now look at them. Sadly, lingerie has gone out of style and they’ll be gone soon enough and they’ll take La Senza with them. What’s in style today won’t be in style tomorrow and then will return back in style next week. It’s like that with everything including politics.

There are reasons that I have for the death of Ecommerce coming after 2030, that involves government intervention and the taxation and new licensing fess of the internet and online businesses, which will kill Ecommerce. It will migrate back to tech, but not after a long time. People have far to much confidence in the government and don’t realize that the government makes the rules and then they change the rules without any consideration to businesses or business owners or individuals. I won’t speculate any further than that on a public forum.

My girlfriend ordered for the first time a few weeks ago online and she is only 39 years old. She doesn’t like internet shopping and would much rather go to a store where she can touch the product. I’m sure she isn’t the only one.

One last thing. Wait until you see May’s numbers.

Thank you for listening :)

It might be a process for ecommerce… but it appears to be mass market, and junk imports that dominate the present trend in the e-commerce market … The Malls all carry the same national brand merchants, but there are other small business in different niches of the market that will be forced to close due to high rents in these malls. Maybe the venue will have to change to a flea-market type of specialty market but that is not yet on-line for e-commerce..

What M.C. I believe is talking about is boutique specialty stores which one finds in tourist areas and upscale districts and other niche areas of the market all over different price points. Maybe this new e-commerce will create a new American revival of competition and local business.

Maybe it has to go back to 1960-70s neighborhood stores of shop keepers display fronts of something similar.

Process?

I would say a new “business model” with low fixed costs, acceptable customer experience, overwhelming choice and competitive price.

The risks are essentially in returns handling.

The profitability might sink as offer becomes oversaturated, as with brick-n-mortar, but there is no reason for it to disappear.

Theater, radio, TV, streaming: the new offers fail to completely eliminate the previous ones.

M.C.,

I remember “layaway” instead of credit cards, where you just waited until you had paid for a desired item. You planned ahead. And catalogue sales at Montgy Ward. I daresay you can’t find layaway anywhere now. It’s an instant society now. And that’s why, IMHO, they can’t get people to, en masse, stay the f*ck home for the time it takes to starve a virus into submission. And why the community is no longer able to support people until this is done. It brings to mind the studies done with children on delayed gratification. But that does not sell stuff, does it?

But private savings are the mortal enemy of politician-centric Keynesians, just another barbarous relic keeping the DC directed economy from the full employment, maximum Aggregate Demand Millennium.

Just look at the triumphs of Keynesianism over the last six decades…

Thrift is just so…retrograde…let your DC betters take the wheel…and the interest on your savings.

The MMT’ers will be along shortly to take your savings too. But it is *Modern* Monetary Theory…tres chic.

Cas127- Yes, thrift was out of style for a long time. Our family thought us radical for not having car loans, saving a proper 20% to buy a home, and foregoing vacations so we could send our kids to college. We even- gasp! – bought a home in line with having just one of our incomes, not both, (out of caution), paid it off as fast as possible, and set aside money for home maintenance.

We did not even tell them we cut our own hair, bought our clothes at Goodwill, and shopped for appliances curbside and on freecycle. Not to penny-pinch, but merely to live within our means. We are mocked for using flip phones. (We are both teachers now- I left advertising and am immune to lifestyle hype).

For many, the next few years will mean a radical change in behavior, and people will be angry as they see the trappings of consumerism on Netflix- things they can no longer afford (and bought on credit). For us – we miss our children and friends, but at least we do not have to add a learning curve to getting through this, and are able to help our neighbors.

Sorry, Cas127my response was meant for Portia.

The charts, especially the clif dives, springboard and platform events, deserve a medal!

Gold, Silver and Bronze.

And the Boxing! Have any of you witness this kind of pummeling?

There is Grace in these times too. People of all kinds, pulling through, completing the Covid treatment. While others, sadly, do not.

At the Olympics during ancient times, there was three types of attendees… one, the Participants, two, the Observers, and three, the Merchants.

This derived the POM POM

It’s not going away. I remember the days of the sears catalog and it’s nothing like that. Before the pandemic hit Amazon was delivering every obscure item I ordered in 24 hours with a few clicks. I don’t need to wander a whole mall or Walmart and ask people where things are, only to find out they don’t have what I want. Granted the pandemic made it all a little bit slower and some things unobtainable, but light years ahead of that catalog still.

You may celebrate light year speed, while I grieve for space to contemplate, and perhaps pass by and notice something I would not have seen if I did not have to wander. Where are you trying to get to, on your way to dying, as we all must?

I still wander malls just to look around. Or at least I did before they closed them all! It’s like the library. That used to be the only place to get a question answered but you had to work the card catalogue and chances were good they didn’t have any books on that topic. Now a few clicks and you’re golden. But it can still be fun to go to a library.

Begging your indulgence, CCC

I now find surfing search engines a lot of fun. I used to work in a library, typing and filing cards. I am trying to remember my feelings about things then. I am one of those (Aspies) who as a child read the dictionary for amusement. Maybe it is all the same–casting about for information as a sort of passion.

Portia, I am often amazed as I walk in my woods at something in nature I had not noticed before.

One does not have be stuck with “Aspies” to read the dictionary for fun. As a kid I dragged out words that were huge laughs for the other boys that found them to be useful in our debauched lives. One could tell if a girl that liked strange words was someone worth knowing.

Heck, I have a giant aged dictionary on a dictionary stand just about the gombit approved social separation distance from myself.

I was always in trouble as a kid in Catholic school. The nuns tired of beating me and turned to locking me in the library and making me copy the dictionary long hand.

Every single letter, every phonetic spelling. Everything. They’d pick a thick letter like M,S,or T and say I could go back to class when I finished that copying every word beginning with that letter.

I didn’t mind that much. It was a great punishment in that it bestowed a lifetime of rewards.

I still can see that giant red unabridged dictionary with the gold cut out scallops for each letter. I was such a troublemaker I probably got 2/3 through it

There used to be an old artist guy in Bellingham WA.

He had small shop, artist.

He had candy by the door, as I remember it, and chocolate.

You walked in, looked at the art, walked out, paid for some chocolate as you went.

I think he used to let the local kids come in and.. well take some of the chocolate or candy for not a lot.

Before doing that sort of thing got seen as creepy. My impression of him at the time was that he really was not that sort of guy.

Customers wanting to go into a store and have some sort of human interaction is, I would like to think, still a valid basis for a business proposition.

But wandering round the stock that your grandmother just lookedat in a mall department store, well, less so.

The bicycle business, that I am in, is seeing unprecedented growth in bicycle sales. Electric bikes have been the holy grail the last 10 years or less, but COVID bike sales to the new enthusiast, we have not seen anything like it. The major bike suppliers will have run out of value price points soon, and will all be out of stock for the year within weeks. Never seen anything like it and I’ve been in the bike business my entire life

Several people here have observed a similar phenomenon in the bike shops they know.

e-bikes ARE NOT true bicycles. they are, however, true dual-use implements: when the battery power is depleted you have a boat anchor.

e-bikes are suitable only for two (2) customer profiles, those who’ve had stroke and those who will have a stroke. or a cardiac event, take yer pick.

on the subject of human mobility, the ideal fuel for same has already been discovered. it’s called “breakfast”.

LOL! Jeez, I am glad I did not have to depend on someone like you to invent the Ebike! I, however, have found that, although I am not a stroke candidate, it has changed my life because I have disability issues that compromise my strength and I live in a rather hilly place, and I can not afford a vehicle any more, nor do I agree that gas powered is the way to go. I use my ebike for commuting to shop and work, and it has a 60 mile charge. Electric-assist, if you please, is the bomb. After I eat breakfast, of course.

Also, Raoul,

Consume

Nannyberries

and

Perish

Oh god not this again. I was browsing Electrik a few days ago with a review on an E-bike and two purists objected that an e-bike is not a pure bike or some such rot. OK, so why are they on a site for electrics????

Moving on to the ‘ideal fuel’ This is about a study on pumping water in the developed world (aka: the Third World) and it compared human- powered pedaling vs diesel. Winner: diesel. The bod as much as we love ours and sometimes others is actually not that efficient. The cost of the diesel was cheaper than the food and time for pedaling.

Mr.Kelly

How did we get from “breakfast” to “diesel” again???

time for me to go to bed

E-bikes are growing in use with people who commute to work on a bike.

A ‘Fat-Tire’ e-bike will get through a Minnesota winter. Heck, there’s even studded tires for riding on icy roads and trails.

To Nick’s comment:

You want to talk human power output; have you watched world-class velodrome sprinters?

My racing weight was 98 kg, and my standing start lap time on a 250 m track was under 19 seconds. As Newton says: Force = Mass x Acceleration.

Now on carbon-fibre bikes, guys can do it in 18 seconds and ride a kilometer, from a standing start no less, in under one minute flat. That’s well over two kilo-watts of power.

Yeah, a turbo-diesel motor of decent displacement puts out a bit more power for a longer time, but the human body is an amazing machine.

I wonder if e-bikes will cause a new problem, ie what will happen with old batteries ?

@raoul

You must be american? only americans have this elitist attitude toward pedal assist/electric bikes. It’s no problems in Europe and abroad. I for one own 3 ebike/assist bikes, emtb, e-gravel, and a commuter bike. I own a regular road bike, a couple of mtbs (YT, Evil, Santa Cruz) and use them all for different rides. Not a stroke victim and thus far am a healthy 40+male. So-you are wrong with WHO the customer is for ebikes. Of the dozen or so personal friends I have with ebikes, only one has health conditions-the others? they got an assist bike because the sport is f_cking hard and this made it more enjoyable.

Nonsense.

E-bikes are niche product situated between bikes and motorbikes in terms of price and comfort.

They’re for people that can’t ride a real bike. When I get too old to ride a real bike it is encouraging to know there will be an alternative that can keep me riding.

So far, the mule trade in WV remains slow …

Agreed.

I have been interested in this bicycle shift.

I have not owned an auto for more than a decade, and a do not live in Sodom or Gamora. 8 miles to a “retail anything”, 3 miles to an Amish Community.

So although not using electricity for commuting, using it for computer and internet?

Why not leave anti-technology puritanism to the Amish. Or join them.

Philip Frank, that’s easy. Buy one of RD Blakeslee’s inexpensive WV mules. There are some amazingly intelligent mules in my past.

“Stubborn as a mule.” is not solely an aphorism.

Sadly, mass transit is looking pretty toxic, judging by the geographic locations of most C19 hotspots.

Thus…one big reason for the bike boom.

Hopefully most non-underground mass transit will wake up and adapt, modifying buses and rail cars to pump a lot more non recycled ventilation through the passenger compartments, diluting the viral load.

And NYC?

NYC is pretty much screwed (in truth, the whole concept of a NYC model type city has been fairly obsolete for 60+ years…but there is a lot of inertia in human affairs).

The subways are pretty much central to practical NYC survival and I just don’t see how subway ventilation can be improved enough…open those windows and the passengers will be breathing rat excrement from 1905 along with C19.

And even more unspeakable things.

I agree on your mass transit observation. Bottom line is private cars are now a must have. The only cities that will do well are cities built around private cars. Cities that do not have the infrastructure for private cars are in real trouble. People that own condos in the mass transit cities are so screwed. NYC, SF, downtown Boston, and downtown Seattle are so screwed. LA is built around cars and so many looked down on LA because it did not have any mass transit. No more. LA is in the drivers seat now.

In the Twin Cities beginning Monday 17 May, as the Governor as eased the Stay-at-Home rules, the light rail and bus system will require riders to wear masks. Since mid-March, the hours of operation have been reduced.

Up until COVID-19 the mayor and city council of Minneapolis have been actively working to reduce the usage of cars in a couple ways: reducing parking spaces on the streets & doubling the parking meter rates. “Known as the ‘Transportation Action Plan,’ this document could guide everything from bike lane creation to pedestrian safety projects and plans to encourage the use of public transportation.”

Not so fast ScJ:

Drove down the coast on the 101 from SLO last July 11, slowly with the windows open after coming right along side the ocean, and loved it, but only until I turned east in Ventura: eyes started burning,,, started coughing and choking!

Went to my biz appointment in TO, and then, instead of setting up to stay and work for at least a few months as requested, drove ASAP right through Rush Hour to Barstow.

Will never go back by choice, no matter how high the pay, etc., even though I really like the folks I was going to work with…

WHAT A freaking mess!!

BTW ScJ, family was in SoCal from the 1800s and a ton of cousins still there, although most have moved out,,,

And, while I am at it, certainly appears that others comments re ”third world” certainly happening and fast in many locations of the area, from SD to Ventura County.

OTOH, I been saying for years that, sooner or later, the ”grandees’ that lost SoCal and most of the SW area of USA are going to get back what was stolen from them in the 1840s era, including all the holdings my family ”bought” in that time and earlier…

If you own RE in that overall area, and cannot trace your ownership back to a verifiable/certifiable signature of one of those grandees/grantees, you might want to get out while the getting is good. I am somewhat surprised this has not already been adjudicated before some world court, but I am certain it will be sooner or later, and not to the benefit of anyone without clear title referencing original grants, etc….

@ vintageVNvet – “If you own RE in that overall area, and cannot trace your ownership back to a verifiable/certifiable signature of one of those grandees/grantees”

_____________________________________________-

I can’t help but laugh …………..

as if “ownership” by those original grandees/grantees established an elevated form of justifiable “ownership”

Sorry to inform you….Los Angeles was actually built on local steam lines giving way to electric trolley systems (with open air available). It was more mass transit than almost anywhere else at the time. The conversion to cars, once a rich man’s toy, followed the set pattern…one of the earliest advocates being Homer Laughlin who got out of Ohio by selling his china factory and heading for the coast when the gettin’ was guud.

for CB: never said anything about ”justifiable” merely discussing ”legal” as in legal, not ”justice” system that prevails.

for buysome: you are so correct about the growth because of the very early and very good mass transit; and what cooked the SoCali goose was when GM made them a deal to replace all that wonderfully efficient transit with a BUS system,,, and that error of the political puppets and their owners, no doubt accompanied by graft out the yazoo, ( and one grand dad failed to get his share of ) did the job quite nicely…

VintageVNvet,

Looks like SoCal car transportation system is a big break because no one wahts anything to do with public transportation. I am already seeing east coasters move into rentals near my home.

I feel you will experience whiplash on this opinion.

In a few years when this pandemic subsides LA drivers will be back in their seats driving solo 6 lanes wide doing 9 miles per hour. Again. Probably at $7-8/gallon.

“(in truth, the whole concept of a NYC model type city has been fairly obsolete for 60+ years…but there is a lot of inertia in human affairs).”

Came to your conclusion about cities nearly 70 years ago and left Detroit.

You’re right about the inertia, too, but if it were otherwise, my little Eden might come to resemble Detroit.

Could see that coming back in January, bought all the bike spares I might need back then.

The plan in London is to get all workers from the suburbs biking in: the lack of clothing, bikes and parts will be a major glitch in that little masterplan!

I had no idea that the end of the world would look like a Monty Python sketch, but so it is…..

That’s great news. Bike shops have been closing left and right in Portland for a few years which kind of mystified me. This is a very bike friendly town.

I agree e-bikes are a wonderful thing. I’ve been itching to buy a BBSHD mid drive kit from Luna Cycles for a while but keep getting hung up on finding the perfect frame. May go cargo frame.

So many good as new bicycles will be on Craiglist 75% off in a month or three.

Perhaps slightly off topic, but one other thing that struck me on these graphs is that in the last 17 years the total retails in $ amount have gone up (other than now and the financial crisis) nearly continuously in a straight line. What is driving that continuous growth? Is that inflation? People buying increasingly more stuff they don’t need? Shifting priorities (in which case which priorities are decreasing?). Is it evenly distributed across demographics? Is it just that more and more of the “informal sector” gets pushed into formal GDP (e.g. instead of just painting your own home, or cooking in your spare time, you now work extra hours to pay someone else to do it ?). The graph shows things are back down to 2012 levels, which is still better than it was just before the financial crisis in 2008, and I would think that most American’s did “fine” just before the crisis and living like we did in 2008 doesn’t sound bad. So just those numbers presumably are missing something important?

My experience is mirrored in many of these charts. We were doing fine from 2003 until 2008, when the bottom fell out for us. We lost or sold everything of value we owned. The climb back for us started in 2012. It has been slow and steady, but we will never fully recover our losses.

The steep climb in the curve is a tale of two cities. One where the downtrodden are slowing recover from their losses. And the other where the well off have gotten a lot more for their money. If you didn’t lose your income in the GFC, it was the best of times.

From the article:

“Before Covid-19 came along, department store sales had collapsed by 45% from $20 billion a month at the peak in 2001 to 11 billion a month earlier this year, despite two decades of inflation and population growth.”

So I think we can safely imply that the growth was due to inflation and population growth.

A ton of it is inflation…it would be interesting to see the charts in constant dollars (even using DC’s see-no-evil inflation figures).

It would also be interesting to see per capita figures for all of the charts.

With some periodic growth spurts, the median US household has probably been stagnant economically since 1974…and that was purchased at the cost of having to have 2 breadwinners.

But the 1950’s were just so…retrograde and backward.

Thank god our betters led us into the sunlit uplands of national debt substantially higher than GDP…even before the vast entitlements lie really kicks in.

And the American political and cultural leadership classes were just so…humble about the bang up path they put America on.

Need to separate out Home Improvement stores, and Harbor Freight. Those stores are clicking.

I just bought a portable generator for the house and I ordered it online from a brick-and-mortar retailer. Their stores don’t stock this model, but they do stock it in their warehouse and retail it online.

Sort of a hybrid retail model.

Similarly, I bought a kayak from Walmart online, the exact same ones they sell in their store, but cheaper. And free delivery. Just two days. Weird.

Where do these show up in the charts?

Non store retailers.

So Walmart delivered a kayak in two days. Not bad. Was it an e-kayak?

Good restaurant story to share.

We don’t eat out much, but have one restaurant in particular that seems special. It is like going to “Cheers”, where they not only know your name, the waitress just holds up her hand for me to indicate a yeah or nay thumbs up for our usual order. She has a phenomenal memory as well, claims it is not photographic, but I think it is. Anyway.

Exactly 7 weeks ago today we had lunch there, which ended up being the last day they were open before being shut down by order. That weekend BC went into stay at home mode. This week the restaurant opened for takeout, and I pre ordered yesterday for today; our usual meal which we then ate at the beach. During pickup I had a chat with the owner and asked him why did he open now, not a few weeks ago, or why not in a few more weeks when more restrictions are lifted?

His reply: “You know Chuck, who works with me in the kitchen? He sold his house just before the virus hit. He wants to buy a new house but cannot get a mortgage unless he is working. He is stuck having to move, but can’t complete his purchase. So, we opened the restaurant so he can get his mortgage. You know what? We can’t keep up unless people order ahead. Business is better than I thought it would be. I may not open the dining room for months, well into stage 4”. (our recovery plan).

Here is a small business owner in one of the hardest sectors imaginable, who has never had staff turnover. Ever. Why? He is the kind of person who opens up and takes a risk for one of his employees. Every winter he shuts down for 3 weeks so staff can take a vacation somewhere warm. You don’t run into people like this very often in this me me me world.

It was nice to go somewhere that wasn’t an empty trail or scary shopping trip.

This does not relate to the article or data. However, it may demonstrate true fundamentals that breeds business success. :-)

Paulo…good story… thanks

Also allways enjoy your comments.

Pretty wonderful story.

Me, it was Taco Tuesday on Cinco de Mayo. A few weeks ago, my nephew gave me this small fold up table which allows me to tailgate for tacos out the back of my beat up mulch totin’ SUV. Been going to Taco Tuesday at this place for a long time – sometimes lunch and dinner since big $1 tacos washed down with Negro Modelo and Los Lobos turned up a bit louder than polite is just, to me, a sign of spring time this year, especially when Taco Tuesday falls on Cinco de Mayo (both, basically, American inventions). Only difference now is Jim, the owner, comes to the window, holds up either a food basket or beer bottle, does his Michael Jordan shrug imitation soliciting my preference and, in a couple of minutes I’m getting card on file ‘table’ service. There were a good number of us scattered around the parking lot with several salutes of ‘Stay Thirsty, My Friend’ accompanying our slowly failing social distancing attempts – bandannas pulled up for forehead sweat rather than down as bandito posers. Hell, had to walk home which was no big deal since I’d just brought the car to have a table and someplace to sit.

It’s important to salute these folks, the ones holding up a beer and/or taco request in the window, the ones who always grin back at you from the bottom of one of Wolf’s now straight to hell lines, making every day a fresh story not seen in the charts of this article. Harder times are coming. And I can sense people looking around and thinking of simpler times, both past and, I think, future.

Record low birth rate for years. Sky high national debt. Grab the popcorn

I salute the wise folks who forbore to bear. I am one of them.

Grab the suitcases and gold.

So I threw the gold and survival stuff and some food into my trusty knapsack and I couldn’t lift it off the floor! Must be the gold.

All I got to say is it looks like Kondratiev was right.. Just a little off on the time frame calculations. But then again, he probably never imagined that the FED would do what it is doing to SAVE the Empire… Only time will tell.. and when it does, it will tell all.

Largest short term drop in retail sales on record (CNN).

IKEA saw increasing sales in 2019. They have online and store sales. They planned to build the world’s largest IKEA store in Manilla. It is supposed to have a 1000 seat cafeteria.

There has been a slight increase in residential mortgage delinquencies, some worry about construction loans and worries about hotel mortgages.

Aw nuts, there goes Manila.

“Vacationed at home and all I got was this lousy E-shirt”…feel free to steal it if it ann’t already out there.

Retail in America is extremely overbuilt, with square footage per capita being as much as 4X that of European countries. Much of this carnage is merely weeding the garden.

Haha,

Europe has the same carnage.

I got bit this week. My wife and I planned a special WWII vacation to Normandy through Belgium and up to Hitler’s Eagle’s Nest later this summer. Paid for it in Feb. when stock markets were still good. Just found out this week that the company (Beyond Band of Brothers) is bankrupt-owner skipped the country back to Hungary. He drained his accounts before he disappeared. The destruction of this tidal wave has just begun.

No, that guy pulled a scam, plain and simple.

There’s presently a group on FaceBook organizing a class action lawsuit: I suggest you get in touch with them as soon as possible.

Ron,

You can do that stuff on your own, you don’t need to pay someone. I hate group tours like that in general. But even more so for something like what you’re talking about. Rent a car and go.

I spent a lot of time on the northern coast of France visiting the beaches. My advice is go in the off season, late fall is the best. The weather is still OK but it’s practically tourist free. The last thing you want is 30 tour buses full of people around you when walking in the American cemetery.

I just came back from a local shopping center in Daly City called Westlake. A new Target opened a couple of weeks ago, and since then I’ve seen people queuing up outside even under the scorching sun.

The future of department stores may be bleak, but some people will not give them up without a fight.

Shop shop shop ‘till you drop!

Just to clarify: Target is not considered a department store. It’s a general merchandise store, same as Walmart.

scorching sun in Daly City? I live to the north of you and sun is not a common word around here….the lines have been tame when driving by the last 2 weeks

Our bars & restaurants are open again. Our little main street was packed tonight. The speak easy is closed. So hopefully we can help reverse that chart Wolf.

Black market revenues will take a hit with the openings. Not sure if they have charts for that.

The supreme court of Wisconsin ordered the governor to open up. Within hours of bars opening, they were packed across the state. All the talk of “will consumers return” is just that, talk. Consumers are returning.

I don’t think that pics of a bar full of covidiots that went viral on the social media and then became the big news of the day is an indicator of broader economic trends.

Consumers are spending, and will be spending more, but that bar full of covidiots is not a good indicator of a Q-shaped recovery or whatever.

But it is a good indicator that there will be many more outbreaks of the virus.

I’d look for Illinois license plates in their lot, which portends the financial virus blow-up 30+ years in the making. JB like a little kid holding his breath for a federal bailout.

Wolf,

If you want to stay in your house for the rest of your life, that is your prerogative. But the majority of people are going on with their lives. Bars, restaurants, hair salons, all doing brisk business as soon as they’re open.

Just Some Random Guy,

That may be the case in your village. In terms of the overall economy, it doesn’t matter what happens in your village, or in one bar. Sure, business will pick up from the near-zero levels, but this nonsense about nothing having happened and everything going back to normal in a few weeks is just obvious nonsense.

Everyone knows that this economy needs to be opened up. But there is a smart way of doing it, and there is a stupid way of doing it. And the stupid way will cost a lot more lives than the smart way.

Yipee! The bars are open! SARS_CoV-2 for everyone! On the house!

I don’t know about bars, but people are certainly not returning to restaurants. OpenTable just released their most recent reservation numbers, and they are not pretty. OpenTable is free for customers FYI. Restaurants do have to pay.

I do believe that pent up demand and people being cooped up will lead to a temporary “surge” for a number of businesses, but I don’t think it will be sustained. Lower income across the country and some jobs simply not returning will act as a very strong headwind.

Also “they were packed across the state”. This needs to be proved. All I am seeing is photos from 3 4 places. I would call them anecdotes.

Well JC Penney has filed for bankruptcy.

https://wolfstreet.com/2020/05/16/the-long-wait-is-over-zombie-j-c-penney-finally-files-for-bankruptcy-department-stores-are-toast-done-in-by-ecommerce/

Raise your hand if you were inside a JCPenny in the last 5 years. Yeah didn’t think so. Departments stores were dead merchants walking long before the ‘Rona. This just accelerated what was already happening.

Yes, exactly. As I said in the subtitle: “Ecommerce booms. Years of brick-and-mortar meltdown get compressed into a few months.”

And in the text: “What we’re seeing here is how the Covid-19 crisis compressed the brick-and-mortar meltdown that has been going on for years into a much shorter time span.”

Just Some RG:

I’m a sucker for a spitball…

I raised my hand……..

Don’t be so definitive; you’ll make more friends!

Stay safe and healthy!

1) With $3K gov liquidity in their pocket, and lower Apr CPI, the

unemployed are on the food line in their brand new $50K F150, because

America is hungry, until the next $3T coming.

2) Trump put a muzzle on Dr. Faust mouth.

Coumo must have said “dashboards” today, but what I heard was “We have dancefloors”! Oh, no. Malls and anchors being converted to Covid-free housing and discoteques? Roof top gardens for food? Everything ordered on-line and rushed to the unloading docks amid a sea of hungry zombie corporations running willy nilly in the streets? Nowhere to land planes for evacuation? “Dawn of the e-Dead”!! (Tickets available in advance.)

Retail store failures are simply a symptom of the bigger disease which is the disparity between inflation driven costs and wages.

Good article and comments. Still amazed when the ex CEO of GE, HD..Nardelli gets rolled out for words of wisdom by the talking heads of CNBC….Just go away please ??

Larry Summers is available ???