The rate cuts for 2019 are a pipe-dream: Goldman Sachs and Deutsche Bank.

It now makes two: The chief economists at investment banks Goldman Sachs and Deutsche Bank have warned their clients that the already priced-in rate cuts this year that markets are so excited about may not materialize.

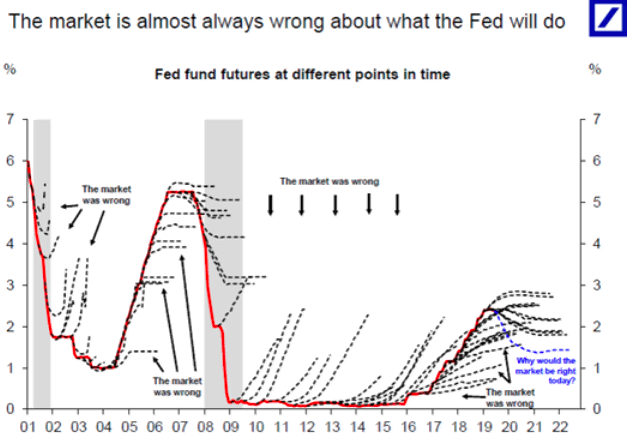

To proof their point, Deutsche Bank chief economist Torsten Slok and his team dug through the data going back to 2001, comparing the path of the federal funds rate – which reflects the Fed’s rate hikes and cuts – to the futures markets for the federal funds rate. They concluded: “The market is almost always wrong about what the Fed will do.”

And they asked: “Why would the market be right today?” That was a rhetorical question.

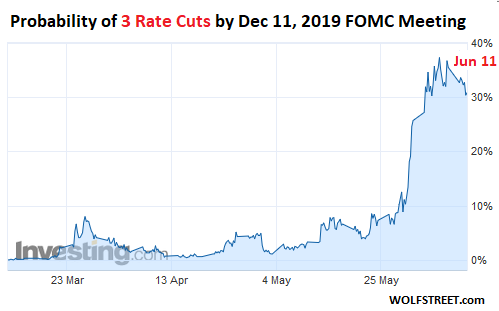

Yet, these bets – that are “almost always wrong” about the Fed’s rate decisions – are now being incessantly cited to show that the Fed will cut its target range for the federal funds rate. At the moment, these traders see an 80% probability that the Fed will cut its target range at least twice by the December 11 meeting, including a 31% probability of three cuts by then, and a 10% probability of four cuts, as implied by trading of 30-day Fed Fund futures.

This chart shows how three rate cuts suddenly gained momentum among Fed Funds futures traders on the CME, though tapering a tad over the past two days (chart via Investing.com):

Anytime the rate-cut mongers on Wall Street can twist something a Fed governor says into a rate-cut projection, they will. For example, Fed chair Jerome Powell gave a speech on June 4 about long-term questions the Fed has been mulling over. The speech was unrelated to what the Fed will do over the next few meetings. Out of context, he shoehorned this line – “we will act as appropriate to sustain the expansion” – into the beginning.

The rate-cut mongers took this line as affirmation of the three-rate-cut expectations. Yet there was not a single word about any impending rate cuts in this speech. That the Fed will “act as appropriate” is standard Fed lingo to describe that the Fed is awake. It can go both directions, hike or cut.

And so the team at Deutsche Bank came out with this chart (via Bloomberg), titled, “The market is almost always wrong about what the Fed will do,” where they compare what the federal funds rate (red line) actually did, and what trading of Fed Fund futures said it would do (dotted black lines):

From 2001 to 2004, federal funds futures projected that the Fed would hike rates. But the Fed kept cutting rates. Then, when the Fed finally started hiking rates, federal funds futures projected all the way along that it would stop hiking rates at any time now. Wrong, wrong, wrong. And so on.

During the years of ZIRP, federal funds futures projected rate hikes, and were wrong about it until 2016, when the Fed finally started hiking rates, federal funds futures nailed it briefly, and then wrongly and consistently projected far fewer rate hikes than the Fed actually undertook.

The sagging dotted blue line from 2019 into the future shows where the market projects the Fed is going. And the Deutsche Bank team observes (in blue): “Why would the market be right today?”

In other words, the market is clueless about the Fed’s rate decisions in the future. It has its own reasons for betting the way it does, but accurately projecting where the Fed is moving with its interest rate target is not one of them.

And yesterday, it was Goldman Sachs chief economist Jan Hatzius in a note, cited by CNBC. He homed in on the market’s interpretation of Powell’s act-as-appropriate line.

Without this line, the speech that was “focused exclusively on longer-term issues at a time of sharply increased worries about trade policy, might otherwise have come across as ‘out of touch’ to some market participants,” he writes.

“In our view, this was not a strong hint of an upcoming cut but was simply meant to provide reassurance that the FOMC is well aware of the risks from the trade war.”

Goldman Sachs expected Fed governors “to be very careful not to deliver an unconditional hawkish message, but to continue emphasizing that they will respond to shocks as needed to attain their mandate.”

Given that the FOMC meeting in June will take place right before the G-20 summit where Trump is hoping to meet with China’s President Xi Jinping on the sidelines, and the uncertainties around it, “the right course of action is to retain optionality,” Hatzius writes.

He expects the FOMC to downgrade the economic outlook a tad at the June meeting, with a few participants signaling that they might favor rate cuts, but that the dot plot’s median forecast for the target range for the federal funds rate will remain unchanged, and that there will be “no signal from Powell that a cut is in fact imminent.”

In terms of the rest of 2019, Hatzius writes: “Although it is a close call, we still expect the FOMC to keep the funds rate unchanged in the remainder of the year.”

But if there are no rate cuts, though the stock market and the Treasury market have surged on the expectations of two or three rate cuts, someone will have to talk down the markets gradually — or else. And maybe Goldman Sachs is trying to lay the groundwork.

At the moment, the stock market and the corporate bond market are in la-la-land, seeing nothing but an economic boom. They clamor for rate cuts. But they’re not seeing a rate-cut economy. So why would the Fed? Read… Here’s My Prediction: If the Fed Doesn’t Cut Rates 3 or 4 Times by Dec 11, Markets Are Going to Crap

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I wish our politicians recognized +- 0.25% rate change will not not make any difference if job outsourcing continues to happen.

The US job market has been doing well for years now. Suspiciously well to be honest: this hints at a combination of factors such as slower than expected wage growth in many sectors and several of those sectors being overheated or very nearly so. If job growth continues even at the slightly slower pace we have been seeing later I don’t know how long serious wage growth all across the board could be delayed.

The US Federal Reserve mandate is to sustain employment, so mission accomplished, but widespread rapid wage growth is a serious problem because in a service-heavy economy it means inflation will quickly start to heat up and become hard to deny. This goes again US Federal Reserve targets of “moderate inflation”. Also us employers are heartless monsters and love to oppress our employees with starvation-level wages worthy of a Dickensian villain. ;-)

“Outsourcing” is an hobgoblin easy to blame but ultimately it’s far less important to the job market than monetary policies and their often catastrophic effects.

It looks great as long as you don’t count people like me.

Today I put a manila folder full of the 8 pages of my tax papers, 2 pages that Medi-Cal sent me, and a cover letter, in the mail and wen to the emergency room at O’Conner Hospital.

They determined that I indeed have cellulitis on my ear (it’s gotten really bad) and some pneumonia. Got prescribed an antibiotic for each, which cost me $58 because my getting kicked off of Medi-Cal. One of ’em is fun – NINE pills a day!

At least I, hopefully, won’t have an ear lobe that looks like a rotten grape and hurts all the time, and won’t feel like crap all the time.

When has there ever been wide-spread, across the board wage increases in the absence of strong labor unions?

That happens either when the labor market gets tight or productivity increases dramatically.

From a theoretical point of view unions are there to ensure a tight labor market of highly qualified and hence very productive workers, the people whom they represent in negotiations. It’s not just a matter of threatening strikes at every turn.

In practice things tend to be far less clean cut, and given my experiences with unions as a worker I’ll refrain from further comments.

Uh, when a guy starts his own biz, and sets his own salary, otherwise, why pay an employee MOAR unless you want to retain him? Or have promoted him/her?

Seriously, if ppl want to make a lot of money, then start your own company, otherwise your just a slave, and sure slaves can form a ‘union’ but in general the plantation boss just makes an example of the trouble makers.

Given that you can still become a plantation-owner in the USA, if you set your goals to such, then why would anybody want to remain a slave for life, well until retirement(non-existent for most)/death.

MC01:

“Also us employers are heartless monsters and love to oppress our employees with starvation-level wages worthy of a Dickensian villain. ;-)”

That is the bottom line. And, in the world of “globalization” it is the platinum opportunity to repress labor as much as possible until there might appear to be a semblance of social congruity in the “Workers of the World” to realize how to fight back.

“Monetary policies” is not as important than “bread and butter” issues; the attempt to manipulate the flows of money for exclusive financial gain is always disastrous.

The NYT recently published an article titled: “Google’s Shadow Work Force: Temps Who Outnumber Full-Time Employees”

Yup the job market is doing “well”. If one of the richest companies in the world is doing this, imagine other employers.

Isn’t that Microsoft’s playbook?

Doing well? If the real wages of production and nonsupervisory workers were adjusted for labor-productivity to match their levels of the early 1990s, these folks would be in for a 50% pay raise. Instead, those wages (not adjusted for productivity) have been flat for the last 50 years.

Meanwhile, real per-capita costs (PCE) have increased over 100% in the same period. Some of these expenditures are optional, but not if the middle class is to remain middle class.

Production and nonsupervisory workers account for 70% of US employment (the highest in the last 60 years, which seems strange given the recent emphasis on college education).

Dale,

This category includes people working in Finance & Insurance (the largest sector in the US), Healthcare, Information (software publishing, book publishing, telecommunications, etc.), Professional and business services, Education, Leisure and hospitality, retail, etc. Anyone who is not a boss, from coders to bond traders (and including some factory workers).

If by “Well” you mean “It literally would collapse without illegal imigrants doing jobs without healthcare.” then yes is going quite well.

The job market has been doing well? Depends whose numbers who look at. Out of 200m working-age Americans, 100 million (!) have no job. In every fifth family, nobody has a job.

There are 200+ applications for the average entry-level office job posting in every major city, and you employers put up a lot of ads for jobs you have no intention of filling. It’s a strong job market for employers only.

@MC01: “widespread rapid wage growth is a serious problem because in a service-heavy economy it means inflation will quickly start to heat up and become hard to deny. ”

This line, which I recognize is in most macro textbooks, is absolutely not true. Yet another reason why macro is such a spectacular scientific failure!

Only the klepto-capitalists claim with a straight face that they cannot pay higher wages. They most certainly can – corporate profitability is near all-time highs GDP, while wages is near all-time lows. This is a big contributor to the wealth inequality problem.

Higher wages, at the expense of profitability rather than inflation, would in fact be a rebalancing of this historical imbalance.

Those who claim higher wages would require inflation simply don’t want to give up their easy loot.

In a standard macro framework, J.K. Galbraith decades ago pointed out that there’s a very simple way to get higher wages and lower profits: go after the non-competitive sectors in the economy, the monopolies, oligopolies and rentier industries. Capitalism only works correctly with genuine competition, and companies should be forced to compete both for workers and for customers.

Competition for workers only occurs when unemployment is low, and it raises wages but not beyond the limits of profitability. Competition for customers brings down prices and profits, but again not below the limits of profitability.

One might add that competition for capital (i.e., meaningful interest rates) is another requirement as well for a healthy economy…

You better hold onto your hat because the next 50 years of automation are going to make outsourcing look pleasent.

But at least historically technology always created new jobs we haven’t conceived of yet. I guess that all depends how our skills compare to AI and robots in 50 years…

Janet Yellin predicted more rate hikes than ever happened.

The worker participation rate peaked in 2000. Low unemployment, but a smaller percentage of people in the work force.

The economy expands over the long run in nominal terms.

+.25%^.25:)

I think it best to ignore main street financial media and the opinion of Wall Street employees. Also i am sure there are “rate hike” mongers out there too.

All that said, i expect the FED to cut before the S&P 500 hits 2600. the Fed takes it’s direction from the markets. No question.

maybe 2650…

but buying all the bad news a week ago netted a lot of R’s……

still in cyclical bull market, earnings are fine….we are still at 2.75 rate, no raise, that will be the down draft….

no reason to lower, they will not….

With data back to the 1825 Bubble, short-dated interest rates such as T-Bills go up in a boom.

What’s more so long as they are rising, it confirms that the boom is on.

The 3-Month Bill reached its high in March and has broken down.

Essentially, the party is over.

– Right !!!! But that’s what A LOT OF poeple consistently fail to recognize. They assume that the FED is able to drive rates higher or lower.

There is ZERO ZERO ZERO chance of the Fed cutting rates when the market is poised to blow through 3200. It will run there with a bullet and if history is a reference overshoot to 3350.

The market, the media and the Fed would not be pricing in rate cuts if they expected the S&P 500 to shoot like a bullet to 3350…… not that i would object too much if it reached that level, mind you. But it would be very overvalued.

Whether the Federal Reserve acts to change the Federal Funds Rate in 2019 there is one sure bet that the Federal Reserve will stay neutral in the 2020 presidential election year. If there is a rate change, up or down, it will happen 2019. There is still the possibility of a .25 increase in 2019.

I agree with above comments regarding outsourcing, plus the 3 regarding the Fed determines rates based on Mr Market and Mr Market alone – not by irrelevant considerations like jobs, inflation, general welfare of nation, the public good and good governance, or trade wars.

There was a time, not that long ago, that the market really didn’t pay too much attention to the Federal Reserve.

And certainly not hang on every word.

A time when the FIRE sector was just a small part of the American economy and there were so many other places to create wealth.

There was also a time when the FBI didn’t give the really big criminals a free pass. I can’t remember when that was, but my 9th grade civics teacher swore we were a nation of laws once upon a time, long before Eric Holder, Loretta Lynch, James Comey, etc. I think he must’ve been addled, since he was in his 60s.

You missed the capo.

Someone correct me if I am wrong but it seems to me that not only can the market not forecast what the Fed will do, but the Fed itself is unable to predict what the Fed will do.

Don’t confuse the monkey with the organ grinder. The Fed will do whatever its Goldman Sachs handlers direct it to do, so of course the Fed can’t predict what it will do, other than continue to debase the currency and bilk the middle and working classes out of their wealth and assets.

Yup. We live in the last stage of the country being cannibalized by an elite that doesn’t even live here anymore. It also seems planned. Anybody with even half a brain could foresee the empowerment of China when American jobs started to go over there for instant profits 25 years ago. These days, the middle and the working classes are being eliminated for shareholders’ profits. It was also easy to see five years ago that US policies would force Russia and China to merge forces. I wouldn’t be surprised, if a plan to cull the herd by a provoked and “limited” nuclear attack against the five electric distribution hubs came up next. Of course, that can wait until there will be nothing left to steal…

doom sells well, more so on Zeroedge though….

you might be able to buy a 10K impression ad page

Both a curious and wise moggy

While short term rates follow the Fed Fund Rate, long term rates supposedly follow expectations of Inflation. I can’t figure out how supply and demand affect rates. 2019 average volume are actually about 5% more than 2018 average and I get it that slightly higher demand will increase price and reduce yields. The surprise is by how much ??? The yield drops seem to be overdone.

My only problems with this article are the sources – Goldman Sachs and Deutsche Bank.

1. The first rule of trading club is that you always do the exact opposite of what Goldman Sachs reccomends.

2. The second rule of trading club is never to listed to German banks whose stock is sliding to zero due to corruption and incomptence.

I’m not disputing the charts or data the banks present, but their motivations in presenting it, particularly from GS.

In my mind the above article is firm proof the Fed will cut sooner rather than later.

Once you understand that the Fed is the oligarchy’s chief instrument of plunder against the 99%, and has been since it’s 1913 establishment by the robber barons of the era, everything the Fed does becomes completely predictable. For example, these pump & dump “markets” are being set up for the next Great Muppet Reaping, which promises to be the biggest, most rapacious wealth transfer in human history.

If plunder is symbolized by the 1% vs the 99% then I would say the chief instrument is Congress. So, the Fed, may only be an agent of Wall Street/Banking. Wall Street/Banking has been empowered by Congress to be the “engine” along with influential Corporations in support of the rules for a Globalized economy. This has been the result of what I believe has been a remarkably successful plan to re-establish Corporate/Conservative power propelled by the idea the US Government (aka human beings*) is a net negative when regulating economic activity. Thus Wall Street and Corporations have been able to increasingly “call the shots”. Hopefully the pinnacle of this idea occurred, when to paraphrase Alan Greenspan, “Gee, I did not know that the Free Market ( aka human beings*) might behave badly without behavioral boundaries”, thus Occupy Wall Street and the 1%. As the promises of the Free Market (and maybe unlimited debt) lifting all boats was proving unsuccessful , Newt Gingrich had long ago introduced a political “scorched earth” policy resulting in a political system where your opponent was evil and compromise made no sense. Congress is now in the position of being unable to solve any problems of significance, not even a pork-barrel enabled Infrastructure bill. So, if Congress is responsible and Congress cannot solve any problems, where does that leave us? Disclaimer: this absurdly brief and simplistic summary of one person’s observations may vary with your own experience.

10 year minus 3 month inversion has deepened and sustained itself since March and the HY spread is seeming to widen as well off a higher base.

My crystal ball is no better than anyone else’s but I don’t see a good enough reason for the Fed to start cutting now. Multiple “insurance” cuts are now baked into the current S&P price, and the market will adjust accordingly and violently when it realizes they aren’t coming.

Maybe then the Fed will change course, but I’ve started trimming my stock exposure for this cycle. Lots of downside potential ahead without a lot of upside.

I agree, they stand down right now….the shock of tariffs is over, heck prices have come down across most products they addressed….

no raise, no cut…

small sell off to scare the new buyers into selling and repeat back to all time highs

Chart #2 : A picture is truly worth a thousand words. The long term treasuries are a bit dangerous right now.

WHY?

When is Fed planning to raise rates?

Now, In one months, 2? next year?

Corporate DEBT is the sub prime of 2019!

Annual deficit is 1.1Trillion and the National Debt is growing 21.2 Trillions. Soon the interest payment on our DEBT may exceed that budget of DOD. by 2021 or 2022.

Has any one in Congress worried about deficit or debt? NONE

10 y yield is below 2.1%. It will be below below 1.5% by the end of the year!

So when the markets figure it out and tank, at what point DOES the fed cut? 10% down 20% down 30, 40 50? Or do they just keep reducing their balance sheet and hiking?

A lot of people say the fed is concerned with stocks and make decisions based on its movements. I tend to believe it. But that isnt really their mandate. Is there any official word or is it just rumor / suspicion / common sense?

Theres so much watching and pontificating but it seems like the fed just has one dial and everyone is gathered around it, yelling what position it should be. Like a game show.

The Fed was spooked into pausing its rate hikes by stocks hitting a sudden -20% air pocket in the fall last year. Now that the bubble is back, rate hikes are on the table again.

That was all caused by the Swiss National bank selling a lot of their U.S. stock holdings. Since this was the Swiss National bank and not the peon day traders from America they didn’t pump the stock market up the next day or next day or next week to embarrass the Swiss National bank. They waited ’til the last trading day of 2018 to take capital losses to rig the U.S. stock market back up with Trump begging everyone to buy the dip so his holdings wouldn’t collapse.

Rates should be up at least another 2%, and then we’ll see how good this economy really is? Everything, in all countries, is just running on credit, debt, currency debasement, + delusion.

Unfortunately, when this party finishes up it won’t be like any other cycle.I grew up on stories about The Great Depression which my folks lived through. That, and their time overseas in WW2. I do not want to replicate those tales, nor my children or grand children, or see anyone else needlessly go through it.

Paulo – I have a copy of this:

https://www.amazon.com/Ten-Lost-Years-1929-1939-Depression/dp/0770103677

I haven’t read it yet but I understand it’s one of “the” books on the Great Depression.

I believe your beloved Farley Mowat wrote about the depression a bit, or his experiences in it, I think in The Boat That Would Not Float?

My feeling is the same. They have borrowed from the future to keep this market going in 2016, 2018, but eventually the chickens will come home to roost.

The fed will cut at least once in 2019 to ensure a trump victory in 2020. Warren or Sanders is not an option for Wall Street

Yes, they have borrowed so far into the future that they have already spent the tax take from their unborn great grandchildren’s final pay cheque’s before their retirement.

Robot factories will supply cheap high-quality goods to the few who can afford to buy them, as for the majority of the population a bleak future awaits them.

Revolution will not aid these masses as the elites will have withdrawn to city states where the masses can not even enter. These city states are developing now in places like san Fransisco many who do not have high salary jobs or high net worth simply can not even afford to rent there.

Next they become residents only zones. with facial recognition and ID card readers on every street automatically directing the police to any unauthorized or otherwise wanted person which you can do in a residents only zone. Before they become completly sealed to keep out any others.

When robots make most things, the world dosent need 2 Billion people, let alone nearly 8.

When the pyramid implodes, the top dosent care, as they have it set up so they retain control all the assets which they are not far from achieving today.

Fed is just trying to keep the delusion er.. party going on.

If there is no Fed target rate to consider, what would be the rate at which US can borrow? Can it even borrow?

How much interest do you expect in return to lend your money to a country that’s $21T in debt and adds $1T new debt every year?

As long as Americans hold 75% plus of it 21 or 210T dosent really matter until they lose control of the game.

If you have a spare 50m years watch the BOJ and Japan as it successfully manages its population decline without Mass or even 10% long term immigration.

In urban environments where there is no work they have already a Housing VACANCY/Abandonment issue. These houses are in much better condition than the Chicago Detroit housing vacancy/Abandoned properties.

Soon many inner-city apartments and small house’s will also become vacant. A+

s this happens the Japanese NPL issues will go away, all by them selves.

Time is a wonderful healer of many things.

Rates are probably near neutral now; raising the FFR from the 2% range to the 4% range will precipitate a crash in equity and home prices. Despite the chatter here, there is almost no inflation, and so, no reason to raise rates.

Massive deflationary forces continue to work in the economy including technology, automation, income inequality, and the aging of the population in the rich world. These forces will continue to work throughout our lifetimes. Deflation is far more the issue than inflation.

Yes, they will cut and do what markets tell them to do, because the Fed is out of control, acting in ways and with powers that were never granted to it. QE and the explicit 2 percent inflation target are just two examples of how the is operating outside of its legal authority.

Anybody who cares to read the 1978 Humphrey Hawkins law will know that the Fed is directed by Congress to seek full employment and then zero inflation. Not 2 percent, but zero. Yet, the Fed, led by luminaries such as Janet Yellen and Bernanke, has advanced a policy of actively embracing inflation.

Second, QE represents a vast inflation of the financial markets and housing, yet Fed officials actually appear in public and talk about the conundrum presented by “low inflation.”

The inflation in home prices that occurred during and after the Fed’s purchase of trillions in securities has permanently raised the price of housing in many parts of the country, preventing millions from purchasing homes.

Not only are these pro-inflation policies in violation of the letter of the Humphrey Hawkins law, but they have contributed to increased volatility in the financial markets.

The third and frequently forgotten mandate in the Humphrey Hawkins law commands the Fed to employ policies that will produce “stable interest rates.” But the economists have long since stopped talking about this.

The biggest problem facing the financial markets today is that the folks at the Fed have no appreciation for how their policies are affecting the real economy. Ten years of inflation, open market manipulation, and other experiments have left the U.S. burdened with trillions of dollars in new public and private debt. The December market break was a direct result of the fact that Fed officials do not really understand the real-world consequences of their actions.

The original purpose of the Fed was to supply liquidity and funds to banks on a regional basis as needed. It should go back to that basic purpose. Having a roomful of academics making decisions based on the concept of central planning is no different than the old soviet Politburo and frankly reckless.

Hear, hear!

David Rosenberg (Gluskin Sheth) is predicting “… 10-Year T-note down to, or through, 1% in the coming twelve months. Lots of money to be made on ‘dem bonds…”

https://twitter.com/EconguyRosie/status/1138435565026709504

I’ll trust Rosie…

Nobody knows where the 10 year will go in the coming 12 months.

On January 15th 2019 when the S&P 500 was at 2615 he tweeted that the rally was a suckers rally. It’s 2885 right now.

If the 10 year goes to 1%,then the Dow goes to 15,000 or lower and those companies with little to no free cash flow with crash and junk bond defaults start in earnest

AGREE 100%

More important question would be “is the Fed always right about what it does”.

If thousands of years of history has any value at all (“This time it’s different”), the Fed shouldn’t even exist.

Hard money is self-regulating and is always “right” (but damned tough, sometimes).

The equity markets appear to be driven by the same believe expressed in the Fed Funds futures. Assuming both are wrong than the equity markets should retrench. This would result in a tightening of overall financial conditions. I am not sure of the exact mathematical relationship but a reduction in equity values by 10% may justify a 25bp reduction in short rates. A 40% reduction in equity values would certainly justify more than a 100bp reduction in short rates to head of a recession. The equity markets reaction to no rate cut therefore forces a rate cut.

The Fed may be reluctant to give up its hard earned “normalization” without a severe tantrum in equities occurring first, all other things being equal. When large asset bubbles are created they enter into the equation with respect to overall financial conditions. A bubble deflating than becomes the equivalent of short rates increasing. This becomes problematic when short rates are so low there is little room to lower them to compensate.

Don’t forget the same gang has already brought 2 boom-bust cycles in this century! They created this 3rd largest ‘everything’ bubble as a CURE for the last one!

This will meet the same fate. NOT if but when!?

With a slowing trend in both growth and inflation measures and projections, including in the US, I reckon most central banks are going to be starting their rate cuts again pretty soon (and, eventually, to stepping up their QE type measures, either in current and/or some redesigned format). I guess the Fed might possibly try to hold in June and cross their fingers and hope that the trend changes, but I wouldn’t count on it.

Excellent article!

The game is indeed rigged.

It would be interesting to see how other variables affect the market. Brexit, currency manipulation, military interventions, government policies announced and later forgotten, crytos, and the like. Of course, including even the most significant factors would call for tens of thousands of pages. Yet it can be done by two or three at a time, even by adding a single variable to the current article at a time. However, some of the materials might be quite dangerous to publish…

The trade deal between China and America fell apart. This would have devalued the U.S. dollar and boosted U.S. stocks. Now we Trump’s “PLAN B”. Plan B has the exact same effect as a trade deal with China. Cutting the Fed funds rate devalues the U.S. dollar and boosts U.S. stocks. Sure its all criminal but this is the “PLAN B”.

Trump only has a PLan A..if that doesn’t work dbl down, that doesn’t work triple down..

Coincident indicators are still ok. Not sure thats what the market is sniffing out. CPI light, PPI light, I don’t see the downside even knowing asset prices are where they are. They did the same thing in the 90’s and we had solid growth before the internet bubble

The general trend on interest rates has to be down because otherwise the national debt will be unsustainable. The deplorables don’t have the means to sustain the debt and the rich won’t. Some things really are obvious.

I have thought for some time now, before the last presidential election, that we had reached peak financialization in the markets. Stock buybacks are a form of liquidation of a company. As income is directed to non-productive uses over time, the productivity of the company declines, it has too. The resulting increase in the price of the stock only improves the company’s ability to borrow, leading to a further weakening of productivity. It’s all right there in front of our faces, but nobody wants to call the baby ugly.

You made some good points there. I agree with them. I hope others read what you wrote.

NOT only ‘unsustainable National DEBT but also record increase in Corporate debt since ’09 which now has been designated as the SUB_PRIME of 2019!

From Northman Trader: “Game over. The grand central bank experiment of the last 10 years has ended in utter and complete failure. The games of cheap money and constant intervention that have brought you record global debt to the tune of $250 trillion and record wealth inequality are about to embark on a new round of peddling blue meth again.

Australia has already cut, so has India. The ECB is talking about it, markets are already pricing in multiple Fed cuts. The new global rate cutting cycle begins anew before the last one ever ended. Brace yourselves as no one, absolutely no one, can know how this will turn out.

Absolutely staggering. We are witnessing a historic unraveling here. Everything every central banker has uttered last year was completely wrong. Every projection they made over the last 10 years has been wrong. No wonder Jay Powell wants to toss the dot plot. It’s a public record of failure.

Why place confidence in people who are staring at the ruins of the policies they unleashed on the world and are about to unleash again?”

So far this market has owned JP, and don’t fight the market. They called the end of the rate hike policy, and now they are doubling down. The Fed Funds futures are commercials in a commodity market, they are always hedging their position, which means nothing. Don’t fight the market means don’t fight the money, EU, BOJ, PBOC, they are all printing. Keep interest rates higher than their ZIRP and the US dollar will remain strong and we can fund our operating needs in the Treasury market, and pay off our BIS obligations. An international market inside the largest sovereign global economy. What can go wrong?

Will they succeed for the 3rd time, in preventing this ‘everything’ bubble going the way of the previous 2 – 2000 & 2008?

They might kick the can again but the ‘same’ tools they have now weaker and doesn’t inspire confidence for an experienced/seasoned investor!

Volatility will keep increasing with ALGOs going crazy!

“It now makes two: The chief economists at investment banks Goldman Sachs and Deutsche Bank have warned their clients that the already priced-in rate hikes this year that markets are so excited about may not materialize.” Is it rate hike or rate cut?

When the “Markets” are talking rat cut this hard, the tail is trying to wag the dog.

This dog has refused to be wagged before, and its forward guidance still says flat to 2021 latest rate shift 2020 would be January.

My Money says if you get a total 50 BP cut between now and January you will be F()& F)(& lucky charlie. I dont even see that much.

which means possible a c67p economy and a c67p for p45 in the 2020 election nobody “Did it to him ” He will have done it to himself.

Before they cut, they can stop Sheet Normilisation by replacing Maturing MBS with T’s.

Which would be a backdoor QE move of sorts as they are only buying mostly short dated T’s currently.

Still a retreat but not a capitulation to the demands of the financiers and speculators which is what a rate cut is.

Of course all of this could go up in Smoke after the G20 Meet. As p 45 will do anything to force the fed to give him the easy economy money he wants going into Nov 2020.

All the last 3 recession have started within # months of the first rate cut!

3 months, I mean

All PRE QE recessions.

QE throws all previous rules, in the trash.

Applying pre QE rules, to a QE economy, then, trading on that analysis/deduction, gets expensive, quickly.

The Economy will still do X,Y and Z due to A,B and C, but not at anything like pre QE time-frames, or even movements.

– Yes, rate cut is coming. Just look at what happened to the 3 month T-bill rate in recent days/weeks.

– Short term rates go up in a boom and go down in a “recession”. Just look through that lense to the 3 month t-bill rate since 1990.

– After the year 1990, 2000 and 2006 short term rates went down: “Recession”.

– After 1993, 2003 and 2015 short term rates started to rise: “Economic expansion”. Or to put it in a different way: People are getting more confident and pull their money out of T-bonds and into e.g. stocks & corporate bonds.

The Federal Reserve has suspended the most fundamental of economic rule….supply and demand.

As the deficits soar and the national debt ramps up, the supply of that debt doesn’t depress prices and raise rates.

The game of the Fed buying up paper with borrowed money, and using those purchases for collateral is about to end. Keeping the punch bowl always full is folly.

Central banks were created to fund government. Central banks increase systemic risk. Increasing leverage is temporary boost until credit card is maxed out. Fed chairman can not tell the truth because system is built on confidence. Widely diversified portfolio is about all you can do to mitigate risk.

Missed a few days due to travel, but this article is absolutely fantastic.

It had always been sort of an open question for me whether the Federal Reserve was genuinely controlling rates, or whether they were merely rubber-stamping what the market demanded. Obviously it depends somewhat on the character of the FOMC chair and membership, but the charts show plainly that the Fed does indeed exercise real power over the markets.

It will be quite interesting to see what happens with next week’s Fed meeting, given the clear dichotomy between yield-curve expectations (and market cheerleading commentary) vs. the Fed’s stance from the last few meetings.

√

Looking forward to that one, dont think I will trade it though, the chances of aggressive whipsaws overrunning stops, is high.